Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”direct injection of enterprise value“?

This week, Fin TV anchors began alluding to the reality beneath the exterior of the US economy.

- David Rosenberg@EconguyRosie – Nov 18 – Count up all the Americans on emergency jobless benefits, on mortgage forbearance and on the CDC no-eviction list, and it’s nearly 30 million hanging on by a thread after Jan 1st. And we have strategists cheering over fiscal gridlock. Go figure.

As we wrote last week, David Rosenberg & his now fellow-traveler Jeffrey Gundlach both believe that stimulus now is the most pressing need for America. Rosenberg even thinks there is a 20% decline in the S&P ahead if we let the economy slide into a recession or something closer.

But the S&P is mostly made up of large investment grade companies & they are flush with cash, said Rick Rieder of BlackRock. He reiterated his view that we will get a 5% nominal GDP in 2021.

- Squawk Box@SquawkCNBC – “When you grow the money supply and then you put the type of stimulus into the system we’ve had … you create velocity. In traditional economic terms when you get money supply and velocity, you get growth. In my mind its just math,” says BlackRock’s @RickRieder

By his simple math, these large companies will see a 4% free cash flow yield next year while the 10-year is mired in a perennial sub-1% yield. That he calls a “direct injection of enterprise value into companies” for a couple of years.

Rieder readily admits that employment will not come back as quickly as the economy does. Jim Bianco pointed out the impact on 70% of the jobs due to Corona Virus.

- “Roughly around 30% of the jobs in the American workforce can be effectively done at home. Seventy percent of them can’t, …. Think surgeon to waitress. They can’t do that at home.”

He added,

- “The people who can effectively work at home are at the higher end of the [earnings] spectrum,” he said. “They won’t be hurt as much by another work-from-home wave coming.”

Add to that the steadily increasing number of layoffs & job losses that companies are murmuring about and the picture for employment does look bleak. But money managers need not worry too much. China or at least buying from China will soon come into vogue &, as Ashley Tellis of Carnegie said on Indian CNN, Biden will add another 100,000 visas for Indian talent next year.

And the Fed will be aggressive in building up its BS via QE, perhaps to send a loud message to Secretary Mnuchin that they don’t need his lousy $450 billion. In fact, we might hear that in the December 16 meeting. Just in time for a Santa rally into year-end?

- Lisa Abramowicz@lisaabramowicz1 – Another record for the Fed’s balance sheet, which has now reached $7.24 trillion. The Fed may boost Treasury purchases and/or extend maturities of the securities it buys through its main QE program because of the dispute with Steven Mnuchin: Medley’s Ben Emons via @theterminal

How good will all this be for large companies? First Trump gave them a huge tax-cut. Now Biden, if & when confirmed, will give them the green light to cut jobs in America & ship them to Asia. And oh yes, a mandatory $15 wage will force large employers to replace workers with robots in both out-of-sight warehousing jobs & front office server jobs. Double And, the Fed will take the balance sheet higher & higher. Meaning a triple dose of the direct injection of enterprise value, right?

This stuff cannot but force Treasury yields further down. So good times again for the Risk Parity crowd? And in case you didn’t notice, RPAR, the Risk Parity ETF, rose 1.6% this past week handily beating Dow (down 74 bps), S&P (down 75 bps) & NDX (down 27 bps). In contrast, TLT rose 2.2% and EDV, the Zero-coupon ETF, rose 2.8% with 30-year Treasury yield closing down 13 bps, the 20-year down 10 bps (despite a D-grade auction), the 10-year down 7 bps and the 5-year down 3.5 bps.

So are bonds going to have more fun?

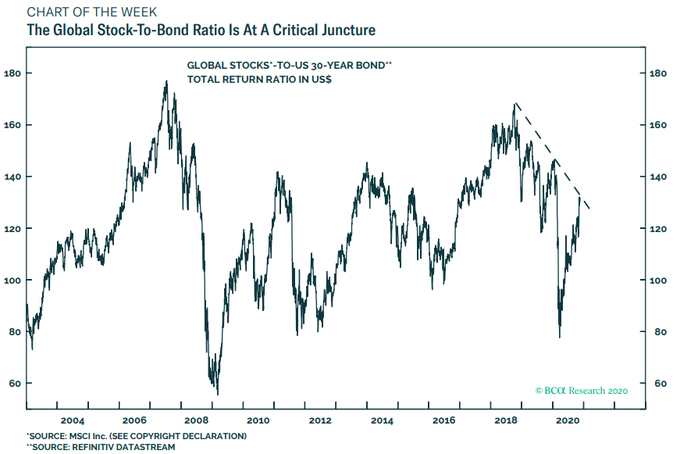

- jeroen blokland@jsblokland – Nov 19 – BCA Research’s chart of the week. Stocks-bonds ratio at a critical juncture.

Aren’t falling Treasury yields great for NDX growth hot shots? Did you notice which stocks were up during Friday’s & Thursday’s declines? An example below:

2. S&P

Per Lawrence McMillan of Option Strategist,

- “Breadth has been strong again, and it remains one of the more bullish factors in the current market. Both breadth oscillators are on buy signals and in modestly overbought territory.”

- “Volatility has been fairly bullish as well. The $VIX “spike peak” buy signal of October 29th remains in place. It will “expire” in late November, unless it is stopped out first (by $VIX returning to “spiking” mode). Moreover, both $VIX and its 20-day Moving Average remain well below the still-rising 200-day MA. That is bullish for stocks, too.”

- “There may be signals on both sides of the market. However, the “big” picture is fairly simple right now: maintain a bullish stance unless $SPX closes below 3500.”

And,

- SentimenTrader@sentimentrader – Nov 19 – Active managers are so bullish they’re leveraged long. Instead of assuming that’s a contrarian negative, let’s take 30 seconds to check. The avg return 3 months later was 5%, with the 3 precedents all being higher, so.

Is there a “yeah but” coming?

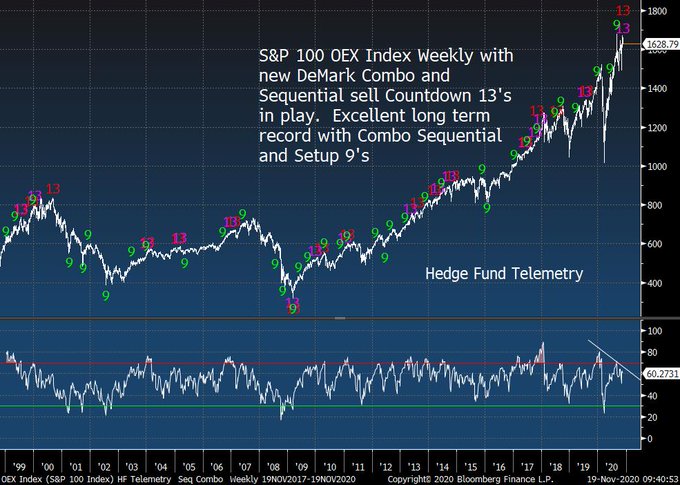

- Thomas Thornton@TommyThornton – Nov 19 – S&P 100 $OEX index with weekly DeMark Combo and Sequential sell Countdown 13’s in play. Excellent long term record. For more take a free trial at hedgefundtelemetry.com

And,

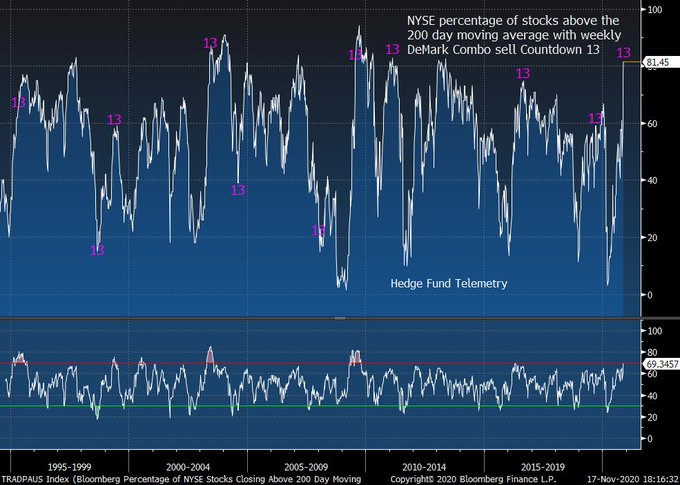

- Thomas Thornton@TommyThornton – Nov 17 – NYSE percentage of stocks above the 200 day moving average with a weekly DeMark Combo sell Countdown 13. Looking back 20 years it’s been a good signal

The two messages above are really not contradictory. The DeMark exhaustion signals are supposedly short term. And it is not uncommon for stocks to sell off after Thanksgiving into sometime in December & then rally strong into year-end. And this year we have the S&P’s best friend on deck for December 16.

So Treasury yields are trending down, momentum stocks are again showing relative strength, Chinese recovery is on and China-US may actually learn to be competitors with some benefits. Which sector could benefit from all this? Does Cramer have a buddy who could shine a light on our question?

- “This is one of those bull markets that works, regardless of how long it takes for us to roll out a Covid vaccine,” Cramer said. “If he’s right [that] this is the beginning of a new cycle … then this move, as implausible as it may be, could just be getting started.”

The “he” is Bob Lang, founder of ExplosiveOptions.net and a colleague of Cramer. And the sector Lang highlights, per Cramer, is Semiconductor Equipment, still an American preserve. Watch Cramer explain Lang’s argument:

Lang’s message is not that incongruent with this section. For example, Lang suggests, per Cramer, that Lam Research (LRCX) is a buy at $400, down from Friday’s close at $433. Just in time for the DeMark 13 count to work & bring it down to $400 ish in time for the Santa rally? Of course, this is just a “wouldn’t it be terrific” kind of a comment. We don’t predict or even claim to predict because we have no clue.

It’s just that we want to be happy & in a good mood during Thanksgiving and year-end.

3. Copy or lovely Adaptation?

You may feel happy or in a good mood when you watch the tender song below from “Zeher”:

“Zeher” is a what we call a Bolly-Holly film. The story and, in fact, the vast majority of shots are copied from the Hollywood film “Out of Time” starring Denzel Washington, Eva Mendes & Sanaa Lathan. Out of Time is a good film set in an urban downtown in which a Cop tracking a dealer type ends up feeling sorry for the dealer’s girlfriend. One things leads to another & the Cop changes his focus to saving the girlfriend from the dealer proving again that the oldest trap for a strong guy is Chivalry for a lovely & seemingly helpless woman. Watch about 35 seconds of the song above from minute 3:20 to see the lovely woman say to the cop

- “I want you inside my heart & my body; I want to build a relationship with you that even God wouldn’t be able to break”

A lovely victim woman expressing her gratitude to a hero cop for saving her. The cop finds it irresistible & gets ensnared. He ends up shooting the dealer boyfriend only then to be shot by the lovely woman he has rescued. She takes the suitcase full of drug money & tells him it was her plot from the beginning. So who saves the cop from the final bullet? Watch the clip of the final scene from “Out of Time”.

What is the difference between “Out of Time” & “Zeher”? The latter changes the location from seedy downtown to lovely, sunny Goa of sea-side beaches and nice houses while virtually keeping every scene from the Hollywood original. Of course, the biggest difference are the songs, Bollywood’s unique talent. These turn into ordinary good watch-once films into memorable ones. You can watch the entire movie “Zeher” on YouTube.