Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TACs is our acronym for Tweets, Articles, & Clips –our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Fed Trajectory

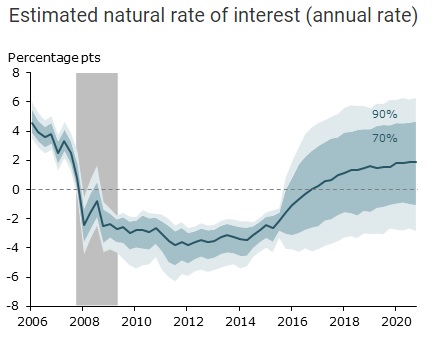

Our position has been simple – this rally exploded two weeks ago upon that awful employment report because of the expectation of additional liquidity from the Fed. That stage was set by an earlier comment by NY Fed President Dudley about neutral rate being lower than the current zero rate. This seemed amazing at that time because the Fed was all set then, we were told, to go live with a rate hike.

This week, the San Francisco Fed, the home Fed of Chair Yellen, came out with a report that quantified Dudley’s comment:

- “And according to Curdia, the neutral rate is currently below zero. Actually, he says it is currently at negative 2.1 percent, in contrast to a long-run level of 2.1 percent.” If he’s correct, the direct implication is that right now, even a federal funds rate target of 0 percent to 0.25 percent is high enough to slow down the economy rather than contribute to expansion.”

That means today’s zero rate is 2% higher than neutral and that could be a reason why the economy is slow & unable to grow the way it should. So, given the Fed’s mandate, it behooves Chair Yellen to add liquidity, doesn’t it? So why blame the markets for their hopium?

Look what Dr. Lael Brainard, the Fed member with the most international experience, said in her speech on Monday:

- “There is a risk that the intensification of international cross currents could weigh more heavily on U.S. demand directly, or that the anticipation of a sharper divergence in U.S. policy could impose restraint through additional tightening of financial conditions. For these reasons, I view the risks to the economic outlook as tilted to the downside. The downside risks make a strong case for continuing to carefully nurture the U.S. recovery–and argue against prematurely taking away the support that has been so critical to its vitality.”

So what does she counsel?

- “With equilibrium real interest rates likely to remain low for some time and policy options that are more limited if conditions deteriorate than if they accelerate, risk-management considerations counsel a stance of waiting to see if the risks to the outlook diminish.”

This is a big point because Dr. Brainard is clearly telling us that they know how to handle inflation but they really don’t have options if deflation sets in. She is 100% correct and we are thrilled to see this intelligent and highly experienced banker speak up so clearly.

We said back in 2013 that the constant threats to “taper” from Bernanke caused rates to explode much higher than they would have had Bernanke begun the taper in June 2013. We have also been blunt in arguing that this year’s constant blabber about upcoming rate hikes has actually caused more harm than any rate hike would have caused. Did Dr. Brainard say the same thing in her speech?

- “Over the past year, a feedback loop has transmitted market expectations of policy divergence between the United States and our major trade partners into financial tightening in the U.S. through exchange rate and financial market channels. Thus, even as liftoff is coming into clearer view ahead, by some estimates, the substantial financial tightening that has already taken place has been comparable in its effect to the equivalent of a couple of rate increases.”

Meaning, the Fed’s irresponsible blabber has created a tightening equivalent to two rate hikes. Oh Dr. Yellen, why didn’t you raise rates in April-May?

So with all this, does the following surprise any one?

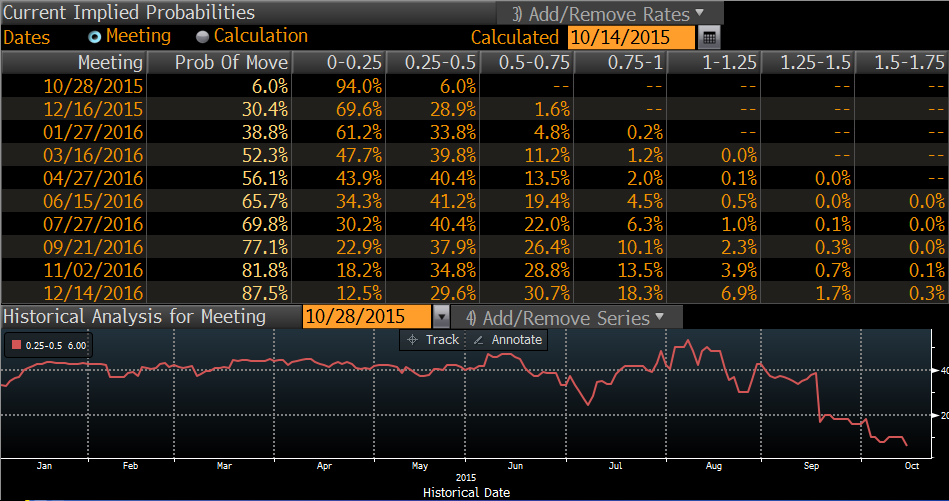

- Wednesday – Charlie Bilello, CMT ?@MktOutperform – Odds of a Fed hike in October down to 6% after the retail sales miss. Lower for longer mantra continues…

But what if the stock rally continues into the FOMC meeting on October 28? Will Chair Yellen issue a hawkish statement after that meeting and hint at a possible rate hike in December? That would be a repeat of what Bernanke did in October 2007 meeting. Remember Bernanke never ended up raising rates after that hawkish tone but felt he had to sound hawkish partly because of the monster rally in stocks into the October 2007 FOMC meeting.

2. U.S. Economy – downshift continues

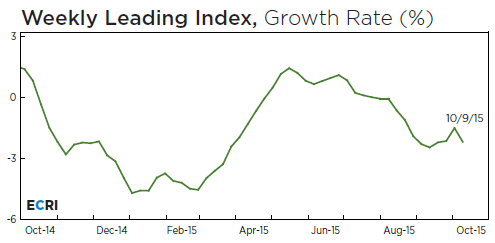

Last week the Atlanta Fed had downgraded their Q3 real GDP forecast from 1.1% to 1%. This week, they downgraded it to 0.9%.

And,

- Lakshman Achuthan ?@businesscycle – U.S. Weekly Leading Index falls to 128.7, as its growth rate decreases to -2.2%. #economy https://goo.gl/NsRZ16

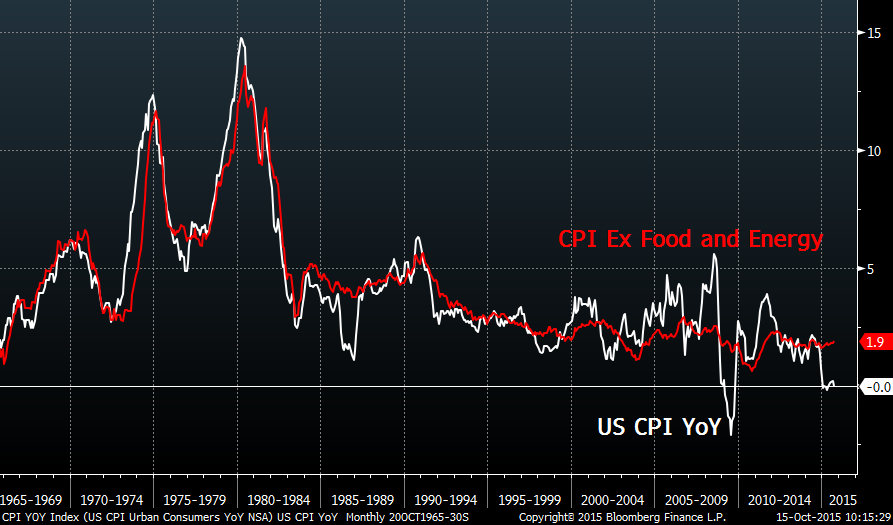

But what about inflation?

- Charlie Bilello, CMT @MktOutperform – Is there enough inflation for Fed to hike?

US CPI (YoY %): 0% Ex Food/Energy: 1.9% (close to Fed’s 2% target)

Owner’s equivalent rent has gone up higher than virtually any other part of CPI. That may be why CPI ex food & energy so high. But is that a reason to tighten? Since,

- Income – Saving = Food + Energy +Shelter + Discretionary Spending

and incomes, except for the high earners, are still relatively flat, doesn’t rise in food/energy/shelter costs actually force decrease in discretionary spending? Remember we are not in the bubble period where borrowings or negative savings increased the left hand side and allowed higher discretionary spending. Is this forced decrease in discretionary spending why Wal Mart lowered its earnings forecast?

3. Bonds

The economy is downshifting to a slower gear & inflation is not going anywhere. So why is the 30-10 year spread so stubbornly wide? Rick Santelli pointed out on Thursday morning that the 30-10 year spread is the widest since May 2014. Empirically speaking, we saw this spread widen & exceed 100 bps during the high days of QE and it came back below 100 once taper was put in effect.

Ours is a simple mind and to us this spread is the best indicator of QE4 hopium in the Treasury market. This is also the reason why the 10-year Treasury is becoming a Siamese twin of the 10-year bund. The markets are expecting an increase in QE from the ECB and then perhaps QE4 from the Fed thus eliminating the divergence in monetary policies between US & Europe. This may also be the reason the 10-year US treasury yield simply cannot sustain a break below 2%. This may also be the reason why the 30-year yield refuses to sustain its break below its 200-day moving average.

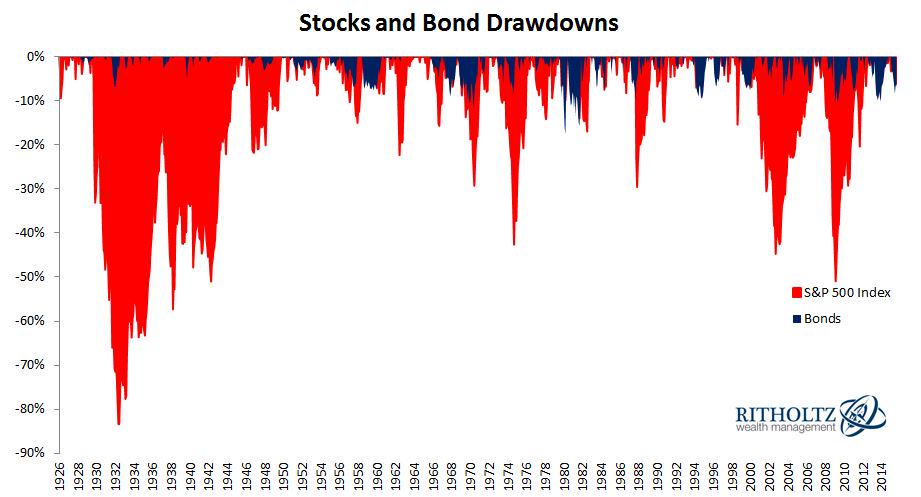

But that doesn’t change the other influence on Treasury yields, the use of Treasuries to hedge stock risk:

- Thursday – Charlie Bilello, CMT ?@MktOutperform – Important read from @MichaelBatnick: why investors still need bonds in a low rate world. http://stks.co/t30GG

4. Stocks

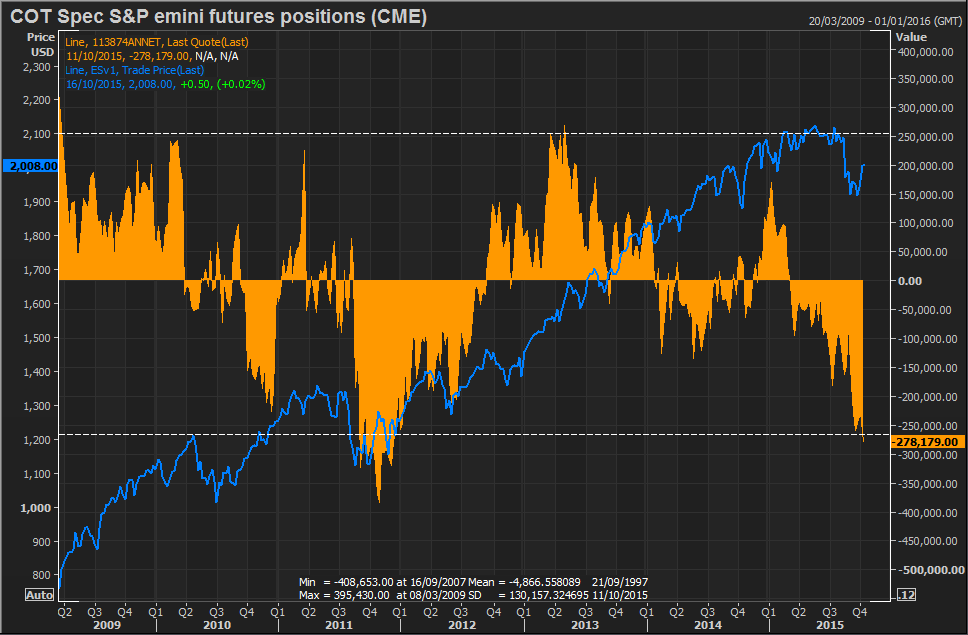

The explosive rally in stocks was not merely due to Fed liquidity hopes or oversold conditions but equally due to a bonfire of huge short positions.

- Monday – Eric Burroughs ?@ericbeebo – BTW that ES spec short is beyond its historic 2 SD extreme

What does a typical options expiration week do to such short positions? It lights them up as it did on Thursday at around noon and on Friday in the last hour. But what happens the week after? NorthmanTrader.com showed below on Thursday:

Ryan Detrick provides another path to a similar projection:

- Ryan Detrick, CMT ?@RyanDetrick – $SPX looking at 3 straight up weeks. Happened in May and dropped the next 2 weeks. Happened in Feb and dropped the next 3. $SPY.

What about a fundamental correlation for this path?

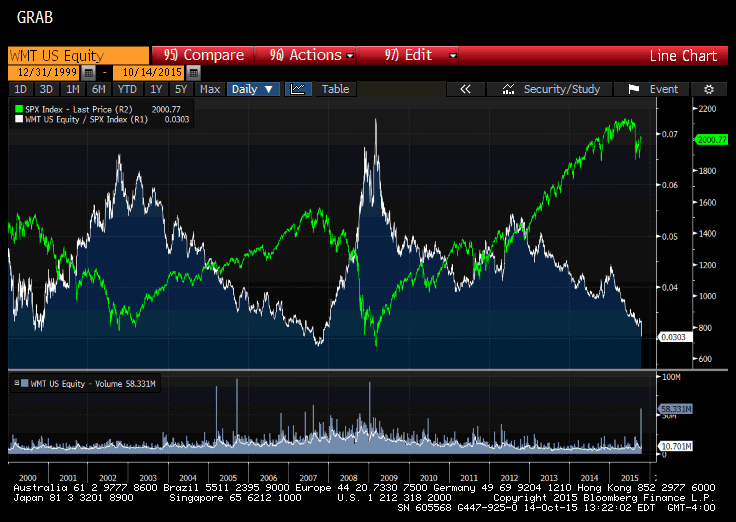

- John Authers ?@johnauthers – Hmmm. When WMT most underperforms the S&P, it tends to signal a peak in the market. And vice versa. Not reassuring.

All of the above is fine but what about the magic of the fourth quarter rally? Doesn’t that negate the above statistical & fundamental stuff? Remember the rally that began in October 2014? But there is always some indicator that spoils the fun, isn’t there?

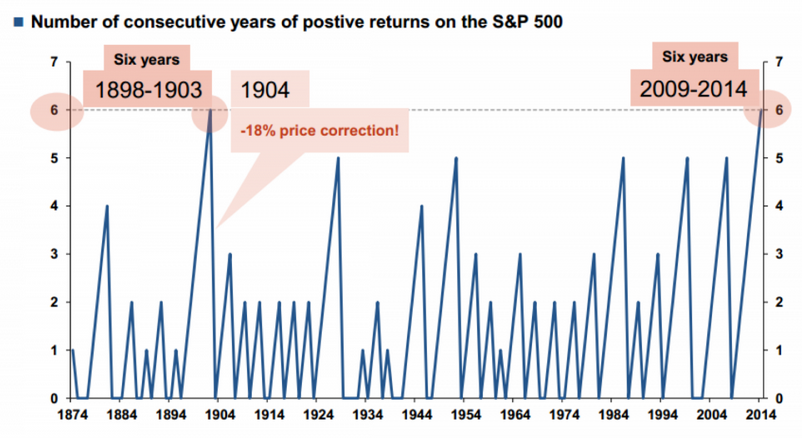

- Tuesday – Steve Burns ?@SJosephBurns – Number of times the $SPX has been up 7 years in a row? 0 via @StockCats

For those who prefer more descriptive opinions,

- Louise Yamada on CNBC Futures Now on Thursday – You always get a rally after a big decline, … The point is that we initiated a downtrend in August and once a downtrend is initiated after something that looks like a larger top, these rallies tend to go back into resistance. Yamada identified the next levels of resistance as the falling 200-day moving average, which comes in at around 2,050 to 2,060 … For Yamada, it’s only a matter of time before the S&P 500 hits the next level of resistance, and investors should be prepared for what could be the start of sharp selling. “A lot of these rallies tend to bring us to a place of complacency before the bear claw may come out again to strike,” she warned. “We are skeptical of this rally”.

- Jonathan Krinsky on CNBC Futures Now on Tuesday – the current market looks a lot more like it did just before the financial crisis. “The correction in August 2007—before we made the major top in October 2007—was led very similarly to the current setup, by the laggards,” … “That leadership makeup does concern us a bit.”Adding to Krinsky’s market apprehension is the S&P 500’s declining 200-day moving average for the first time in four years. “The primary trend in our view is that the slope of the 200-day moving average is now trading down. That gives us a more cautious outlook.”We have a lot of overhead resistance in the 2,040-to-2,060 range, and I don’t think that’s going to be easily surpassed.” At the very least, Krinsky expects the S&P 500 to retest the 1,900 level in the near future before resuming its advance.

But what about some bullish opinions?

- Lawrence McMillan in OptionStrategist – “Market breadth oscillators are strong and back in overbought territory once again, and that should continue to bode well for stocks. Volatility indices have generally moved lower, and that is bullish. $VIX will remain in a (bullish for stocks) downtrend as long as it continues to close below its 20-day moving average. In summary, the indicators are all bullish, so we continue to have a bullish intermediate-term outlook“.

And,

- The Fat Pitch – “October through year-end and into January is typically the strongest continuous period of the year for equities. If the BAML survey is a guide, then many fund managers entered this month with low equity allocations and very high cash levels (new post). They will likely want to be in the market by year-end, and the pressure to get invested will only grow as price moves higher. This is probably a strong tailwind and it was a prime reason we originally expected risk/reward to be positive at the lows.”

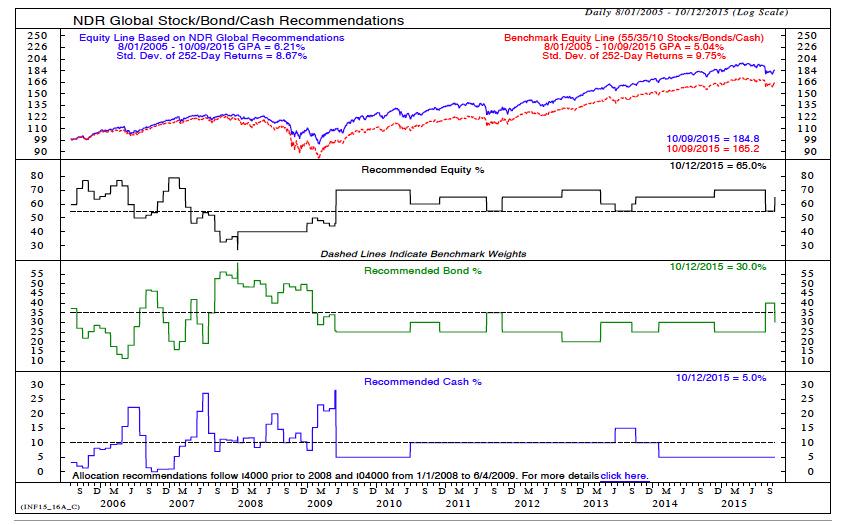

- Tuesday – Ned Davis Research ?@NDR_Research – Ned and Tim Hayes agree…year end rally now probable

And a fundamental case?

- Richard Bernstein – Our proprietary research suggests that the profits cycle is likely to trough either in the third or fourth quarter depending on the level of write-offs toward year-end … That would imply that the relationship between Fed Funds and the profits cycle might return to a more normal one and, if that is the case, we think the equity market can continue advancing as it would during a mid/late-cycle environment.

5. Gold

Gold was the hot trade this week. Josh Brown on CNBC FM said “price action in gold looks best it has since 2011; its becoming a hot trade“. Jim Eurio of CNBC Futures Now said “I am unabashedly bullish on gold“. Andrew Hecht of Commodix.com said “see plain selling for Gold & see a print at 1200 pretty soon may be even 1225 but 1243 May high is a key level“.

The miners have had a fantastic rally:

- Wednesday – Lawrence McDonald ?@Convertbond – Bear Market Rallies in the Gold Miners $GDX since 2013 – 33%, 22%, 41%, 26%, 39% #DXY #Dollar #Fed

McDonald should know and has every right to take a victory lap. He pointed this out a number of times when belief in Fed rate hike was high and when gold miners were at their lows. But he knows how to take profits too. The Bear Traps Report suggested selling the second 1/3rd of what their buy recommendations near the lows.

- Thursday – Mark Newton ?@MarkNewtonCMT – #Gold rally also stretched nearterm, Initial breakout nearing resist, but larger trendline resist hits @ 1250-$GC_F

On the other hand,

- FXCM ?@FXCM – Gold Price 1207 and 1255 of Interest Over the Next 2 Weeks http://bit.ly/1OGdvyr

6. Oil

A 50% pullback from the lows in a major level, right?

- Mark Newton @MarkNewtonCMT – Commodities meanwhile have stretched up over 5% in the last 9 trading days, retracing 50% of pullback since May– CCI

Commodity markets like Brazil and commodities like Oil fell hard late this week. Brazil was already down before the news of the resignation of the Finance Minister hit after market on Friday.

- Thursday – Holger Zschaepitz ?@Schuldensuehner – US #Oil drops the 4th day in a row on supply glut as inventories rose by a whopping 7.5mln barrels to 468.6mln.

SLB didn’t help with its earnings conference call on Friday morning. On the other hand,

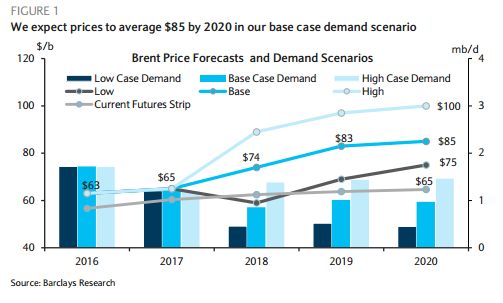

- Thursday – William Watts ?@wlwatts – Barclays says this is why oil could rebound a lot faster than you think http://on.mktw.net/1Lv79kF

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter