Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”played to script“

Simple description of September & it came from Jeff DeGraff on CNBC Closing Bell. He also said it is setting up for a good seasonal October.

For us, VIX has been the numero uno signal so far in 2021. Jim Cramer had highlighted the work of his techni-pal about the bearish signal from VIX rising simultaneously with S&P rising back in the -re-September days. We kinda are seeing the opposite now. May be we need thicker glasses as the lady witness in My Cousin Vinny, but we are seeing VIX climbing less or less stridently while the S&P falls hard.

We wonder if this is an early anti-bearish signal. Look at the 10-day chart below and notice that the VIX is being sold off as it spikes. And the VIX sell-offs are larger & almost steeper than the VIX spikes.

We love TACs because the smart ones tend to articulate what we think much better than we ever could. Listen to what Anastasia Amoroso, strategist at iCapital, said on CNBC Squawk Box on Friday:

- “I expect that may be a little more tactical technical downside to this market but that could reverse to the upside over the course of Q4 … seasonality is now coming over to be on our side … [in response to an interruption by Sorkin] … near term, the fact that we didn’t hold the 100-day & the fact that we are not at technically oversold levels, that does give me pause; may be another further downside; the next stopping point is a good way to measure that there is another 5% downside ; the next stopping point is the 200-day .. “

Then Ms. Amoroso got tough on Sorkin and said,

- ” … at the same time I am not going to say lets wait for that & sit on the sidelines,; I think there are tangible things investors can do … ”

Like what? Unlike many guests, Ms. Amoroso gave a real idea, a gem of an idea at least to our way of thinking (min 1:54):

- “.. one thing I will point to in the options market – if you look at the put pricing right now & the volatility that has blown out so much on the put pricing, you can sell that put, you can monetize that volatility & you can buy the call option which is very cheap relatively speaking; … there are things you can do to position for a little bit more downside in October and an eventual rebound at year-end”

The strategy is not new but what was new is that a mainstream strategist laid it out for all viewers in contrast to the majority of guests who use trite “cautiously optimistic” type phrases.

We have said before that, to us, Andrew Ross Sorkin is a classic BrIndian Brahmin – Intellectual condescension is their hallmark and it is often expressed via elitist name-dropping. Watch & listen to what Sorkin said to Ms. Amoroso at minute 1:11 of the clip:

- “… we were just talking to the head of TPG actually 2 days ago and he said you know put your seat belts on; you are putting your seat belts on?”

Mr. Sorkin is highly intellectual, an Ivy Leaguer & brought up in an intellectually elite Jewish family. He inherited eliteness & has also earned his. Our guess is “Amoroso” is an Italian-origin name. Ms. Amoroso is a woman & seems younger than Mr. Sorkin. We may be wrong but to us the question by Mr. Sorkin seemed soaked in elite intellectualism & elitist name dropping against a younger woman with lesser elite standing in educational Manhattanite society. As we said, a perfect BrIndian Brahministic putdown. That is why we fondly think of Andrew as a near-perfect BrIndian Brahmin.

Speaking of “playing to script” and the risks of October, Lawrence McMillan of Option Strategist wrote on Friday:

- “As is often the case, September turned out to be a bearish month, as $SPX made a new all-time high on the 2nd trading day of the month, but then reversed and traded down to the lows of the month on the last trading day. This action has put the $SPX chart in a downtrend, as there are now lower highs and lower lows (on a closing basis). A move below the mid-month low at 4305 would confirm this bearishness. We now enter October, which has a reputation as a “bear killer,” but the first part of the month can be ugly before lows are reached later in the month.”

2. Treasury Rates & a week with a hmmm observation

While the FinTV anchor universe was focused on rising rates, look what we noticed and said hmmm!:

- 5-year treasury yield fell by 2.5 bps on the week; 3-year yield fell by 6 bps; while the 30-year yield rose by 4.7 bps with 10-yr yield only up 1 bps.

What does this steepening suggest? That Fed, despite its rhetoric, might actually be forced to get more dovish? Because commodity inflation pressures are increasing while the underlying economy might actually need lower rates? Is there any economic indicator that might be suggesting the latter?

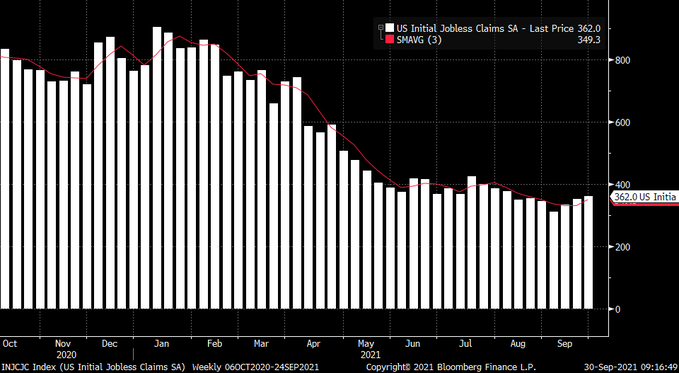

- Richard Bernstein@RBAdvisors – Sept 30 – #Jobless claims (leading indicator) have basically been flat for 3 months. If…if… they start to trend upward then defensives not either #cyclicals or growth might be appropriate.

And 5-2 year Treasury rates would actually decline, right? But is this all supply-side?

- Lisa Abramowicz@lisaabramowicz1 – “We have been sounding the alarm on the deteriorating macro landscape for some weeks now. It all boils down to accelerating negative supply-side dynamics defined by 2 key features: an upgrade to inflation & a downgrade to growth expectations both at the same time:” DB’s Saravelos

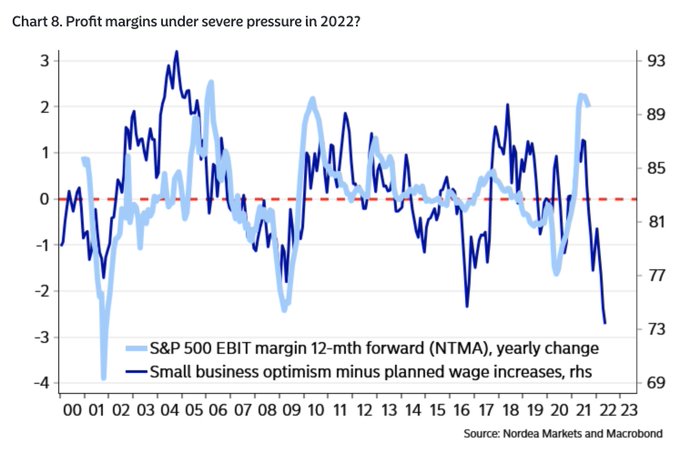

Is it possible that small business profitability might be a problem in 2022?

- Jesse Felder@jessefelder – ‘We have constructed a simple profit margin “warning” indicator that consists of NFIB small business optimism in the US minus planned wage increases. It’s clearly flashing red.’ corporate.nordea.com/article/67962/

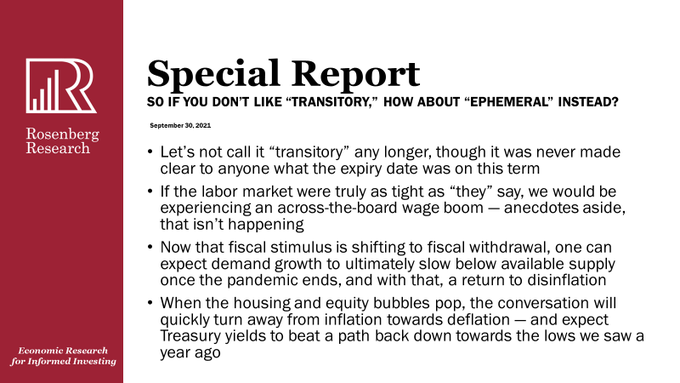

These might seem un-rosy to many . But how do they appear to Rosie?

These might seem un-rosy to many . But how do they appear to Rosie?

Does that mean long duration Treasuries might become appealing?

In this episode of The Journey Man, @RaoulGMI tests his own thoughts of an impending economic slowdown with @EconguyRosie.

In Rosenberg's view, the Fed’s forecasts, along with most analysts’ forecasts, are most likely dead wrong.

Watch to find out why 👉https://t.co/fzIiWBmNE6 pic.twitter.com/qtP1brHF1v

— Real Vision (@RealVision) September 29, 2021

3. Commodities

Anastasia Amoroso also spoke about energy in a podcast:

- “I like energy but it has rallied a lot; Oil fundamentals will be incredibly bullish by December 31; we are going to be running 1.5 barrel deficit & drawing down inventories while oil inventories are well below their 5-year averages – very bullish setup“

But she warned that “OPEC meets next week; risk is that they push up supply“. What about profitability of U.S. energy companies? She pointed out that the breakeven oil price for U.S. energy sector is $50. So the sector is seeing less leverage & greater profitability.

What might be a big driver for this? Climate Change? Yes but not the way you probably think. That is why Dollar & Oil might be rising simultaneously:

- Lawrence McDonald@Convertbond – USD price action is telling you the ESG driven Gas Crisis has placed the UK and Europe in recession. *120% surge since August.

The relentless pressure on companies to stop investing in fossil fuels. So the Taliban-like ESG zealots might have contributed to this scarcity of traditional fuels. Not just Oil but Coal. Who would have imagined that both China & India would be down to negligible inventories of coal? Kudos to Larry McDonald of Bear Traps Report for being early & 100% correct about this.

- Macro Charts@MacroCharts – BTU – among the best all year, therefore watching closely if it continues. Cyclicals could extend higher for months still, we’ll see. Hope my recent charts helped in that direction.. Will share a matrix soon, with other names that stand out. There are many.

For those who believe monthly charts are better than daily or weekly charts,

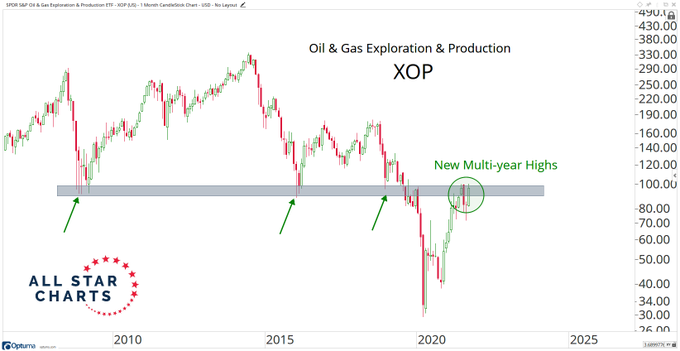

- J.C. Parets@allstarcharts – On a monthly closing basis, we’re now seeing new multi-year highs for Oil & Gas Exploration & Production $XOP

Sure, but that is looking backwards. How about looking forward? Uggh!

- Lisa Abramowicz@lisaabramowicz1 – “A cold winter could push diesel past $120/bbl and Brent past $100.” Potentially, “oil prices could spike and lead to a second round of inflationary pressures around the world. Put differently, we may just be one storm away from the next macro hurricane.” BofA’s Francisco Blanch

4. Cramer’s Club

A story from many years ago! Someone dear to us used to keep asking us for stock picks. It is not something we like to do because the backlash can be harsh. And that is what we kept experiencing in that case. Then Jim Cramer & CNBC launched Mad Money show. And, for once, we acted smart & fast. We suggested to our dear ones that they watch Cramer’s show because it was about stock picks & not macro.

We are still thankful to Cramer for getting us out of that bad bind. That is why we are excited about the launch of his Investor Club. Many in our personal network know of our investment articles but are disappointed with the absence of actionable stock ideas. We can’t wait to get them introduced to Cramer’s club. Hopefully then they will leave us alone.

Besides our own selfish motive, we do think Cramer’s Investment Club will be successful & beneficial to many. But what if it is? Will CNBC make it a paid-service? Hope not.

Going back to pre-Greek Sanskrut, there were two designations for important teachers – Aacharya & Upadhyay. The latter were compensated economically for teaching while the designation Aacharya was reserved for those who taught to all without receiving any compensation.

So Jim Cramer should endeavor to become an Acharya for those interested in learning about stocks. Then one day he could formally be termed as Crameracharya.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter