Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”year-end gift to investors“!

Last week Emily Roland of John Hancock described income on bonds as the best holiday gift and this week it was the turn on the equity rally. Anastasia Amoroso of iCapital said the following to CNBC’s Andrew Ross Sorkin on Friday:

- “If we do continue to build on this rally, I would sort of think about it as the year-end gift to investors, one that you probably want to cash in & not hold on to … “

Eric Johnston of Cantor isn’t waiting to cash in until the holidays, not even until next week’s Thanksgiving holiday. He came on CNBC on Thursday November 17 to say buying by CTAs & Hedge Funds is done and this rally is in the 7th/8th/9th inning. He added forward outlook is very poor. He had gone to neutral a few days ago, as we seem to recall.

Kristine Bitterly of Citi Private Wealth said on CNBC Fast Money on Wednesday that the FOMC meeting on December 13 is critical & will determine what follows. She has a definite Overweight on Fixed Income with focus on investment grade bonds/US Govts/Munis/Preferreds and within equities she prefers health -care & staples.

That was the theme of the week. Hardly any one was bullish about the next couple of week. One of the “hardly any” was Options guru Jessica Inskip via Jim Cramer on Tuesday, November 15:

- “The charts, as interpreted by Jessica Inskip, suggest that this rally could potentially have real legs, at least through mid-December. Things could change as we get closer to the next Fed meeting a month from today, but in the meantime, there’s a lot to like about this market,”

More precisely, Cramer said Inskip sees a bullish S&P rally after the end of November expiration (Nov 18) to December 16 expiration. She also thinks things get a lot bearish in January.

On the other hand, as Lawrence McMillan of Option Strategist wrote on Friday:

- “Breadth has struggled this week, and the breadth oscillators have succumbed to sell signals once again. This is the first of our internal indicators to turn bearish, so this could be significant.”

- “$VIX has continued to decline, for the most part, and that is generally positive for the stock market. The “spike peak” trading system exited a profitable trade earlier this week. So, there is no longer a “spike peak” buy signal at work. However, with $VIX and its 20-day Moving Average both being below the 200-day Moving Average, that is a trend of $VIX buy signal.”

- “In summary, the bears are not done, as indicated by the continuing downtrend on the $SPX chart. They have attempted to suppress every rally this week.”

Tom McClellan also warned of the possibility of this rebound failing but did not put a time frame on it:

- “Having the VIX fall while prices are falling, or rise while prices are rising, is not normal, and it is a sign of a weird market. This sign most often appears at price tops, as divergences are forming and momentum is being lost, although there are exceptions.”

- “The stock market in October 2022 attempted another rebound effort, and that price rebound was accompanied by a falling VIX, which is the normal condition. But now the VIX is correlating slightly positively with stocks, which says that the rebound effort is wobbling, and will likely fail.”

2. Recession – profits or economic?

Richard Bernstein and Ellen Zentner of Morgan Stanley both think that the U.S. will avoid a recession next year. But both Bernstein & Mike Wilson of Morgan Stanley are warning of an earnings/profit recession next year.

Yet,

Since a picture is better than words,

- J.C. Parets@allstarcharts – – If you take the lasers out of your eyes, you’ll be able to see the higher lows in growth stocks & lower lows for bitcoin allstarcharts.com/growth-stocks- Growth stocks are showing relative strength compared to #bitcoin and other crypto assets

What gives? One answer is “resilience” & “less degradation” in earnings for some key sectors next year. That is the thesis of Citi Strategist Scott Crohnert who has an over-weight on tech for 2023:

- “our expectation in that we will find tech’s inherent growth will prove somewhat defensive as the year unfolds; … the tradeoff we are looking for is more resilient earnings as we go thru the recession circumstance at the same time as we get to a point of lesser Fed overhang on valuation we think tech is poised for a revaluation higher … financials with a higher interest rate backdrop are poised to show more resilient earnings growth … “

Interestingly, Mike Wilson with a steep fall in earnings view & Scott Crohnert with a more resilience in earnings view both have the same 3,900 target for year-end 2023.

3. Tech & EM

Jonathan Garner of Morgan Stanley said this week that

- “the U.S. Dollar has made a major peak & now an up cycle in Semiconductors and Technology Hardware is poised to begin; that is why we upgraded Korea & Taiwan; both these markets are outperforming very strongly in the last two weeks … ”

As a result, both Korea & Taiwan are cheap, especially in comparison to the Indian stock market which is “by far the most expensive market in our coverage“, Garner said on CNBC TV 18 India. But he spoke differently about one sector in India:

- “ … that links to household formation underlying earnings growth dynamics for a young population; Indian financials are clearly differently positioned than, for example, Korea, Taiwan or China financials where you don’t have such positive tailwinds … “

India has been identified differently in different time periods, the most recent being a technology-focused country. We think the next identification will be as a country of financials – banks, brokers & insurance.

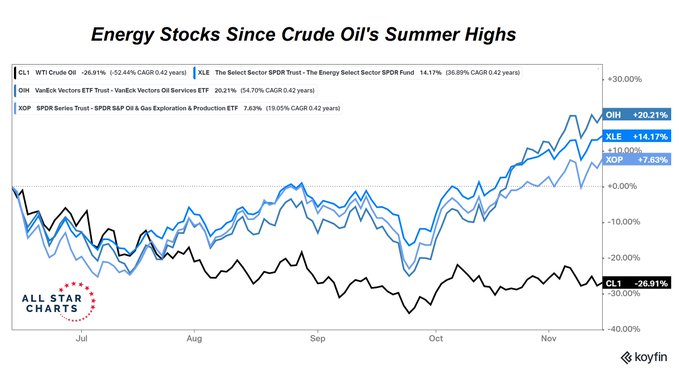

4. Energy

Energy has had a bad week but not so much for energy stocks. Does that make energy stocks a buy or a sell?

On the other hand,

Energy ending the week under pressure:@CarterBWorth charts the sector.@Michael_Khouw sets up a trade on $OXY.

And @dennisdavitt gives his stamp of approval pic.twitter.com/IcTieSIHwd— Options Action (@OptionsAction) November 18, 2022

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on Twitter