Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”all breadth signals staying at highs“

What we saw at noonish on Friday sums it up for us:

- Jason@3PeaksTrading – – ES_F hitting 4250 big liquidity level now, all breadth signals staying at highs

The vaunted JPMorgan said it well too:

- Via The Market Ear – Friday am – Short covering getting extreme – Short covering getting extreme as net US hedge fund flows turn positive. JPM writes: “…the short covering has been the main driver of late and is now one of the most extreme in the past 5 years on a 20d basis (-3z). The covering has pushed net flows into more positive territory as well.”

You know that $VIX had to break below $20 for this. Not only did it do so, but it did so on a weekly close to $19.53, down 7.7% on the week. And what a week it was:

- Dow up 2.9%; SPX up 3.3%, RSP (equal-weight SPX) up 3.9%; NDX up 2.7%, Russell 2000 up 4.9%; IWC (Micro Caps) up 5%; DJT (Transports) up 3.7%.

And the Dollar was down with both DXY & UUP down 73 bps on the week:

- EEM up 2.4%; EWZ (Brazil) up 7.5%; Indian ETFs up 2%; ASHR up 2.5%; EWY (South Korea) up 1.3%; Copper up 3.4%; CLF up 7.7%; FCX up 4.8%; MOS up 5.3%;

All this prompted one of the earliest bears to say that June lows would end up being the cycle lows. Jonathan Krinsky said on Monday August 8 that 4231 level for S&P would give him a new frame of reference:

- “ … 4231, that’s the 50% retracement of the entire decline on a closing basis from January high to June low; that’s important because since 1950 we have never seen a market that, has gone down 20% or more, reclaim 50% of that decline & then gone to make new cycle lows … a close of 4,231 … just give you a frame of reference that suggests may be June lows were the cycle lows & you want to get more constructive on pullbacks … over say next 3-6 weeks … “

It might be interesting to go back to the signal Mr. Waller gave the markets on Thursday July 14 that the market is “getting ahead of itself” in pricing in a 100 bps rate hike:

Recall also that Larry Williams said “this is it, I like it” to Jim Cramer on Monday that week based on Commercials being long a record number of contracts while speculators being way short. In that week, @Sentimentrader highlighted this graphically and also tweeted on July 14 that “bets on a market meltdown Traders have shoved nearly $10 billion into inverse ETFs, about a double from May“.

Having remembered what Mr. Waller said on July 14, we thought back to THE Signal this year – about QT by Ms. Brainard on April 5:

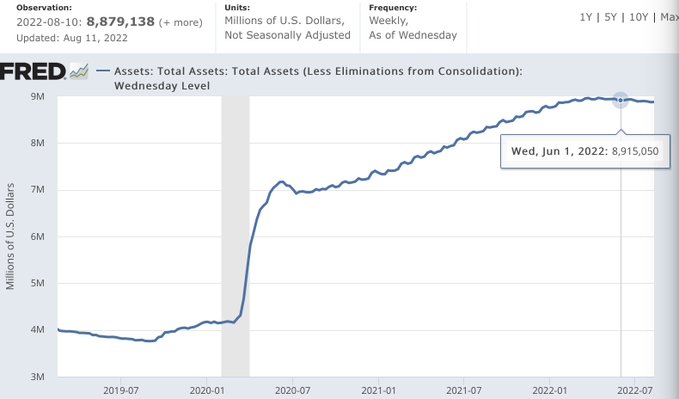

Isn’t it obvious that the two best signals this year came from the Fed? Still think the Fed doesn’t count? What is more interesting is that the signals were verbal without much action following the words! For example, look at the action that has followed Brainard verbal QT fire:

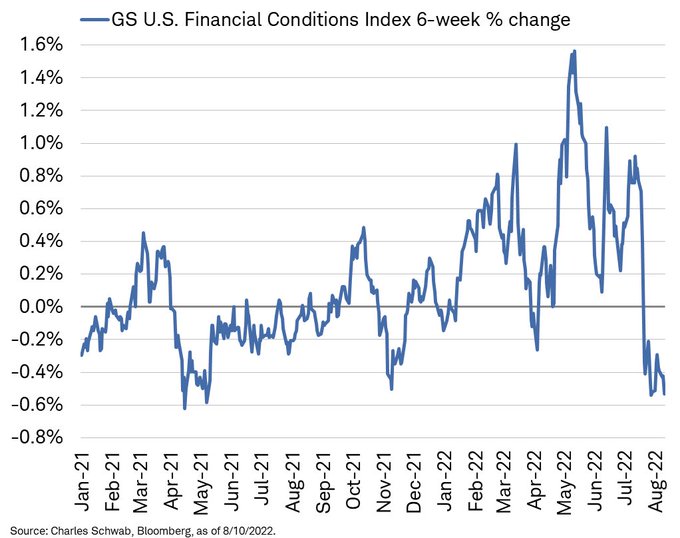

So much for Brainard. What about action following Waller’s signal, you ask? Don’t just ask but look at what has happened since mid July in the chart below:

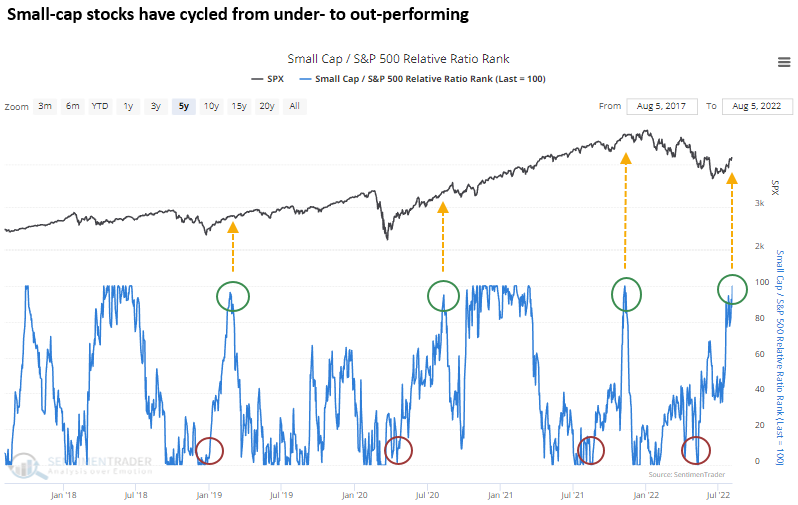

What about a cross asset indicator that might support this financial easing chart? Think back to prior periods after a big Fed-created bear market in stocks – what usually leads in that easing based rallies? Sentimentrader highlighted the triggering of a new buy signal this week on August 9:

- “The Small Cap/S&P 500 Relative Ratio Rank signal triggers when the ratio between them reverses from the bottom of its multi-month range to near the top. … triggered a new buy signal last week “

What happens after such a buy signal is triggered? Sentimentrader writes:

- Large-cap stocks rallied 77% of the time over the next two months after other signals.

- Small-cap stocks rallied 74% of the time over the next month after other signals.

2.”… Fed is not driving this ship … “

Remember week ago Friday when the stronger than expected NFP report brought out hordes of Fed-mouths & FinTV elites to slam Jay Powell & talk about more & more hikes by the Fed. Remember how the 2-10 year curve inverted to all time lows thanks to 2-yr yield rocketing up 36 bps the week ending August 5 while the 30-yr yield only rose by 4 bps.

So concern about this week’s CPI report were nearly frenzied. Look what happened to long rates vs. short rates post Wednesday morning’s CPI release via SHY (1-3 yr ETF) vs, TLT (20-yr + ETF):

What gives? The “softer” CPI was not actually soft but just a tad softer than feared. Was it positioning once again? The entire FinTV universe was buzzing about the hitherto unseen level of curve inversion. So the positioning of curve inversion trades had to be mega, right? Did the soft CPI create at least a fast walk to the exit of this trade, if not a run?

That is what it looks like. The action post Wednesday in TLT/EDV/ZROZ was indeed a fast walk to the exit with the 30-yr yield up 3 bps on Wednesday, up 14 bps on Thursday and up 4.5 bps on Friday.

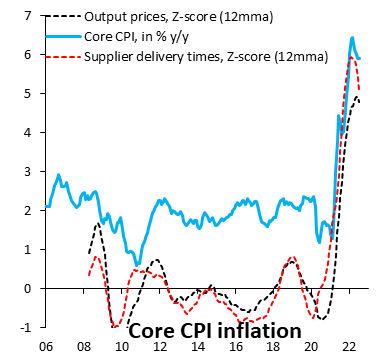

- Robin Brooks@RobinBrooksIIF – We think the dovish Fed “pivot” is real and will keep building. The reason is inflation, where the underlying drivers of the inflation surge in 2021 are shifting. Output prices – the prices firms charge consumers – are topping out (black) & delivery times are shortening (red)…

What if the curve inversion actually flattens more & more? Historically the signal from a first yield inversion & then a yield flattening means the Fed is about to ease pushing down 2-5 year rates & taking off the recession risk pressure that led to long rates falling.

The funny part of this is that the Fed words have very little to do with it going forward. The Fed will indeed become more data dependent. This fact was highlighted by Jim Paulsen of Leuthold Group who said “I don’t care what the Fed is going to do; the Fed is not driving this ship“. (hmmm, does one drive a ship or steer it?) Paulsen sees an easing cycle ahead & that makes him stay bullish.

That brings us to the upcoming release of Fed minutes, minutes of the “now neutral” FOMC meeting. What will these minutes say next week? That brings to mind a clip from the one of the finest TV serials ever, the clip titled A Clear Conscience. In that Humphrey, the UK Cabinet Secretary, educates the PM’s secretary, as below:

- ” .. choose, from a jumble of ill-digested ideas, a version which represents the Prime Minister’s views as he would, on reflection, have liked them to emerge … the purpose of minutes is not to record events; it is to protect people; … you try to improve what has been said … ”

Lucky for Chairman Powell that what he said in his presser can now be officially recorded as FOMC intent, given the fall in the CPI this week.

3. Europe & Commodities

As the tweet below shows, the easing in financial conditions is US-specific & does not apply to Europe.

How does this not lead to “demand destruction” for oil? In fact, Cramer’s technipal Carley Garner told him on Wednesday August 10 that “OPEC doesn’t believe oil can sustain $100 oil in this global economy” and that “oil rally was due to sanctions“. She also points out that US Rig count has finally begun to go up. So in her view, “if oil breaks $90, it can go to $60“.

But she points out that, because of positioning (large speculators have already unloaded 50% of their net long positions) and due to seasonal patterns, “oil has multiple support levels which could trigger a sizable bounce … a bounce into $97-$102 … but this is a bounce to SELL ” . Watch this clip.

By the way, Ms. Garner also said that the 10-year Treasury yield can go to 2% or lower, a view Jeff Gundlach has already mentioned based on the copper-gold ratio.

That brings us back to our inner worry about the current situation being analogous to 2008. That was driven by Bernanke Fed being more hawkish than was wise leading to a slide in the economy that they could not arrest despite lowering rates. This time, we fear, Europe might lead US economy into a downturn. We also recall the strong risk rallies before the final capitulation.

This week, Tom McClellan came forth with a similar concern in his August 10 article titled Sentiment Rebounding Too Much. We urge all to read this article. A couple of excerpts are below:

- “This zoomed-in look allows us to see that the blue line for the Bull-Bear Spread is up well above the detrended SP500 plot. In other words, sentiment has rebounded more than what the price bounce would suggest is merited. … We saw an example of that latter principle back in early 2009“:

- Analysts as a group thought that October 2008 was the washout low, and they started getting optimistic too early. In their defense, it was really ugly in September and October 2008, with Lehman Brothers going down. That arguably should have been enough to put in a bear market bottom. But then after a failing bounce, stocks rolled over and headed down to an even lower price low in March 2009. The Investors Intelligence Bull-Bear Spread got all the way back to a positive spread in January 2009, which was more optimism than was supported by the magnitude of what prices were doing, and that excessive optimism had to get unwound into the March 2009 final price low. So a similar scenario could very well unfold this time.

Would that be the 3,000-3,250 low that some are arguing? Tom McClellan does not give any price targets, only a sensible warning.

4. India’s 75th Independence Day

Monday August 15 is the 75th Independence Day of today’s India. In that context, allow us to talk about the Indian stock market & one of our favorite Buffet-type stocks. The Indian stock market is actually less down ytd than the S&P as of this week, despite the 7%-8% fall in the Indian Rupee. In fact, the Indian stock market has NOT fallen below the S&P performance this year even during the fear of the Rupee breaking above 80.

But what about going forward? This week Deutsche Bank came out with a recommendation titled Indian macros are firing on all cylinders:

- “Indian macros are firing on all cylinders,” Mayank Khemka, chief investment officer for India at the bank, said in an interview, pointing to economic data ranging from power and fuel demand to auto sales. “When all of this is happening, it has to reflect in corporate performance. From here, the expectations of market returns should be in line with earnings growth, which is likely to be in double digits.”

Our approach to the Indian market has been kind of Buffet-like by focusing on a few stocks that have secular long term earnings growth like ICICI Bank (IBN). Higher consumer income & resultant loan growth is one of our secular themes. IBN’s latest results showed a beat in loan growth, especially home loans. Below are a few charts of IBN vs. the best US financial – Goldman Sachs. These charts look even better for IBN when compared with JPM. And IBN has outperformed even on long stretches when S&P handily beat out the Indian stock market (MSCI basis):

And since the turn of the century:

The above is not a stock recommendation in any way. We do not follow IBN or any other stock either formally or informally. That is why our approach is Buffet-like long term based on secular themes of population growth & income growth.

We end this by inserting a clip of one of our most cherished shlok, a universal invocation for an earth & universe that is ideally full of contented peace & tranquility (Shaanti):

The first verse says:

- “Om, lead me from un-Truth to Truth; lead me from Darkness to Light; lead me from Death to Immortality; Shaanti, Shaanti, Shaanti.”

The second is about Svasti, a state of universal good & well being:

- “Om, Let everyone be happy; Let everyone be without illness (of physical & spirit); let everyone see only the good & noble; Let no one feel feel/experience any grief.”

The third verse projects this Shaanti on the entire universe:

- “Om, May there be Shaanti in Heaven, May there be Shaanti in the atmosphere; May there be Shaanti on Earth, May there be Shaanti in Water, May there be Shaanti in Plants/produce, May there be Shaanti in all creations of God; May there be Shannti in Brahman; May there be Shaanti in All, May there be Shaanti in Shaanti; May this Shaanti grow within me; Om, Shaanti, Shaanti, Shaanti!”

The 4th verse is an exhortation:

- Wherever you live, make it free of fear; in all directions make people & animals free of fear

This was chosen as the opening Shaanti-Mantra of the serial Chanakya – a portrait of the statecraft of Vishnu-Gupt Chanakya, the Acharya of Taksha-Shila University, then the greatest university in the world.

Chanakya organized a student movement to rally the entire north-west to fight against the invasion by Alexander of Macedonia. After the destruction of Alexander’s army, Chanakya took his movement into north-eastern India & toppled the King of Magadh, the huge kingdom. His student Chandra-Gupt founded the great Maurya Empire & began a 1,000 year march towards India becoming the strongest Power with 33% share of Global GDP (per world bank documents) in 900 CE.

Prime Minister Modi is an avid student of Chanakya and his amazing text Artha-Shaastra (Politico-Economic Statecraft). And this serial is a fantastic portrayal of that period and a great story.

The decisive battle was between Chandra-Gupt and Seleicus Nicator, the successor of Alexander & founder of the Selueicid empire in today’s middle east. Chandra-Gupt won decisively and, in the manner of that period, his daughter was given in marriage to Chandra-Gupt and all provinces in greater India were ceded to Chandra-Gupt, that include today’s Afghanistan & eastern Iranian provinces.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on Twitter