Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Hyde-Fed or Hyde-Minutes

Think back a month & half to the Tuesday before Thanksgiving. The 30-year Treasury yield was at 2.04% without any panic even though it had rallied up about 12 basis on Tuesday & Monday. The Nasdaq 100 was sort of weak without any sense of turmoil. The next day, Wednesday November 23, the day before Thanksgiving, the “minutes” of the November FOMC meeting were released at 2 pm.

And hell broke loose. The 30-year yield went down hard on Wednesday afternoon and fell off the proverbial cliff on the Friday after Thanksgiving. Between 2 hours on Wednesday afternoon and on Friday after Thanksgiving, the 30-year yield fell by 19 bps. The following week featured testimony from Fed Chair Powell which, because of its hawkishness, pushed the yield 20 bps lower that week to close at 1.692% on Friday December 3.

Remember what a stunner that November Non Farm Payroll number was. That stabilized the Treasury market and the 30-year rallied in the next two weeks to close at 1.82% the day before the FOMC and Chair Powell’s presser. That presser was more restrained or less-hawkish than the minutes that were released 3 weeks prior. That restrained presser did a great job of stabilizing the Stock & Treasury markets and paving the way for the Santa Claus rally.

Focus now on how restrained Powell’s presser was on December 15 and remember that presser was only 30 minutes after the FOMC statement released that afternoon. In that presser, Chair Powell made no statement about letting the Fed’s balance sheet run off.

Now fast forward to this Wednesday, January 5, 2022. Why did all hell break loose that afternoon with stocks cascading down? Because the minutes of that December 15 FOMC meeting released on Wednesday January 5, 2022 contained a believable discussion of FOMC members discussing letting the Fed’s balance sheet runoff.

This is a big discrepancy between the Powell presser on December 15 and the Fed minutes of that December 15 meeting released this week. So either Chairman Powell deliberately withheld that discussion in his presser on December 15 from his audience & the nation Or the FOMC minutes released on Wednesday January 5 are NOT an accurate set of minutes of what had transpired during the December 15 FOMC meeting.

Now go back & recall that exactly the same thing happened in the Fed minutes released on Wednesday November 23. Those minutes delivered a stunning surprise, a whole new policy that had not been revealed by Chair Powell in his presser following the November FOMC meeting.

Frankly, we have suspected for some time that the so-called “minutes” of the previous FOMC minutes are not really honest minutes but a vehicle to provide details of the updated views of FOMC members in the two-three weeks following the FOMC minutes. It would so much more honest of the Fed to label these releases as “updates” instead of “minutes”. That might alert investors & analysts to potential major changes & prevent unnecessary trauma in markets.

Going back to our November analogy, it seems that Powell pressers on FOMC day are intended to show Jekyll-FOMC to keep markets composed and the wrongly-termed “minutes” released 2-3 weeks later are intended to scare investors with a Hyde-FOMC image. Presumably this is intended to reveal to the FOMC how the markets would react to the policies they might be considering. This might be useful to the Fed but it seems highly dishonest to us.

Which asset class behaved the same after the release of the two sets of Fed “minutes” discussed above?

Yes, the NDX or QQQ fell hard after the release of Fed “minutes” both time. In stark contrast, the 30-year Treasury behaved very differently after the release of November & December Fed “minutes”.

Notice that the 30-year yield rose 4 bps after the 2pm release of Fed “minutes” on January 5 while as we pointed above the 30-year yield had fallen by 19 bps in the day & half after the release of Fed “minutes” on the afternoon pre-thanksgiving.

2. Rates

Why did long-duration Treasury yields behave so differently this week than they did during Thanksgiving week? After all, the “minutes” released this week were even more hawkish than the “minutes” released on the Wednesday before Thanksgiving?

The steep sell off in the week and half from Thanksgiving to Friday December 3 was driven by fear of the Fed doing damage to the economy by becoming unduly hawkish. That fear, in our opinion, subsided from December 3 onwards because of the strength of the NFP report that day. The Santa Claus rally & the rally in 30-yr yield positively changed the outlook of investors towards the U.S. economy, we think.

How big was that rally in 30-year yield? From 1.69% on December 3 to 2.064% at the close of Tuesday, January 4. Is that why the stunning “runoff of Fed balance sheet” did not provoke a big reaction in the 30-year yield?

To be frank, the two sets of reactions in the 30-year yield could also have been due to market positioning. The shorts in the 30-year were humongous before the Thanksgiving week and so the scare of the Fed making a mistake led to massive short-covering from Thanksgiving into Friday, December 3. These shorts were presumably re-established during the December 3 to January 4 period as the 30-year yield rose from 1.69% to 2.06%. Given this huge move in 30-year & the large short position in 30-year, the hawkish surprise on January 5 didn’t have a big impact on the 30-year.

The big difference in Treasuries reaction from the two sets of minutes was in the 2-year yield. It rose by 6 bps on Wednesday and by 5 bps on Thursday. So the 30-2 spread actually flattened a bit after the release of the “minutes”.

Look where the 2-year yield closed the week – 87 bps. So it has factored in at least 3 Fed rate hikes of 25 bps each. Now if the 2-year yield rises by another 13 bps, it will reach 1% or as much as 4 rate hikes in 2022. So how much room does it have to go up in a straight line?

Note Chairman Powell appears before the Senate committee next week. Does he feel the pressure to exhibit a robust hawkishness or can he be both firm and not too hawkish in these comments? Then we get the CPI & PPI after his testimony. How the Treasury markets react to all that should be revealing.

Remember the next FOMC meeting & Powell presser is on Wednesday, January 26, 2022. Is it possible that the markets keep acting bad in the next couple of weeks to force Powell to speak dovish? Or will we get a stabilization or even a soft rally before the FOMC to persuade Powell to reveal all his inner hawkishness.

Finally the turbulent action of this week might be due to the pressure on large speculators to get positioned the way they want. How else can one explain this week’s 10% rally in Bank of America and a 15% rally in OIH?

Remember our old (early 2021) valuation measure we termed MC/FB – ratio of Market Cap to size of Fed’s balance sheet. What would happen to this measure of value when the Fed starts running off its balance sheet, meaning when the size of the Fed’s balance sheet gets smaller every month? The Market Cap of Stocks would get more & more overvalued. Is that really why the QQQ fell off a cliff last week?

3. U.S. Economy

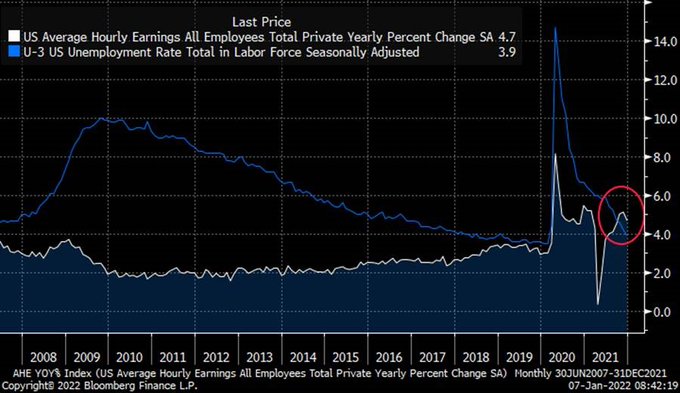

How does 3.9% unemployment interface with inflation?

- Richard Bernstein@RBAdvisors – – Today’s #employment report reinforces budding wage/price spiral. #Wages now rising faster than the #unemployment rate for the 1st time in #data history.

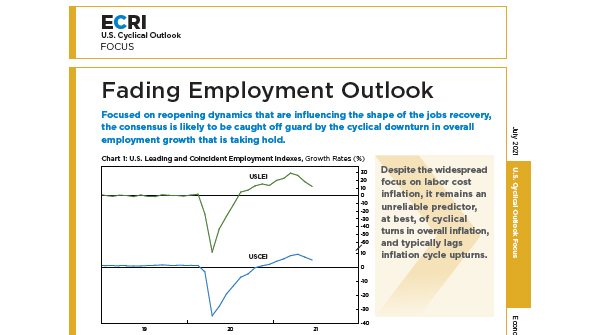

On the other hand, ECRI is on the side of a cyclical slowdown:

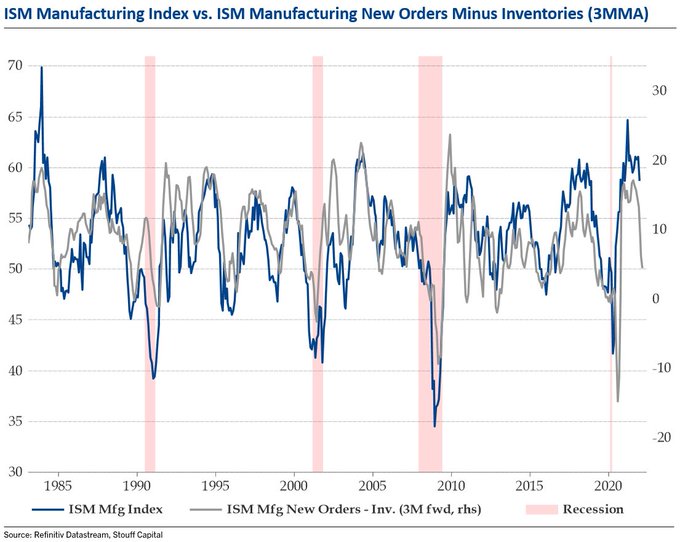

For those who consider ISM to be a leading indicator,

So is it possible the recent rate upsurge meets a slowing U.S. economy sometime in late Q1 or early Q2? How will the Treasury market react to that, especially if shorts in Treasuries have been built up to the nth-degree?

3. U.S. Stocks

What equity trade is the cousin of the Short Treasuries trade? And how intense has that been?

- Lisa Abramowicz@lisaabramowicz1 – Hedge funds are the most overweight value vs growth stocks in at least four years: JPM data

How did one prominent name react to this (courtesy of a J.C.Parets retweet)?

- John Bollinger@bbands – Attention growth stock HODLers. Many great long-term opportunities are being created. You should be working on your shopping lists while waiting for the ‘value’ madness to wane.

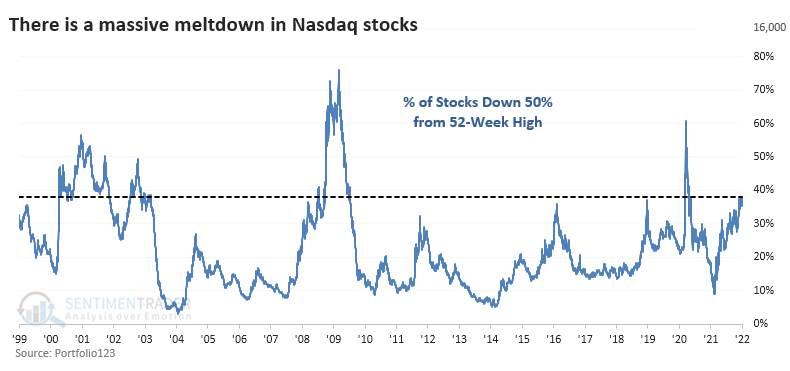

Everyone knows that Nasdaq stocks have cratered. But might this sell-off go further before it stops? One view is from Sentimentrader.com:

- After Wednesday’s post-FOMC selloff, more than 38% of stocks trading on the Nasdaq are now down 50% from their 52-week highs. Only 13% of days since 1999 have seen more stocks cut in half. … At no other point since at least 1999 have so many stocks been cut in half while the Nasdaq Composite index was so close to its peak. When at least 35% of stocks are down by half, the Composite has been down by an average of 47% (!) from its 3-year high.

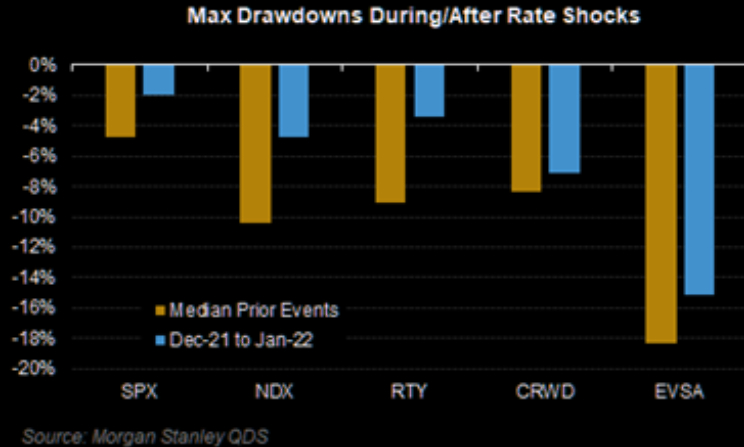

Holy carnage! Does the Nasdaq have to fall by 47%? On the other hand, some expensive sectors might have fallen enough, according to Morgan Stanley via The Market Ear:

- The Market Ear – Sell-off in “Crowded longs” & “Expensive Tech” almost done – The superb QDS team at MS showing that their Crowded Longs (CRWD) and Expensive Tech (EVSA) baskets are 85% of the way through their typical downside move during a “rate shock” vs. indices which are only 40-50% of the way through. Software now approaching 2019 trough valuations (Gavin Baker).

Is there another area within technology that might beat the NDX? Semiconductors, said CNBC’s Carter Worth on Friday:

The chips are crumbling. @CarterBWorth breaks down a terrible week for the semiconductors and what could come next $SMH $SOX $SOXX pic.twitter.com/EUhk7CEsuE

— CNBC's Fast Money (@CNBCFastMoney) January 7, 2022

What about the S&P 500?

- David Rosenberg@EconguyRosie – Strip out oil (thank you, Libya!) and banks (thank you, Fed!), and the S&P 500 is down 2.5% for the year — and no higher now than at the beginning of November. A two-sector story. #RosenbergResearch #DavidRosenberg #RRMacro #InvestmentResearch #economics #StockMarket .

Forgetting all the above mumbo-jumbo, a simple question is what do cycles say? Fortunately, Jim Cramer gave us a glimpse into the views of the legendary Larry Williams in a short clip on his Mad Money show:

- “… On an immediate basis, he thinks market’s recent rally will hold up thru the middle of this month; then S&P will get hit with its first real correction which is going to be brutal… but you are going to get a wonderful buying opportunity by late February … “

What about the intermediate term? Williams thinks, via Cramer, that there will be “a selloff in June-July, then a rally followed by a correction in September & then a big rally into year-end …”. Watch the abridged clip yourselves:

Is there a strong sector that could continue its rally for the next 30 days?

- Jason Goepfert@jasongoepfert – – Energy bulls are persistent. For the 2nd day in a row, $XLE is on track for a > 3% gain. It’s had back-to-back 3% gains 18 other times since its inception. Over the next 30 days, it rallied 17 of those times, with a median return of +7.3%.

4. International

The U.S. Dollar went down 55 bps on Friday despite the strength of the NFP report. And the worst hit sector rallied hard with FXI (Hong Kong) up 2.15% & KWEB up 2.67%. The strength spread to most emerging markets – Brazil was up 1.87%, South Korea up 2.57% & already strong Indian ETFs up 80-100 bps on the day.

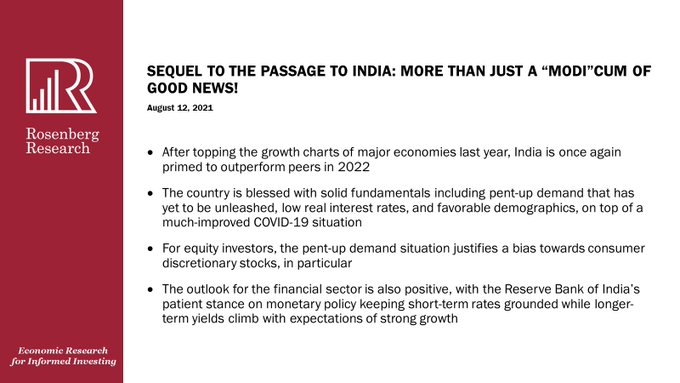

Indian ETFs did very well even on a weekly basis with MSCI-INDA up 3.2%, Nifty-INDY up 3.5% & WisdomTree EPI up 3.5%. And Rosie wrote positively about Indian market for 2022:

- David Rosenberg@EconguyRosie – – Special Report: Sequel to the Passage to India: More Than Just a “Modi”cum of Good News! Sign up for a free trial to access! bit.ly/323DvEt #RosenbergResearch #DavidRosenberg #RRMacro #InvestmentResearch #economics

Remember the story we relayed a few weeks ago of Katrina Kaif, the British born-bred woman who became the item superstar of Bollywood. We hear reports that Amazon paid Katrina 800 million rupees (about 12.5 million USD) for rights to videos of her recent wedding. This is a tribute to the crazy spending appetite of that film-crazy society. Man, do they spend!!! Unfortunately we were never beneficiaries of such spending because we were born into the wrong gender & were nerds on top of that.

India also received praise from an unlikely source this week. The Taleban Government profusely thanked India for sending 500,000 Covid vaccines to that cash-starved country.

At the same time, the Taleban detained 7 members of the NaPakistani forces for violating the borders of Afghanistan. It seems the Durand Line of 1893 is rapidly becoming an issue between the Taleban & their previous benefactor-handlers, the NaPaki military. How serious might this become? The ultra-extremist Haqqani Network that was closest to NaPak Military is now publicly siding with Afghani Taleban against NaPak. And this was the network that was protected by the Napak military from U.S. military counter-terrorist operations.

If this is not enough, the new news is that the Taleban have now reconstructed their suicide battalion & deployed it in Badakshan, the province that borders China & Tajikistan. Mullah Nisar Ahmad Ahmadi, Deputy Governor of Badakshan said of this battalion:

- “The defeat of the US would not be possible without this battalion”.

Now this battalion is deployed near the China-Tajikistan border of Afghanistan. This seems to support our very long-held view that the Taleban are Afghan-nationalists and, while they were happy to get NaPaki help & sanctuaries, they would turn against NaPaki & Chinese attempts to enter Talebani Afghanistan.

Think back to Vietnam. China helped Vietnam fight against US forces but when the US forces left Vietnam, China & Vietnam became adversaries within a couple of years. It is even worse between Pashtuns of Afghanistan and Panjabi NaPakistan. For its part, Russia would prefer that the Taleban direct their forces against Afghani borders with China & NaPakistan instead of Central Asia. The centuries old game might be beginning anew.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter