Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Week as a whole Or Last 2 Days?

The week as a whole was positive:

- Dow up 78 bps; SPX up 46 bps; NDX up 15 bps; SMH down 9 bps; RUT down 1.5%; AAPL up 64 bps; AMZN up 1.4%; GOOGL down 25 bps; META down 53 bps; MSFT down 30 bps; BAC up 2.5%; C up 2.2%; GS down 1.1%;

The Dollar was up about 55 bps on the week and Copper stocks were hit hard along with foreign stocks:

- CLF down 2.3%; FCX down 3.7%; EEM down 11 bps; EWG down 1.6%;

Gold & Silver had a great week and so did mining stocks. Oil rallied hard on mid-east turmoil with oil stocks:

- Gold up 5.3%; GDX up 7.3%; Silver up 5.2%; SLV up 4.9%; Oil up 5.8%; Brent up 7.6%; OIH up 6.1%; XLE up 4.5%;

Lo & behold Treasury rates fell on the week & Treasury ETFs rallied:

- TLT up 3.4%; EDV up 4.1%; ZROZ up 4.6%; with 30-yr yield down 20.2 bps; 20-yr down 18.9 bps to 4.9715; 10-yr down 17.8 bps to 4.621%; 7-yr down 15.2 bps to 4.654%; 5-yr down 11.6 bps to 4.641%; 3-yr down 7.5 bps to 4.815%; 2-yr down 3.3 bps to 5.052%; 1-yr down 2.2 bps to 5.405%;

On the whole there was ‘”quiet on the positioning front“, at least Via The Market Ear – “… Pretty similar backdrop to last week“:

- JPM: Overall positioning levels were fairly unchanged with the TPM Level at -0.3z (=fairly low, albeit not capitulatory).

- GS: Overall Prime book was small net bought on the week at the tune of 0.1 standard deviations (=nothing)

- MS: Bill Meany’s PB Strategic Content team highlights that this week’s activity was much of the same. Net and gross leverage increased a mere +1% and +2% respectively (=nothing)

But the last 2 days of the week provided jolts:

2. Treasury Rates

The upside/downside return disparity seems “wild” indeed:

- Katie Greifeld 🎃@kgreifeld – Oct 12 – the risk/reward in duration right now is wild. 12-month expected returns for 30-year Treasuries if yields… – rise 50bp: -2.9%; – fall 50bp: +13.2%

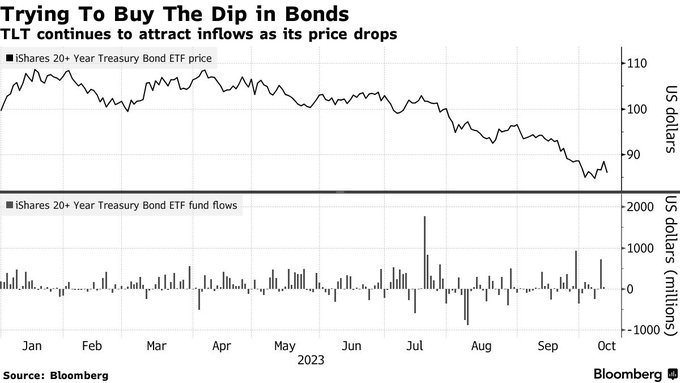

This positive Treasury move did suffer a serious blow on Thursday with both a worrisome CPI and a horrible 30-yr auction. But the institutional appetite for long duration Treasuries (TLT) remains strong per:

- Jesse Felder@jessefelder – ‘Wall Street pros have been sinking record sums of cash into TLT in a high-conviction bet that interest rates have peaked. All year they’ve been wrong, with an estimated $10b loss — yet demand has only intensified as the fund’s plunge has deepened.’ https://bloomberg.com/news/articles/2023-10-12/dreams-of-big-treasury-gains-backfire-with-10-billion-etf-loss

This view was well articulated by Kathryn Rooney Vera to CNBC’s Becky Quick who was trying to shame her for going against Becky’s demi-God Lee Cooperman. Ms. Vera pointed out that the Fed seems nearly done (with possibly one rate hike left) and at this stage Fixed Income generally does very well. Watch especially the last minute of the 3:12 minute clip below where she says her 2024 target for 10-yr in 3.75%.

We must point out Mr. Cooperman’s consistent habit (over a decade at least) of speaking about interest rates. He is a superb stock picker & that has been the reason for his stupendous success. But his track record in speaking about interest rates is poor, to be gentle. Go back several years & find him disagreeing with Gundlach about rates on CNBC & be proven wrong. He can do whatever he likes but we blame Becky Quick for taking his off-hand comments & shaming Ms. Vera with those. Frankly, it is Ms. Quick who needs to be ashamed of her behavior.

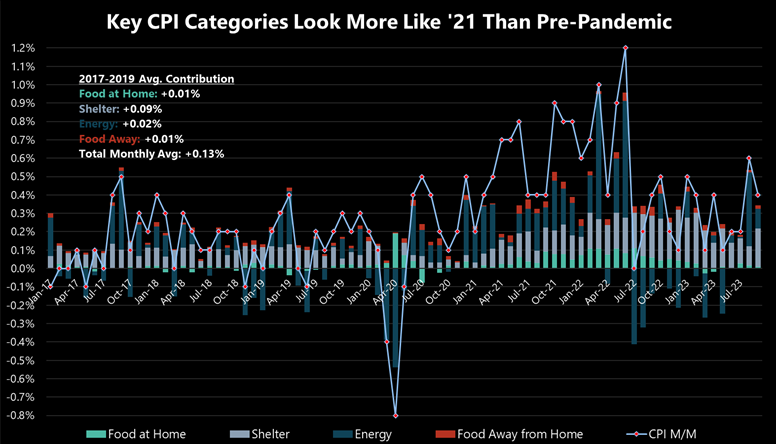

On the other hand, the CPI did raise some serious doubts about whether inflation will remain sticky & prevent the Fed from raising rates in 2024.

- Via The Market Ear – CPI smells like that 21 spirit – “Although M/M CPI prints over the past 12mo had plenty of encouraging aspects, the last few have better resembled early ’21, when inflationary pressures really started to accelerate. Clearly, the intermediate path isn’t a sustained trajectory of lower M/M prints, and that could be an issue for the headline Y/Y prints (and equities). ” Source Jeffries

Within 3-4 hours of the CPI print, came the horrible 30-yr Treasury auction. That was the worst auction of the three auctions this past week. But each auction (including the 2-yr) disappointed, especially wrt to pre-auction levels.

What happened on Thursday could be a precursor to what happens in 2024, as Michael Shaoul of Marketfield Asset Management pointed out on Thursday October 12 on BTV Surveillance. Watch & listen to this clip and focus on why he says the Fed may have to launch yield curve control next year because “CPI will remain sticky” and “Fed has boxed itself in a corner“:

- “… I think the quality of auctions, the amount of bids they get, after-market response post-auctions matter …. you know it wasn’t that the yield in the U.K. was so high this time last year; it was clearly a disorderly market – massive forced selling in the institutional community – that’s when a central bank wakes up extremely quickly …. “

Did we see a “liquidation” type selling just a week or so ago that made Peter Tchir feel something in the Treasury was cracking? That could have been just a taste of what could come next year!

The possibility of that sort of action makes Michael Shaoul say the Fed may need to use Yield Control to keep the Treasury market from exploding. Listen to him below:

3. Stocks

Look at last week’s chart of SPY.

Wasn’t Monday just terrific? We actually thought it was a repeat of January 17, 1991 – the day the US Airforce (with NATO allies) began the bombing campaign against Saddam Hussein. That ended the bear market of 1990 & led to a spectacular rally (see chart below). That was simple because the markets knew on that day the Iraq war was essentially over. Also recall that the Treasury market had already begun to rally from the October 1990 Treasury curve at 9%. Recall that the Treasury rally did not end till the 3-month T-bill touched 3% at the end of 1993.

Look again at the above SPX chart of last week. Monday’s rally continued into Tuesday & suffered a small jolt at 1 pm Tuesday because of the weak 2-year auction. But the real blow to the S&P came at 1 pm on Thursday with the horrible 30-yr auction. Look at last week’s TLT chart in Section 2 above and see that TLT actually rallied (about 1.75%) on Friday.

But the SPX did not rally on Friday. It opened up probably on strong earnings from JPMorgan & Chase but didn’t hold the rally. Actually see below that even JPM despite its opening jump ended up closing lower on Friday relative to SPX.

We will spare you Friday’s BAC chart and only say that on Friday BAC closed below its Thursday close.

How bad was Friday in the stock market?

- Walter Deemer@WalterDeemer – Fri – Oct 13 – Today is the day most thought Monday would be.

How badly did Friday spook one who has been bullish?

- Dean Christians, CMT@DeanChristians – 4:09 PM · Oct 13, 2023 – One for the bears. For only the third time in history, the following happened – VIX up > 15%; Gold up > 3%; Crude Oil up > 5% — Dates: 9/17/08, 9/17/01, 10/13/23

After that, let’s hope that the “Or” in the tweet below comes true on Monday & not the “either” case:

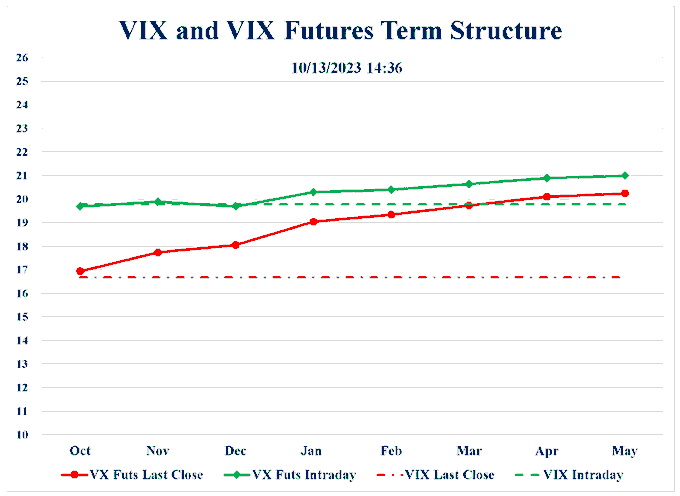

- Jim Carroll@vixologist – Fri – BIG change from this morning 😳 Based on history, the jump in $VX futures is quite large relative to the drop in equities. Either Monday is a big down day for the stock market or this gap shrinks a lot. (BTW, I have no idea) twitter.com/vixologist/sta…

That’s all short term right? Not the one below:

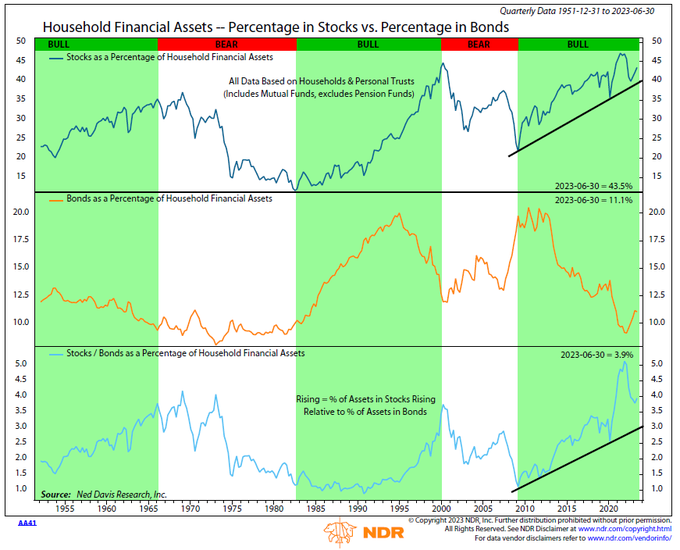

- Willie Delwiche, CMT, CFA@WillieDelwiche – Fri Oct 13 – The shading hasn’t been updated (yet) but the data suggests we’ve moved from secular bull to secular bear. Chart via @NDR_Research

Then he added:

- Willie Delwiche, CMT, CFA@WillieDelwiche – Look at the top and bottom panels. Bull markets are between troughs and peaks, bear markets are between peaks and troughs. Top and bottom lines both appear to have peaked = therefore secular bear market. That’s what the data says, but no one wants to admit it.

But a day earlier:

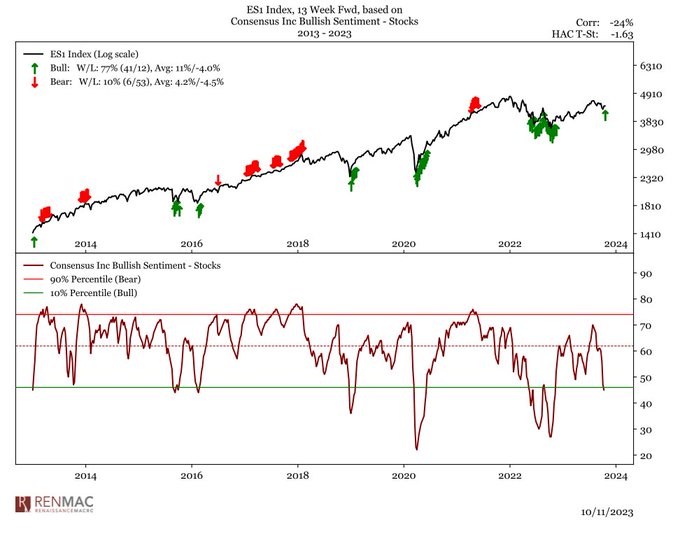

- RenMac: Renaissance Macro Research@RenMacLLC – Oct 12 – Consensus Inc bulls in the bottom decile for the first time in almost a year. $spx

Go back another day to Wednesday to feel there is fuel:

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – CTAs record short $SPX. – “Per GS model, [the] CTAs are now buyers of SPX in every scenario over the next month,” said the bank in a note from Monday”. “According to a note from the bank, these CTAs are short some $90 billion of global equities, what it says is a zero percentile reading. In the U.S. alone, they are short $47 billion in equities — the largest U.S. short position for this group on record“. https://marketwatch.com/story/momentum-traders-set-to-buy-the-s-p-500-in-every-scenario-says-goldman-sachs-c32efb10?mod=panda_marketwatch_author_alert

So what stocks might be terrific buys if the following proves correct?

- Jason Goepfert@jasongoepfert – Oct 13 – Managed money is back to a largish net short position in gold. The only other times they bet like this, gold: ↗️ Rallied 30% ↗️ Rallied 32% ↗️ Rallied 26% $gld

And if GLD rallies like this, how much could gold miners (GDX, GDXJ, GOLD, NEM) rally?

4. Israel-India & Cricket World Cup

We wrote emotionally last week that we stand for Israel in this enormous tragedy. This week we are very happy to see that we actually were more subdued than the majority of Indians worldwide. What Naor Gilon, Israel’s Ambassador to India, says below is absolutely true:

- ” … regular Indians, its amazing; … I mean I could raise another IDF (Israeli Defense Force) with the volunteers ; every one is telling me I want to volunteer & I want to go & fight for Israel; …. this wide support, strong support is unprecedented for me … its unbelievable … India & Israel the closeness is something I cannot even explain ; .. it is something very emotional, very deep that it is beyond any normal connections between two peoples or countries, something very unique … ”

This Saturday was the World Cup cricket match between India & Pakistan in Gujarat. M. Rizwan, Napak’s terrific & leading batting star, had said publicly that when Pakistan defeats India, he & his team will offer that victory to Hamas as support for their fight against Israel.

As it happens, the Indian team blew away the Pakistani team and fans offered the victory to Israel.

Seriously folks, you should check out the Pakistani clips of their reactions to this loss. It’s funny. Look even Israeli Mossad got into the fun:

It appears there's a famine in Pakistan. We humbly extend a hand to assist in this time of crisis… we will get you more flags!

In other news: India defeats Pakistan in cricket world cup. pic.twitter.com/y8esqBvb0F— ISRAEL MOSSAD (@MOSSADil) October 14, 2023

Send your feedback to [email protected] Or @Macroviewpoints on Twitter