Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.The Good Action

Our “bullish flavor” stock points of last week actually did prove bullish. It looked dicey after the NFP report on Friday morning, but the first hint of a turn came from Academy Securities on Friday morning via Zerohedge:

- zerohedge@zerohedge – Oct 6 – “expect, as the day goes on, for many in the markets to question the veracity of this report and for the early losses in bonds and stocks to be dramatically reduced, if not finish the day and the week in the green!” – Academy Securities

That did come true in stocks for the day and the week if not in bonds:

- Dow down 30 bps; SPX up 47 bps; NDX up 1.8%; SMH up 2.2%; RUT down 2.2% DJT down 1.1%; VIX down 40 bps;

The underlying strength was pointed out by Helene Meisler on Saturday:

- Helene Meisler@hmeisler – QQQ volume finally tops 70 million shares. First time in 2 months.

- Helene Meisler@hmeisler – At 68% Nasdaq’s up volume (as % of total) was the best since late August.

- Helene Meisler@hmeisler – SOX green 6 of the last 8 days

A summary of reasons for Friday’s “massive squeeze”came Via The Market Ear:

- 1. CTA positioning: Currently SHORT -$40B on SPX, the most significant short in the model’s history.

- 2. HFs have increased their short positions. US notional short exposure is around the 80th percentile since early 2018.

- 3. Rate volatility decreased…chart shows MOVE inv vs SPX.

- 4. Employment report was not as strong as headlines suggested. Wage growth was softer, and unemployment remained consistent in the household report. (GS)

The stars were the leaders:

- AAPL up 3.5%; GOOGL up 5.1%; META up 5.1%, MSFT up 5.1%, NVDA up 4.5%

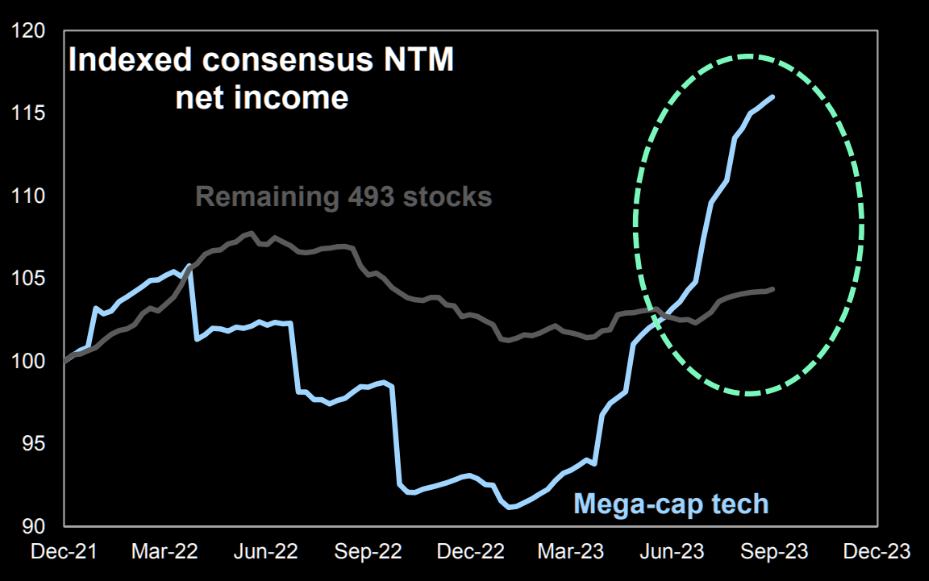

And just about most other sectors got hit, the worst of which was the disaster of the year – Bank of America down 5% for the week. To put it simply, the big negative in this market is Credit. So the stocks & sectors that have huge reserves of cash, balance sheet strength are, like the mega cap techs, are winners as the chart below via The Market Ear shows:

What is a more brutal way of saying this?

- J.C. Parets@allstarcharts – “S&P493“ is really just a cry for help.

Jeff DeGraaf of Renaissance Macro pivoted to a bullish posture for the rest of 2023 based on the spike of the 20-day lows to 56% (highest since the Silicon Valley Bank selloff). The 20-days lows have an 80% effectiveness of winners over losers., he said. DeGraff also alluded to the back up in Treasury yields but called it a strategic problem that will come up in 2024 but not a tactical problem for 2023. He pointed out that only 23% bullishness on Treasuries at this stage & that is supportive of stocks for the rest of 2023.

Another interesting viewpoint came from Mary Ann Bartels on Monday. She pointed out what trades well is the current leadership which tells her that “this is just a correction“. She said, based on their quantitative measures, the markets are actually cheap & certainly not as expensive as they appear to be. Regarding Treasury yields, she said the 10-yr can go up to 5% & back off and the 2-year won’t go up more. Based on all that she made a powerful call:

- “I think we could go into a super cycle of growth stocks … you are going to see PEs levels that will curl your toes .. we are not even there yet … “

Frankly, we are sympathetic to this view assuming this rates tantrum cools down with just a slowdown in the consumer & the economy. What might happen then, especially in the Mary Ann Bartels scenario above?

- Via The Market Ear – 1999? The NDX 1999 vs now chart updated… Source Refinitiv

2. Treasury Rates

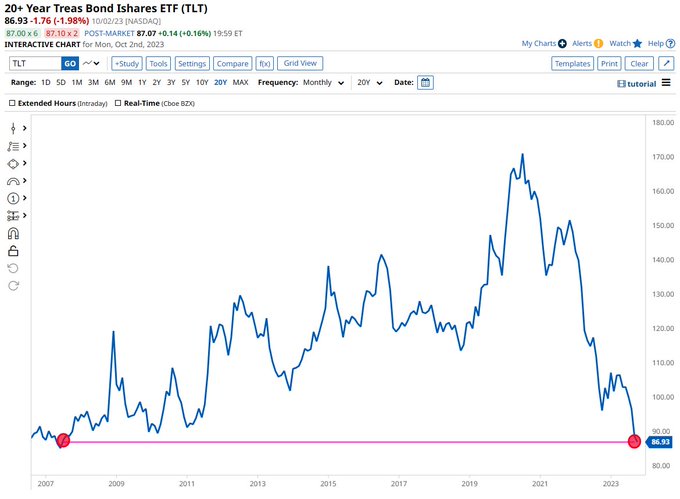

What a week in long duration Treasuries or TLT? Friday’s close looked terrible.

- Barchart@Barchart – 16-Year Low 🚨: $TLT closed at its lowest price in more than 16 years and is now approaching the lowest price since inception in 2002

Now a first buy of Bonds in 5 years from a money manager:

- Roy Mattox@RoyLMattox – Oct 5 – Buying bonds! We are adding the TLT which represents the 20 year Treasury bond down 53% off the high and making a 20 year low. First time we have bought a bond in 5 years across multitude of accounts.

And a smart trader:

- Joe Kunkle@OptionsHawk – Bonds have bottomed. There..I said it

Western Asset Management is a well-known money manager, one we have heard of since CNBC had a good & thoughtful show named Strategy Session. Below is their portfolio manager John Bellows talking about why they are buying bonds:

A parable about parabolic assets:

- Walter Deemer@WalterDeemer – Oct 6 – “Parabolic advances usually carry further than you think, but they do not correct by going sideways.” — Bob Farrell

In contrast, a crystal clear message from one who experienced a huge crisis:

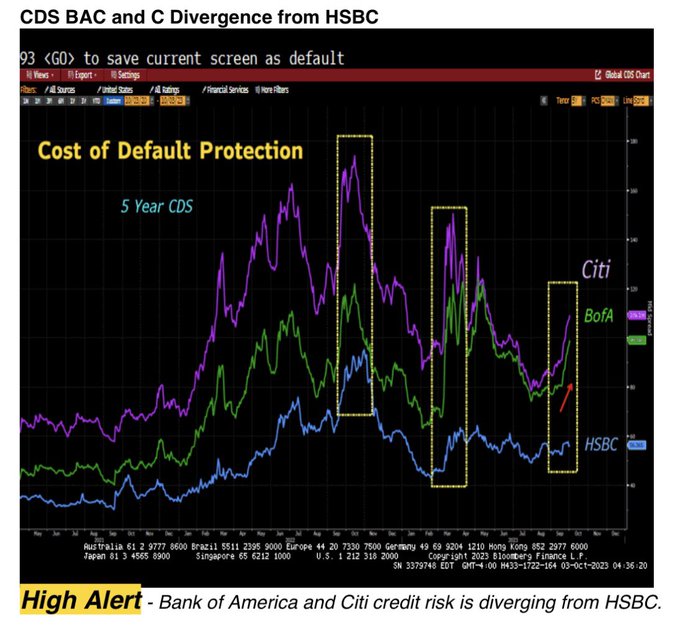

- Lawrence McDonald@Convertbond – Implications for Markets 1. Possible — SIZE — short covering in US Treasuries, CFTC data shows the market is extremely positioned short. This crowd is way offsides now. 2. EM Credit risk, CDS has been moving wider for weeks. Dollar strength – a Fed exporting inflation to emerging markets – wrecking-ball status. Watch Citi C equity, with possible large exposure to Middle East EM. 3. Gold will be bid, 1-2% higher is likely. 4. Oil, Brent will likely be $3-6 higher, maybe more. Transportation risk in the region is now high. We are now in a multipolar world, yet most investors have a portfolio designed for unipolar complacency.

Finally, a very important linkage:

- Lawrence McDonald@Convertbond – – With US Treasuries at 5%, Bank of America is close to 45x levered, at 6-7% infinitely levered. youtube.com/watch?v=bWiBI0

3. Our Reflections – Treasuries, Banks, FED et al – in 6 sections

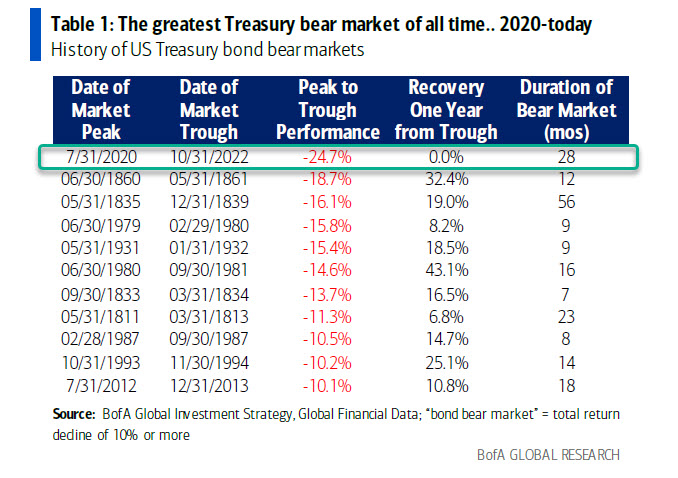

3.1 “Worst Treasury bear market of all time”

Allow us to begin with a chart of something that Fin TV has been drilling into viewers:

Forget the chart. Focus on the words “greatest … bear market” & double-focus on its creator – BofA – Bank of America. Now look at the chart below of BAC, Bank of America stock, & TLT, the Treasury ETF focused on long maturities. The chart begins on January 1, 2022 & stops on this weekend.

Yes, long maturity Treasuries (TLT) are down 40% in value, a horrifyingly stunning loss given the “hallowed” safety of US Treasuries. Even Bank of America gets it. That’s why they printed the above chart.

But did the brilliant investment minds at Bank of America notice something else in the above chart? That their own stock, BAC, is down as much as TLT is for the last year & 9 months!

And BofA is NOT a smallish regional bank like Silicon Valley Bank or even First Republic Bank. It is a celebrated Bulge Bracket bank which you find all over America. How smart & big? They were the bank to which Merrill Lynch ran in 2008 to avoid suffering the fate of Lehman Brothers. And Bank of America was so big, so rich in assets that they swallowed up that biggest brokerage in America without even a small burp.

Since we brought it up, let us expand the chart above (TLT vs BAC) to January 1, 2007, the period when America slept soundly convinced that their homes were absolutely safe. ( its a monthly chart to fit the 16 yr period)

Notice that BAC, the Bank of America stock, rallied all the way from 2009 to Q4 2021. And notice further that both BAC & TLT began falling in 2022 with BAC falling a bit more than TLT since January 1, 2022 (see that chart above).

Not only since then, but even since the critical Fed meeting on July 27, 2023. Look at the BAC vs TLT chart below from July 26, 2023, the day before that Fed meeting, to now:

Again, BAC has fallen more than TLT has since the July 27 Fed meeting! But you probably have not heard this on any Financial TV show. In fact, if you watched CNBC, especially their after-market “game show”, you would have seen & heard absolute glee in their voices about how TLT was being sold & sold. You would have heard rank admiration in the voice of the show’s court-jester about how the Fed was doing the right thing. There was even a note of semi-sacred joy about how TLT-owning evil-doers were being punished for their bad behavior if not outright sins.

But these same financial “game show” people never uttered a word about how BAC, the Bank of America stock, was being punished worse than TLT. You would think, those “fast money” stock gamers would talk more about the faster fall of BAC than of TLT. But stocks seem noble to that show while TLT & Treasury bonds seem anti-noble if not outright evil.

It is imperative for us to add that Bank of America is used above mainly as an example of American bulge-bracket banks. In fact, BAC is one of the most recognized banks in America and, with its Merrill Lynch acquisition, perhaps the most important bank in America. (yes, we have heard of JPMorgan Chase too but it is a somewhat different case as we will see later). And, in full disclosure, we have a bank account at BofA (as with Chase) plus a couple of IRAs at Merrill Lynch. Plus we own some BAC stock in our IRA as well. So nothing personal about BofA. Just the facts!

By the way, other big banks show the same kind of damage & correlation with TLT that the above BofA chart shows. That is all except one bank.

3.2 TLT vs BAC and TLT vs JPM

Look at both YTD charts & the July 26 to now charts.

Wow! Compare the above year-to-date TLT vs JPM chart with the ytd TLT vs BAC chart below.

The two charts begin to diverge in April 2023 just around the JPM-First Republic deal. After that, JPM stock started showing a resistance to the TLT correlation damage. For a better view, compare their performance vs TLT from July 26 to now.

And

Wow! Wasn’t the acquisition of First Republic at the request of the Financial agencies? We did hear that Mr. Dimon cut a very friendly deal to enable the Agencies to give First Republic to JPM.

But was there something else that gave JPM a degree of protection against fall in Treasuries (TLT)? Look JPM is virtually unchanged between July 26 & now while BAC is down double-digits vs. TLT. And JPM is up 8% vs TLT since the September 20 FOMC while BAC is down 5% vs. TLT. Perhaps JPMorgan hedged its Treasuries exposure via futures or other means while BAC & other big banks did not. In that case, good for JPM & bad for BAC & others.

Please don’t get angry with us simple folks, Mr. Dimon! But we can’t help pointing out that the word “Jamie” or “Ja-mi-e” (जमाई) means Son-in-Law in Hindi, historically a title that involves receipt of gifts or dowry from the other side. Sorry, we just couldn’t resist this linguistic jest. Please forgive us!

Now back to our main topic.

3.3 – Who turned Good into Bad?

Allow us to wander into an allied area, allied only in that people make similar mistakes in different spheres. After WWI, the French built a massive defensive line to prevent German armies invading France again. Built to be invulnerable to aerial bombings and tank fire with an underground railways, this Maginot line was deemed impregnable against a German attack.

Now look again at the TLT-BAC map from January 1, 2007 to this weekend:

Given the power & strength exhibited by TLT in the 2008 crisis, the Federal Reserve mandated all banks to maintain sizable reserves of Treasury Bonds (TLT) & Mortgage Backed Securities as an impregnable defense against future “credit” risk, meaning infiltrations of low credit debt into Bank Balance sheets. And Fed’s regulators made banks conduct regular stress tests to ensure that the defenses were solid. How many times did we hear Bank analysts pronounce the Bank balance sheets as “fortress”? To put it simple, the Fed made a wall of Treasuries (TLT) and kept pronouncing it as a “fortress”.

Weirdly the French Maginot line was also described as a “fortress”. Guess what happened to this “impregnable fortress” in WWII? The Germans bypassed the Maginot line & cut thru the forests to move fast well below the Maginot line into France. The defensive troop formations in the “fortress” were stranded & proved worthless.

At least, the French did NOT damage their “fortress” themselves! Our Fed, our highly reputed Federal Open Markets Committee (FOMC) backed by hundreds of economic Ph.D.s, did precisely that. Beginning in 2022, the FOMC began raising interest rates AND thus began damaging the prices of Treasuries (TLT). Did they realize that they themselves were breaking down the defensive line they had mandated to protect Bank balance sheets?

Why would they? Their Treasuries-Mortgage Backed (a la TLT) “wall” had worked well from 2009 to 2021. So they didn’t even pause to think or even try to modify their own mandated defensive line to protect it from their own actions. They got to their first wake up call in March 2023 with the near overnight destruction of Silicon Valley Bank & the troubles of First Republic Bank.

Look at the fall in BAC in March 2023. But the regional banks involved were small &, more importantly, TLT was not affected. Meaning the defensive wall was ok & once the bosses fixed that leak, even BAC rallied into late July 2023, as can be seen above.

How did the Fed fix the leak? As Kelsey Berro of JPMorgan Fixed Income said on Thursday October 5 on Bloomberg Surveillance,

- “… the BTFP, Bank Term Funding Program, the Fed put that in place in March; …. the BTFP program was important because the Banks can now pledge those Treasury securities & even though they have a price in the market place of 70-80, they can be pledged at par …”

Presto! The leek in the fortress balance sheet was fixed as you can see in the rally in BAC in the above chart. Again, BAC is used just as an example. Virtually all banks rallied post BTFP into (look closely & hard) into the July 26 FOMC meeting & Chairman Powell presser.

Clearly either the Fed-heads thought the leak in bank balance sheets was FIXED for good or, in their ignorant arrogance, they thought they could fix anything. Look what the Fed did to the Treasuries wall & to banks first on July 27 & then again on September 20:

TLT fell 16% from July 27 to now & BAC fell 20% from July 27 to now. And there is noting BofA could do about it. Because not only their own “defensive line” of Treasuries & Bonds has been getting demolished, their own defender, the Fed, has actually been shooting at them by SELLING from its own inventory, the same Treasuries & mortgage that make up the “defensive line” of the banks. So not only is BofA balance sheet is under attack from outside but it is also from attack from inside its own defenses.

This is what the Fed has done – they have converted the defenses, they ordered the banks to build for 12+ years, into massive liabilities. Thus, to use an expression of @Convertbond Larry McDonald, the Fed has by itself converted the interest risk of BofA & that other banks into credit risk.

In other words, the Fed may be on the verge of combining the 1987 interest rate crash with the 2007-2008 credit crash – a mega double crash. Now this is our simple-minded construct, one we hope & pray is totally impossible. Hopefully it has a tiny merit at least in focusing Fed’s attention on the Fed’s own madness.

3.4 Why not extend BFTP to big banks like BofA?

That worked in March for regional banks, right? Why not do the same for BofA & other large banks? The number we recall hearing from Ms. Kelsey Berro was about $108 billion. That wouldn’t suffice would it?

The BofA balance sheet is $3 trillion, mostly comprised presumably of what Fed mandated in 2009 – Treasuries & Mortgage Backed securities. After the worst bear market in history, say most of it is worth 50-60 cents on the dollar. But the Fed can allow the Bank to pledge to the Fed at 100 (par). So the Fed balance sheet would have the burden of $1.5 trillion, give or take a bit. Then say the same is offered to other big banks that have a combined balance sheet of say $15 trillion. A pledge at par for them would be another $7.5 trillion.

So we are talking about $22-23 trillion or so. Can the Fed put that on? Or will that break the Fed, to use a phrase of @Convertbond Larry McDonald?

Is there a statutory limit for the Fed’s balance sheet, a balance sheet that already owns Treasury bonds bought in 2020 at 1% coupon? If not, they can get the Congress to pass an emergency “TARP” like bill to take on say $8 trillion more, right? After all, Paulson & Bernanke got a much more recalcitrant congress to do a $800 billion TARP. In contrast, this is 2023 with a much more amicable & permissive congress, some say.

If not, could we at least make the Fed & especially Powell tone down or perhaps be less destructive in his pressers?

3.5 Loose lips sink ships

It seems frightening to us to think that Powell actually planned to say what he did at his presser on September 20. It was the most irresponsible & destructive speech we have ever heard from any Fed official! That speech & the accompanying dot-plot is what triggered the flood of selling Treasuries.

Read what the gentle Priya Misra said on CNBC Squawk Box on Wednesday, October 4:

- “… I think some more humility, some more time; they are continuing to do QT; they don’t talk about quantitative tightening; that’s a part of this move; the Fed is ignoring that QT has an impact – QE had such a big impact; to argue QT is NOT tightening; they are are still doing QT plus they are telling us they are not going to cut rates for a pretty long time; they are tightening thru what they are saying; they are tightening thru QT; I wish they would give it some time … “

Kelsey Berro phrased it differently but had the same message on BTV Surveillance on Thursday October 5:

- ” … the Fed is telling you we are NOT going to stop until it is painfully obvious that the economy can’t handle it; … we think the economy is not going to handle these rates but the Fed is going to be the last to admit that!”

Bernanke was the last Fed chair to do precisely that. It stemmed from the institutionalized confidence of the Fed that they know how to ease & recover the economy but that they really don’t know how to control inflation. That semi-religious arrogance is why Bernanke went too far in letting the economy slow down. Only to realize too late that the economy was NOT responding to his easing. That is when he & Paulson asked Speaker Pelosi for $800 billion TARP.

Same institutional arrogance is driving Powell & his merry band. Sadly he doesn’t have the intellectual respect Bernanke enjoyed and his merry band is much weaker in experience & intellect than Bernanke’s FOMC. And, sadly, Yellen does not have the GS-CEO aura that Paulson had. But hopefully they will have a kindler & gentler House to deal with when they go with a multi-trillion TARP II request.

3.6 The Really Big Risk

Chair Powell has not sunk the Treasury ship yet, but his loose lips clearly created a feeling that “something is cracking” to use a Peter Tchir expression. The sell-off in Treasuries we saw was violent & one-sided. Clearly “the buyers stepped away” as they normally do in such waterfalls.

Then on Monday, October 2, we heard Larry McDonald of Bear Traps Report say that they “keep hearing that there is a long only mutual fund or pension fund that is blowing up & losses in Treasuries are spectacular” . It certainly felt like that. But that in itself is NOT the big risk, the risk Peter Tchir of Academy Securities expressed on BTV Surveillance on Thursday, October 5:

- “I do think something has cracked; for the first time in my life time, people are actually questioning exactly where Treasuries are going to be & that is very concerning to me“

That uncertainty has been created by Chair Powell of this Fed & Chair Powell alone. We would like remind him that the entire reason for his institution is the Treasury Market. The Treasury Department & its function is the legacy given to our country by Alexander Hamilton & he did it over the sincere & angry protest of Thomas Jefferson. While the Fed was actually created much later, its main & sacred function is to always maintain the safety of the Treasury market which in turn is critical to the banking system.

We ourselves believe that America’s financial primacy in the World stems from & only from the clean & safe functioning of the Treasury market. And like Peter Tchir, we feel uncertain about whether this Fed will protect & guard the Treasury market as America’s only truly safe asset.

What is a safe asset or safe asset class? To paraphrase Peter Tchir:

- people own them in huge size in their portfolios because we are never worried about losses &

- it is what the Banking system owns a lot of; and our Banking system. always levered, owns a lot of Treasuries.

We hope Chair Powell & his FOMC realize that they exist because of the Treasury market & not the other way around. That doesn’t mean they should not pursue policies that lower prices of Treasuries or even cause intense sell-offs. In fact, they often need to do so as other Chairs have done before them. But no Fed Chair, in our memory, has created a doubt about the viability of Treasuries by speaking in extremely angry & loose terms as Chair Powell did on September 20 in his presser.

We are not concerned about the violent selloff we saw last week because of some fund’s positioning. We are quite concerned about buyers stepping away from owning Treasuries the way they stepped away from buying commercial paper & corporate bonds in 2008. Buyers can usually handle price risks provided they are not sudden or waterfall like fast. But buyers cannot countenance liquidity risks, risks that they got “a whiff of” during the last few days, to quote Peter Tchir.

That is a worry expressed by Priya Misra on Friday on BTV Surveillance:

- “I also worry about liquidity risk … its not appreciated until times become volatile like right now! … The US domestic bank community is sitting on massive unrealized losses … asset managers are my biggest concern right now – do we start to see outflows from bond-funds? Bond funds had massive inflows this year; if outflows begin, bond funds will become forced sellers… “

When does a burst of a bubble become a systemic problem? To quote Peter Tchir again – “when a safe asset breaks“! Remember a home, a house purchased, was deemed to be a safe asset for & by Americans until 2008. People were never worried about losing money on their house and the Banking system owned that asset class in mega size. That is why the burst of America’s housing bubble & its associated entities caused that enormous impact.

Recall that the burst did not happen in one or even two tranches. The burst began, to quote Peter Tchir again, with

- a little break in early 2007;

- then a bigger break in late 2007;

- the “ultimate problem” didn’t hit until 2008

Now look at the year-to-date chart of TLT vs. BAC again.

The first break in Banks was in March 2023; the second break is taking place now in October 2023. Do we really want to experience next year a 3rd & concluding collapse of the Banking system & long duration Treasuries (they are the same trade now as we have seen)?

That, in our sincere opinion, might force a substantial change to the Federal Reserve system. Who after all would tolerate an institution & its practices that were responsible for two enormous crisis in America’s financial system?

So our first suggestion for the Fed & Chair Powell is to lighten the tone & the absolute statements used in the September 2023 statement & presser. Part of that might be replacing the dot-plots (that suggest single-minded & obstinate certainty) by bar-plots that suggest flexibility in upper & lower estimates of rates.

Our second suggestion, in the interests of two-sided markets, is to

- reduce or suspend the current pace of QT (to avoid needlessly adding to the huge unrealized losses iceberg) &

- make it quietly known to large dealers that the Fed would be a buyer in violent selloffs to avoid waterfall declines. That might prevent the “whiff” of a breaking of the Treasury market.

4. We Stand with Israel.

We were New York residents & worked near Broad & Wall on September 9, 2001. We actually saw the 2nd plane hit the World Trade Center. We walked later that morning with a wet undershirt around our nose to uptown.

Seven years later we were visiting Mumbai when the 26 November 2008 terrorist attacks hit Mumbai.

This is our 3rd terrorist attack of consequence & the first one we view from a large distance. But we completely understand the horrific level of this one. We are also very happy to see that India’s Prime Minister Modi was very early in his unequivocal & emotional support of Israel & Israelis. We were also happy to see that several Indians had offered to go to Israel to fight Hamas with Israeli army.

Our prayers & very best wishes are for Israel & Israelis.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter