Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we clude important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.From Multiple Expansion to Earnings?

Carter Worth, the resident CNBC FM technician, said the following at the beginning of his remarks on the Friday evening show:

- “It has been all multiple expansion, right! .. to begin this year, S&P tech was trading at multiple of 22; now it is 29. SOX index was trading at 16, now it is at 24“

That brings him, Dan Niles & many others to earnings. But before we go to that intersection, allow us to take a small detour via financial instability & its impact on interest rates. The SVB crisis hit on Friday, March 10, as we recall. And, as many might recall, the 2-year Treasury yield fell over 100 bps in the aftermath. The chart of SHY, the 2-5 yr Treasury ETF, does not justice to what happened in the 2-5 yr sector. But it does shed a key light:

Notice SHY peaked on Friday, March 24 and fell what it seems as a bit. But it looks different in yield terms. This past week,

- 1-yr Treasury yield up 33.3 bps; 2-yr Treasury yield up 26.5 bps; 3-yr yield up 22.7 bps; 5-yr yield up 18.2 bps; 7-yr yld up 14.3 bps; 10-yr yld up 10.3 bps; 20-yr yld up 3.5 bps; 30-yr yld up 0.9 bps;

Now look at the chart of JPM vs. the SHY for March & notice JPM bottomed on March 24, the same day SHY topped out:

All this is suggesting that the financial instability panic is now behind us. Will that lead to higher short term rates? We were surprised to hear Bob Michele of JPMorgan Fixed Income Asset Management say they would buyers of 2-year Treasury at around 4.30%. He expects a 50% backup from the rally that occurred in March.

When the SVB crisis hit & when the authorities jumped in over the weekend of March 10, we wondered whether we were seeing a parallel to the Bear Stearns- JPMorgan shotgun marriage on March 16, 2008. That recollection also made us wonder whether we would see a “stability again” rally in 2023 as we saw in 2008. Interestingly, Bob Michele brought that parallel up on Friday, March 31 in his detailed interview on Bloomberg Open:

- ” … next quarter we could see risk assets rally; … looking at that seminal moment when Bear Stearns & JPMorgan combined under regulatory supervision … the next quarter was great for markets; equities went up 15-20%; high yield credit spreads retraced a quarter … you could have a feel-good period … “

Look at the chart below from January 2008 to March 2009:

The rally Mr. Michele spoke of was from mid-March 2008 to mid-May 2008. He ignored, it seems, the correction in that rally from first week of April 2008 into mid-April.

Friday was so joyous with both core PCE coming in softish with personal income highish that no one spoke of next week’s employment data. What if that comes in strong & the PMIs also are ok with inflation numbers not as un-weak as markets expect? Will the rates market bounce higher in yields & will the stocks suffer a correction? We will wait & see.

But Dan Niles of Satori Funds, the man with the hot hand, is not waiting. He has already raised the shorts in his portfolio up to 25% from near zero (he went from 55% short to near zero shorts on March 13). And his shorts target the banks; specifically bank earnings as he said on CNBC on Friday, March 31:

- “.. rally up to 4100 or until earnings start to get repriced; JPM reports on April 14; earnings will have to be cut anywhere between 10%-20% on banking ps because deposit rates going up a lot which squeezes their net interest income margins … ; its not in the numbers yet despite the desperate belief it is … we are now about 25% short; will get up to 55%; … we are targeting the banks; that’s where we have started adding back the majority of our shorts; .. earnings are going to matter & people are going to start to preview those; bank stocks haven’t necessarily discounted the earnings cuts that are potentially coming; …

- “Re IT spending – Financial services are 2nd highest with $4.4T , about 11-12%; these banks are not focused on spending money; they are focused on surviving & so with a lot of these tech companies in enterprise, you are going to have an issue with earnings … Auto delinquencies are at their highest level since 2006; credit card delinquencies are starting to rise; seeing high pressure on consumer & he is going to run out of the excess savings; … the back half of this year is going to be problematic from earnings standpoint …”

Dan Niles also referred to another period in 2008-2009 to emphasize his point that “earnings do matter“:

- ” … remember we have lived through the false rally narrative back in 08 & 09; the S&P rallied 24% in 6 weeks until Jan 6, 2009; everybody said worst was behind us with TARP … ; in the next 2 months, the S&P went down 28%; … so earnings do matter”

Dan Niles has a terrific record as well a hot hand currently. Who are we to argue with him? But we wonder whether a rally after a banking shock like we just experienced is so easily given up just on bank earnings! Rallies, we think, happen on belief & would it be so unreasonable to believe that bad bank earnings this quarter might be more of a fundamental low rather than a beginning of a steep fall, a la Micron earnings? Especially if the rate of economic growth does slow down a bit? And doesn’t a stock market decline early in an earnings period sometimes gets reversed as more earnings come in ok? That would be like the rally from mid-late April 2008 into late May 2008 (see above chart).

Another factor that might support ok earnings or disbelief in bad earnings is a four letter word – Cash:

- Via The Market Ear – Half a trillion – Investors add $508bn to cash in Q1’23. Last time they did that in same size (bigger actually) was spring of 2020 which lead to the mother of all FOMO rallies.

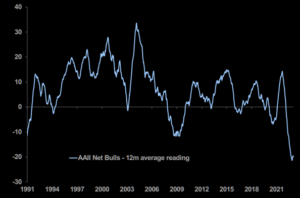

Another 9-letter word in support – Sentiment:

- Via The Market Ear – Never this bearish for that long – Investors have never ever been this bearish for such a long time period.

The point below by Bob Michele might actually support a stock rally in April. If the data in April is actually deemed irrelevant, then the negative earnings data could be ignored and the positive earnings data could be embraced:

- “I actually think the data we are looking at is irrelevant; it is not important; the data that is relevant is the data we are going to see in September… “

Mr. Michele strikes a contrast between the “long & variable” lag in data and what he terms as “cumulative” lag. That, he thinks, will pound away at the economy and that “recession is inevitable” by the end of the year. And

- “central banks are tightening credit ;now the banks will have to tighten credit & bank lenders as well; … reverse multiplier in QT is sucking credit out of the system“

Another interesting point he makes is that the current banking mess reminds him of the S&L crisis of late 1980s & early 1990s. He points out that ultimately the Government had to create the Resolution Trust & the Resolution Funding Trust to address that nationwide problem. He thinks we are going to need something similar to that now where we can re-organize regional & community banks & put them on their own stable footing.

Kudos to Lisa Abramowicz of BTV for getting so much out of Bob Michele. Listen to their entire conversation from minute 27:30 to 33:35 and again from minute 38:55 to 42:43.

That brings us to a rare clip for CNBC. Listen to Jeffrey Gundlach cover a range of issues about the Economy, Banks – US vs. Europe, Treasuries, High Yield & the FED. Kudos to Scott Wapner for building a terrific relationship with Jeffrey Gundlach & a few other must-listen-to guests. It also seems evident that these guests like speaking with him. That probably makes them speak more openly and that goes to benefit simple folks like us.

Especially interesting is Gundlach’s conviction that the powers will choose inflation over other alternatives following a recession in the USA. And if you want an interesting parallel to Fed’s inflation bravado, listen to the last minute of the clip above (minute 20:26 to minute 21:20).

For a different & far scarier view, listen to the clip below of Nouriel Roubini:

- “… we have wage inflation around 6% & people don’t want to go to work because the labor market is tight; that means inflation is not going to fall to 2%; if wage inflation stays around 5-6% with a tighter labor market, then inflation is not going to fall; then the Fed will have to hike rates much more than 5%; and if they don’t do it because they worry about an economic or financial crash, there will be a de-anchoring of inflation expectations & that will end up in high inflation, recession – kind of stagflation that we saw in 1970s”

2. CNBC on Block (SQ) & Adani Enterprises

Hindenburg attacked two different firms this year. More recent was Block (SQ), a CNBC favorite. Its management & strategists have been frequent guests on many CNBC shows & its stock was widely touted as a Buy on CNBC. Now SQ is down 75% from its all-time high and, yet, there has literally been minimal coverage about why SQ was featured in a Hindenburg short.

Contrast this with how CNBC covered the Hindenburg research on Adani Enterprises. If that wasn’t enough, two CNBC Anchors, Seema Modi & Frank Holland (as we recall) went out of their way to ridicule the decline in Adani stocks while covering the decline in SQ with a gentle touch. And it was the same Seema Modi who was the last to report on the pivotal purchase of about $1.8 billion of Adani stocks by a prominent NY-based EM fund. And for being the last FinTV reporter on this story, veteran anchor Carl Quintannia actually rewarded her with “what a scoop?” compliment!!!

In stark contrast, Bloomberg was early in their strident coverage of Adani stocks but they were, via their reporter, Annabelle Droulers, early & right about the purchase of Adani debt by Oaktree, the coverage of the Adani roadshow & the pivotal purchase of Adani shares by the NY-based fund.

The reality is both stocks fell 75% from their highs. But Adani is the only one with major US institutions buying in its bonds & stocks. Also Adani actually owns physical infrastructure assets while SQ seems to be a theoretical fintech concept without any real assets, technology or otherwise. Yet, CNBC reporter Modi & her colleagues laughed at Adani on CNBC air while nursing wounds of SQ.

So we can’t help wondering whether the gentle & forgiving treatment of Block (SQ) & the contemptuous reference to Adani has some deeper cause within CNBC, the Fin TV network with the longest track record of on-air anti-Hindu contempt!

By the way, Bloomberg reported on April 1, 2023 that Adani Ports (of the Adani Group) completed the acquisition of the Kariakal Port. Where is this port & why might be significant?

As Mint (a Wall Street Journal related company) reported:

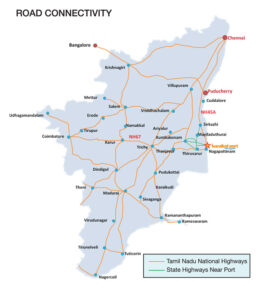

- Karaikal Port is a sizable all-weather deep-water port located in Puducherry, India, with five functional berths, three railway sidings, over 600 hectares of land, and an existing cargo handling capacity of 21.5 million metric tonnes. As the only major port located between Chennai and Tuticorin, the port benefits from its strategic location, providing easy access to the industrial-rich hinterland of Central Tamil Nadu.

The CEO of Adani Ports said:

- “We are envisaging to double the port capacity in the next five years and also add a container terminal to make it a multipurpose port… “

Why do we like this acquisition? A simple map might help:

Karaikal is the southern most dot shown in the above map located just above the northern tip of Sri Lanka. That makes the new Adani-owned port the closest port in mainland India to the Indian Andaman-Nicobar island chain located at the entrance of the Malacca Straits. As Indo-Pacific trade grows, as supply chains recede from China, Karaikal is likely to benefit.

And Karaikal has the largest road network of any port in the state, a hallmark of Adani Ports:

Bloomberg also reported that last week, Adani management met with US investors including PIMCO & BlackRock re their plan for a private placement of bonds.

We found the above by simply searching for “Adani” on Bloomberg.com. What did the corresponding “Adani” search reveal on CNBC.com? Look for yourselves & wonder why on earth would any one refer to CNBC as “first in business worldwide“?

3.Indo-Chinese Thrills

It has been awhile since we wrote about Indian-Chinese cuisine – Chinese cuisine with Indian spices. Before the 1962 war Indo-China war, there was a thriving Chinese community living in Bengal. That was the origin of Indian-Chinese cuisine. Guess what?

Bloomberg reported on March 31 that Nestle SA, the world’s biggest food company, is in talks with a $1 billion deal to buy India’s Capital Foods, the owner of “Ching’s Secret” noodles. Personally speaking, these are not our first choice in quick food but, after days of Lean Cuisine & Healthy Choice entrees, these noodles break the boredom. More importantly, they are convenient to make & that also makes them popular in India.

As a simple tip, the prices on Amazon are about 2X more expensive than Asian-American vendors (who also provide 2-day delivery like Amazon Fresh). And, yes, CNBC has not heard of this deal yet or, being Indian, they feel it is beneath their “first” brand.

If Nestle likes Indo-Chinese, how can us simple folks resist inserting a classic Indo-Chinese song (from 1958 with English subtitles)? Dan Niles, Bob Michele & Jeffrey Gundlach might offer great insights, but can they deliver audio-visual entertainment like the clip below?

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on Twitter