Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Markets last week

Is there any one who doesn’t know what the market did last week? But it might be useful to factually state how bad it was & it might also help when we look back.

US Indices:

- VIX up 48.7%; Dow down 2.9%; SPX down 4.2%; RSP down 3%; NDX down 5.9%; SMH down 11.6%; RUT down 5.7%; MDY down 4.9%; XLU down 65 bps;

Key Stocks & Sectors:

- AAPL down 3.9%; AMZN down 4.4%; GOOGL down 7.9%; META down 4%; MSFT down 4.1%; NFLX down 5.2%; NVDA down 14%; MU down 10.5%; BAC down 5.1%; C down 5.7%; GS down 6.1%; JPM down 5.8%; KRE down 5.2%; EUFN down 2.9%; SCHW down 3.8%;

Dollar was down 32 bps on UUP & down 49 bps on DXY:

- Gold down 43 bps; GDX down 5.9%; Silver down 3.4%; Copper down 3.5%; CLF down 13%; FCX down 10%; MOS down 10.4%; Oil down 7.3%; Brent down 9.3%; OIH down 8.9%; XLE down 5.7%;

International Stocks:

- EEM down 3.5%; FXI down 3.5%; KWEB down 1.4%; EWZ down 1.7%; EWY down 7.6%; EWG down 2.9%; INDA down 2.2%; INDY up 3 bps; EPI down 2.7%; SMIN down 57 bps;

Rates along the Treasury Curve fell hard with rates in the belly of the curve down the most;

- 30-year Treasury yield down 18.2 bps on the week; 20-yr yield down 19.9 bps; 10-yr down 19.6 bps; 7-yr down 20.9 bps; 5-yr down 21.2 bps; 3-yr down 24.3 bps; 2-yr down 26 bps; 1-yr down 30.4 bps;

- TLT up 3%; EDV up 4.5%; ZROZ up 4.8%; HYG down 33 bps; JNK down 34 bps; EMB down 17 bps;

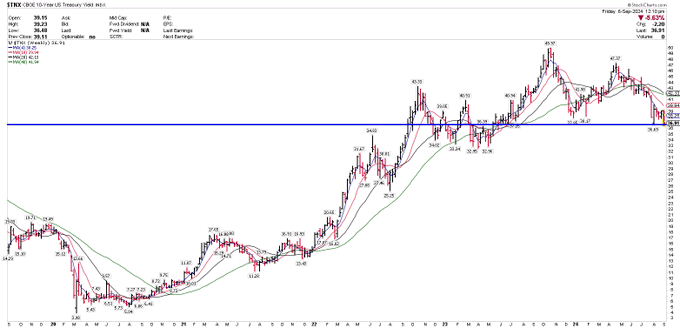

Looking at what smart traders on Fin TV love to hate, the 30-year Treasury yield dropped to 2024 lows on Friday:

But there was a silver edge to the above red action on Friday’s 1-day chart:

A pretty steep rally in the 30-yr yield from about 10:20 am to just after noon & the 30-yr yield closed UP on Friday & that too closed a bit above 4%. And NVDA bottomed just at the moment the up move in TYX stopped just after noon.

We are known to be simpletons to the point of being naive but does the above NVDA action have anything to do with what Dan Niles said on CNBC Closing Bell Overtime:

- “we covered some of the AI-related shorts at the end of the day because some of them were getting oversold – its never a straight line down … you are going to get some rallies; so I took some of those positions off … “

NVDA did close up 2 points from that low just after 12 pm. Naively we wonder whether other traders began covering some of their shorts a bit afterwards; not just in NVDA but in SMH, & NDX. Frankly, we did think the close above 4% of the 30-yr yield was interesting.

That brings to mind what Rick Rieder (doesn’t he now define BlackRock than vice versa!) said on Bloomberg TV – Market Rate Cut Pricing Is ‘Aggressive: . To elaborate further he said – “last 3 months core CPI is running under 2%; take out shelter which is running negative …. you have a slowly deteriorating labor market … but the slope of the line is not that intense so they should go 50 but will they – I don’t know” .

Another smart guy posted that “they are buying Bonds” & actually explained why:

- J.C. Parets@allstarcharts – Sep 7 – What does the yield curve mean to you? Are you one of these recession people lol? Or are you one the ones who is only looking to profit in your own portfolio? Put me in the latter group. Here’s what we’re doing https://allstarcharts.com/all-star-charts-premium/2024-09-06/bonds-hit-new-year-date-highs

And,

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – Sep 6 – $TNX weekly rollover with a lot of room to the downside. Wide ranges and bounces are possible, but the weekly trend has rolled.

As reported by Fin TV, Apollo’s Torsten Slok said after the NFP that – “This report is better than in July. This economy is not slowing down in the way that markets are anticipating. We will not get eight cuts over the next 12 months.”

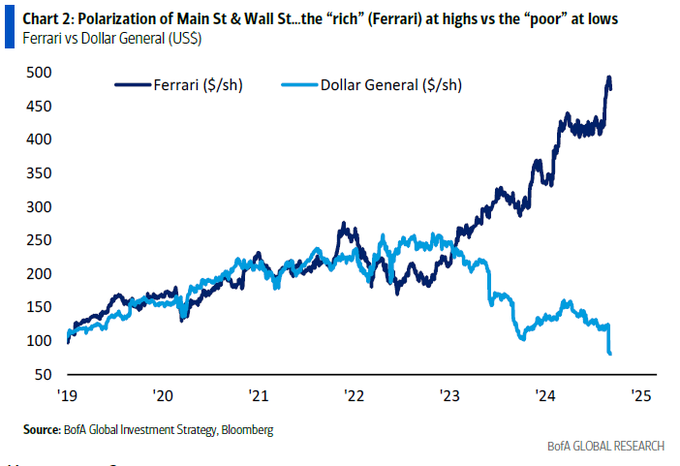

Could the “polarized consumer” be responsible for this divergence of opinion?

- Thomas Thornton@TommyThornton – A great chart of the polarized consumer today from BofA

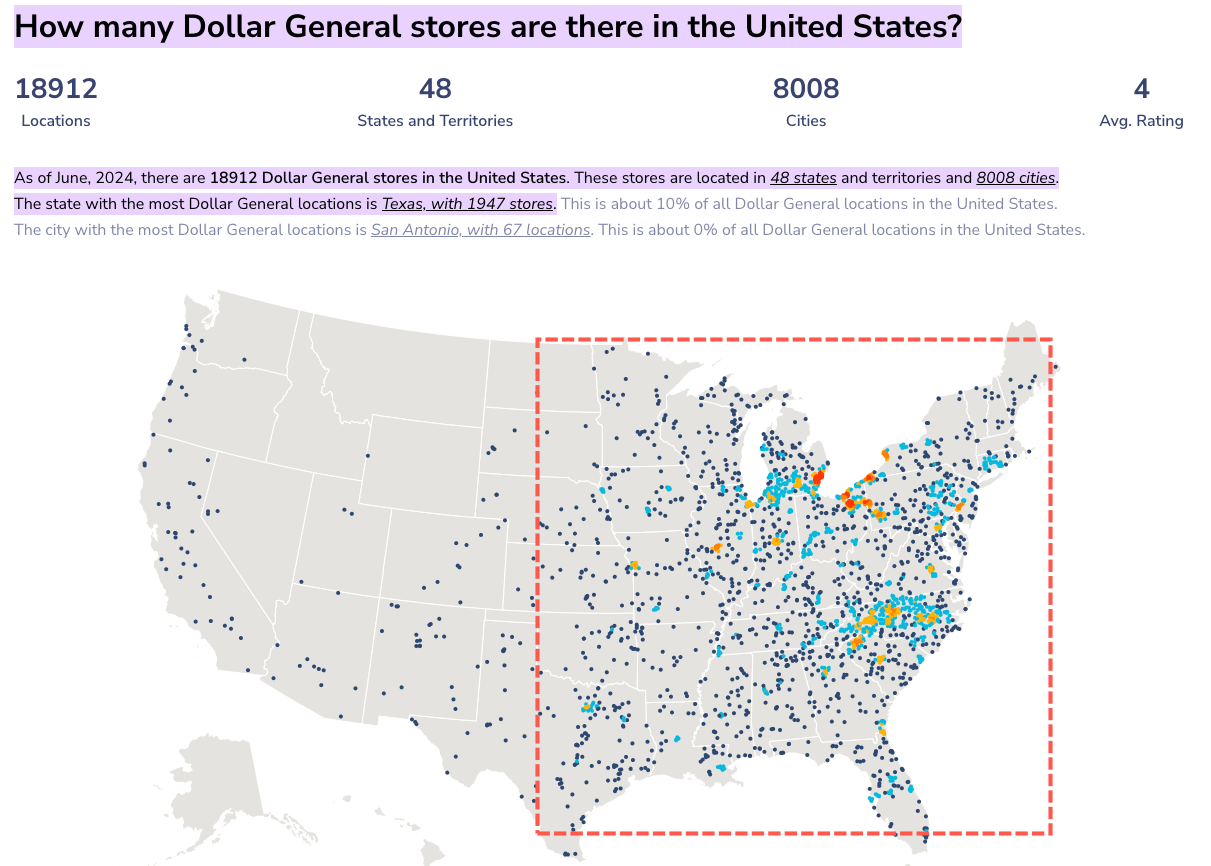

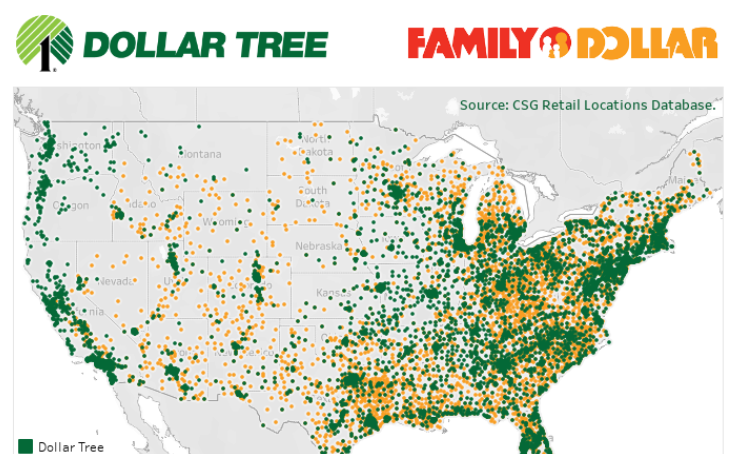

Would this have a major political consequence this November given where Dollar General, Dollar Tree et al are located, as ZeroHedge reported?

2. Equities

We have to congratulate the gurus we featured in our Section 2. On the other hand in our August 25, 2024 article

- John Kolovos of Macro Risk Advisors who said – in election years, volatility tends to rise ; that’s why I like VIX calls right now; there should be hiccups along the way; its very rare to see the market rip from this point until election day; … there is huge risk coming to the market right now

- Larry Williams via Jim Cramer – “this rally is kaput; …. rally will run out of steam by August end; … there will be a rally in September but it will be sold; the real rally will begin 2 months from now … “ … “Larry’s charts showed tough sledding for the S&P 500 next week led by the most important stock in the entire market … NVDIA; Given that the market is overbought plus the short range oscillator …, the idea that the rally is kaput has some resonance; “

- Tom McClellan in his article Annual Seasonal Pattern’s Late Summer Dip. – we should see a decline from here to a preliminary bottom due in late September, followed by a retest bottom in early October. But the stock market does not always follow such average patterns exactly. The situation is further complicated by this being a presidential election year, so the normal seasonal up move that happens in late October may not happen this time. In election years, investors often continue holding their collective breath until the votes are tallied in November.“

What now? Tom Lee had predicted a 7%-10% correction till November. He pointed out before the close on Friday that the S&P was already down 5%. So he wouldn’t sell more now, perhaps because he thinks the Fed can engineer a soft landing.

A different way to characterize this week is:

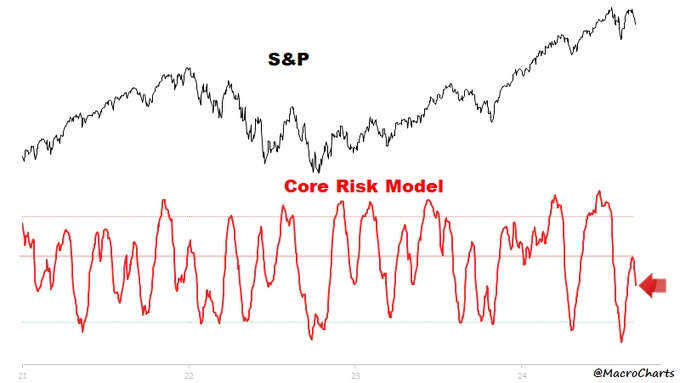

- Macro Charts@MacroCharts – Sep 7 – Momentum Crash in full force: Stocks were hanging by a thread all week, with significant risks building. A classic secondary failure now underway — with room to get much more oversold.

Having mentioned what we said above about NVDIA making Friday’s bottom below 101, we have to feature some smart opinions about Semis:

- Seth Golden@SethCL – Sep 7 – Put up, or shut-up time for Semis. Head to gun 🔫 suggests test of 200-DMA for support, with 5-day RSI at 17 (wowsa)and closing below lower Bollinger Band, bounce is imminent. Renewed uptrend likely demands 2 consecutive weekly closes back above 200-DMA. $SPX $SMH $SOXX $NVDA $QQQ $AMD $MU

We quoted above from Dan Niles regarding his covering some of his AI-related Shorts on Friday afternoon. He makes sound points, historical & fundamental, about NVDIA & others in the clip below. We only wish Jon Fortt did not take away his time by a needless academic-type question:

3. China-India

As John Maynard Keynes not so famously said – “Words ought to be a little wild for they are the assault of thoughts on the unthinking” (via @chris_robb1).

No one in our limited experience follows this Keynes dictum more frequently than Jim Cramer. This section is due to the clarity of his two 1-liners on Friday morning. If you find this section helpful or even tiny bit interesting, give kudos to Cramer.

Cramer said “China is a disaster” referring, as we recall, to the downgrade of China by JPMorgan, hitherto the most bullish shop on China. That led us to:

- Christopher Robb@chris_robb1 – – I think China’s problems are structural and long-term. Those expecting a quick economic recovery from government stimulus will likely be disappointed. x.com/chris_robb1/st #China #Economy #Asia #Ecommerce $BABA $KWEB

This lovely image is from Mr. Robb’s article titled – Pain is coming to Chinese Stocks. At the top, the article quotes Zongyuan Zoe Liu, China’s Real Economic Crisis:

- “Simply put, in many crucial economic sectors, China is producing far more output than it, or foreign markets, can sustainably absorb. As a result, the Chinese economy runs the risk of getting caught in a doom loop of falling prices, insolvency, factory closures, and, ultimately, job losses. Shrinking profits have forced producers to further increase output and more heavily discount their wares in order to generate cash to service their debts.”

Kudos to Mr. Robb for a long & detailed article. Any one interested in China should read it, in our humble & uneducated opinion. We are more used to quick comments such as:

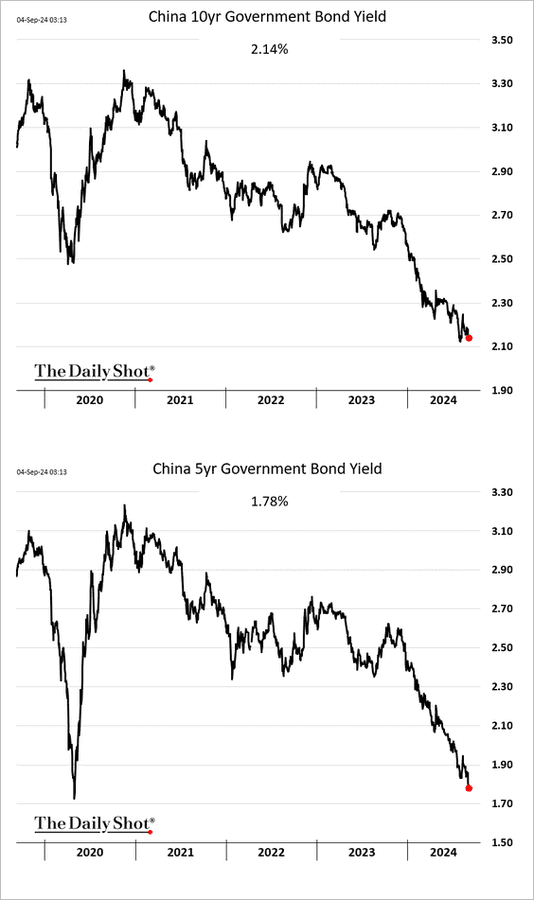

- (((The Daily Shot)))@SoberLook – The PBoC has been selling bonds to raise yields, aiming to avoid sending a signal of China’s economic weakness. So far, it’s not working.

On the other hand, charts like the one below suggest a trading bounce is likely as discussed on X.

Last week, we featured an attack by the Baloch Liberation Army on Napaki military venting their anger at China’s role in grabbing Balochistan’s mineral & fishing assets. In this section, we provide an economic presentation of why China went that far away across a restive region to invest as the central asset in China’s One Belt One Road initiative. Giving that up would be a serious blow to both China & the power of President Xi Jin Ping. Seriously watch the clip below & ignore the flaming title used for promotion on YouTube – the clip below is a thoughtful semi-scholarly discourse.

Later on in the same show, Cramer said he didn’t understand how India is growing so much. Kudos to Cramer for his honesty. So many are probably wrestling with the same question. Everybody has known about India for years if not decades. Now seemingly all of a sudden, the term India comes up everywhere catching some CNBC anchors unawares.

An amazing change has occurred in the 5 months since PM Modi’s election in June 2024. At that time, we coined the “Modi Unbound” to illustrate what we thought might happen until 2029. He has been almost all over the World (except perhaps Latin America) with his message that they should use India as the base for their operations in Asia from the Middle East to the Far East. And he has demonstrated that India is equally at ease in dealing with Putin as with Biden-Zelenskyy and operations in India will benefit them both in different ways.

Look at this recent visits – Poland, Ukraine, Singapore, Brunei. The message is the same – invest in India, sell in India & use India as a base to sell from Saudi Arabia/UAE to Near East like Malaysia/Indonesia to Singapore/Philippines & beyond. In most countries, there is an Indian diaspora to back him up. Look at the Bloomberg article about India & Singapore signing a Semiconductor deal. Another positive factor for India is the new respect for Indian Military power in Air/Sea/Land and the wide array of Indian-designed, India-manufactured weapons that many are impressed with.

The world is absolutely fed-up with what the Ukraine war has cost the world. In the midst of all that, India is the one country that proudly & realistically advertises friendship with both. Add to that the demographic growth & you have a unique story in the world. Russia wants to import Indian workers & Indian techs to live & work in India. So does Poland. A world tired of poor & unemployable migrants wants peaceful, hardworking people who have proven in the Middle East & other lands that they can assimilate & help their host country grow.

Add to that the massive growth in useful, productive infrastructure all over India, a country of its size. Not that India does not have problems but, for the first time, the world recognizes that India has a Government that is absolutely wedded to progress & growth.

India’s biggest problem has been its neighbors. But even that bothers partners less and less. Look at Malaysia, a determined Muslim nation that has been cold to India, visiting India & discussing ways in which both countries can partner. And Malaysia has expressed serious interest in India’s new fighter plane Tejas & its runaway success with Brahmos missiles.

The contrast with China could not be more stark. But that in itself creates a problem for China.

4. Geopolitical – Indian subcontinent

4.1 Land (Stan) of the Morally/Spiritually Pure (Pak) – China

Many major cities in America have been subject to walk-in shoppers simply lifting merchandise they like & walking out. We thought a limit had been reached when the local Fairway Market began locking up Haagen-Das Belgian Chocolate ice-cream. But then we realized how Harbaugh’s “who’s got it better than us” cry is valid for us as well.

Look what happened to a new shopping mall opened in Karaachi, the most prosperous & business-like metropolis in NaPakistan. Named the Dream Bazaar Mall, it became a nightmare for the overseas Owner in 30 minutes. Watch the 3-minute clip & see for yourselves how the multi-storied mall was looted in literally 30-minutes.

Again this is in a luxury shopping area in the largest city, the center of business & located in the most peaceful province in NaPakistan. Last week, we showed the day when traders all across that land had shut down their shops in protest of inflation & taxes.

So how is the Napak Government spending its monies? By establishing martial law in Balochistan to protect Chinese investments after last week’s massive attack in Balochistan.

Last week, we had reported that the Majeer Brigade of Balochi Liberation Army that had attacked the Napak military had been trained by the TTP (Tehrick-e-Pakistan) or Pakistani Taleban. This week the TTP announced publicly that they will now do operations with the Balochi Liberation army as their partner. That has to send chills thru the Napaki Government. But at least Balochi group is new & small and the TTP is still only capable of isolated attacks. At least, the real Taleban of Afghanistan is not involved, right!

Guess what happened on this past Thursday night on the Afghanistan-Napakistan border. This Thursday night (Afghan time), Afghani Taliban forces attacked the Napaki army posts near Spin Boldak & Torkhum & built new border posts into hitherto Napaki territory. The Talebani guys said the new border is where they are erecting the border posts. Remember neither the pre-Taleban Afghan govt. nor the Taliban govt. have ever accepted the British-established Durand Line (in 1890s) as the border between Napakistan & Afghanistan. As the clip below (minute 1;12 to minute 1:29) shows, the Taliban demand to pushback today’s border from Spin Boldak to Torkham crossing worked.

The Afghani forces attacked the NaPakistani forces at midnight when the Napakis were at a disadvantage. What disadvantage you ask? Remember how much military equipment the US left behind while leaving Afghanistan in a hurry! Apparently, the new Taliban army now has 42,000 pieces of night vision fighting equipment while the Napaki army has zilch. So in a night fight, the Taliban fighters can create havoc with the Napaki army.

Seriously folks, look back & read our article Afghanistan or Pakhtunkhawa or Both? written on July 10, 2021 in the immediate aftermath of the US withdrawal under President Biden. In that article we quote a WSJ article quoting a Napaki military official as saying:

- “Our jihadis will be emboldened. They will say that ‘if America can be beaten, what is the Pakistan army to stand in our way?’” said a senior Pakistani official. “War does not suit us at all. We’ve seen it for 40 years.”

Our thesis at that time was that, despite Napakis celebrating US withdrawal as their victory, Napak will now become the frontier at-risk land. That seems to be proven accurate.

But wait a minute. The Taliban-Afghan regime doesn’t have anything to combat the Napaki airforce, right? Well, if we all get that, don’t you think the Taleban get that? Guess what is another fresh piece of news from the Taleban? As the English-language clip below reports, the Talebani Afghan government is negotiating a deal to buy air defense equipment from Russia.

Wasn’t the Taleban created by the Reagan Administration & NaPaki Government to fight the occupation of Afghanistan by the Soviet Union? Now Russia will probably supply military hardware to the same Taleban to fight the Napaki Government. Let us all be thankful that the USA is out of this mess.

The reality is that Afghanistan, Balochistan, India have existed as entities for thousands of years. After all it was thru Balochistan that Alexander took his beaten-down army out of India into Iran. All the problems in the area began when Britain created this vile artificial entity named Land (stan) of Spiritually Pure (Pak).

Now for the final piece of the map:

Once again look at the above clip from minute 2:10 onwards to see people sitting on a mountain road & blocking it. They are the predominantly Shia Muslims living in the area labelled Pakistan Occupied Kashmir (POK). This is Indian territory under the Partition Agreement which Napak keeps occupying. Now as you can see, the Muslims of POK are fed up of NaPakistan & want to merge into India.

Strangely the Taliban Government in Kabul has publicly come out in support of POK being remerged with India. Why? You ask? Look at the orange labelled Wakkan Tract within Afghanistan in the above map. That is the ONLY land access between POK-India & Afghanistan-Wakkan.

Why is the Taliban interested in a land border with India? Historically Afghanistan has traded with India for thousands of years. That’s true but secondary. What does the Taleban really want? They want to deliver the shortest & most economical route between India & Russia. If you think we are joking, go back & read our article on May 21, 2023 titled Now The Other Side of the Globally Mega Deal? Or watch the clip from that article that we re-post below:

Think and realize that every part above reduces China’s footprint in the Afghanistan-Balochistan-POK belt through which China’s One Belt One Road initiative passes. So the big big achievement of Xi Jin Ping & China’s treasured dream of access to the Persian Gulf is kaput when the small countries & people become truly independent of the artificial entity named NaPakistan. And that risk is due to the increased power & presence of India.

But before we discuss that, we have to go across India to the Bay of Bengal & the Indian Ocean

4.2 BanglaDesh & India

In the midst of all the unrest inside NaPakistan, the new coup-established regime in BanglaDesh is trying to create an alliance with NaPakistan. Not unsmart but is BanglaDesh going to give part of its Treasury to a needy NaPakistan? Or will NaPakistan send some troops to BanglaDesh? If so how?

We heard media reports that BanglaDesh is reviewing all the MoU (memorandum of understanding) that BanglaDesh had established with India with the goal of terminating those deemed unsuitable for today’s regime. We also read reports that India in turn is doing the same and has taken steps to stop expanding the diesel pipeline from India into BanglaDesh.

In the meantime, Yunus, a Nobel Peace Prize winner & reportedly an associate of Hillary Clinton, is leading a regime that is pro Al-Qaida (having released its leader) & now helping BanglaDeshi Jammat-e-Islami deal with China.

In the meantime, stories abound about the lynching of a 15-year Hindu boy by Muslims inside BanglaDesh.

What happened to the socialist-oriented students running the new regime in BanglaDesh?

4.3 Back to China-India

The above shows that the stage is building towards a decision China might need to consider – whether they keep losing mindshare to the benefit to India or whether they create a military conflict to damage current Indian stature. The next 2.5 – 3 months will be important because once December begins, snows begin to shut down mountain passes across the China-India line of control.

In this context, it is interesting that at this week’s meeting of the Joint Chiefs of Staff of the Indian Army, Navy & Air Force, Indian Defense Minister stressed the need for the Indian military to be ready for war if one is forced on India. An interesting and simple statement given the flareups on all 3 sides of India’s border.

Kinda akin to a simple statement by Cramer that led to the above detailed examination?

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X.