Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”Dollar at the epicenter” and “Big shift in mood music“

We have been pointing out for a couple of weeks that the 3 trends that drove up the stock market in 2023 look like they are stalling if not outright reversing – Weakness in Dollar, Treasury yields down & Gold up.

This was emphasized by two smart investors this week:

Emily Roland of John Hancock on Friday on BTV Surveillance (minute 1:45:18) – “this week it feels as if there has been a big shift in the mood music” ….. “Dollar has been at the epicenter of every move in the market … “. She ended with “ … now we are hearing about margin pressure … top line growth slowing meaningfully ,, we think there is going to be a major war on margins in 2023“. Her final statement was “we love Bonds“.

Jonathan Krinsky of BTIG on Tuesday on CNBC Overtime – “... key issue for us is for the entire duration of this bear market … is that stock market has been in inverse correlation to the Dollar; from January to last September, stocks sold off. Dollar peaked in September; Stocks bottomed; Now Dollar has put in a bottom last Tuesday … we don’t see a ton of downside for the Dollar ; its tough to see a lot of upside for equities here ” . Krinsky did say if the S&P breaks out above 4,200 then its different and before that he used the false breakout curse word for the equity rally & added that “with a false breakout, from fast moves in one direction come fast moves in the other direction” ”

That brings us to:

2. US Stock Market

Many can & do come to tell us about a selloff in the stock market after it has taken place. But sometimes we hear a smart opinion warning us about a selloff just in time. We speak of Jim Cramer sharing the views of his techni-pal Carolyn Boroden on Monday evening on Mad Money.

- Cramer told viewers that Ms. Boroden was putting up a Yellow Caution Flag because both time & price are against us; that she sees a firm ceiling of resistance between 4192 & 4199 and her indicator for a sell off is the S&P’s 5-day exponential moving average (ema) to cross below the 13-day ema. Cramer also relayed her warnings that 6 time cycles were coming due this past week and that 3 more come in the week ending February 24th.

So, to summarize a la Cramer, cycles of Ms. Boroden are suggesting not just a pullback but “a meaningful pullback“. And Cramer put this out last Monday with ample time to reduce positions or sell ahead of the pullback that happened later last week. Watch the clip below to get the full color & to see Ms. Boroden’s charts:

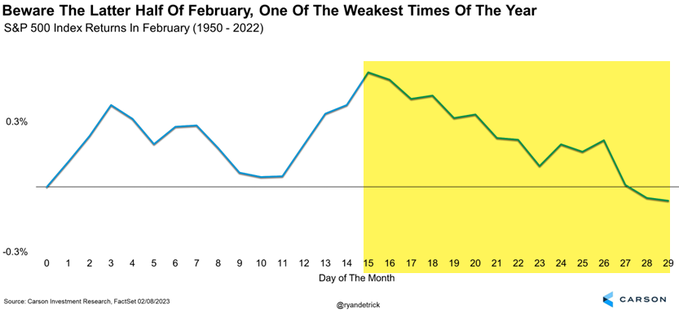

An old dictum says listen when a bull suggests weakness ahead. And it might be hard to find a more steadfast bull than Ryan Detrick:

What about VIX, you ask?

- Andrew Thrasher, CMT@AndrewThrasher – Feb 9 – Since I know how much everyone loves some TA on $VIX charts, here’s a fun one…

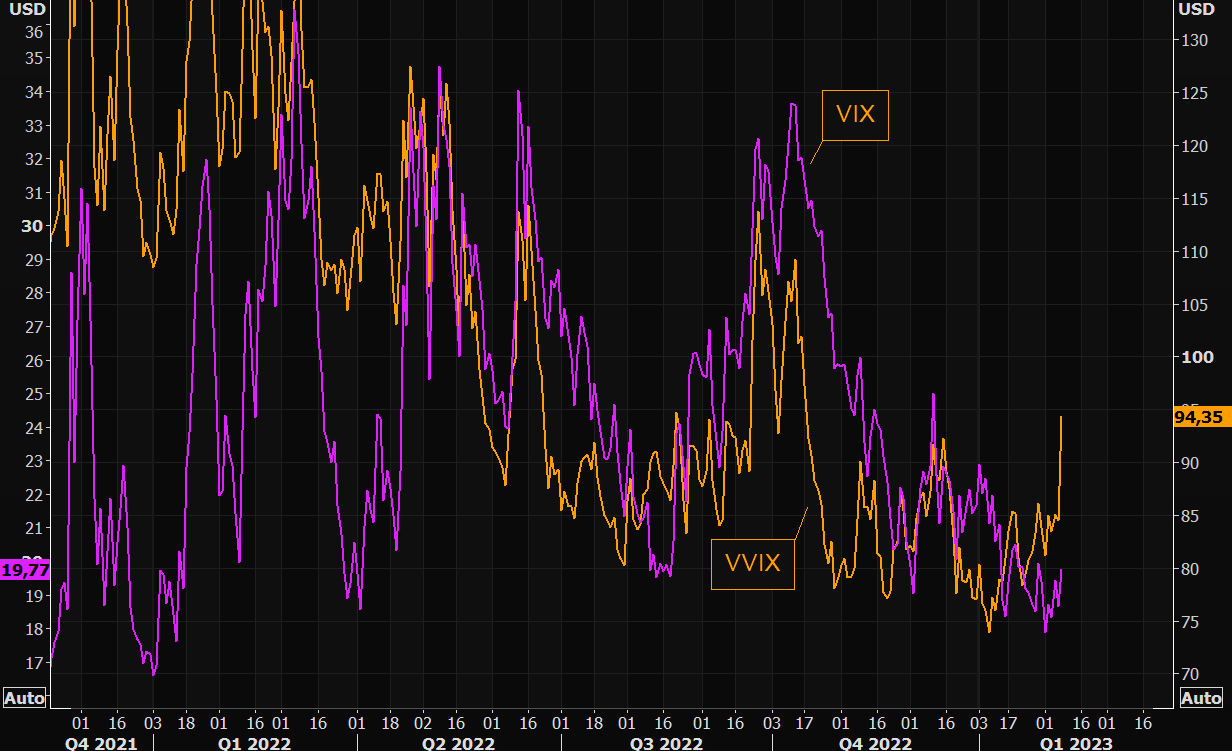

But should the rate of change of VIX rise sharply before the VIX does?

- Via The Market Ear – Wed Feb 8 – VVIX exploding higher – VIX of VIX is exploding higher. The crowd is loading up on VIX options. Do we see VIX catching up soon?

Everyone says that Tuesday February 13 is a big day because the CPI is released that morning. So is a selloff more likely to occur before the CPI is released or after? One view is:

- SpotGamma@spotgamma – Feb 9 – We continue to think the market will have a much easier time declining after the 13th vs before it, as CPI plays into the clearing of the positions that are holding markets in the 4100-4200 range.

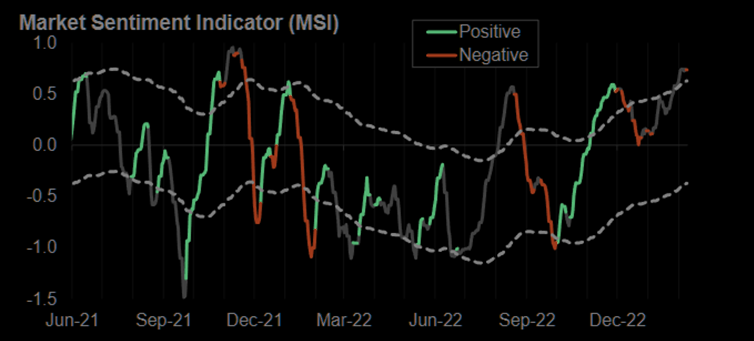

Since the sentiment about this stock rally has been described by some as “euphoric”, is there a quant measure that tells us if that is or isn’t so?

- Via The Market Ear – MSI has turned risk negative – In case you missed it, the Morgan Stanley Market Sentiment Indicator (MSI) has turned risk negative.

At this point, it might be worthwhile to review this past week:

US stock indices – Dow down 17 bps; SPX down 1.1%; RSP down 1.4%; NDX down 2.1%; RUT down 3.4%; IWC down 3.6%; DJT down 3.1%; SMH down 1.6%;

Dollar up 70 bps; VIX up 12%; Gold down 16 bps; GDX down 2.2%; Silver down 1.5%; Oil up 9%; Brent up 8.6%; OIH up 4.3%; XLE up 4.9%; CLF down 7.6%; FCX down 1.3%

International stocks – EEM down 1.8%; EWZ down 1.4%; EWY down 1.5%; EWG down 2.5%; INDA up 32 bps; FXI down 2.9%; KWEB down 4.7%;

Treasury yields – 1-yr up 10 bps; 2-yr up 23 bps; 3-yr up 25 bps ; 5-yr up 27 bps; 7-yr up 26 bps; 10-yr up 22 bps ; 20-yr up 20 bps; 30-yr up 20 bps; EDV down 5%; ZROZ down 4.1%; TLT down 3.2%;

What about the sell-off in Treasuries? Why talk about it until we see the CPI & the market’s reaction to it?

Send your feedback to [email protected] Or @MacroViewpoints on Twitter