Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we clude important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. “plus ça change, plus c’est la même chose”?

The TFI test, conducted by the Educational Testing Service, “is a French-language proficiency test that measures the everyday French skills of people whose native language is not French. It is for language learners of all levels, regardless of their background”. Talk about a promise vs. reality!

Most may not know it but Mathematics would not be where it is today without the contribution of French Mathematicians. Even today’s Las Vegas would not be the same without the development of Probability by Laplace & Fermat (at the urging of the gambling houses in Monaco). So we were compelled to demonstrate knowledge of French in our graduate studies in Mathematics. The most convenient way was to pass the Test of French as Foreign language from ETS.

ETS might not want to use us in their marketing though we scored 99+ percentile in the French language test. The reality is that we don’t even know a Squatola of French, let alone Squat. But, with our under-graduate studies in Mumbai, we knew the tricks of identifying what the test-creators test for & delivering it to earn great exam scores.

So while we believe we know what the above French title means, we thought we might use an English language source to explain the meaning.

“The more things change the more they stay the same

Ah, is it just me or does anybody see

The new improved tomorrow isn’t what it used to be

It’s the same old story but it’s told a different way“

The message “its the same old story but its told a different way” was broadcast this past week by some really smart folks who see it and rejected by so many others who don’t.

Look what Oksana Aronov, JPMorgan Asset Management head of market strategy and alternative fixed income, said to CNBC’s Melissa Lee on Friday morning:

- (min 3:12) – “I think we are staring at a very extended period of higher rates than we saw in the past decade & we are going to live in volatility levels that characterize pre-GFC world which is where we are now; …. the long run Fed Funds rate prior to the GFC was around 5%”

To us simple folks Ms. Aronov is saying clearly that the post-GFC period is gone & relegated to a bad memory while we are now in a pre-GFC type period of high interest rates. And she is saying it to CNBC’s Melissa Lee who champions that type of “high inflation is enemy no. 1″ & “Treasury yields must rise fast & high to combat that” zeal. Ms. Lee is ably aided in this zealousness by a couple of anti-inflation & “Short’em Treasuries” missionaries on her show.

It was Melissa Lee’s zeal that reminded us of the “The more things change the more they stay the same” proverb. Dylan Ratigan, the founding anchor of CNBC’s Fast Money, was actually even more verbally hot in his anti-inflation zeal than Melissa Lee (but perhaps less abusive in tolerating dissent on the show).

Remember how Greenspan raised Fed Funds rate at every FOMC meeting from mid-2004 onwards in increments of 25 bps. That slow but steady tightening actually resulted in a growth spurt in housing, stocks & inflation. So when Dylan Ratigan began Fast Money in June 2006, inflation & Fed’s tolerance of it was the big story. Ratigan verbally built on it until fears of inflation & cries of Short Treasuries became the opening & closing song titles of CNBC Fast Money.

If you watched CNBC Fast Money for the past few weeks, you heard the same song featured in different ways with different cast members.

So below we present a DIFFERNT STORY from some smart folks who don’t speak of the pre-GFC period but of the onset of GFC conditions & their impact in 2007-2008 & even going back to 2000.

Before we move on, allow us to wonder at the spelling used for JPM’s Ms. Oksana Aronov above. From what we notice & have been told, the last names of women in Russian end in “aa” sound. For example, Petrov-Petrova (Nadia Petrova), Sharpov-Sharpova (Maria Sharpova), Fedorov-Fedorova (Oksana Fedorova), Medvedev-Medvedeva (seven Oxana Medvedeva names in LinkedIn). We noticed because the “aa”-endings for women are common to Indo-European languages & are supposed to originate in Sanskrut (Carl-Carla, Robert-Roberta, Frederick-Fredericka etc.)

While that might be a Linguistically same story told a different way, below shows that the practitioner part of JPM Fixed Income Asset Management might be telling a totally different story via Ms. Kelsey Berro than the Strategy & Alternate Fixed Income part of JPMorgan Asset Management told above via Ms. Oksana Aronov.

In our view, the absolutely critical investment decision going forward is to choose between being in a pre-GFC period now vs. sliding now into a slowdown, perhaps a la 2007-2008 or 2000. Our own question using Bon Jovi’s words – “is it just us or does anybody see“ the slowdown we & a few see?

2. “Cleared for Soft Landing – Bloomberg in July 2000“

We didn’t want CNBC to feel lonely. So the quote below:

- “I was looking at a Bloomberg article written in July 2000 titled “Cleared for Soft Landing“; ultimately just a few quarters later, we had a recession“.

That was Kelsey Berro, a JPMorgan Fixed Income Asset Management portfolio manager. She elaborated below in a Bon Jovi type style:

- “where we have been skeptical in terms of market pricing this year is this idea of a soft landing; now a soft landing is possible but track record isn’t there; that’s what their track record shows; more likely than not, the Fed is going to engineer a hard landing, not a soft landing – it is interesting to look back at what financial markets & the Fed were saying; they were talking about the same thing in 2000 & 2006 which were hiking cycles that ultimately ended in a recession; ; …. we do think that underneath the surface , there are cracks forming more broadly in the economy because of the unprecedented amount of tightening we have seen from the Federal Reserve & Central Banks around the world;”

Did she point to an indicator to show how “unprecedented” it is now?

- “San Francisco Fed has a proxy Fed Funds rate which is essentially a measure of policy restrictiveness which goes beyond what the Fed Funds rate is telling you; That proxy FF rate is 7% & that is the highest it has been since early 2000. So the policy is already restrictive enough to have lower growth & lower inflation“.

How built in is the Soft Landing belief?

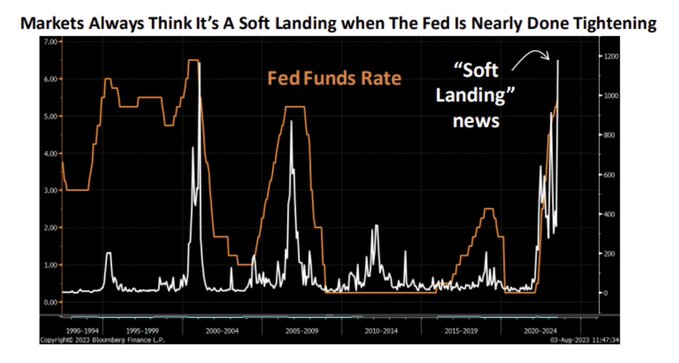

- Kantro@MichaelKantro – “Soft landing” news on @business is now higher than in 2000 and 2007. #macro

What did they call’em in 1994?

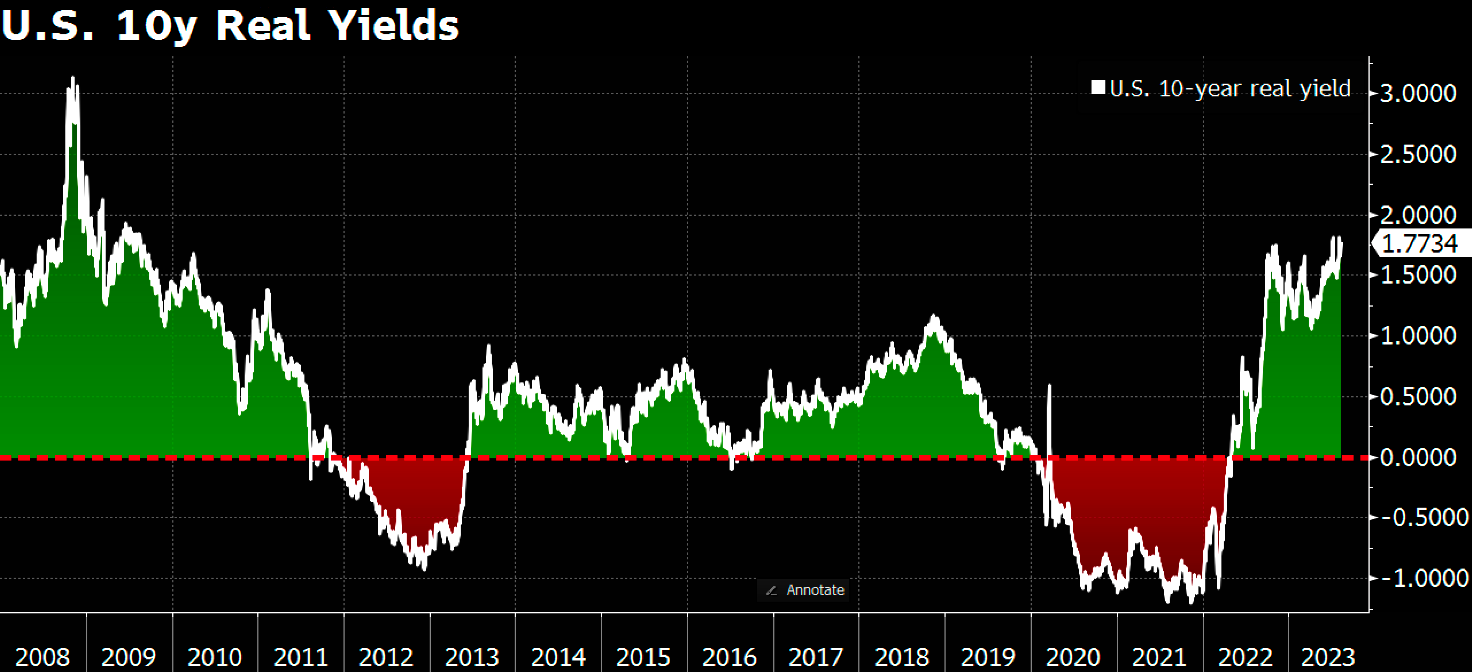

- Via The Market Ear – Bond vigilante extreme – The comeback of bond vigilantes: US 10y real rates have jumped to 1.77%, almost the highest level since 2009. Source Bloomberg

How oversold are Treasuries now?

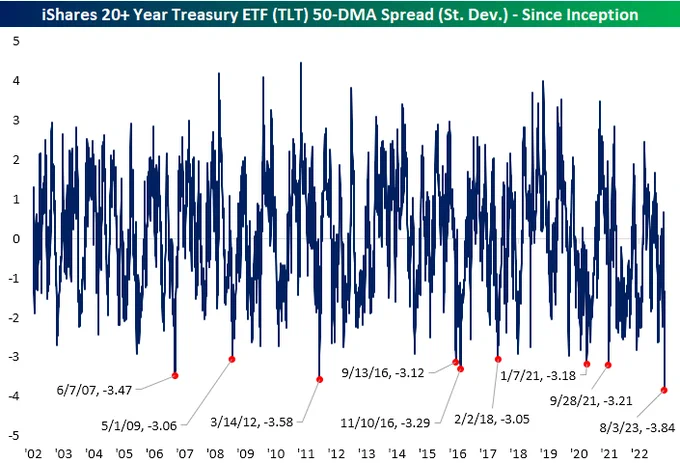

- Bespoke@bespokeinvest – At its recent low, the 20+ Year Treasury ETF $TLT was its most oversold on record since 2002. -3.84 standard deviations below its 50-DMA. Check out our more detailed write-up on this here: https://bespokepremium.com/interactive/posts/think-big-blog/long-end-historically-oversold

Wow! Kudos to the bravery, the zeal of CNBC Fast Money experts & followers of Ackman to SHORT long maturity Treasuries now? But some were not impressed:

For another comparison with 2000:

- Via The Market Ear – Mortgage rates highest in 23 years – US 30-Year fixed-rate mortgage reached 7.53% on Friday, the highest rate since October 2000 Sources: Bloomberg, Bankrate.com, christophe-barraud.com

3. Did nobody hear the fall of the subprime tree?

Remember how inflation was the bugaboo in early 2007? Every credit accident was treated as isolated while stocks were going up & Treasury rates were selling off. But as Mr. Victor Khosla, founder of Strategic Value Partners, said to Andrew Ross Sorkin on Thursday;

- ” .. I have never been busier in a market that looks so serene – equities up 16%; high yield at 6%; high yield market looks like serene ducks gliding across the horizon; … you look at what’s going on underneath & how busy people like us are already busy; its just pointing to large parts of this economy are going to struggle; high yield will be in a crisis when spreads get to 800 bps over Treasuries ; It happened 5 times in this century; just now spreads are 400 bps; no crisis;”

Where is the problem besides commercial real estate?

- “if you look at the manufacturing businesses I was talking about; good businesses, great market share – 15% volume declines – GFC like volume declines ; if you look across Europe, the slowdown is happening all across; its broad based“

So?

- ” … the bottom part of the high yield market is already in a crisis where we are seeing opportunity; do we think spreads go out to 500-600 bps over Treasuries by end of this year? Yes … our view is cautious; careful“

In another case of “same old story but … in a different way“, think back to Bernanke’s rhetoric in Q2 2007 & recall how subprime was just a small part of his concern!

Very smart to remain “cautious, careful” in 2023 in our view. Because it enables you to look to 2024 with dry powder!

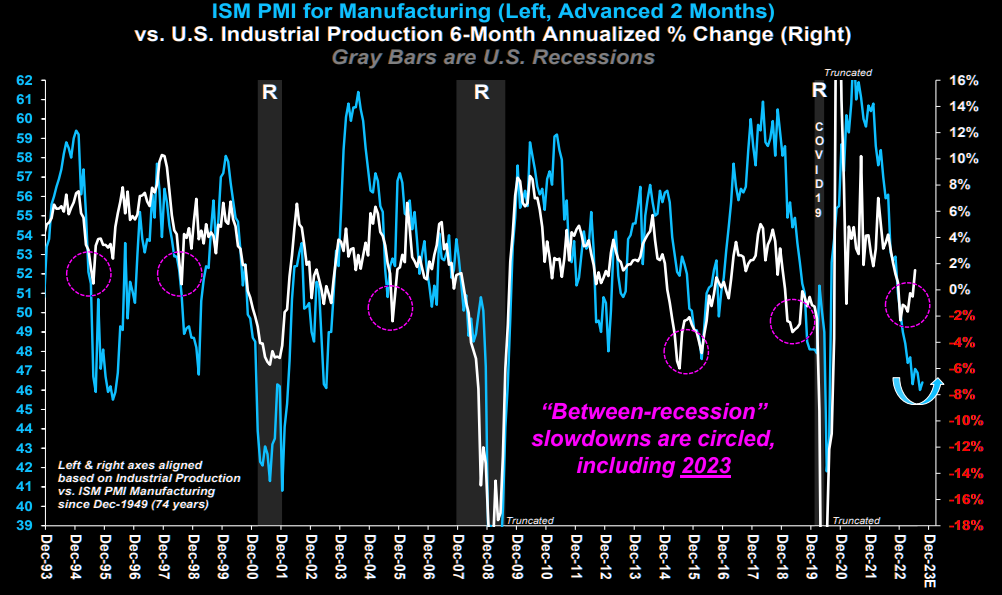

- Via The Market Ear – Now: just an “in-between” recession – “Many investors’ mistake in 2023 was expecting a 1H23 recession; we think that risk is 2024E and 2023 is just a slowdown“. Source Stifel

Speaking of GFC-like volume declines,

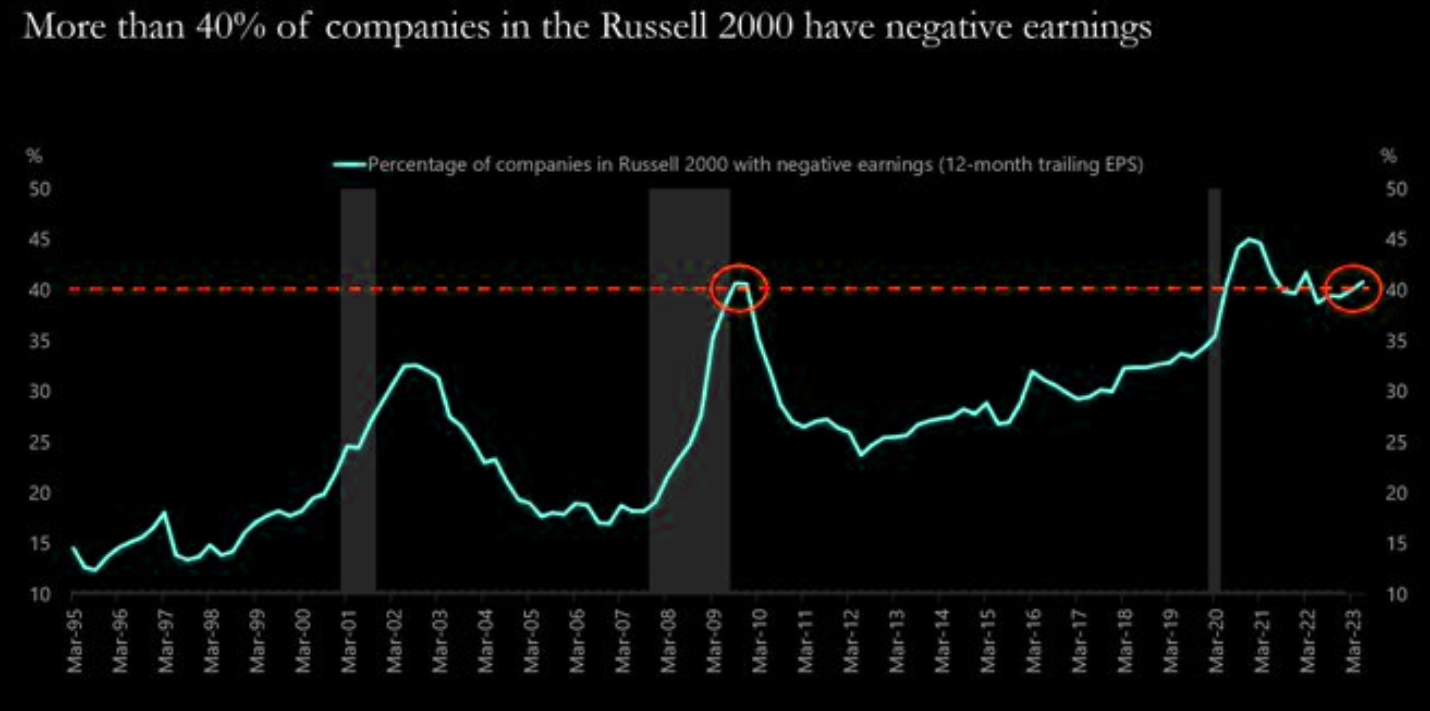

- Via The Market Ear – Companies with negative earnings – More than 40% of the companies in Russel 2000 have negative earnings. These are levels not seen since the peak of the pandemic, but more importantly the height of the great financial crisis of 2008. Source Apollo

What about China? They have always come across with growth since the GFC, right?

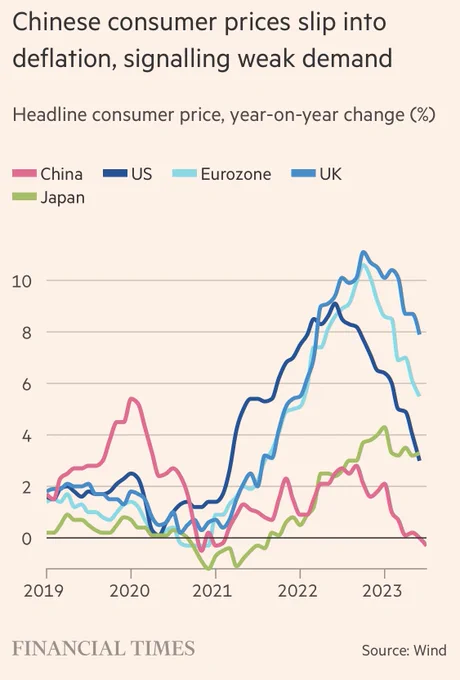

- Theresa Fallon@TheresaAFallon – “The Chinese economy is now at serious risk of sliding into a deflationary episode that could spark a self-reinforcing downward spiral in growth and private sector confidence,” said Eswar Prasad, a China finance expert at Cornell University. “The government needs to act quickly… Show more

But hasn’t the Fed always come in with such lows in liquidity since 2009? Yes, but look what they are doing now!

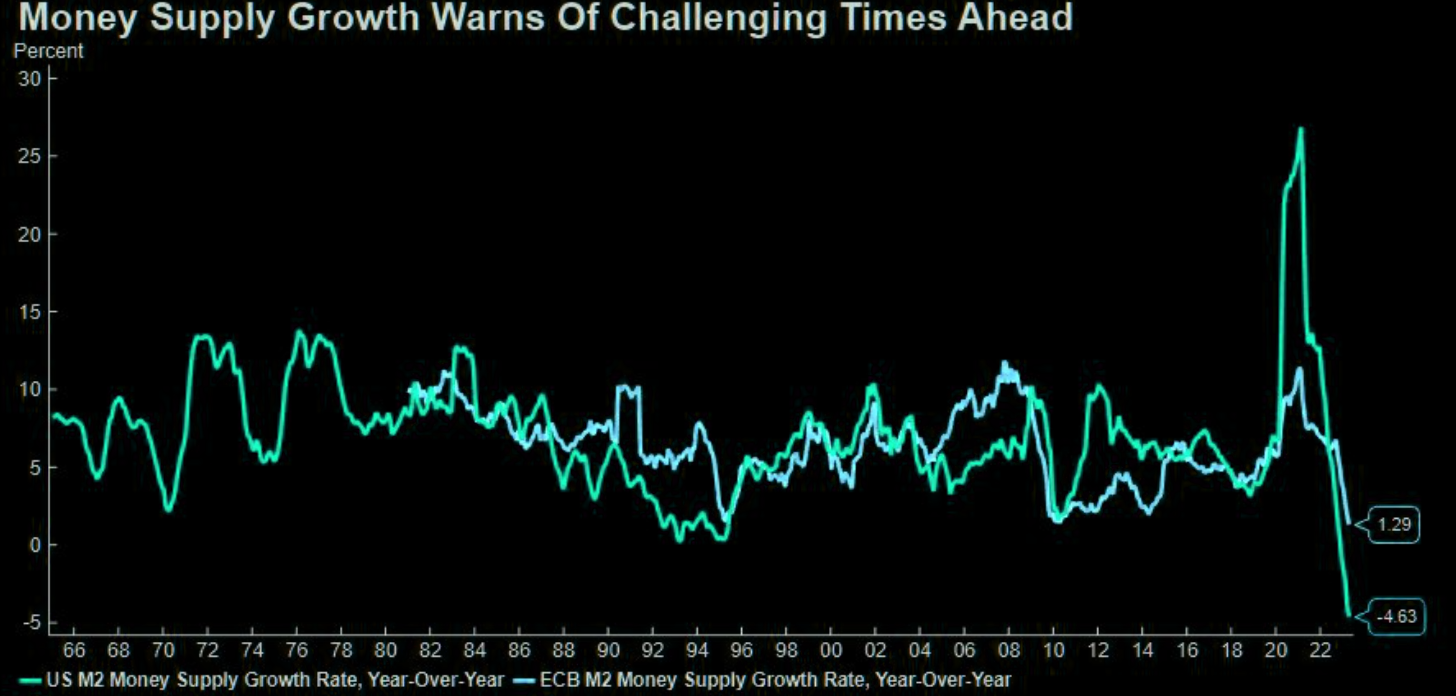

- Via The Market Ear – Lowest ever money supply growth – U.S. and ECB M2 money supply growth rates have fallen to their lowest year-over-year levels ever recorded. Source State Street

But look at the stock market. It is telling them & all of us that this is NOT the time to worry. Perhaps 2024 might be but not now! Otherwise wouldn’t the Fed be reducing QT & increasing money supply? No. Because all the CNBC Fast Money type cognoscenti are telling them to kill inflation first!!

Before you feel sad, look how the Stock market & the Treasury market behaved from mid-August 2007 to mid-October to 2007!

Do you think that repeats in 2023? Be positive & think of what comes before October? It is called September & what is on September 20, 2023? Will Chairman Powell will stun us positively? If so, won’t even Melissa Lee & her angry gang sing into year-end?

Do you rememberThe 21st night of September?Love was changin’ the minds of pretendersWhile chasin’ the clouds away

No, we are not drunk! But this is the only way we know how to end this article on a positive note!

Send your feedback to [email protected] Or @MacroViewpoints on Twitter