Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.From “Cool Tone” to “Panic”?

Last week, we termed the public remarks of Chairman Powell as “cool tone”. That they were but that was so long ago, right? This Thursday an army of Fed honchos invaded public media to make it clear how aggressive they were against inflation & how they wouldn’t dream of cutting rates until inflation surrenders publicly.

Wasn’t that weird given that Services ISM had just published a softer number? That made us wonder about the comment we have heard on Fin TV that the Fed Chair is told about the headline NFP number on Wednesday evening. If so, then that explains the panic in the Fed to swoop en masse on Fin TV on Thursday & emphasize their war against inflation, a 50-bps war against 2.5% current PCE expected target to bring it down to the etched-in-stone 2% PCE target.

How media smart they were to stress their uber-hawkishness on Thursday just before the 303,000 jobs added number was released on Friday at 8:30 am? They got what they wanted. Interest rates shot up almost 10 bps across the curve AND Dow rallied 307 points, NDX rallied 230 points in celebration of a strong economy congratulating Fed’s anti-inflation war. Look how Friday made the past week look OK to anti-inflation hawks:

US Indices:

- VIX up 22%; Dow down 2.3%; SPX down 1%; RSP down 1.8%; NDX down 80 bps; SMH down 1%; RUT down 2.9% IWC down 1%; MDY down 1.8%;

Stocks & Sectors:

- AAPL down 1%; AMZN up 5.1%; GOOGL up 1.3%; META up 8.6%; MSFT up 1.2%; NFLX up 4.8%; NVDA down 2.6%; MU up 4.4%; BAC down 2.1%; C down 2.5%; GS down 2.4%; JPM down 1.3%; KRE down 4.4%;

Dollar was down 11 bps on UUP & down 23 bps on DXY. That’s added fuel, right?

- Gold up 4.6%; GDX up 7.3%; NEM up 11%; Silver up 10%; Copper up 5.8%; CLF down 1.8%; FCX up 5.3%; MOS up 2.4%; Oil up 4.6%; Brent up 4%; Nat Gas up 1.7%; OIH up 3.9%; XLE up 3.8%;

And all the above achieved at a necessary cost to stop future march of evil inflation:

- 30-year Treasury yield up 20 bps on the week; 20-yr yield up 20 bps; 10-yr up 18 bps; 7-yr up 18 bps; 5-yr up 17 bps; 3-yr up 14 bps; 2-yr up 12 bps; 1-yr up 3 bps;

- TLT down 3.3%; EDV down 5.5%; ZROZ down 6%; HYG down 1.2%; JNK down 1.4%; EMB down 84 bps;

See, even in fixed income, the stuff that Rick Rieder is buying in delight is the front of the yield curve in income-producing assets, credit, securitized market; not Treasuries. He said his new ETF is trading at 6.80% yield. His exultant thesis is “when you step back, there is something really impressive going on here“

What is one thing that is “really impressive going on here“?

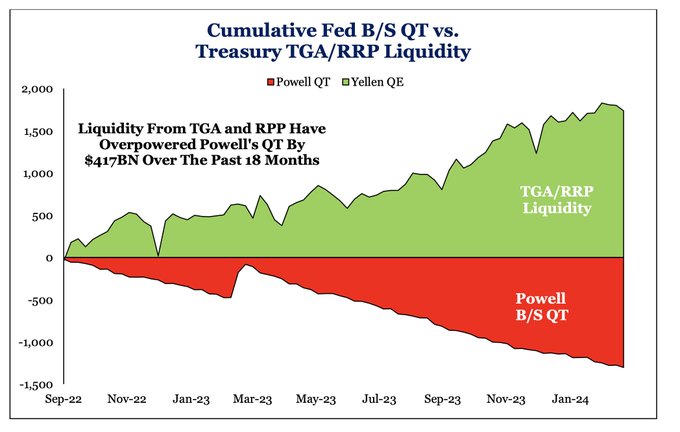

- Holger Zschaepitz@Schuldensuehner – It’s the liquidity, stupid! Yellen’s stealth QE overpowering Powell’s QT. This is why risk assets, including Bitcoin, performed so wonderfully in the first quarter. (Chart via SRP)

Before we get to what Signor Rieder specifically described as “really impressive“, let us take a detour to a Professor of Economics interviewed by the always candid Rick Santelli on Friday afternoon in his Bond Report. We tried to search this clip on CNBC.com & on CNBC YouTube without success. Why would they hide that conversation between the Professor & Santelli? Below is what remember of the Professor’s remarks:

- “most of the jobs added are part-time; the employment-per-person is going down; it is a recession for the individual … “

This Professor was sensibly eloquent & Rick Santelli did not fight with him. Another came to the same conclusion:

- David Rosenberg@EconguyRosie – It is a bull market in (i) part-time jobs, (ii) self-employment and (iii) multiple job holders. Outside of these areas, employment actually contracted more than -500k in March and by -2 million in the past year. What an economy!!

Now back to what Rick Rieder described as “something really impressive going on” –

- “… we are bringing in more & more people into the workforce, some thru immigration … you are putting more & more people to work because you are expanding the workforce … think of what this means if you are the Fed; you actually brought a lot of people in the workforce … you are hiring a lot of people … & if you look at average hourly earnings, they actually didn’t go up; … so what’s happening is you are expanding the workforce, putting a lot of people to work & you are no pressuring wages of any significant magnitude because you are expanding the workforce supply side story. Pretty darn impressive is the Fed can be more patient ....”

Did he see anything on the other side of this new dawn? Yes, Rieder did add a “maybe” –

- ” may be … lower income people are getting hurt by some of these … some of the demand functions, the cyclical parts of the economy are under pressure … “

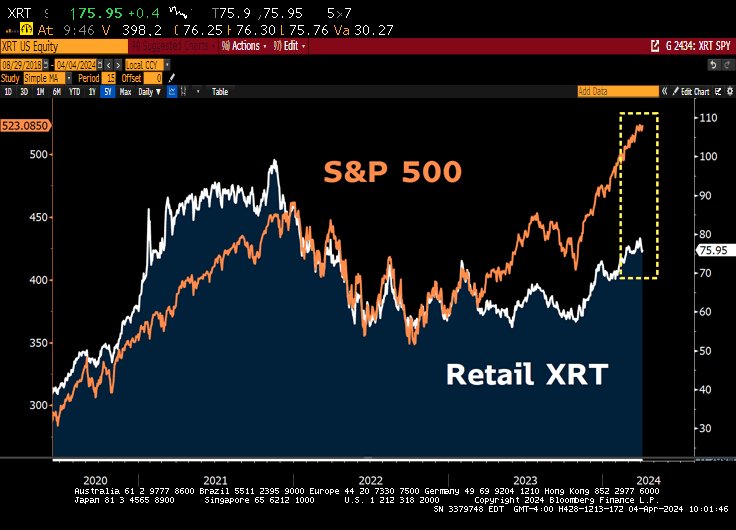

Like XRT, perhaps?

- Lawrence McDonald@Convertbond – Apr 4 – Kohl’s KSS – Equity $3B Debt $7B Cash $183m; Free Cash Flow $600m – *Highly levered — Retail XRT and the Russell 2000 IWM are just a rates trade with 5s (five-year US Treasuries) yield > of 425bps (4.25%). #Bonds

Not all on the Fed sang to the marching tune. Witness what Austin Goolsbee said on Thursday:

- “if you look at the broader economy, it doesn’t really look like broad-based overheating. Those labor market metrics are coming back into better balance. There are some things that are a little cautionary, like consumer delinquencies – they are rising. And in the past rising consumer delinquencies have been an indicator that the business cycle is kind of turning so it doesn’t feel like broad overheating. So I think, if you take a longer arc, inflation is coming down & we are going to get to 2%.”

Rick Rieder also gets to that point eventually:

- “… I think you are going to get core PCE numbers over the next couple of months – 2.5% core PCE & 5.375% Fed Funds rate. … even if you get 100 bps off of Federal Funds rate, you are still operating at a restrictive level. So I still think they would like to do it. We need the data to support it, We think we will get that.”

Seriously doesn’t this remind you of April 2008? That was when that reflationary rally began & long-duration Treasury yields spiked hard while materials flew. That effectively pre-empted Bernanke & company from easing rates when they should have. Later they lowered 100 bps in a panic but the damage was already done.

It is important to remember that 2008 became 2008 BEFORE Lehman was put to sleep. We are not even remotely suggesting that 2024 will have a similar event. We simply think that damage to the economy, especially to the “lower income people” will be severe by the time the Powell Fed cuts in an emergency mode.

They tell us that the services economy in the US is much larger than the manufacturing economy. If true, what does the following say?

- Liz Ann Sonders@LizAnnSonders – April 4 – Dueling price pressures for ISM PMIs … services prices (orange) eased sharply in March while manufacturing prices (blue) continued to trend higher

And,

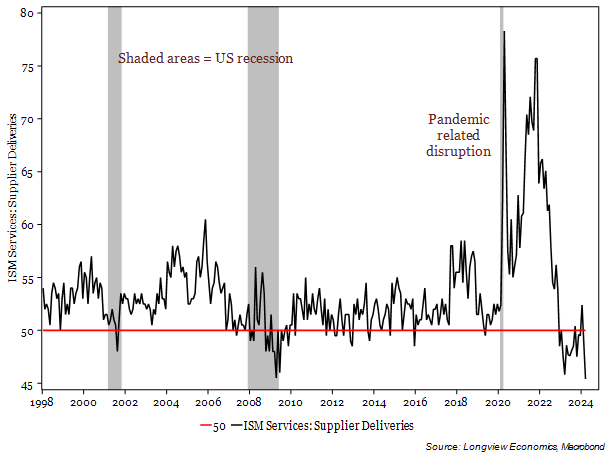

- Longview Economics@Lvieweconomics – Apr 3 – Sharp fall in ISM service sector ‘supplier deliveries’ for March. Is this what a ‘no landing’ look like?

Below is the complete clip of Rick Rieder’s comments in Bloomberg’s The Open on Friday, April 5:

2. Rates

Kudos to @jaykaeppel for warnings about TLT last week:

- Jay Kaeppel@jaykaeppel – Mar 26 – 5-week average of 30-year Treasury Optix crosses above 80% for first time in six months. NOT an “automatic sell signal”, BUT definitely an item for the unfavorable side of the weight of the evidence ledger for bonds. @sentimentrader

Those who listened to him saved themselves a lot of pain this week. What does he say this week?

- Jay Kaeppel@jaykaeppel – Apr 5 – Another potential warning sign for long-term treasuries. Bullishness coming back with a vengeance per Conference Board – Bonds indicator. Small sample size, but make of it what you will. @sentimentrader

Speaking for ourselves, we hold on to our belief that the April 2024 reflationary move is similar to the April 2008 reflationary move. What did TLT & the 10-yr yield (TNX) do then? Deliver a buying point in June!

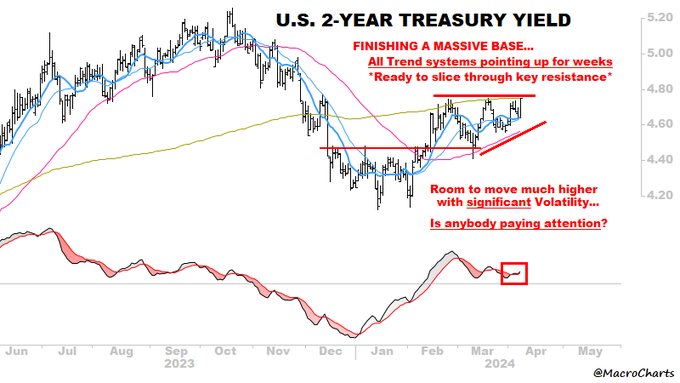

Frankly what should scare equity investors is the message of the chart below – the one that might bring on a Fed Rate Hike scare!

- Macro Charts@MacroCharts – April 6 – Is anybody paying attention?

Speaking of long-duration Treasuries, why not listen to the one who has been far more right than most & delivered high returns to those who listened to him? He is Gary Shilling & look what he told Julia LaRoche:

- “(min 27:00) I like US Treasuries ; they are safe haven; …. inflation is coming down more slowly but it is coming down ; is diminution of inflation that is really important; … we are looking at an easing of inflation & that is the biggest driver of interest rates; … if you look at the entire post-WWII era & long-term Treasury bonds, there is a 70% correlation between yr/yr change in CPI & Treasury bond yields; that’s amazing given other factors that could affect that; …. but the primary determinant is inflation ; and so if you are right on inflation, you got a big leg up in forecasting Treasury Bonds…I think we are in a period of easing inflation, not as quickly as some people had hoped, but I think we are on that path; .. In my views a strong reason for Treasury Bonds PLUS a safe haven … it is probably the biggest safe haven instrument in the World … ” /

3. Commodities

In sharp tactical contrast to the above,

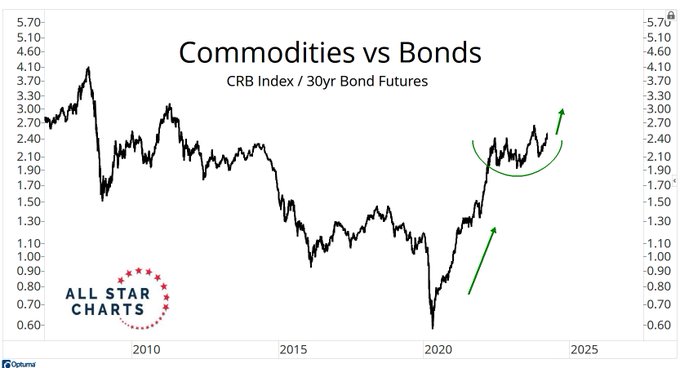

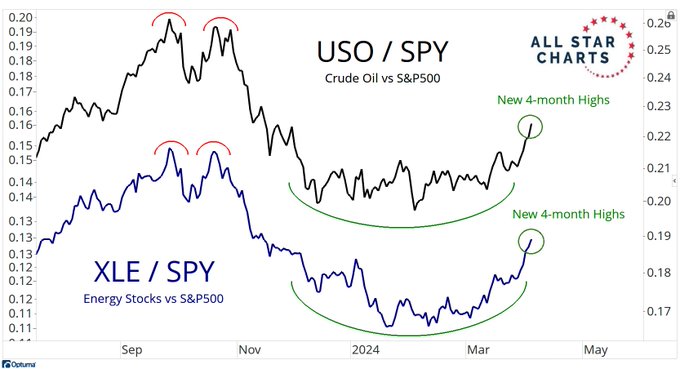

- J.C. Parets@allstarcharts – Apr 5 – Are you going to tell me this is a downtrend? Commodities are king this cycle. Not stocks. And certainly not bonds https://allstarcharts.com/commodities-stocks-bonds/

And,

A breakout?

- David Keller, CMT@DKellerCMT – · $XLE is breaking out of a monster base on the weekly chart. Top ranked stocks using @StockCharts SCTR rankings: $MPC $PSX $VLO $FTI $TRGP $FANG

Switching to precious metals:

- Jesse Felder@jessefelder – ‘Silver is attempting to break out of a massively bullish “cup with handle” price pattern.‘ https://kimblechartingsolutions.com/2024/04/silver-breakout-adds-to-massively-bullish-price-pattern/ by @KimbleCharting

Finally a cautious opinion:

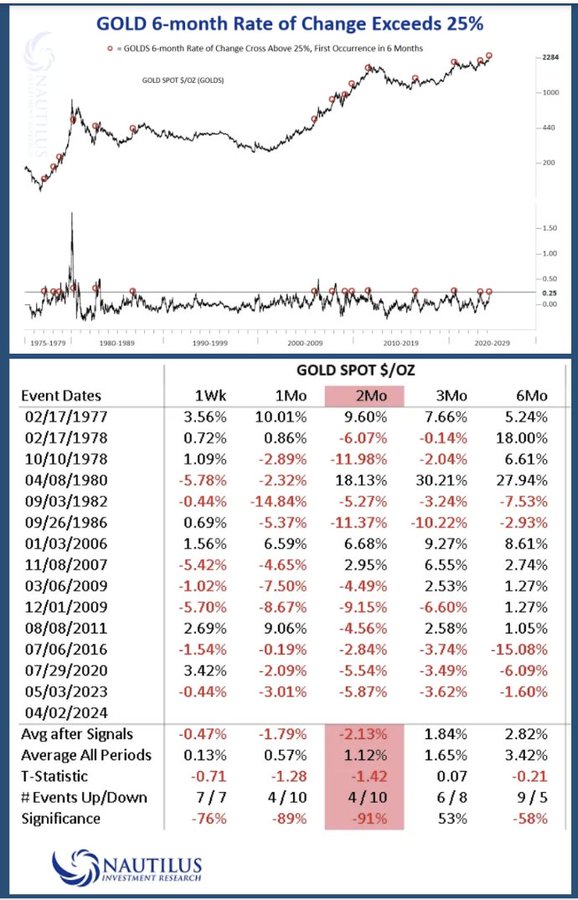

- Seth Golden@SethCL – Prospecting for #GOLD ? After a 25% gain, you might wanna lower expectations? Over the next 3 months the returns are historically negative, with GOLD falling in price, after such a rally! $SPX $SPY $QQQ $GLD h/t @NautilusCap

4. Stocks – S&P, China, India

Given the impact of potential geo-political events that might take place post-Ramadan, all we do today is show a comment re Thursday’s fall.

- Jason Goepfert@jasongoepfert – The S&P 500 is on track to hit a 52-week high (closing prices) intraday to completely collapse to a 10-day low on the same day. It’s only happened 4 other times since 1993. Two of them eventually preceded the 2011 correction. The other two, nothing.

China – So many people are waiting for Chinese, at least Hong Kong & tech stocks, to rally from their oversold condition. China’s Securities Regulatory Commission has a new chairman & that apparently has tended to mark a bottom, CNBC’s Jon Fortt said. Then he asked Marko Papic of ClockTower whether it might be so this time too: Marko Papic said:

- “eventually the answer would be yes; my concern right now is that while we have had a pickup in manufacturing activity which is a global phenomenon ( you saw that in US as well this week), the problem with the domestic economy really relies on credit growth ; … that number for China is actually down 12% for the combined Jan-Feb months which takes out the effect of their New Year; So that’s a problem – its the lowest rating since 2012; the stocks have bounced back on rumors of policy support, but we haven’t seen any fiscal support thus far; I think this rally will have to go to the bottom in January & then I think you will have a great entry point in China in Chinese equities“.

In response to a question by Fortt, Papic compared the situation to US:

- “in the US we have had 10 years of de-leveraging; US households also got 3 trillion dollars worth of stimulus in 2021. In China they are where we were 10 years ago; they are in the decade of de-leveraging; that’s why we are constantly being disappointed by their credit data & that’s why it is very difficult to invest in anything in China that depends on domestic economy; now externally focused companies that are selling abroad are benefiting from American consumption & European recovery & that could be an investment strategy for the remainder of this year & into next year .… “

This would have been a perfect spot for a Louis Rukeyser student to ask names of such externally focused companies. Papic went on to give some examples of industries:

- ” its like in Germany; right now the DAX is at an all-time high even though German economy is effectively in recession; so if you have externally oriented equity indices, they can do well even if the domestic economy is suffering; in China’s case, it would be a lot of EV manufacturers, battery supply chain, alternative energy companies should do well; PLUS because of the situation at home, the currency may be quite weak which makes those companies quite competitive … for next 6-18 months; … However, for most investors, I would say that domestic credit is NOT confirming a rebound in China… On top of that, the government is imposing austerity like we did in 2010, 2011 when the Tea Party came to power; … same things are happening in China – they are actually trying to narrow their budget deficit at the same time as their private sector is de-leveraging… I would wait for the policy makers to commit much bigger support for the real economy … “

Kudos to CNBC’s Jon Fortt for enabling Marko Papic to make so many points. It is a confident anchor who lets an expert add so much value as Papic did above.

Below is another value-added discussion on Bloomberg with Mark Mobius, the first name that comes to mind when you say emerging markets.

Japan-India – The conversation began with the Japanese Yen about which Mobius said:

- “Japanese are fighting a losing battle & they better give up; there’s no way that they are going to do anything to strengthen the Yen & it will probably continue to weaken at the end of the day; .. the other interesting thing about the Yen & about Japan in general is that a lot of Japanese investment money in finding its way into Southeast Asia & to emerging markets generally; …. so the Yen will be distributed widely in these emerging market countries“

When asked his top pick among Asian countries, Mobius replied:

- ” the pick for me is India; India is the place even though India has come back a lot & it has even at some point outperformed the US market. India still has a long way to go. … And Japan is going to play a role in India .. they’re are beginning to make a big push into India. That’s going to help not only Indian stocks but its also going to help Japanese stocks as well, those who are going into India”.

Those who want to understand the level at which this is being done should hear Indian External Affairs Minister JaiShankar say the “World will watch … ” how Japan & India support each other thru various relationships and initiatives,.

Moving to India proper, we confess we have been having a degree of difficulty in being bullish on India in the short term given how far Indian stocks have come. Our proven style has been to go in when foreign investors run out & Indian stock market undergoes a correction. That doesn’t work first with the fact that the Indian stock market is now dominated by Indian investors & not foreign ones and secondly we are just stunned with the progress we are seeing in so many sectors.

But how & why would someone jump in at high valuations? So we were so happy to hear the hard question asked by Bloomberg’s Mark Cudmore to Mark Mobius:

- “Are you not concerned by just the extreme valuations we’re getting in the Indian stocks. I understand the structural story – incredible growth, great demographics – long term brilliant but the valuations in Indian stocks – they make US stocks seem discounted & cheap. I just don’t see where is the most upside for the year ahead – a lot of other Asian stock markets like Vietnam, Hong Kong, that seem much more discounted compared to India.”

Oh, Man! Bravo Mr. Cudmore! And, as you will see, a double Bravo & Oh Big Man to Mr. Mobius for his clear-cut answer below:

- “very interesting point to make, because if you look at PE ratios, yes other markets look cheap; .. what we focus on is Return on Capital, Return on Assets. And if you look at Indian companies in that regard, they are doing exceptionally well; … what we found is that companies with a high return in capital, high return on assets tend to catch up on the PE level; … PE is high at the time you notice high return in capital; But as you go forward, that PE level comes down because of high return on capital because earnings are growing faster than the price.”

Isn’t that why $NVDA doesn’t go down despite its high PE? What Mobius said is absolutely true about the smartest Indian companies.

On the other hand, Indian growth is NOT going to match India’s ambitious targets without new sectors coming up & delivering growth in earnings that hasn’t been counted or even expected yet. And that is entirely due to PM Modi, his drive, his ambition and his ability to galvanize his nation with a perfect goal. It was in 2014 when he launched Aatma-Nirbhar-Bhaarat-Abhiyaan – Aatma being Self, Nirbhar (reliant on) Bhaarat (India) & Abhiyaan (drive). We loved the concept but we, frankly, did NOT expect it to succeed so phenomenally. This has made a few sectors into long term drivers of double digit growth for next 20 years or more.

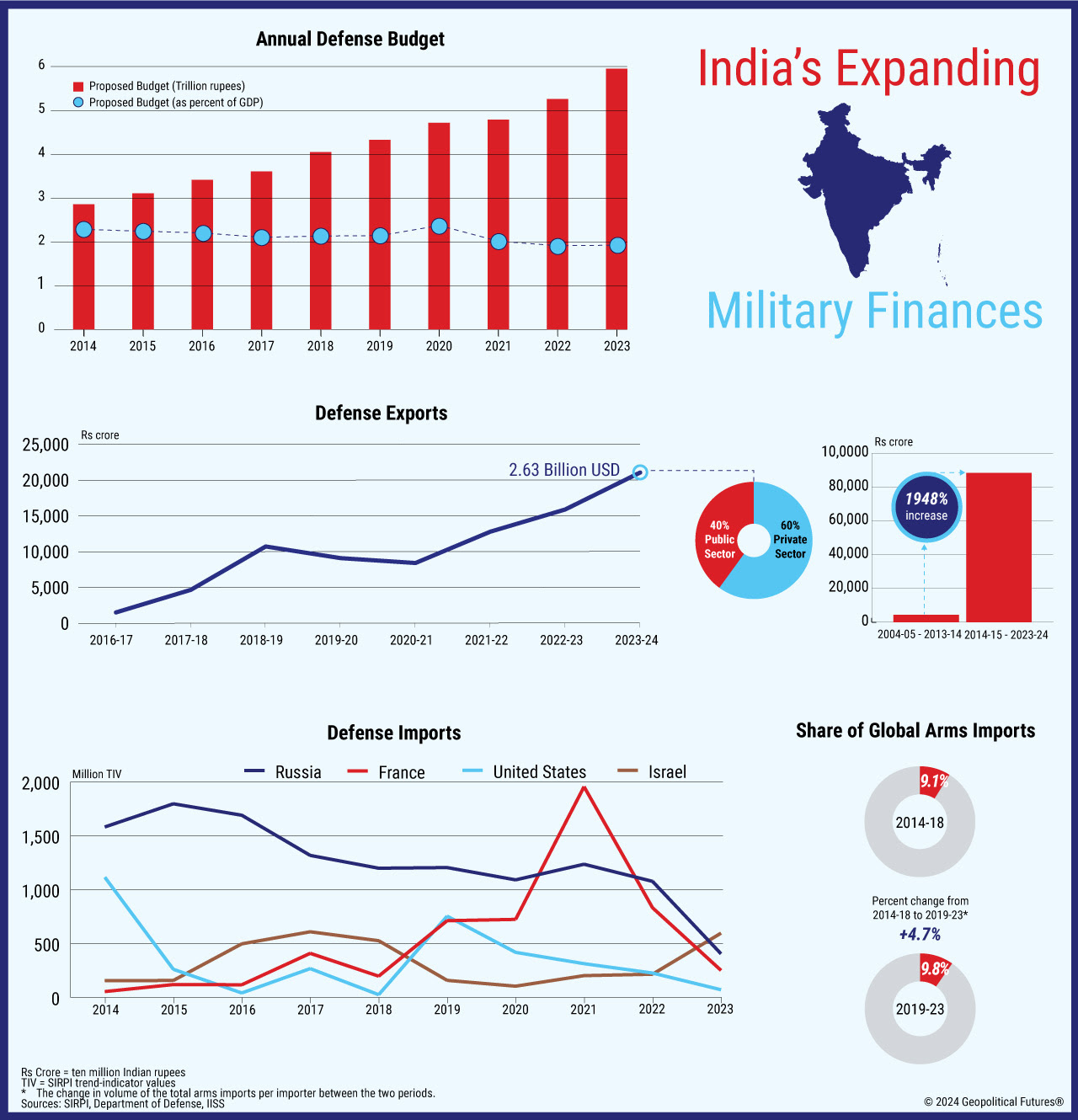

The Defense sector is one we have been focusing on. As PM Modi said recently, when he became PM, India was the largest importer of arms in the world & no one had heard of India exporting arms. This is where the Aaatma-Nirbhar-taa doctrine has paid off big. In 2023, Indian defense exports reached $2.6 billion and PM Modi has assigned a $5 billion target for 2025. Now geostrategic firms have begun to take notice:

(Courtesy of Geopolitical Futures)

And the exports are among the large, complex kind – BrahMos supersonic missiles, Military Aircraft. But the export orders are still of a 200 million to 400 million range, not in the US multi-billion range.

Understand we feel utterly stupid in even speaking about stocks like HAL or Hindustan Aeronautics Ltd. We have known of this company for decades but as old foggy public sector company. To realize how stupid we feel, look at the chart. We saw the vertical move in November with the ChandraYaan landing on the south pole of the moon, but thought it was an over-reaction. Stupid is a compliment given how we feel, HAL have launched a new fighter aircraft Tejas MK1a to be followed by Tejas Mk2 which will have the GE F414 engine.

We see so many Indian ETFs including the Indian Internet ETF but, as of now, no one has launched an Indian Defense ETF. Already 80 countries are importing some defense equipment from India when Indian defense orders are just making their mark.

By the way, the above doesn’t mean India is reducing imports of sophisticated equipment. In fact, despite its jump in export revenue, India remains the world’s 2nd largest defense importer. Just look at the sophistication & scale of the US-India military relationship:

By the way, this week India launched its Agni-Prime missile that borrows from last month’s launch of long-range MIRV-ed Agni 5 missile . This Agni-Prime missile is capable of hitting moving targets & has a range of 1,000 – 2,000 km. It can be launched from a truck or a railway bed anywhere. Watch the clip below & see why Agni-Prime is labelled by some as a Carrier-killer. Guess whose aircraft-carriers will be deemed as not entirely welcome in the Indian Ocean?

These launches are keeping us away from discussing another sector of big potential, both for India and for friendly countries. Last month, India became only the 2nd country in the world with this technology. Hopefully, it will draw attention of those who are long term bulls of Uranium.

It is this competition with what used to be a fat & lazy publicly owned sector that is forcing Indian private companies to focus on return on assets & return om capital as Mark Mobius said on BTV.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on Twitter