Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Trends Continue

By trends we mean the three we have noticed in the past few 3-4 weeks – Dollar rising, Treasury Rates rising & Gold falling. Sadly & boringly, these continued this past week:

- Dollar up 30 bps; Gold down 1.2%; Gold Miners down 4%; Silver down 1.3%; SLV down 1.1%;

- Dow down 12 bps; SPY down 27 bps; NDX up 43 bps; RUT up 1.4%; DJT up 62 bps; SMH down 69 bps; EEM down 1.1%; VIX down 2.5%;

- 30-yr yld up 4 bps; 20-yr yld up 5.4 bps; 10-yr yld up 7 bps; 5-yr yld up 9 bps; 3-yr up 10 bps; 2-yr up 9 bps; 1-yr up 11 bps; TLT down 95 bps; EDV down 1.4%; ZROZ down 1.4%; HYG down 51 bps; JNK down 35 bps;

The last two are what we lead with below.

2.Liquidity & Credit

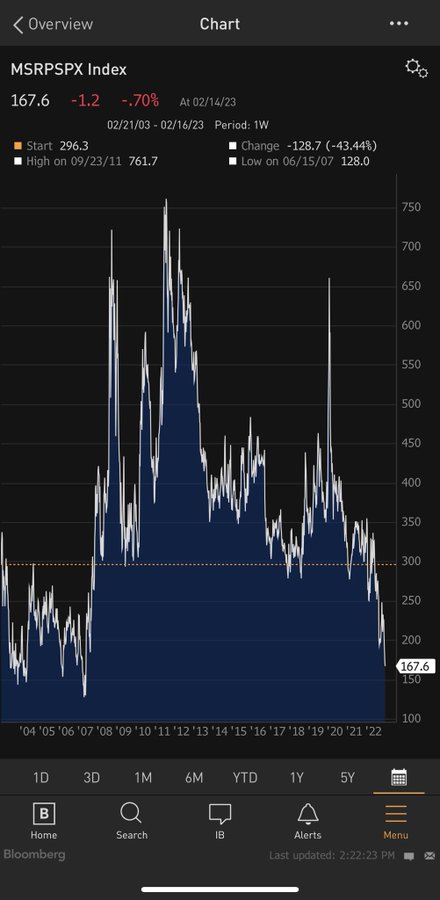

Two words that most equity investors ignore until it is too late. We don’t know whether it is too late now but at least we can’t ignore these now thanks to Tom McClellan and his article on Friday titled HY Bond A-D Line Showing Liquidity Problem:

- The SP500 broke out in 2023 above the year-long downtrend line that everyone has been watching, and has been struggling a little bit in February 2023 trying to extend that breakout. While it looks like just a pause for the SP500, the underlying weakness is evident when we look elsewhere, especially among the investments which are the most vulnerable to liquidity problems, the high yield corporate bonds.

- One can even make the case that the HY Bond A-D Line serves as a better canary in the coal mine than the composite NYSE A-D Line. This A-D Line started showing us a big bearish divergence in late 2021, and even ahead of the pretty big divergence in the NYSE’s A-D Line. That bearish divergence correctly foretold the awful market weakness we endured in 2022.

- There is no bearish divergence showing now, but we are seeing a suddenly weak HY Bond A-D Line. It peaked on Feb. 2, 2023, the same day as the SP500, but since then it has been falling almost daily and has now dropped below its 5% Trend. Having it below that exponential moving average (EMA) is what happens during price downtrends.

- The message is that financial market liquidity has suddenly left the building, and that this is going to come around and bite even the big cap stocks which can muscle aside the little guys for a while, like the big pigs at the feeding trough, but eventually it affects them too. The vulnerable ones are more useful in this respect, showing us that the liquidity is drying up ahead of time.

Who else do we listen to about this complicated stuff?

- Lawrence McDonald@Convertbond – Feb 17 – “Sales of CMBS Plunge 85% as Commercial Property Markets Freeze” | Can’t hedge new deals in this market. Higher rates mean a lot of defaults.” v @rcwhalen *dear equity investors – basic math – see loans outstanding vs where they are priced – 200-400bps south of here. Shit storm.

Is it only CMBS?

- Lawrence McDonald@Convertbond – Feb 18 – The Freeze — “Its not just CMBS. Auto ABS and CLOs are also going dark. The all-in cost of capital is up 5X in some cohorts. 10% collaterals are needed to drive the arb. Most borrowers cant afford it. The ones with no choice are not the credits you want.” (2) Via @Stimpyz1

Then Mr. Convertbond cites a famous name via a retweet:

- boaz weinstein@boazweinstein – Feb 16 – Past 20yrs of Equity Risk Premia. Yikes! Still think credit is the better short because of the asymmetry of HY at 400bps with defaults starting to rise.

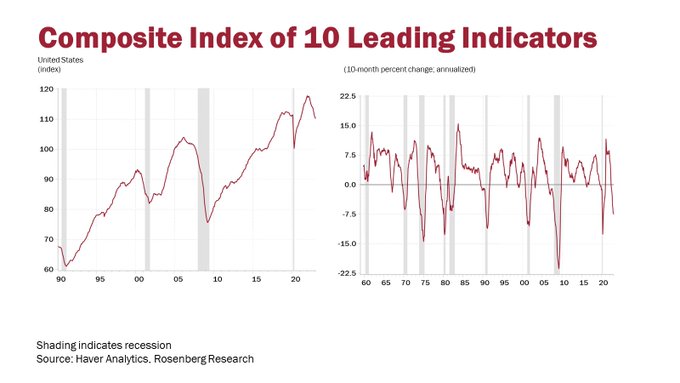

By now, everyone knows what David Rosenberg thinks. Still,

- David Rosenberg@EconguyRosie – Feb 17 – Just as the lagging and coincident indicators rose 0.2% in January to new highs and are all the focus, the index of leading indicators dropped 0.3% and has declined now for 10 straight months, a 100% iron-clad recession forecaster.

But are the coincident & lagging indicators following the leading ones? The one interesting comment that suggests so came from Dana Telsey to BTV’s Tom Keene & Lisa Abramowicz on Wednesday March 15 (at 2:20:35 minute of the clip):

- “keep in mind, I don’t take January as seriously as I take March, April & May; … I think the lower to middle income consumer, where we have seen the tradedowns, is what I am concerned about as we go thru the first half of this year …. We have heard so far that you are seeing even customers with $100,000 house-hold incomes, companies like seeing more consumers at that level of household income; you are seeing some of the lower tier companies, the Dollar Stores & even off-pricers where their average household incomes they were getting was under $40,000 and now consumers with $60,000 household incomes are going there; the trade down is real & that’s what impacts the March-go forward time period” …

3. Equities

We all know that stocks move on liquidity. But how critical has Fed-provided liquidity been over the years?

- Lawrence McDonald@Convertbond – Feb 16 – Since Lehman failed, EVERY single meaningful counter-trend rally in US equities required ONE thing to get stocks through overhead supply, QE* and promised rate cuts. *Balance sheet expansion by the Federal Reserve. Now the Fed is hinting at 50bps of rate hikes and doing QT.

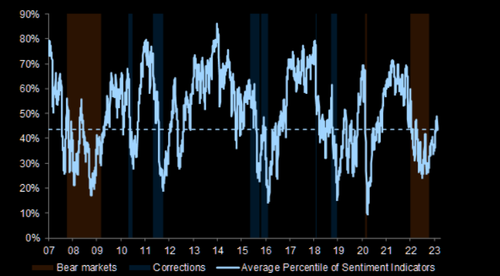

On the other hand, positioning tells a different story:

- Via The Market Ear – Highest since last April – GS: “Our indicator of positioning and sentiment has reached the highest level since last April“.

How does that tally with the below? Is the positioning being reduced?

- Via The Market Ear – Friday – Breaching the 2023 trend channel – SPX is currently below the trend channel that has been in place during this year. Note we are below the short term 21 day moving average. Not looking great…

The medium term determinant of stock prices are earnings & the multiples put on them. Dan Niles is negative on both going forward and has raised the shorts in his portfolio. Listen to him explain why:

Is it possible that earnings don’t just go down but we get an earnings recession?

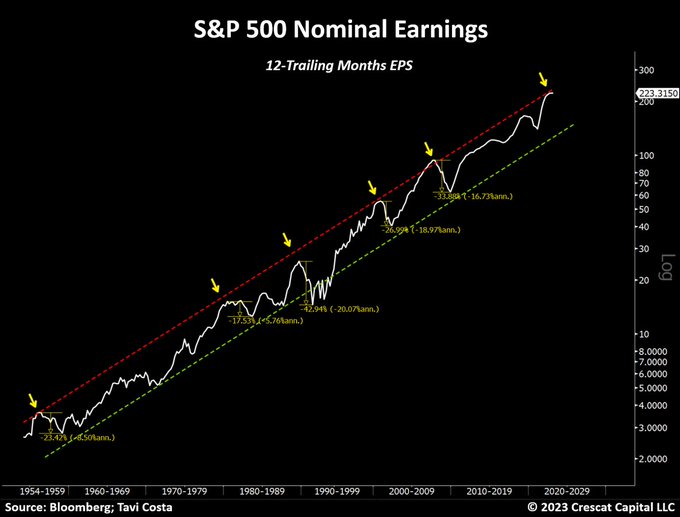

- Otavio (Tavi) Costa@TaviCosta – Corporate earnings have been trending in an upward channel for 70 years. Every time profits reached the upper band of this range, an earnings recession followed. At peak levels, we are at a critical juncture once again. This is an important consideration, particularly at…

Isn’t the above a classically Worthian chart ? Speaking of technicians (like Carter Worth), we hoped technicians could show us the way. Unfortunately, they speak at cross purposes like Economists! First BTIG’s Jonathan Krinsky:

Second, FundStrat’s Mark Newton:

Given all the above, why not wait for the markets to tell us this coming week. And an important message they could give us is about the outlook for semiconductors. As always, the reaction to earnings is more important than earnings itself.

4. Adani Washout to Adani Earnings

Two weeks ago we wondered whether, instead of the Adani washout damaging the Indian market, the charts suggested buying INDA vs. SPY going forward. Below is the INDA vs. SPY chart for the past two weeks:

Nothing conclusive but not an inauspicious beginning. A lot has happened in this story during the past two weeks, developments that have prompted us to downgrade the impact from Adani Washout to Adani Turbulence. For a detailed discussion, see our adjacent article Adani Turbulence – Our Reflections II.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on Twitter