What a week! It began with the just execution of ISIS leader Al-Baghdadi by US special forces and ended with the US stock market reaching new all-time highs. These two great book-end events may have a common factor, a 5-letter word – Trump.

1.Trump Tale

Look what Nobel Laureate Robert Shiller said the week before:

- “We’re maybe in the Trump era, and I think that Donald Trump by inspiration had an effect on the market — not just tax cutting.”

Others may scoff but we don’t. Because we have been following & using Shiller’s journey into what he now calls Narrative Economics, a study of “How Stories Go Viral & Drive Major Economics Events“. To us, he began this journey on March 20, 2014 by using the term Tale Risk in his Project Syndicate article titled “The Global Economy’s Tale Risks“. The term Tale Risk is a cute play on the well known statistical term “tail risk”. Shiller smartly inverted tail to tale to describe how risks can change from negative to positive because of a confidence creating leader, in Shiller’s case Japanese Prime Minister Abe:

- “Fluctuations in the world’s economies are largely due to the stories we hear and tell about them. Since Prime Minister Shinzo Abe assumed office in December 2012 …. the impact on Japanese confidence has been profound. … He sticks to the script, telling a story of taking aggressive and definitive action against an economic malaise that has plagued Japan for decades. He inspires confidence;”

Shiller’s article fit with our own thinking about major turning points that great leaders create on their own and we liked his term “Tale Risk”. So we used it a week later on March 29, 2014 to describe the Modi Wave in our article Why Are They Upgrading India Now? – “Wave” or “Tale Risk”?.

The Modi impact on India & on Indian markets was so large that we applied the “Tale Risk” term again in August 2014 & in November 2014.

Then came November 2016 & the stunning victory of Donald Trump over Hillary Clinton and actually over the Bill Clinton doctrine that had governed US economic policy since 1994. So on November 12, 2016, 4 days after the election, we wrote Tale Risk & a Momentous Reversal of the Bill Clinton Doctrine?:

- “Not only was the Trump victory stunning in its own right, but equally stunning has been the wave of enormous confidence sweeping through American markets. Bill Ackman, a prominent Hedge Fund manager, said “I woke up on Wednesday morning bullish about America“. Ackman added “he [Donald Trump]is going to get a lot done; nothing has been done in USA for a very long time … extremely bullish for growth“. “

There is no doubt that the power of the Trump tale impacted the world from the day of his election. So we began wondering whether the term “risk” was even appropriate to describe the Trump impact. So on December 3, 2016 we wrote Donald Trump – From Tale Risk to “Tale Reward” in 3 Weeks:

- “Shiller created this term in 2014 to explain how a new charismatic leader can inspire a wave of confidence that can lead to significant upside in the success of his nation. Shiller did not really get how correct he was. … Had Shiller understood Donald Trump, he would have changed his term from Tale Risk to Tale Reward. Since he didn’t, we now formally unveil our term Tale Reward, a realized form of Shiller’s Tale Risk.”

But today’s Shiller has not only recognized the power of the Trump Narrative but he is also using it to estimate & predict its positive impact on the US consumer in the next year or two. Listen to him yourselves:

2. Narrative Economics – the book

Remember December 2015 when “Donald Trump put forth a plan to “temporarily ban” Muslims from entering America “until our representatives figure out what’s going on”? Remember the media outrage that quickly changed to even NBC’s Chuck Todd saying the following on NBC Evening News that week:

- ” … there may be more people that support Trump’s position but don’t necessarily want to tell somebody over the phone when we do these polls that they are for him; there is one other thing is this poll that is good news for Donald Trump – 77% of Republicans say that they appreciate or like the way he tells it even if at some point he does it inelegantly; lot of people in this party like how Donald Trump is bringing up some issues … “

While the political experts on TV were saying how Trump’s candidacy was finished, we heard something very different from a Muslim cab driver in Manhattan. He was not that offended by what Candidate Trump had said & added that a man who can bring up such polite well-mannered children cannot be bad. Taxi drivers know a lot more about celebrities in their city & hear a lot and, generally speaking, their opinion turns out be worth listening to.

That is why we liked what Shiller writes in his book about Narrative Economics vs. professional economists:

- “It is rare to see a professional economist … quoting what a businessperson or newspaper writer thinhs is going on, let alone what a taxidriver thinks. … Traditionally economists who study data have excelled in creating abstract theoretical models and in analyzing short-run economic data. They can accurately forecast macroeconomic changes a couple of quarters into the future, but for the past half century, their one-year forecasts have been on the whole worthless.“

In contrast, Shiller says “narratives are major vectors of rapid change in culture, in zeitgeist and in economic behavior“. He writes:

- “Narratives take the form of sequences of words, which makes the principles of linguistics relevant. Words have both simple, direct meanings and connotations, in addition to metaphoric use. .. Modern neurolinguistics probes into the brain structures and organization that support narratives. ”

- “The human brain tends to organize around metaphors. … Linguist George Lakoff and philosopher Mark Johnson (2003) have argued that such metaphors are not only colorful ways of writing and speaking; they also mold our thoughts and effect our conclusions.“

- “Neuroscientist Oshin Vartanian (2012) notes that analogy and metaphor “reliably activate” consistent brain regions in fMRI images of the human brain. That is, the human brain seems wired to respond to stories that lead to thinking in analogies.”

In his own words,

- “A key proposition of this book is that economic fluctuations are substantially driven by contagion of oversimplified and easily transmitted variants of economic narratives.”

And his message?

- “collaborative research between economists and experts in other disciplines holds the promise of revolutionizing economics.”

What would we recommend to Prof. Shiller? That he stop using the word “contagion” to describe the spread & assimilation of economic narratives. The term contagion is often understood as a metaphor for a spread of bad, malignant conditions while the spread of economic narratives can be both good & bad. And his own analysis of Trump’s example & message is a positive one in that it encourages consumer spending & pushes the next recession further into the future.

We prefer the term “assimilation” instead of contagion. After all, the effect is only realized by assimilation of the narrative & not merely by its existence. A contagion that is not assimilated in economy’s or society’s innards is almost useless, right? And an assimilation can be both good & bad while a contagion conjures up extremely negative images like Ebola, Plague, AIDS just to name a few.

3. Trump, Fed, Confidence & Recession

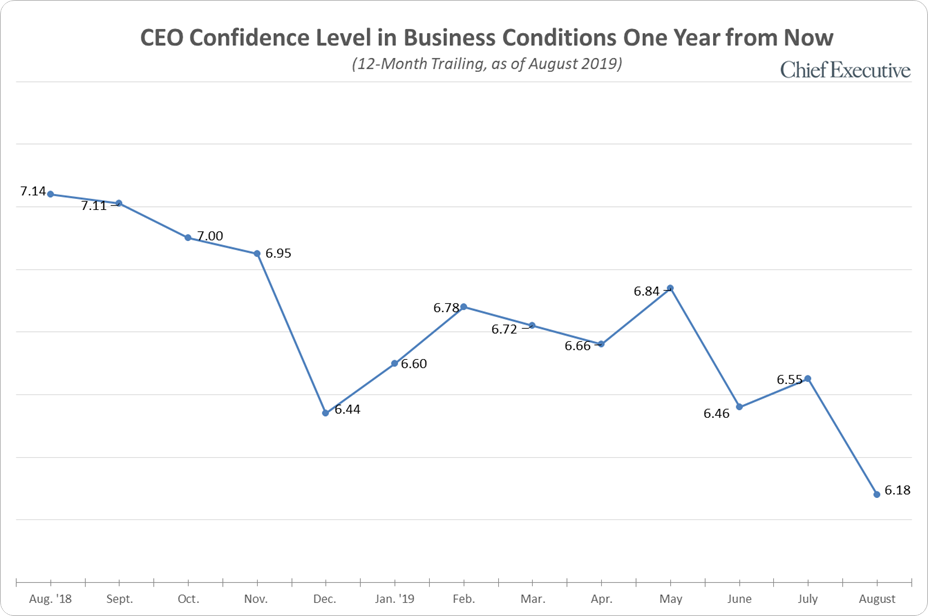

There is no question that the last quarter was filled with worries about the US economy following other major economies like Germany & China into a recession. Trade war, the 2020 election and the potential impeachment of President Trump were some key factors as was the apparent resistance of the US Federal Reserve to ease financial conditions. Look at the chart below of CEO confidence from ChiefExecutive.net as of August 2019:

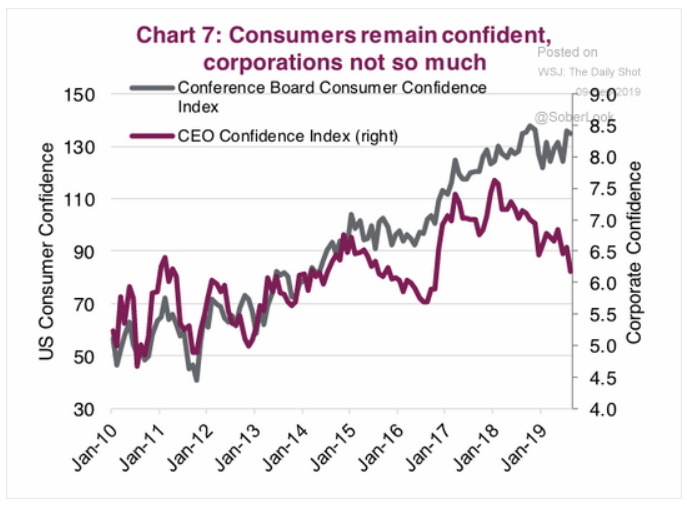

How did we go from such dismal outlook at the end of August 2019 to new all-time highs at the end of October 2019? Remember that the U.S. economy is 70% consumer spending and look at the picture below that explains far more than 1,00 words could:

- Teddy Vallee@TeddyVallee – Consumer vs. CEO confidence

See how the purple line of CEO confidence exploded up from January 2016 into early 2018 based on the Trump Tax Cut & Deregulation initiatives. Then it started slipping because of US-China trade war concerns & fears about the 2020 election.

Contrast that with the gray line of Consumer Confidence. This line also exploded after the 2016 election but has not wavered to any serious extent. This is the simplest way to understand the Trump Narrative. So as long as the confidence in Trump remains unshaken, the US economy should remain fine.

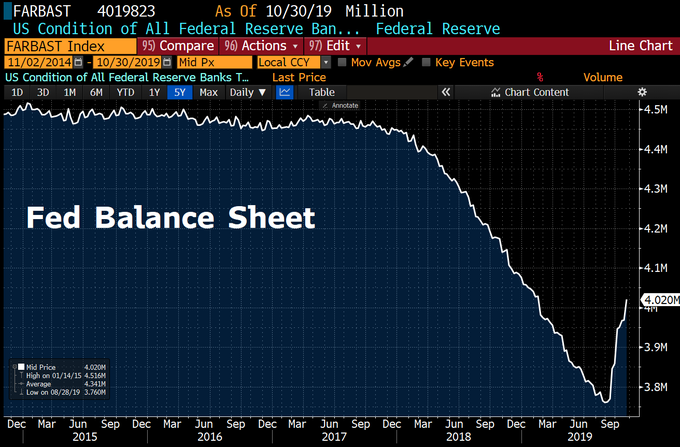

There was also a big factor underneath that has changed in the past 4-5 weeks from a big negative to a positive. That factor is the ultimate Deep State in America – the US Federal Reserve (“Fed”). While President Trump & his administration is the engine of US Economy, the Fed is the transmission. And as virtually every middle class or lower middle class American knows, a car doesn’t travel fast or well without both the engine & transmission working in unison.

So President Trump has been absolutely correct in saying that the biggest problem for the US economy has not been China but the Fed. Now finally the Fed has come around in the last 4-5 weeks. Witness:

- Holger Zschaepitz@Schuldensuehner – In case you missed it: #FedBalance Sheet jumped above $4tn this week as Fed has restart QE (which must not be named).

And we saw what happens when the Fed transmission starts working WITH the Trump engine – we get new all-time highs in the stock market & hopefully a very Merry Christmas.

Now imagine that the sham impeachment circus ends or even loses credibility and US-China come to a truce. Then will CEOs be content to remain that far behind the confident US Consumer? We doubt it. After all, even Nobel Laureate Robert Shiller has come around & accepted the Trump Narrative, right?

Send your feedback to [email protected] Or @MacroViewpoints on Twitter