Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”classic canaries in the coal mine“

This week demonstrates why we always think of one name when the year 2007 is mentioned. Look what Larry McDonald told Maria Bartiromo on Fox Business on Tuesday, March 8, two days before the SVB mess hit TV:

- “,,, our 21 Lehman Systemic Risk Indicators are pointing to one of the highest probabilities of a crash in 60 days …“

Then he added:

- “… look at the underperformance of regional banks; they are your classic canaries in the coal mine; they have underperformed the S&P by 6%-7%-8% in the last few months; regional banks are telling you something really bad is happening under the surface – real estate, auto loans … – massive cracks under the surface & that’s why the market is probably goes down 10%, 20%, 30% in the next 60 days … “

The next day SVB, Silicon Valley Bank, fell 60% & it was shut down by regulators a day later on Friday May 10.

2. “playing with Frankenstein“

Now that he was proven prescient, Larry McDonald was invited on CNBC Squawk Box and he again provided critical inputs to Becky Quick:

- “… this is like the S&L crisis (Savings & Loan crisis) in the 1980s; Fed needs to get inflation down … so they are playing with Frankenstein … they don’t really know what could happen but they need to get inflation down .. they are doing that & now we are having a run on some of these banks … its going up the curve … Charles Schwab was off 10% yesterday .. in our careers you might see that once or twice in a day … so this is definitely a contagion process … I think the Fed is now probably end up cutting rates by 100 bps by December … “

- “… our 21 Lehman Systemic Risk Indicators are at their highest levels since Lehman & COVID right now … they are exploding higher; so now, within the next couple of months, as the contagion brews up the channel up to high yield, leveraged loans across the entire ecosystem; that’s when the Fed will have to bring about the fire hose & cut rates probably within 6-9 months … ”

We had just entered the financial business as the S&L crisis exploded. So the analogy fits in our opinion. It took a couple of years for that crisis to finally wind down. The rest of the markets went along their merry way after January 15, 1991. We also recall that in October 1990, the entire Treasury yield curve was just above 9%. As the Fed began lowering rates, the 3-month Treasury bill finally touched its low of 3% at the end of 1993, the year the mega guys made a billion dollars each in long maturity Treasuries.

In fact, our first big trade was asking a major client to buy a large position in 25-year Treasury zero coupon strips yielding 9+% in October 1990 when his natural inclination was to buy the 1-year Treasury (also yielding 9+%). This has remained with us & also proved quite profitable from October 2007 to December 2008. This is why we wrote two weeks ago that

- “you really don’t want to be anywhere near the smell of Rosie Rosenberg being proved bigly right again unless you own lots & lots of ZROZ“

Speaking of the Un-Rosie:

- David Rosenberg@EconguyRosie – Mar 10 – Talk about how SVB is a one-off reminds me of all those shoulders that shrugged in ‘07 when New Century Financial shuttered. 2 months later Bernanke said it would be “contained”. 4 months after that, it was Countrywide. It’s as if the word contagion doesn’t exist for some people.

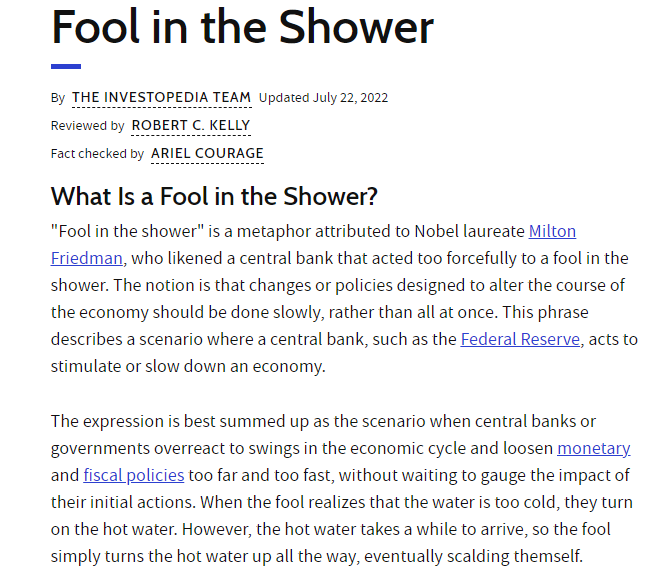

3. “Fool in the Shower”

Think about what Chairman Powell said in his January FOMC presser! He used the “disinflation” term a few times & he got hot, strong payrolls number 2 days latter & a hot inflation number the following week. The 2-year Treasury proceeded to rocket up by 80 bps in February 2023.

So was it natural for him to come across as sternly hawkish on this past Tuesday only to be stunned two days later by the SVB “Frankenstein” his policies & words had created. And this time,

- Jeffrey Gundlach@TruthGundlach – – Don’t look now, but the 2 year Treasury is down almost 50 bp in two days. Last two times this happened: 2001 and 2008.

You just have to feel bad for our esteemed monetary leader, right? Wrong, said some pointing to a real monetary legend:

- Eric Basmajian@EPBResearch – – One week ago, people said, “monetary policy isn’t working,” and the Fed should do more. But the recession has already been set. Textbook Fool In The Shower. These “events” aren’t random. No one believes anything until the market tells them.

How did David Rosenberg describe it way back on March 1?’

- “In any event, it looks to me that everyone has taken leave of their senses ever since that payroll report at the beginning of the month (January also did line up as the top 5% warmest of all time, a 1.5 standard deviation event, so I imagine that influenced all the data, as in the unprecedented plunge in utility output). A ripping +517k surge that was not corroborated by the ADP number (+106k) and ADP has a much larger sample size (460,000 establishments versus 122,000), adjusted for the new population count, the Household survey showed a tepid +82k.“

And how did he describe the Fed?

- “This Fed continues to believe it has to fight for its perceived loss of credibility this cycle. It has two fears. One is the memory of Arthur Burns in the 1970s and even Paul Volcker in 1980, which is ending the tightening cycle prematurely. Second, the Fed is consumed with financial conditions, which is a critical input to its macro forecast.”

The second condition of Rosie is what Larry McDonald called “playing with frankenstein” in the clip in Section 2 above.

4. 1st Impact

So far in 2023, the corrections in the Stock Market were from a positive fear of sorts – fear of a stronger than expected economy (a positive result) that might lead to higher interest rates. This was the first week we saw a negative fear – fear of something wrong with the underlying economy that led to a waterfall like decline in rates that mainly happens in bad times. As Gundlach tweeted, the “2 year Treasury is down almost 50 bp in two days.”

But for the week as a whole, the action was more subdued:

- 30-yr yld down 19.2 bps; 20-yr yld down 21.4 bps; 10-yr yld down 26.9 bps; 7-yr yld down 28.8 bps; 5-yr yld down 29.5 bps; 3-yr down 28.7 bps; 2-yr down 27.9 bps; 1-yr down 15 bps;

And Treasury ETFs outperformed their high yield ETFs by lot:

- ZROZ up 4.5%; EDV up 4.7%; TLT up 3.5% ; HYG down 1.8%; JNK down 1.8%

Lower Treasury rates didn’t help the stock markets:

- Dow down 4.4%; SPX down 4.5%; NDX down 3.8%; RUT down 8%; IWC down 8.9%; DJT down 6%; EEM down 4%; FXI down 7.8%; KWEB down 11.1%; EWY down 4.3%; EWZ down 84 bps; Indian ETFs down 1.5%-2.8%;

U.S. Dollar fell on Thursday & Friday but was smallish up on the week. But that didn’t help metals and it hurt commodity stocks badly:

- Gold up 65 bps; GDX down 4.3%; GDXJ down 6.3%; Silver down 3.5%; SLV down 3.5%; Copper down 1.7%; CLF down 14.5%; FCX down 13.3%; Oil down 4.1%; Brent down 3.8%; Nat Gas down 19%; OIH down 10.7%; XLE down 5.5%; MOS down 13.5%; UNG down 19.3%;

The most stunning fall for us was Charles Schwab down 24.2% on the week, down much more than Coinbase down 17%. And the least fallen were Semiconductors with SMH down 2.5% only.

5. 2nd Impact

Politically this could be a disaster for President Biden & the Democrat party. One way to think about this is:

- Vivek Ramaswamy@VivekGRamaswamy – – No bailouts. Right answer: govt should get out of the way & let another bank acquire SVB on the cheap. If taxpayers bail out a bunch of tech startups who failed to manage risk, that’ll trigger an “Occupy Silicon Valley” of historic proportions – and rightly so.

His politically astute line is “… there was no bailout for East Palestine” referring to people of Ohio whose lives were literally uprooted by the accident. Interesting how Fin TV anchors who often wax proud on air about being from Cincinnati have not expressed any sympathy for the mainly lower income Ohioans who were devastated by that horrific accident.

So the big guys did what they had to do. They declared that no depositor will ever lose any money ever in any American bank. This is MEGA. It instantly makes every single bank in America SAFE, safer than U.S. Treasuries, for every single American regardless of how poor or rich they are.

In short, NO LEHMAN ever for a bank depositor.

A question? – Does that apply to all the monies that come to America from overseas regardless of the Citizenship of the depositor? If so, did a massive sucking machine just get created for any cash lying around in unsafe banking systems around the world?

2nd question? Does this lead to a systematic acquisition of poor balance sheet banks by larger banks? No. They don’t have to buy the bank, only the deposits at the bank with balance sheet risk. Conversely, do smaller banks start raiding JPMorgan & other big banks by offering higher interest rates for deposits? Why would the rich now avoid these small banks because their cash deposits are NOW as protected at a neighborhood savings bank as they have been at JPMorgan Chase.

6. Bear Stearns like Market Impact?

In addition to the S&L crisis, we wonder if this SVB crisis just became another Bear Stearns crisis of May 2008. Remember that the Bondholders of Bear Stearns were bailed out in full. Then remember how Pimco’s Bill Gross & El-Erian then went around recommending bonds of investment banks to clients.

We could be in another one of these rallies. Witness the tweet below dated Saturday:

- Bob Lang@aztecs99 – Mar 11 – with the elevated volatility and extreme oversold oscillator readings, we could see a whopper of a gap higher soon.

Despite this solution to SVB & Signature Bank, the Fed is unlikely to light a fire under Treasury rates at least until the May meeting. So the Dollar is down, interest rates could be stable to down & stocks are probably oversold or might get oversold fast. Would that create a “whopper of a gap higher“? We have no clue of course but it might be sensible to look at taking the other side of any decline this week! At least for a rally!

Notice that even Ed Hyman is saying this weekend that the Fed should pause their rate hike campaign. That raises a question – Does the Fed HAVE to announce they have suspended their QT? And would the Fed have to announce they are beginning a new QE aimed at longer maturity Treasuries? Because what SVB has demonstrated to the Fed, Treasury & their political masters is the need for stable or lower 20-30 year rates!

Just a note however to investors in the “entire ecosystem” of leveraged loans, high yield debt & other such risk assets. These are NOT protected by the new depositor protection plan. In fact, our guess is that the Fed-Treasury-Govt would welcome an opportunity to publicly let “speculators” get wiped out now that they have protected depositors!

Guesses apart, all we really know is that the week ahead could prove very interesting!

7. Touche!

Some might remember that Bill Ackman attacked Adani Group when the Hindenburg report was published. This weekend, the CFO of Adani Group mocked Ackman’s demand of a bailout of SVB:

Send your feedback to [email protected] Or @MacroViewpoints on Twitter