Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. Week as a whole

Oil, Gold, Silver up; rest down.

- Dow down 1.6%; SPX down 2.4%; NDX down 2.9%; SMH down 4.2%; RUT down 2.3%; DJT down 1.7%; EEM down 3%; EWY down 3.2%; EWG down 1.9%; KWEB down 6%; BAC down 1.5%; C down 4.2%; GS down 2.9%; MU down 3.2%; AAPL down 3.1%; AMZN down 3.6%; GOOGL down 1.3%; META down 1.8%; CLF down 3.8%; FCX down 4.2%; MOS down 2.8%; UNG down 9.3%; UUP down 30 bps; DXY down 41 bps;

The one star was NFLX up 13%. But that did not help the mega cap tech stocks that report this coming week. If they go down after earnings or worse if they disappoint & go down hard, then you know!!!

But what if they act like Netflix or even close to like Netflix? Remember October is about to end soon! And we are already seeing rainbow colors in some tweets about an year-end rally. The first one, even though a bit early, is below:

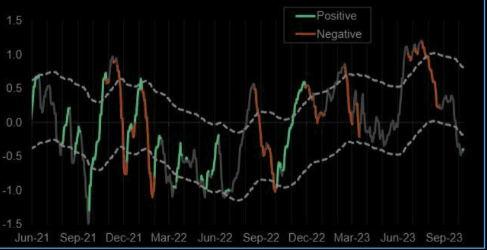

- Via The Market Ear – Fri Oct 20 – Reminder: MSI has turned risk positive – Morgan Stanley’s cross-asset team’s Market Sentiment Indicator (MSI), which aggregates survey, positioning, volatility, and momentum data, turned positive a few days ago, exiting the neutral reading it has held since August 23, 2023. Source MS

How negative do stats look at this stage?

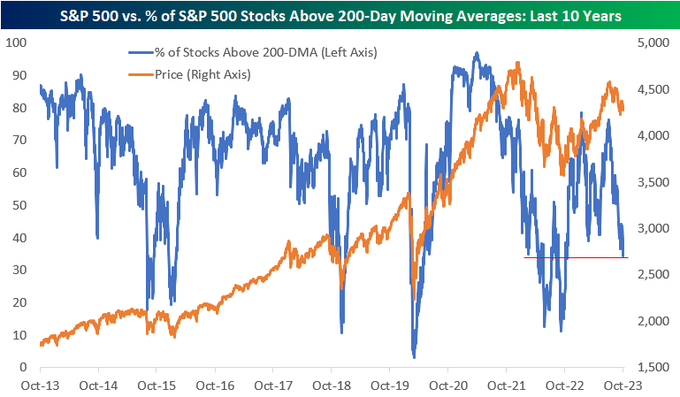

- Bespoke@bespokeinvest – Thu Oct 19 – Just 34.5% of S&P 500 stocks closed above their 200-day moving averages today; the lowest reading since November 3rd of last year. Here’s a historical look at this reading. Thoughts?

We ourselves are somewhat partial to availability of fuel.

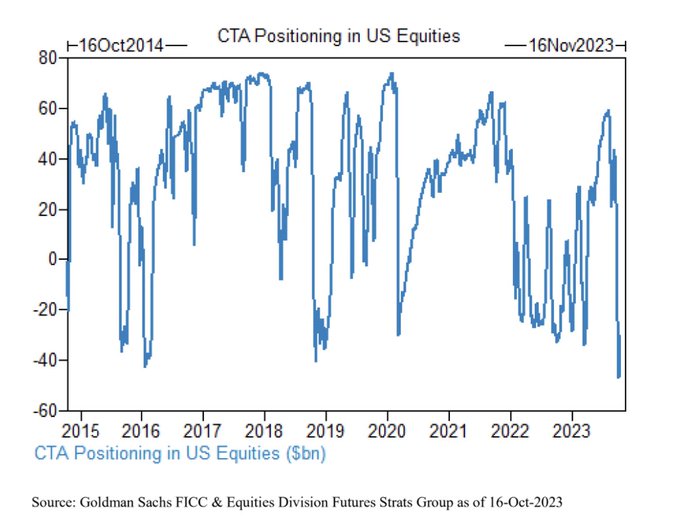

- Barchart@Barchart – Thu Oct 19 – CTAs are short $30 billion of U.S. equities, one of the largest short positions recorded in the last 8 years

That’s too broad for us. Where could hungry bulls feed somewhat safely?

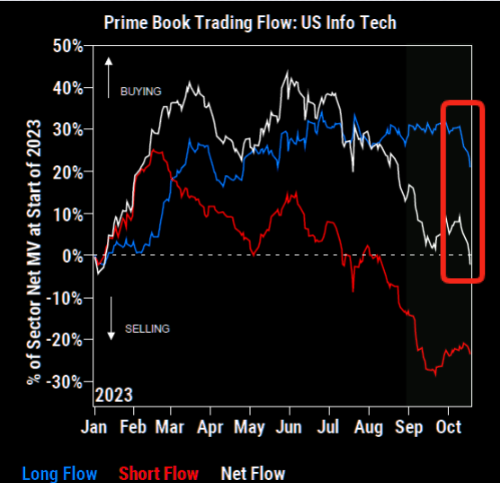

- Via The Market Ear – Fri Oct 20 – Fading tech – Info tech is the most net sold sector so far in October according to GS prime book. Source GS PB

We like M&Ms. So when we quote one “M”, we like to quote the 2nd “M” if possible, M being Merrill Lynch in this case.

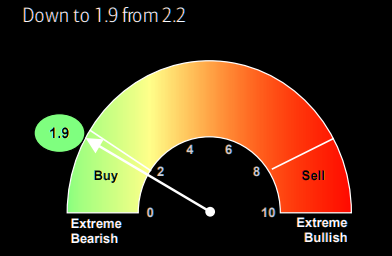

- Via The Market Ear – Fri Oct 20 – The king of signals says buy – BofA’s bull and bear indicator has continued moving lower and has started flashing the contrarian buy signal here. Track record is: “…median 3-month returns post buy signal imply = US stocks 5.4%, global stocks 7.6%“. Dare to be contrarian here?

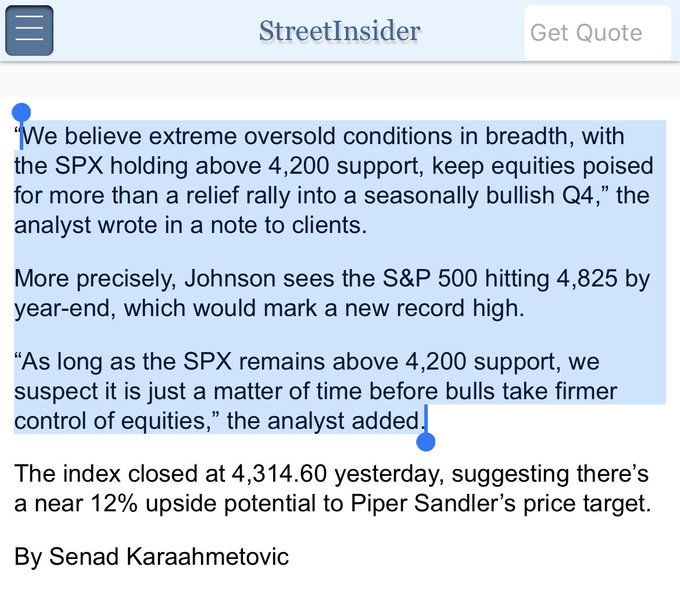

One reason to follow the bullish stuff above is a semi-proverb which says “you don’t get hurt falling out of basement window“. Using this proverb Craig Johnson of Piper Sandler boldly reaffirmed his 4,825 S&P target on Friday. Below is a summary of his call courtesy of J.C. Parets:

The above “basement window” proverb is accurate under most conditions except when just below the basement window opens a gaping sinkhole. And what type of sinkholes have been opening under most portfolios since September? Those created by Fed Chair Powell. His propensity to screw up verbally was brought up by no less of a Fed authority than David Rosenberg:

- David Rosenberg@EconguyRosie – Oct 20 – Jay Powell needs a PR person to teach him how to make sure his prepared statements mesh with his Q&A session. Last thing anyone needs is the confusion from a Dr. Jekyll followed by Mr. Hyde routine like he pulled off yesterday.

How true! The prepared speech did prompt a short rally. Now look at what the S&P did just as the Q& A began & what it continued to do into Friday’s close!

Mr. Rosenberg’s terminology brought back memories of what we had written on December 4, 2021 in Section 3 of our article Jekyll vs. Hyde or a Faustian Bargain?

- “And when & how did Powell display his internal Hyde? On Wednesday November 24, the day before the Thanksgiving holiday & in the release of Fed minutes that ordinary Americans don’t read and that mainstream U.S. media does not cover.

- “But markets read the minutes and understood the enormity of the turn from Jekyll-Powell to Hyde-Powell. Look what happened on Friday, the half-day after Thanksgiving:

- Dow Jones fell by 905 points; the S&P 500 fell by 107 points; the Nasdaq 100 fell by 342 points & Transports fell by 611 points. And Treasury rates fell off a cliff with the entire range from 30-year rate to 2-year rate falling by 12-13 bps (0.12-0.13 %).

- That rout took place because the markets understood that the turn to Hyde-Powell was an enormous risk to the health of the U.S. economy. … “

Perhaps not to the U.S. economy as a whole, but to one sector & one pride of America entity for sure! The entity that revealed $131 billion unrealized loss on its balance sheet this past week.

And what type of asset on its balance sheet led to these losses? The same assets that the Fed mandated all banks to hold – yields on long duration bonds (30-yr below):

So will this prove to be a chasm that hurts the followers of Craig Johnson who fall out of their portfolio basement windows?

Or is there a factor that mitigates at least a decent portion of that risk?

- Michael A. Gayed, CFA@leadlagreport – Thu Oct 19 – Powell is now scared out of his f******* mind.

More on this later with two smart smart investors.

2. Interest Rates

Just a couple of charts with one call before we go on to our discussion about the Fed.

- Via The Market Ear – US 10 year going parabolic – The trend lines are getting steeper and steeper. This move is going parabolic. The golden cross from mid July has been truly golden Source Refinitiv

By the way, the day after the above chart was published came the confusion about a Jekyll-like Powell speech vs. Hyde-Powell like Q&A remarks. Look at the move in the 30-yr yield from 12:45 pm on Thursday to early Friday level. It sure gets steeper every time Powell speaks.

What has it done to VXTLT?

- Via The Market Ear – Thu Oct 19 – VXTLT panic – Another day, another new recent high for the VXTLT. The move since recent lows is extreme. Stress is huge. Source Refinitiv

So has anyone made an obvious while obviously gutsy call?

- Via The Market Ear – Got IEF calls? Goldman’s main rationale for buying IEF calls is that they see the 10 year moving down to their “fair value” around 4.2%: “…combination of temporarily slow growth in Q4, recent treasuries underperformance and an attractive call prices offer a compelling opportunity for investors to hedge lower yield risk using IEF calls“. Source Refinitiv

Do note that the above call is intended to Hedge lower rate risk meaning even if it is wrong the underlying short rates position makes money & if it is right it serves as a hedge.

Note that the blackout period for FOMC participants began on Saturday, October 21. So no chance of getting more destructive remarks from Chair Powell before his presser on November 1. Also allow us to say that, after his Hyde-like expressions this past Thursday, Chairman Powell will be thoroughly coached to stick to the prepared FOMC statement & then follow a Greenspan-like say no evil policy.

As we will see in the next section, the FOMC & Chairman Powell are reportedly “focused on the bond market sell-off” and are “concerned about the long-end getting out of control“. So in that mode they are unlikely to be overly aggressive & risk a further parabolic takeoff.

With the above thought framework, we think that stocks might rally into October month-end especially if the mega caps don’t disappoint either in earnings/guidance or in after-market action. Given the short base & if Chair Powell speaks a two-sided mantra on November 1, we could even see a Happy Thanksgiving indeed!

And what else might do well, even more than it has already done?

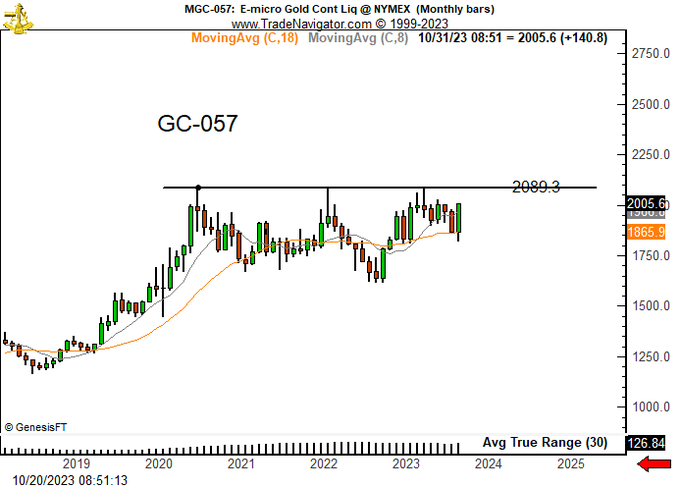

- Peter Brandt@PeterLBrandt – Fri Oct 20 – Featured chart. To date Gold is forming an engulfing sweeping reversal month. This is one of the most bullish charts I have seen in 48 years of trading $GC_F $GLD

3. Fed & Markets – the Really Big Risk

Once again, look at the chart of the 30-year Treasury yield below from the July Fed meeting to today including the now infamous September 20 meeting:

The Fed raised interest rates by 25 bps in the July 26 FOMC meeting. Naturally the 30-year yield went up in response. But in the September 20 FOMC meeting, the Fed did NOT raise rates but only stated its hawkish stance for the future. And still hell broke loose.

The 30-year yield went almost parabolic and we saw a violent waterfall like sell-off in long Treasuries (or TLT). What was more frightening than the sell-off itself was that no institution stepped forward to buy Treasuries that were being virtually liquidated.

That was something no one had seen before. Because Treasuries are the safest bonds in the world & they trade in the deepest & most liquid market in the world. Why do investors own them in record sizes? Because investors are never worried about losses in that ultra-safe asset class, as Peter Tchir of Academy Securities said on Bloomberg Surveillance on Thursday October 5. He also added that,

- “I do think something has cracked; for the first time in my life time, people are actually questioning exactly where Treasuries are going to be & that is very concerning to me“

Priya Misra of JPMorgan Asset Management pointed out on Bloomberg Open on Thursday, October 19 that,

- “we were buyers early on in the move; then when they broke the technical levels (in post Sept 20 selloff), we stepped back; .. we needed to wait and see when it settles down “

And institutional buyers stepping back is the main reason why Treasury rates have lifted almost parabolically. As we hear, the Fed members are confused because, in their view, they didn’t raise rates; they only explained their concerns about the future. They simply don’t yet understand that they communicated with Treasury market in a way reminiscent of the way captain communicated with Cool Hand Luke:

- Fed – You’all good? with the hawkish rhetoric

- Investors – wish you would stop being so good to us, Captain!

- Fed – what we have got here is a failure to communicate!

After the beating in late September & early October, buyers simply stayed away. Because, like that immortal phrase above, what we have had post September 20 FOMC has been a failure to communicate. And we saw that again on Thursday October 19 when Chair Powell deviated from his prepared speech & caused a steep decline in Treasury prices again & created a steep sell off in Stocks.

As Priya Misra said on Bloomberg Open in the morning before Powell’s lunchtime speech:

- “I don’t think the Fed understands how hawkish that September Fed meeting was … which I think took all the buyers & put them on the sidelines … everyone decided we would just wait & hang out in cash … “

But we think they have now woken up at least to the notion of a failure to communicate. Look what Jean Boivin, (BlackRock Investment Institute Head) said in the same conversation:

- “I think they are focused on the bond market selloffs but I think they don’t know themselves what to make of the long term rates backup … we think we are now in a world where the Fed itself doesn’t know what it is doing; doesn’t know what to make of long-end … so you have seen that they are concerned about long-end getting out of control and that is going to dominate over, in my mind, the recent data … volatility is like completely surreal“

To us that last sentence is the most crucial one. As long as volatility remains crazy high, buying appetite will stay dry. And that is what the Fed has to fix & fix fast. And they have the instrument to do that. They can keep talking about rates & rate dot-plots (we prefer bar-plots) BUT they have to ACT via buying Treasury bonds when needed. Their mindless QT or selling 100B$ of Treasuries & Mortgage-backs was for a period when investors wanted to buy Treasuries. Since the September 20 Fed meeting, it has been a period of buyers staying away & who, in their right minds, would keep on selling under those conditions?

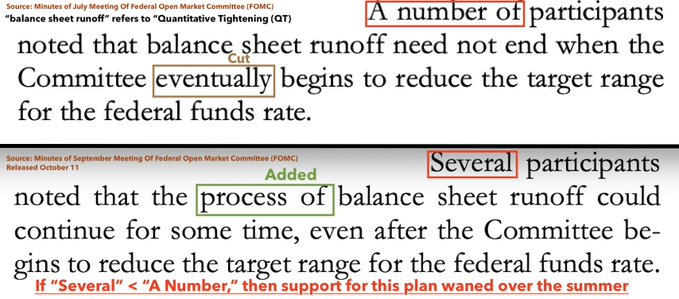

But don’t hold your breath! Because the FOMC members are discussing just the opposite – how to keep QT even when they begin cutting rates!

Going back to Bank of America & other banks dealing with huge unrealized losses,

We are simple folks & we think QT should be suspended until the Fed brain trust earns back the trust of Treasury buyers. Hopefully, these guys with 600 economic Ph.D.s know bond markets better.

Send your feedback to [email protected] Or @Macroviewpoints on Twitter