Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Italian Referendum

First Brexit, then Trump & now Italy, we kept hearing this week. We saw articles that said the young of Italy are disillusioned & will vote against PM Renzi. We wonder. Secondly because the youth don’t vote much & the side the youth preferred lost in Brexit referendum & in the US election. And firstly because the same yahoos who confidently predicted victories of #BrexRemain & Hillary are now confidently predicting a “No” vote.

Our entire knowledge base of Italy is restricted to Italian Food & a quick touristy trip to Italy. So all what we can do is merely wonder. The English people, especially the non-London English, remain proud about Britain and wanted to reclaim it. We wonder if the middle aged & older Italians really want to jettison the ties to Europe and reclaim the pre-EU Italy with its constant currency devaluations & political instability.

The bigger question is what might happen if the Italians vote No or Yes. The No vote will be a relief for Italian banks & Italian stability. A yes vote will instantly create volatility in Italian banks & the possibility of a Renzi resignation. The US markets should be fine unless the Italian & European banks crater & that infects US moneycenters. But all this is rack speculation on our part.

2. NFP & US Economy

For once, we got a payroll number that meant nothing. Because all the asset classes did nothing between the 8:25 am prices & the closing prices. The number was a non factor except it solidified the priced-in certainty of a rate hike on December 14.

- David Rosenberg on Friday – While the unemployment rate sank to 4.6%, the lowest rate since June 2007, this was primarily due to a 226,000 implosion of the labor force;

A more granular comment from:

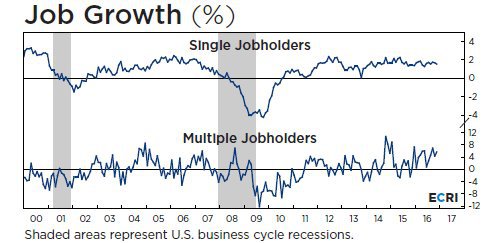

- Lakshman Achuthan @businesscycle – Multiple jobholder ranks swelling faster, as yoy single jobholder growth dips to 6-mo low. #Jobs https://goo.gl/md5iqD

What about the US economy getting stronger?

- David Rosenberg on Friday – The mantra is that the U.S. economy is building some momentum into Q4, but actually quite the opposite is happening

Getting to markets, remember how “its all” supposed to be “about currencies & yields“?

3. U.S. Dollar

Talk about a gimme!

- Peter Brandt @PeterLBrandt – #KISSOFDEATH for USD $DX_F $UUP $EURUSD

Jeffrey Gundlach turned negative on the Dollar in his conversation with Reuters:

- “The dollar is going to go down, yields have peaked and will move sideways, stocks have peaked as well and gold is going to go up in the short term.”

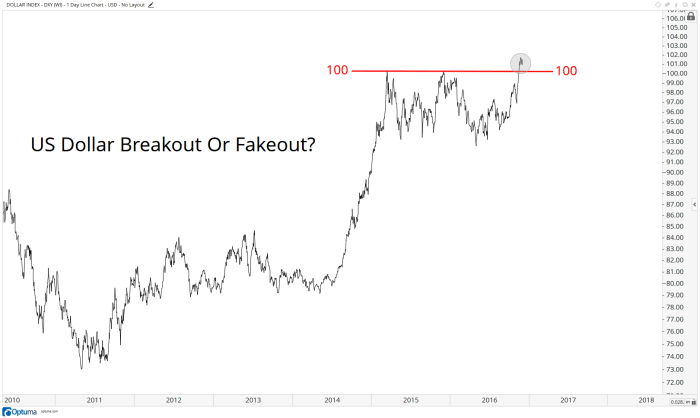

J. C . Parets wrote a piece this week asking Is This US Dollar Breakout The Real Thing? He ended it with:

- “Was this breakout for real? Or are we about to see a nasty mean reversion? I’d argue that if we’re below 100, the latter is the higher probability outcome. So that’s the level I’ll be watching:”

4. Treasury yields

Last week, we referred to a Bloomberg article which stated Treasuries Have Never Been as Oversold as They Are Now. Apparently Jeffrey Gundlach agreed based on what Reuters wrote “Gundlach began purchasing Treasuries last week and agency mortgage-backed securities on Tuesday, as yields have risen … ” His comment re Treasuries:

- “I am less defensive now on Treasuries and I am less negative on the 10-year Treasury note at a 2.35 percent yield than we were at 1.35 percent yield,” he said. “Bank of America’s dividend yield is 1.39 percent while the 3-year Treasury yield is 1.45 percent. I mean, really?”

DeMarkians seemed to concur:

- Mark Newton @MarkNewtonCMT $XLF and $TNX both are signaling TD SEQUENTIAL 13 sells today first time since early Nov, so this yield rise might not make it til #FOMC

Chris Kimble posted an article titled Interest rates could peak here, says Joe Friday:

Tom McClellan wrote on Friday that “signs from the data on those bonds [investment grade] now suggest that the bond market is at an oversold extreme“. He added:

- “This RAMO [Ratio-Adjusted McClellan Oscillator] has just recently plunged to a very deep oversold level, reflecting the strong downward acceleration in the bond A-D data. And now more importantly, we have a bullish divergence, with bond prices making a lower low but this Oscillator making a higher low. That shows a waning of the downward momentum, and is a setup for a rebound“.

5. Stocks

This was a negative week for stocks, but isn’t that what is expected in early December?

- Ryan Detrick, CMT @RyanDetrick – Don’t forget gains in #December tend to happen late. Since ’50, S&P 500 in Dec on the 15th MTD is flat (0.05%), but by end of mo is 1.62%.

What else did Ryan Detrick tweet this week?

- Ryan Detrick, CMT @RyanDetrick – Nov 30 – The S&P 500 has never been down in December three consecutive years (going back to ’28). It is currently down two years in a row ….

- Ryan Detrick, CMT @RyanDetrick – Nov 30 – S&P 500 creating an engulfing candle on a monthly chart. Rather rare, but bullish. Since ’90, next month up 1.4% on avg and higher 11 of 16.

- Ryan Detrick, CMT @RyanDetrick – Nov 28 – Strength usually = strength. S&P 500 >3% in Nov and up >8% YTD heading into Dec, Dec only been down once since ’82 (6 of 7). Avg gain +2.8%.

But there are 8 trading days until “15th MTD”. So what might lie ahead?

- Urban Carmel @ukarlewitz – There’s now a potential neckline at 220.2-.3 area $SPY

And,

- Mark Arbeter, CMT @MarkArbeter – Updated chart: Was a bit early here but slope reset may be at hand. $IWM, $RUT

6. Gold

Gold miners rallied hard this week with GDX up 3.7% and GDXJ, ABX & NEM up 5% on the week. Silver also rallied 1.3%

- Peter Brandt @PeterLBrandt – #GOLD almost perfect retest of 25-month falling wedge bottom on weekly chart. $GC_F $GLD

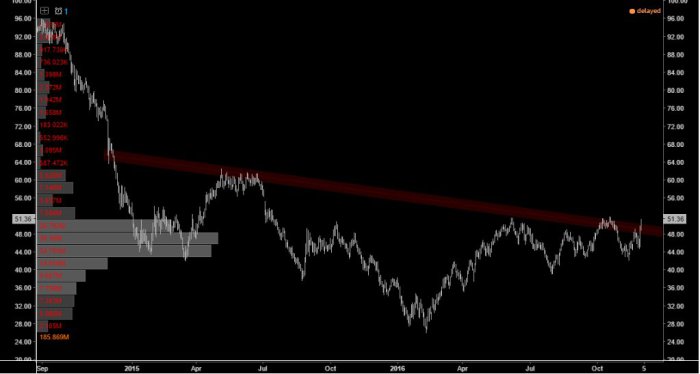

7. Oil

Will wonders never seize? Did OPEC actually come together for a deal? USO & BNO rallied 11.5% this week. This is the story of post Trump election – big money finding itself on the wrong side of a major surprising event & baboooom!

Truth may actually be stranger than fiction in this case. Guess who was the diplomatic smoother between Saudi Arabia & Iran? To quote from a Reuters exclusive article:

- Putin’s role as intermediary between Riyadh and Tehran was pivotal, testament to the rising influence of Russia in the Middle East since its military intervention in the Syrian civil war just over a year ago.

- “Putin wants the deal. Full stop. Russian companies will have to cut production,” said a Russian energy source briefed on the discussions.

- But Putin established that the Saudis would shoulder the lion’s share of cuts, as long as Riyadh wasn’t seen to be making too large a concession to Iran. A deal was possible if Iran didn’t celebrate victory over the Saudis.

- A phone call between Putin and Iranian President Rouhani smoothed the way. After the call, Rouhani and oil minister Bijan Zanganeh went to their supreme leader for approval, a source close to the Ayatollah said.

- Prometheus @PrometheusAM – Crude looking very technical here… ……

8. Was it something we said?

Send your feedback to [email protected] Or @MacroViewpoints on Twitter.