Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.King Still?

2021 did end with a rally. It was a terrific year to stay strong & long. What happens in 2022? We have no clue but we do think on the whole 2022 might surprise positively. We also think it might scare us at some point with a jolting hit to stocks & confidence. But that might bring the Fed solidly to our side. After all, this is a huge election year.

The first question is about the direction of the U.S. Dollar. The world economy needs a weak Dollar and some suggest we might get it.

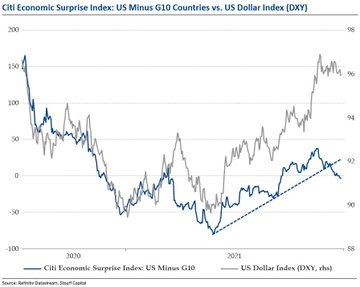

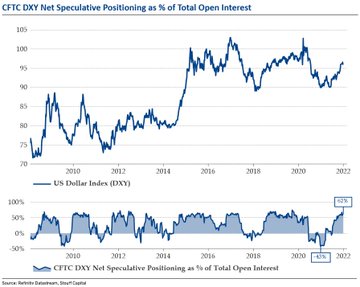

- Julien Bittel, CFA@BittelJulien – Let’s talk king dollar. At the end of ‘20, speculators were record short at a time when the dollar was very oversold… A bull case wasn’t difficult. Next year we’re less constructive. US relative economic momentum is turning lower & specs are very long. More in the New Year.

Even a small fall in the U.S. Dollar in January will convincingly demonstrate that the breakout in the Dollar a month or so ago was a false breakout. And such false breakouts often lead to meaningful outcomes in financial markets.

Based on what we hear on Fin TV, a softer trajectory of U.S. economic growth is now factored in.

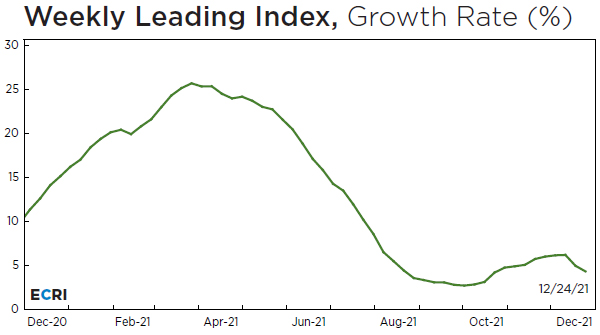

- Lakshman Achuthan@businesscycle – ECRI’s U.S. Weekly Leading Index growth rate decreased.

What about Real Growth & its implications?

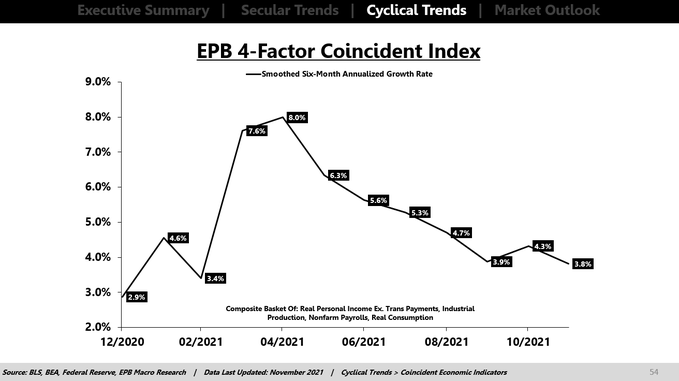

- Eric Basmajian@EPBResearch – – Real growth is declining When growth is declining, there are several comparisons to think about: –Treasury bonds over stocks –Large-cap over small-cap –Growth over value –Quality B/S over crappy B/S –USD over cyclical FX –Low beta over high beta What would you add/subtract?

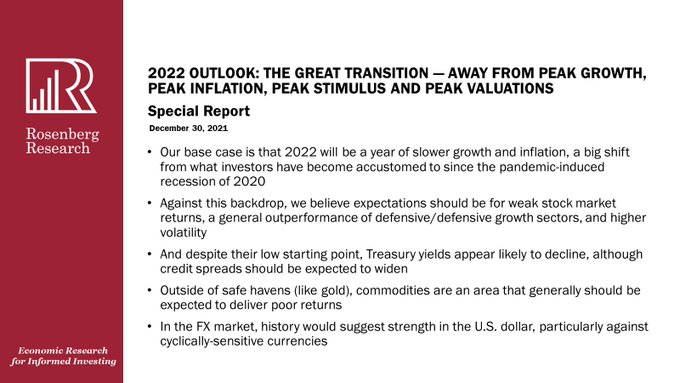

How does one non-bull see 2022?

- David Rosenberg@EconguyRosie – Special Report: 2022 OUTLOOK: THE GREAT TRANSITION — AWAY FROM PEAK GROWTH, PEAK INFLATION, PEAK STIMULUS AND PEAK VALUATIONS Sign up for a free trial to access! bit.ly/323DvEt

So we do see that a weaker economy, softer Treasury yields & a weaker Dollar are somewhat priced in & that too ahead of NFP & inflation data coming in the next few days. That data, and more importantly, the reaction of markets to that data will be more important, we think.

2. 5,000 ahead?

For those who believe in Newton’s law:

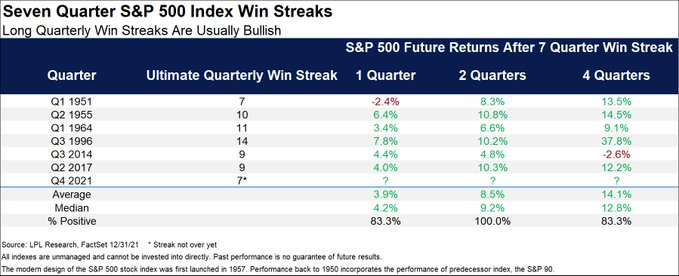

- Ryan Detrick, CMT@RyanDetrick – Here’s what happened after previous 7 quarter S&P 500 win streaks (like we are about to have). Higher 100% of time 2 quarters later probably would surprise most. Bottom line, long win streaks rarely end right away and they usually open the door to continued higher prices.

Another way to put it:

- J.C. Parets@allstarcharts – For you Dow Theory enthusiasts, the Dow Jones Industrial Average and Dow Jones Transportation Average both just closed at the highest levels for any month, quarter or year in American history.

Yeah but what about the non-Dow ordinary stocks?

- J.C. Parets@allstarcharts – Here’s the S&P1500 closing the year out at new all-time highs. This index includes all the S&P500 Large-caps, the S&P400 Mid-caps and S&P600 Small-caps. No evidence here of a downtrend yet.

Even the firms of those who seem bearish on the economy point to the magic number ahead:

Tom Lee also uses the 5,000 target for the S&P but as a short term peak that might be realized in January. He does foresee a 10% drawdown which he calls a buying opportunity. And what does he think will do well? Energy, FAANGs & Health care.

But what are some cognoscenti looking at?

- Lawrence McDonald@Convertbond – China equities KWEB, BABA, TCEHY (up 8 -10%) are trading like Munger finally convinced Buffett to take a stake? – So similar to BYD Co Ltd equity 12 years ago. Warren is your ultimate high capitulation buyer.

But is there any economic or credit basis for China over US?

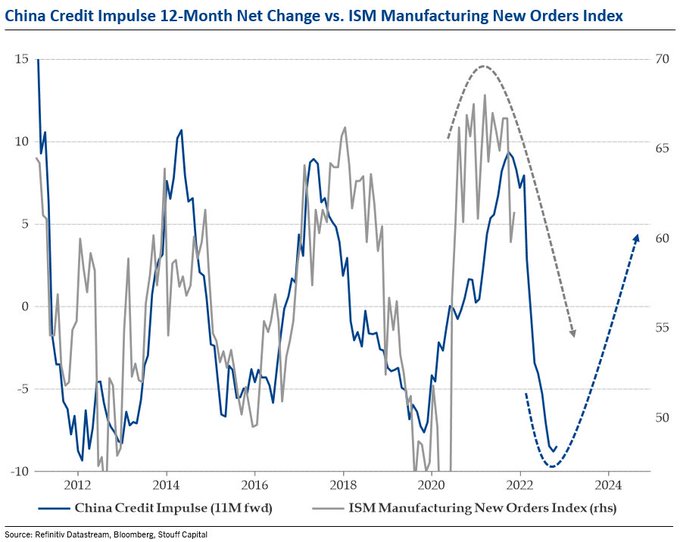

- Julien Bittel, CFA@BittelJulien – – Bloomberg’s China Credit Impulse finally ticked higher this November. By a very small amount, but signs of life for the first time in 8 months. My guess is we just saw the low. Given the long lead over ISM, China will drive US/DM cycle lower next year. Buy / sell in ‘22.

Getting back to next week,

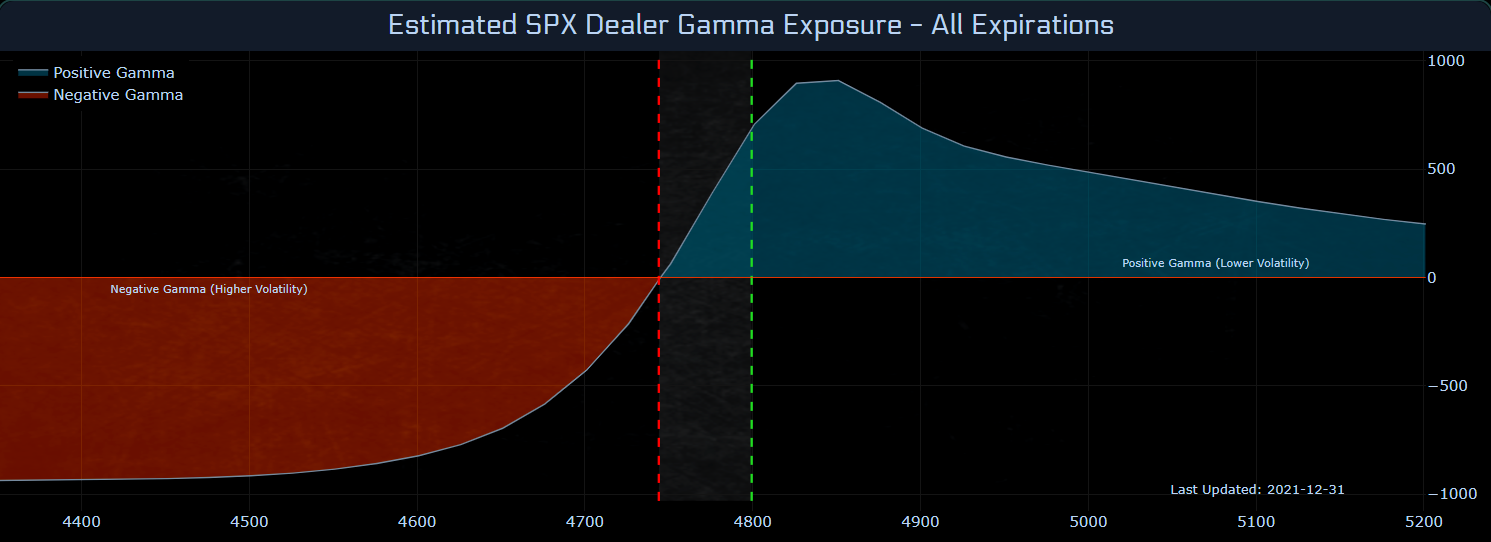

- The Market Ear – Long gamma agony ending soon? SPX remains in long gamma territory, but note the flip level is just slightly lower (4745 ish). As Spotgamma reminds us: “There remains a substantial amount of gamma expiring in the S&P today(>35% in the S&P500), with 4800SPX/480SPY being the predominant strike.” Next week should have the markets move more “freely”.

What do they mean by “move freely”, you ask? They write “markets move without the long gamma “shock absorbers”“.

3. Geo events

Speaking of China, we do see come big changes in the offing in 2022. For more details, see our adjacent article A Big Change in the Offing for 2022? Or a Bigger one?

Finally, allow us to wish our readers & their families a very Happy & Healthy 2022.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter