Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”2 down days come & gone?“;

Look what happened on this past Monday & Tuesday – NDX was up 233 & 252 points. Then came JPMorgan’s Dubravko Lakos-Bujas on CNBC Overtime, the new show of Scott Wapner.

Near the end of the above clip, Dubravko Lakos said:

- ” … if you look at the next few days, you have this month-end, qtr-end rebalancing when we do think equities get sold & bonds get bought. … bonds had one of the biggest selloffs on a quarter-to-day basis historically; I think the market has gone too fast to discount geopolitical tensions; that’s the thing we have to pay attention to & the Fed; On the Fed side, a lot is priced in; we don’t think this is imminent recession and there is still time to reevaluate the situation “

Wapner said:

- ” … you think in the near term equities get sold off?”

Then the exchange went like this:

- DLB – “Wednesday-Thursday; tomorrow & Thursday; you got month-end, quarter-end;”

- Wapner (laughing with derision) – “Marky my calendar; you are that good!!!”

- DLB – “its just looking at historical pattern; month-end tends to be quite powerful; & when you sort of see the biggest quarterly bond move that we have seen; I think its hard not to argue bonds get a bid for equities & equities could get sold on this wed-thur“

- Wapner – everybody mark their calendars Wed & Thursday – we are going to see what happens ….

This is what happens when short term success gets to a TV anchor’s head & he stops listening. Wapner was mocking DLB for daring to voice a 2-day call. But DLB was not making a generic 2-day call. Wapner did not even listen to DLB’s point about large scale portfolio rebalancing trades expected in the 2-days that marked the month-end & quarter-end.

JPM’s DLB was not the only one making this case. Nomura’s Charlie McElligott wrote exactly the same thing. Yet CNBC’s Wapner, full of ego & success of his new show, went nasty & overboard!

So was JPM’s DLB correct? Look at the data – On Monday & Tuesday, NDX rallied 233 & 252 points. Then DLB warned on Tuesday evening. QQQ kept rallying a bit on Wednesday morning only to turn south at 1 pm on Wednesday. QQQ was down 168 points on Wednesday & down 233 points on Thursday. So “we are all seeing what happened” during the 2-days of Wednesday & Thursday.

Clearly Wapner saw it too. But did he have the honesty or the grace to admit on his Friday’s show that DLB was correct & Wapner should not have mocked him? Actually shouldn’t Wapner have invited JPM’s DLB on his show on Friday & ask him what stocks might do next week after the huge Month-end, Quarter-end rebalancing is behind us? Wapner is smart enough to figure that out himself but being smart is hard to do when your head is swollen.

2. Curve Inversion

Look where the various Treasury rates closed on Friday:

- 3-yr rate at 2.629%; 20-yr at 2.587%; 5-yr at 2.56%; 7-yr at 2.5%; 2-yr at 2.454%; 30-yr at 2.432%; 2-yr at 2.454%; 1-yr at 1.696%;

And on the week,

- 30-yr rate fell by 16.5 bps; 20-yr fell by 16.1 bps; 10-yr fell by 10.5 bps; 7-yr fell by 6.4 bps. But 5-yr rose 0.2 bps to 2.56%; 3-yr up 10.9 bps to 2.629%; 2-yr yld up 16.8 bps to 2.454%; 1-yr up 3.6 bps to 1.696%;

This is complete bull crap in our humble opinion. This “curve-inversion” has nothing to do with US economy. It is entirely due to appallingly bombastic statements Hyde Powell made on Monday, March 21, in which he hinted raising rates by 50 bps in meeting after meeting. What is worse is Jay’s Hyde-Powell type bombast had nothing to do with economics or monetary policy & it had every thing to do with the public posture he wants to convey for his political bosses & his ultra wealthy supporter circle.

Seriously take away his bombastic chest-beating & remove the huge 33 bps rise in 2-yr , remove the 41 bps rise in the 5-year; remove the 37 bps rise in the 3-yr that took place from March 21 to March 25. You take these crazy moves out and guess what – the yield curve is NOT inverted. Heck, take away even half that crazy move & find that the yield curve is not inverted.

This is also demonstrated by the 3-months – 2-yr spread. It is a PLUS 190 bps while the 2-yr – 30-yr is inverted. That is entirely due to Powell’s public bombast vs. his “lily-livered” actions to use a Rich Bernstein phrase.

Listen to veteran Barry Knapp of Ironsides Macroeconomics talk about the so-ballyhooed inversion & compare it to breakeven curve inversion.

So what should investors do about Treasuries?

From The Market Ear on Thursday, 3/31 – The world needs to buy bonds. – “That is basically JPM’s quick take. According to the investment bank investors globally appear to be very underweight bonds, outright as well as relative to equities. They also write”:

- “Historical experience suggests that severe bond fund outflows do not last more than one quarter outside crisis periods”

- “We thus believe this quarter’s rotation away from bond funds into equity funds will subside into the coming quarters implying less bond fund selling and less equity fund buying in Q2 and beyond”

- “Their analysis suggests that the 90bp rise in the Global Agg bond index yield YTD more than compensates for the expected $1.9tr deterioration in the balance between global bond demand and supply for 2022”

3. Stock Market & Credit

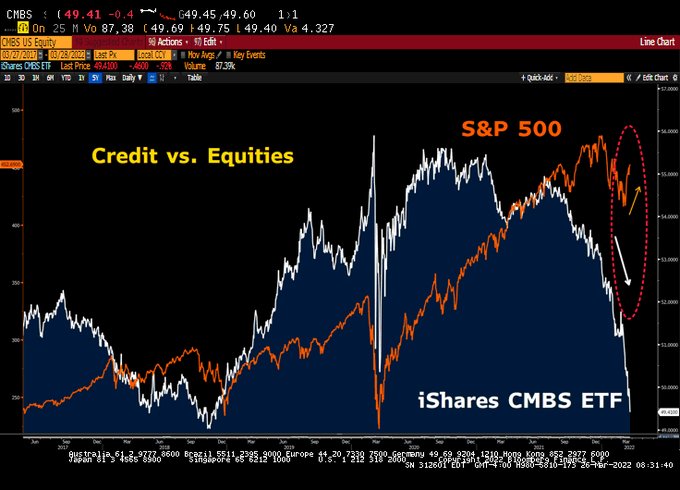

- Lawrence McDonald@Convertbond – – What is on Powell’s Mind? One ETF to Watch for Signs That the Fed Will Change Its Mind – Very Important take here: bloomberg.com/news/articles/

In contrast, Jonathan Ferro of BTV pointed out laughingly this week that he sees liquidity as plentiful. We found that interesting because our highly simple indicator has been saying the same for the past two week:

- This week HYG & JNK, unleveraged high yield ETFs, were up 76 bps & 81 bps on the week. In contrast, leveraged closed end funds, DPG & UTG were up 8.4% & 4.7% resp. The week before HYG & JNK were down 1.4% & 1.3% resp. Again in stark contrast, DPG & UTG were up 2.5% & 1% resp. And that was the week in which 2-7 yr Treasury rates shot up 33-38 bps.

What’s going on? Is it that Powell’s words can move Treasury rates & even the institutional ETFs but his words are not impacting other classes? How can leveraged funds seriously outperform their unleveraged counterparts when the Fed is moving Treasury rates up in a near-vertical fashion?

Going a bit macro, we think if Powell manages this cycle into a 1994 or 2011 version, then he will be recognized as Maestro V2. If his public bombasts end up converting this cycle in to a malignant recession, then he might be called different names.

4. Positioning

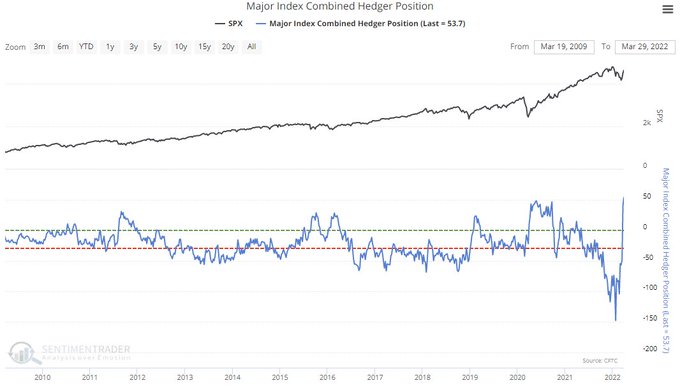

As we hear from many smart people, near-term performance is mainly driven by positioning. In that context, two views about equity speculators vs. commercial hedgers in equities:

- SentimenTrader@sentimentrader – – In a very rare display, “smart money” commercial hedgers are net long every major equity index futures contract (S&P 500, DJIA, Nasdaq 100, Russell 2000). They’re now holding more than $53 billion worth of contracts net long, a record high, exceeding May 2020’s $48 billion.

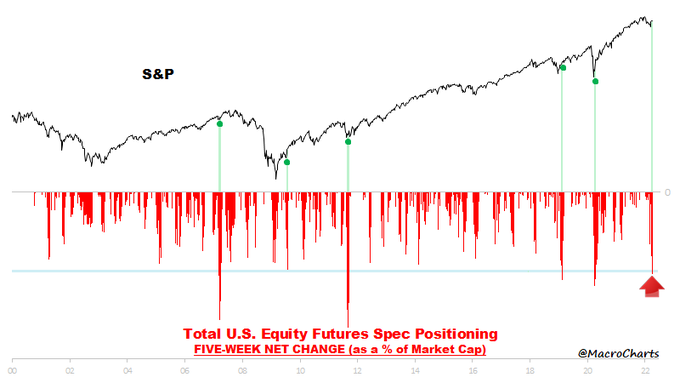

What about speculators?

- Macro Charts@MacroCharts – – Equity Traders sold relentlessly into this rally: • Five *consecutive* weeks of selling since the Feb bottom • One of the biggest purges ever (as a % of Mkt Cap) • Spec positioning now massively Short – at risk of a further squeeze Similar setups led to some Major rallies.

5. Ukraine

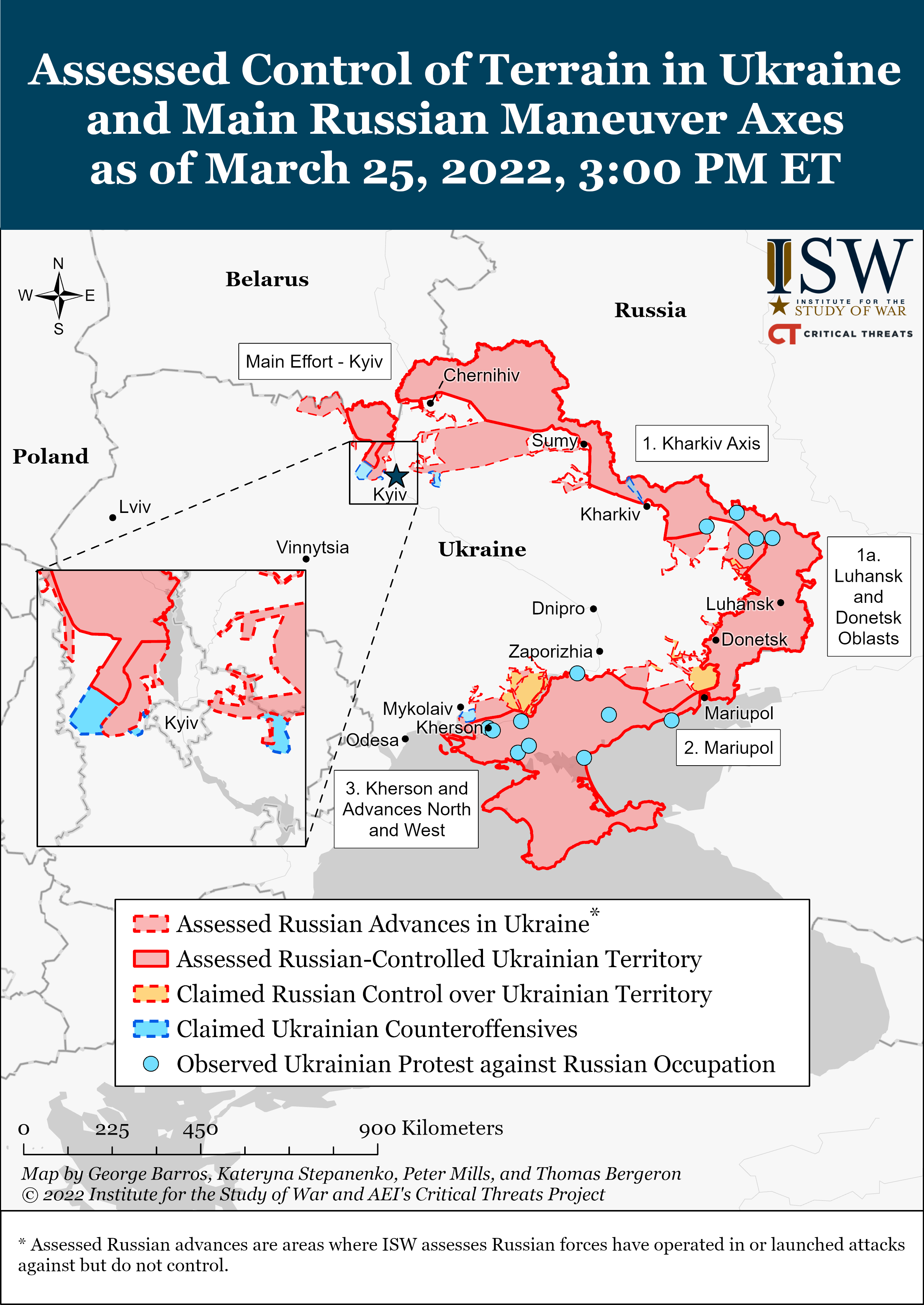

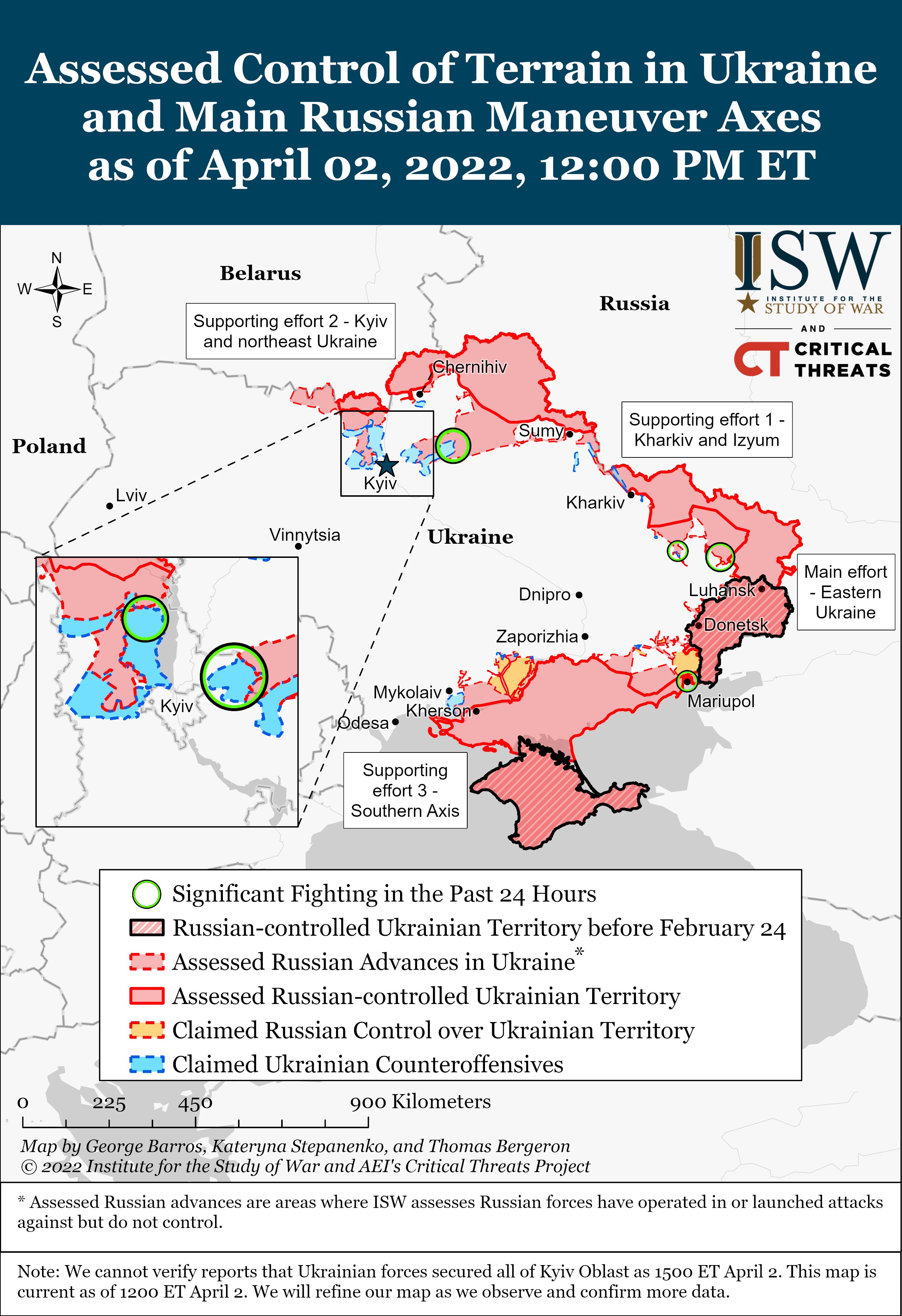

Last week we touched on expert opinions about Russian military embarking on a pincer operation to trap a large number of Ukrainian troops massed to fight Russian troops in Luhansk & Donbass area. We reproduce last week’s diagram from ISW:

Now compare the above with the ISW diagram as of April 2, 2022:

Notice the two green circles to the southeast of Kharkiv & north of Luhansk pointing out “significant fighting in the last 24 hours“. With this map, look at the March 28 CNN clip titled “Splitting Ukraine in 2 might look like this“:

The “minimalist” map in the clip above begins its southward march at the circle named Izyum. Other NBC clips maintained that Izyum is critical to this approach, one of which stated that “Izyum is the main battle area“. We mention this because on April 2, 2022, ISW reported:

- Russian forces in Izyum conducted an operational pause after successfully capturing the city on April 1 and will likely resume offensive operations to link up with Russian forces in Donbas in the coming days.

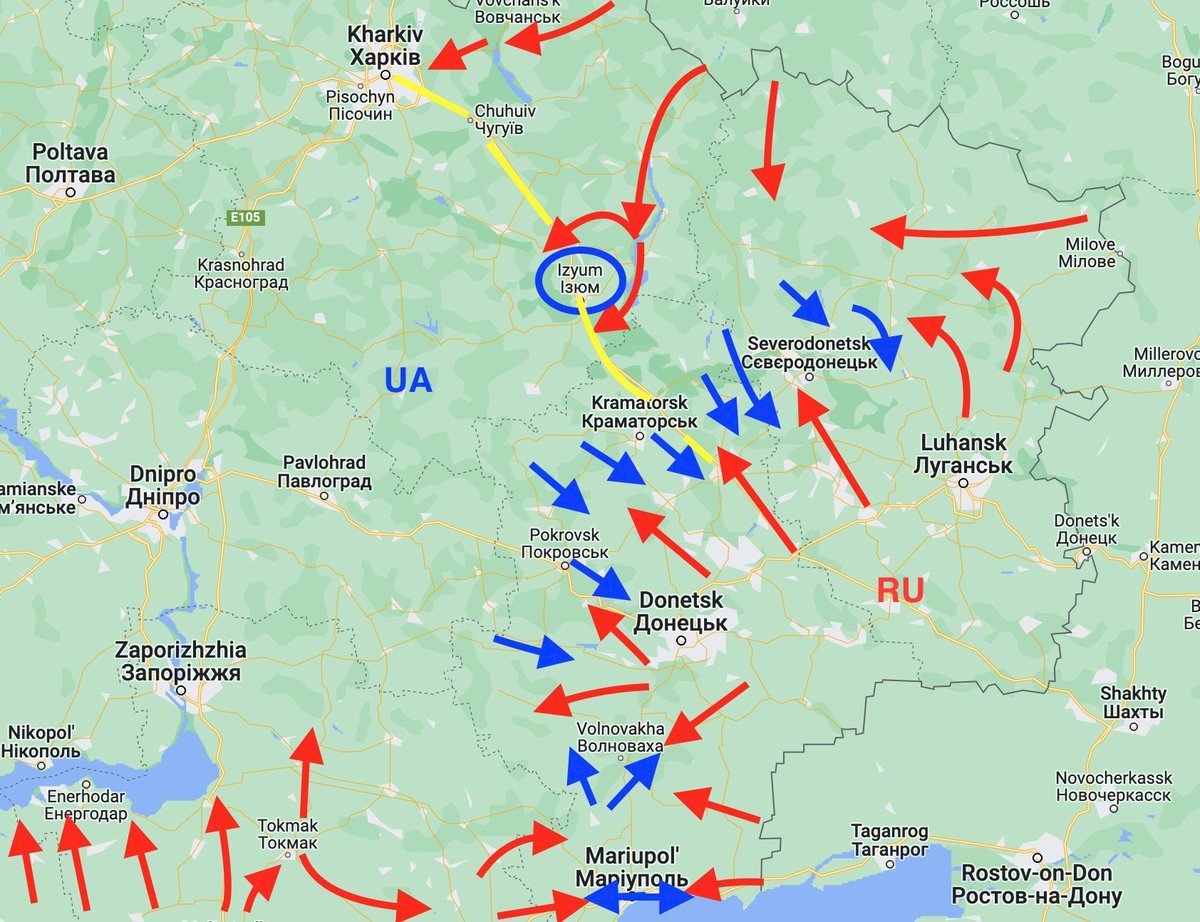

We insert below a map of the Izyum area without knowing anything about the entity that produced it or the date of the map. It is inserted below ONLY to illustrate the importance of Izyum geographically. It is clearly a dated map since Mariupol is now virtually in Russian hands:

Now look above at Izyum knowing that Russian Military has it. Once their “operational pause” is completed, wouldn’t the Russian military be also behind the Ukrainian military in addition to facing them? We also saw a CNN clip point out that the operational & supply lines problem Russian military had faced south of Kiev could now be faced by Ukrainian forces in the east facing Donetsk & Luhansk. This is now worse because Izyum sits atop the key artery between Kharkiv in the north & the Donbas front in the east and Russian military could cut Ukrainian supply lines as long as they control Izyum.

But the most interesting clip we saw was about the Ukrainian attack on a fuel depot inside Russia. CNN’s Kimberly Dozier called this as “one of Biden administration’s worst nightmares” because such Ukrainian successes might provide Putin the excuse to escalate to tactical nukes: Watch & listen to it:

"One of the Biden administration's worst nightmares."

CNN global affairs analyst @KimDozier explains how the purported attack on the Russian fuel depot, which the Ukrainian military hasn't commented on, affects the US' role in the Russia-Ukraine conflict. pic.twitter.com/mhEdPCmmW5

— CNN (@CNN) April 1, 2022

From what we read, it seems that UK & France are encouraging Ukraine to keep fighting the war while the Biden administration is in two minds. They probably want Russia to bleed & keep weakening their army. But they don’t want Ukrainians to win or even appear winning because that might force Putin to escalate using more deadly weapons.

What we find most weird is that USA & Russia are not talking directly with each other even at the Blinken-Lavrov foreign policy level let alone at the Presidential level. However deeply felt were President Biden’s remarks about President Putin, those intensely personal remarks would probably make it impossible for President Biden to meet President Putin.

But getting back to the investing game we are happy that this ghastly mess is restricted to Ukraine & the markets are fine with that.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter