Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Hope?

Below is what we wrote last week after posting bullish points & comments from the cognoscenti.

- “Note that the blackout period for FOMC participants began on Saturday, October 21. So no chance of getting more destructive remarks from Chair Powell before his presser on November 1. Also allow us to say that, after his Hyde-like expressions this past Thursday, Chairman Powell will be thoroughly coached to stick to the prepared FOMC statement & then follow a Greenspan-like say no evil policy.”

- “As we will see in the next section, the FOMC & Chairman Powell are reportedly “focused on the bond market sell-off” and are “concerned about the long-end getting out of control“. So in that mode they are unlikely to be overly aggressive & risk a further parabolic takeoff. “

- With the above thought framework, we think that stocks might rally into October month-end especially if the mega caps don’t disappoint either in earnings/guidance or in after-market action. Given the short base & if Chair Powell speaks a two-sided mantra on November 1, we could even see a Happy Thanksgiving indeed!

Well, the silence from the Fed did prove to be a bit golden!

- TLT up 1.2%; EDV up 1.8%; ZROZ up 1.6%; 30-yr yield down 6 bps; 20-yr down 8 bps; 10-yr down 8 bps; 7-yr down 8 bps; 5-yr down 9%; 3-yr down 1.6%; 2-yr down 7 bps; Big credit funds were OK with HYG up 46 bps & JNK up 58 bps;

Unfortunately our second conditional disappointed badly either in earnings/guidance or after-market action or both:

- GOOGL down 9.9%; META down 3.8%; NFLX down 94 bps; MSFT up 99 bps; AMZN up 2.1%;

That leaves AAPL (down 2.8% this week) to grace next week & that too the day after the Powell presser. And the Dollar was up with UUP up 47 bps; DXY up 35 bps. Gold, Silver & Copper were up with Oil down hard. The above doesn’t sound like it but the big stock indices were beaten badly & soundly despite VIX down 2% on the week:

- Dow down 2.1%; SPX down 2.5% (to 4117 way below the 1495 support); NDX down 2.6%; SMH down 2.7%; RUT down 2.6%; DJT down 6.2%; BAC down 4.4%; C down 3.5%; GS down 3.4%; JPM down 5% (thx to Mr. Dimon’s announcement of a stock sale in 2024?);

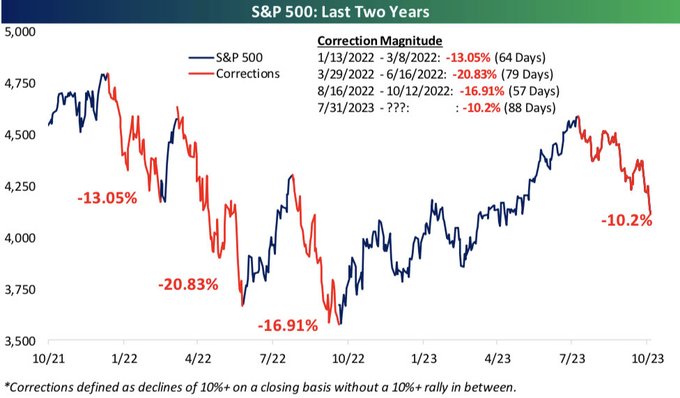

Everyone knows now that the S&P has corrected by 10%. Does any one know the answer to the follow-on question?

- Bespoke@bespokeinvest – Here’s a look at the four 10%+ corrections we’ve had in the last two years. Just registered #4 last week. How deep will this one end up being?

2. Looking at the brighter side!

Let us go back to our well-quoted smart guys who have proven right a couple of times:

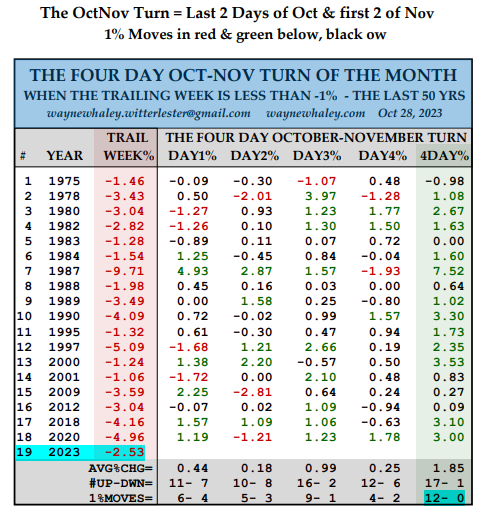

- Wayne Whaley@WayneWhaley1136 – Oct 28 – 17 CONSECUTIVE POSITIVE OCTNOV TURNs. Define the OctNov Turn as the last 2 trading days of Oct & first 2 of Nov which are the first 4 days of next wk. The S&P was down 2.5% last wk. The last 17 times, the wk before the OctNov Turn was down more than 1%, the Turn was positive.

Now a smart DeMarkian who makes a living calling turns:

- Thomas Thornton@TommyThornton – Oct 29 – The script of lower highs and lower lows has worked well. $SPX had a DeMark Sequential sell Countdown 13 on July 13th and I am expecting a new Sequential buy Countdown 13 this week or next. S&P bullish sentiment is now 10% bulls. A tradable bottom within the next ten days is increasing. There are plenty of negative landmines with geo-macro events, earnings, the Fed, and economic data that we will navigate.

Even a Buffet indicator has turned positive:

- Holger Zschaepitz@Schuldensuehner – Global stocks have lost another $1.5tn in mkt cap this week on still-elevated US 10y yields and on not good enough earnings results. All stocks now worth $98.2tn, less than global GDP. This means that the Buffett Indicator is once again below the critical level of 100.

What about emerging markets you ask, especially after last week?

- Jay Kaeppel@jaykaeppel – Oct 27 – Not everyone is surprised that Emerging Markets have plunged in recent months. But history suggests it may soon be time for the Bears to take some chips off the table. @sentimentrader

Speaking of Emerging Markets, we saw a heading on Bloomberg that JPMorgan just has upgraded India ($INDY) mainly because $INDY has a track record of appreciating 13% into the 2024 election. We ourselves have refrained from discussing India equities this year simply because simple guys like us have learnt to wait until some sort of pessimism takes Indian stocks down.

For those who care, SMIN, Indian small cap ETF, has done much better than the Nifty in India this year as the chart below shows:

Since most above can fall under the “beta” umbrella,

- zerohedge@zerohedge – Thu Oct 26 – McElligott: The Biggest Pain Trade Of All Is A “Beta Rally” Into Year-End That Nobody Has On

But frankly, “beta” today means the megacaps. So how is a smart hedge fund manager positioned in these mega-beta names after the earnings?

- Dan Niles@DanielTNiles – Thu Oct 26 post-mkt – Magnificent 7 recap: 1) we own $MSFT & $NVDA for AI, 2) covered shorts in $TSLA (earlier) & $AAPL today but looking to reshort higher, 3) no position in $META but looking to buy, 4) sold $GOOGL 5) own $AMZN for surging profits. Covered shorts now <1% of assets for oversold rally.

Nice way to end this section, right?

2. Rates & their Master

What beta-fuel does a rally need? Treasury rates going down or at least staying calm. Last week, we highlighted Goldman’s idea of buying IEF calls. That wasn’t too bad. What’s on the slate for next week?

- Jason@3PeaksTrading – Oct 27 – $TLT buyer into close for 6250 Feb $93 calls at $1.37, lots of bullish flow in bonds this week as they likely form a bottom.. yields closing the day on lows

Do investment grade bonds also rank as soft beta?

- J.C. Parets@allstarcharts – Oct 24 – Are you buying Corporate Bonds after this retest of the lows from exactly 1 year ago?

Will the Masters of Rates see it the way Brian Moynihan said per Rosie or dismiss it?

- David Rosenberg@EconguyRosie – Maybe Ackman heeded Brian Moynihan’s comments: “Frankly, the Fed has won the battle of the American consumer – they are slowing down. And the question is what happens next”. What comes next is the end of the ‘soft landing’ and the transition to the ‘hard landing’.

Two ways to play TLT sentiment:

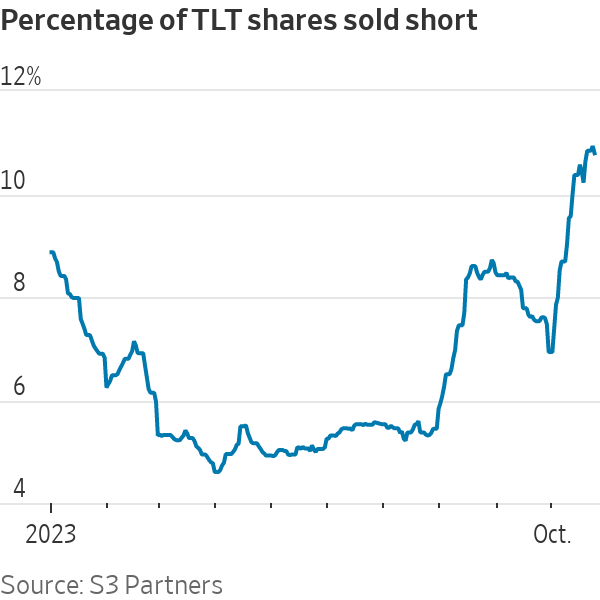

- Eric Wallerstein@ericwallerstein – Oct 29 – Nearly 11% of $TLT shares are sold short via

@jackpitcher20 : https://wsj.com/finance/investing/buy-the-dip-investing-mantra-lives-onin-the-bond-market-at-least-b5d2996f?st=03gwd4vzh4ozki8&reflink=desktopwebshare_permalink

vs.

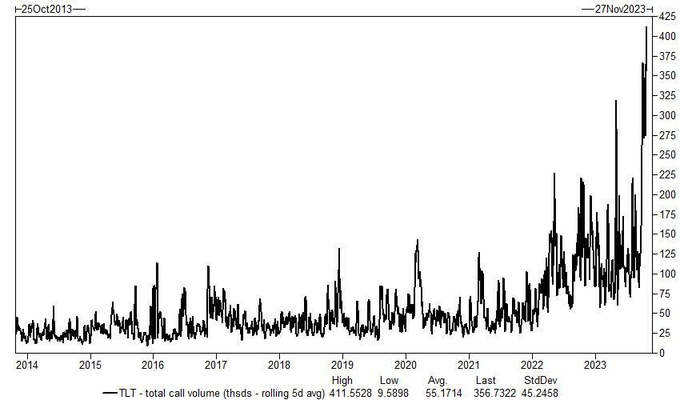

- Markets & Mayhem@Mayhem4Markets – Oct 29 – $TLT call volume has hit record highs recently, with most of those calls being bought to open That’s a little too bullish to say that the rise in rates on the long-end is over

Who decides between the above two views? Chair Powell or the economic data? Can Chair Powell hint at a wait & see posture only to see a strong payrolls number or does Chair Powell stay hawkish only to see a weak payroll report?

What would the FOMC statement & the Powell presser do to a lovely chart?

- J.C. Parets@allstarcharts – Oct 28 – With just a few days left in October, here’s Gold flirting with putting in its highest monthly close in history

Sunday’s NFL games delivered a message that even the most downtrodden can rise & defeat the highest elite. Who would have thought that Denver would literally run over Mahomes & Kansas City Chiefs?

Frankly, we can’t wait for Wednesday FOMC statement & the Powell presser.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter