Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”… global reset of giant proportions … “

The best short enunciation of today’s environment that we have seen:

- Michael A. Gayed, CFA@leadlagreport – – If you think this environment isn’t worse than 2008 or 2020, you’re out of your f****ng mind. Stop throwing stones and slinging arrows. What is happening is unprecedented in history and goes beyond the value of your portfolios. Wake the f*** up. [astericks were added by us; the original tweet is un-astericked]

But could all of these problems be solved & even solved fairly quickly? The legendary energy trader Mark Fisher pointed the direction in his conversations with CNBC’s Scott Wapner. We carry forward his logic below:

- Fisher said that Putin could pull a Crimea in a couple of weeks. Meaning after the “vote” in the Russia-occupied territories comes in “yes”, then Putin could publicly support a ceasefire saying Russia’s objectives have been met. What about Ukraine, you ask? Fisher said Ukraine could be told to accept it. That, Fisher said, would be a buy trigger.

- Since Ukraine would have to be energetically encouraged to accept this situation by the US, perhaps the US might also have do something. Perhaps US would suspend all financial/economic sanctions against Russia for as long as the ceasefire holds. Russia, in exchange, would let natural gas flow in plenty to Europe & let food exports sail uninhibited. That would be a huge buy trigger for all of Europe, America & the World.

- The above two could lead bullish investors to totally ignore the earnings cut that are feared by Wilson, Johnston & co. But what about the Fed, you ask?

- Actually, in the spirit of the above, Fed Chairman Powell could publicly say that the FOMC is considering pausing its rate increases for the next 2 FOMC meetings to let the damaged economies recover. He might also add that the Fed is pausing QT for 3 months adding, of course, that the Fed’s commitment to fighting inflation remains just as resolute.

Why on earth would Putin settle now? And would Ukraine (USA, really) allow Putin to settle with what he has occupied as Russian territory? Perhaps because the alternatives have just become dreadfully dangerous.

Reportedly the Biden Administration has informed the highest levels of Russia that US will respond with catastrophic damage on Russia if Russia uses tactical nukes in Ukraine. How does Putin respond to that? Put Russia’s strategic nuclear forces on red alert to respond to a crippling US nuclear attack on Russia?

It really depends on how confident the US military is of destroying Russia without allowing America to be damaged critically. If they are very confident, then they will not support any peace discussions that allow Putin to say his objectives have been met. If they are not, then a settlement is not out of reach. Perhaps Mark Fisher, given his contacts in the energy space, has some reason to think a settlement is possible.

That raises the question – What if the probability of the above accord gets priced in as non-zero by markets? How much fuel has been collected to ignite a bonfire of leveraged shorts of the intensity never before seen?

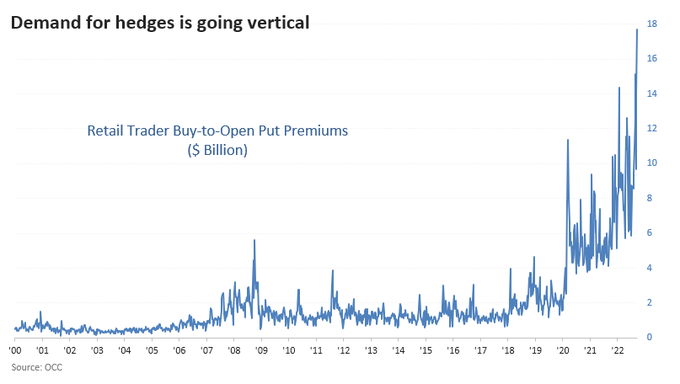

- Jason Goepfert@jasongoepfert – – Full-on crash mode. Retail traders spent $18 billion buying put option protection last week, a record. They’re holding $46 billion worth of index futures net short, a record. Leveraged traders are betting on very, very bad things happening very, very soon.

We have always been warned that oversold in September-October has a different meaning than oversold in other months & at other times. Oversold in September-October tends to get more oversold until the markets experience a cathartic decline. Look at the potential decline David Rosenberg is contemplating:

- David Rosenberg@EconguyRosie – – We could be building towards an Oct/87 crash, led by an aggressive Fed & surging bond yields. Difference is that commodities then were in a bull market, the dollar was stable & real GDP growth was +5% YoY. So this financial tightening could be worse & there is no economic support

Note this is a different Rosenberg than the one who has been warning about deflation. That shows how nuts Powell’s Fed had become. How far could consumer confidence drop in these markets?

- Jim Bianco biancoresearch.eth@biancoresearch – – FinTwit is calling for “face-ripping rallies,” Peak hawkishness now, and the worst sentiment in decades. In the real world, none of this is true. This is why I’ve warned that sentiment in a bear market can go to apocalyptic/suicidal levels. Not close to “Johnstown” yet.

It has been developing for awhile. But this is the week when the world has been forced into a reset by the same people entrusted to protect it – global Central Banks.

That brings us back to the deal a la Mark Fisher that we discussed above. Perhaps a crash like October 87 is what might be needed to brings USA, Europe & Russia to do a deal that is unpleasant to all three.

2. “.. markets will do what markets do … “

We recall the sage Richard Bernstein saying years ago that the Federal Open Market Committee really has no understanding of international markets or conditions; that it is an insular group that cares not see what is happening outside America even though it might have significant impact on American economy & American markets.

Chairman Powell & his committee proved it again this past week. Surely they know that Europe is in severe economic crisis & the Euro currency is cascading downhill. Did they see the mess in Britain? Did they even see the state of the Chinese currency? They might have but they didn’t care because it was not their business!

Look what happened. What the FOMC did and what Powell stated in his presser was an invite to recession in America. And as Jeffrey Gundlach stated that afternoon, that “… today’s bond-market action is very recessionary looking … “. Indeed, the 30-year Treasury rate fell on Wednesday afternoon.

- Then look what happened the next morning – 30-yr yield rose 11 bps; 20-yr yield rose 15 bps; 10-yr rose 19 bps; 7-yr rose 21 bps; 5-yr rose 21 bps; 3-yr rose 19 bps; 2-yr rose 12 bps.

This is Europe blowing up & sending the flames into America. Did the Fed care? We heard a Fed-watcher say on Fin TV that the Fed has contempt for U.S. politicians. How arrogant have they become?

However, they might be the epitome of caring humility compared to the disdain of markets expressed by UK Chancellor Kwasi Kwarteng who said dismissively – “ … the markets will do what markets do … “.

- Tracy Alloway@tracyalloway – – The UK is really trading like an emerging market right now. Bond yields up while the currency crashes. Featuring veteran EM investor @M_PaulMcNamara : bloomberg.com/news/articles/

Frankly the above tweet insults today’s emerging markets that are actually better managed than the UK unless you mean submerging markets like Na-Pakistan.

The explosion in British Gilt rates caused a further rise in U.S. Treasury rates on Friday morning and a 1.5% rally in the U.S. Dollar on Friday. Guess markets do indeed do what markets do as Mr. Kwarteng so eloquently said over in London. So what did the Dow Jones do on Friday?

Sorry but we just don’t know what world Mr. Powell & his committee are living in! Don’t they know that $50 trillion has been added to leverage since 2018, as Larry McDonald tweeted? Volcker never had to deal with such leverage! To put it another way,

- Raoul Pal@RaoulGMI – Reminder – US total debt is 100% of WORLD GDP. No economy in history has carried this much debt as a percentage of world debt. Good luck with your sticky inflation meme…

And guess what is happening to breakevens as the quixotic Powell rides to slay the inflation dragon?

- Raoul Pal@RaoulGMI – – Ok, final tweet on how this is a total mess… 5yr Break Evens have broken key support. Next is the round trip back to 2019…the CB experiment of Volker worship in a massively indebted economy is on its last legs in the coming month or two. 1/

And Powell was proud to highlight their commitment to QT, or shrinking the Fed’s balance sheet, while raising rates like crazy while curtailing money supply & sending the U.S. Dollar streaking up causing financial havoc in the world. This is all so utterly nuts that a sensible & illustrious man was provoked to rant:

3. Sensible opinions

Professor Siegel is an academic & some might dismiss his opinions. On the other hand, Jeffrey Gundlach & Scott Minerd are sensationally successful investors. Watch & hear what they say:

Now a detailed (20 minutes) conversation between Scott Minerd & CNBC’s Brian Sullivan:

4. Who’s left to Sell?

Perhaps we are so oversold that a snapback rally is near? That is what smart Dan Niles suggests, after a big crash on Monday:

- Dan Niles@DanielTNiles – – Big crashes on Monday follow bad wk & bad Friday but 70%+ of my technical metrics (holdouts VIX & volume related) are oversold w/ 50% threshold. Staying disciplined & covering shorts. Believe SPX ~3K is still THE low but expect nxt bear mkt rally. Already 5 in 2022 w/ avg of 9%

Who better to ask about individual investor allocations than Fidelity?

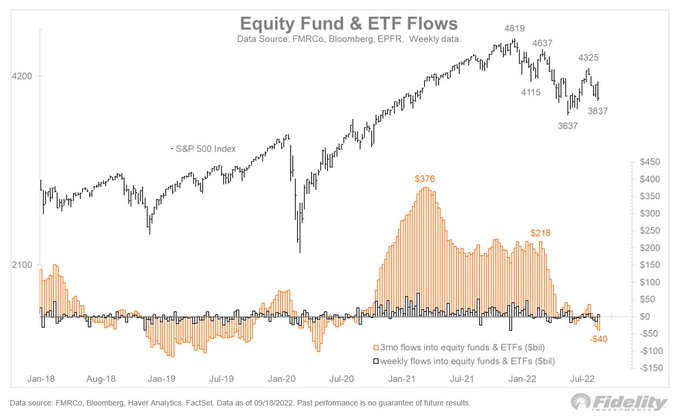

- Jurrien Timmer@TimmerFidelity – – Not throwing in the towel: It’s surprising how little capitulation there has been in the market. Yes, the sentiment surveys are all negative, but actual flows have not been. This seems consistent with the lack of volatility in the market (as illustrated by the muted VIX).

That seems to be similar to the feedback about Merrill Lynch clients:

- Lawrence McDonald@Convertbond – – Narratives “Sooooo many bears out here” vs. “BofA private clients still have 63% allocation to equities”

We have all heard from & about Mike Wilson but we had not realized how wide his numbers are from consensus. Read what he said on Bloomberg Surveillance this week:

- ” … spread between our forecast & the actual forecast by the Street bottoms up has never been wider; only time it has been this wide was in 2008 & 2001; you know what happened there … the end-game for us is all about earnings & the growth now; we are just not optimistic over the next 6-12 months …”

4. What a week

Finally to encapsulate this week:

- Dollar up 3% (both UUP & DXY); VIX up 14% to 29.92; Dow down 4.3%; S&P down 4.6%; RSP (equal-weighted S&P) down 6%; NDX down 4.6%; RUT down 6.6%; IWC (microcap) down 7.1%; DJT down 4%;

- AAPL down 7 bps; MSFT down 2.8%; GOOGL down 4.1%; AMZN down 7.9%; NFLX down 6.8%; META down 4.4%;

- Oil down 7.4%; Nat Gas down 12.4%; XLE down 9.7%; OIH down 12.4%; Copper down 5.5%; CLF down 11.6%; FCX down 9%; MOS down 7%; GDX down 5.7%;

- EWZ up 1.9%; EWG down 7.3%; EEM down 4.5%; EWY down 6.9%; INDA down 3.6%; INDY down 3.6%;

- TLT down 1.7%; EDV down 1.6%; HYG down 2.7%; JNK down 2.7%; leveraged DPG down 7.9% & UTG down 8.4%; 30-yr yield up 9.7 bps; 20-yr yld up 11 bps; 10-yr up 24 bps; 7-yr up 29 bps; 5-yr up 34 bps; 3-yr up 38 bps; 2-yr up 34 bps; German 2-yr up 41 bps;

Is this enough of a sell-off? After all, the S&P rallied on Friday afternoon to close above its June low. But Carter Worth of CNBC Options Action said on Friday after the close that “we go lower“:

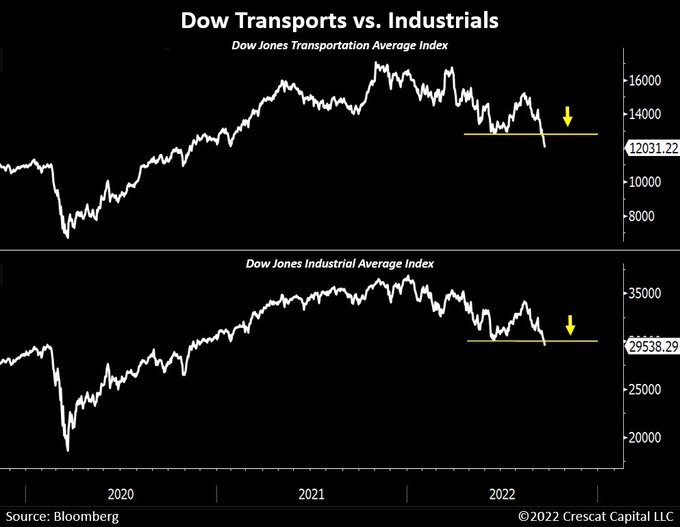

- “I think there is a lot of hype that somehow because we are back to the June lows, that we will hold; the S&P is one index but major indices from NYSE Composite, Dow Jones Transports, European Bourses have all undercut their June lows; so have HYG, JNK & junk paper; I think we go lower”

5. From Putin back to Lenin

We began with a comment about Putin; so we might end with a Lenin comment & a chart about the land of Mao:

- Paulo Macro@PauloMacro – – CNH fricking 7.10 … think Lenin’s “decades where nothing happens, and days where decades happen.”

6. America’s Inventive Spirit

Remember the “both” commercial of Jerry Jones & Deion Sanders?

No one has ever asked us, but we also have nurtured a “both” hope for sometime. Jerry & Deion can eat Pizza but our first love has always been chocolate. And we usually have had to make a choice between Belgian Chocolate ice cream & Chocolate Chip ice cream.

Guess what we discovered today at our neighborhood Fairway (in our 1st visit since before Covid hit in February 2020).

How can you be negative about a country with such inventive & desire-fulfilling spirit? And it pays off in America too – just look at how General Mills stock is laughing at the notion of a bear market!

Send your feedback to editor.macroviewpoints@gmail.com Or @Macroviewpoints on Twitter