Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”holiday gift“; “fattest pitch in markets” & “yeah it is” ….

- “ … on the election, it was significant; the House controls spending; having a small majority makes the Speaker subject to the Freedom Caucus which is not going to spend money even in the event of a recession so with a recession possibility next summer, the Fed is operating on a high wire without a net; they own the economy now; there will be no fiscal backstop; the other thing to consider is, since the yield curve is indicative of a recession starting in summer of 2023, then you are looking at peak unemployment on average 14-15 months after the start of a recession; that’s in all 12 recessions since WWII on average; ,,, if that’s the case, you will have peak unemployment in 2024 election which guarantees a left or right wing populist campaign & outcome; and populism is always a threat to Central Banks – So I think it would be malpractice if the Fed doesn’t consider last night very tough on them because it puts all the pressure on the Fed … “

- “risk-free rate being high at this point & we do think that market yields … will be peaking over the next few months … we are extending duration & recommending a barbell … “.

- David Rosenberg@EconguyRosie – Nov 10 – Biggest downside miss on the core CPI since Apr ’20. Ex-shelter/food/energy declined by 0.1%, the first dip since May ’20. That is a 1-in-40 event & never happened in the ’70s. Services ex-rent came in at -0.1% MoM & core goods (ex-food/energy) fell 0.4% after a flat September.

- 30-yr yield down 26.9 bps; 20-yr yield down 28.8 bps; 10-yr yield down 32.2 bps; 7-yr yield down 33.2 bps; 5-yr yield down 34.2 bps; 3-yr yield down 34.7 bps; 2-yr yield down 29.8 bps; 1-yr down 13.7 bps; TLT up 3.85%;

How prosaic is that? In contrast, look how Emily Roland of John Hancock translated the CPI into a gift idea for the Holidays on Bloomberg Open on Friday:

- “Market reaction to the CPI report yesterday was a massive wave of short-covering; it wasn’t entirely unexpected to see inflation pressures moderate; we have been expecting that and, by the way, if you thought yesterday’s CPI report was soft, just wait until the housing market begin to catch up; … the shelter component of the report yesterday was responsible for nearly half the month/month gain; the mortgage rates now about 7%, we are absolutely going to see a precipitous decline in home prices from here & inflation is going to fall further… what investors are missing here is that CPI always declines into a recession because demand is slowing; and markets are simply not priced for that scenario …. holidays are coming up & what I suggest you buy are Bonds – income on high quality bonds at 5-6% – haven’t seen such yields in 10 years – we like the income; leading indicators are negative for 3 consecutive months; yield curve is the most inverted since 1981 telling us something is wrong with Fed policy here … we expect to see big earnings decline; a normal earnings recession is about 20%+ going into a recession & we haven’t started to see that yet … so income on higher quality bonds is the best holiday gift you can give your friends & family … “

- ” … CPI release was the event … we have been waiting to finally get this rally in bonds that we have been talking about seems like for months…. election which is enough to block crazy fiscal next year & the CPI which really confirmed that inflation has peaked & can come down pretty quickly … so all that leads up to what we think was the fattest pitch in the market which was going long duration growth assets that is tied directly to the move in rates – that’s basically our call to a “T” ….. ”

- ” … there is not a single inflation leading indicator that is NOT measurably off its highs – housing, labor markets; that’s going to continue to move in our direction in 2023; that’s going to take a lot of pressure off the Fed; the question is how quickly we get those rate cuts … next year is going to be very different than this year … a much better environment for big tech – dominant market share, big margins, strong cash flows, corporate balance sheets, valuation that has already come down a long way …. ”

- “we think right now they (nasdaq techs mega) look extremely attractive relative to cyclicals; so what’s happened is you have this massive rotation, really quick in the last week, out of META, GOOGL, Amazon into industrials, energy, financials ; we think that is extended far too much and if you look at 2023, the big concern now, especially with rates at 5%, is that the likelihood now of recession is going up based on where rates are; so we are going into recession — do you want to own levered companies that are cyclical at high valuation or do you want to own these mega cap names that are now beaten down; valuations are very attractive; they are cheaper than industrials right now with great balance sheets & business models that have much more secular growth that should do much better in a recession and you are getting these right now at these extreme levels; so at a minimum, for a short term trade, we think there is big reversion to come in the coming days or weeks ….”

- “that market went up 6-7% tells you that people were just out of position – so probably further to go, I would say through Thanksgiving, may be even into early December … 4,000-4,150 was the range we targeted on the S&P 500; – Dow Jones, Small Cap Index have already exceeded their 200-day averages, substantially in case of the Dow; so as Nasdaq gets toward its 200-day, we could actually see the S&P go thru its 200-day to the upside …. once we get thru the 200-day that will probably get the animal spirits going even more; that will draw in more passive flows that track that type of data & we could see an overshoot; I wouldn’t rule out 4200-4300; —– this is a trading call; it could be profitable if right; but it is still a bear market & it can rip you apart … “

In stark contrast to the “it is still a bear market” opinion of Wilson, Ben Laidler responded thus to Tom Keene asking him “is this like Christmas Eve 2018?“

- Yeah, it is! I do think the bottom is in for a lot of reasons – earnings are hanging in there; sentiment is very poor; valuations are low; now critically the inflation fever is beginning to break – that’s not enough to get us on to the next bull market, but its absolutely enough to tell us that the bottom is in – this is absolutely the necessary first step; & we learnt a lot of things yesterday – you got to be in it to win it ….. we are going into the end of the year, historically the best seasonality of the year …. after such a historically bad year in all asset classes, so much cash on the sidelines – I am looking forward to a less bad 2023; I think those are the ingredients for Christmas continuing to come early – this is a market where you want be invested but you want to be reasonably defensive as we get validation that inflation just continues to come down; we get to the top of the Fed cycle & look forward to cuts in late 2023… next year is going to be very different than this year … earnings are going to come under pressure & you are going to get valuation relief; that’s a much better environment … “

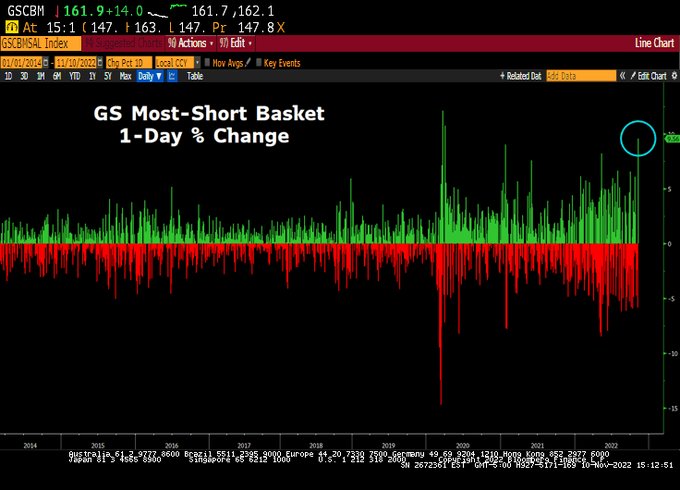

How intense was the short-covering this week?

What if the stock market does what it did after the above short covering extremes on March 24 & April 4 2020?

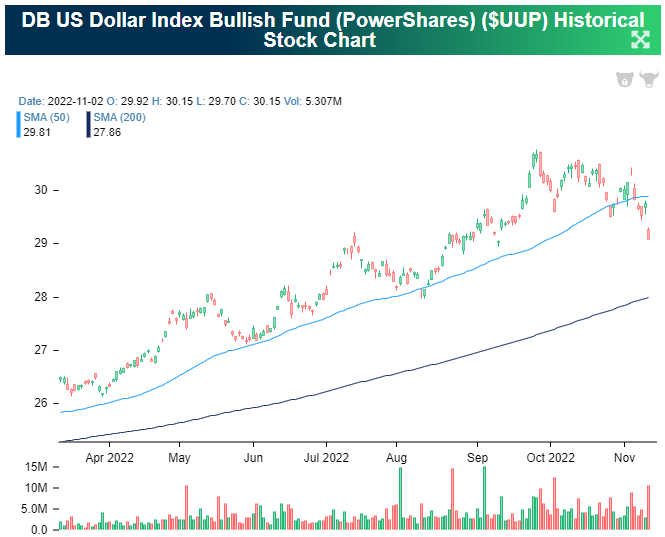

2. Dollar – the mega factor

This would spell relief for the entire financial world if it sticks. Look what it has done already to Gold & Gold stocks not to mention Silver stocks.

- Lawrence McDonald@Convertbond – – How crowded is U.S dollar positioning? Outstanding #forex data from @jnordvig – the DXY BBDXY story always has a number of engines – a) central bank policy path b) global economic backdrop – rarely in the history of capital markets have we seen this kind of overdosing.

If this Dollar overcrowding starts coming down in a secular manner, then we may indeed get a decade of EM outperforming US markets.

3. The Event

Mike Wilson actually spoke of 4 events in the past two weeks – “Fed itself, strong NFP, election enough to block crazy fiscal next year and then the CPI“-, before saying “CPI release was the event“.

We, in contrast, are simple folks with simple minds. We don’t need complicated analysis to figure out what the big event was. We know it when we see it. And all of you can see it either in a snap shot at the end of the clip or watch it happen through the 44 seconds it took for Tom Brady to score the touchdown to beat the Rams.

If you doubt it, just listen to Pete Carroll of Seattle Seahawks speak after Brady & Bucs defeated his team in Munich. He said they could not get near Tom Brady all game, they could not stop the rushing attack and they could not stop Tampa Bay for holding the ball in the final drive – all things no one associated with the Bucs all season.

You might not remember this week’s CPI release for very long but many would remember the above 44 seconds for a very long time. It was The Event.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on Twitter