Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Tone Changed?

If you are like most people, many of your family arguments tend to result from the tone you might have used in making your point. It is not all that different in big things in big settings. Recall the classic “failure to communicate” line from the Captain to Cool Hand Luke we used on October 22 in Section 3 of titled Fed & Markets – the Really Big Risk: What was the result of that failure to communicate during the July 26 presser & the September 20 presser of Fed Chair Powell?

The move was parabolic & VXTLT showed panic. So we wrote on October 22 that “we think they have now woken up at least to the notion of a failure to communicate“. What made us feel so? The views expressed by Jean Boivin, BlackRock Investment Institute Head, on Bloomberg Open on October 19, 2023:

- “I think they are focused on the bond market selloffs but I think they don’t know themselves what to make of the long term rates backup … we think we are now in a world where the Fed itself doesn’t know what it is doing; doesn’t know what to make of long-end … so you have seen that they are concerned about long-end getting out of control and that is going to dominate over, in my mind, the recent data … volatility is like completely surreal“

So, we felt, “in that mode they are unlikely to be overly aggressive & risk a further parabolic takeoff“. With that thought, we highlighted Goldman’s call to buy IEF calls on October 22. How has the long end of Treasury market fared since Monday October 23?

TLT rallied 1.2% from October 23 to October 29 & then rallied 3.9% further this past week. Its high beta equivalents EDV & ZROZ rallied 1.8% & 1.6% in the first week and then rallied further further 5.9% & 6.6% this past week.

Treasury yields collapsed this week:

- 30-yr yield down 24.5 bps; 20-yr down 26 bps; 10-yr down 26.5 bps; 7-yr down 28.1 bps; 5-yr down 26.5 bps; 3-yr down 20.6 bps; 2-yr down 17.2 bps ;1-yr down 12.5 bps;

- Credit performed well too – HYG up 2.9%; JNK up 2.8% with leveraged ETFs up big – DPG up 9.1% & UTG up 8.7%;

This week we saw “symmetry” between the new communication tone of Chair Powell & the evidence presented by economic data. While the data is a positive, we think the more material change has been, as Jeff Gundlach said to CNBC’s Scott Wapner, “somehow the tone seems to have changed“. And this “changed” tone of Chair Powell is what may have fixed the failure to communicate that almost “broke” the long end of the Treasury market.

How does the TLT performance over the past two weeks compare with S&P performance?

And how did our favorite ZROZ (zero-coupon Treasuries ETF) perform vs. the S&P?

Go back to Terry Bradshaw & see that his 4 Super Bowl victories were direct results of his long bombs to Lynn Swann & John Stallworth. Ditto for Tom Brady. That is relevant because ZROZ, the long Zero-coupon ETF is the long pass equivalent in Treasury ETFs. We also mentioned it because Indian Mathematicians discovered Zero & Arithmetic did not proceed further without the discovery/invention of the Zero number concept.

The above comparison of TLT/ZROZ to SPY demonstrates that almost everyone, except both Fast & Slow CNBC & their Fin TV kinfolk, never tell their viewers that long-duration rates (TLT) move first & then stocks follow. That is why instead to thinking about when/how TLT might rally, much of their energy is focused to celebrating the downtrend of TLT. Don’t wait for that to change because it is not their failure to communicate but a refusal to accept reality. The Fed can’t do that because they actually have an important job to do.

The state of the Non Farm Payrolls report on Friday, November 3 prompted both Mohammed El-Erian & Rick Rieder to say that the Fed is done on Bloomberg Open on Friday. The host John Ferro also said that Andrew Hollenhorst of Citi also said that the Fed is done.

So now what? A rally in rates till the eye can see? As we all saw, the rally in Treasuries began on Wednesday November 1 when Treasury Secretary Yellen released a Treasury refunding schedule that skewed to larger auctions at the shorter end. The markets got the message and the Treasuries rallied. Rick Rieder reminded viewers of this & said the actual refunding will begin next week and, at $500 billion, it will be 40% bigger than the corresponding auction a year ago. That, Rick Rieder said, is the real test – “can we keep pumping this much debt in the system on the risk-free trade”?

On the other hand, Carter Worth, resident technician at CNBC Fast Money, says the 10-year yield can fall to fill the gap at 4.1985%.

We will find out next week. Of course the question on most minds is where will the buyers come from? Mary Ann Bartels of Sanctuary Wealth gave an interesting & different answer on Bloomberg Real Yield on Friday, November 3. She said we have a very large buyer in the market that no one is talking about – the individual investor. This buyer has not been able to get a decent income for the last 16 years & now they lock in 4.5% – 5% in ladders.

The reaction from the new host Sonali Basak & the Institutional guest Gargi Chaudhuri of BlackRock, in our view, was to mock what Mary Ann Bartels was saying. Ms. Chaudhuri as the Institutional Head of Rates at BlackRock has probably never met an “individual investor” at least not one that she didn’t look down upon. And Sonali Basak has been covering Goldman & other bulge bracket firms for Bloomberg. Frankly, these two Indian-origin women brought the traditional Brahmin mockery of people at lower-grade firms to Bloomberg Real Yield that has been hosted admirably by John Ferro & Katie Greifeld. To be even more frank, we, as Indian-Americans, feel personally shamed by what we saw & heard on Bloomberg Real Yield this past Friday.

We actually think Mary Ann Bartels will turn out to be right as she has been in other calls this year. And her call fits with what Bob Michele, head of JP Morgan Asset Management, has said about the steady high demand from a variety of investment platforms including Pension Plans & Wealth Management firms.

The FOMC meeting on November 1, 2023 evoked a memory of another FOMC meeting a day before November 1; the one on October 31, 2007. That 2007 meeting was the first signal that the economy was slowing and that credit issues might be more relevant than believed at that time. How did TLT behave from November 1, 2007 for the next couple of months?

What if the U.S. economy begins a slowdown phase as it did in November 2007? Below is what Nomura suggests:

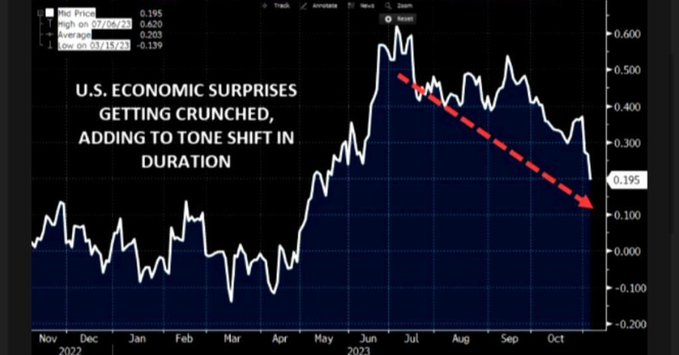

- Via The Market Ear – “Duration has no friends until the data dumps”….but it looks like it’s starting to happen – Source Nomura

2. Bonds & Stocks

It was back on April 4, 23 that we first listened in detail to Barbara Reinhard, Head of Asset Allocation at Voya Investment Management. She said at that time,

- what we saw in March is an important shift .. US outperformed rest of the world pretty strongly; …. we think 700 bps of the international markets outperformance over the US is largely behind us & we think it is the US that is going to be the leader going forward; .. you have that in coincidence with very high cash levels in mutual funds & also somewhat depressed sentiment which is a very important push forward for equities rally …

Look how right she was:

We are simple folks & we like to follow people who have been right before, especially when they express their views sensibly & with evidence. That is why we are highlighting the big call made by Barbara Ryan on Monday, October 30 on Bloomberg Surveillance (minute 1:43 to minute 1:50);

- “… We think bonds are showing probably their best value for the better part of 15 years; … we think inflation is likely to continue to cool over the course of the next few quarters; we think Fed is getting very close to finishing raising rates …. and … almost all the times the Fed has stopped raising interest rates, within 12 months, you get a rally in Bonds … lastly you are also at a very good point on duration curve… right now if you own 30-yr bonds & ylds go up by 50 bps, you would lose only about 3%; if yields were to decline by 50 bps, you would gain about 13%; so duration at this points is very much in investor’s favor;”

- “we are adding longer duration Treasuries to our portfolio because we think the yields to be had after inflation are very attractive & can also act as diversifier for equities; … the return for bonds over the next 10 years is north of 4.5% … “

Jeffrey Gundlach spoke with CNBC’s Scott Wapner for about 26 minutes after the presser of Chairman Powell. His basic message was that we are getting close to a recession & Treasury bonds are quite attractive at this moment. He added that it is quite likely that that we see rate cuts over the first half of next year, bigger rate cuts than what the Fed thinks now. He said the equity market is really over-valued, doubly so over the stock market. His longer term allocation remains at 25% long duration Treasuries, 25% cash; 25% equities & 25% commodities.

A new addition to the recession is nearer than markets thought is Lauren Godwin of NY Life Investments.

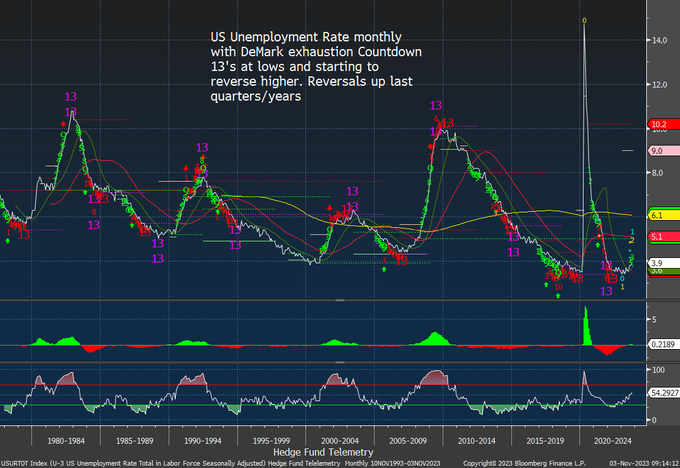

Since rise in the unemployment rate is a positive signal for interest rates to go down, below could be relevant:

When this year began, we did fear that the refusal of the Fed to ease conditions would be similar to the refusal of the Bernanke Fed to ease in 2007 when they should have. Now our personal belief is that we might end up seeing a bad recession kinda like the 2007-2008 or 2000-2002. Below in Section 4, we provide some charts to explain what they see.

3. Hope succeeds

Last week, we pointed out a few bullish tweets & charts in our article. It was following a bad period for equities which were resting on a think edge of support. Thanks to interest rates falling & the Fed turning sensible, the equities markets enjoyed a spectacular rally this past week.

- Dow up 5.1%; SPX up 5.9%; RSP up 5.7%; NDX up 6.5%; SMH up 8.2%; RUT up 7.6%; DJT up 7.1%; VIX down 29.3%; AMZN up 8.5%; AAPL up 5%; GOOGL up 5.7%; NFLX up 8.7%; META up 5.9%; MSFT up 6.9%;

The stars this week were the banks because of the steep rally in long-duration Treasuries, the asset class that accounts for the large losses on Bank balance sheets. With rally in those Treasuries, BAC went up 13.2%; C up 10.5%; GS up 13%; SCHW up 11.5%. As long as long duration Treasury prices go up or remain stable, the Banks should ditto.

The really big story could be the Dollar. UUP was down 1.2% & DXY down 1.4% on the week. But is that just the beginning?

- Peter Brandt@PeterLBrandt – Possible “King’s Castle” top in U.S. Dollar Index $DX_F

International stocks did very well indeed. EEM up 6.3%; EWZ up 6.5%; EWY up 9.2%; EWG up 5.6%; Indian funds were the least up around 3% on the week. Material stocks like CLF, FCX were up 6.8% & 4.4% resp.

What’s next? Below are the views of Dom Wilson of GS via The Market Ear:

- We had more softness in the data, so that slowing in growth we’d been waiting for has finally become visible

- we’ve had refunding announcements better than feared

- the BOJ was less aggressive

- Fed was a bit more explicit about the impact of the tightening in financial conditions on their thinking.

- sharp rally in risk, particularly in areas like VIX and IG CDX that seemed to have embedded most risk premium.

- Positioning has clearly played a big role in the sharpness of the squeeze

- very clear break back above the 200-day MA for the SPX is going to make the technical crowd happier and probably renew the focus on seasonals.

Equities just need some stability according to him:

- “As usual, we’ve moved a long way very quickly. I think it may get harder to keep pushing yields a lot lower, but for equities you probably just need to have more stability. To keep that relaxation theme going, we would ideally need to see continued signs of some softness in the data. That would help to cement the narrative that the Fed is likely to done, keep rate volatility heading lower and push people back towards equities.”

Most of the smart commentators we follow were more reticent after the big move last week:

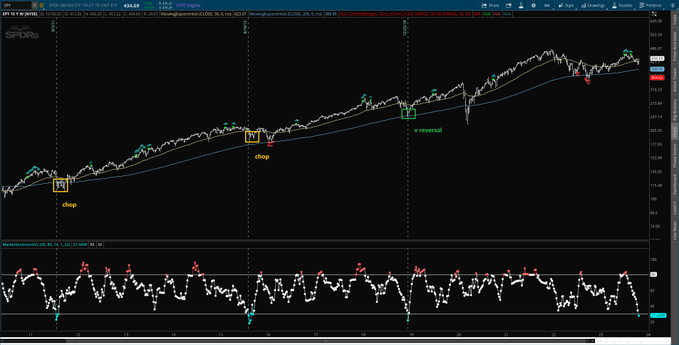

- Trader Z@angrybear168 – $SPY weekly sentiment drops to bearish extreme zone, happened 3 times since 2009 low, longer term bullish but short term could see more chop.

We read a number of tweets about a Zweig thrust and a Whaley Thrust. But Mr. Whaley himself was a bit reticent.

- Wayne Whaley@WayneWhaley1136 – 5 PCT WKS ABSENT A +2% DAY. In an effort to balance the plethora of bullish thrust studies that will be in circulation this wk, I submit the following. Last wks 5.8% advance came without a 2% day. I see 16 of those since 1950. The forward results, were of the pedestrian variety.

And,

- Wayne Whaley@WayneWhaley1136 – Nov 3 – And now the race begins to see who can post the most bullish thrust signal.

Our hope having been met this past week, we prefer to let the market show us where it wants to go this week.

4. A bad bad recession ahead?

The charts below are presented without any commentary. The message is very stark & one that can be ignored by those who believe the chance of seeing another major downturn like 2007-2008 & 2000-2002 is zero. Do remember much of the below might apply only to those who can’t afford a money market fund portfolio &/or a bond portfolio. But also remember that much of the below applies to that group mocked as voters. And think how they might react a year from this past week!

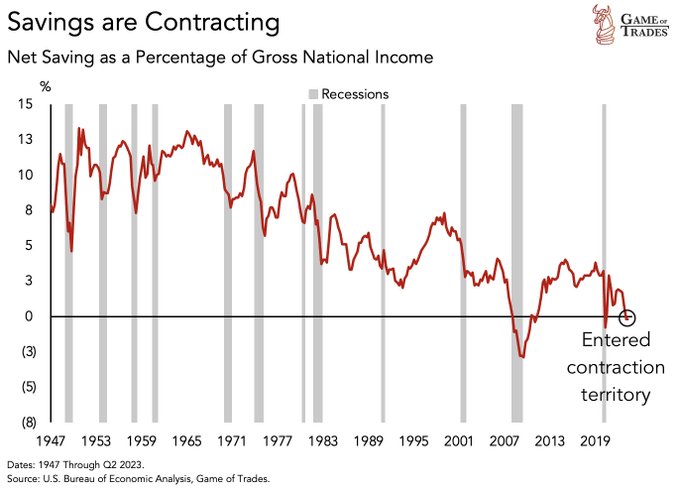

- Game of Trades@GameofTrades_ – This has happened ONLY 3 times in the last 75 years Savings as a % of national income is now contracting The previous 2 contractions coincided with the: – 2008 Financial Crisis – 2020 Pandemic High interest rate + high debt environment is a strong headwind for the consumer At this rate, MAJOR economic volatility is not far away

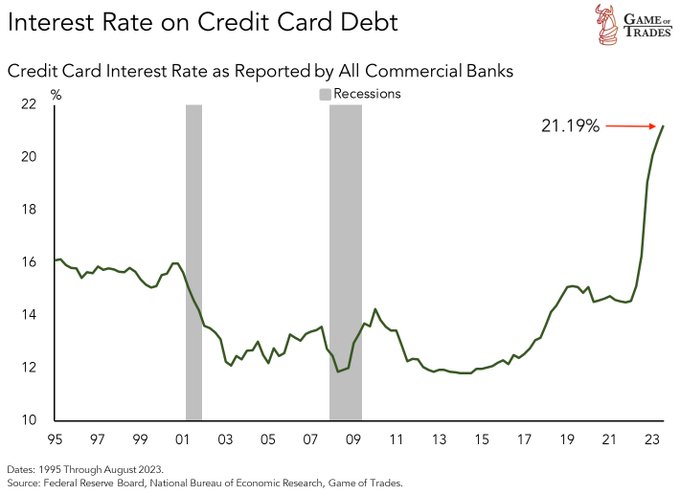

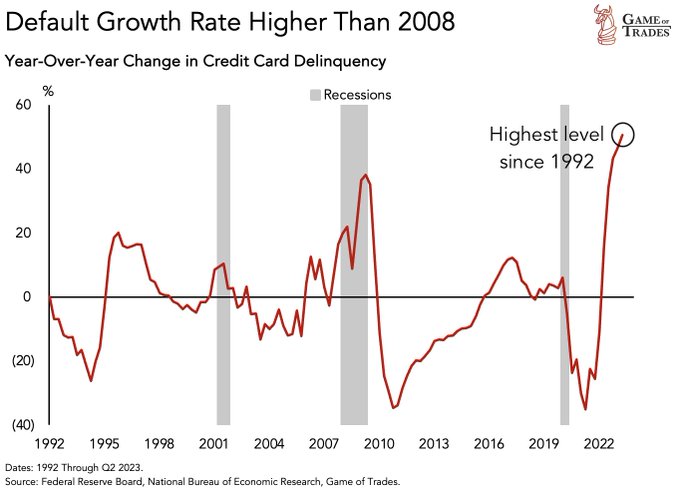

- Game of Trades@GameofTrades_ WARNING: Credit card interest rates have spiked to 21.19% A level that has NEVER been seen in 25+ years This is happening at a time when credit card debt have surpassed $1 trillion And personal interest payments has crossed above $500 billion There is only 1 word to define this: Unsustainable

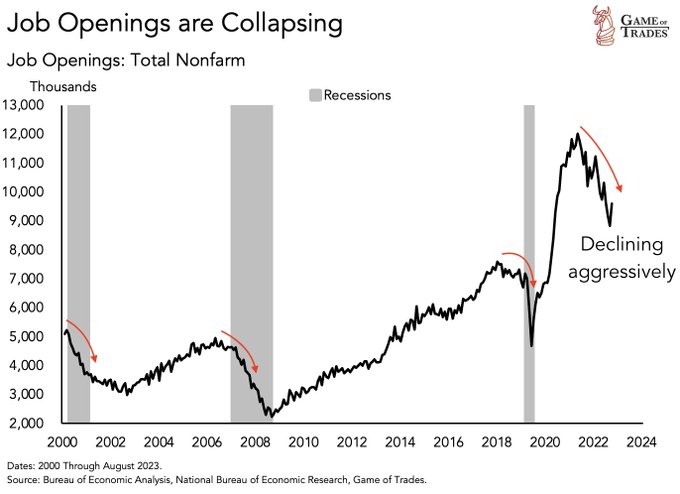

- Game of Trades@GameofTrades_ The labor market is nearing trouble Job openings have been falling off a cliff Similar declines have occurred 3 times since 2000: – Dot Com bubble – Financial Crisis – Pandemic All of them ended with a lot economic volatility The worst part: This is happening at a time when the consumer is running out of excess savings

And so on! Will even a rapid sequence of interest rate cuts help improve all this? But wait! The Fed doesn’t care about all this. Either they think these warnings are just nuts or they don’t fit with history judging them as New Volckers!

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on Twitter