Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Markets Last Week

Fixed Income:

- 30-year Treasury yield up 6.1 bps on the week; 20-yr yield up 6 bps; 10-yr up 4.6 bps; 7-yr up 4.2 bps; 5-yr up 3.7 bps; 3-yr up 5.8 bps; 2-yr up 6.6 bps; 1-yr up 4.6 bps;

- TLT down 1.3%; EDV down 49 bps; ZROZ down 1.8%; HYG down 29 bps; JNK down 47 bps; EMB down 1.1%; leveraged DPG up 58 bps; leveraged UTG up 3.1%;

US Indices:

- VIX down 9.3%; Dow up 3%; SPX up 2.9%; RSP up 2.2%; NDX up 3.5%; SMH up 3.2%; RUT up 3.2%; MDY up 3.7%; XLU up 2.3%;

Mega Caps:

- AAPL down 1.7%; AMZN up 40 bps; GOOGL up 1.3%; META up 8.9%; MSFT up 11.1%; NFLX up 4.8%; NVDA up 3.1%; MU up 1%;

Financials:

- BAC up 3.6%; C up 3.1%; GS up 3.9%; JPM up 3.8%; KRE up 4.1%; EUFN up 81 bps; SCHW up 4%; APO up 1%; BX up 3.7%; KKR up 2.9%; HDB up 1.8%; IBN up 2.9%;

Dollar was up 55 bps on UUP & up 41 bps on DXY:

- Gold down 2.5%; GDX down 3.6%; Silver down 2.8%; Copper down 4.2%; CLF up 11.9%; FCX up 67 bps; MOS up 4.4%; Oil down 7.5%; Brent down 8.2%; OIH up 1.9%; XLE down 58 bps;

International Stocks:

- EEM up 3.5%; FXI up 3%; KWEB up 4.9%; EWZ up 82 bps; EWY up 3.5%; EWG up 2.7%; INDA up 1.7%; INDY up 2.1%; EPI up 1.5%; SMIN up 90 bps;

In the midst of that appallingly stupid & almost-treasonous yelling of “Sell America” on that crazy Friday at CNBC, one man spoke sensibly & correctly. He has also been correct all year in his views on TV. Finally CNBC’s Carl Quintannia brought him on CNBC to explain the rebound. Zervos gave a sensible & correct answer & then Sara Eisen stepped in with her brilliant question “is it time to Buy America again“?

We think what David Zervos, Jeffries Chief Market Strategist, said from that moment onwards (about minute 3:30 of the clip below) is a must listen. Below are a few excerpts:

- “I don’t think Buy America ever stopped … there are people who will move to the Euro; Euro is the natural place , the biggest place you can go to as an alternative to the Dollar ; And it has been an incredible run in the past two months; the Euro is up 10% to the Dollar, …. this has been a major, major currency trade … I do think the Euro is going higher; … I think the Dollar is going weaker“

Why is this good for us, you ask? David Zervos said:

- ” the story is really the 1985 Plaza Accord story, an 85-style plot ; … In the trade negotiations, we are going to rebalance the playing field and part of that is ending what this Administration sees as currency manipulation; the Dollar is still very strong; within the last 20 years, Euro has been at 1.60; $/Yen at 75 and the Pound over 2; … this is an extraordinarily strong Dollar & it makes us less competitive …. I call it in US’s case a competitive re-valuation because we are not devaluing; its still a strong Dollar world; still a Reserve Currency Dollar “

What will the Trump Administration do?

- ” I think what they are going to put on the table is a program by which countries have to think about not just changing what they buy from the US; not just getting the trade imbalances set via purchases or thru tariff changes but also thru currency policy; …. a more Plaza-like dollar-rebalancing trade which should be really helpful in bringing our trade deficits down and rebalancing what this administration sees as an unfair trading playing field”

As we said, watch this entire clip:

Mike Wilson of Morgan Stanley also called a multi-year top in the Dollar this week on CNBC.

2. Equities

After a great couple of weeks, we have to begin with a cautionary message:

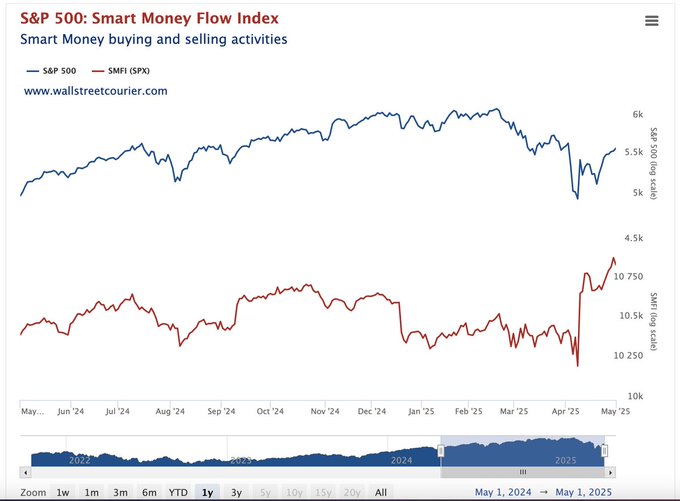

- Seth Golden@SethCL – Smart Money just “flinched” – Bearish divergence as of Friday, with $SPX $SPY markets going higher and yet Smart Money Flow Index faltered. Exhaustion and/or pause may be needed before another leg of rally. $QQQ $ES_F $NDX $IWM $RUT $NYA $VOO $DIA h/t @WallStCourier

A sensible comment that may be mocked by many:

- James DePorre@RevShark – I do not recall a period when there was this much market strength with such widespread negativity about the economy. The narrative that tariffs will be a huge economic disaster has been embraced as a near certainty. I don’t see any high-visibility strategists postulating a positive outcome. Much of it has to do with dislike of Trump, but it is creating classic contrarian action

How contrarian?

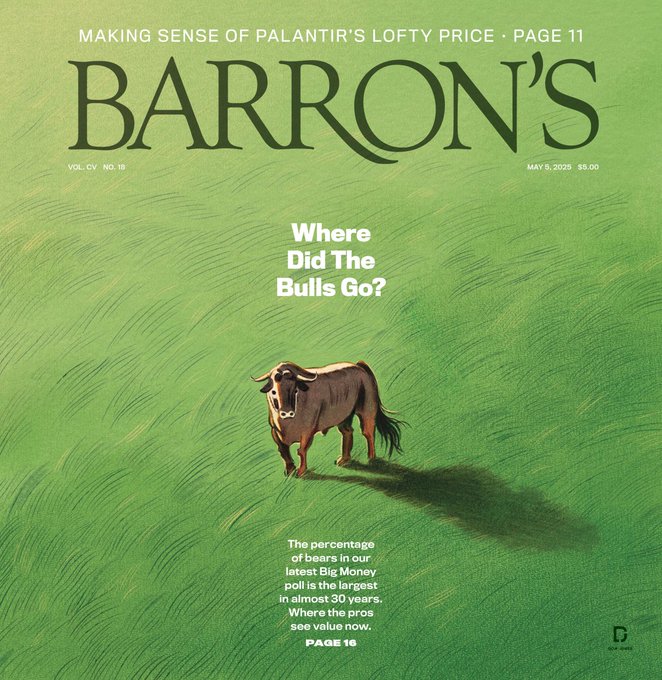

- Macro Charts@MacroCharts – Barron’s: Where Did The Bulls Go? “The percentage of bears in our latest Big Money poll is the largest in almost 30 years.”

And what leads price?

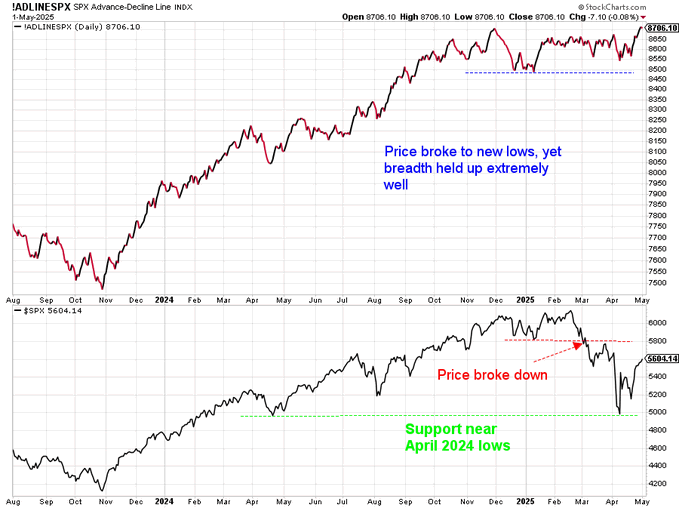

- Ryan Detrick, CMT@RyanDetrick – May 2 – One of the reasons we said the lows were in (before this 8 day win streak) was how well breadth was holding up. Now we have new highs for the S&P 500 A/D line, another clue the worst is over. Breadth leads price and it would be perfectly normal to see new highs in the S&P 500.

Why not actually hear from Mr. Detrick?

- “we had a 19% bear market … we know the economy is not perfect, it is slowing down …. but as of right now, we have corrected more than 50% of that near bear market …. from history, in these near bear markets, once you correct more than 50%, only once have we rolled back over to make new lows ; that was 2022; … the other 10 times before that, we didn’t make new lows … a lot more positives out there … market breadth has been so strong even on the 19% near bear market … look at Advance-Decline lines; they really held ; … learnt long time ago breadth leads price, this is a healthy market; tell you what, the lows of the year are already in …. & the bulls are going to have a little more fun …. don’t sell in May & go away — we think there will be a good rally in May & into the next 6 months ….”

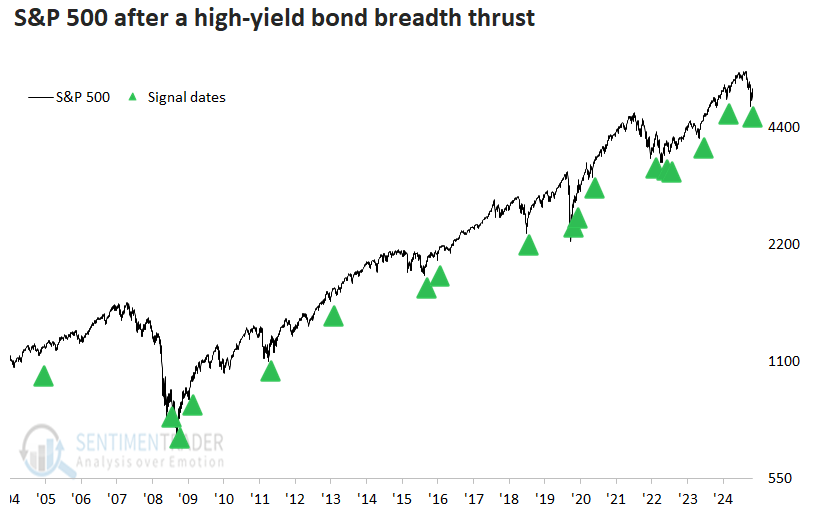

And how about a non-equity Breadth Thrust or (Breakaway Momentum that could actually prove to be bullish for equities?

- SentimenTrader@sentimentrader – The most risky corporate bonds, high-yield, triggered a breadth thrust, often referred to as breakaway momentum, a concept popularized by respected market analyst Walter Deemer. 🔗 Read @DeanChristians‘s Apr 30 article “High-yield bonds join the breadth thrust party”: https://users.sentimentrader.com/users/modeledge/high-yield-bonds-join-the-breadth-thrust-party

We began this section with caution and we end it with another speculative element of caution that fits in with the Interest Rates section below:

- The Market Ear@themarketear – 2008 or 2020? GS: “YTD Nasdaq performance (light blue line) is tracking a very similar trajectory to both 2020 (green line) and 2008 (dark blue line); in 1 instance, Nasdaq finished +40% for the year; in the other, it closed down 40% for the year ... “

3. Interest Rates

Treasury rates have been falling for the past 3 weeks on steadily declining data. Did that adequately price in the slowdown? To his credit, Mike Wilson of Morgan Stanley said yes &:

- Seth Golden@SethCL – M.S. Mike Wilson: Is a growth slowdown priced in? Ab-so-lute-ly, and more so than may need to be. This week’s ISM manufacturing could be the bigger market mover than even payrolls. $SPX $ES_F $SPY $QQQ $NYA $RUT $DIA $VOO $VIX

Wilson seemed more focused on this excess slowdown pricing for stocks but his view proved perfect for Treasury rates. Friday’s jump in Treasury yields was larger than the week’s overall rise in yields. The biggest movers on Friday were 1-yr T-bill rate & 2-year T-rate, both up over 12 bps on the day.

By Wednesday, inflation numbers seemed tame:

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – All PCE numbers came in much lower vs last month and both monthly PCE and monthly Core PCE came in flat. Both 12-month #s came in 40-bps lower than last month.

How do the 2-yr & 30-yr look ytd?

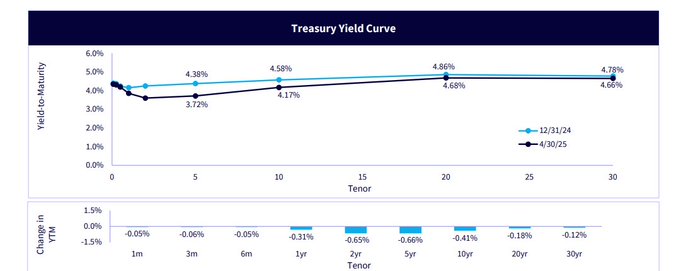

Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi – The 2yr is down 65bps YTD 30yr off just 12bps

The real question is whether the slowdown in soft data is now being seen in the hard data? Peter Tchir of Academy Securities was the first to highlight that on Bloomberg “... the economic data is starting to look weak; look at the ADP today, it is coming in; everyone’s been waiting to see the soft data translate into weak hard data; I think we are just starting to see that; I am not optimistic right now unfortunately;”

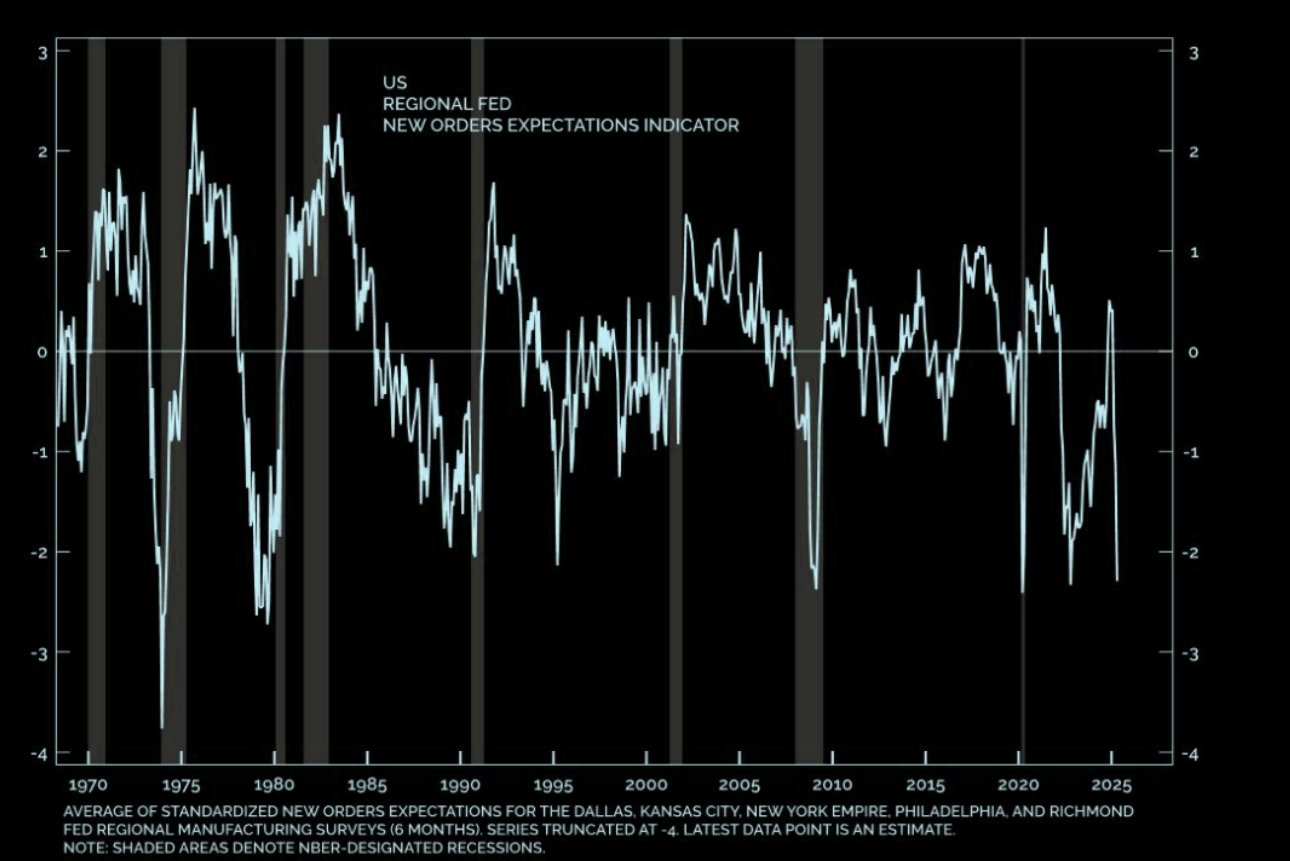

Are new orders holding up? Not according to:

- The Market Ear – Deep into recessionary territory – The new order components of the regional Fed PMIs have collapsed deep into recessionary territory.

A troubling commentary came from Evan Sohn of Aura Intelligence on Thursday who pointed out that “Staffing & Recruiting for the year is down 28%; HR (Human Resources) is down 40% for the year“. This entire clip is worth a serious listen, in our opinion:

That fits in with

- Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi – Torsten at Apollo: We could see a dramatic weakening in the labor market over the coming months.

And then you have Home Prices starting to crack from straight shooter Diana Olick of CNBC:

We have begun to recall the soft data vs. hard data debate from 2007 & 2008 when that Fed kept focusing on hard data & the comforting fact that Treasury rates were stable to moving up. Then came June & the picture changed in both 2007 & 2008.

Below is the chart of the 30-yr yield from Jan 1 2007 to 31 October 2007. Look the 30-yr yield went higher through out May 20027 & then peaked in June 2007 & then ……

Below is the chart of the 30-yr yield from January 1 2008 to October 31, 2008. Look again at the 30-yr yield peak in June 2008 & then it began falling.

Today there is no indication that Q3 will bring in a severe slowdown but look back & recall that there was no indication of a severe slowdown in June 2007 or even June 2008. And given what we are seeing in the world today, you have to be blind or a total looking-back brain to think severe inflation is likely in the next few months.

Look what gentle, calm & usually upbeat Nancy Tengler, CEO+CIO of a wealth management firm said on Bloomberg The Open (minute 20:21) on Thursday in response to a question from BTV’s Matt Miller:

- “The Fed Chairman has been 100% wrong at every turning point & I think that when I make mistakes, it engenders humility; But there is NO humility from this Fed; … this would be a good time to cut as opposed to last August & September when he cut 50 bps & ultimately 100 bps and the 10-year rose; I think the market has expressed a lack of confidence in this Fed; I think the stubborn sort of heels dug-in with “we are going to wait for the data“; that guarantees they are going to be too late.”

The ideal overnight rate should be a bit below the 2-yr Treasury yield. And that is where MV-ONR rate is & stays at 3.75%. But we confess that as & if the hard data begins to move even closer to the soft data, MacroViewpoints is likely to cut the current 3.75% ONR to a lower number.

In this respect, we urge readers to read the Second Quarter 2024 Quarterly Review & Outlook from Hoisington Management that was just released. Of particular interest should be the final section titled Cyclical Indicators Forecasting Slump. A couple of excerpts below:

- “The average real GDP and GDI per capita growth fell meaningfully below the paltry 20-year trend growth in the first quarter. Three of the six monthly cycle dating indicators of the National Bureau of Economics Research (NBER) have revealed a shift from expansion to contraction. …. Cyclical economic deterioration and constrictive monetary and fiscal factors point to a weaker economy, less inflation, and low Treasury yields.”

4. The One Predominant Factor – both short term & long term

Friday morning we got a sliver of positive speculation about Chinese plans to cut Fentanyl supply to America. And look what happened on Friday:

KWEB EEM

If you believe that the USA-China trade conflict will be either resolved or at least cooled down, then China-focused ETFs are absolute buys. On the other hand, if you believe some of the stories coming out of China, at most a small position makes more sense.

Let us be clear. The fundamentals of the conflict are as clear as they were after Pearl Harbor under President Roosevelt. Just listen to Secretary Bessent lay it out simply & succinctly.

The clip above also shows reporters engaging in a terse harangue with Treasury Secretary about who called/met whom? The questioner assumes that if anyone is not being not entirely honest, it is the Trump Administration. Interestingly we saw & heard the clip dated May 1,2025 titled – Protracted War: Xi’s plan to outlast the U.S. in the trade war. Listen at 0:45 to what it revealed:

- “Trump said Xi Jin Ping would have to call him first … so grudgingly Xi called ; But instead of talking Tariffs, Xi went straight for Trump’s hot button – Taiwan; Meanwhile, China’s foreign & commerce ministries scrambled to deny that any talks were happening at all; Chinese officials insisted there were no talks, no negotiations, no agreements with the Americans; But Trump told the press our people have been talking with them “

Then, the clip reports:

- “on the 24th, South Korean media spotted something unusual – A Chinese delegation was seen making a secret early morning trip around 7 am to the US Treasury department; Its believed that China’s finance minister quietly slipped away from the G20 finance meeting in DC taking 10 aides with him for a closed door meeting at the Treasury; What was discussed? No one knows. We are already seeing the aftermath and it doesn’t look good ; The talks appear to have failed; both sides walked away angry“;

So, if true, the above points out that Pres. Trump was correct & China was deliberately giving out false news. Then “How do we know? , asks Ms. Lei herself about the failure of the above meeting that China says wasn’t even held. The answer from Ms. Lei below:

- “Well, Trump didn’t hold back; In an interview with ABC, when asked about the new 145% tariff on Chinese goods, he said bluntly “they deserve it“; Beijing wasn’t just upset; they wanted to make a public statement; almost immediately after the secret talks collapsed, China’s foreign minister Wang Yi showed up at a BRICS meeting in Brazil and gave a fiery speech calling on BRICS nations to unite against the US; He warned that appeasing the bully would only make it stronger; And if the world stayed silent, compromised or backed down, the bully would only push further.”

Then Ms. Lei adds:

- “So in my assessment the not-so-secret US-China trade talks collapsed and Beijing is furious. Just a day later, Chinese ministry released a 2-minute slick dramatic video, this time with both Chinese & English subtitles; … asked Chinese to read Chairman Mao’s speech in 1930s called Armed, Protracted War or How China will Win? … Mao wrote the speech in May 1938 during the early stages of the Sino-Japanese War ; message being that China can survive & defeat a stronger enemy by mounting a long struggle; … CCP is signaling that it plans to apply Mao’s strategies to the current trade war;”

Ms. Lei adds further:

- “In my view, we have completed stage 1 & are now entering the strategic stalemate phase; .. so they are preparing for the trade war to be long, painful & costly; Tactic = lower tariffs on some goods as a soft approach but impose higher tariffs on others; pull back in certain areas while pushing back on others …. goal is to drag out the conflict & exploit divisions inside the US; Xi’s top loyalist … is going to lead this battle …. Beijing is preparing for a long, painful battle .…”

But what about the talk about Xi losing power & his trusted allies being removed from CMC, Central Military Council? Ms. Lei had discussed this in her clip released just 5 days before on April 26, 2025. That clip is titled Xi’s CCP rivals use the tariff war to bring him down. The clip discusses 3 questions, as its introduction says:

- 1. Who are the real enemies lurking within the CCP?

- 2. What do they secretly want — and what are they hoping to avoid — as the tariff war escalates?

- 3. Has Xi Jinping fallen into a trap he can’t escape?

We urge all to watch this clip. It shows the broad & deep coalition of allies of previous rulers lined up against Xi and the fact that the coalition is itself splintered into factions with conflicting goals. Ms. Lei’s conclusion seems to be that the anti-Xi coalition will probably let Xi really fail in this trade conflict & then remove him. Doing so during the early-mid stages of the trade war might put them at risk if they depose Xi & fail badly themselves. Watch this clip at least to get an idea of how complex this trade war has become in the CCP:

The above is probably the real game. What is happening to workers in China is being shown in many clips like the one below from China Observer on May 2, 2025 & titled The Tariff War Ignites China’s Social Pressure Cooker, Mass Strikes and Protests Sweep China:

The above is what we found in Chinese media from Chinese sources. Guess what we found from an American host named Morgan Brennan working for an American network named CNBC? Below is the one question she asked Mark Mobius, one of the most well-known emerging market investors in the world:

- “How about China? Because we know that the domestic economy there has struggled; I have spoken to a number of CEOs, with big businesses there, who say they are seeing green shoots but amidst this US-China trade war, one of the pieces that perhaps is getting overlooked is just how much negotiations between the US & other countries around trade right now are sort of aimed at ringfencing China in; & I will give you an example – Indonesia has apparently put forward a proposal to the USTR that hinges on two key points: first Indonesia would lower the trade gap with America, bolster American imports but the second is that Jakarta will reduce imports from other countries ; they import a lot from China; is we see more of these types of deals struck with the US, how great is the risk for China?”

Read the entire question again & perhaps you might wonder as we did! Not one iota of concern about “how great is the risk to America?; and not one iota of satisfaction that what Indonesia & other countries are doing will benefit the American worker & USA. The entire question revolves around sympathy for China & lack of concern about American worker or US economy. And in case you didn’t know, Ms. Brennan mainly covers the Defense sector and China does not buy US weapons. So which CEOs did she talk with to get so sympathetic towards China?

Mark Mobius, in stark contrast, was honest, factual and clear in his response:

- “I think China is in a very very bad situation because the target by the US is China; there is no question about that; & a lot of practices that took place under the World Trade Organization were violated time & time again and I believe at the end of the day, China is really going to be in trouble unless they come to the table & concede an awful lot. I am afraid that, given the current political structure in China, they will not be willing to do that and that is not a good sign. I believe, at the end of the day, other countries like Indonesia will open up their markets, reach an agreement with US because the danger here is transshipments; the US is going to watch very carefully any transshipments, meaning Chinese goods going thru Vietnam. Indonesia & all these other countries will be severely curtailed. ”

Upon hearing this answer, Ms. Brennan remained silent & her co-host Jon Fortt merely said “Ok, Mark Mobius“! What a pro-America TV Network, right!!

To be fair to this CNBC co-host team, they might have shown less of a pro-China attitude because, in our opinion, their usual stance is distaste & even contempt of India. And Mark Mobius was very positive about India at the beginning of their conversation saying” India is still the story; India is doing very well & I believe India is going to be benefiting from what’s happening between China & USA”. Listen to his comments about India & China below as well about Latin America.

5. “India, India, India..”

So she let out her frustration at how her interview with an financial executive went . And how intense must that frustration be? Because CNBC’s Sara Eisen usually, at least the way we see it, expresses her feelings about India in a meanish but low-intensity sort of way. But in this case, she just let it out. She was describing to her co-host her frustration at her interview in which the American executive kept talking about the company’s growth in India despite it being a small percentage of the overall revenue. Frankly, we thought it was funny.

In honor of her outburst, in this section we will cover India, India, India from three angles.

Everybody knows the intense & sizable correction the Indian Rupee & the Indian stock market went thru starting in late September 2024. But as we pointed out in our March 16, 2025 article (same article in which we featured Get Ready to Rally call of Larry Williams), that year to date INDA had moved ahead of S&P 500 at the beginning of March 2025. In that article, we had also highlighted observations of Ridham Desai of Morgan Stanley:

- “RBI (Reserve Bank of India) has put a 3-pronged correction – cutting interest rates; committing itself to liquidity & starting to lift regulatory burden on Banks … India’s policy environment today is far more certain than the rest of the world’s, whether it is US, Europe or China … look what bond investors are doing; 900 million dollars of inflows two weeks ago; last week 2 billion; Foreign debt flows have turned vertical (via gesture) ; they are suggesting that Rupee has now reached a level where they don’t expect much more in terms of downdraft; that has been a very important change that has happened“

All that proved correct. Look at the INDA performance ytd:

Sara Eisen was not the only CNBC host frustrated about India. Jon Fortt was much more subtle than Eisen but he made his lack of positive feedback about India clear to Emerging Markets Guru Mark Mobius on Monday this past week. Mobius’s comments are below:

- “India is still the story; India is doing very well & I believe India is going to be benefiting from what’s happening between China & USA; … a lot of manufacturing requiring high labor inputs would go to India obviously; …. India is gradually coming to an agreement with the US; …. that will be very positive for India; …. I don’t believe that it (recent India-Napak problem) will have much impact on India’s ability to export-import & manufacture…. its too big a country to be harmed by these kinds of issues … “

Then on Friday, something happened for the first time. Domestic Institutional Investors went ahead of Foreign Institutional Investors in their ownership of Indian stocks:

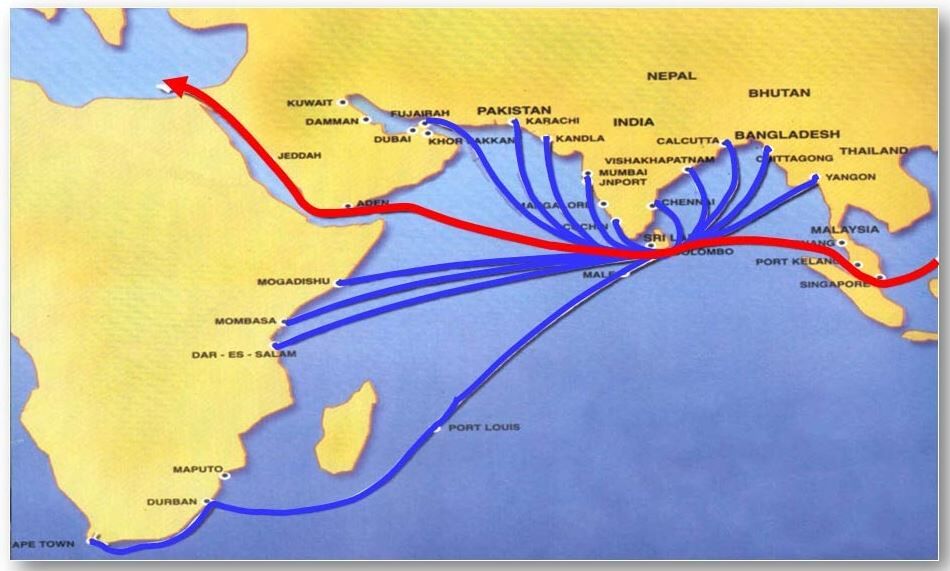

Moving on to the 3rd India item of the week, PM Modi inaugurated India’s 1st transshipment port on the south-eastern coast of India that will not only save India about $220 million but also create a long term competitor to Sri Lanka’s Colombo port, the current dominant port for international cargo. We had discussed it before in our December 25, 2023 article.

And what did Adani Ports stock do that day or in the 3 weeks prior to inauguration of this port?

And what is the scale of cargo traffic this Indian transshipment port can compete for? It is the red arrow from Asia thru Straits of Malacca to the Suez Canal or the Straits of Hormuz.

And what is proximity of this new seaport to the huge naval flow in red above?

No need to say more except re-expressing our personal thanks to Bloomberg’s Annabelle Droulers for her determined, honest & free reporting of the Adani Washout in February 2023 when Adani Ports traded at around Rs. 400/-.

Finally & with apologies to Sara Eisen for breaking her 3 India mentions limit, below is this week’s 4th case in which India benefits & is shown in a positive way:

Send your feedback to [email protected] Or @MacroViewpoints on X.