Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Kudos to Gundlach!

What a terrific gutsy call By Jeff Gundlach after the Powell presser on June 15? For those who didn’t follow him on CNBC Overtime, below is the short version of his call:

- ” … there is a counter-trend rally coming at the long end of the treasury market which I have been advocating as a hedge but if you haven’t done it, ytd the 10-year is up 189 bps; so a counter-trend rally in the bond market which may have started today & the long end even stared to participate in today’s rally … I wouldn’t be surprised to see the long bond go down to 3%“

How right was Gundlach in reading how Treasuries would react to what Powell said? Look at the fall in interest rates from close of pre-Fed Tuesday to this Friday’s close:

- 30-yr yld down 16 bps; 20-yr yld down 19 bps; 10-yr yld down 33 bps; 7-yr yield down 38 bps; 5-yr yld down 41 bps; 3-yr yld down 45 bps; 2-yr yld down 38 bps; 1-yr yld down 25 bps;

To quote BMO’s Ian Lyngen on BTV Surveillance on Friday,

- “… effectively what the market is saying [to the Fed], you can hike now but you are going to have to start cutting much sooner than in prior cycles … “

Since we prefer pictures to words,

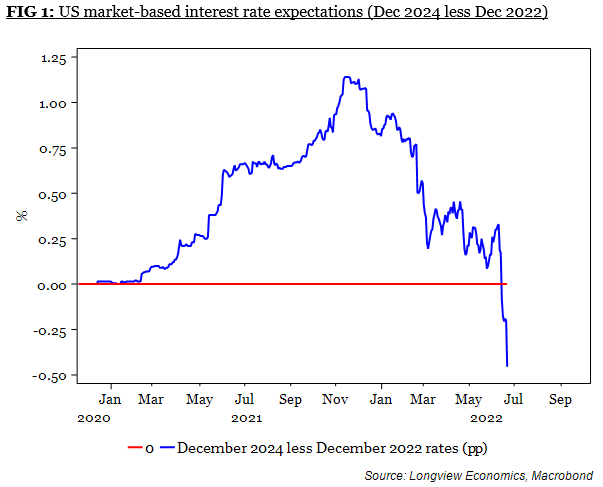

- Longview Economics@Lvieweconomics – – Powell’s testimony had an impact on US rate expectations with the Dec 2024 Fed funds futures contract moving sharply higher (on price) and lower on implied rates. With that, the market is now pricing almost 50bps of rate cuts between the end of this year and the end of 2024…

But Gundlach’s target for the 30-yr yield is 3%. That is 28 bps away. What might get it there? Ian Lyngen said on Friday:

- “…. there will eventually be demand for 10-yr & 30-yr paper; we haven’t seen the key investor classes of Japan & parts of Europe really come in to start buying Treasuries yet; when we do, that will be worth 35-45 bps & that gets you below 3% … “

- ” …. there does tend to be key moments of capitulation on one direction or the other; right now the vast majority of the market is Short Treasuries; there will be a point where people will wake up & say I don’t want to miss out on these higher yields … ”

In other words, Lyngen is calling for a FOMO moment in rates, to use the term he had used in his previous BTV appearance.

Can any discussion about Treasury rates be even somewhat complete without the R-word? Perhaps not. So we have to bring in views of a R-name to shed light on R-word probability!

- David Rosenberg@EconguyRosie – – Memo to the uninitiated: it is the change in jobless claims and not the level that presage the recession call — and the move off the cycle trough says we’re more than 80% of the way towards heading there. #RosenbergResearch #Economy

So what should investors focus on? Rosenberg was succinct & clear in his clip:

- …. as per Treasuries the bear market here is at a far more mature stage than the equity market; there is a ton of inflation priced in; what isn’t priced in is the recession staring us in the face; … the long bond 30-yr Treasury makes you money in total return terms no matter what the starting point is in recessions because inflation declines in all recessions including the 3 horrible periods in 1970-1980 ; so while equities always lose you money, Treasuries always make you money …

He also pointed out that

- “…. normally the S&P bottoms 2/3rd or 3/4th of the way through a recession ; this recession is just getting started …. what does that mean for markets? 3100 for the S&P and over 700 bps for the high yield spread meaning at least 200 bps wider than we have today; … “

We urge all to watch his clip below:

2. U.S. Stocks

Our basic theme, articulated 2 weeks ago, remains:

- “If buying TLT starts working, then other assets will. If TLT keeps getting clobbered, then the Inferno will get hotter. That we think will be the bottom line for the next few weeks”.

As described above, the action this week was more in the belly of the Treasury curve & not in the long maturity TLT arena. Still both TLT & EDV were up this week, up 70 bps % 1.50% resp.

And stocks followed with enthusiastic glee:

- Dow up 5.4% or up 1,612 points, SPX up 6.4% or up 237 handles; NDX up 7.5% or up 840 points; RUT up 6% or up 100 points, Dow Transports up 5.3% or up 679 points

The biggest day of the week was Friday in which Dow, S&P & NDX added 50% of their weekly gains. That, apparently, was due to a rebalancing in Russell and addition previous-crazy-overvalued AMZN, META & Netflix in the value index. That was the trigger for a big MMANAA move this week:

- Microsoft up 8.4%; META up 4.6%; Amazon up 10%; Netflix up 9.4%; Apple up 7.8% & Alphabet up 1%.

If the end of last week was a Russell rebalancing, next week ends with month-end rebalancing. What might that do, at least according to one bullish analyst:

- Thomas Thornton@TommyThornton – – Marko from @JPM out with a note thinking the markets could be up 7% with end of month rebalancing.

Really? What might be the fuel for such a move?

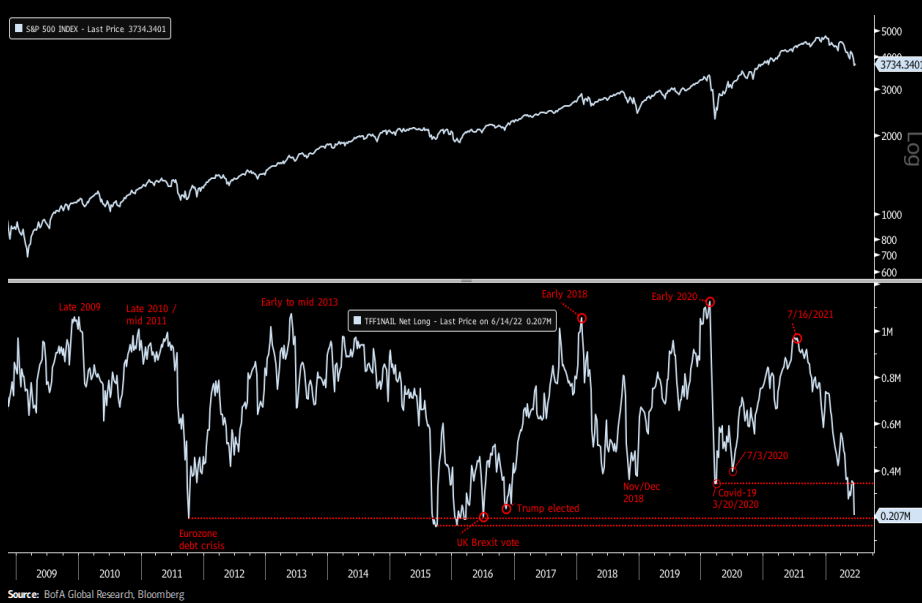

- The Market Year – Dare the contrarian long? If you trust SPX net longs at least. As BofA shows asset managers are the most bearish on SPX futs since Brexit and the EU 2011 crisis.

BofA is fine but isn’t a big rally call the province of JPM this year? They didn’t disappoint:

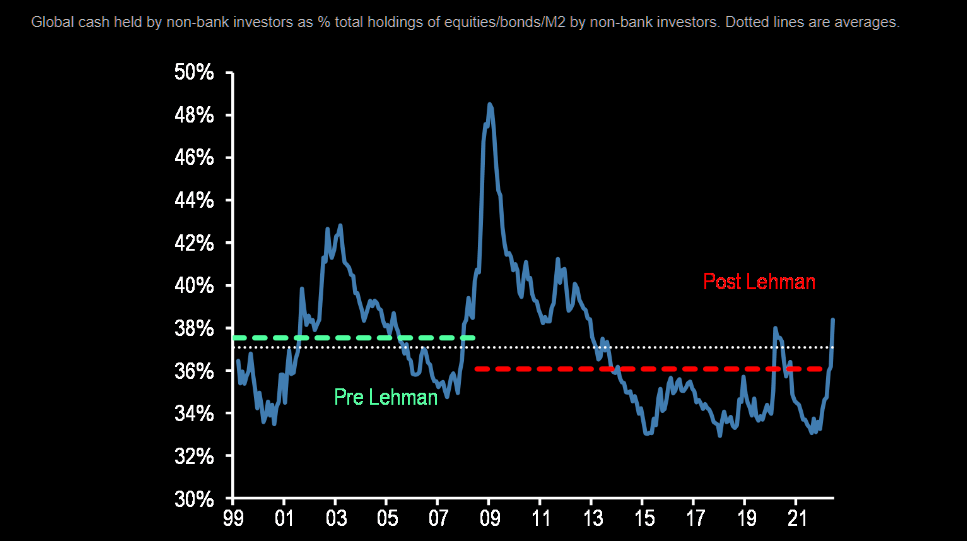

- The Market Ear – Cash is smash – Greek flow-god Nikos of “Flows & Liquidity” fame is getting all worked up about the new Cash Mountain now rising like Mount Olympus….JPM: “Our proxy for the cash allocation of investors globally based on the stock of M2 to the stock of financial assets rose sharply in recent weeks surpassing its previous peak seen in March 2020 at the peak of the pandemic crisis. With investors currently very overweight cash, both equities and bonds should find support into the second half of the year“

While we enjoy this bounce, we are aware that this could well be a bear market bounce a la the 2008 summer bounce. That might also mean this could be a big bounce albeit in the ongoing bear market, as Dan Niles says to Becky Quick in his clip below:

At the same time, commodity stocks have been torn apart as if they were attacked by ravenous wolves. Copper down 7%, FCX down 8.7%, MOS down 7.6% are just the leaders. And energy stocks have been smashed.

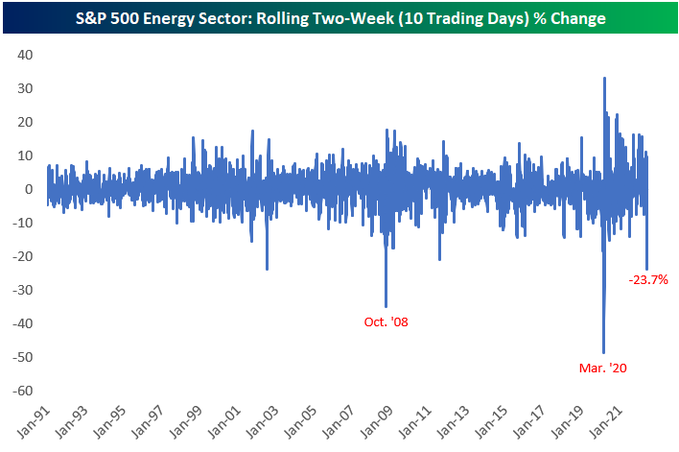

- Bespoke@bespokeinvest – June 24 – At -23.7%, this is the 3rd worst two-week (10 trading day) drop for the S&P 500 Energy sector over the last 40+ years. The only two-week stretches that saw bigger drops for the Energy sector came in October 2008 and March 2020…

But this decline seems to have tempted CNBC’s Carter Worth into suggesting a long position in XOP:

Charting the $XOP

Take a look at @CarterBWorth and @Michael_Khouw’s take on the energy comeback. pic.twitter.com/Ot691zN3Js

— Options Action (@OptionsAction) June 24, 2022

4. Lithuania, Indra & the Great Flood

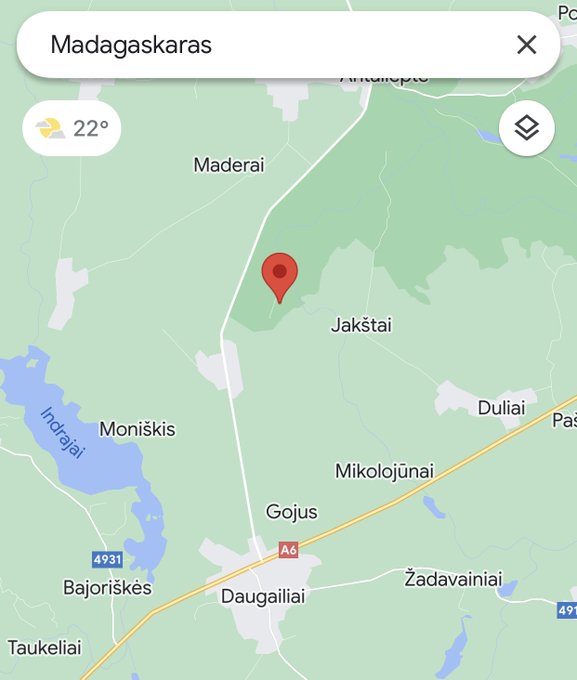

We saw this tweet a few days ago:

Our attention was immediately drawn to body of water labelled Indrajai. Apparently, it is a body of water in the Utena District in Lithuania.

We recall an article on page A1 of WSJ (a couple of decades ago) about how people could talk in Sanskrut to Lithanian farmers prior to World War I & the farmers could understand it. That is relevant here because Indra is a amazingly important name in Indian civilization, the Lord of Atmospheric Deities (very different than God & God’s roop/representations).

Indra is the ultimate alpha figure of ancient Indians or Sindhav coming out of Sapta-Sindhu, the land of 7 rivers. He remains today one of the most popular suffixes for Indian names – like the first name of Indian PM Modi = Narendra for Nar+Indra, the Indra of Men; the previous Chief Minister of Mumbai Devendra= Dev+Indra, the Indra of Dev; Yogendra = Yogi + Indra, the Indra of Yogis.

And Jai means victory, which was the absolute characteristic of Indra. Hence the name Indrajai. We find it amazing that the name has lived on to this day. Of course, today’s “Hindus” show no resemblance to Sindhav who followed Indra into influence in literally thousands & thousands of miles away from India. Witness the town that was named Indra-Pura (city of Indra a la Singapur, the city of lions) from 192 CE to 1832 CE in today’s Vietnam:

Go a bit left of Indrapur above to notice Angkor, the site of the largest religious monument in the world (built around 12th century):

According to Wikipedia, Lithuanian is said to be the most conservative of the existing Indo-European languages, retaining features of the Proto-Indo-European language that had disappeared through development from other descendant languages.[3][4][5]

Speaking of names with a heritage, we always considered the name “Sara” as primarily a Jewish name. While going through a quick search for the above, look what we discovered:

- “The Name Sara also has Indian roots referring to “Geeta Sara” meaning the conclusion of Bhagwadgeeta. Sara also has multiple meanings in Sanskrit such as essence, main point, substance, etc . [3]“

We can’t help adding that perhaps CNBC’s Sara Eisen & IMF’s Geeta Gopinath should discuss this & solve the mystery of why Ms. Eisen correctly pronounces her “Sara” name while Ms. Gopinath allows the sacred “Geeta” name to be semi-butchered.

Having said that, we must point our that the Sanskrut term for “essence, main point, substance” is phonetically written as “Saar” or “Saara“. Meaning it is not a feminine term.

In any case, the more we find out the more we want to understand the ancient relationship between Jewish people & Indians. Some claim it goes back to the Great Flood in which Manu was saved in a boat by a giant whale with a horn. The whale took Manu’s boat against the flood waters coming down the Himalayan mountains to the top of that body of water. As the flood receded, Manu’s boat came down slowly & he with his few friends were saved. That is why the Sanskrut term Maanav means descendants of Manu.

What is supremely interesting is that Manu & his son Vaisham-Payan gave lectures about the civilization that was destroyed by the flood & those lectures are saved & read to this day as Manu-Smruti, or the recollections of Manu.

Sadly these expansionist people of the Rg_Ved, the oldest religious text extant, have been beaten down over the past 1,500 years & changed into today’s pathetic Hindus or BrHindus.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter