Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”Blessed are the Believers for They shall be Rewarded in …”

Usually such phrases end in words like “Heaven”, “next life” or something like that. How lucky are we that so many believers in our prosaic & un-benevolent business have now been so rewarded within 3 months? We are also taught that the depth of the belief (exemplified below by triple leverage) is an important element of the rewards received. Just look at three simple examples below:

(67% – TMF – Triple leveraged TLT)

(72% – URTY – Triple leveraged IWM)

(214% – SOXL – Triple Leveraged Semi ETF)

Ok, but where does the belief come in? Did much of it originate in one week ending in October 2023? Look at our weekly Investment Article dated October 29, 2023 & notice the quotes/predictions therein:

- “the FOMC & Chairman Powell are reportedly “focused on the bond market sell-off” and are “concerned about the long-end getting out of control“”

- “Eric Wallerstein@ericwallerstein – Oct 29 – Nearly 11% of $TLT shares are sold short via @jackpitcher20″

- “Jason@3PeaksTrading – Oct 27 – $TLT buyer into close for 6250 Feb $93 calls at $1.37, lots of bullish flow in bonds this week as they likely form a bottom.. yields closing the day on lows”

- “Holger Zschaepitz@Schuldensuehner – …… All stocks now worth $98.2tn, less than global GDP. This means that the Buffett Indicator is once again below the critical level of 100. … “

- “Thomas Thornton@TommyThornton – Oct 29 – …. I am expecting a new Sequential buy Countdown 13 this week or next. S&P bullish sentiment is now 10% bulls. A tradable bottom within the next ten days is increasing. “

And then the ultimate non-believer view that week from McElligott of Nomura (isn’t a confirmed non-believer actually a deep believer in lack of belief?)

- zerohedge@zerohedge – Thu Oct 26 – McElligott: The Biggest Pain Trade Of AllIs A “Beta Rally” Into Year-End That Nobody Has On

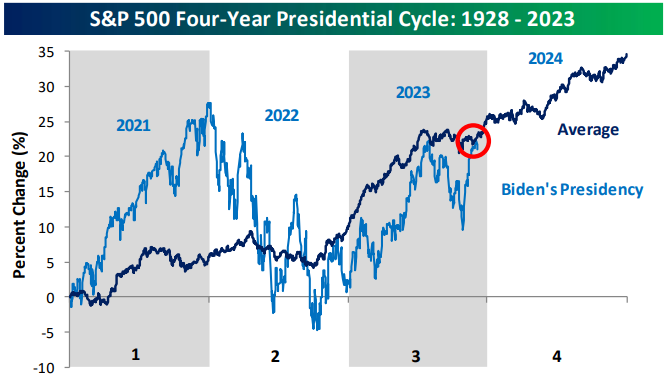

We guess after this past week, a number of people have put on a beta rally into year-end. Will that be a mistake given the plethora of overbought warnings out there in just about every market?

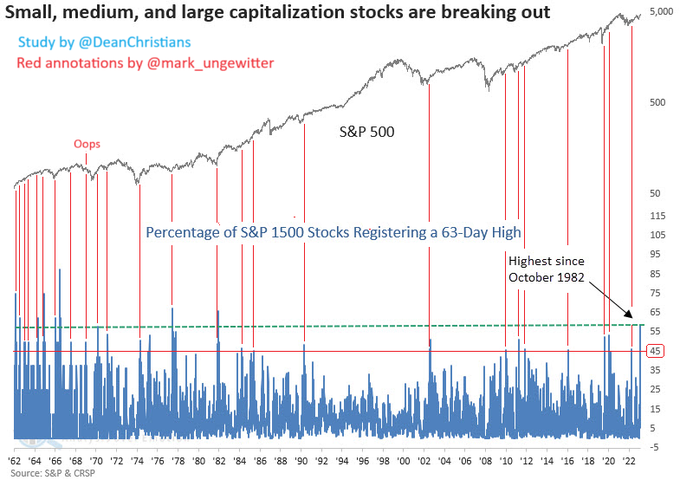

Or are we in a good-overbought condition that, in the past, has delivered 20% returns over next year?

Escape Velocity

“The average forward return after these things happen for the next year is 20%. That puts the S&P somewhere around 5800.” – Jeff deGraafhttps://t.co/JWMHARPtb8 pic.twitter.com/ezNI9sdkNi

— RenMac: Renaissance Macro Research (@RenMacLLC) December 16, 2023

As Jeff DeGraaf says above,

- “The escape velocity we saw in equities yesterday – it did start to percolate earlier in the year but really came to the fore yesterday. 71% of the S&P names made 20-day highs yesterday – that’s a huge number. Historically I think is happened 7 times in the last 4 years; the average forward return for the next year is 20%; That puts the S&P somewhere around 5800, if that holds true. Its a sign of breadth, sign of confidence. Its an overbought condition but it is a good overbought condition; what does it say about next month? Not Much!“

A visual representation of the breadth thrust:

- Mark Ungewitter@mark_ungewitter – Dec 16 – Multi-cap thrust. H/t @DeanChristians

2. The Move in Rates

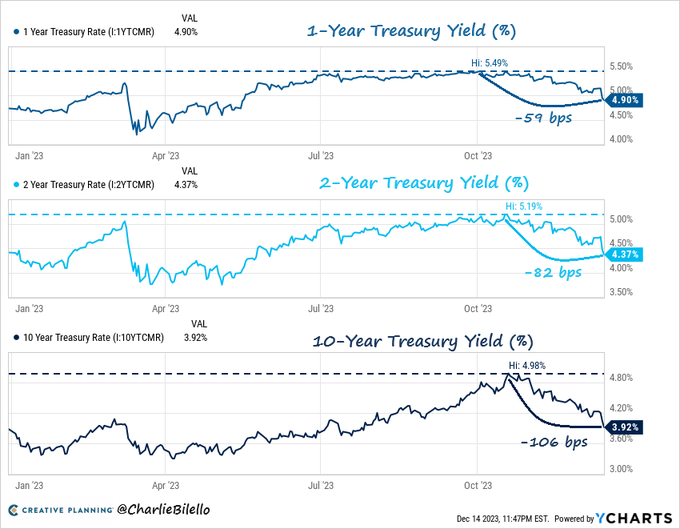

The real reward of the week was the dramatic move in Treasury yields thanks to Chair Powell & the FOMC:

- Charlie Bilello@charliebilello – Huge move lower in Treasury yields over the past 2 months as the market starts pricing in 2024 rate cuts… 1-Year: 5.49% –> 4.90% (-59 bps from Oct high); 2-Year: 5.19% –> 4.37% (-82 bps from Oct high); 10-Year: 4.98% –> 3.92% (-106 bps from Oct high) and our own addition 30-Year 5.13% …> 4.03% (-110 bps from Oct high);

Fixed Income did very well this week:

- TLT up 4.9%; EDV up 7.3%; ZROZ up 7.9%; TMF up 15.8%; HYG up 5.4%; EMB up 1.6%; 30-yr yield down 29 bps; 20-yr down 29 bps; 10-yr down 32 bps; 7-yr down 36 bps; 5-yr down 33 bps; 3-yr down 33 bps; 2-yr down 28 bps; 1-yr down 17.5 bps;

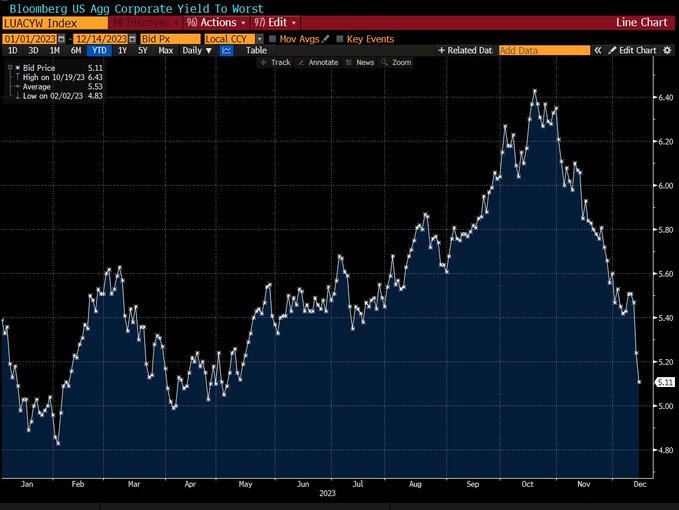

What about investment grade bonds?

- Lisa Abramowicz@lisaabramowicz1 – Dec 15 – US investment-grade bond yields have just had the biggest two-day drop since April 2020.

What about supply concerns about Treasury issuance, you ask? Look at the market reaction to the 30-yr Treasury auction that took place on Tuesday, the day before the huge news from Chair Powell:

That post-auction reaction in both Treasury yields & in stocks speak volumes. Yes those who bought the 30-yr on Tuesday must be thrilled now. But they didn’t know. It is worth pointing out an old lesson that people throng to buy Treasury auctions when Treasuries are rallying just as they declared a won’t-buy strike in October after the Mr. Hyde presser of Powell on September 20.

If Chair Powell & his FOMC are confident about inflation coming down next year, then will the supply of 30-yr Treasuries, the best & safest investment in the world in a falling inflation period, be an issue in the next few months? Not really is our guess!

In this context, we would like to remind readers about the Caste System in Fin TV where smart, experienced practitioners are mocked just because their views contrast with those from “highly prestigious” institutions. We take you back to Bloomberg Real Yield on November 3 in which views of Mary Ann Bartels were seemingly “mocked” by Gargi Chaudhuri of BlackRock (can you get ever higher in prestige?) & the host of the show. We do not wish to repeat what we wrote then, but it is a relief to see that markets have agreed with what we wrote about Mary Ann Bartels in our article on November 5 – “We actually think Mary Ann Bartels will turn out to be right as she has been in other calls this year“.

Most of us know that a Caste System is followed more intensely in larger institutions by people with a higher “mindshare” when some one from a less prestigious entity dares to go against the ingrained (though false) views of a highly regarded expert. In case you don’t recall, read what we wrote in our article on October 15, 2023:

- “This view was well articulated by Kathryn Rooney Vera to CNBC’s Becky Quick who was trying to shame her for going against Becky’s demi-God Lee Cooperman. Ms. Vera pointed out that the Fed seems nearly done (with possibly one rate hike left) and at this stage Fixed Income generally does very well. Watch especially the last minute of the 3:12 minute clip below where she says her 2024 target for 10-yr in 3.75%.”

- “We must point out Mr. Cooperman’s consistent habit (over a decade at least) of speaking about interest rates. He is a superb stock picker & that has been the reason for his stupendous success. But his track record in speaking about interest rates is poor, to be gentle. Go back several years & find him disagreeing with Gundlach about rates on CNBC & be proven wrong. He can do whatever he likes but we blame Becky Quick for taking his off-hand comments & shaming Ms. Vera with those. Frankly, it is Ms. Quick who needs to be ashamed of her behavior.”

As we recall, Ms. Quick said to Ms. Vera that Leon Cooperman had told her to not buy Treasuries below 5.5%. Now look back to October 15 & notice Mr. Cooperman was badly wrong again while Ms. Vera was right. Also, if you go back & search on this Blog for Mr. Cooperman’s disagreements with Mr. Gundlach about Treasury rates, you will find that Mr. Cooperman was wrong about 80% of those times.

This is not about Becky Quick or about Sonali Basak. It is about our abhorrence of the Fin TV caste system which encourages TV hosts to look down publicly at guests from smaller & less-“prestigious” firms while paying homage to guests from highly “prestigious” firms.

The “weirdest” exhibition of this we keep seeing at CNBC is a “Cramer vs. Cramer” type of situation. We all know CNBC takes pride in exhibiting mostly everything what Jim Cramer says on air regardless of how ludicrous it sounds to many. What many don’t know is that the same CNBC studiously avoids mention of what we think Jim Cramer does best – his “off the charts” segments on his Mad Money Show!

This past Tuesday evening, the day before Chair Powell stunned the markets & propelled Treasury prices skyward, Jim Cramer highlighted the bullish views of his techni-pal Carley Garner about Treasuries & 10-yr Treasury yield. As we recall, Cramer said that the large speculator short position in 10-year Treasuries was extremely large; that Ms.Garner thinks Treasuries will rally & even possibly to levels like 2.5% on the 10-yr yield. We heard this but were not in a position to take notes (without which it would be irresponsible for us to say more about what we heard).

What a phenomenal call from Ms. Garner via Jim Cramer and what a ridiculously stupid decision by CNBC webmasters to hide this call from CNBC viewers. Our simple request to the mega-shot Ms. Quick is that she publicly shame her management for the above decision to hide Cramer’s off-the-charts segments.

How can we tie our “editorial” comments above to investment reality? It turns out that the three true experts we refer to above – Ms. Garner- Cramer, Ms. Mary Ann Bartels & Mr. Gundlach ALL share the 2.5% target for the 10-year yield in 2024.

That brings us to the clip below:

3. Dr. Jekyll & Mr. Hyde and their masters

First & foremost, we think Chair Powell & the FOMC took the correct decision to signal on Wednesday, December 13 that they are DONE with the tightening cycle and that the next Fed action would be to cut rates in 2024. The economy was sending clear messages that it was slowing & that inflation was slowing even faster.

But their completely unexpected 180-degree pivot in rhetoric & action stunned financial markets. Literally no one in the financial or Fin TV space expected what they did. What was the point of taking this radical step literally 7 market days before Christmas? Wouldn’t it have been better & more Fed-like to signal this change in early-mid January followed by the FOMC announcement on January 31, 2024?

Forgive us, but this haste reminded us of another sudden 180-degree change announced the day before Thanksgiving without any prior signaling. Trying to figure out the reasons for the hasty & pre-holiday 180-degree pivot, we had written on December 4, 2021:

- “President Biden & Democrats have the opposite problem in 2022. Inflation has exploded from 1.4% at the start of 2021 to 6.2% currently. What has that done to President Biden’s popularity? Look at the chart below from The Market Ear: So what do you think President Biden & Democrats want from the Fed Chairman in 2022? Get tough on inflation & bring it down was priority one, we guess.”

We also remarked on the timing in that December 4, 2021 article:

- “On November 22, President Biden announced the re-nomination of Fed Chairman Powell and, on November 24, Chairman Powell surreptitiously slipped in the Fed’s change to “Whip Inflation Now” policy in the Fed minutes (released late afternoon before Thanksgiving). And then Chairman Powell reiterated this new & revised fight inflation above all policy in his congressional hearings”.

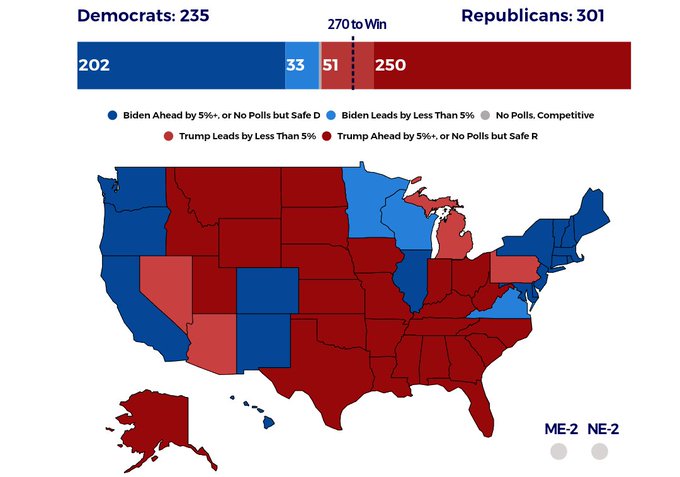

Now President Biden & Democrats have an opposite problem and, actually, a much much bigger problem. It was control of the Congress that was at stake in November 2022. What is at stake in November 2024 is the Presidency & Control of House & Senate. Its even worse than that. What is at stake is America itself & so the need to protect America from its greatest danger has to be of greater consequence for the Fed than virtually anything else, such as Fed policy.

If you doubt us, look at the tweet below dated Sunday, December 10, 2023:

- InteractivePolls@IAPolls2022 – NEW: @RacetotheWH Swing States polling avg. (Biden vs Trump, July 20 Dec. 10) GA: D+0.2 R+5.7 AZ: D+1.2 R+4.9 NV: D+2.7 R+2.9 PA: D+1.5 R+2.3 MI: D+1.6 R+1.3 WI: D+7.3 D+1.9 —— EC based on polls Trump — 301 Biden — 235 racetothewh.com/president/polls

And, as far as we have seen, the entire Federal Reserve with virtually almost all of the Economics crowd is religiously anti-Trump.

Don’t forget that the anti-inflation measures taken by the Fed & the Biden Administration worked to reduce inflation before the November 2022 election. That ended the anti-Biden wave just in time.

Now look at the timing this week. On December 12, Dr. Lael Brainard visited CNBC & spoke with Sara Eisen, her own media representative at CNBC. On December 13, Treasury Secretary spoke on CNBC just hours before the FOMC announcement & Powell’s presser. Frankly, the only thing Mr. Powell could have done to prevent the FOMC’s 180-degree sudden turn was to resign before the FOMC statement was broadcast. That would have been suicidal to his future as a thinker, speaker & investment executive.

Unlike in November 2022, this turn in Powell is fortunately from the malevolent Mr. Hyde to the benevolent Dr. Jekyll. Look what Mary Ann Bartels said on Bloomberg Real Yield on Friday, December 15:

- “we actually see manufacturing troughing; we are seeing real GDP on yr/yr basis actually turn up & the spending legislation bills that Biden signed really start impacting the economy next year – Inflation Protection Act, Chips Act & Infrastructure Act; I wouldn’t be surprised if at some point we do see inflation go negative; … one of the surprises could be if the 10-year can actually fall to 2.5%;”

Remember draining the SPR was the smartest political act of mid-2022. It killed energy inflation & enabled the Democrats to beat back the Republican “wave”. We are not smart enough to even think about what might happen in November 2024 but inflation negative with sub-3% 10-yr rate with easier homebuying conditions with the economy turning up are not bad conditions for running on smart economics if not Bidenomics.

Of course, we don’t mean to suggest that the Fed is a political entity but it is probably fair to say that the Fed is on the side of bankers like Jamie Dimon, private-equity titans & hedge fund billionaires. And that is the side that Paul Volcker was on.

Is that the message of the Bespoke chart below?

4. Bonds “vs.”or “&” Stocks

First it was CNBC’s Scott Wapner who kept jostling with Jeff Gundlach about whether money in cash will move to Stocks instead of Bonds. Then came the revealing slip of the tongue from Melissa Lee, the “dictator” of CNBC Fast Money in her question on Friday:

- “Siting in Bonds, is there any desire to put that money in markets?“

See “bonds” are NOT even markets to the whip-wielder of CNBC FM!! Thanks for the transparency, Ms. Lee!

That does not mean the tweet below is for Ms. Lee. We know we are “untouchable” for Ms. Lee, CNBC FM and indeed for all of CNBC but no reason for them to banish the smart JC from their guest list:

- J.C. Parets@allstarcharts – I see some people still think these two aren’t (or shouldn’t be) moving together. But they are…

The charm of Ms. Lee might be her visibly inflexible & domineering nature but some of her regulars are flexible, courteous & often right. One such made what we thought was an amazing case on Wednesday, December 13, the day that shall be live in investment memory for a long time:

Semi stocks may have been lagging, but not for long!

The Chartmaster @carterbworth lays out the charts to explain why the $SMH might be ready for a turnaround. pic.twitter.com/zil4GaE985

— CNBC's Fast Money (@CNBCFastMoney) December 13, 2023

The above was followed on Friday by a technology investor with a stellar record invited above all by Andrew Ross Sorkin. And we thought he only deals with the philosophically highbrow sphere:

Nothing including Fed-induced rallies works without fuel. That can be new money moving in from cash or forced-buying from short-covering. That was the point of Tavis McCourt of Raymond James on CNBC Exchange on Wednesday. When you read-watch his views, note that he appeared on TV about 30-40 minutes BEFORE Chair Powell’s bombshell on Wednesday afternoon:

- “2-3 turns of multiple expansion in the last 6 weeks which is really a substantial amount; midcaps that had been trading 20%-30% below historical norms are now only 5% below historical norms; small-caps that were 35%-40% below historical norms are now only 20% below historical norms; large caps outside the Big 7 trading at 5%-7% below historical norms are now 5%-1-% above; so at some point, you got to have better earnings to keep the fire going; I think we are OK, but the rally due to realization that inflation fight is behind us has come to an end; … Bond rally will come either way“

Speaking of “landing”, Tavis McCourt said above that we “wouldn’t know till late 2024”. What about others?

Our two favorite Fixed income experts this year have been Priya Misra & Kelsey Bero, both of JPMorgan Asset Management. Kelsey Bero told Andrew Ross Sorkin on Friday that their mantra has been “its a soft landing unless proven otherwise“. She like all does think real yields are still very high & “bonds will outperform cash“. Priya Misra told Tom Keene that we will see a hard landing BUT that was just before the Powell’s FOMC decision at 2:15 pm on Wednesday.

In a similar way, two smart investors we have followed this year & who now thankfully differ in the no-yes debate on recession are Anastasia Amoroso & Lauren Goodwin. Also both think Bonds are a good bet.

Is it time to pivot out of large cap growth stocks and into areas of the market that have dramatically lagged? @AAmoroso_1 weighs in: pic.twitter.com/YjaLnwO9Po

— CNBC's Closing Bell (@CNBCClosingBell) December 14, 2023

In contrast, Lauren Goodwin thinks recession is likely but doesn’t see any chance of negative data for next several week. We do urge readers to focus on the last question & Ms. Goodwin’s answer – recessions tend to become visible suddenly, something we agree with.

Does the market rally have any juice left? Here's why @macrolg thinks so: pic.twitter.com/USEHmkOR6C

— CNBC's Closing Bell (@CNBCClosingBell) December 15, 2023

The Dollar fell by 1.3% this past week on both UUP & DXY counts. What might work well if the Dollar stays weak AND the US economy remains ok? See a good discussion on CNBC Fast Money below (see Ms. Lee, we can praise as well as criticize!):

If domestic markets slow, are there more attractive investments overseas?

"The opportunities are everywhere," says @timseymour.

He, @CourtneyDoming and @Bonawyn take a trip around the globe. $EWW $INDA pic.twitter.com/FSLqOzucH3

— CNBC's Fast Money (@CNBCFastMoney) December 15, 2023

We do intend to write about India next week with a special focus on something big that very few people focus on or even know about. As a tease, it takes us back to what Dubai did in early-mid 1990s. More on all that next week.

Since we began with Rates, perhaps we should end with Rates and in a gentle non-positive way:

- Jay Kaeppel@jaykaeppel – Dec 16 – A 50% retracement of 2020-23 bear market could propel TLT to $130. That said, TLT trader sentiment is flashing yellow. Red dots = @SentimenTrader TLT 20-day Optix cross above 76%. Bonds sure to reverse lower? Nope. Bond traders getting a little ahead of themselves? Could be.

5. Quick Summary of the last week

Broad Indices & Key Stocks:

- VIX down 65 bps; Dow up 2.9%; SPX up 2.5%; RSP up 4%; NDX up 3.3%; SMH up 7.2%; RUT 5.5%; IWC up 4.4%; DJT up 5.3%; BAC up 8.7%; C up 2.1%; GS up 8.2%; SCHW up 10.8%; AAPL up 43 bps; AMZN up 1.8%; GOOGL down 1.8%; META up 71 bps; MSFT down 1%; NVDA up 2.9%; NFLX up 4.1%; MU up 8.6%;

Commodities & International Index ETFs:

- Gold up 74 bps; GDX up 4.6%; Silver up 3.5%; Copper up 1.1%; CLF up 7.7%; FCX up 9.6%; Oil up 59 bps; Brent up 1.2%; OIH up 4.3%; XLE up 2.5%; EWZ up 2.3%; EWY up 2.7%; EPI up 2.3%; INDY up 2.4%;

Send your feedback to [email protected] Or @MacroViewpoints on Twitter