Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Markets Last Week

US Indices:

- VIX down 4.5%; Dow up 1.2%; SPX up 1.5%; RSP up 1.2%; NDX up 2.1%; SMH up 3.1%; RUT up 2.1%; IWC up 1.7%; MDY up 85 bps; XLU up 1.5%;

Key Stocks & Sectors:

- AAPL up 3.9%; AMZN down 1.4%; GOOGL up 4.6%; META down 88 bps; MSFT up 1.3%; NFLX up 1.7%; NVDA up 2.9%; MU up 3.5%; BAC up 2.2%; C up 83 bps; GS up 3%; JPM up 3.1%; KRE up 2%;

Dollar was down 63 bps on UUP & down 78 bps on DXY:

- Gold up 2.2%; GDX up 4.7%; NEM up 3%; Silver up 11.7%; Copper up 9.1%; CLF up 46 bps; FCX up 5.3%; MOS up 4.3%; Oil up 2.1%; Brent up 1.2%; Nat Gas up 16.8%; OIH up 2.1%; XLE up 1.3%;

International Stocks:

- ACWX up 2%; EEM up 3%; FXI up 5.7%; KWEB up 7.1%; EWZ up 57 bps; EWY up 89 bps; EWG up 89 bps; INDA up 2.9%; INDY down 51 bps; EPI up 4%; SMIN up 1.7%;

And interest rates moved down on weaker than expected economic data:

- 30-year Treasury yield down 8.5 bps on the week; 20-yr yield down 8.5 bps; 10-yr down 8.2 bps; 7-yr down 7.8 bps; 5-yr down 7 bps; 3-yr down 5.9 bps; 2-yr down 4.1 bps; 1-yr down 4.6 bps;

- TLT up 1.4%; EDV up 2%; ZROZ up 2%; HYG up 40 bps; JNK up 62 bps; EMB up 85 bps;

But for second week in a row, interest rates rose across the curve on Friday; up this Friday from up 4.5 bps on the 7-yr to up 3.6 bps on the 2-yr. The market action this week did concur with what Katy Kaminsky of Alpha Simplex said on Friday on Bloomberg Surveillance beginning at min 52:56:

- “…. market seems to be polarized between 2 views – bullish view on equity & growth Vs. worry about sticky inflation and higher for longer; … as a result, trend signals view long equities with short fixed income; long Dollar & long commodities. … for us we are still short in fixed income; short bond signals really telling you higher for longer; … commodities are what we are watching the most; .. massive moves in commodities this year; copper in particular has been up tremendously lately; … Agricultural products starting to pivot ; … ”

It was semi-brave of Tim Seymour of CNBC Fast Money to allude to the 2008 rally in Copper earlier this week. But Friday’s breakout seems to have quieted his misgivings. What did Friday’s breakout suggest to others?

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – May 17 – $COPX full breakout, could have a long runway. Bigger bases = bigger breakouts.

On the other hand, Jamie Dimon himself voiced concerns about inflation to Francine Laqua on Bloomberg:

- “… I am worried about it; we have very big fiscal deficits & underlying inflation may not go away the way people expect it to .. a lot of things are kinda inflationary; the green economy; the militarization of the world; infrastructure requirements; restructuring of trade; fiscal deficits – so I think there are a lot of inflationary forces in front of us that may keep it higher than people expect. … So I the change in my view is whatever the world is pricing in for a soft landing, I think its probably half that ….”

When asked why markets are NOT pricing that, Mr. Dimon replied:

- “lot of happy talk; the future isn’t predictable like that; I am a student of history; … I go back to the booming markets of 72 & the collapse of 74; healthy markets of 80s & the 87 market crash; 1990 real estate crash; & almost all of them were NOT predicted the year before … ”

We find it interesting that Mr. Dimon did not speak about the “dancing” markets of 2006-2007 & the 2008 crash of the banking system. On the other hand, perhaps he did expect it & had prepared his bank to benefit from that crash.

But do both goods & service inflation move in parallel? And what might it mean when they don’t?

- Albert Edwards@albertedwards99 – May 16 – Is the Fed about to make another major screw up? Keeping rates high to kill rising supercore services inflation has resulted in unprecedented falls in core goods inflation (record fall since the late 1950s-apart from a few months in 2003).Super core inflation is rising mainly……due to vehicle insurance at 22.6%. The excuse of rising maintenance and parts have long since passed. This and other rampant services inflation is impervious to higher rates. The Fed are nuts to target something they can’t really control, creating unprecedented goods deflation

A really profoundly simple & intuitively plausible comment about services inflation came on Friday from uber-manager Rick Rieder of BlackRock with his suggestion on Bloomberg wall street week that to Cure Services Inflation, the Fed should cut interest rates. If you go hmmm, do listen to him below:

- ” … we are moving to a services economy; more money is being spent on services; goods prices have come down so much, its allowing for disposable income to go into services that is actually buoying prices & services ironically; …. “

- “I am not certain that raising interest rates brings down inflation; In fact, I would lay out the argument that actually if you cut interest rates, you bring down inflation; why is that? .. look what is happening now; … lower-income – higher percentage of their net worth is in the debt – credit cards, student loans, auto-finance, etc., what’s happened is you have raised rates & that has created a real impact – but the

- “other side of it is you actually have an economy because of this massive transfer from the public sector of the government to the private sector; people of higher income – middle to higher income – are getting a big benefit from these interest rates; and that’s flowing into to the people that spend in aggregate on services; so there is an ironic things that nobody has ever seen in history – big transfer of money from the government into the private sector; private sector now is a creditor vs. a debtor in terms of the big pocket of wealth; higher end restaurants killing it – lower end having really a tough time ; you saw it in all the earnings reports in this last quarter ;

- “and then the other side of it – not only is lower income getting hurt; not only is small business getting hurt; local banks getting hurt; you look at companies today; normally when you raise the interest rates, companies pull back; companies termed their debt out because we went thru not only a transfer of money from the government to the private sector ; we kept interest rates down for so long; 70% of the high yield market termed their debt out when the Funds rate was under 1%; they have no debt coming due; no real maturity wall; … s

- “so you raise rates & it doesn’t really matter; in fact, companies are sitting on a lot of cash; so they are actually getting the benefit of higher rates; the point being, I think the Federal Reserve can get that rate down from 5.375% to even to 4%-4.5%, still restrictive rel. to 2.80% core PCE; … because we have never seen it in history …

- “let me thrown in one other thing, there has been ageing of the population that we have never seen before & a wealth creation at the higher end ; if you break down the demographic today, there has been an incredible growth to the savings, spending from older people , 55 & above; its fascinating – if you keep the real rate high; huge benefit to those people & their turn around & spending; so why is inflation high? health-insurance, auto-insurance, they are sticky; unresponsive to interest rates; & older people are spending, middle-high income are spending & are keeping that service level inflation high; “

We wish David Westin of Bloomberg had asked the obvious question – if the Fed cuts rates by 2%, then wouldn’t that hurt the earnings of companies that are sitting on huge cash balances? If so, would their stocks go down &, in turn, reduce the buying back of their stocks that Rieder said (on CNBC) was a big reason for stocks to keep going up?

2. Stocks

Now look at a different Avataar of Rick Rieder on CNBC Closing Bell on Friday- gung-ho, non-sedate, tossing words like incredible but remaining sensible & logical:

- “$110 billion of an authorized buyback; …. they are buying two average-sized S&P companies per annum; the whole market cap of the New Zealand stock market is $90 billion; its pretty incredible; check out other Mag 7 companies – I looked at 4 – they are buying $320 billion of stock… the technicals in the market are truly staggering; … sales weren’t so good but the earnings are actually pretty good; stickiness of margins – software development, AI – its pretty impressive;

- I think people underestimate the incredible technicals in equities; still throwing 18-19% ROE ; technicals arguably matter more than fundamentals; when you buy back that much stock; this sort of earnings; this persistent ROE; the equity market is functionally taking top-line revenue wth GDP running at 4.5-5% nominal GDP ; that’s an operating leverage machine that is throwing off what are terrific earnings; I still think it is going higher; …. could you get another 10-15% in the equity market this year? I don’t think that’s much of a stretch at all‘

- I think its the buybacks; its earnings that are still pretty good.. there is such an intense focus on rate cuts…. when people see that, you get another push in the equity market; … I would still hold equities for the next couple of years …. “

Great stuff above but much of it kinda confusing to us. For example, Rieder said sales were not that good but earnings were pretty good. How long does that continue? Also won’t buybacks stop mid-June ahead of numbers. Where would the buying power come back for those 2-4 weeks? And what if earnings don’t rise as expected in July as they did in Q2? If so, technicals that are “staggering: now might become merely terrific.

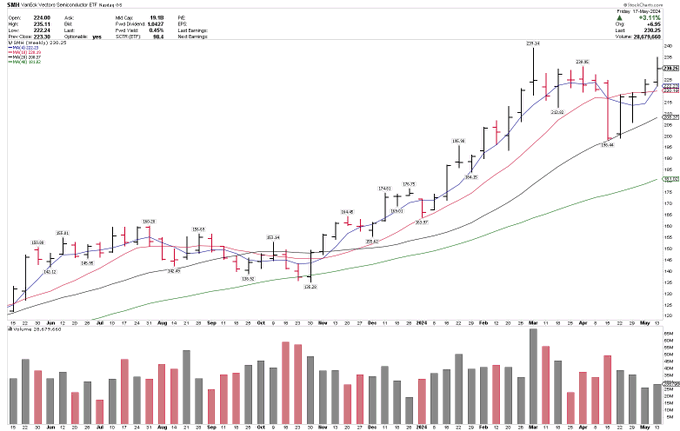

But that’s us being simple-mindedly non-daring as usual. When we feel so, we look at Semiconductors. How do they look to some who understands charts?

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – May 19 – $SMH record weekly closing high, bullish weekly MA cross.

Hopefully, NVDIA shows again next week that it is still NVDIA.

At the other end of the spectrum,

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – May 19 – $SLV early breakout – could be set up for much higher.

What does our near-term seer see?

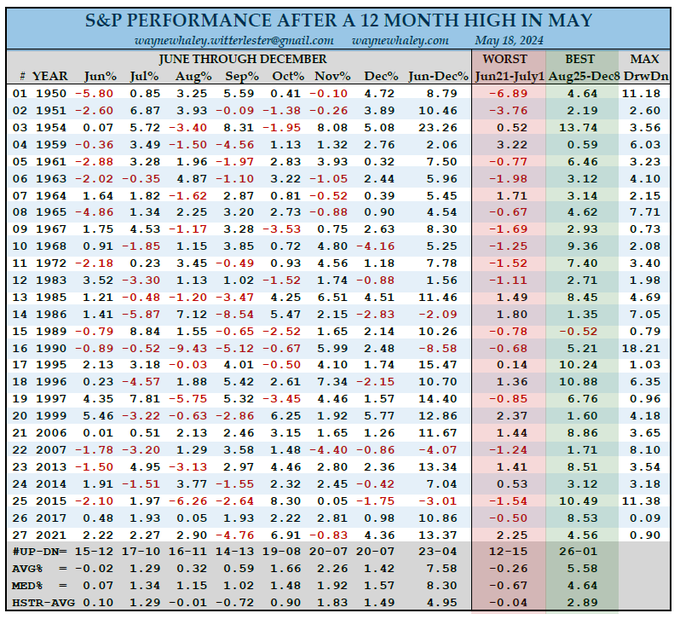

- Wayne Whaley@WayneWhaley1136 May 18 – A NEW HIGH IN MAY – MAKES THE FALL RALLY A STRONG PLAY

- I shared 28 new studies with my commentary subscribers this am plus 14 prior studies in the Addendum which are still in play. Below is this week’s give away selection.

- On Wednesday, May 15, 2024, the S&P closed at 5308.15 which was a new All Time High.

- Given that 50% type Bear Markets can take years to erase, I often fancy ’12 Month High’ as to ‘All Time High’ scans as they capture the same market characteristics while providing a larger sample size.

- Since 1950, there have been 27 prior years of those 74 in which a High for the rolling year was set in May.

- In those 27 cases, the following June-December performance was 23-4 for an avg 7.58%, seven month gain.

- The 10% moves during the final seven months of those 27 calendar years were 12-0 to the positive side.

- The fall rally I reference is Aug25-Dec8 with 26 wins after a May High vs on fractional loss. The scan deemed June21-July01 as the weakest period with a 12-14 mark for a modest 0.26% avg loss.

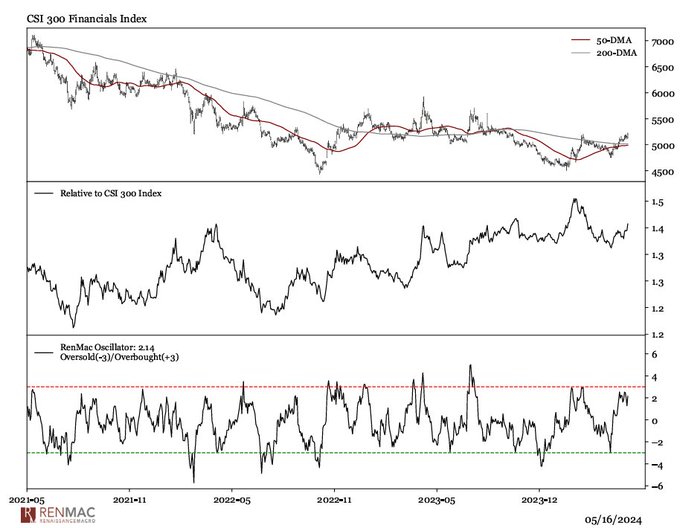

3. China

- RenMac: Renaissance Macro Research@RenMacLLC – May 17 – Strong overnight session translating into $KWEB, $EWH and $MCHI. We continue to believe this is a secular turn, it doesn’t hurt that Chinese banks are helping to lead the charge….yea, we’re aware of their relationship w/ the red-hats,

Jeff DeGraff of RenMac added to his conviction over the weekend:

- “China continues to act well’ we have called the bottom there; continue to believe that’s a big turn; … I think the turn in China is similar to the U.S. turn in 2009; .. I think its going to be a multi-quarter call; things are going to play themselves out; you are going to look back in 2 yrs and feel that you should have been a buyer … “

Rick Rieder spoke above about things we have never seen before. Jim Rickards speaks about some thing that we have never seen before either, something that seems unfathomable:

- “China is going thru something that the world has never seen … they are going to lose 600 million people over the next 50 to 70 years. This is a demographic implosion. … “

- “The U.S. has a military doctrine called the Broken Nest theory. … it means if China invades Taiwan, we or the Taiwanese would very quickly destroy all the semiconductor manufacturers in Taiwan. We will just blow them up & China won’t get anything. They will have the broken nest“.

The clip then discusses the plans of Taiwan Semiconductor to build a fab in Arizona.

4. India

In March & April, we had written about what we felt was the emergence of India’s Defense sector as an attractive investment. In fact, we felt on April 7, that we had missed the short term boat:

- “Understand we feel utterly stupid in even speaking about stocks like HAL or Hindustan Aeronautics Ltd. We have known of this company for decades but as old foggy public sector company. To realize how stupid we feel, look at the chart. We saw the vertical move in November with the ChandraYaan landing on the south pole of the moon, but thought it was an over-reaction. Stupid is a compliment given how we feel, HAL have launched a new fighter aircraft Tejas MK1a to be followed by Tejas Mk2 which will have the GE F414 engine.”

If that was a surprise to us, then this past week’s earnings release was a a stunner. The HAL stock jumped by 10% on better than expected earnings. Below is the 1-year chart of HAL vs. INDA, the BlackRock large-cap India ETF.

Note that, the Tejas Mk2 with the GE F414 engine is not even factored in the numbers. Then comes the AMCA, the 5th generation Advanced Medium Combat Aircraft.

The above is impressive but the 6-month HAL vs. NVDA chart below stunned us:

We don’t expect the growth of HAL to match NVDA’s growth going forward. But high growth stocks that are just being recognized deliver performance, don’t they?

At this point and, as we recall, we need to credit Jim Grant for recommending Lockheed Martin (LMT) when it languished around $28 in 2002. Anybody who bought it then & held it has done well indeed. And it and the defense sector are still deemed to be long term growth ideas.

As the clip below from an Australian Military entity says, the goal of HAL’s AMCA fighter is to replace the Sukhoi SU-30MKI fighter that is today “recognized as the best multirole aircraft produced in the East“. The real point being HAL has the potential of high growth over the next 5-10 years and, at least until now, few know about it.

We have not written about Indian stocks for the past few weeks because there is one factor that dominates how the Indian market will act in June & beyond – the results of the election that will be completed on June 1. The results will be announced on June 4.

5. CNBC & AANHPI

AANHPI stands for Asian American and Native Hawaiian/Pacific Islander. May is the month to recognize and celebrate the role of the AANHPI community in the history of the United States. The first celebratory ad we saw on CNBC features Melissa Lee, the host of CNBC Fast Money:

We think the above is an honest & well done piece that fits the AANHPI theme very well. Then we saw the following piece by & about an Indian (or Indian-American?) woman named Dipali Goenka.

Ms. Goenka says in her clip:

- “I come from India, I come from a patriarchal family community earlier where you know it was about having a male child & I had two daughters. For me to lead by example was so important. But they really saw that yes, the legacy that leave for them is about financial independence about being empowered to do what you want to do and really make an impact.”

Frankly we were confused when we heard this. First we know couples from an earlier generation and also from today’s generation that have only 2 daughters without a son. They didn’t have any problems in raising their daughters in India. One of those families has both daughters in USA, one a Doctor & other working on Wall Street. Their parents were middle class & didn’t think it was a big deal.

When we first saw the CNBC-Goenka clip, we assumed Ms. Goenka was financially & socially without resources & that had created a serious problem for Ms. Goenka. Then we saw that CNBC described her as Welspun Living CEO “Dipali Goenka”. And we remembered that Goenka was also the name of a very rich & successful family in India. So we checked this unique gift to modernity called Google.com. Guess what we found:

In another article, we found the following:

- Welspun Group, a Mumbai-based conglomerate founded by BK Goenka. …. As to Welspun Group’s connection with Adani, in 2005, the Adani Group entered into a joint venture – Adani Welspun Exploration Ltd – with Welspun Natural Resources Pvt Ltd. According to a press release, the Adani Group has a 65% shareholding in Adani Welspun Exploration Ltd through Adani Enterprises Ltd, which has Gautam Adani as chairman and his son Rajesh Adani as managing director.

Perhaps readers might recall that Gautam Adani has been one of the richest people in the world &, indeed, he was the Richest man in the world prior to the report published by Hindenberg Research in January 2023.

So it seems Ms. Goenka & her two daughters are a part of an extremely rich family & hence she presumably she had enough monetary resources & physical help to raise her two daughters. And being daughters of a billionaire, their father can also leave them a legacy of financial independence.

The contrast with the grandparents of Melissa Lee could not be more stark. The Lees started a business & through their hard work they raised 5 kids presumably without help from a Chinese billionaire. It is easy to describe Ms. Lee’s grandparents as folks who lead by example. In contrast, we still don’t understand what example did Ms. Goenka lead with.

This is not about Dipali Goenka but about CNBC. Didn’t CNBC find another more deserving Indian-American woman to celebrate for achieving the American Dream? Perhaps her marrying a billionaire is the American Dream CNBC wanted to celebrate. If so, why did they choose Melissa Lee unless she too is married to a billionaire.

We are inclined to think that Ms. Goenka was featured by CNBC because she is stylish & of white-fair complexion. We have seen how CNBC, the “first in business worldwide” network wasn’t even aware of the Black-complexioned President Murmu of India, the most populous country in the world.

Ask yourselves whether CNBC would choose Fair-skinned, stylish Dipali Goenka for their feature or a Black Indian woman like President Draupadi Murmu. There is no shortage of dark-complexioned Indian-origin women in America who have achieved more than Dipali Goenka with far less resources. Then look again & ask yourselves which of the complexions below better fit CNBC’s white-preferred image.

(Dipali Goenka) (Draupadi Murmu)

Then we remembered the word used by Dipali Goenka in her message – “Patriarchal“. And that is the code-word used by US media, especially the NY media to condemn India & Indian society. In the past, the code-word was “caste system” even though “caste” is a Iberian term that was imported by Britain into India. After the election of PM Modi, the new code-word for soft condemnation of India has been “patriarchy” or “patriarchal”. Since that is the code-word, use of that code-word by the stylish, urbane & billionaire wife Dipali Goenka was chosen to fit CNBC’s anti-India mission.

But since CNBC chose “patriarchy” as the definition of India, we thought we might reveal today’s true state of patriarchy as governed by India’s Judicial system. As you read the below, perhaps you might feel that the true all-Indian term today is NOT “Patriarchy” but “Modesty“, modesty of a woman.

P. “Patriarchy” as practiced today in India

We don’t believe any one in CNBC, Bloomberg or Fox have a clue of the barest outline of how “patriarchy” has metamorphosed in India, principally at the directive of the Indian Judiciary. Everything we list below is from published work of other institutions & authors.

The discrimination & cruelty that follows below will SHOCK most decent people. Don’t blame us if, after they check out the below, female readers might swear to NEVER visit India with their sons or their husbands.

M-not-P -1. Molestation of a woman by a male in India

Let us begin with a story in which we helped a 2-year old boy escape jail/punishment. For details, check out our article dated April 29, 2017 titled 2-year old boy in India’s Gender Hell … In a dispute about more mundane issues, a 35-year old woman from one side of the dispute lodged a police complaint accusing a 2-year old boy from the other side of molesting her. Now no sensible legal system would lodge a charge of molestation on a 2-year old boy for molesting a 35-year old woman. But the Indian Police officers did. And that 2-year old boy faced a jail term. We were outraged & reached out, in our intense way, to Delhi. It worked and the next day, the charge of molestation against the 2-year old boy was dropped.

You must understand that charge of molestation by a woman is a very effective charge in India. A woman doesn’t need to show any evidence either of the act or against the “molester”. The law states that, prima facie, her word must be believed. The entire onus is on the male to prove his innocence. Because the “Modesty” of the woman accuser MUST be Preserved.

Now imagine you as a mother or father are walking with your son in the crowded airport & your son brushes against a woman or she brushes against your son. That’s more than enough for her yelling that she was molested. And, if she wants, she can ask for police to lodge her case. If you are of Indian origin, you are stuck & your only option is to offer to pay that woman for the abuse she suffered & that is what the Police might politely suggest to you as well. If you are of White origin from US/EU, the police will try what they can to tell the woman to buzz off because they don’t want a scene with a White traveler. But if the woman is smart or experienced, she won’t until she is paid.

You can argue that she bumped into your son or husband. But that doesn’t work with a molestation charge because, under a ruling of Indian courts, a woman can never molests a male. And her accusation is enough because she is a woman. False accusation of your son or your husband is NOT important. What is important, above all, is maintaining the accusing woman’s Modesty.

M-not-P- 2. Sexual Relations between an adult & a minor –

We remember a case reported on Twitter in which a 50-year old woman had begun a forced sexual relationship with a 12-year old son of her neighbor. It became a regular affair & the boy’s parents came to know about it. They were infuriated but the woman refused to stop. Sadly, the boy’s parents made the cardinal mistake of going to the police.

In most civilized legal systems, the woman would be charged with statutory rape. But not in India’s “patriarchy”. Because remember under Indian law, a woman can never legally molest a male, let alone rape. So once the 50-year old woman admitted the sexual encounters with the 12-year old boy, the police had no choice but to charge the 12-year old minor for rape of the 50-yr old woman despite knowing the facts.

One way out for the boy’s parents & the boy was for the 12-yr old boy to MARRY the 50-year old woman otherwise he would be sent to jail. That was the advice by the Women’s Council, a legal advisory body established by the Indian Government (now such body exists for boys & men). But it is illegal for a 12-year old boy to marry & he would also go to jail if he did unless the police overlooked it. And the jail sentence for under-age marriage would be a much smaller sentence than the one for “rape” of the 50-year old woman.

Enter another Indian law, the one that says a wife has the absolute right to live in the “matrimonial home“. So this woman demanded the right to move into the 12-year old boy’s house, meaning his parents house. After all this, the woman could divorce her minor husband & walk out with at least 50% of the estate that the boy’s parents would leave for him. Doesn’t it read like a tale from hell? No – it is only protection of the woman’s Modesty.

M-not-P – 3. A woman’s claim of rape must be believed

In case of a rape accusation, the Police are required to believe the woman’s word. So the accused male is instantly put in prison until the case is heard. That is why many men prefer to pay the woman & settle the false allegation. Check Twitter & you will read details about women who have serially filed rape cases against many men in the same year & collected from all. Remember the woman’s word is enough & the Courts would not allow evidence of her prior false accusations against other men.

This is why, if asked, we suggest to women to go alone to India leaving their husbands & sons in America. Because, legally speaking, there is NO SAFER country than India in the world for an woman & no more dangerous country in the world for a man.

Why? Because hardly any woman has gone to jail in India for making a false accusation of rape against a man. So it is a very easy game for a woman to file false claims against a man, any man. It is a rewarding game that can be played again & again. Remember the singular objective is to preserve the woman’s Modesty.

M-not-P-4. Does being rich or very rich protect you?

It used to. But not after the intensely sad & unfortunate case of Sajjan Jindal, a billionaire & the Managing Director of JSW group. In that celebrated case, a woman accused him of raping her in Mumbai. After claiming rape by Mr. Jindal, neither did the woman give any details nor did she register her document. Given the stature of Mr. Jindal, the Mumbai Police did investigate fully & finally declared the case to be FALSE.

- Deepika Narayan Bhardwaj@DeepikaBhardwaj – RAPE CASE AGAINST SAJJAN JINDAL FALSE : MUMBAI POLICE – The woman never appeared to either register 164 statement nor gave any evidence to substantiate her allegations. Despite repeated attempts to take her testimony, she remained unavailable, says @MumbaiPolice

Ask yourselves how could a woman recklessly accuse a highly respected CEO like Sajjan Jindal of rape without providing any evidence whatsoever. Don’t ask, just remember that a woman doesn’t have to produce any evidence of attempted rape or even the slightest abuse when she accuses a man of raping her. And she has no risk of being punished for making a false allegation. Because, say it again, the singular objective is to preserve the woman’s Modesty.

If you are a female American reader including CNBC white anchors, ask if you want to travel to India with your male husband or your male sons. If billionaire Sajjan Jindal, MD of JSW & 2021-2022 chairman of World Steel Association had to go through this, what chances do your husbands & sons have of escaping from such false charges without paying hefty damages.

And note again that the Police did NOT file any charges against the woman who made the false accusation. Because, under Indian law, a woman’s Modesty is sacrosanct.

M-not-P-5. When your daughter-in-law & yr son live with you

As we said, a wife has the right to come & live in her Matrimonial home, that typically being where her husband lives. And, in many middle class families, it is hard for a young couple to find a safe & affordable apartment. So its fairly common for the young couple to live with the husband’s parents.

In more & more cases, the result is tragic for the old parents. Below is a case posted on X.

Heartwrenching assault of elderly father-in-law by daughter in law in Mangalore's Kulasekhara. The culprit here is Umashankari, an officer in KEB in Attawara

Please take action @MangaluruPolice @DgpKarnataka

Via @daijiworldnews pic.twitter.com/fNQxluwSXw

— Deepika Narayan Bhardwaj (@DeepikaBhardwaj) March 11, 2024

Understand that if the above father-in-law attempts to resist, then the daughter-in-law can file a case against him for violating her Modesty, abuse & attempted rape. She wouldn’t need any evidence for that accusation & her father-in-law didn’t get any help from the above video.

Because the laws are so one-sided & the Judges have ZERO sympathy for men, the Police now don’t even bother to investigate or charge the offending women.

And it doesn’t have to be physical abuse. It can be humiliation as well:

Can a boy touch and old lady in the similar manner?@yogitabhayana @MinistryWCD @shailichopra

Constitution surely needs few amendments including one where outraging modesty of men exists. pic.twitter.com/UqsR7bkWKS

— U day (@menzquint) April 25, 2024

M-not-P. 6. Wife vs Husband

What is the bottom line?

- The DV Warrior (Parody)@BakraofDv – In India a #husband cannot file a domestic violence or 498A case against his wife even if his wife: – bre@ks his bones – daily abuse – having adulterous relations – misbehaves with him,his parents & family daily. Because there is no provision for this in Indian law.

Want to see an example?

If he will call the Police now then he will be arrested under CrPC 107/151 for breaching peace. Police will send him to jail to ensure his safety. Thats the only help a male victim of #DomesticViolence can get from the Police.pic.twitter.com/vA7G6lqXPX

— NCMIndia Council For Men Affairs (@NCMIndiaa) May 11, 2024

Notice the police are watching the above and how can they stop it? Police will send him to jail to ensure his safety. Marriage is the most common arena in which a woman can beat up a man & he dare not resist. Because the woman’s Modestyis sacrosanct.

Watch the interaction below of a irate woman customer of a Bank & the Bank Branch Manager – Reason, the bank’s server was down & the woman could not withdraw money. So she began hitting him. Again, if the Branch manager had resisted, the Police would have arrested him for hitting the woman. Because even hitting the woman in self-defense would make him guilty of violating the woman’s Modesty.

https://x.com/i/status/1785200886945620251

What about the ultimate physical abuse?

If the wife did “beat her husband to death”, is the fact that she used a stick & not something more deadly to kill him relevant at all? Yes, if the Supreme Court of India needs something to show they are being “kind” to a woman?

M-not-P. 7. Maintenance of spouse post divorce

It is normal for the higher paid spouse to pay maintenance to a lower paid spouse. In fact, we know a Doctor in NYC who ended up giving their house & paying maintenance to her husband. That is probably because USA is NOT a Patriarchy.

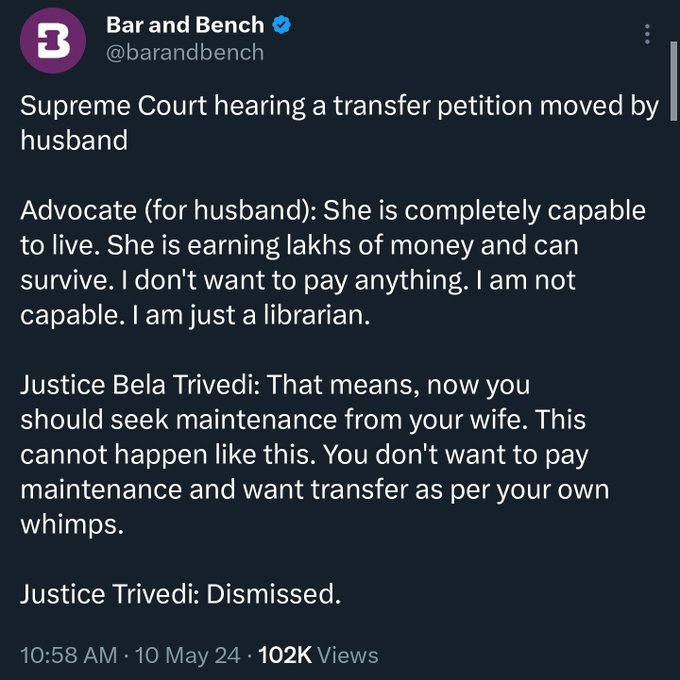

How does an Indian Judge think of asking a much wealthier wife to pay maintenance to a much lower paid husband? “This cannot happen like this“. Asking a much richer woman to pay maintenance to her husband is just too stunning for this Indian Supreme Court Judge!!!!

What happened to a husband because of maintenance he couldn’t pay?

- Arnaz Hathiram@ArnazHathiram – Heard @SanjayAzadSln on @KapilSibal podcast He was complaining how our jails are flooded with undertrials I never say this, but it’s KARMA that is coming for all politicians (BJP leaders will be next if they lose) Please read how medically ill husbands are thrown in jail thanks to all lopsided matrimonial laws in India ARTICLE IN THREAD BELOW@voiceformenind

What sane person would classify above Indian legal system or society as “Patriarchy”? So what prompted Ms. Dipali Goenka, a CEO & successful wife of a billionaire & related to one of the richest multi-billionaires in the world, to proclaim her unique achievement of raising her two daughters in her ultra-rich family? And what CNBC brand executive and/or TV anchor fell for Ms. Goenka’s unique achievement of raising her two daughters in a billionaire household?

This is another example of why we believe some key part of CNBC is consumed with anti-Hindu hate. Someone at CNBC made the decision to use Ms. Goenka’s use of “patriarchy” as a convenient excuse to depict today’s India in a anti-woman manner. All that mattered for that CNBC decision-maker was a chance to defame Indian society.

While the Melissa Lee clip was broadcast only once that day, the anti-India Dipali Goenka clip was broadcast multiple times on the afternoon shows at CNBC. As we recall, those were all shows anchored by CNBC’s Kelly Evans. But we don’t know whether that was her decision, her Producer’s decision or of someone higher. But they all, including Ms. Evans, should be deeply ashamed of themselves. Unless the CNBC women involved also believe their own Modesty is paramount & above the well-being of their own sons, fathers & spouses.

To us, this was simply the most racist anti-India display any one has ever orchestrated at CNBC, regardless of the decision-maker. And we can voice this opinion in America because the American legal system is based on Truth regardless of an American’s gender, race or any made-up characteristic like “Modesty“.

PS: To the best of our knowledge, none of the laws described above were actually legislated & passed by India’s Parliament. They were, we believe, laid down as dictates of India’s independent Judiciary. As we hear, the protests about these dictates are now proliferating & might catch speed after the current election is completed.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X.