Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.The Really Big Story of the Week

No, we don’t mean the raising of tariffs on Chinese exports. That is a big story but really not that big. Why? Look how the US Stock Market behaved this week. Every morning, US indices opened down; went down a few hundred points & then rallied from there to close modestly down. Because the Chinese tariffs are not that big a factor for the US market & the US economy.

But the reality is that President Trump has drawn a bead on China. And the real reality is that whenever America has drawn a bead on a foreign adversary, America has proceeded very methodically & very smartly to squeeze their options & strength to provoke them into a conflict America can win. The Soviet Union is the most recent example. They were a major challenger & where are they now? The other example is Japan from the 1930s, the example most relevant to today’s conflict with China.

For a broader & possibly deeper discussion of this week’s tariffs action, see our adjacent article titled China’a Ignorant Arrogance – President Trump’s Smarts; Back to 1930s USA vs. Japan.

The Trump team understands that the real adversary in this trade fight is the U.S. stock market and not China. So the news releases are managed as carefully as possible to not change the bullish tenor of the U.S. stock market. And, frankly, the tenor of the U.S. stock market depends much more on the Fed than on Chinese tariffs.

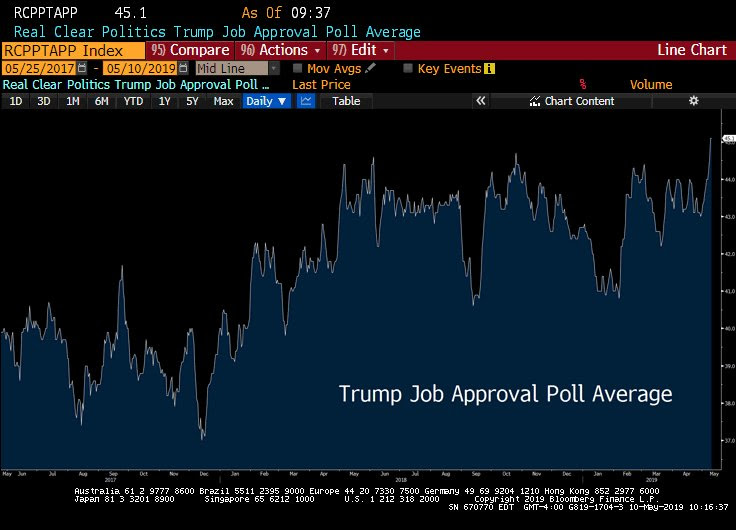

On the other hand, we think this week’s tariffs action on China will make President Trump more popular as the defender of America. But how popular is he now? Look at the chart tweeted by Larry McDonald (@convertbond) of Bear Traps Report:

And that is without this week’s truly big deal, this week’s verbal agreement. What verbal agreement you ask? An agreement that, according to previous comments of Mohamed El-Erian, will take the US GDP trajectory to a sustained 3% handle – a Trump-Pelosi-Schumer agreement on a $2 trillion infrastructure program. Read the accolades from Democrats for President Trump:

- Schumer – “We agreed on a number, which was very, very good, $2 trillion for infrastructure, … Originally we had started a little lower; even the president was willing to push it up to $2 trillion. And that is a very good thing”

- Peter A. DeFazio, (D-Ore.), chairman of the House Transportation and Infrastructure Committee – “It was a good, positive meeting, … the President spent a good time listening, and then he had things to say on his own. It was pretty balanced. He responded to points that were made and made points of his own. “

Who do the Democrats think President Trump is? FDR? They would be right if they did. Remember what we wrote on January 23, 2016 just before the Iowa Cacus in our article Reagan, FDR, & Nixon – 2016 Election:

- “It would actually be easier for Donald Trump to move left & adopt the FDR banner than it would be for Bernie Sanders to move right to appeal to Reagan supporters”

Donald Trump was a life-long Democrat; he loves building things & he has always been attuned to what construction & industrial workers think. He has great respect for President Reagan but his heart was always with FDR type policies. So when he needed Republicans in 2016, he emulated Ronald Reagan. Now the Republican Party is his. However, he needs blue collar Democrats & Big 10 country to back him in 2020. So he is now gravitating to where his heart has been – FDR type infrastructure program that will bring jobs to blue-collar urban labor & their unions.

2. President Trump & the Fed

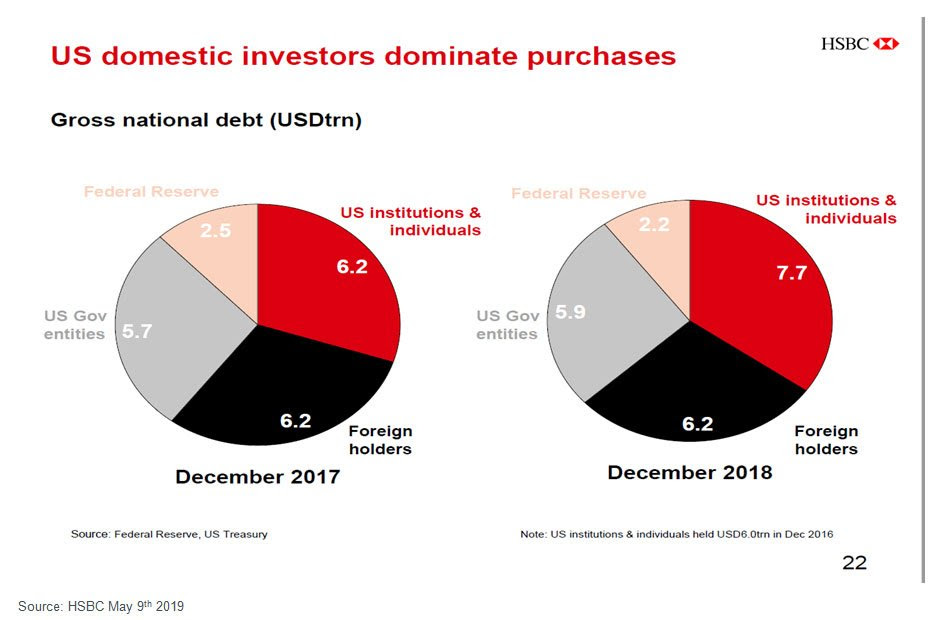

How would you fund a 2 trillion dollar infrastructure program? First you need low rates, really low rates. Rates are already low, lower than most would have bet on at the end of 2018. But they are not low enough to raise $2 trillion. What if the Fed lowers interest rates by 100 bps and that gets the 10-year rate to 2% (already a forecast among many economists) and the 30-year rate to 2.5%?

At those rates, could the U.S. Treasury raise $2 trillion by launching a 30-year Treasury bond that pays about 2.5%? Hasn’t Secretary Mnuchin spoken wistfully about such a possibility? Hasn’t Jim Cramer publicly advocated such a program on TV with his usual passion? The structure & incentives could be negotiated but the need for such a bond would be obvious to many, especially the Pelosi-Schumer-DeFazio wing who want to show why the middle class & labor should vote for them in 2020.

Would Chairman Powell actually oppose such a joint Trump-Pelosi-Schumer demand? Especially when the Treasury market is almost screaming for a rate cut at the next FOMC? Would Chairman Powell oppose this when his own colleagues like Dr. Brainard are already talking about “the possibility of targeting longer-term interest rates as a “new” tool to combat the next recession.’”

Even the Fed should realize that a $2 trillion infrastructure program would inject such enthusiasm & related capex that it might actually avoid the “next recession” or postpone it by a couple of years.

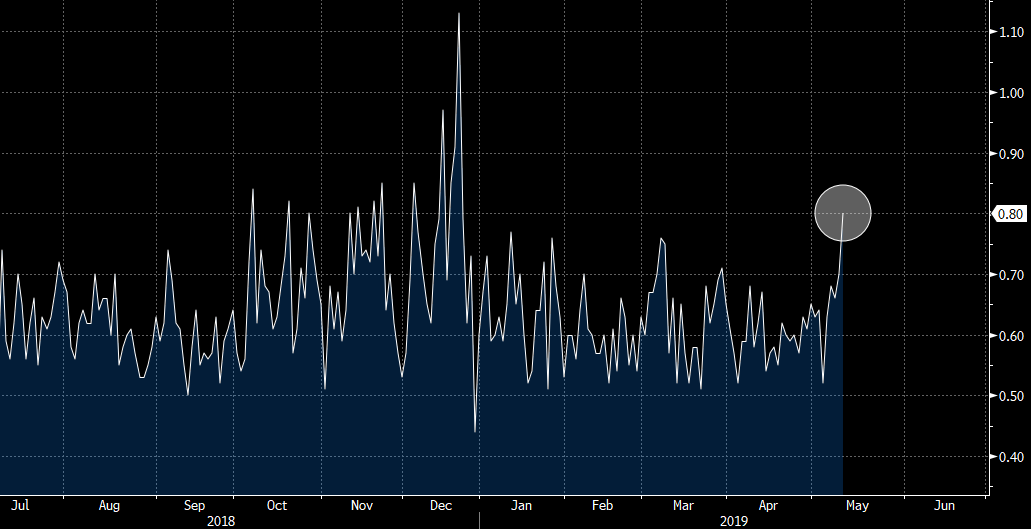

3. Need for a rate cut

Let us count the reasons. First, even after the rise in rates on Friday, the 3-month yield closed the week at 2.431% (1-month yield at 2.432%) while the 10-year yield closed at 2.465%. So the 10yr-3mo spread is down to 3 bps & so is the 10yr-1mo spread. And the entire 7yr-3mo (& 7yr-1mo) spread is negative or inverted.

This is AFTER Chairman Powell told us current level of inflation is transitory. Secondly, Powell could be & is, in someone’s opinion, wrong:

- David Rosenberg @EconguyRosie Fade today’s PPI headline. The core consumer segment was flat as a pancake. Core intermediate PPI was -0.4% and core crude was -1.2% (-4.5% YoY) so the leading ‘pipeline’ price measures are melting away. Doesn’t look too “transitory”, Mr. Powell.

Rosenberg added on Friday:

- Hints of Deflation – The key as always is the core and for the third time in a row, it printed +0.1%