Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we cde important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Kernen, the F-term, the J-Fortress & the Bon Jovi theme

To his credit, Joe Kernen was the only one at CNBC whom we heard refer to the F-term with a “silent killer” adjective. Look what he asked Barry Knapp of Ironsides Macroeconomics on Tuesday on Squawk Box:

- “so you think Fitch is on to something with the banks …. is this like the silent killer? we don’t even see this underlying issue that you are talking about right now ; …. how will it finally come out? … will there be something that breaks again? “

What did Fitch say this week about US Banks?

- “A Fitch Ratings analyst warned that the U.S. banking industry has inched closer to another source of turbulence — the risk of sweeping rating downgrades on dozens of U.S. banks that could even include the likes of JPMorgan Chase. “

Include even the fortress balance sheet of all fortresses? That made us wince & take a double look. But before you look, remember the rally in JPMorgan stock after that celebrated earnings report on July 14. How has $JPM performed since July 14, especially compared to KRE, the regional banking ETF?

Frankly, we were stunned to see that KRE has out-performed JPM by almost 5% in the month after JPM’s glorious earnings report on July 14. And JPM has made a weekly close below its 50-day moving average!

What’s going on? Honestly we don’t have a clue! But harking back to the Bon Jovi theme “It’s the same old story but it’s told a different way“, we remembered the JPMorgan story of 2007-2008. It was just as celebrated in that era as it is in this era. That is why JPMorgan was asked to help out the US financial sector by buying out Bear Stearns by the Treasury & Fed. JPMorgan did & was praised for it. While not as bad as the acquisition of Country Wide Credit, the gift of Bear Stearns to JPMorgan turned out be a poisoned chalice of sorts.

That recollection brought us to the celebration of JPMorgan on July 14, celebration for being chosen by the Treasury & the Fed as The Fortress Bank to receive the gift of First Republic assets without any costs or liabilities. We also recalled bits of reportage that described the liberal granting of loans by First Republic to clients, for example loans made against pre-IPO stock held by insiders. If true, we have to wonder what ratings do agencies ascribe to loans backed by holdings of stocks that may not go public for some time?

So is the gift of First Republic “assets” to JPMorgan another example of a poisoned chalice, not perhaps at the scale of Bear Stearns of 2008 but still of a scale that creates concern? Is that why the Fed & Treasury were so eager to get JPMorgan to buy First Republic over other banks in the KRE? Is that why the much maligned KRE is now outperforming the vaunted JPMorgan?

Let us be clear. Ours is mere speculation, speculation about the reason why JPMorgan bank stocks might have under-performed KRE, the regional banking ETF, as well as KBE, the banking ETF? It may be something totally different and the First Republic assets received by JPMorgan might be of high quality. And JPMorgan might simply be over-owned & KRE under-owned & that might explain the chart above.

Or it may be as simple as what Barry Knapp said to Joe Kernen?

- ” … only 3 curve inversions so deep – Oct 73, Dec 79 & Dec 80; deep recessions followed; …. curve needs to dis-invert; Fed is going to have to cut rates in 1st half of next year or the situation in the banking sector & small business if going to get increasingly worse – that’s the unstable equilibrium that I am referring to … ”

Remember how the problems began in Subprime in 2007 & were deemed restricted to that sector without fear of collateral damage to the mainstream banking sector. We all know how the subprime seeped into higher quality portfolios & eventually into large bank balance sheets.

A similar argument was unintentionally provided by RBC’s Gerard Cassidy to CNBC this week:

- “… so far most of those problems are not in the commercial banking industry but in the shadow banking industry with the commercial mortgage backed securities; that’s where the problems are happening right now …”

Hope those problems stay in that shadow banking arena & don’t seep into the commercial banking industry which itself is not growing well.

- David Rosenberg@EconguyRosie – U.S. bank lending growth has completely stagnated on a 13-week rate of change basis. Every line of business is either slowing sharply or contracting outright (autos, C&I). The reason why Atlanta Fed is so high on its GDP estimate is that it ignores the credit aggregates.

Since a picture is worth lots of words:

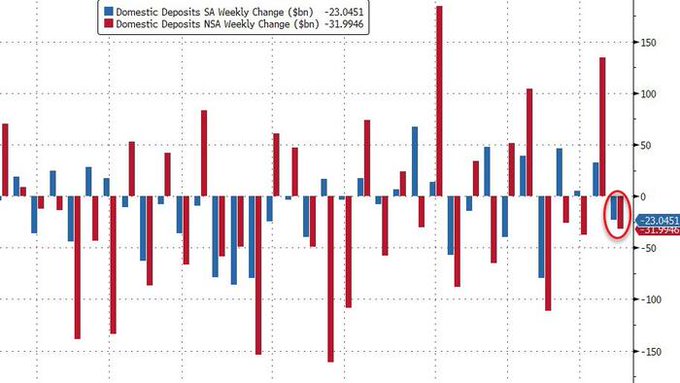

- zerohedge@zerohedge – Aug 18 – Large Bank Loan Volumes Shrank Last Week As Deposit Outflows Re-Accelerated

Some smell a storm coming!

- Michael A. Gayed, CFA@leadlagreport – Thu – Biden says China is a “ticking time bomb” a few days ago. Congressional members are buying inverse ETFs betting against the stock market. Someone knows something. A credit event is coming.

Remember how we all are told about the strength of the US labor market with all those new jobs added every month? What if that turns out to be fake? Not our speculation this time, but a fact quoted by Barry Knapp to Joe Kernen in the clip above:

- ” … report a couple of weeks ago that business employment dynamics goes back & really digs in on the labor market …. it turns out that all the jobs, that the birth-death model was supposed to approximate business employment created last year, never existed; it was originally estimated that 1.3 million small business jobs were created in 2022; turns out that was like 60,000; So we are going to have a big massive downward revision to last year’s employment; chances are small businesses are struggling far more than it appears based on this big macro data; .. will eat away at the foundation of the recovery & the expansion probably; does it need to turn into a deep broad-based recession? No as long as the Fed gets us to this dis-inversion of this curve right away which at least means reversing those last 3 rate hikes …. “

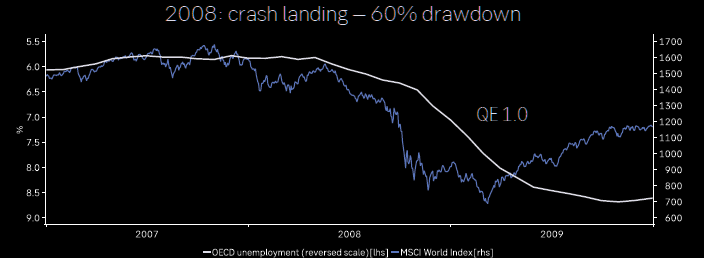

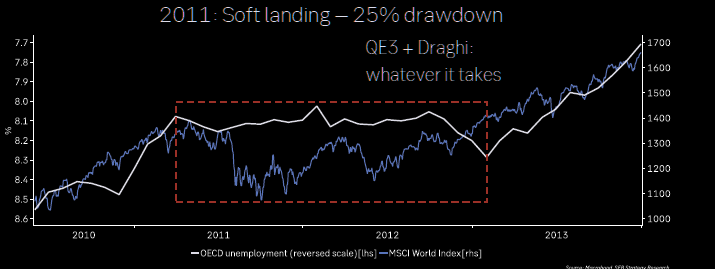

Barry Knapp is absolutely right in our opinion. In fact, alacrity in cutting rates & stating so clearly was the difference between 2007-2008 & the European recession of 2011:

- Via The Market Ear – Is it summer ‘08 or spring ‘12? Timing of decisive policy reaction is key to outcome– Source Macrobond

Will Chairman Powell give us a signal from Jackson Hole?

2. “Fear Complacency; Move Right Now into ….”

Rarely have we seen a Head of Global Wealth at a big firm so emotional as David Bailin of Citi was on CNBC Squawk Box on Thursday:

- ” … minutes were hawkish; so bond markets reacted but bond market is also presenting us with an incredible opportunity because the minutes were looking backwards; when we look ahead to 2024, we are going to see inflation fall substantially & you rarely get an opportunity to buy bonds with these kinds of real yields in them …. by the end of 2024, CPI will be 2.5%-3%; … last remaining part of inflation that is related to real estate is what is going to come down next year; … there is a huge amount of cash on the sidelines … average ultra high net worth investors have 15%-20% of their money in cash; they are taking short term view; they are piling into short-duration Treasuries & they are nor looking at where else they can move their money; … I say you can get 5% for 6 months or you can get 6% for 5 years; which should you do? My view is people should be moving out in duration right now to intermediate or longer bonds; in order to do that, you have to believe inflation is going to normalize; … I just don’t see a lot of people buying intermediate & long duration bonds …”

What does he worry about & what does he love?

- ” what I worry about now is complacency; .. everyone is like its not going to happen; then we are more vulnerable‘ …. when you look at 2024, you are going to have a moderate demand on employment; have major sectors of the economy that are going down; inflation rate is 1-2%; some parts are higher but we are absolutely headed down …. that’s one of the reasons why we love bonds at this point; …. “

Catherine Keating of BNY Mellon echoed some of these sentiments saying on CNBC Squawk Box:

- “It’s good to be balanced in bonds too and NOW is actually the time to take some duration ; we haven’t done that for a long time .. but we think this is the time to take some duration“

David Rosenberg is much more direct both in words & action:

- “We are making a shift; we are taking 5% out of over-priced US equities & putting the proceeds in the under-valued & deeply shorted US Treasury market; stock market does not appreciate the deflation underway in China .. the credit crunch that is sure to follow in the recent wave of Moody downgrades of US regional banks and the end of the student debt relief program in the months ahead which is sure to exert a dampening impact on the biggest spenders in the economy, the youth; … We like Treasuries; our duration scorecard is the most constructive .. since last March which actually presaged a 50-bps downdraft in the 10-year Treasury note yield ;… our models also really like Gold “

Risk premium of stocks over bonds?

- Via The Market Ear – Equities are looking more and more expensive – Equity risk premium (S&P 500 earnings yield- UST 10Y yield).

What about positioning?

- Via The Market Ear – Macro mavens in long bonds – Macro Hedge Fund exposure to 10-year treasuries.

And,

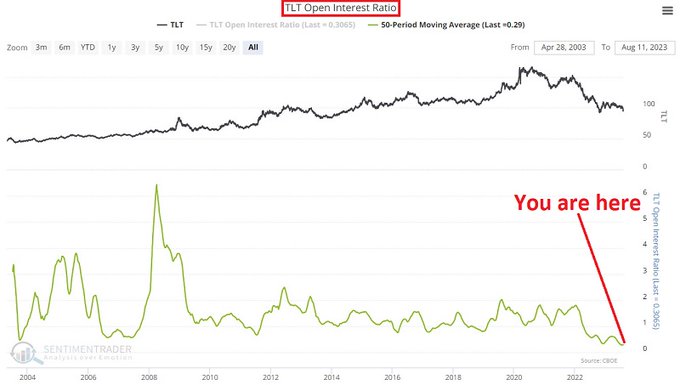

- Jay Kaeppel@jaykaeppel – This does NOT “guarantee” a low or bottoming process for bonds. BUT, FWIW 50-day average of TLT Open Interest Ratio (open puts to open calls) recently hit the lowest level it’s ever recorded. Time to be looking for a bottom? @sentimentrader

But has any one stepped up to buy?

- J.C. Parets@allstarcharts – Fri – I started buying some TLT this morning. Will be looking to add if it starts to work. Anyone else nibbling down here?

We concur totally, especially given the high-momentum selling of TLT & long-duration Treasuries on Thursday. It felt like a final or semi-final purging that historically has led to an opportunity to buy. Unlike stocks, Treasury yields are essentially a mean-reversion type asset that needs external inputs to maintain their extreme movements. A better commentary about Thursday’s sell-off came on Friday morning from Kelsey Berro of JPM Fixed Income Asset Management on Bloomberg Surveillance :

- “… 4.33% was intra-day high for 10s; 4.42% for 30 yrs; we have been able to hold up on those levels & back off; fairly encouraging there; the most striking thing is that the terminal rate pricing has essentially remained unchanged; it has been static around 5.4%; so no movement there; market is very comfortable with the terminal rate; if we really believed that these policy rates were not making an impact on the economy & no one was bothered by 7% mortgage rates; then the market should be pricing a lot higher terminal rate; it is not; inflation breakevens should be taking off right now & they are not;“

Isn’t supply of Treasuries a big concern? How does David Rosenberg answer it?

- David Rosenberg@EconguyRosie – The “supply” argument is a ruse in terms of explaining the pop in yields. Has more to do with the BoJ tweak, revised Fed views and “no recession” narrative. Since 1980, the correlation between changes in marketable debt and Treasury yields is exactly 0%!

How does Kelsey Berro, a portfolio manager, look at the issue?

- “2 things to keep eye on; 1) swap spreads – how are cash Treasuries bonds trading to the Swap market? 2) Primary Dealer Holdings – if there was a really big issue in taking down supply, we would have actually seen primary dealer holdings beginning to ramp up; we have actually seen fairly good takedown in the auctions; inter-auction buying has continue to increase; so there are people, stronger hands, that are taking yields at these levels; … ”

Ms. Berro sees far far far more in a week in terms of positioning & trading in Treasuries than we would see in our life time. But, based on what we have seen in results of trading peaks, we totally concur that stronger hands seem to be emerging to buy long duration Treasuries that weak hands are selling. And, if true, that usually results in a rally in the assets sold off by weak hands.

Of course everything everybody has said above might look wrong & foolish after Fed Chairman Powell is done speaking next Friday. After all, we were left felling stupid after he piled on in December 2018 on the massive selloff he himself had caused in October 2018.

3. Soft or hard landing with or without a recession?

Did Kelsey Berro answer this question in her appearance on Bloomberg Surveillance on Friday? You be the judge of that!

- “(minute 1:21:47) we have been looking back to the end of prior rate hiking cycles- 2000, 2006, 1995 – what we found in all these scenarios is that when the Fed stops, everybody thinks we have engineered a soft landing; in 2000-2001, 2006-2007 we were talking about the exact same things; soft landings; we weren’t sure policy was tight enough; it looked like the Fed had done it; “

Of course that proved wrong, seriously wrong. So Ms. Berro said she examined 1995, the one time Fed had engineered a truly soft landing. What did she find & what is her recommendation to investors?

- “in 1995, the 3-month-10-yr yield curve never inverted; in 1995, the credit, in the data from commercial banks that you get at 4:15 on Friday, never contracted; right now it is in contraction already; all these things are suggesting to us that policy is actually restricted & we need to give it time; actually policy has actually been tight only for a few quarters …… this is actually a time to be buying fixed-income … ”

Then Ms. Berro elaborated with simplicity of trading wisdom when anchor Jonathan Ferro asked her about her views on buying high yield:

- “I would be very cautious with high yield spreads in the 400s here; this is a pricing that is perfectly priced for the soft landing; you look at the upside-downside; how much tighter can you go vs. how much wider might you go in spreads? that asymmetry to me is very obvious;”

- “that asymmetry is also obvious in the bond market; how much higher can you go in yields? may be a little bit; how much lower can you go in yields when the Fed starts cutting rates? A lot!!!”

Whatever you may think of David Rosenberg, you must admit he doesn’t leave his listeners hanging in doubt. He didn’t do so on Thursday on BNN Bloomberg:

- “people have taken the stock market rally & fit it in the narrative that there isn’t going to be a recession; everybody is throwing in the recession call; part of that is reflected in this run-up in bond yields & the Fed staff just threw in the towel in the recession call. So I will just say that the recession has been delayed; it has not been derailed;”

What then?

- “…we are not getting out of this without a recession; then what’s gonna happen is you are going to have a huge default cycle; you have already started to see it in auto loans; you are seeing it in credit cards; you will see it across the gamut; but what have banks been doing? the Banks have been raising their loan-loss provisions as you get Brian Moynihan & CEOs like Jamie Dimon with happy faces in front of (TV) people like you; they are raising their loan-loss provisions; why? because they know what’s coming down the pike“

Then he went to what we would call the Bon Jovi title theme – “The more things change the more they stay the same“:

- “… this all reminds me of the Summer of 07 – rates backed up sharply; everybody was saying where’s the recession? And the recession started in December 07; ….. (but before that) the 10-yr note ratcheted up to 5.35%; … later it goes down 100 bps; so the worst thing to do right now is to extrapolate what’s been happening for couple of months in the bond market; I am saying I am buying into this; … I would be adding more fat coupon yields to portfolio right now that will pay off in the next 12-24 months … “

4. What might one do now?

Given all of the above, what to do now? Buy long duration Treasury bonds now, or at least buy Treasury bonds now, if you agree with the smart people above.

Assuming that works meaning bond yields at least stabilize here & even go down a bit, where else might you choose to be? As even David Rosenberg admitted in the above clip, bonds are just not as sexy as stocks are! Which stocks are sexy in particular – FANG, Semiconductors, AI stocks, Software stocks!

Recall what Kelsey Berro said about 2000-2001, 2006-2007, 1995 – in all of these scenarios, everybody thought that the Fed had engineered a soft landing! Why should August-September 2023 be any different? So if, by some miracle or a minor brain operation, Fed Chairman Powell hints at some kind of even short term dovishness, then Treasury rates would go down & sold-off FANG-Semi-AI-software stocks & other growth stocks might rally hard.

You might well consider us nuts or at least drunk to discuss buying tech stocks given what we have written above today & wrote last week. So allow us to quote a smart technical analyst who seems to concur:

Summary of what Mark Newton says above is simple:

- sentiment indicators, Elliott Wave & even DeMark indicators are starting to show that yields are getting close to peaking;

- oversold conditions in the stock sentiment gauges are close to materializing,

- if yields start to rollover , then it would be very very good for technology stocks.

How do you summarize the above?

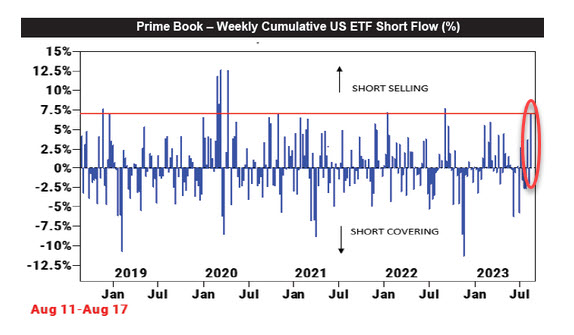

- zerohedge@zerohedge- Fri– Yup: here comes the squeeze – GS prime book chart

Specifically,

- Bespoke@bespokeinvest – Thu– Nasdaq 100 $QQQ now oversold (>1 st. dev. below the 50-DMA) for the first time since January 6th.

And, perhaps a day early,

- Joe Kunkle@OptionsHawk – Wed – NYMO -88 , hit the green snapback line

Going back to our musical themes, this would be like enjoying a ride on the Bon Jovi theme train drinking all the way to meeting Earth Wind & Fire in mid-late September before or after the September Options expiration. If that doesn’t sound like a fun ride, what would?

Send your feedback to [email protected] Or @MacroViewpoints on Twitter