Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Financial Conditions and OR vs. Economy?

We always thought financial conditions & financial markets were an intrinsic part of the economic picture. So using this integrated view, the economy seems to be going in the right direction:

- Lisa Abramowicz@lisaabramowicz1 – – Citi’s European economic surprise index has reached the highest level since the beginning of 2018.

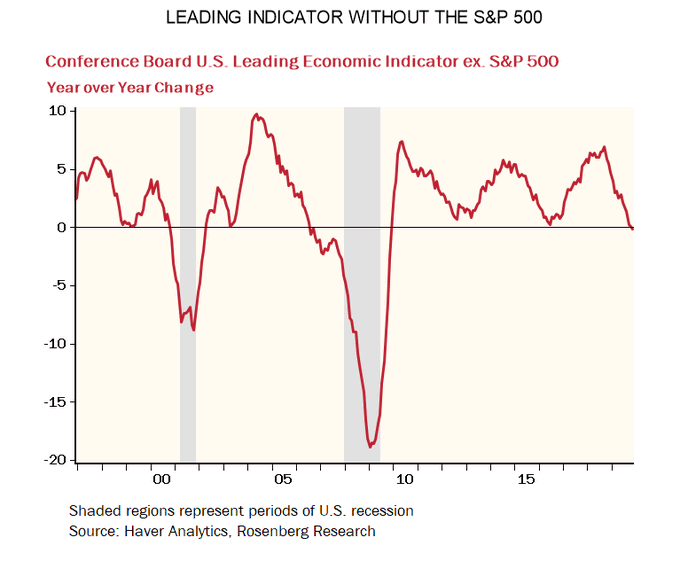

On the other hand, the segregated view looks almost recessionary:

- David Rosenberg@EconguyRosie – The Conference Board LEI is now negative YoY without the hand-holding of the liquidity/momentum-driven stock market. Big disconnect between the financial economy and the (1% growth) real economy.

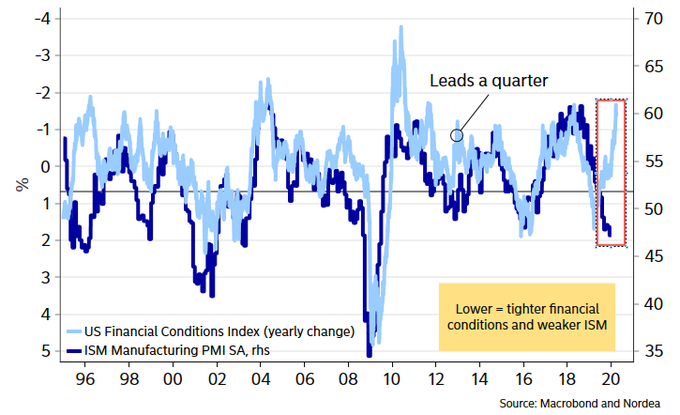

This is a big deal because the Fed’s faith in QE is founded on their conviction that easing financial market conditions leads to economic stability & recovery. But some now point to a disconnect:

- AndreasStenoLarsen@AndreasSteno – – Financial conditions (i.e. equities, credit bonds) -> NORTH PMIs -> SOUTH This is a bizarre disconnect and I don’t have a good feeling about it. Link –> ndea.mk/DoOrDie2020

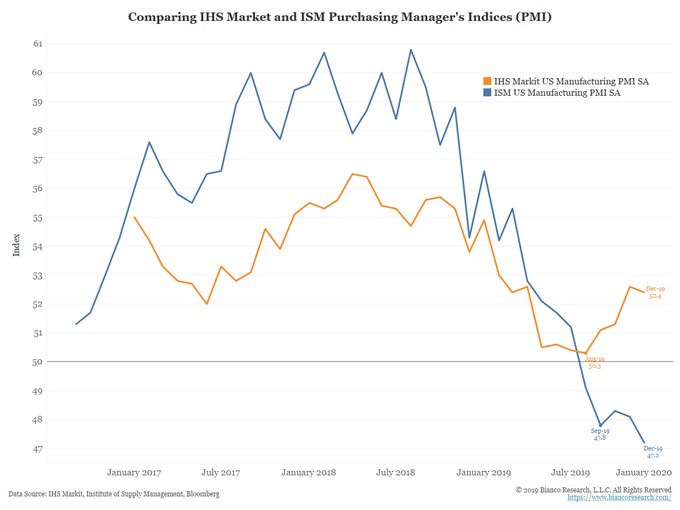

Could there be an issue with the accepted PMI or purchasing manager’s index? An issue that could perhaps be better viewed with a different index for measuring purchasing manager data?

- Jim Bianco@biancoresearch – Both ISM and IHS Markit calculate Purchasing Manager’s Indices (PMIs). Earlier in by timeline (beginning of the week) we discussed the differences. The gap between the two is widening.

Data about the activities & near term intentions of the nation’s purchasing managers is of vital importance to understanding the U.S. economy & to making decisions about interest rates & stocks. So what exactly is going on between these two indices?

- AndreasStenoLarsen@AndreasSteno – – Could Boeing explain the difference between ISM and Markit PMIs? Any clues out there

Boeing is certainly big enough to change the picture presented by purchasing managers. That brings up a question – we have CPI & CPI ex-food & ex-energy; we have Durable Goods report & ex-transportation Durable Goods report. So why can’t we have ISM & ex-transportation ISM? In fact, why not create different views of all economic reports by ex-ing out large & volatile sectors?

2. “Gentlemen Prefer Bonds“

After all the above esoteric this vs. that discussion, isn’t it relaxing to look at a clean & clear reality?

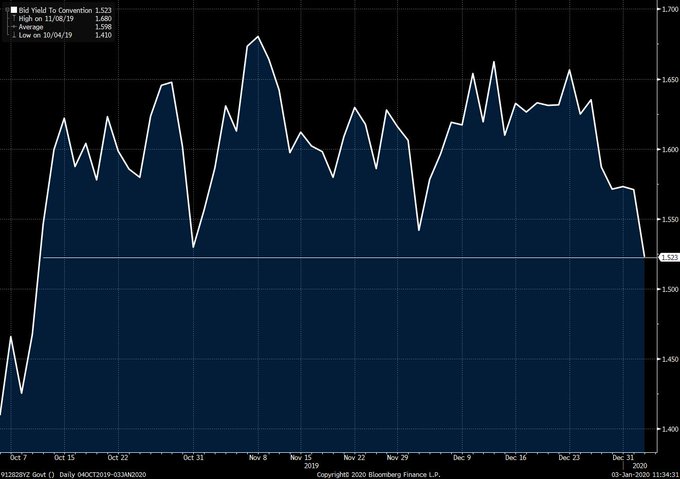

- Robert Burgess@BobOnMarkets – So much for the “booming” economy. Treasury 2-year yields back at their lowest since early October, ISM is getting weaker, weekly jobless claims ticking up on a continuing basis & NY Fed’s GDP nowcast just published moments ago puts 4th-qtr GDP at 1.13% and 1st-qtr GDP at 1.05%

But is this as clean & clear as it looks? Does this fall in 2-year yields have more to do with the huge liquidity poured in to address the year-end Repo problem?

Perhaps, it is easier to simply measure what people are feeling?

- Richard Bernstein@RBAdvisors – – Historically when @ConferenceBoard#ConsumerConfidence“Present Situations” was extreme relative to “Expectations” the #economy subsequently slowed. Note current extreme vs. growing #investor bullishness.

Well, what is a good indicator for an upcoming slowdown in the economy?

- Raoul Pal@RaoulGMI – Your friendly, resident FitTwit bond bull here… Have you seen the chart of the 10 year bond futures? Bonds are seeing a fall in growth dead ahead. Consensus sees growth. Gentlemen prefer bonds.

Interest rates certainly closed down on the week with the 10-5 sector down 8.5 bps & the extremities 30-yr & 3-2 yr yields down only 6 bps. But once again we ask whether we should believe these numbers? Because ex-out the safe-haven run on Friday (due to the strike on Soleimani) & rates along the 30-7 yr curve actually rose a bit on the week.

So we can’t wait until the jobs number next Friday.

3. Stocks

Two hard down book-end days & one explosive up day mid-week is what this week was. After all that, the Dow & the S&P closed down a few basis points while the Nasdaq & NDX closed up a few more basis points. The Russell 2000 & Transports closed down a bit more.

The first day of 2020 revolved around China’s stimulus & the second day of 2020 revolved around the Soleimani strike. We think the first is the more sustained influence on global markets.

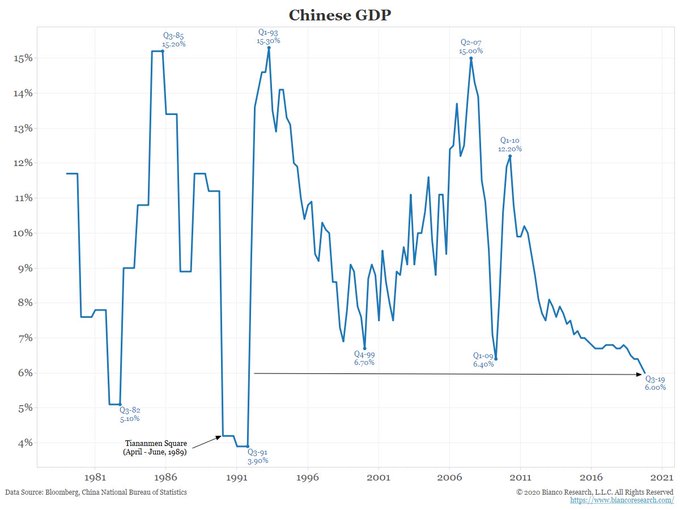

- Jim Bianco@biancoresearch – – And why are they doing it? Because their economy … sucks. GDP is at a 28 year low, Their stock market is still 30% off its all-time high set 12+ years ago. That’s why they are signing phase 1 in 2 weeks.

So we do expect China to keep their foot on the accelerator to stabilize their economy & to try to get some more growth. In contrast, we think the effects of Soleimani episode will be more transient & almost irrelevant to the US economy.

The bigger risk in the intermediate term will be withdrawal of the massive liquidity injected into markets by the Fed. A less than robust economy in Q1 might stay their hand in Q2 & then they will face the election.

In the meantime, the Santa Claus rally did materialize in fact:

- Bob Lang@aztecs99 – ABOVE 3224 on the spx 500 makes the Santa Claus rally bullish. next up first 5 days of January, and then January. happy new year everyone!

Frankly, we can’t but feel somewhat impressed with the action in US stocks on Friday. After a very big decline over night, the day action seemed restrained. The sell-off into Friday’s close seemed mainly due to fears of what might happen over the weekend. Then after the close, we heard about another strike on leaders of a different Shia militia in Iraq.

It will be interesting to see how US stocks act on Monday. If we get no retaliation from Iran over the weekend and US stocks rally on Monday morning, then this episode may recede in the background at least until the next such episode. On the other hand, if US stocks continue their decline on Monday without any retaliation from Iran, then it might suggest a back step in the rally.

Given all that, we concur with the steady hand:

- Lawrence McMillan of Option Strategist – In summary, the technical indicators remain bullish. We will act on sell signals if they are confirmed, which so far they haven’t been. Meanwhile, continue to roll long call strikes higher and to tighten trailing stops.

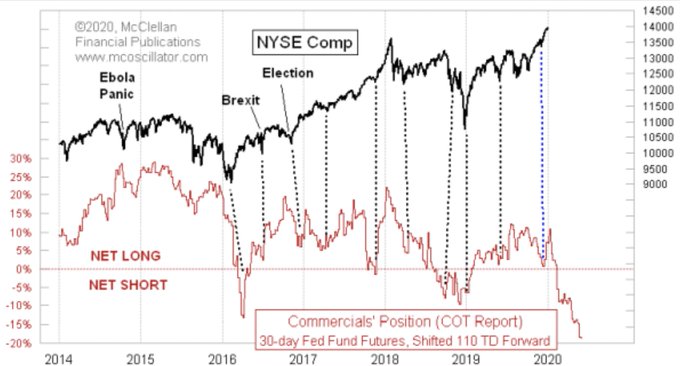

On the other hand, you see a different call from Tom McClellan:

- Jesse Felder@jessefelder – ‘Over the past 100 or so trading days, we have seen a big move in the commercial traders’ net position, moving from net long the Fed Funds futures to net short in a big way, implying that there is a big down move coming for stock prices.’ mcoscillator.com/learning_cente by @McClellanOsc

Gold rallied 2.4% this week & reached some old highs. But Gold miners underperformed Gold. Oil rallied 2.2% on the week but, despite that rally, Oil stocks underperformed Oil. We would prefer to wait for next week rather than speculating on why in vain.

4. What follows the “first ever” decade?

Hmmm; what makes the 2010s the first decade ever?

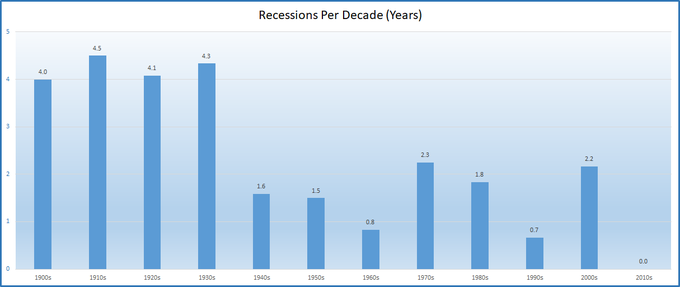

- Ryan Detrick, CMT@RyanDetrick – What is the chart of the decade? This might be it. The 2010s will become the first decade that didn’t see a recession.

May we hope, perhaps in vain, that the 2020s match the 2010s in this regard!

Send your feedback to [email protected] Or @MacroViewpoints on Twitter