Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Ukraine Truce, a necessary big step

The big event on Friday February 28 was the “utter & complete disaster” of & by Zelenskyy in his Oval Office meeting with President Trump. That, apart from the month-end fireworks, let to the rally on last Friday afternoon.

Despite the NFP report on this Friday morning & the cool comments of Fed Chair Powell, we think the big event on Friday March 7 was the statement by President Trump in the Oval Office when asked if “President Putin is taking advantage of the US pause right now“:

- ” I actually think he is doing what anyone else would do; I think he wants to get it stopped, settled & I think he is hitting them harder than he has been hitting them and I think probably anybody in that position would be doing that right now; he wants to get it ended”

That, to us, settles it. It is the singularly clear declaration from President Trump that is absolutely bullish.

He had added earlier:

- “I believe him [Putin]; I believe him; I think we are doing very well with Russia; …. I am finding it more difficult frankly to deal with Ukraine and they don’t have the cards; I find that in terms of getting the final settlement, it might be easier dealing with Russia which is surprising because they have all the cards”.

He had also remarked earlier:

- “I think Ukraine wants to get it ended … but I don’t see it …. I don’t quite get it … I don’t know they want to settle; if they don’t want to settle, we are out of there because we want them to settle”

Interestingly, CNN-News 18 reported at Friday 3 am NY time that Putin is ready for Ukraine Truce Talks But With Conditions. We wonder if that suggests that the Saturday morning report by CRUX that “10,000 Ukrainian Troops Fear Encirclement in Kursk” is realistic. After all, Ukraine has reportedly planned to give back the Russian territory of Kursk it holds in exchange for some of the Ukrainian territories held by Russia. But what if Russia takes back Kursk or captures 10,000 Ukrainian troops before the Truce talks begin? No wonder President Trump remarked “I don’t see it …. I don’t quite get it” about Ukraine’s lack of desire to “settle“.

We think President Trump laid it out simply, clearly and firmly. But the trouble is that, in our opinion, the Ukraine disaster is just a symptom, not the disease. And curing the disease will take awhile. More on that later.

Economically the most bullish message that came through in Friday’s NFP report was:

- Secretary of Treasury Scott Bessent@SecScottBessent – The reprivatization of the American economy is just beginning. February’s jobs report showed that 93% of the jobs created were in the private sector.

We have heard Secretary Bessent speak on different networks last week. We think he could prove to be the best & most profound architect of the US Treasury market & the US economy, perhaps since the 1st ever Treasury Secretary, Alexander Hamilton.

Just think – President Trump leading a transformation of current EU-afflicted Europe and Treasury Secretary managing the re-privatizing the US Economy from its current pathetic public dependency! Could you think of anything more BULLISH for America & the World?

2. Markets Last Week

US Indices:

- VIX up 19.9%; Dow down 2.4%; SPX down 3.1%; RSP down 1.9%; NDX down 3.3%; SMH down 3.3%; RUT down 4.1%; MDY down 3.4%; XLU down 2.4%;

Key Stocks & Sectors:

- AAPL down 11%; AMZN down 6.3%; GOOGL up 2.1%; META down 6.5%; MSFT down 1%; NFLX down 9.2%; NVDA down 10.2%; MU down 1%; BAC down 10.3%; C down 12%; GS down 10% JPM down 8.3%; KRE down 7.3%; EUFN up 7.1%; SCHW down 5.3%;

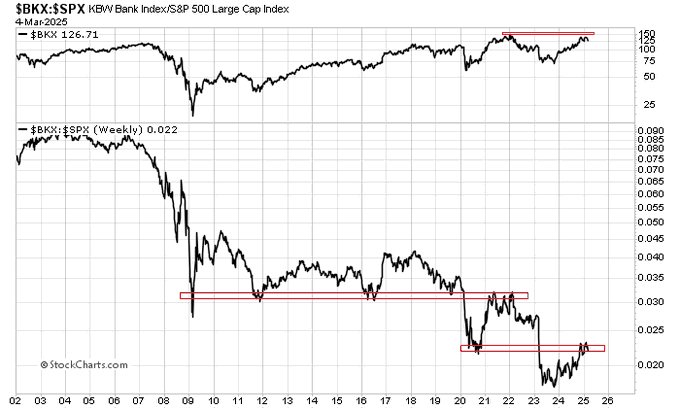

No Mas, said one about America’s great banks:

- Mark Ungewitter@mark_ungewitter – Banks? No thanks.

European Banks? Yes said another:

- J.C. Parets@allstarcharts – The European Financials ETF hit new all-time highs again after a historic week. Stock market investors keep winning, but all they keep telling you is how bad things are lol

Dollar was down 3.4% on UUP & down 3.5% on DXY:

- Gold up 2%; GDX up 4.8%; Silver up 4%; Copper up 3.4%; CLF down 9.3%; FCX flat; MOS up 4.8%; Oil down 4.24%; Brent down 3.9%; OIH down 3.1% bps; XLE down 4%;

International Stocks:

- EEM up 2.5%; FXI up 5%; KWEB up 9%; EWZ up 3.8%; EWY up 2%; EWG up 8.4%; INDA up 1.1%; INDY up 1.3%; EPI up 4.2%; SMIN up 7.6%;

As the wise said:

- Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi – If you are bullish Europe, just buy China $FXI better yet, load up on 3x long China $YINN .. +64% last 3 months

Guess what? Even the discarded Indian market was up this past week with SMIN blowing away big caps as if it were a bull market. Kudos to Stephanie Link of CNBC Half Time for her smarts.

But what if you want to stay away from EM stuff & remain developed? You learn that “great” like “beauty” is in the eyes of the be-holders.

- J.C. Parets@allstarcharts – These are the most important companies in the world outside of the U.S. hitting new cycle highs. EFA represents Developed Markets Ex-North America. So think a ton of Europe, UK, Japan, Australia etc. What a great week for stocks

Treasury & Fixed Income:

- 30-year Treasury yield up 10.6 bps on the week; 20-yr yield up 11.7 bps; 10-yr up 9.7 bps; 7-yr up 8.8 bps; 5-yr up 7.2 bps; 3-yr up 3.7 bps; 2-yr flat; 1-yr down 3.2 bps;

- TLT down 2.1%; EDV down 1.7%; ZROZ down 3.3%; HYG down 87 bps; JNK down 1.1%; PFF down 2.5%; EMB down 1.2%;

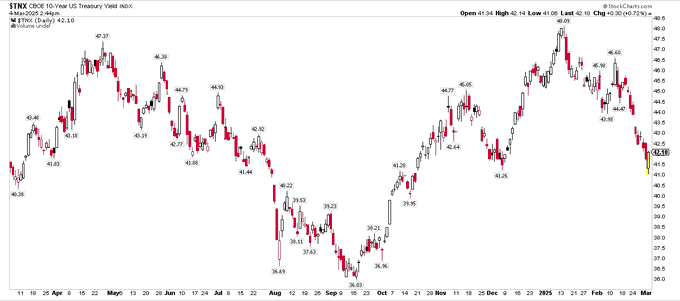

Last Friday we saw high bullishness about Treasuries/TLT. That seemed premature to us before the NFP report as we wrote then. A smart observer noticed the big sign on Tuesday this past week. Kudos to Mr. Zaccardi.

- Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi – Big bearish reversal in Treasurys today $TNX $IEF $TLT

3. Bullish & Bearish

There is no shortage of highly oversold signs after last week. In fact, we find most smart observers pointing to those. But how do we guess whether this is a bullish sell-off or is it a lead into a bear market? Is there an indicator that we can look at?

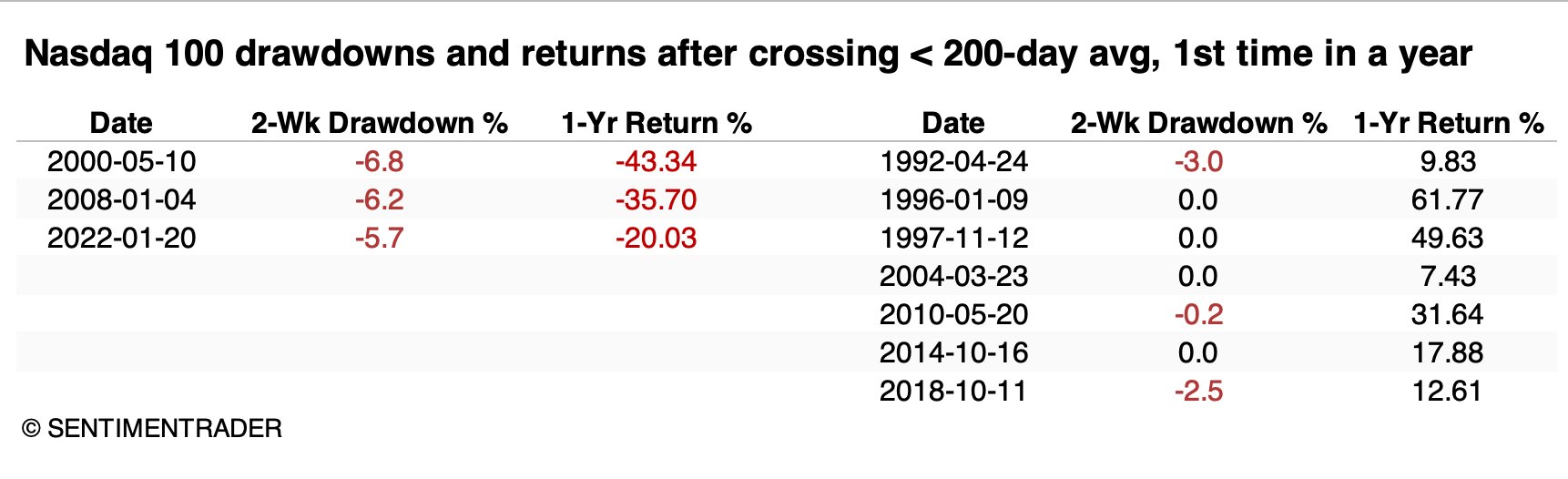

- Jason Goepfert@jasongoepfert – The Nasdaq 100 $QQQ closed below its 200-day average for the first time in over a year. Watch the next 2 weeks. Every time it lost its 200-day after an extended run and suffered at least a -3.5% drawdown within the next 2 weeks, it led to a bear market. When the 2-week drawdown was less than -3.5%, 1-year returns were positive every time.

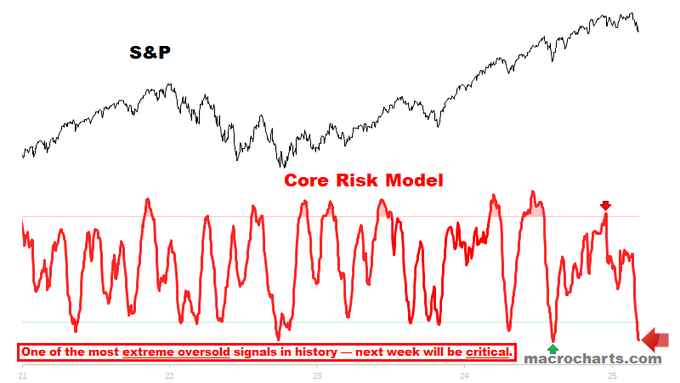

That was about next 2 weeks. How about next week?

- Macro Charts@MacroCharts – One of the most extreme oversold signals in history. Next week will be critical.

From 2 weeks to next week above. How about a 1-day look at this past Friday?

- Seth Golden@SethCL – Outside reversal day like this past Friday with “Hammer Candle” has been indication of interim low and subsequent uptrend. $SPX $ES_F $SPY $VOOX $QQQ $NYA

But aren’t candles soft? How could you hammer with a candle? That may be why we don’t understand technical charts. But simple facts we get, even though they may be the least reliable.

- The Market Ear@themarketear – NDX seasonality about to kick in?

3. Big Geopolitical News of the week

Yes, we all have focused on Ukraine & what it means geopolitically & economically to America, Russia & EU. But all that might get worked out soon Or result in greater conflict if it doesn’t. But that is a transient issue, one way or other. In contrast, something happened this week that will impact America for the next century, if not beyond.

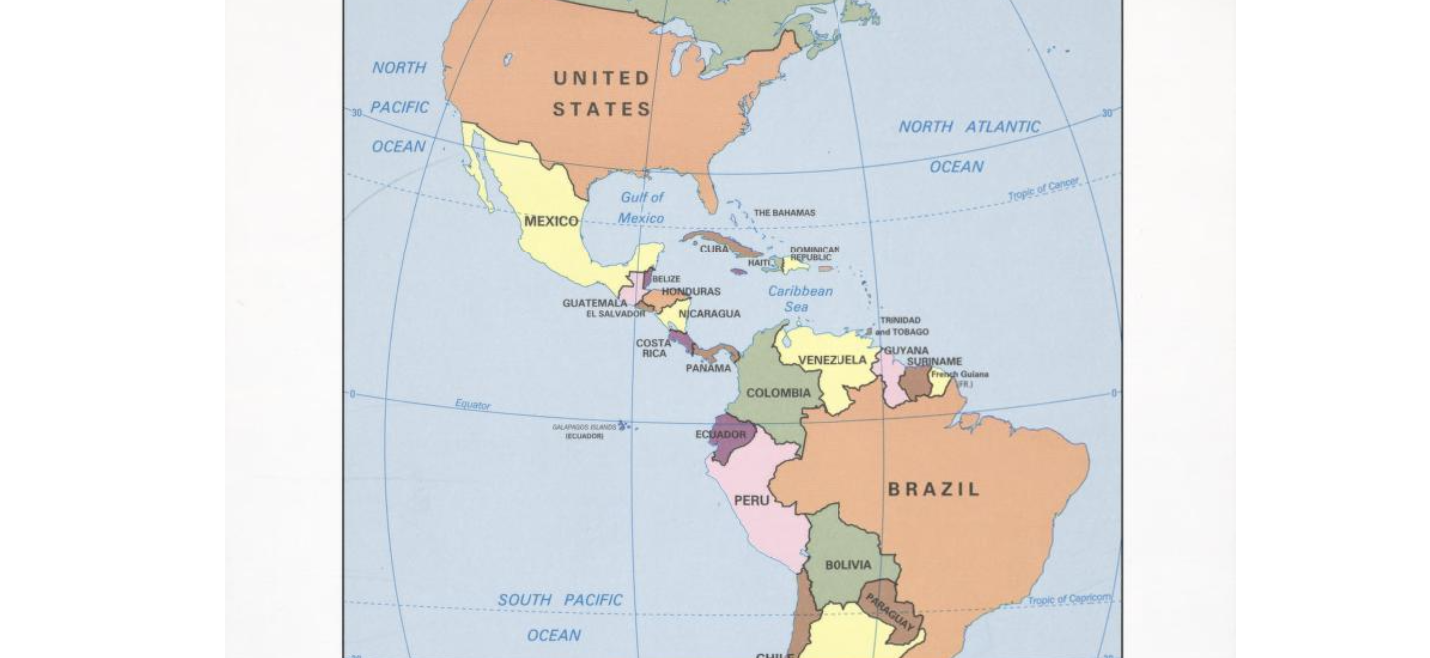

Just look at the map of Americas, especially the two huge oceans – Atlantic & Pacific. America is the one large, powerful & rich country that relies on both these oceans. Clearly this geographic separation US access to two huge oceans became unacceptable once it became physically possible to build an all-weather canal between the two oceans. As history.state.gov points out,

- President Theodore Roosevelt actually dispatched U.S. warships to Panama City (on the Pacific) and Colón (on the Atlantic) in support of Panamanian independence from Columbia. Panama declared independence in 1903 & provided the United States with a 10-mile wide strip of land for the canal, a one-time $10 million payment to Panama, and an annual annuity of $250,000. The United States also agreed to guarantee the independence of Panama.

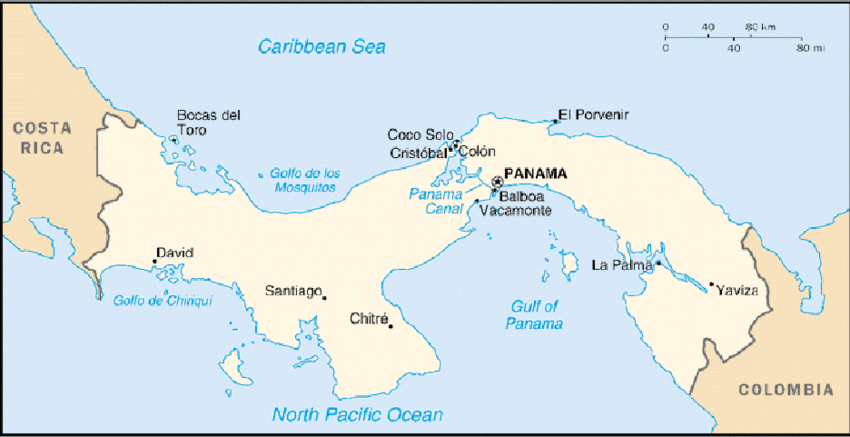

What makes such a Canal effective & what gives the power & ability to regulate naval traffic thru the canal? Ports on both sides of the Canal! As an relevant aside, look at how we described the acquisition of the Haifa Port by Indian firm Adani Enterprises two years ago. That acquisition has enabled linkage of the Persian Gulf (Dubai) & the Mediterranean (via Haifa to Greece, Italy & southern Europe).

The Panama Canal issue is much simpler. The road is already built. All that matters is control of the ports on both sides of the Panama Canal to persuade Panama to play ball. Very few had heard of Adani before the Haifa deal. In contrast, who hasn’t heard of BlackRock? But who had heard of financial firm BlackRock as an owner of Ports?

Now everybody does. News broke this past week that BlackRock

- a group led by BlackRock agreed to buy the Balboa and Cristobal ports, located at either end of the Panama Canal, as well as 40 other port facilities in a $19 billion deal. “

Port of Balboa, with access to Gulf Panama & Pacific, and Port of Cristobal with access to Carribbean Sea & Atlantic, sit at the two ends of the Panama Canal, thus delivering virtual control of passage thru the Canal to the United States.

Remember what President Trump said during his Presidential Address on Tuesday, March 4:

- “My administration will be reclaiming the Panama Canal, and we’ve already started doing it. … just today, a large American company announced they are buying both ports around the Panama Canal.“

Speaking of canals, who hasn’t heard of the Suez Canal? But what sea route between Northern Europe & China would be shorter by 3,000 nautical miles than the Suez route? The Northeast passage through a fast warming Arctic.

Ok, but what does the Arctic look like on a map? We get Russia, Canada or even the farther away United States. But what is that BIG light green block in the middle that should, at least geographically, dominate Arctic shipping?

Greenland, of course – the world’s largest island. Currently in the jurisdiction of Denmark, it only has about 57,000 people. Paying each resident to Greenland $2 million would be fairly easy for America. And Greenland is NOT happy about being lorded over by little Denmark. Watch President Trump explain why America needs & wants Greenland & why, he says, “we are going to get it one way or the other:.

Also read USA Today’s “Five Ways Trump’s Greenland Saga could play out“. His promise to Greenland is that “we will keep you safe, we will make you rich & together we will take Greenland to heights like you have never thought possible before“.

4. The Real Disease & the Conflict it creates

Getting back to Section 1 above re Ukraine, neither Zelenskyy nor his team have would have survived this disaster on their own. The Biden Team was the foundation of their strength & determination. That is gone but the European side of that team is still in charge. They might be shaken by the clarity of President Trump but they are not willing to listen to reason. That, in itself, is not surprising given what Europeans have demonstrated by & in creating two World Wars.

Fortunately, today the Europeans are pathetic, weak & utterly incapable of actually waging war. Double actually, they don’t even have the ability to supply Ukraine with the needed weapons. Some of them like UK & France still think they can fight a real war, even a nuclear war. That may have prompted UK’s PM Starmer to commit to 20,000 British troops to fight, if necessary, in Ukraine. Trouble is Starmer thought that Britain is another EU & he is the un-elected but total leader of his country!

How did that work for him? The below is dated Friday, March 7.

Well, UK is not even UK after its Brexit. The EU still backs Ukraine, right? And they have the juice. But the juice seems to be losing its potency, as Prime Minister Meloni of Italy demonstrated last week. It is titled EU in CHAOS! Meloni Directly Challenges Von Der Leyen & Aligns with Trump.

We began with UK on one geographical side of Europe, moved on to the center of Europe. Now let us go to other extremity of Europe that borders on Ukraine and watch the clip titled POLISH MEP MADE VON DER LEYEN CRY RIGHT IN EU PARLIAMENT!. Just watch the first 45 seconds to get the flavor & then the rest that gets to Hungary et al.

Now we come to the disease that is poisoning Ukraine – The EU laid out 5 principles this week which, according to them, are a must for any peace negotiations. You can read those in the linked clip but they seem insane to us, insane enough to ignore the results of the war so far. Fortunately, unlike in the two world wars of last century, none of these EU nations will send their own troops to fight Russia. All they have promised is $30 billion of funding. By the way, Hungary has blocked this by using its Veto.

Now Hungary has publicly accused the EU of blocking peace in Ukraine:

If Ukraine listens to the EU and refuses to agree to peace on terms already dictated on & by the battlefield, President Trump should simply get “out of there“, as he put it. He has already taken a verbal step by saying US troops in Germany will move to Hungary.

The disease is that the EU leadership is NOT elected in an European election. Unless that disease is cured, Europe will remain a grave risk for the entire world.

Send your feedback to [email protected] Or @MacroViewpoints on X.