Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.The Magic Johnson standard

Magic always said a superstar is one who plays like the superstar in the really big game. That makes Jay Powell a true superstar, in our opinion. We wrote last week that this would be “the most important presser of his tenure“. It was and, as Jeffrey Gundlach said, this was Powell’s best presser yet. What Jay did breathed hope & relief into the world reeling from a whirlwind of dangerous financial winds that had already caused, per Larry McDonald, about $30 Trillion of wealth destruction.

So we had wondered last week – “… Chairman Powell has been a maestro in his pressers. So what if Powell actually appears to hint about a data-dependent policy going forward? If not in September but at least by November?“

We were wrong. Powell did neither appear to hint, nor hint. To everyone’s astonishment, Chairman Powell affirmatively stated in his presser “ANOTHER UNUSUALLY LARGE INCREASE TO DEPEND ON DATA“.

In our humble opinion, this simple sounding statement must have been absolute hell to create & to say given the monumental significance it had for financial markets. Had it gone wrong, the Federal Reserve would have been tarnished & Chairman Powell’s standing in markets, in the Biden administration & in the minds of the American people would have destroyed. How incredibly exhausting must have been the preparation & the courage to make that simple statement? We don’t have to guess. We all saw the exhaustion in his body language near the end of the presser. Kudos to Bloomberg’s Tom Keene for being the sole Fin TV anchor to notice & mention the exhaustion in Mr. Powell.

The Fed’s challenges are not over. The world economy is still at a precarious stage. But now Jay Powell has revived the hope that, in the words of Gundlach, “a crash landing is avoidable“.

Well done Maestro!

2. Impact of that one statement of Chair Powell

Just look at Wednesday’s charts for two U.S. stock indices to see the lift after the one statement “another unusually large increase to depend on data“:

The Dow was up 436 points, S&P up 103 and NDX was up 515 points on Wednesday. That prompted some to opine that the rally was exhausted at the end of Wednesday & that, like the prior Fed presser rallies, this one too will be sold off on Thursday. Only on Fin TV do such obscenely wrong “sales-traders” remain on air!

Let us see pictorially how the U.S. indices did the rest of the week:

These should make us all wonder at the arrogant stupidity of a “sales-trader” to opine that this Powell-inspired rally was exhausted by Wednesday’s close.

The impact of Powell’s new “data-dependence” was magnified because the economic data released on Thursday & Friday supported his decision to become more data-dependent. The BEST illustration of this was that TLT FELL on Friday instead of rallying hard. Rates in belly of the Treasury curve fell hard post Powell presser but the 30-year yield actually rose a bit from 1:50 pm on Wednesday to Friday’s close:

- 30-yr yield up 3.4 bps; 20-yr yield down 1 bps; 10-yr yield down 10 bps; 7-yr yield down 14 bps; 5-yr yield down 17 bps; 3-yr yield down 17 bps; 2-yr yield down 17 bps; 1-yr yield down 9 bps.

This was a clear statement from the Treasury market that what Chairman Powell had signaled might actually reduce the risk of a significant downturn.

The U.S. action above is fine but it probably pales in significance to what Powell actually achieved for the global economy:

Thanks to Jay, the Dollar, as measured by DXY, fell hard on his data-dependent comment & kept falling into Friday’s close. Now the rest of the world has “a chance to breathe“:

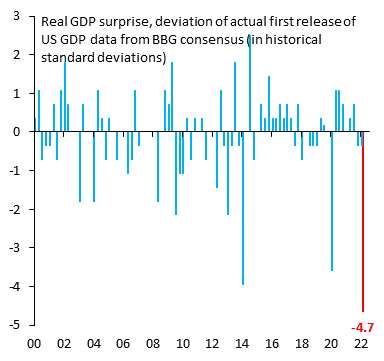

- Robin Brooks@RobinBrooksIIF – – Yesterday’s weak US GDP is a game-changer for markets, especially EM. The fact that Q2 growth came in at -0.9% q/q constitutes a -4.7 standard deviation surprise relative to consensus (+0.4% q/q). The strong US story is over. The hawkish Fed story is over. EM can breathe again…

Read what Gundlach said after the presser:

- ” … June was a terrible month for the high yield bond market & the emerging markets; then we had a pretty strong rebound in, particularly, corporate bonds & the high yield bond market ; they got a second wind after the press conference today; I think we have an interesting situation now where markets are priced so cheaply enough … where the starting point for certain parts of the credit market & for some of the risky parts of the stock market is such that the possibility of good returns … over a 6-12 month horizon has significantly improved … “

3. Real Question

The more interesting set of comments came from Morgan Stanley’s Mike Wilson on Wednesday after Gundlach. Interesting because Wilson seems to agree with Gundlach re the big points.

- “It’s the beginning of the end; … We are getting closer to the end of Fed’s tightening campaign; is this the last hike? probably not; could it be? It could be ; depends on how fast things deteriorate … “

Notice Mike Wilson has steadfastly stayed away from the questions about the economy. In fact, he studiously avoids commenting on the economy. All he dares to speak about are corporate earnings. Is that because, as BTV’s Tom Keene once alluded, Ellen Zentner is the boss of economic commentary at Morgan Stanley & she has so far refused to use the R-word.

Except on Wednesday after the close, that is. Then Mike Wilson said the following after his “depends on how fast things deteriorate” sub-comment above:

- ” … the market always rallies once the Fed stops hiking until the recession begins; the problem with that is that it is unlikely to be much of a gap this time between the end of the Fed’s hiking campaign & beginning of recession … “

Ed Hyman himself has a 3-month window for that gap. He spoke about M2 plunging to zero (from 30% last year) and said “… both inflation and economic growth are going to slow significantly in 3 months … it is going to be a race between the Fed Funds rate & the Bond yield … “

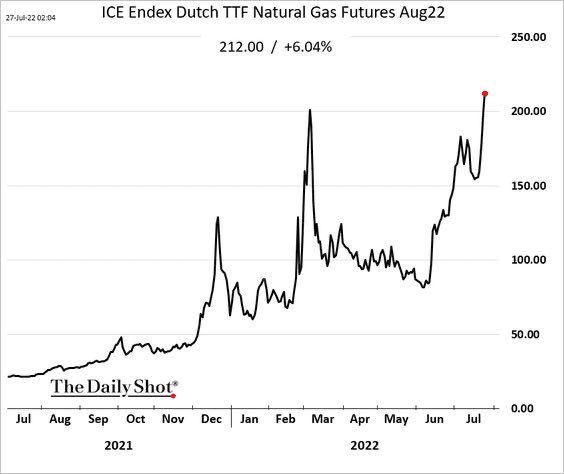

Powell might have injected some breath into EM but he is utterly powerless to inject flames (of natural gas) into the 2nd largest economic region in the world, the world that impacts U.S. Growth & earnings of S&P companies.

- jeroen blokland@jsblokland – – The terrifying part of the recent spike in European #NaturalGas prices is the timing. Mid-summer! I don’t see how we ever get to the above-potential #GDPgrowth forecasts of the EU, IMF, and other economists with rationing coming.

Why can’t they use electricity instead, today’s Marie-Antoinette might ask?

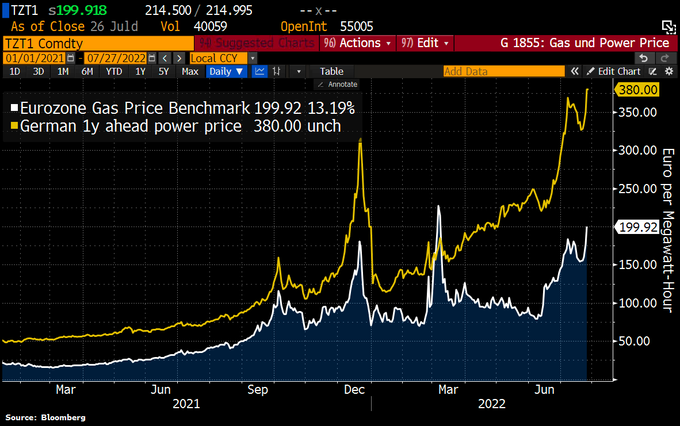

- Holger Zschaepitz@Schuldensuehner – Jul 29 – This horror chart suggests that #Germany is heading for a huge energy crisis. Not only are gas prices near record highs, but electricity prices in particular are signaling stress.

So why should risks in Europe & USA be treated at or near par?

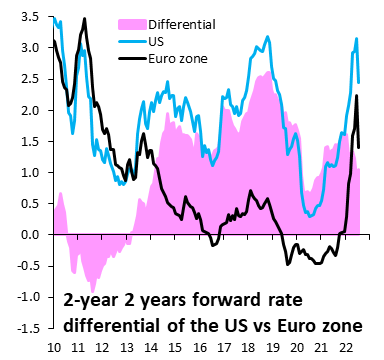

- Robin Brooks@RobinBrooksIIF – – Euro downside is massive. Markets are trading recession risk in the US on par with that in the Euro zone, taking down the terminal rate for ECB and Fed hiking cycles by about the same amount recently. That’s silly. The Euro zone is going into deep recession. Euro will fall a lot!

We are far more concerned about the recession in Europe than the value of the Euro because recession in Europe does usually get imported into America.

Note that even semi-bullish Gundlach (he is so on credit more than the S&P) is not sanguine because he said ” .. a crash landing is avoidable … soft landing is the goal but won’t give it great odds … “. Mike Wilson doesn’t give economic odds but said about earnings & S&P targets:

- “… you have 2 outcomes in front of you – soft landing or recession. Even in soft landing, we think $15 of earnings risk to $225 vs. $240; that suggests downside to 3,500; in a recessionary outcome; its much more severe to $195 in earnings & … now you are talking as low as 3,000 … “

The big question will be the message sent by the Treasury market in the next 3 months:

What is the next big level?

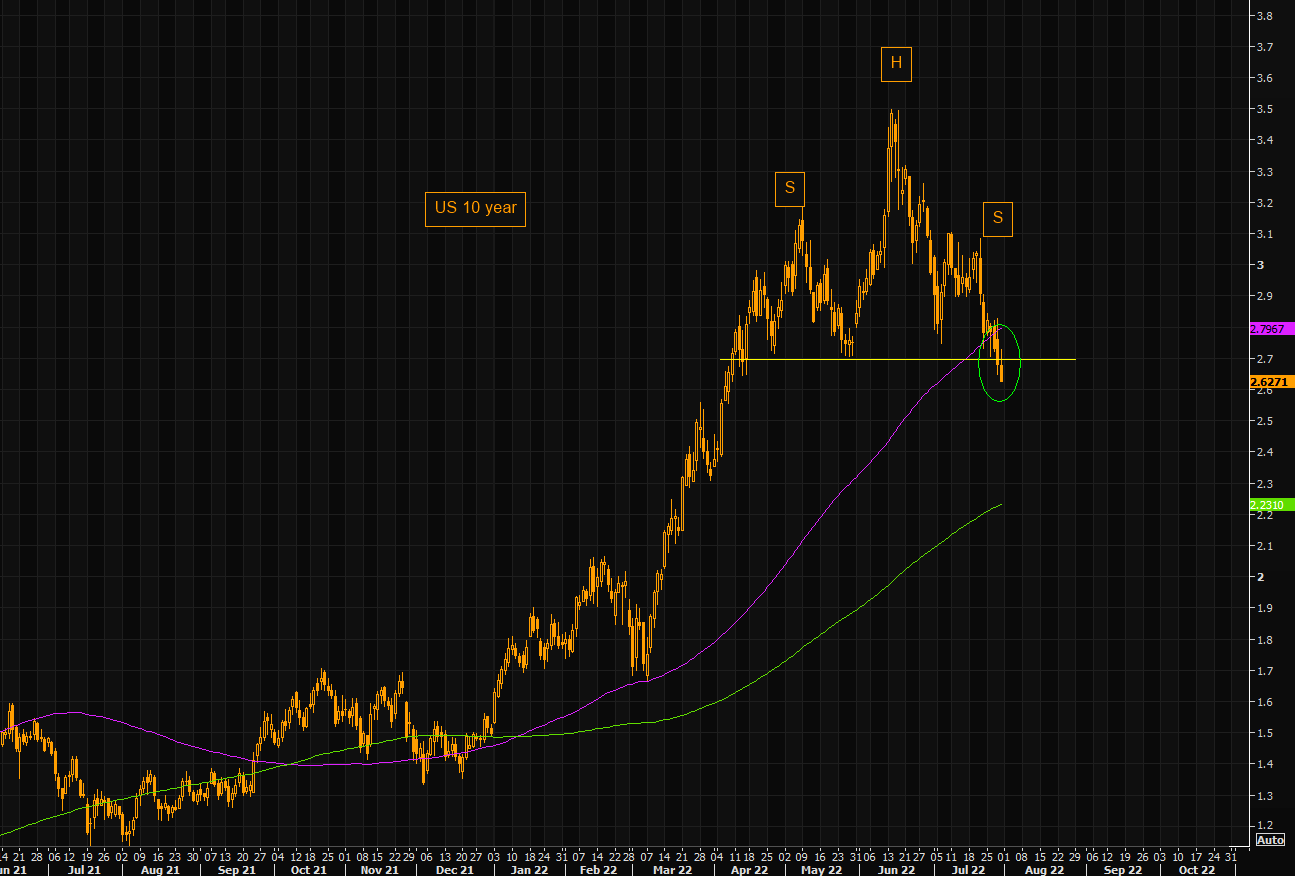

- The Market Ear – US 10 year – the HS – Earlier this week we outlined the head and shoulders formation in the US 10 year. We are now “well” below the huge 2.7% level as well as the 100 day moving average. Yields have moved sharply lower, but there are no big levels until 2.3% ish, slightly above the 200 day moving average.

A couple of weeks ago, @TommyThornton tweeted saying something like those who are calling for a short, shallow recession are the same who previously called for “transitory inflation”. Mike Wilson might have nodded to the recession possibility but made no attempt to distinguish between a short recession & a long protracted recession. Who can you get to opine about a protracted two-year recession?

The R&R crowd & the not fun frolicking kind despite the gorgeous locale:

We're in a technical #recession… so what now?

How long will it last? Is it sharp & short, or shallow & drawn-out? How do you position for it?@EconguyRosie & @RaoulGMI break it all down 👇

"We're in the early stages of what is probably going to be a 2 year recession." pic.twitter.com/dcUL5Or2xj

— Real Vision (@RealVision) July 29, 2022

What does the superlatively Un-Rosie* say above to Raoul of “Buy Bonds & Wear Diamonds” fame?

- ” … We are in early stages of what is gonna be probably a two-year recession; so that’s where we are right now; the beauty of this call is that it separates itself from the consensus view that we are going to experience a soft landing or a short & shallow recession .. it could be a shallow recession ; its not going to be short … that’s where we are … “

This brings us back to Gundlach and an important point he made:

- “… this is what the Fed wants to avoid, a downturn of significance, because I think they understand they are probably going to print again; so ironically if you want to have less inflation long term, you want to really avoid overdoing it now & causing that more steep recession … “

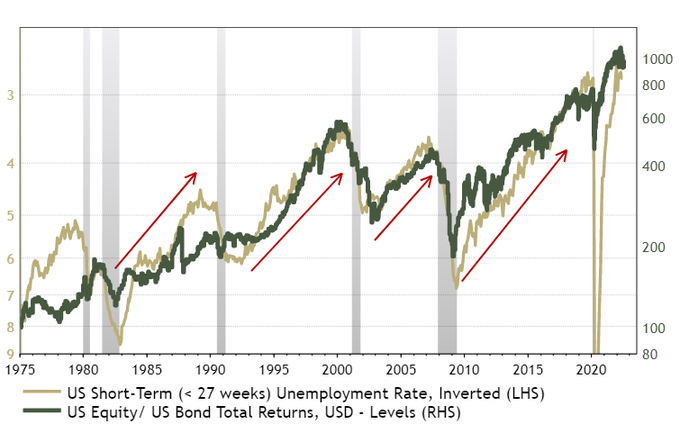

We will find out in Ed Hyman’s 3-month window whether the Fed can still avoid “overdoing it now”. So how do you bet now? Ask yourselves if unemployment will be higher in a year or lower?

- Ian Harnett@IanRHarnett – The only question you need to ask for your asset allocation “will unemployment be higher in a year’s time?” If the answer is yes, then underweight Equities vs Bonds…Simple but effective…

Wasn’t that the message of (Citibank’s) Kristine Bitterly, of Gary Shilling & of David Rosenberg?

*we simply can’t resist using adjectives to adorn Mr. Rosenberg’s Rosie nickname. But allow us to stress that it is only done out of serious respect for his work & the accuracy of his previous predictions.

4. Near Term

This 3-month & long term stuff is too depressing. How about some cheer in the short term? It has been beautiful but does it stay that way? One indicator to watch might be the VIX. And what do the FOMC-days typically do to the VIX – “Suck”?

- The Market Ear – VIX knew – Last time VIX was here the SPX traded at… Everybody knows you can’t compare VIX to absolute levels of SPX as volatility is mean reverting, but you get the point. Market is now “sucking” risk premium out of the market. Hopefully we see real inverse panic kick in and people puke vols further. That would open up for great long volatility trades.

What if the $VIX gets puked out to say sub-20? Will that make some cry? What will they do about it?

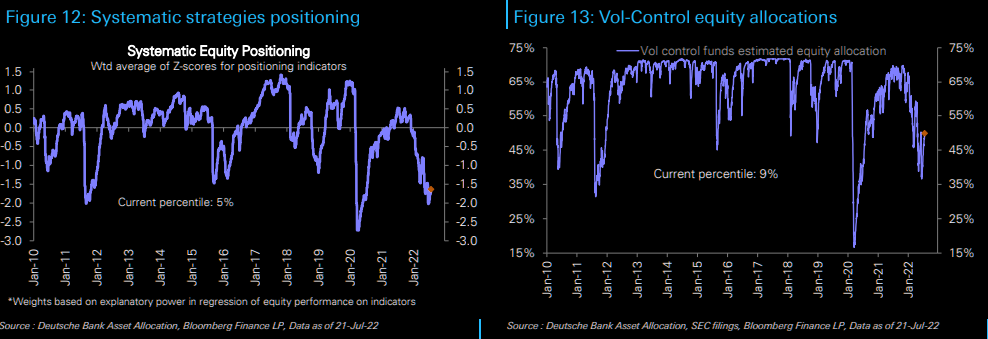

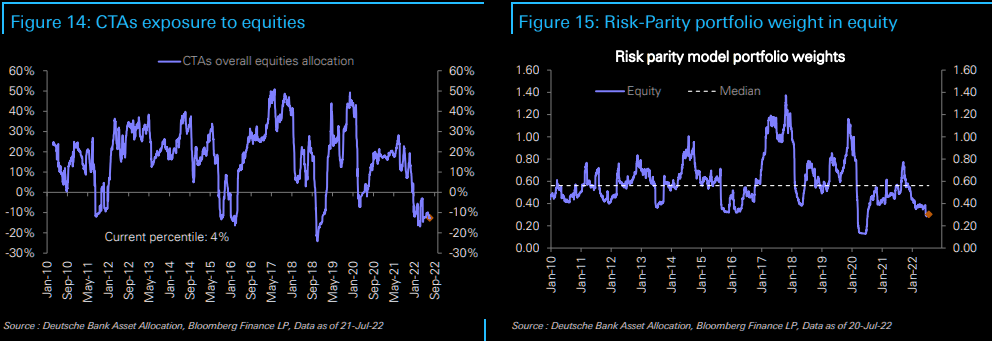

- Via The Market Ear – Thu – Systematically not long – The computer and model driven crowd has experienced huge agony and p/l pain during this latest market squeeze. They have all been running extremely light equity longs. Good luck to those that have had to chase longs in this poor liquidity environment. Mission impossible…

Is this is a discretion vs. valor moment?

- Jay Kaeppel@jaykaeppel – – $NDX closing in on an important test… Whether it breaks through or fails, it will tell us something important. #sentimentrader

After all this, a simple question – is there a buy coming out of Powell’s big decision? How about two instead of one?

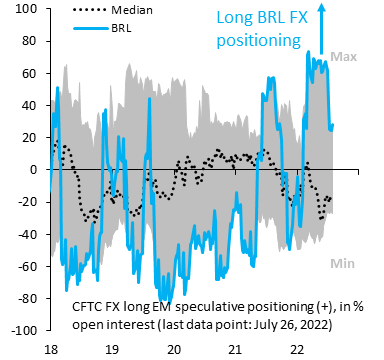

- Robin Brooks@RobinBrooksIIF – – Brazil’s Real will keep strengthening towards our $/BRL 4.50 fair value in coming weeks. That’s because foreign investor pulled back after the June hawkish Fed shift. That hawkish shift ended this week. Foreign investors will pile back into Brazil as they’re structurally bullish.

And,

Send your feedback to [email protected] Or @MacroViewpoints on Twitter