Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.A heartwarming Christmas Eve

Yes, a pro Quarterback is a terrific position with compensation to match. No position is more responsible for winning or losing a game. Yet, quarterbacks with talent are often treated badly & almost abused to the point of being wrecked by their ignorant & arrogant coaches.

We were so happy to see some of these quarterbacks have found a home and success under a smart coach. Take Baker Mayfield – picked as a No. 1 draft pick by Cleveland & then discarded by a terrible owner. After trying out from team to team, we are delighted that he has found success and a home with Tampa Bay.

Another College Champion is Tua Tagovailova, the guy who won a national championship at Alabama. As Jimmy Johnson said on Fox OT on Sunday, he was a wreck, mental & physical, under a different management at Miami. Now, under an intelligent coach like Mike McDaniel, Tua looked like Tua again in driving his team for the win against Dallas on Sunday. In fact, Coach McDaniel can’t seem to stop praising Tua, said Jimmy Johnson.

Then we have Detroit Lions, the team that hasn’t won anything for 30 years. They finally got a terrific coach like Dan Campbell; they did a trade sending a terrific quarterback like Mathew Stafford to LA Rams & getting Jared Goff & other draft picks. They got Michigan’s defensive end Aidan Hutchinson on a number 1 pick. All that paid off against Minnesota Vikings which we also like on Sunday. And Detroit won its division for the 1st time in 30 years, something Hutchinson said felt like beating Ohio State after losing year after year to the Buckeyes.

Rarely have we seen good things happen to so many good guys as it happened on this Christmas Eve. With that feeling, don’t blame us if we begin & focus on happy, bullish predictions below.

2. “immaculate disinflation on steroids”

Believe it or not, this phrase came from the sometimes dour Lisa Abramowicz (“LA”) of Bloomberg Surveillance on Thursday, December 21. Ms. LA was trying to digest what Mary Ann Bartels of Sanctuary Wealth was suggesting when she used the phrase. Below is a detailed description of the views of Ms. Bartels expressed on the above-mentioned show. We recommend listening to this entire 22-minute Bloomberg Open show to really understand both the reasoning & predictions of Ms. Bartels:

At minute 1:52:

- “Going into 2024, we think inflation continues to go down & I wouldn’t be surprised if, either in 2024 or 2025, we actually go to a negative CPI. And I don’t think that is being factored in. In terms of growth, when I am analyzing the year/year change in real growth, its actually improving. So I think its actually possible that you have inflation come down lower than people expect in 2024 and we have better growth. That’s positive for earnings; that’s positive for for the equity market.”

- “Now for the fixed come market, I think short term we can get a backup in rates because rates have moved. But I think if inflation continues to drop and the Fed begins cutting rates, Rates are going to fall a lot lower than people expect. So we are calling the year of 2024 the Bucking Bull. I think people are going to be bucking the bull market in both bonds & stocks in 2024.”

Then at minute 6:00:

- “When I look at the 10-yr Treasury yield, I just want to add, what people are not pricing in, is that at some point, whether in 2024 or 2025, the 10-year yield can go to 2.5%. I am always looking for what is possible that the market is not expecting. And, from technical analysis, 2.5% is actually doable. So, if you actually get those inflation numbers down, I think that’s going to be a huge surprise and if, rates continue to fall the way we think they can, that’s really going to continue to ignite the equity market.”

- “Now we’re starting to see a broadening; we are starting to see what didn’t work this year like Small Caps, Banks & Financials rally. But the question is are these the new leadership? and we don’t think that’s where the new leadership is. We do think the market stays cyclical. We think the new emerging leadership is in the Industrial space, leveraged into Biden’s legislations – CHIPS Act, Infrastructure Act, the Inflation Protection Act.“

- “I think the true leadership in the market remains Technology and the pocket that we think sustains that leadership are Semiconductors. I know they are up a lot this year. They can certainly consolidate into 2024. But I still see significant upside. In fact, they are just starting a new cycle. And when they start a new upcycle, that generally lasts for a couple of years. And in terms of the Magnificent 7, they were actually supported by earnings. It wasn’t our putting in wind sauce in these stocks. They actually produced the earnings this year when the other stocks did not produce the earnings. So I do think that they can continue to participate, but you will see the space actually broaden out” (7:51 minute).

Then about Credit at minute 12;45:

- “we are (bullish on credit) but we want to stick with quality. We moved our duration & went to benchmark a few months ago. And we’ve actually been in the high yield market because of the lack of issuance. …. Although we see inflation coming down this year, we think over time, inflation is going to re-accelerate & actually yields will get back up again” (minute 13:40).

Kudos to Ms. Lisa Abramowicz. Few anchors would have let their guests speak so much without interrupting.

After the talk about a new upcycle in Semiconductors, how can we exit this section without the below?

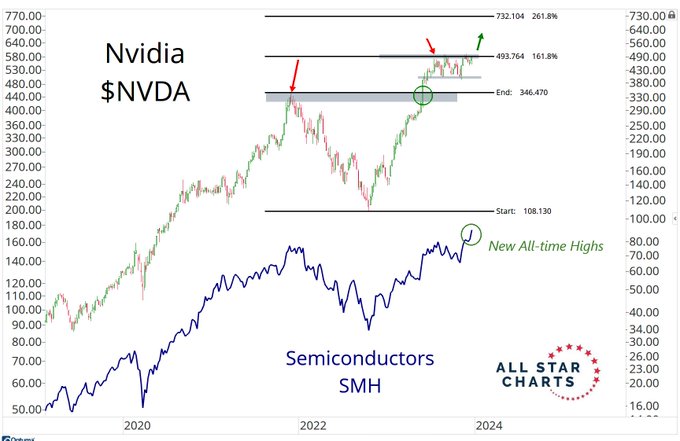

- Joe Kunkle@OptionsHawk – Dec 20 – $NVDA monthly, just coiled under that 1.618 Fib extension

And,

- J.C. Parets@allstarcharts – Dec 20 – Another 50% rally coming in Nvidia $NVDA https://allstarcharts.com/nvidia-ready-for-another-50-rally/

And is there really a possibility rates could fall a lot & hard? Doesn’t that depend on how restrictive & high Fed has maintained rates?

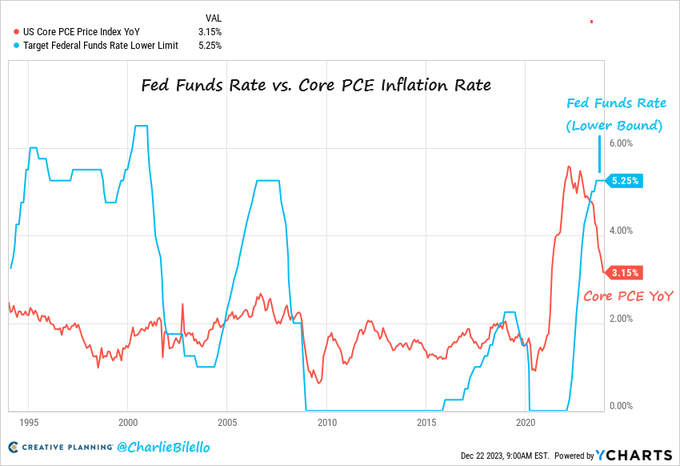

- Charlie Bilello@charliebilello – Dec 22 – The Fed’s preferred measure of inflation (Core PCE) moved down to 3.2% in November, the lowest since March 2021. The Fed Funds Rate is now more than 2% above Core PCE, the most restrictive monetary policy we’ve seen since October 2007.

3. Credit Risk over Duration Risk & correction in 10-year yield

Those who don’t recall Peter Tchir of Academy Securities should, if they care, take another look at Section 3.5 titled The Really Big Risk of our October 8, 2023 article and his starkly memorable quote on Bloomberg Surveillance on Thursday, October 5:

- “I do think something has cracked; for the first time in my life time, people are actually questioning exactly where Treasuries are going to be & that is very concerning to me“

His current views, as expressed on Bloomberg Surveillance on Thursday, October 21, 2023, reflect the massive rally since then & his “that’s just overdone” feeling. It is a useful & smart discussion that can be found in that clip from minute 1;43:00 to 1:50:23. He thinks the 10-yr yield will go back to 4.10%-4.20% range & he doesn’t see much more than a 5% drop. What we found interesting is what “things he is looking buy“.

- “I want to own energy stocks; I don’t love Oil itself but I think energy stocks … are top candidates for M&A activity; … less enthusiastic about the banking side of things; less enthusiastic about Russell 2000 as a whole. But I do like energy and I do like commercial real estate to be honest”

- “I am very comfortable with credit risk; at the investment grade side of things, there is an ongoing thesis that I have that people are going to over-weight investment grade credit vs. Treasuries. I think you are getting much better signals from a lot of US companies – they did such a good job both issuing long-dated debt”

- “then at the other end of the spectrum I think people have been so bearish on the CCCs, B- sector, especially in leveraged loans, that money is going to start coming into the market; a lot of money got allocated to distressed debt investors – those distressed debt opportunities aren’t coming up; so if they have to chase that market & … you get a really nice squeeze in credit; you get the bottom-end doing better; you get the high quality doing well; if you see the CLO market return more robustly – signs are that is going to happen; that will help credit ; I actually like Credit risk better than duration risk“

But isn’t credit risk kinda synonymous with liquidity? If so, how does liquidity look to smart observers? This was answered by Tom McClellan in his article on Thursday, December 21, 2023 titled Plenty of Strength in HY Bond A-D Line :

- “Now we are once again seeing great strength in this A-D Line, as it is going up at a very steep angle, and matching the price gains of the SP500 step for step. The message is that liquidity is plentiful, and should remain so for a while. There is no sign of a divergence yet, and I would expect that we shall see a divergence with prices before any real trouble gets started. That has been the track record for these data, which FINRA publishes going back as far as 2005.”

Note he doesn’t rule out trouble ahead but says we will see the trouble coming via divergence in prices.

4. Soft Landing vs. Recession in 2024 & When?

One economist answered it straight by saying she needs “3-6 months

- to NOT have a rise in unemployment;

- to NOT see consumer materially pull back;

- to NOT see Cap-ex decline.“

She adds,

- “we are talking 6 months from now if we have NOT seen this develop, then yes this time is remarkably different and we have to change our tune. But we have not yet seen that relationship between rates & economy break just yet.”

Such clarity of thought & intellectual honesty is why we have tried to listen to Frances Donald of Manulife when we can. Listen to her yourselves below:

The following day, she discussed emerging markets & Europe on Bloomberg Surveillance (minute 31:05 to 38:15). Interestingly she appeared to be more stern/angry than she was on CNBC Exchange above while still making the important but possibly controversial point that ” the consumer is declining, slowing; we don’t need the consumer to be in a recession for the US economy to be in a recession“:

- “… we are in a global easing cycle; every single day I see an emerging market cutting; they led the cycle on the way up; they are clearly leading on the way down. Every morning I wake up to inflation prints that are surprising to the downside; … the toothpaste is out of the tube … we have already effectively eased; … if we get easing out of financial markets, it will help us come out faster; we will reduce the odds of a financial accident; … Germany is most probably in a recession; whole range of DMs are in recession; Asia is slowing prominently; …. it takes 2 years from the 1st rate hike to impact the labor market; that’s Q1. until we get thru the next 3-6 months, we can’t say the relationship between rates & labor markets is broken “.

Speaking of next 6 months, what signal is the US stock market sending? Jeff DeGraff of RenMac came on CNBC to speak to (of all people) David Faber & reiterate what he had said the week before about 71% pf the S&P having hit 20-day highs:

- “… 6 other times that has happened since 1957, the return over next 6 months was 14%; … you might get a pullback or pause but again the burden of proof is absolutely on the bears here; history, internal momentum which is really important has really confirmed & we think it implied escape velocity for the S&P; … so I think there is more to go here ; …. the 20-day high implies breadth; its about the 493 stocks … tactically in February you might see animal nature coming back … its a little frothy but its more an outlier in this case …”

5. Back to folks who carried us this year

- Bespoke@bespokeinvest – Dec 23 – Four charts highlighting the shift lower in inflation: commodities down, unit labor costs down, supply chain stress down, and money supply down.

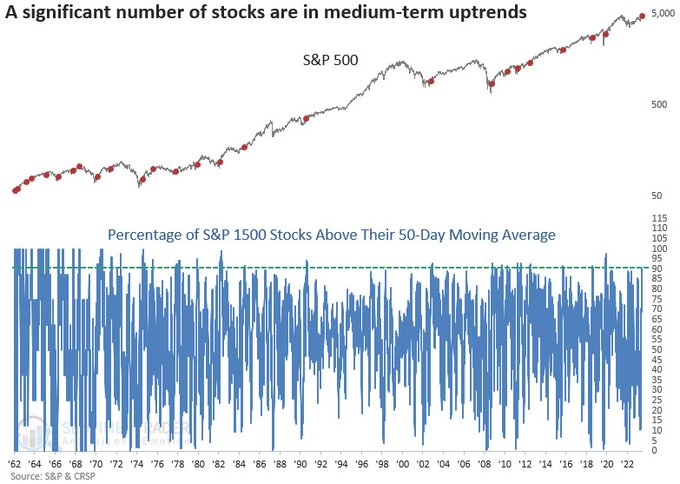

- Dean Christians, CMT@DeanChristians – Dec 23 – A former money manager, George Chestnutt, once said, “The best forecaster of market action is the action of the market itself.” With over 90% of S&P 1500 stocks in medium-term uptrends, Mr. Market suggests the outlook for the S&P 500 is favorable.

- Jay Kaeppel@jaykaeppel – Dec 23 – % of SPY stocks above 50-day MA crosses above 90%. Since 2000, SPY higher 98% of the time 12 mos. later. Median gain +13.8%. A “sure thing?” Nope. An item for the favorable side of the ledger? Yep.

What about next week?

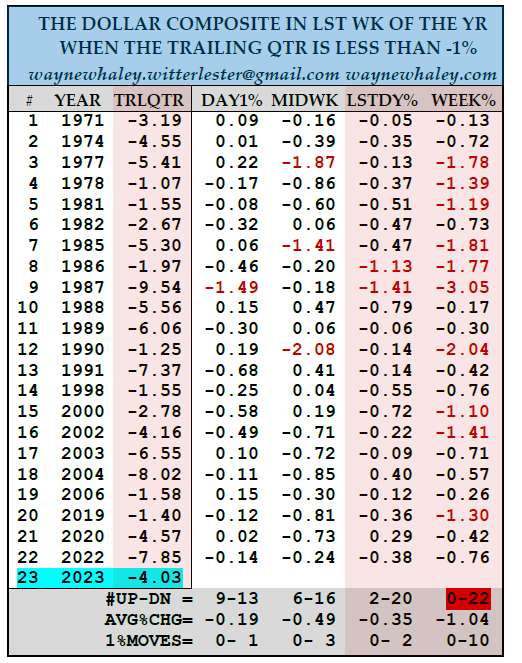

- Wayne Whaley@WayneWhaley1136 – 0-22 DOLLAR COMPOSITE SETUP FOR LAST WEEK OF YEAR. Define the last week of year at Dec25-31 and trailing qtr at Sep25-Dec25. I see 2023 trailing qtr of -4.03%. I have dollar data from 1971. Since 1971, if trailing qtr is < -1%, Last wk of yr is 0-22.

But,

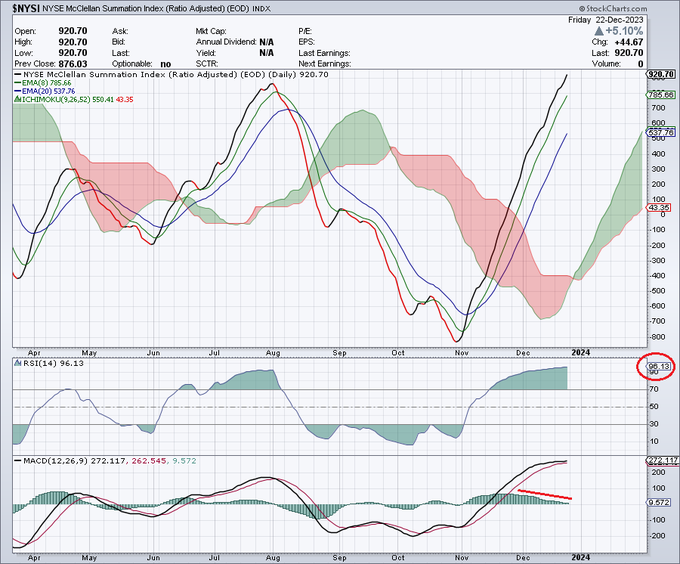

- Trader Z@angrybear168 – Dec 24 – $SPY NYSE summation index still in bullish mode but MACD momentum waning + overbought RSI, stay nimble.

And,

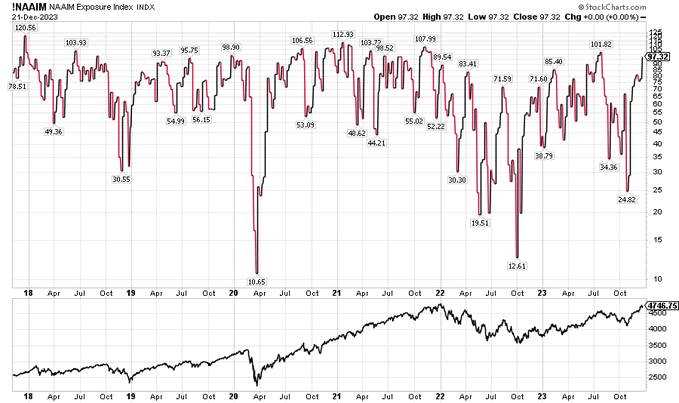

- CyclesFan@CyclesFan – Dec 22 – I’ve seen a few posts about NAAIM being at 97%. A high number in December doesn’t mean much. In December 2017 it hit 120%. SPX topped only 6 weeks later. In December 2019 it hit 99%. SPX topped only 8 weeks later. In December 2020 it hit 106%. SPX topped only 8 weeks later.

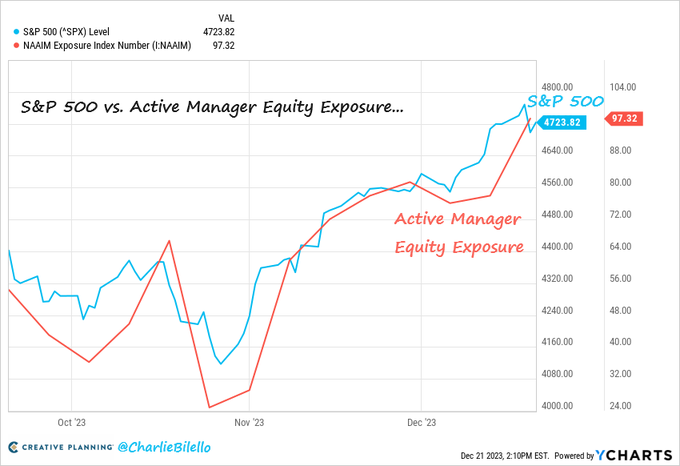

Doesn’t the above fit with DeGraff’s animal spirits in February warning? And how big has been the NAAIM rise?

- Charlie Bilello@charliebilello – Dec 22 – Active managers had less than 25% exposure to equities in late October when the S&P 500 was at 4,100. Today their equity exposure has jumped to 97% with the S&P 500 above 4,700.

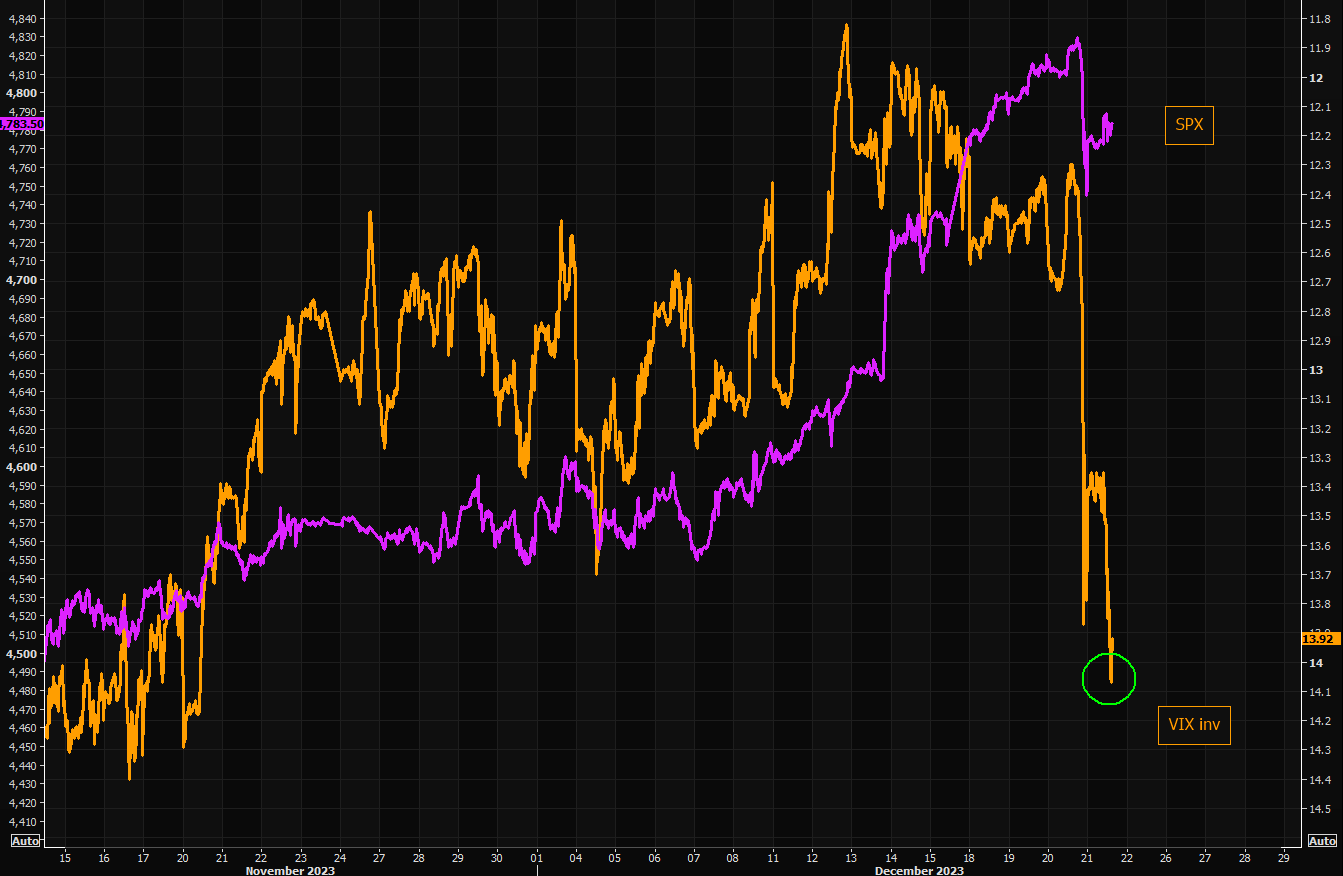

What about the VIX?

- Via The Market Ear – Dec 21 – Somebody is nervous – VIX continues moving higher today, despite the fact SPX has managed bouncing from yesterday’s panic. The sudden bid in volatility shouldn’t be dismissed. VIX hasn’t closed here since November 20. Chart shows SPX vs VIX inverted.

6. “Perfect” Emerging Market?

First & foremost, we must say that it gives us a good feeling to see a veteran with at least a Quasi-Indian* name speak about India & that too in such magnanimous terms. Not merely that, but his first clip below goes right to the digitization revolution going on in India, the latest evidence of which is a $12 mobile phone that brought the recent Cricket World to virtually every Indian’s cell phone. How could Disney compete with that reach of Reliance?

*Advani, Lalvani, Gehani, Motvani, Belani, Masani, Shivdasani, Ramchandani, Jethmalani, Mirchandani, Khubchandani are names that we instantly remember; in fact, we have never heard of a name ending in “ani” that is not a Sindhi name (ex-Indian province of Sindh). So is it possible that the Pisani name is NOT of Sindhi origin? No, say we unless proven otherwise.

First, Pisani’s The “perfect” emerging market? clip focusing on India’s unique digital identification system & what it has enabled:

With this digital ID system, the Modi Government was able to direct Indian Banks to open several hundred million no-fee Bank Accounts for the poor – rural & semi-urban. This was a huge breakthrough because the Modi Government could deliver stimulus cash directly to the bank accounts of the needy instead of the old corrupt system of using local officials to deliver cash. In addition, state governments began sending salaries of workers directly to the bank accounts (in the wives’ names) instead of handing out weekly cash to workers. This eliminated the problem of male workers being enticed to stop at roadside bars to drink with their payroll cash.

The Modi Government & the Reserve Bank of India are totally focused on keeping inflation low. So during COVID, they were able to send aid to the poor via web-based vouchers deposited in their bank accounts that could ONLY be used by the recipients for food & education-vouchers that could only be used for the account holder’s kids. This use of food vouchers minimized inflation that would have resulted via cash payments to people. This is a big reason why India came through the COVID pandemic without generating high inflation.

So when you watch the above clip, keep in mind the scale of this technology delivery based on digital identity via cell-phones including $12 cell-phones with large amount of data.

The next Pisani clip is titled Then & Now: India versus China:

We also suggest this week’s discussion of India on Bloomberg TV with Trinh Nguyen, Senior Economist at Natixis. The clip opens with her stating “India is our key conviction call“.

Finally any one interested in investing in India should watch the 45-minute discussion by Ridham Desai of Morgan Stanley titled 6 Most Important Things To Watch Out For In 2024: The most important point Desai makes is:

- “we have a young population that is highly aspirant; that wants to win; its a force that is very difficult to counter; people should not, even for a moment. under-appreciate how much the rising lower middle income group wants to succeed; that’s our driving force; that is NOT an advantage almost any other country has”.

7. An emerging label for India?

India, in US eyes, has gone through phases. First it was known for Indian Doctors who had moved to America & practiced all over America. A couple of decades ago we met an Indian Doctor in a small town in Georgia who, he said, had delivered babies of every cop in that town & vicinity. So he said no cop one in town would ever think of giving him a speeding ticket. And the local Mercedes dealer would reserve for him the first car of a new model Mercedes produced.

Then India became known as the leader in the Technology services business via outsourcing. At that time, we recall a Project Manager telling us that “Indians are good techies but they are not managers“. A couple of decades later, it is hard to find a dominant large technology company that doesn’t have Indian-Americans in its senior management.

Now India is being increasingly known for the strength of its financial sector & the power of its large private banks like ICICI & HDFC. With clips like Pisani’s & the one of Nguyen Trinh, India is increasingly becoming a high conviction call. We hear that over $30 billion will flow into India for investment in Indian Bonds thus diversifying Indian firms into Debt investing & management.

But all that is known & mostly discounted. What then is the Next Big area for global recognition, revenue & respect for India?

We got interested thanks (& we mean serious thanks) to Hindenburg Research for their Washout of Adani Enterprises, India’s largest private ports management company. In the midst of that, Adani signed the deal to purchase the Haifa Port. We all know now that the Haifa Port is the final destination of the India-Middle East-EU economic corridor announced at a the G-20 this year. Yes, it is kinda dormant now because of the radiating turbulence of the Israel-Hamas battle. But, if you think about it, the mess in the Red Sea with Houthis actually is a big selling point to finalize, build & activate the IMEC corridor to avoid the Red Sea.

By the way, what a fantastic opportunity it was to step into Adani Enterprises stock, especially after laser-smart US distressed debt funds went in early February?

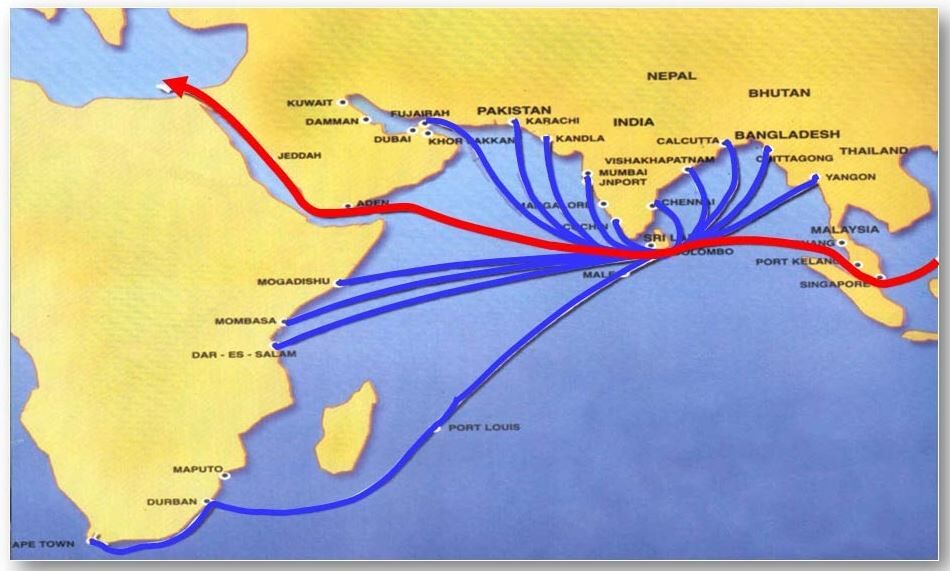

Fast forward to mid-November 2023 to notice the $553 million investment by US DFC (Development Finance Institution) in Adani’s Sri Lanka Port to counter Chinese influence. The scale of global traffic through Colombo is just huge:

Look closely at the map above & ask why doesn’t India have a international trans-shipment hub on its own western coast? It can be closer to the incoming traffic from the Straits of Hormuz, Arabian sea and the traffic from the Cape of Good Hope.

Since you ask, allow us to tell you that the first phase of such a new international trans-shipment opened in October 23 near the southern tip of India as shown below:

Since that doesn’t tell you much, below is a video clip that provides a better description:

Is this what might be a new label for India? Heck No! Not with the small stuff above. What you need to know is the huge scale of what India is building – an international trans-shipment port plus a naval-airforce base right on the top of the Malacca Straits. That is on the island of Great Nicobar that is bigger than Singapore & Dubai city combined.

Read our adjacent article “Is India on the cusp of a take-off” to read about it. The $9.5 billion has already been budgeted & the work has begun. That is a project that might India to reclaim the title “rules the waves” from Britannia. Seriously, the scale & the reach of the Great Nicobar project will surprise you.

Send your feedback to [email protected] Or @MacroViewpoints on X