Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”comes like a hurricane .. leaves immunity in its wake“

That is a description of the Delta virus strain that we can understand. It came late Friday on CNBC Fast Money from Dr. Monica Gandhi, UCSF Professor of Medicine. Best you listen to the short clip below. It might make you bit more optimistic as it made us:

And what does an immunity leaving hurricane do? It accelerates our ability to live with it, per Dr. El-Erian:

- Lawrence McDonald@Convertbond – The silver lining in the delta variant – it’s accelerating our ability to adjust, live with the virus. via @elerianm with @FerroTV

All this erudite stuff is fine, but we prefer a media indicator:

- Via The Market Ear on Thursday – Peak Variant? Making it onto Newsweek cover and in doomsday fashion feels peak:ish….Topol: “The Newsweek magazine must be getting desperate for sales to go with this cover. Delta is bad enough; there’s no clinical evidence that Delta “Plus” or Lambda provide competition with it. Let’s not make bad matters worse”

2.NFP

Should we simply view the ADP numbers as covers of The Economist or Newsweek? A surefire indicator to trade against? Friday’s 943,000 jobs number totally demolished the negatives left by the much weaker than expected ADP number on Wednesday.

But the ADP number did serve a useful purpose. It enabled the establishment of a double bottom at 1.12% for the 10-year yield. The 10-year yield did bounce from 1.12% to 1.22% to closed at 1.175% on Wednesday. Then Friday’s NFP number shot it up to close at 1.30%.

How good was the NFP data?

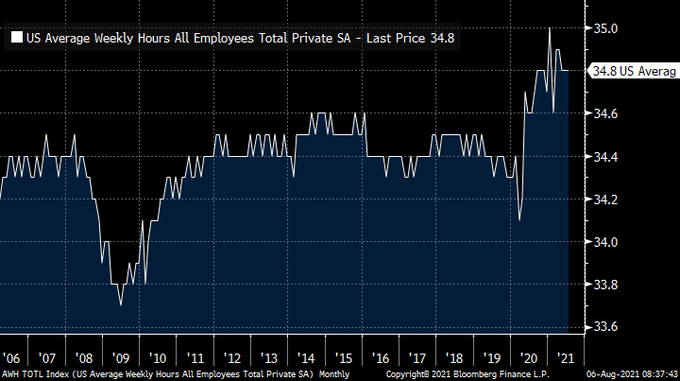

- Rick Rieder@RickRieder – The #JobsReport data continued to display consistent, and durable, strength in July, as we witnessed 943,000 #jobs gained on the month, with upward revisions of 119,000 jobs total announced for the months of May/June.

He amplified that on BTV saying that for the last six months, every single month has shown 1 million jobs added on a non-seasonally adjusted basis. And he went to state his basic theme that equities with cash on hand, ROE & free cash flow are much more attractive than bonds.

What does the NFP mean for macro going forward?

- Mark Newton@MarkNewtonCMT – 3 Important technical developments this am following a stellar Jobs report- 1) Treasuries rolling over & a backup in yields looks likely in the days/weeks to come 2) US Dollar pushing back higher in a way that will lead to a test/breakout of recent highs 3) Prec Metals weakening

That leads to, as monetary issues do, to the Fed:

- Richard Bernstein@RBAdvisors – Leading indicator in today’s strong #jobsreport remained VERY strong. Maybe the #Fed will now get a spine and clearly taper?

Is there any other issue for the Fed? Yes, it looks so & her name is Lael Brainard. Is her new aggressive anti-Powell tone a campaign salvo or a trumpet of victory?

- Jesse Felder@jessefelder – ‘Brainard, considered a leading candidate to take over as Fed chief in February if Powell doesn’t get a second term, said she’s much more inclined to use regulatory tools to head off financial excesses like asset bubbles than the Powell has been.’ – “bloomberg.com/news/articles/2021-08-01/brainard-differs-with-powell-ahead-of-biden-fed-chair-choice?sref=qpbhckVU”

And Senator Manchin wrote to Fed Chairman Powell suggesting a taper soon to target inflation. Hmmm, is the Senator early or late on his inflation alarm?

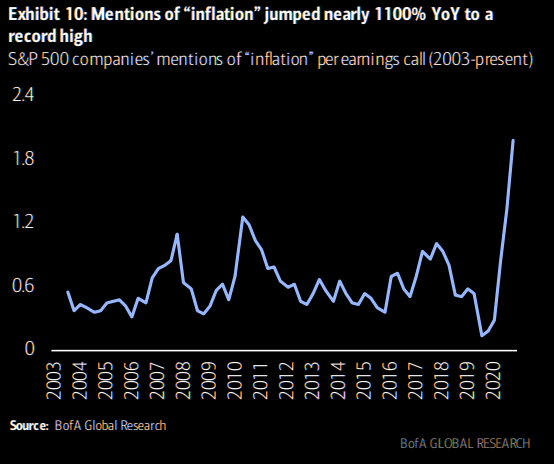

- Via The Market Ear on Thursday – Transitory inflation? How transitory is the inflation everybody is talking about? Mentions on inflation by companies per the latest earnings calls is +1100% yoy.

So just as most feel Chairman Powell has done a terrific job navigating the U.S. economy through the pandemic, he seems to be getting told that’s it! He is not the only one because so many luminaries are saying that to the S&P and the Nasdaq 100 at their all-time highs.

Speaking of Nasdaq 100,

- Via The Market Ear on Friday – Don’t forget the 2/10 year yield spread – The US 2/10 year yield spread is pushing above the negative trend line that has been in place since early June. Russell is one of the losers from the negative yields spread trend. A close above that trend line and the relative Russell bull could wake up once again.

3. Watch Out

This week began with Mr. Stocks Cramer himself warning on Monday evening about the seasonal pattern pointed out by Larry Williams for August. The abridged clip below shows a weakening Advance-Decline line & a poor On Balance Volume line:

Then on Tuesday evening Cramer relayed the Sequential 13 warning from Tom DeMark. Some quick excerpts from the clip below:

- DeMark’s timing & price models are finally in alignment & he thinks we could soon see a significant top in both S&P 500 and Nasdaq 100; … DeMark thinks this is indeed different; … If both S&P and QQQ give sell signals at the same time, it could get ugly .. DeMark thinks a meaningful top is more likely … Dow is trading erratically & showing a 7-megaphone pattern like the one in 1929

Usually DeMark clips speak of the 13-count about to happen in the near future & we are left wondering whether it did actually happen or not. This time, a DeMarkian confirmed the 13 count:

- Thomas Thornton@TommyThornton – $SPY $SPX $QQQ $NDX daily time frame with important DeMark Sequential sell Countdown 13 and Combo strict versions with Sell Countdown 13’s too. This is what was mentioned on @jimcramer show that Tom DeMark was anticipating. This could be an epic call @DeMarkAnalytics

If that wasn’t enough, another seasonality-focused & usually bullish analyst tweeted the below:

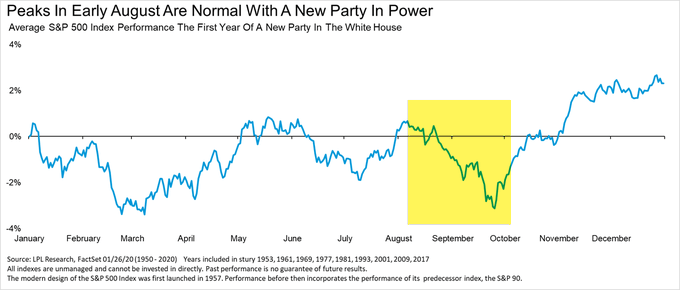

- Ryan Detrick, CMT@RyanDetrick – As you probably heard by now, the calendar is a potential worry for stocks. But did you know that the S&P 500 historically peaks on August 6 (today) when a new party is in power in the White House? Add this to the checklist of things to not ignore.

Guess who also came in with a peak but non-predictive model call this week?

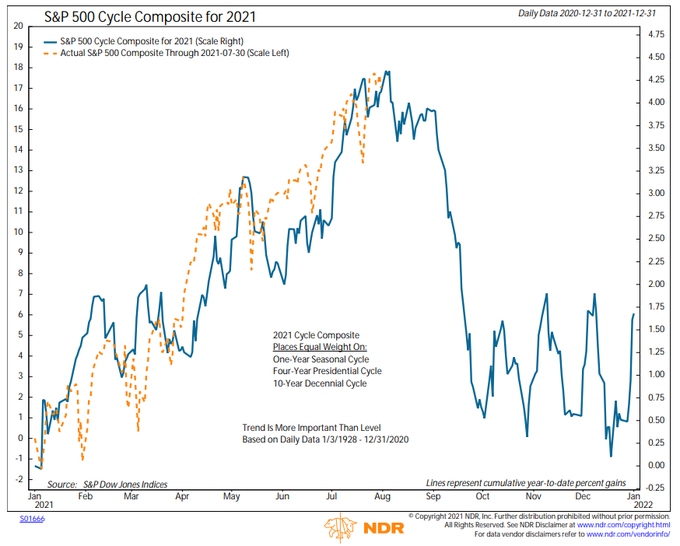

- Ed Clissold@edclissold – Aug 2 – The NDR SPX Cycle Composite for 2021 peaks today. Note that this is NOT a predictive model. It’s a composite of 3 historical cycles: 1 yr, 4 yr (post-election) and 10 yr (yrs ending in 1). Think of it has history’s view of what 2021 could look like.

4. On the Other Hand,

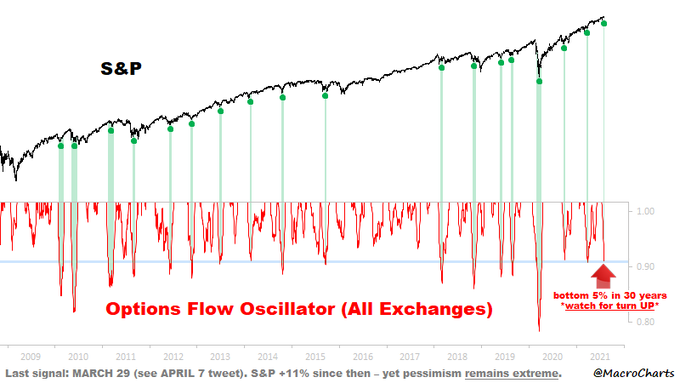

Options flow seems to sending the opposite message, at least according to one who has been right at key inflection points in 2021:

- Macro Charts@MacroCharts – Aug 3 – Everyone has a foot out the door. Options Traders are *again* among the most negative in 30 years. Most signals led to market bottoms or rally extensions. This remains a “wall of worry” in full force (for months) – not even close to complacency. Follow the Trend.

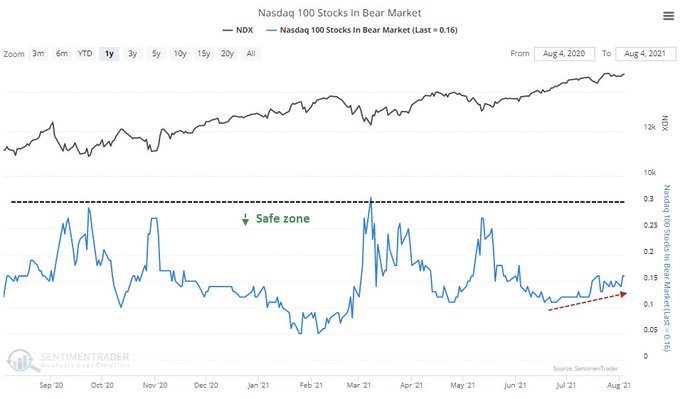

Not everybody dislikes the QQQ, at least not on a protracted basis:

- SentimenTrader@sentimentrader – Aug 5 – The number of Nasdaq 100 stocks more than 20% off their highs is the most in 2 months when the NDX was 2,000 points lower. That’s weird. Still, as long as fewer than 30% of them are in bear markets, the NDX has almost zero chance of heading into a protracted decline.

In a similar vein, Bob Lang of Explosive Options wrote in his email on Friday – Volume and breadth improve while market action remains constructive:

- The first trading week of August is in the books, and much like July, records continue to fall. New all-time highs were tagged on the SPX 500, Industrials and Nasdaq. The Explosive Options portfolio had another strong week, putting our YTD increase at a nice 16%.

- Volume trends and market breadth are starting to look better (breadth was particularly poor last week). Today’s job report signifies the economy still has room to grow. As we heard from Fed Chair Jerome Powell last week, long-term economic growth has to be solid before the Fed contemplates a shift in policy.

- All around market action has been constructive, especially in the face of the hollow belief that markets have to go down in August. That wall of worry is likely to drive markets even higher as short sellers cover their positions. Earnings have been outstanding this quarter and guidance is top notch. Too much optimism? We’ll continue to play it cautiously, as usual.

Going back to something that has been a good guidepost, VIX closed down 11.5% this week to 16.15. Lawrence McMillan of Option Strategist wrote on Friday:

- The $VIX “spike peak” buy signal from July 20th is still in place. Moreover, the trend of $VIX continues lower. That is, the 200-day Moving Average is falling. So these are positive signals for the overall stock market.

- Overall, we are in much the same situation that we’ve been in for a while: $SPX is strong, and some of the internals of the market are weak. So we continue to recommend holding a “core” bullish position as long as $SPX is above support at 4370, and one should trade confirmed sell signals around that bullish “core.”

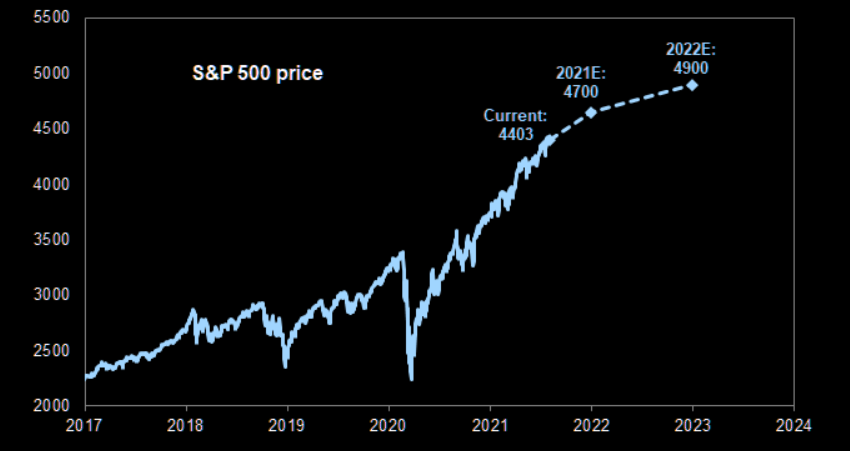

What about the Firm whose stock made a new all-time high on Friday?

- Via The Market Ear – The road to 4900 … 11% in a little less than 1.5 year if you believe GS new 2022 S&P500 price target. And it is earnings driven. GS: “We raise our EPS estimates to $207 (from $193) in 2021 and $212 (from $202) in 2022. These represent annual growth of 45% and 2%, respectively, and compare with bottom-up consensus estimates of $201 and $217. Relative to consensus, we expect stronger revenue growth and more pre-tax profit margin expansion as firms successfully manage costs and as high-margin Tech companies become a larger share of the index. Unlike consensus, we assume corporate tax reform passes and is a headwind to EPS in 2022 and beyond. In a scenario with no tax reform our EPS and price targets would be roughly 5% higher“

5. Commodities

Gold, Silver & Copper were all down this week as Dollar rose. Oil was flushed out this week, down 7.8% and Brent down 7.7%. But some like a flush out:

- Mark Newton@MarkNewtonCMT – Aug 5 – I can make a good risk/reward case to buy into #Crude & #Energy here for an August long trade, given WTI’s ability to have risen back ABOVE early July lows- Structurally, this is appealing with stops at 65 $CL_F #BlackGold #TexasTea

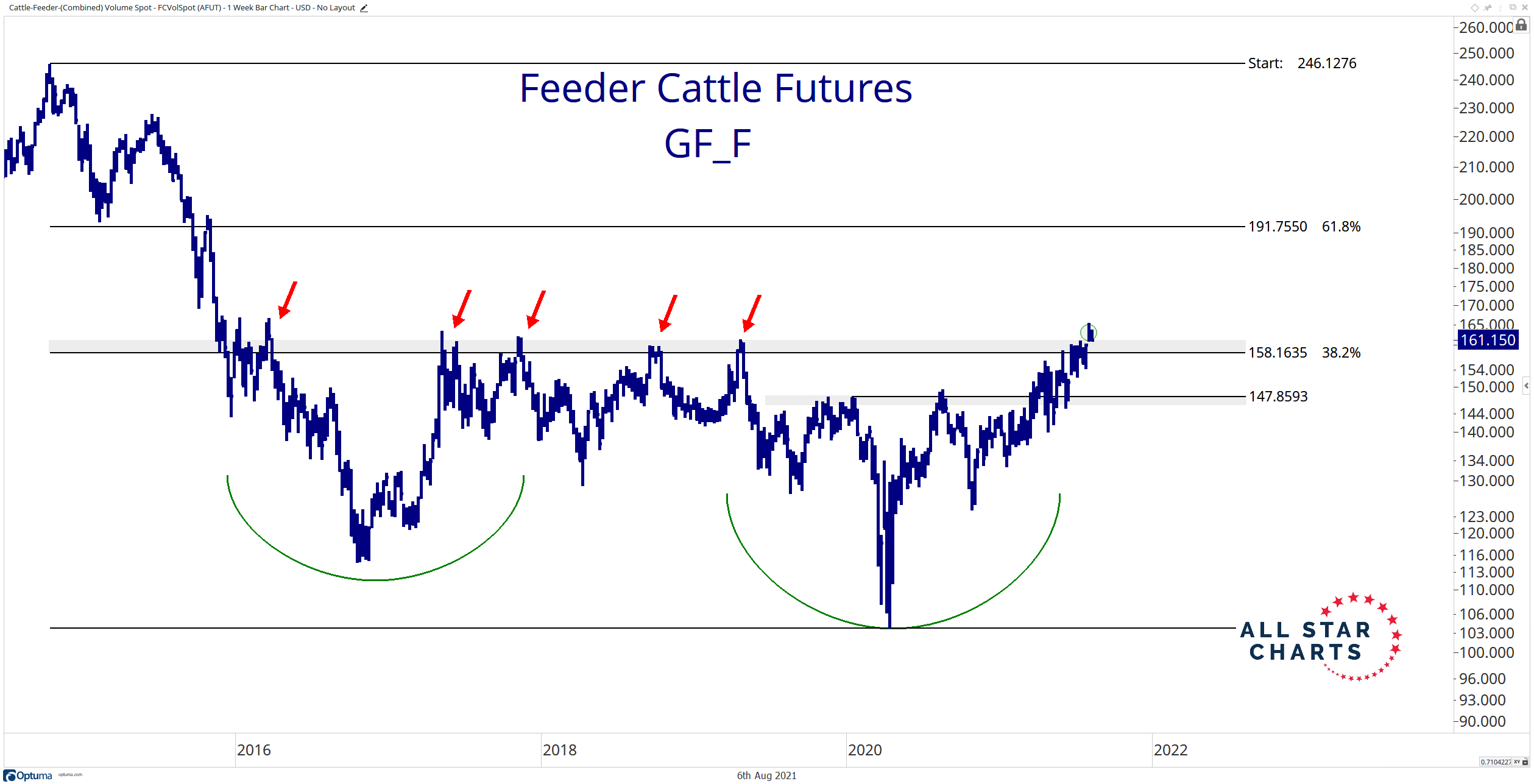

Look what J.C. Parets wrote in his Friday email:

- “Breakouts continue to emerge left and right within the commodity space as participation expands to more and more subgroups.”

One of the subgroups he highlighted is Feeder Cattle futures:

On a more top-down basis, take a look at:

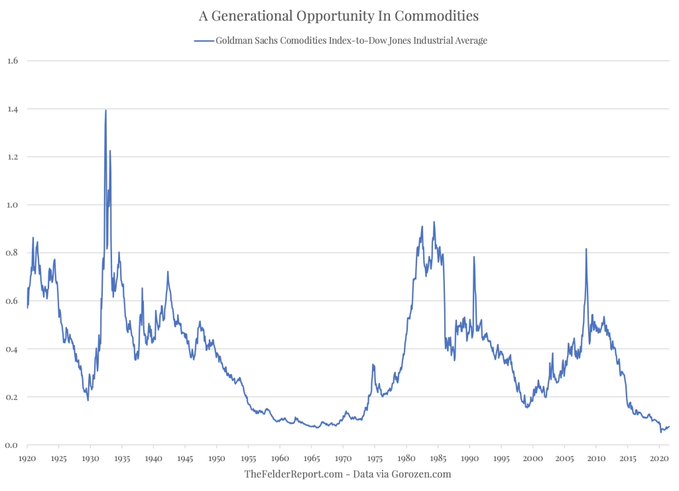

- Jesse Felder@jessefelder – Aug 4 – NEW POST: A Generational Opportunity In Commodities, Part Deux thefelderreport.com/2021/08/04/a-g

To quote from his introduction:

- “Exactly a year ago, I wrote a blog post titled, “A Generational Opportunity In Commodities?” arguing the bullish case for things like copper, precious metals, oil, etc. Since then, the Bloomberg Commodity Spot Index has almost doubled in value, leading some to believe it may now actually be overvalued.”

- “However, commodities have been in a consolidation phase for well over a decade now. The consolidation phase seen during the 1960’s lasted just about as long as the current one; the subsequent breakout higher proved to be a good inflation signal.”

Send your feedback to [email protected] Or @MacroViewpoints on Twitter