Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”coming over to our side“?

Last week on Friday, October 1, Anastasia Amoroso of iCapital said “… seasonality is now coming over to be on our side … “. Is that already beginning to happen?

We are simple folks & to us seeing is believing. And what we like to see if the VIX is showing “an early anti-bearish signal“. We wrote last week:

- “… Jim Cramer had highlighted the work of his techni-pal about the bearish signal from VIX rising simultaneously with S&P rising back in the -re-September days. We kinda are seeing the opposite now. …. we are seeing VIX climbing less or less stridently while the S&P falls hard. … And the VIX sell-offs are larger & almost steeper than the VIX spikes.”

Look at this week’s action in the VIX. Better still, look at the 10-day chart of VIX:

Is that a VIX-peak cluster that we see from Tuesday September 28 to this Monday, October 4? Now compare this to the 10-day SPY chart.

Putting on a Tom McClellan type hat (way way too big for us, to be sure), displace the VIX-peak clusters by 2-days and invert them to get the above cluster of SPY bottoms.

Then, on Tuesday October 5, Cramer’s techni-pal Carolyn Boroden spoke about S&P timing clusters coming together and said “4278 (which happens to be Monday’s low as Cramer pointed out) appears to be the floor“. And Ms. Boroden said, per Cramer that “odds of a reversal are higher during these few days“.

But her caveat, per Cramer, was that she “won’t be putting a ton of faith without a buy signal & for her that’s when the 5-day exponential moving average crosses back over the 13-day emv.” On Friday, the 5-day emv closed at 436.09 while the 13-day emv remains a hair higher at 436.57. Wonder which way Monday will go?

In any case, Cramer said of Boroden that “.. she is convinced we are due for a bounce & today may just be the beginning of that bounce“. Now that’s walking the walk. Because the Dow & the S&P rallied by 440 points & 54 handles during the next two days, a rise bigger than the week’s rise of 420 Dow points & 34 S&P handles.

How did the VIX do? It fell 11.3% on the week to 18.77. Remember what Anastasia Amoroso said on Friday, October 1 on CNBC Squawk Box?

- “… if you look at the put pricing right now & the volatility that has blown out so much on the put pricing, you can sell that put, you can monetize that volatility & you can buy the call option which is very cheap relatively speaking … “

Any one who sold puts either on Friday October 1 or Monday October 4 did quite well by Friday’s close. So kudos to Ms. Amoroso for her timely & courageous call on Friday, October 1.

But that was the week before. Did she do anything smart and courageous this week? Actually she did. Believe it or not, Ms. Amoroso said on BTV that she would be buying right now in the semiconductor space:

- “I do think some of the big tech companies are starting to look attractive … their PEs have come down from 27 to 23 … but if you ask me for the sweet spot of tech right now, this is where we would be buying right now; … I actually look at the valuation of semiconductors which have corrected 8% or so; the valuations are now exactly at their 5-yr average low; this is a sector that is no longer crowded ; we have seen a lot of hedge fund money come out of technology (except for software) …. I would look for the semiconductor trade here … ”

Like many BTV clips, the anchor allowed Ms. Amoroso to speak at some length to make her point instead of interrupting her. Watch this clip.

We hope everyone remembers the superb call by Larry Williams, as communicated by Jim Cramer, to sell the S&P on September 17. Ok, that was great but when does Mr. Williams suggest buying? Cramer did not say specifically but pointed to the 1923-2020 seasonal pattern of buying the S&P on the last trading day of October (or November 1, in this case).

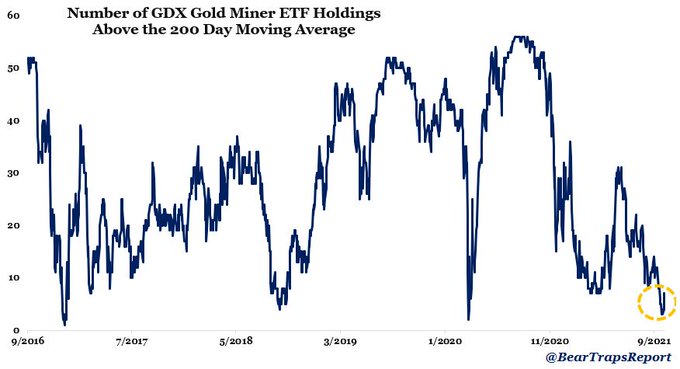

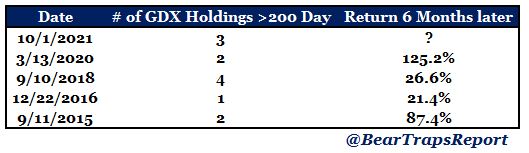

If buying semiconductors sounds brave, how about buying the asset class that has been utterly sold off? About two weeks ago, we gently broached the idea of buying KWEB or Chinese tech ADRs that have been gored. But we really know less than nothing about China. So we have been looking for smart guys to get in first. We noticed that Larry McDonald of Bear Traps Report, the master of capitulation-reversal trades, begin recommending KWEB as a conviction idea based on the scale of capitulation.

Smart guys like Sentimentrader.com have been pointing out that Chinese Tech companies have been shown persistent insider buying. Now this Friday, Carter Worth of CNBC Options Action stepped up and suggested buying KWEB & Chinese tech ADRs. Watch this clip, especially the charts:

And Chinese ETFs were the best EM performers this week with most up 3%+.

2. Fed & Supply-Demand of Jobs, Inflation vs. Recession

The Non-Farm payroll number was stunningly weak, coming in at 194,000 vs. 500,000 estimate. Some termed it stagflationary:

- Holger Zschaepitz@Schuldensuehner – US 10y yields top 1.6% for the first time since June after stagflationary US jobs report. NFP headline number w/194k way below expectations for a 500k gain. BUT with tightness in the labor market, wages were solid, rising 0.6% MoM vs 0.4% expected.

Others scoffed at the wage inflation commentary:

- David Rosenberg@EconguyRosie – Rare have I ever seen a jobs report replete with so many inconsistencies. The ‘wage inflation’ was concentrated in just two sectors — retail and education/health. The other 70% of the jobs market saw just a 0.26% gain.

Well, if wage gains are so paltry, what happens to retail sales?

- David Rosenberg@EconguyRosie – Digging deeper, Atlanta Fed is now at -1% for Q3 real final sales. Could be early recession sign — all of the past seven followed an oil shock. Get defensive; it’s not too late.

What should the Fed do about creating employment? Nothing they can do said the august panel on Bloomberg Open on Friday. As they argued, there is no shortage of demand for labor. That is very high. The problem with this NFP number is the supply of labor. And there is nothing the Fed can do to create more workers. The only Government agency that could help is the Immigration Service that can open US doors to workers from other lands.

What is a portfolio manager to do? A humongous one was asked by Jonathan Ferro of BTV on Friday. For the first time, we heard a less than enthusiastic tone about U.S. equities from BlackRock’s Rick Rieder:

- “Frankly, this is a more uncertain environment; I have to say I still think equities are going higher; … we can’t get enough production because we are having a hard time getting labor; … I think you have got to bring down your expectations; … we are shifting to areas where companies have pricing power; some of the tech companies, healthcare companies that are not as sensitive to the labor cost acceleration or to the inability to hire people ….I still think equities are going higher but I have to say some of what we have seen today play out and what we have seen over the last few weeks does mute a little bit of what we think of the near term upside … ”

If you think this is not enough uncertainty, listen to Larry McDonald tell Maria Bartiromo that Powell will not be reappointed.

3. Commodities

What does Mr. McDonald like the most?

A cute but scary little calculation for Exxon. What is the value of Oil Reserves of Exxon, especially as compared to its market cap?

- Lawrence McDonald@Convertbond – – ExxonMobil $XOM with Oil at $81 Reserves: 15B+barrels Value: $1.2T Stock Mkt Cap: $261B via@thelykeion Colossal future demand fossil fuels: One billion human beings in China without an automobile. One billion in India without air conditioning.

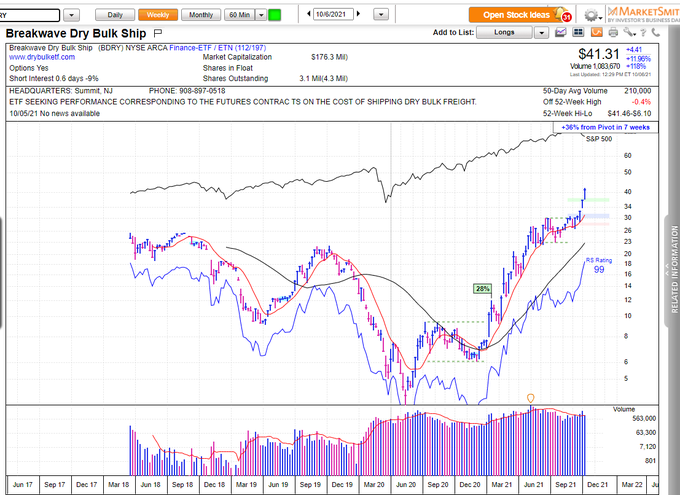

- Mark Newton CMT@MarkNewtonCMT – – Dry Bulk Shippers breakout still not high on the radar for Wall St Bets..hmm #IBDPartner I’ll be discussing my favorite sectors to overweight/underweight & stocks to favor in a report in the near future@MarketSmith

@IBDinvestors – The entire Shipping space =Best part of TRAN

The above notwithstanding, the US indices have tended to sell off hard on Monday setting an ugly tone to the new week. Will that change next week? The bond market is closed. So we won’t have bond selloffs to contend with.

Be careful out there!

Send your feedback to [email protected] Or @MacroViewpoints on Twitter