Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.from 200-week to 200-day? Plus RVM?

What seemed to us as being ebullient last week actually proved rational by this week’s end. Look at what this week delivered:

- Dow up 5.7%; SPX up 3.9%; RSP (equal-weighted S&P) up 6.1%; NDX up 2.1%; RUT up 6%; IWC (micro-caps) up 5.7%; DJT up 6.9%; TLT up 3.2%; EDV up 5.5%; 30-yr yield down 10 bps; 10-yr down 21 bps; 5-yr down 16 bps; 2-yr down 6.5 bps; AND Dollar down 1% with VIX down 13%; ..

Recall that Mike Wilson of Morgan Stanley turned positive on rally prospects when S&P bounced up from the 200-week moving average. Now he expects the S&P to possibly rally up to the falling 200-day level (around 4,150 when he spoke & 4113 on Friday). He added that “in terms of time“, it could be around Thanksgiving. His caveat was about “whether it is going to be Black Monday or Red Monday” & that could be “when fundamentals may overtake technicals to the down side“. He added “I want to make it clear that if the market starts to trade off again & if the S&P breaks down & goes below 3,650 we will become bearish again“.

Finally Wilson added a positive “… we like the price action in the last couple of months notwithstanding some negative earnings reports; .. if stocks don’t go down on bad news or market doesn’t on bad fundamentals .. “

That RVM (rear-view-mirror) dictum seems precisely why Dan Niles went longer on Friday than on Wednesday:

- Dan Niles@DanielTNiles – – 5 tech megacaps ($AAPL $AMZN $GOOGL $META $MSFT) that reported are down ~9% on avg this wk (have covered many shorts & buying $AAPL today) & S&P passed this test up ~3% on 1% lower $USD & ~25 bps drop in 10Yr yields. Expect bear mkt rally to continue & less aggressive Fed on 11/2

The “less aggressive Fed on 11/2” is the biggest factor for this coming week, in our opinion.

2.“summer & fall of 2007“?

- David Rosenberg@EconguyRosie – – Complimentary Report — Breakfast with Dave — Central Bank Forex Intervention Is the “Fund Flow” Constraint on Bonds Read today’s report: bit.ly/3SJ3nde Sign up for a free trial: bit.ly/3dbhQj2 #RosenbergResearch

The last line on page 11 of this complimentary report is his comment phrased as a question:

- “Why do I feel that I am reliving the summer and fall of 2007?”

Despite being simple-minded, we do remember the FOMC meeting on October 31, 2007 and its aftermath. Those who don’t should watch the charts below of SPY & TLT from October 31, 2007 to November 30, 2007:

As we recall, the markets were positioned for a benevolent Bernanke ahead of the 10/31/07 FOMC meeting. Bernanke, in reality, proved less benevolent than the market expected. Voila above!

That was the day in 2007, based on our probably faulty recollection, when what was deemed good for the Treasury market became deemed as bad for the stock market. Will this week’s FOMC on November 2, 2022 bring good cheer to both Stocks & Bonds or will, once again as in November 2007, what is good for bonds will not be deemed good for stocks? We will find out in 4 days.

In fact, as we understand, Mike Wilson discussed the current irrationality of both Bonds & Stocks last week, comments that seemed to have been ignored by Fin TV:

- “In many ways, the bond market is as irrational about inflation next year as equity markets are about earnings; … for the same reason – bond markets are addicted to Fed guidance on rates the way equity investors are addicted to company earnings guidance. Eventually both will be exposed as wrong, in our view.. but the timing of that recognition remains to be determined … the bottom line, as we begin the transition from Fire to Ice, falling inflation expectations could lead to a period of falling rates that may be interpreted by the equity market as bullish until the reality of what means for earnings is fully revealed … “

Another bottom line expressed by Wilson was that “the bottom line here is that the bond market is finally offering investors real value that may start to attract capital … “

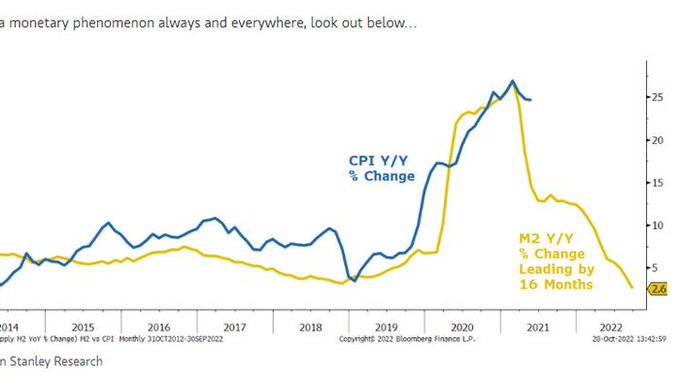

That brings us to the hot-off-the-web twit below:

But will the Fed respond quickly & forcefully to this? That brings us to what Priya Misra said on BTV’s The Open on Wednesday October 26 in response to ferro asking her “How bad is it going to get, Priya?”:

- “I think pretty bad! .. Fed doesn’t have the policy space to respond … real rates are extremely high … you have a Fed that may be downshifting but they are going to keep going .. we already have QT putting tighter financial conditions in an environment where the consumer has largely run through accumulated savings … is making for a slowdown in consumer spending … so we are looking for a pretty deep recession at the end of next year going into 2024 and the Fed can only respond once inflation can get to the 2% level ; … I think the bond market is starting to wake up to it … we are pricing in 120 bps of cuts in 2024 from 5% terminal rate – that is still a very restrictive policy … inflation is still too high, too sticky; Fed is worried about its inflation credibility … they are not going to respond … “

Now do you understand why Rosie wrote about “reliving the summer and fall on 2007″? What Misra said above was also the problem Bernanke had on October 31, 2007. His Fed didn’t want to lead the bond market that had not yet woken up to what 2008 would be. Today, Powell has even less room to downshift as hard & fast as he might need to. So the 2023 FOMC might find itself chasing the economic slowdown just as helplessly as Bernanke FOMC chased the economic slowdown in 2008.

So where on the Treasury curve would Priya Misra focus? As she told BTV’s Ferro:

- “ .. I like owning Treasuries – only question is front-end or long-end … I like owning the long-end .. owning the long-end is where the recession risk if going to be priced in … “

3. Garner & Cramer

The story of this year’s bear market has been the relentless bull market in the U.S. Dollar. That is why it was interesting to hear Jim Cramer relay the case of Dollar weakness ahead from his techni-pal Carley Garner on Monday evening. The case is best understood by watching the clip below but the bottom line is that Ms. Garner sees a divergence in RSI of the Dollar & expects the Dollar to fall first to 105 & then all the way down to 97.

Of course, Chairman Powell might have something to do about the Dollar on Wednesday, November 2.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter