Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Silence is Golden!

Look back to what we had hoped for on last Friday, March 5:

- On the positive side, Friday [March 5] showed that there is a limit to puking, even puking Treasuries & Nasdaq stocks. That is why, despite a 379K jobs report (vs. 200K expected), the 30-yr rate settled down in the afternoon to close down on the day & TLT closed up a bit on Friday.

- Is there a “Tums” available to prevent puking next week? The most effective one might be silence from Chairman Powell & his merry band of talkers until the FOMC meeting the following week. There is another hurdle though – 10-yr Treasury auction on Wednesday & the 30-yr Treasury auction on Thursday. If those go through without too much damage, then rates might stabilize next week.

Hoping against all hope & common sense, we wonder whether Powell & Co can postpone the Fed meeting on Wednesday, March 17 by a week. Another week of total silence from Powell & his merry band of Fed talkers would be so helpful.

The 10-year & 30-year auctions went off without any fireworks. Treasury rates did stabilize and actually were down on the week until Thursday as the S&P & the Dow went to new all-time highs. But the stabilization in rates ended on Thursday. Waking up on Friday morning, we all saw the sharp increase in Treasury rates. The strong PPI number didn’t help. The sharp rise in rates on Friday was bigger then the rise in rates over the entire week:

- 30-year yield up 10.4 bps on Friday (vs. up 10.3 on the week); 20-yr yield up 12.2 bps on Friday (vs. 12 bps on the week); 10-yr yield up 9.8 bps on Friday (vs. up 6.6 bps on the week); 7-year yield up 8.2 bps on Friday (vs. 5.2 bps on the week); 5-yr yield up 6 bps on Friday (vs. up 5 bps on the week);

Nasdaq 100 was down almost 1.9% pre-market on Friday. But it closed down only about 89 bps. The S&P was down pre-market but closed up to close above 3940. The real story was the VIX which closed down 5.6% on Friday. Contrast that to the jumpy VIX of the two weeks before. In fact VIX closed down 16% on this week to close at 20.69 despite Treasury yields down hard on the week & TLT down another 1.7%. It is an old dictum that the stock market doesn’t correct twice for the same reason. That brings us back to silence being golden. Without another new scare from Jay Powell, the sharp rise in rates on Friday didn’t matter much, we think.

The 16% fall in VIX last week is a positive. It led the way for the S&P & Dow to reach new highs. So, as Tom Lee said on CNBC on Friday, “the VIX is giving us a pretty decent signal” or as Lawrence McMillan wrote this Friday “ The $VIX “spike peak” buy signal of March 4th is still in effect, and the trend of $VIX is downward, and that is bullish for stocks.”

Kudos to David Tepper for his call to CNBC’s Joe Kernen on Monday morning:

- “… we are at the high end of the range at least for several months on the 10-year & may be the new range is 1.3%-1.7% … but he expects it to be much more stable now, the 10-year, .. which makes it safer to be in stocks for now …. you got possibility of stable rates with $1.9T ]of stimulus] and combination of these two things could be very bullish for stocks … at the low of Friday on the Nasdaq, that’s when he got really bullish & was acting … “

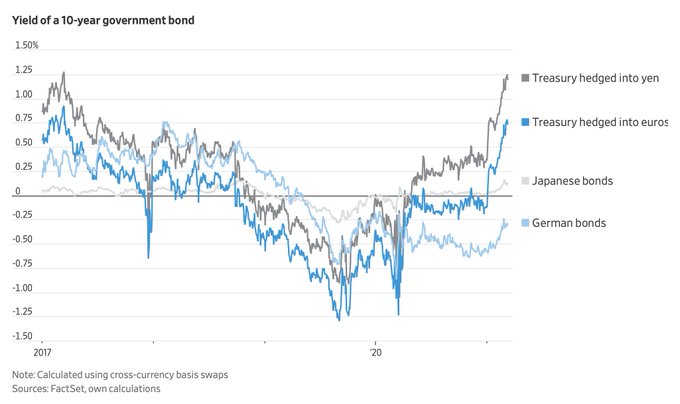

Another positive for Treasury stabilization is the yield advantage of 10-year Treasury to overseas investors, especially to Japanese investors:

- Jesse Felder@jessefelder – Thu – ‘Even after the cost of currency hedging, the 1.5% available on a U.S. bond gives investors in the eurozone and Japan a full percentage point more yield than their domestic bonds—the most in four years.’ wsj.com/articles/the-t

That was a classic Tepper call. Look what stocks did this week:

That was a classic Tepper call. Look what stocks did this week:

- Dow was up 4.1%; S&P was up 2.6%; even the NDX was up 2.1%; Russell 2000 was up 7.3%; Transports were up 3.9%; Dow Utilities were up 4.4%

And “the S&P did something really important” on Thursday, said Tom Lee on CNBC 1/2 Time show on Friday:

- … broke to a new high after a period of consolidation … if you look at last 2 periods of consolidation, almost immediately you had 10% rallies – so that gets us up to 4300; … lots of reasons to be more optimistic; path of disease coming down faster; brand new leadership coming through epicenter stocks – these are under owned names & they have potential to rally another 50%-60%; could fuel this S&P move; .. I do think VIX is giving us a pretty decent signal … bond market is important to watch; something we need to be afraid of ; right now it is co-operating; … investors got more cautious the last couple of weeks; … there is a lot of liquidity coming into the economy; … stocks are not that expensive ; equity risk premia have a lot of room to fall which means PEs can go up & earnings surprises could be tremendous …

Now ask yourselves what might happen if TLT & long-duration Treasury bonds actually rally? But wait a minute. Who is nuts enough to call for a Treasury rally? Look what Larry McDonald of Bear Traps Report said in his preview of next week’s FOMC meeting:

- “if …………., we would probably get a some type of rally in TLT & bonds in the short term; that’s probably very highly likely“.

What is the secret clause starting with “if” above?

2. SLR & 1987

Who does the Fed & its chairman report to? The Congress. So isn’t it safe to say that Chairman Powell is trying hard to not create a temper tantrum in the Senate Banking Committee? And isn’t it known that Senator Elizabeth Warner loves to create a tantrum?

Now go back to April 1, 2020 when everyone was trying to make sure that the U.S. economy and markets survive. And remember how hard Treasuries were sold in March 2020. And who is the second-last resort buyer of US Treasuries? U.S. Banks. So, as Bear Traps Report writes,

- “On April 1st, 2020, the Federal Reserve announced that it would exempt U.S. banks’ Treasury bond holdings and holdings at Federal Reserve Banks from Supplementary Leverage Ratio (SLR) calculations for one year. This was done “to ease strains in the Treasury market resulting from the coronavirus.”“

Normally extending this exemption for another year or so would be silently successful. But nothing is normal when Senator Elizabeth Warner gets involved. She wrote a letter recently, with Senate Banking Chairman Sherrod Brown, against granting an extension of the exemption under SLR. The reason seems to be their belief that such an extension would be another bailout of Banks.

So what would it mean to banks if the SLR relief is not granted by the Fed? As Bear Traps Report writes:

- “If the Fed ends the SLR cushion, we see US banks as a net seller of Treasuries. …. No SLR relief means banks must turn away deposits and then there is nowhere for money market capital to reinvest (ex RRP which is still capped) that MMF Bill maturities floods more cash. So entire money market constellation trades close to zero or lower and Banks can’t buy US Treasuries no room on Balance sheet due to SLR so they start puking them out, TROUBLE!”

Is it possible that Banks have already started selling Treasuries, ahead of March 31, 2021, to make room on their balance sheets? Is that partly a reason for the Treasury selloff two weeks ago?

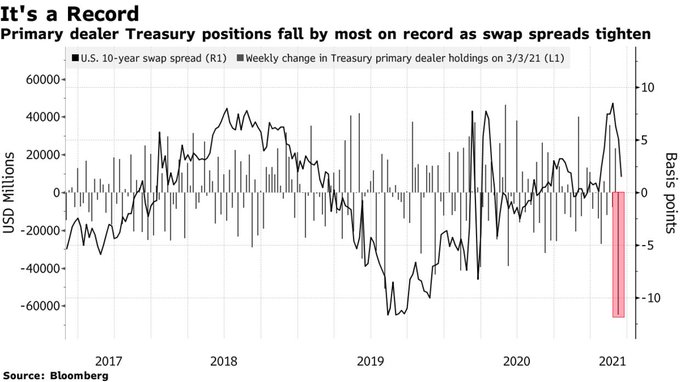

- Jesse Felder@jessefelder – ‘Treasury holdings at primary dealers dropped by a record $64.7 billion to $185.8 billion. One explanation is that dealers are taking steps to trim holdings before the expiry of a key regulatory exemption on March 31.’ bloomberg.com/news/articles/

The Fed can easily slip in a line about extending the SLR relief in the FOMC statement next week or say it in a technical matter-of-fact manner in the Presser. Or they could decide to wait until the following week.

If they decide to wait, we may get another week of puking of long term bonds and that might actually lead to another VIX spike. As we all know, the markets hate uncertainty! What if they end this uncertainty? Larry McDonald said in his preview of next week’s FOMC meeting:

- “if we get certainty on the SLR, we probably get some type of rally in the TLT & Treasury Bonds over the short term; that’s probably very highly likely“

If the Fed provides certainty on the SLR and we indeed get a rally in Treasury bonds for some time, then getting a serious rally in stocks is a reasonable probability. Such a rally could put the Fed in a comfortable situation even until September as Tepper suggested.

But what comes after September? They call it October. And what is Larry McDonald’s high conviction opinion?

- “I want to say it with high conviction – that probability of an inflationary shock is the highest in literally 30 years … that points clearly points us to some type of yield curve control at some point this year or may be in Q1 2022″

Look what even deflationary Rosie said this week in his article “Brace yourself for some pretty ugly inflation — then look past the hiccup to the trend.”

- “It’s clear that the upcoming year-over-year trends in headline inflation are going to look pretty ugly in the coming months, but the major reason is that we are coming off pandemic-induced price declines from the winter and spring.”

- “The base effects are so strong that even if sequential readings in the CPI were to come in flat, the year-over-year percentage change in the United States will still go to 2.5 per cent by May from 1.4 per cent currently. If you just string out monthly CPI increases of 0.2 per cent — and this is conservative seeing as what energy prices alone are doing — the headline inflation rate by May will go to 3.3 per cent. And the headlines in the media will scream, “Highest Inflation Rate Since November 2011.””

And Q3 is going to be the peak period for plans for an infrastructure bill. What might this do to long duration Treasury rates in Q3?

Remember the last time 30-year Treasury bonds kept going up in yield & down in price while cyclical stocks kept going up? That divergence became so great that even the Wall Street Journal displayed the two charts on page A1. That was Q3 1987.

There was a first sell off in Bonds in April 1987 and a rally in Treasuries after that first selloff. Then the second sell off began in late Q2-early Q3 and stocks continued to rally because rates were rising for “good reasons” until the divergence became too much. Then came October 1987.

3. The other side

What if the Fed provides positive certainty about the SLR extension and Treasury Bonds rally? Is there enough fuel to sustain a decent rally?

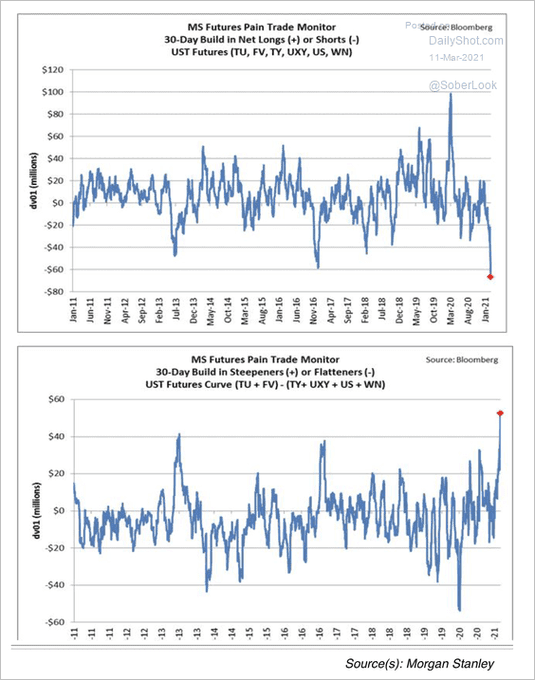

- Jesse Felder@jessefelder – Thu – ‘Trades betting on higher rates and a steeper yield curve appear crowded.’ thedailyshot.com/2021/03/11/sha via @SoberLook

And what does Larry McDonald, he of the reliable capitulation model, like the most in the commodity space? Gold & silver miners he said this week – like Newmont (NEM) that has a 6 PE & a 4% dividend yield. And remember Signor McDonald was the one who was exhorting all to buy Exxon & Chevron last fall. So what is he is right again and Gold starts outperforming Copper & other commodities? Remember the Gundlach dictum about Treasury rates & Copper/Gold ratio?

How do other commodities look to some?

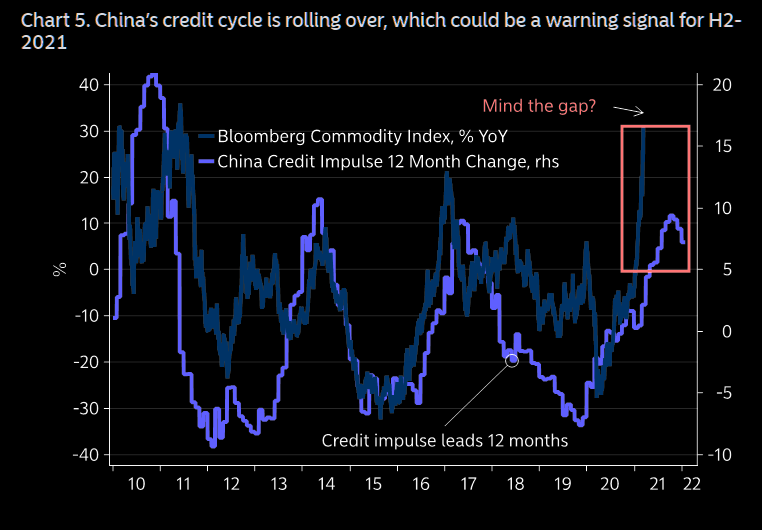

- Via The Market Ear – Commodities – approaching huge resistance levels – Everybody loves commodities these days. Yes, the longer term negative trend is broken, but being bullish commodities here is not a unique view anymore. Weekly RSI on BCOM is at highest levels since the GFC. Overbought can stay overbought, but BCOM has some huge resistance levels slightly higher. As we pointed out earlier today, China credit impulse is rolling over and it matters, maybe not yet, but soon… As Nordea writes – “China is currently running hot in credit/m1/m2 terms, which is usually a good signal for industrial commodities, but there are signs of Chinese credit growth rolling over into the second half of 2021. If you pair this with a hawkish balance-sheet move by the Fed, then you may have the perfect cocktail for much weaker risk appetite, but first things first. This is not a story for March/April, but maybe rather for May/June.”

So a Treasury rally could begin with Fed providing certainty next week & on fuel from extreme shorts in Treasuries. It can then extend if China credit growth rolls over & commodities reverse. That might get the S&P to Tom Lee’s target of 4300.

4. Kudos to Laura Ingraham & Tucker Carlson

As a part of the wider Asian-American group, we must give kudos & our thanks to both Laura Ingraham & Tucker Carlson of Fox for focusing on the increasing hate-filled violence against Asian Americans. It has reached such a point that even President Biden condemned it in his TV address on Friday.

But CNBC did not even mention it despite three Asian Americans on its on-air staff – Melissa Lee of Chinese origin, Ylan Mui of Vietnamese origin and Seema Mody of Indian origin. In contrast, Laura & Tucker have focused on this horribly racist outbreak without being of Asian origin. Once again, thanks & kudos to them.

We are glad President Biden addressed this violence but disagree with his premise. But his mentioning it shows the increasing outrage of the Asian-American community. It was instructive to see two new Asian American congresswomen elected in California. It is a pleasure to see the Democratic Asian American caucus reaching out to the new Republican Asian Americans to form a bipartisan group.

(Newly elected Congresswomen Kim & Steel)

We come from a democratic system that thrives on identity politics in which allies of different “jaati” make & leave political alliances. In that system, a party that takes a particular “identity” for granted pays a heavy political price. Clearly Mr. Biden became President mainly because of total commitment & support from the African Black community. And they deserve a large share of the spoils of Biden victory.

But such a share, a visible share, often backfires with other “identities” moving away as seems to be happening in America. It is clear that more Hispanics/Latins are moving towards Republicans and we would not be surprised to see a large number of Asian-origin people move towards Republicans as well.

This is another contrast emerging between Fox & CNBC. Right after the election, CNBC began embracing African Black guests on its network, a step we support & praise. But nothing CNBC does is clean. If you watch CNBC, you will quickly see that CNBC added more African Blacks to its shows mainly by reducing the number of Asian American guests. A cleaner & more moral network would have done so by reducing the number of the privileged class of races & adding African Blacks while preserving Asian Americans.

The reality is CNBC only serves the privileged White (Christian + English Jew) class with only a token public nod to the underprivileged to hide its private reality. If you have any doubts, just watch Asian-origin Melissa Lee vs. White, Blond Sara Eisen. The latter makes no bones about being mainly for her class while the former is so afraid to even show her Asian roots.

We all have heard about selective search of Google & other FAANGs. Look what we discovered when writing this section. We used Google to search for “ Tucker Carlson on violence against Asian Americans“. Guess what Google showed us:

- Of the top 8 searches, 4 results were “Biden condemns” and the others were Washington post, CBS, Fox, the Hill. At the bottom of the search page was a solitary mention of Tucker Carlson about his views on COVID.

Guess Tucker Carlson has been censored and we didn’t even know it.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter