Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Biden Fed!

Last week we had written about the then curve inversion as “complete bull crap in our humble opinion” and added:

- This “curve-inversion” has nothing to do with US economy. It is entirely due to appallingly bombastic statements Hyde Powell made on Monday, March 21, in which he hinted raising rates by 50 bps in meeting after meeting. What is worse is Jay’s Hyde-Powell type bombast had nothing to do with economics or monetary policy & it had every thing to do with the public posture he wants to convey for his political bosses & his ultra wealthy supporter circle.

Last week, the 3-year yield was the highest yield in the 2yr-30yr Treasury curve. So how did the Fed cure this feared “curve-inversion”? By getting an even more powerful member of the Fed to launch an even more appallingly bombastic statement.

And it worked because “poof” went the curve inversion on Tuesday April 5 thanks to a bombast from Lael Brainard, nominated to be the Fed Vice Chair & the one with the most political power & loyalty. The best & most succinct comment about the Brainard bombast came from one not normally praised for being succinct. Josh Brown, CEO of Ritholtz Wealth Management, said on CNBC Half Time Report on Tuesday April 5 (at about minute 7:20 of the show):

- “I would say Lael Brainard is on a mission from God to rescue Joe Biden’s midterms“

How is sternly warning the stock market about Rapid Quantitative Tightening a mission to rescue Joe Biden’s midterms? Well, look what President Biden had unveiled a week ago as a key part of his new plan?

- “As part of its budget proposal for fiscal year 2023, the Biden administration is pushing a measure that seeks to ensure that those worth more than $100 million pay a federal income tax rate of at least 20% on their income, including unrealized gains on assets – which are not currently taxed“.

Even if this proposal doesn’t pass into tax law, attacking billionaires for their obscene stock wealth would seem to be a populist campaign slogan. And look who jumped on the band wagon this week? Bill Dudley, the guru of the Fed & a long time head of the New York Fed, published his moral prescription on Bloomberg.com – “If Stocks Don’t Fall, the Fed Needs to Force Them“.

It seems that a rally in the stock market is seen as anathema to President Biden’s chances in the midterms. They think running against excessive stock riches of billionaires is good politics for them. If you doubt our conjecture, look at the match of strong rally action followed by Fed verbally stomping on it.

Think back to March 18, two days of the “maestro” Powell presser. Remember that stocks ran as his presser started as race horses do when the gate is opened. Clearly that presented horrible visuals for the Biden Fed. So Chairman Powell came on Monday, March 21 to stomp on the stock rally.

But, as we see from the 1-month charts, Powell did not end up stopping the stock rally. Instead, he “inverted” the Treasury curve. And as the long duration Treasuries outperformed, so did the NDX stocks. Ergo it was necessary to get the real power player to speak up.

Brainard did & see above how the NDX reacted with fear. The NDX fell 339 points on Tuesday, 322 points on Wednesday & another 205 points on Friday to close the week down 3.6%. The Russell 2000 closed down 4.6% & the Transports closed down 6.7%.

Yes if this continues then the Democrats can certainly run on having hurt the beastly billionaires where it hurts the most – in their unsold stock portfolios. But how is that good news for the middle class voters with 401-Ks?

- Wall Street Silver@WallStreetSilv – Apr 8 – Temporary ?

After getting hit hard in their pocket books from rampant food inflation & gas price rises, they are supposed to be happy that their retirement monies are also getting torched?

What happens if the stock market does listen to Lael Brainard & Jay Powell and we get a 20% decline in the stock market as some smart gurus predict? Will President Biden celebrate that as a success of his policies?

Wait a minute. Is that why this Biden Fed has focused only on verbal stomping on the stock market instead of walking their walk? Ask yourselves, why didn’t this Fed raise rates this week, especially in conjunction with the “updated” Fed minutes? Wasn’t it the perfect opportunity to both raise rates & do some QT instead of simply babbling about it? Or did the Fed not act because it is easy to take back words but much much harder to take back a rate hike & QT action?

Speaking of their resolve, think back to the Wednesday before Thanksgiving 2021. That was the day the Fed began talking about rate hikes via their then-“updated” minutes. How much have they actually done since Thanksgiving 2021? One rate-hike of 25 bps!

2. Curve action

Recall the effect Powell’s bombast of March 21 had on the Treasury curve that week:

March 21 – March 26: 5-yr yield up 41 bps; 7-yr yield up 38.7 bps; 3-yr yield up 36.8 bps; 10-yr yield up 33.6 bps; 2-yr up 33.5 bps; 20-yr up 22 bps; 30-yr up 18.5 bps;

Compare that with the effect of Brainard’s bombast this week:

April 4 – April 8: 20-yr yield up 34.6 bps; 10-yr up 33.4 bps; 30-yr up 30.3 bps; 7-yr up 28.4 bps; 5-yr up 20 bps; 3-yr up 10.5 bps; 2-yr up 6.6 bps;

So while the 3-year yield was the highest last week, this week it is the 20-yr yield at 2.916% followed by 7-yr at 2.777%, 5-yr at 2.731% & the lowest yield was the 2-yr at 2.516%.

None of this has had anything to do with the state of the economy or policies implemented. It is entirely due to verbal bombasts by the Fed-heads.

Give them credit, though. Treasury market has been listening to them and acting on it:

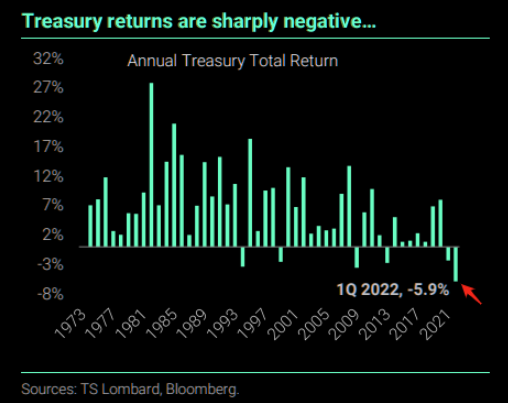

- The Market Ear – Worst start in forever – Yes, we are talking about the horrible start to Treasury returns, down ~6% YTD.

And

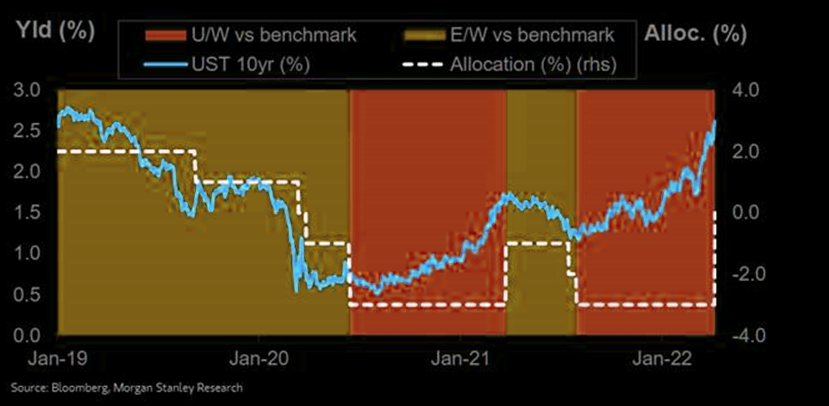

- The Market Ear – MS cross-asset says enough is enough in bonds – Morgan Stanley Cross-Asset Strategy are closing out their short recommendation on USTs…

Anyone actually saying Buy?

- Jim Bianco biancoresearch.eth@biancoresearch – Bonds to Buy After an ‘Epic Rout.’ | Barron’s

3. Stocks

First the View of the Flow Show of BAML:

- “inflation shock” worsening, “rates shock” just beginning, “recession shock” coming. ISM <50. EPS growth <0% by year end; cash, volatility, commodities, crypto to outperform bonds, stocks … SPX <4000 in 22, GT30 >4% in 23; stagflation = long defensives & inflation assets, short cyclicals & deflation assets.

Last week, we showed the stark contrast between long positioning of “commercial hedgers” and short positioning of “speculators”. This week a different way of describing the positioning:

- The Market Ear – Professionals vs Amateurs – Last week alone showed $18bn of global inflows into equites. The retail bid is alive and kicking. On the other side, GS PB data showed yet another week of selling and de-risking from the ‘professional’ community. The Prime book saw de-risking activity in 15 of the 21 trading days in march, the cumulative $ de-risking would be the second largest month/month over the past five years and gross exposure now at its lowest level since Q3 2020 and towards the bottom quartile on a 5y back test (Goldman)

Ok but what about net exposure?

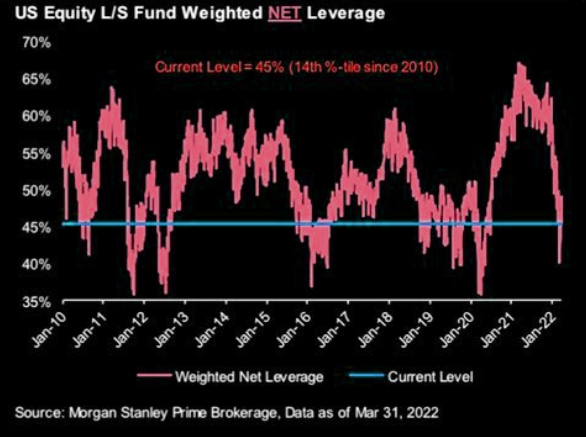

- The Market Ear – Hedge fund net leverage – Morgan Stanley Prime Brokerage data as of end-Q1. That is significant.

How does the market action look from above?

- The Market Ear – SPX – boring perfection – Not sure if we have ever seen this before, but SPX futs day highs touched the 100 day moving average, day lows saw it touch the 200 day…and we are trading unchanged, currently putting in a classical doji. No conclusion, just an observation for market geeks.

And what does Lawrence McMillan of Option strategist say in his Friday Summary?

- Overall, we are treating the current market as somewhat range- bound, looking for a breakout above 4637 or a breakdown below 4420 as an area to add bullish or bearish positions, respectively.

Finally a group that usually has been right:

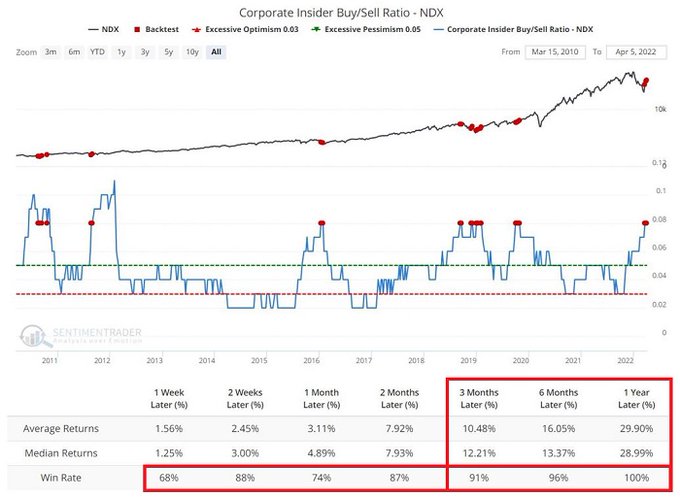

- Jay Kaeppel@jaykaeppel – – And another week of aggressive open-market buying by corporate insiders of Nasdaq 100 Index companies. Which again raises the questions: *Are they crazy? *Or do they no something we don’t? *Should bullish case be given the benefit of the doubt? #sentimentrader

4. Ukraine

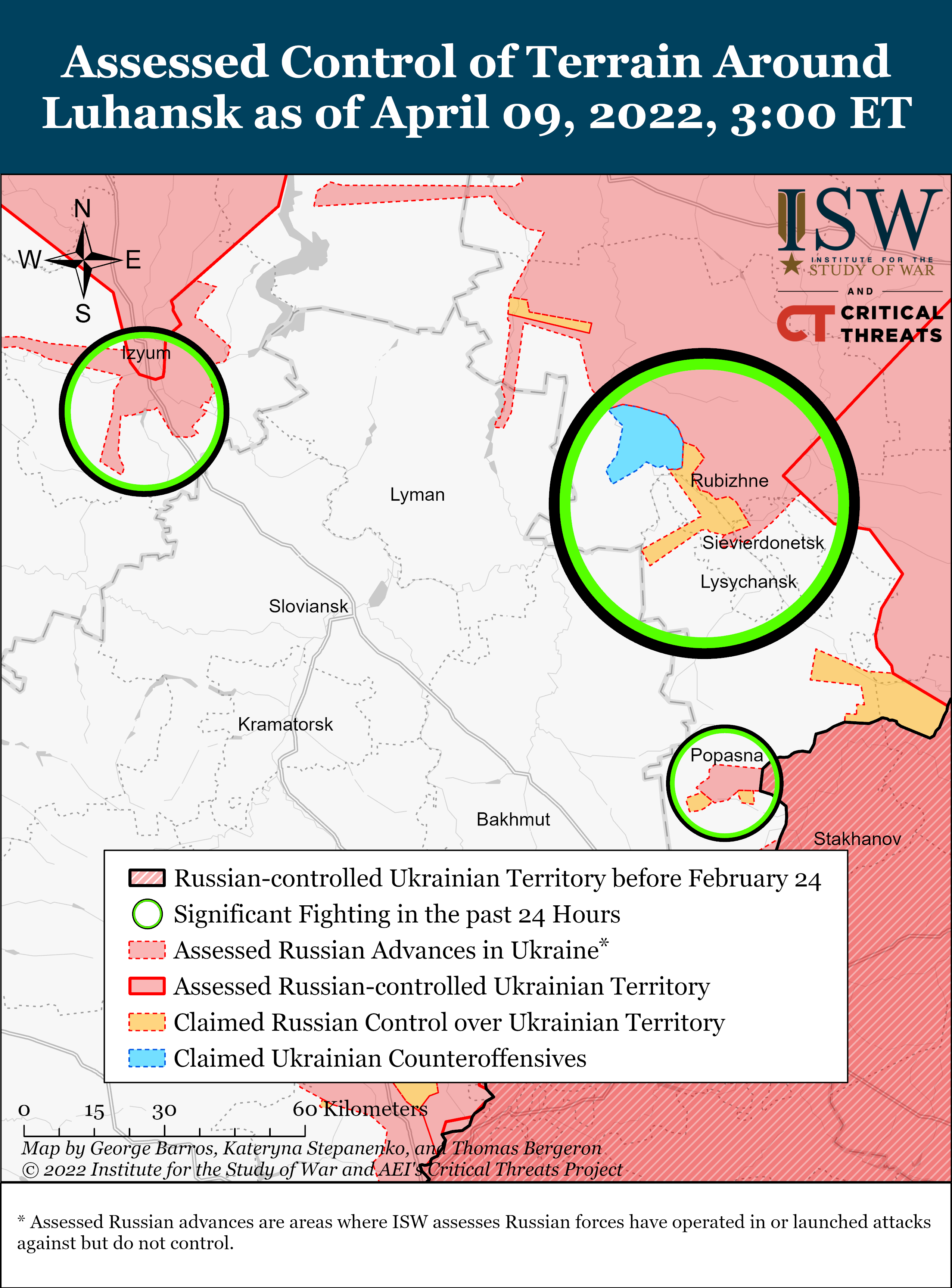

We were somewhat surprised with the speed with which Russian forces captured Izyum last week. This week Ukraine & every one else was focused on the Donbas-Luhansk area. And we saw absolutely no progress from Russian forces towards their next objective, the very critical Sloviansk. The best way to see the flexibility Sloviansk would provides Russian is via the NYT map below:

But Ukraine forces are guarding the Izyum-Sloviansk road per ISW and according to ISW’s RUSSIAN OFFENSIVE CAMPAIGN ASSESSMENT, APRIL 8:

- “Ukrainian forces continued to repel daily Russian assaults in Donetsk and Luhansk Oblasts.”

- “Russian forces continued attacks south of Izyum toward Slovyansk and Barvinkove but did not take any new territory.”

What might be worse is the following report:

- “Russian forces are increasingly refusing to reenter combat, and the Kremlin remains unlikely to quickly redeploy effective forces from northeastern Ukraine to operations in Donbas. The Ukrainian General Staff reported that more than 80% of personnel in some unspecified Russian units previously involved in combat operations are refusing to return to the front”

But what stuns us is the sheer stupidity of this war effort:

Kramatorsk in the map above was the place where the missile struck the railway terminal. It is southwest of Sloviansk. Look at the wide open area between Sloviansk, Rubiznhe, Popsana & Kramatorsk & wonder why the Russians are not carpet bombing this area.

Imagine for a moment it is the American military that is attacking this area. Could you imagine any US forces getting exposed to dug-in well armed defensive forces without the entire area bombed by a wide range of bombers & anti-tank aircraft? Even back in 2003, weren’t the Iraqi battalions with heavy armor first virtually decapacitated by weeks of intense bombing?

From what we hear on TV, the Ukrainian forces in Donbas & Luhansk are the best that Ukraine has & they have been superbly dug-in for over 7-8 years backed up by a solid infrastructure & battle plan. No wonder Russians can’t even progress from Izyum to Sloviansk for over a week!

Now read the key takeaways from ISW’s Special Edition: Russian Military Capabilities Assessments dated April 9:

- “Russia is unlikely to be able to mass combat power for the fight in eastern Ukraine proportionate to the number of troops and battalion tactical groups it sends there.”

- “The Russian military continues to suffer from devastating morale, recruitment, and retention problems that seriously undermine its ability to fight effectively.”

- “The outcome of forthcoming Russian operations in eastern Ukraine remains very much in question.”

What can be said in a nutshell?

What about the new Russian General in charge, the guy who headed the Russian war in Syria? If we recall correctly, he had Hezbollah & the Iranian militias serving as his infantry. Clearly Russian infantry is far far less capable and far far less determined to accept casualties. So will this new General convert the Donbas into another Syria with incessant & brutal bombings? And does Russia even have such quantities of armaments left after the disaster around Kiev?

While we have no real clue about what will happen in eastern Ukraine, we can see what is already happening in weak economies around the world?

5. Food inflation & global instability

Just pictures & tweets suffice for this week, courtesy of retweets by Jim Bianco:

More video from Sri Lanka, where the currency is collapsing and food shortages are increasing.

Protesters in Sri Lanka have defied a nationwide curfew and now just broke through more police barricades.

Sound ON pic.twitter.com/xcXtYxI7QN

— Wall Street Silver (@WallStreetSilv) April 9, 2022

People in UK speaking about higher prices for food and energy.

This is just the beginning.

Sound ON pic.twitter.com/QsvlqgnGwc

— Wall Street Silver (@WallStreetSilv) April 9, 2022

- Wall Street Silver@WallStreetSilv – Apr 9 – Fears for global food security are growing. Even from the relative stability of Belgium, consumers are already feeling the effects. Now, it’s producers who are sounding the alarm.

New video footage from the economic collapse happening in Peru right now.

The people are upset over high costs of food and fuel.

Sound On pic.twitter.com/u2ctOhj6IY

— Wall Street Silver (@WallStreetSilv) April 9, 2022

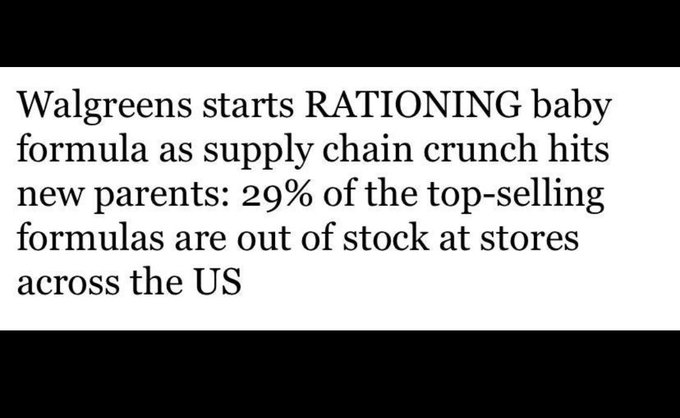

And coming back home:

- Wall Street Silver@WallStreetSilv – Apr 10 – Avian Flu: U.S. farmers forced to kill millions of egg-laying hens, reducing the country’s egg supply and driving up prices in some areas.

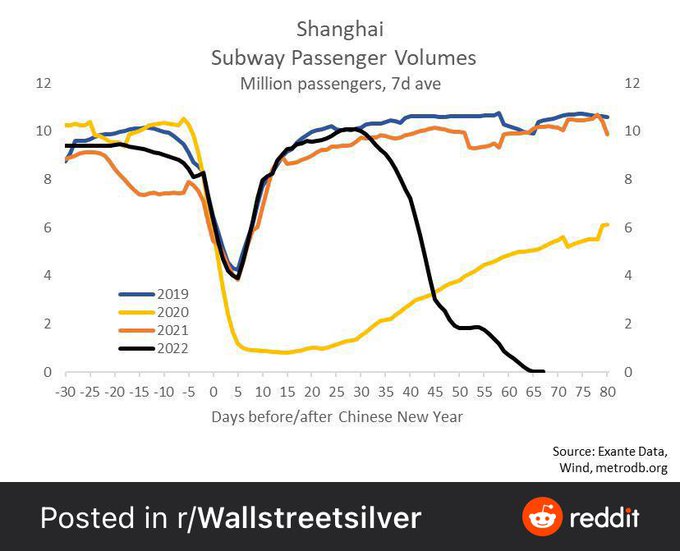

Nothing sounds so horrible as the clips from Shanghai but the rest of the world might also ponder about the “supply chain” issues:

But not to worry. The Fed will solve the inflation problem by destroying consumer demand in America & around the world by hitting the U.S. stock market & making U.S. interest rates explode up.

It seems IMF thinks differently. After China’s One Belt One Road bankrupted Sri Lanka via making them accept Chinese debt for unnecessary projects, IMF is now considering a loan to Sri Lanka to address their food crisis & perhaps to pay off the Chinese Debt. And then the IMF can give another multi-billion dollar loan to NaPakistan to save them from the strangle-hold of Chinese Debt from the Himalayan-height of China-NaPak friendship.

The real question is, with all this going on, how come U.S. Treasuries are not a Buy? Or is what we are seeing now is a mere tip of the global iceberg & we need to see a Titanic level accident to start buying U.S. Treasuries?

Send your feedback to [email protected] Or @MacroViewpoints on Twitter