Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.In the face of Powell & Bullard

Bloomberg’s Lisa Abramowitz was the first we saw on FinTv who used the E-word on Wednesday after the FOMC stunner:

- Lisa Abramowicz@lisaabramowicz1 – The scent of a potential policy error…..longer-term yield curves flatten out on the Fed’s decision as traders price in slower longer-term growth:

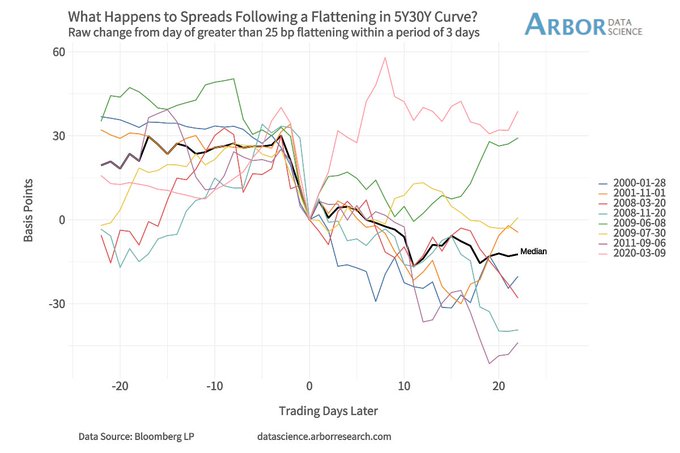

She wrote about the 10-5 year Treasury curve. But far more interesting is the 30-5 year Treasury curve. After all, the 5-year is the highest beta in the belly of the Treasury curve and the 30-year yield is the cleanest & purest indicator of futures inflation expectations (at least when the Fed is not doing the Twist).

The 30-5 year curve flattened by 10.4 bps on Wednesday while the 10-5 curve flattened only by 3.4 bps. That however was just the beginning. The 30-year yield fell by another 18 bps on Thursday & Friday to close at 2.015%. The 20-year actually closed at 1.96% breaking the 2% barrier. The 10-year yield left behind the 1.50% barrier to close at 1.44%.

At least the 30-year yield stayed above 2%. That break might be a psychological event. But what level must it hold?

- David Rosenberg@EconguyRosie – Keep an eye on 1.92% on the long bond yield. That’s the 200-day moving average and we are closing in on that level. We break that and it’s a case of look-out-below!

What happened to long-duration bonds seemed to surprise so many on FinTV. Frankly, the real surprise to us was that so many were surprised. One such had actually predicted what happened:

- Will Slaughter@MilwaukeeBonds – Not a lot of people have noticed that bonds (the long end at least) have been in a bull market for 3 months now…whether they remain so will depend on the Fed’s urgency to dial back additional stimulus. I wouldn’t be shocked if hawkish messaging is outright bullish for long Ts.

So basic, so simple and so historically accurate! Yet so surprising to so many?

2. Bullard vs. Powell

Actually what happened on Wednesday should have been bullish for a TLT + QQQ portfolio, a term we got from Bloomberg’s Brian Chappatta on NFP day, Friday, June 4. That brings us to our title for this section:

Wednesday was virtually a non-event for QQQ+TLT with QQQ down 34 bps, and TLT down 9 bps. The equity markets & TLT rallied within 10-15 minutes of Powell’s presser as we can see below in the 1-day charts of FOMC day- July 16:

These rallies continued on Thursday with QQQ up 1.29% and TLT up 1.50%. Then came Friday morning and the jaws of the QQQ-TLT spread burst wide open on Friday morning with QQQ down 81 bps and TLT up 1.88% by Friday’s close.

We focus on QQQ because it is the one stock index that does better when TLT goes up. So why did QQQ fall hard on Friday while TLT rallied very hard? One word answer – Bullard. That was one of the most arrogantly deaf-blind Fed-head appearances we have seen. He trashed the stock market in the pre-market session and when CNBC’s Becky Quick pointed that out, he shrugged it off by saying “markets will move“. The 10-year did move up 2-3 bps initially to 1.51%+ while Bullard was speaking. But then came the fall off the cliff with 10-year falling to 1.44% and 20-year falling below 2%. Thankfully, the 30-year stayed above 2%.

What Bullard’s arrogant deafness did is awaken fears of an economy looking downwards and the possibility of the dreaded D-word. Even CNBC’s Josh Brown* who scoffed at Powell after his presser on Wednesday got religion by Friday’s Half Time saying that no chance Powell hikes rates; if he does he inverts the curve. Steve Grasso went much farther on the 5pm CNBC show by using the adjective “deflationary spiral” for the US economy. Later in the show, he retracted the “spiral” part but left the “deflationary” adjective intact.

*a quick tell for CNBC Anchors about Mr. Brown. When he is sure, he usually nets it out – short & fast. When he doesn’t know, he tends to get loquacious and starts to lecture. So when he starts to go on & on, better to move on to other commentators.

Some worried about this even before the FOMC meeting:

- Will Slaughter@MilwaukeeBonds – Another bullish factor for bonds is that the feared fiscal blowout planned by the Biden admin is rapidly evaporating. Half the states have ended supplemental UE, there likely won’t be another COVID relief bill, & the infrastructure bill is melting like an ice cube in August.

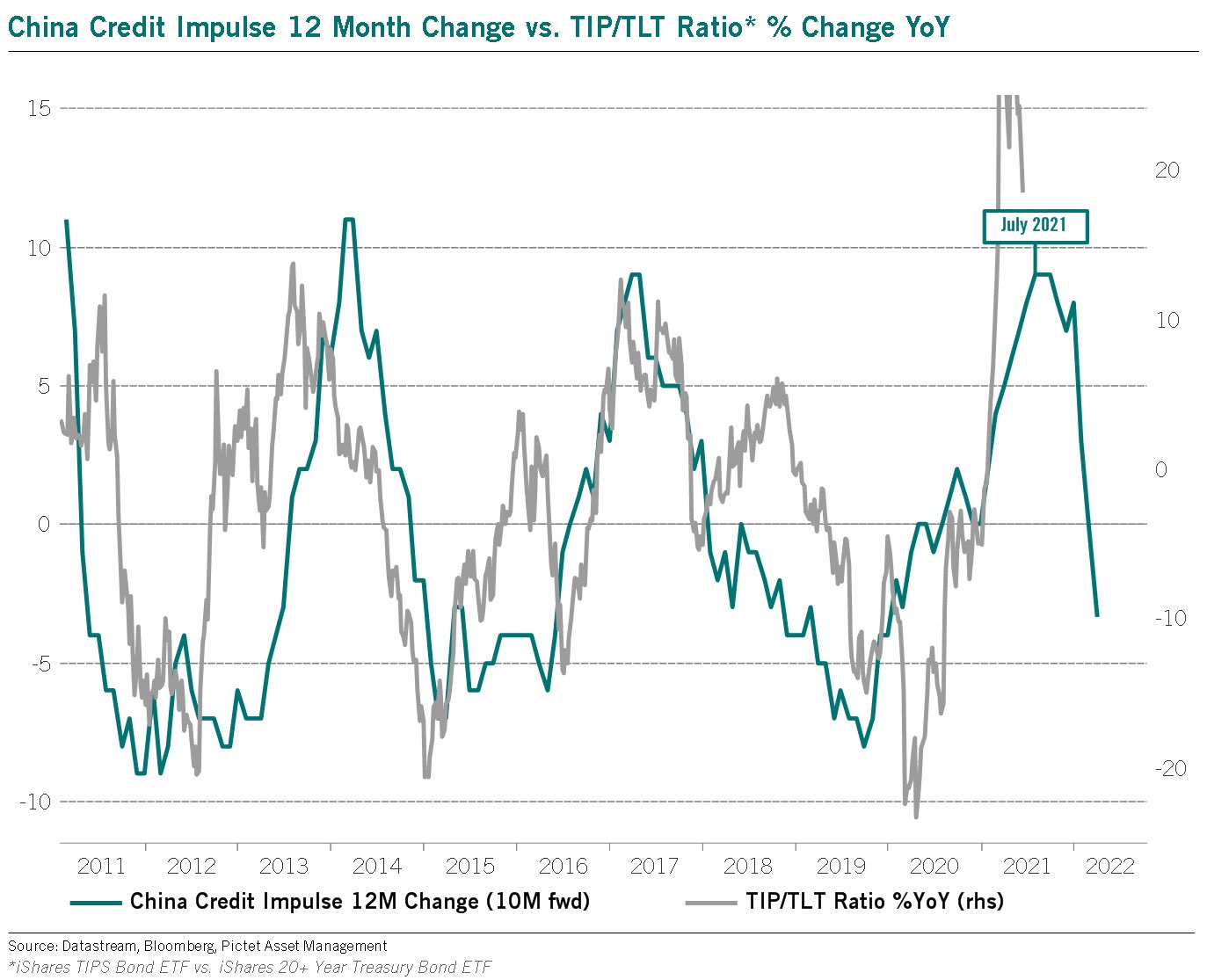

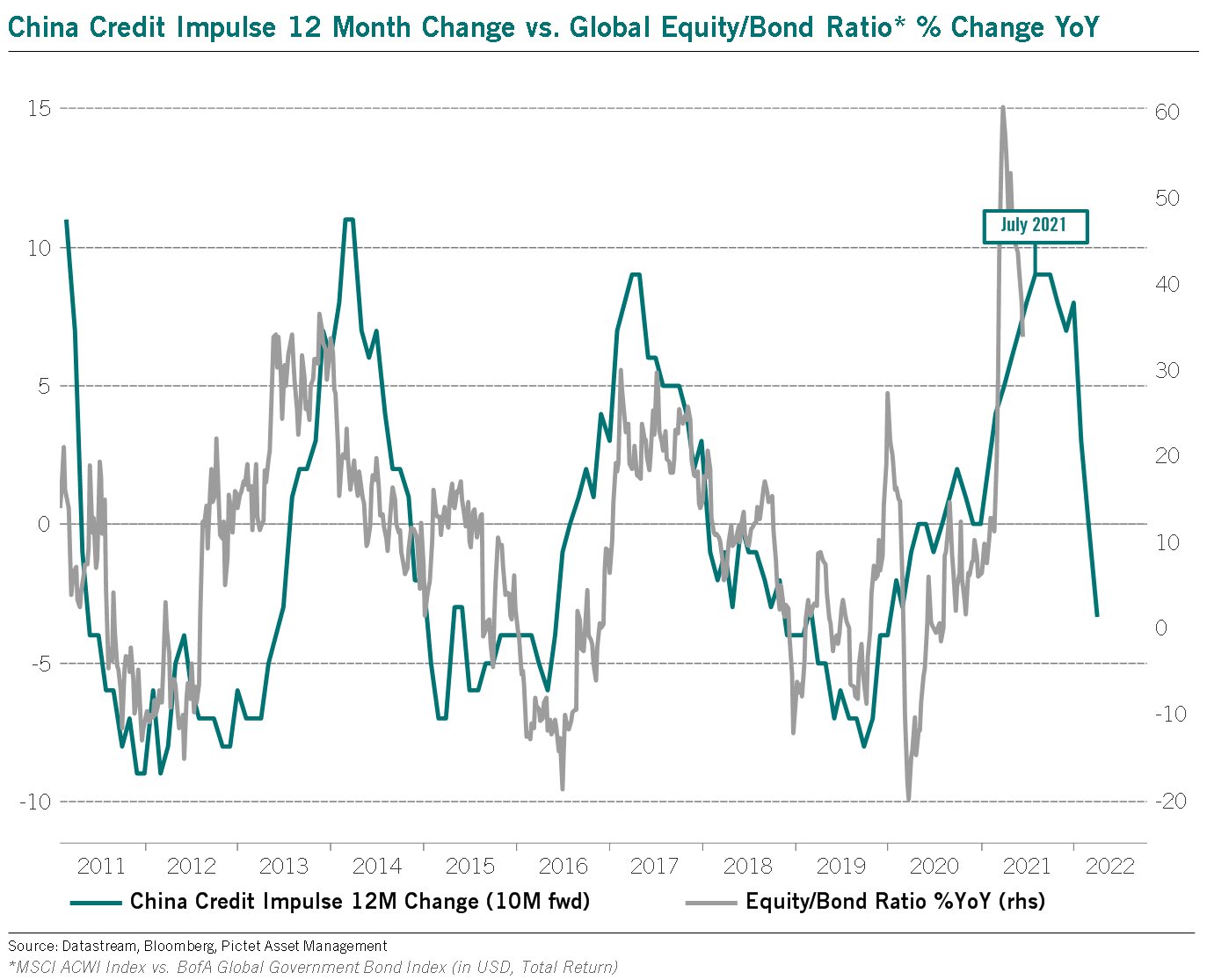

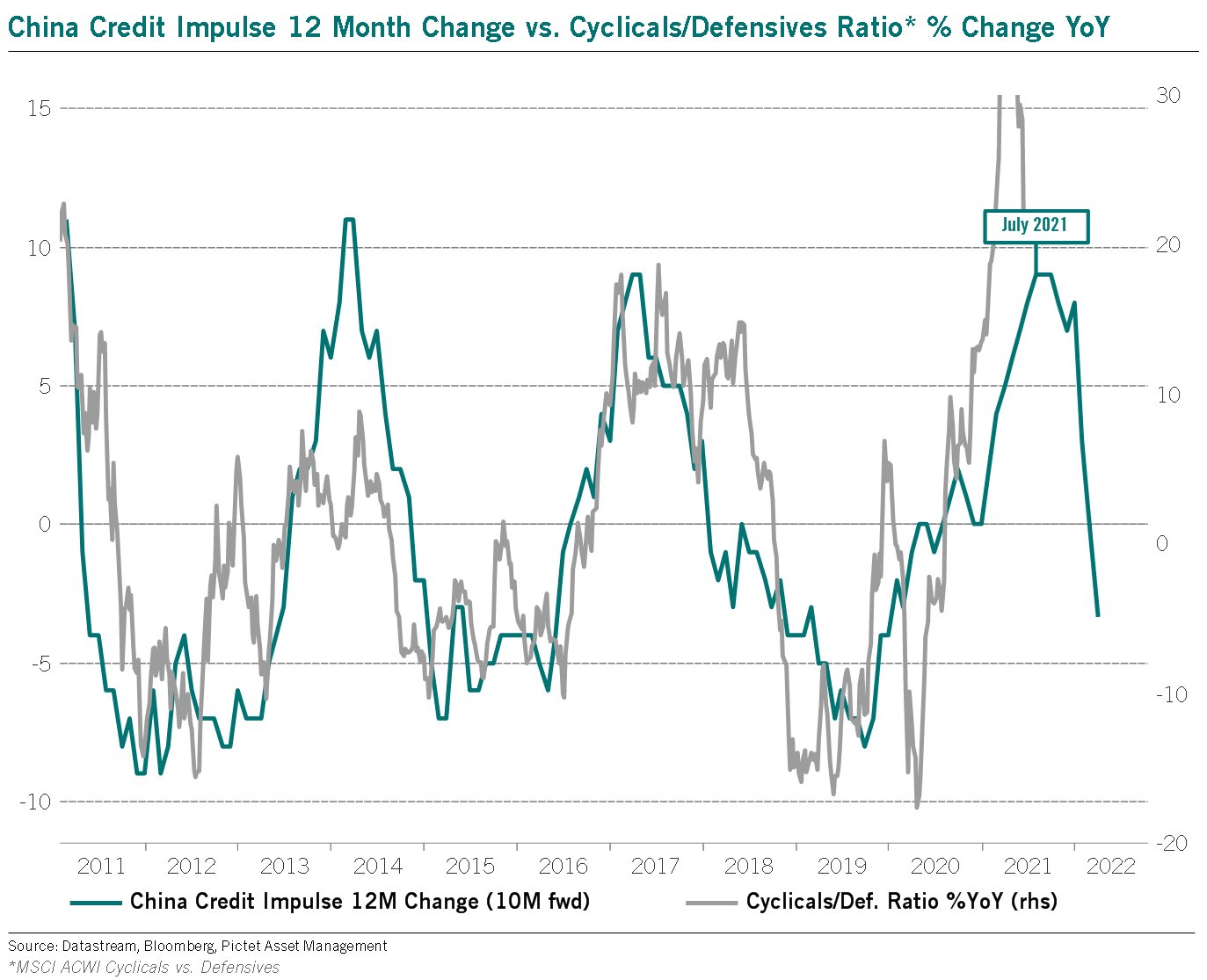

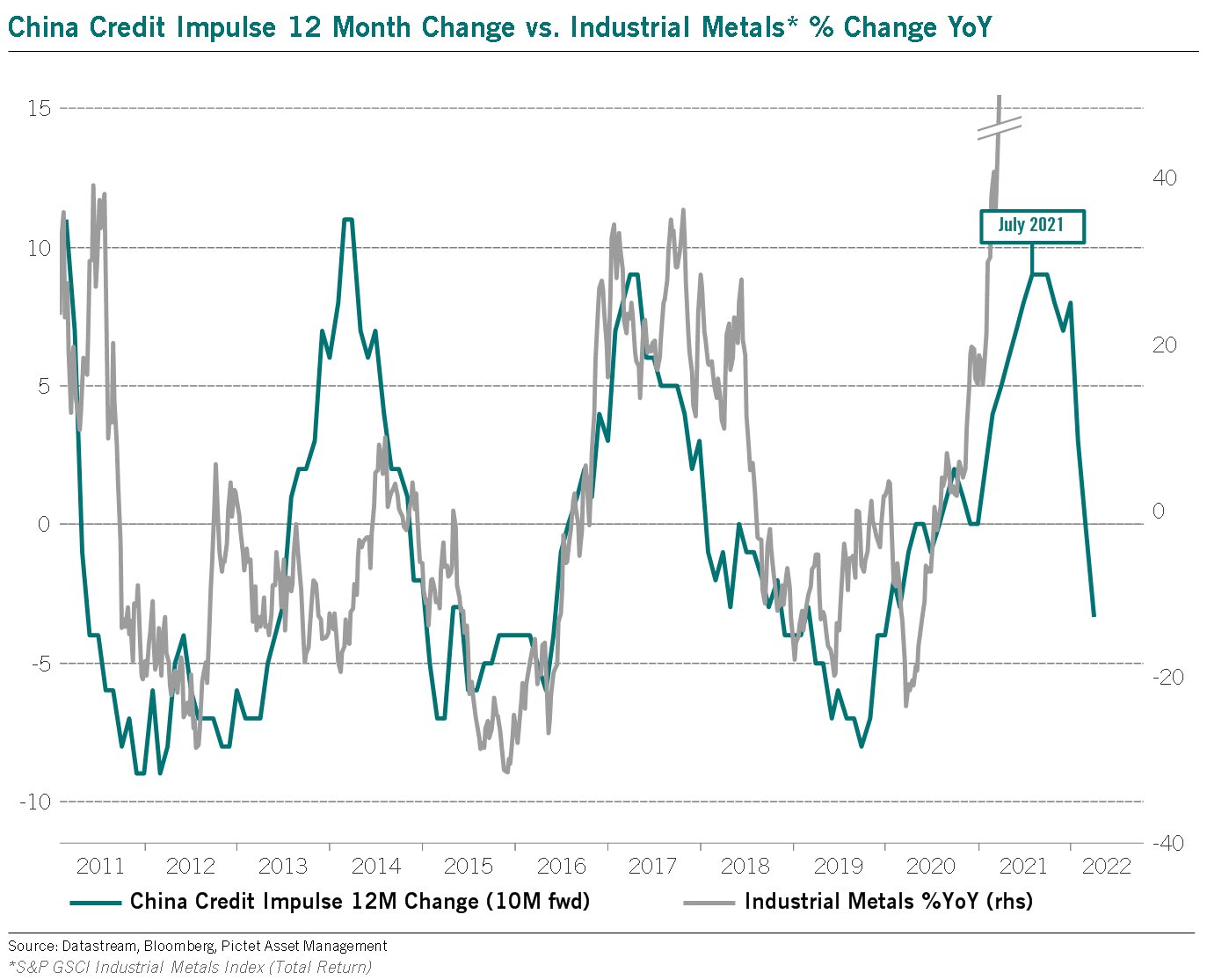

Ok, but what about that big economy that usually sends commodity inflation our way? Look at the four charts posted by @BittelJulian:

- China Credit Impulse 12 Month Change vs. TIP/TLT Ratio% Change YoY

- China Credit Impulse 12 Month Change vs. Global Equity/Bond Ratio % Change YoY

- China Credit Impulse 12 Month Change vs. Cyclicals/Defensives Ratio % Change YoY

- China Credit Impulse 12-mo change vs. Industrial Metals % change YoY

The above may not be all.

3. Powell in the minority in FOMC?

Kudos to Bloomberg’s Lisa Abramowicz for a second smart comment on Wednesday post-FOMC. As we recall, she said “Powell looked glum” in the presser and the markets took comfort from that. We think she was absolutely correct. The rally during the Powell presser began because the stock markets saw Powell was not really committed to the taper or even to the hawkishness of the statement. No wonder the rally continued on Thursday.

Then Bullard came in on CNBC Squawk Box and demolished this good feeling. Bullard was far more hawkish on CNBC than Powell was in Wednesday’s presser. We saw what that did to financial markets on Friday.

That brings us to the third smart comment from Lisa Abramowicz. This one was on Friday afternoon as she hosted the 1 pm Bloomberg Real Yield show. She remarked, as we recollect, about Powell at about 1:10 pm – “sense of disagreement – increasingly not finding himself in the majority“.

Once again she was absolutely right, we think. We will find out more next week, from the numerous Fed-head speeches, where they stand in this Powell-Bullard difference. Already as Morgan Stanley’s Michael Kushma said on BTV Real Yield on Friday that he “didn’t know there was so much dispersion at the Fed“. So what the markets do next week might depend a lot on what the various Fed-heads say.

But there might be another deeper issue at the Fed. Most know that Paul Volcker was finally forced to resign when he lost the majority of his committee. And we have felt since the election that the Biden team wants to replace Powell with Lael Brainard. The Biden team and the Democrat party are united in their resolve to spend a lot of money to win the November 2022 election. Everything rides on keeping the House & the Senate for them and very little is going that way for them.

But Powell may the wrong Fed Chair for that masterplan. They probably think they need the Brainard-Yellen tag team for that. If they choose to keep Powell, they might need to announce Powell’s reappointment by mid-September or before the September 22 FOMC meeting. If his reappointment is not announced by then and if he again finds himself in the minority in the FOMC at the September meeting, what does he do? We sincerely hope all this is stupidly simpleton speculation and the markets remain sanguine about Chairman Powell’s reappointment.

Fortunately, the Fed keeps on doing what it has been doing despite the talk this week:

- Holger Zschaepitz@Schuldensuehner – Jun 17 – #Fed balance sheet tops $8tn for the first time ever as Powell keeps printing press rumbling. Total assets rose by $111.9bn, most since March, due to increases in security purchases, traditional lending. Fed balance sheet now equal to 37% of the US’s GDP.

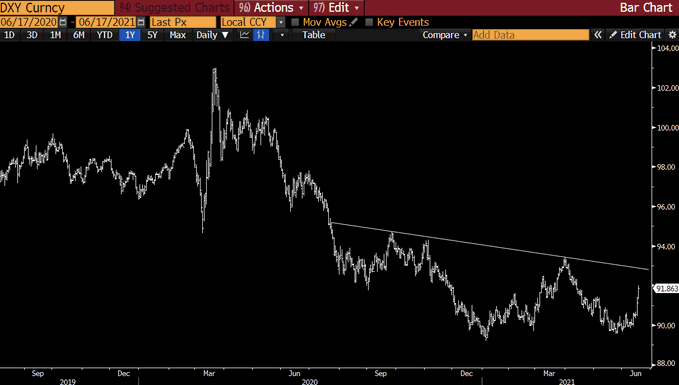

4. U.S. Dollar

In a clearest statement that Fed talk about the future is more important than current action, the U.S. Dollar rose 1.9% this week. But is this a big deal? Just as Treasury rate fall is not a very big deal until the 30-year breaks the 200-day at 1.92% per Rosie, the Dollar move is not a very big deal unless,

- Raoul Pal@RaoulGMI – Jun 17 – We need to see the dollar break this inverse head and shoulders first…

Naturally, with Dollar rising, Real rates rising and inflation expectations falling, Gold fell 5.8% this week with gold miners GDX & GDXJ down 10% + this week. Silver was down 7.5% & Copper was down 8.8% on the week. Market darlings like CLF & FCX fell by 19% & 15% resp.

Oil was up 1% but energy stocks were hit hard – OIH down 8% & XLE down 5%. Even Petrobras fell by 2% this week.

5. What’s Next?

We think a lot depends on what the various Fed bigshots say next week. But below is for it is worth.

First the 30-5 year curve:

- Arbor Data Science@DataArbor – Periods of flattening like we’ve seen this week (past 3 days -25 bps!) typically result in more flattening for the 5y30y curve.

What about the 10-year Treasury?

- Nautilus Research@NautilusCap – US 10-year Yield …… Monitor the 6-month Moving Average……… ?

Were those who sold on Friday smart? Last Monday, on June 14, Jim Cramer communicated the late June seasonality trade of Larry Williams. The net-net call:

- If you sold the S&P on the 8th last day (or 9th last day), or Friday June 18, and bought on the first profitable opening after 3-days, you had a great chance of making money on that trade.

Watch this short clip yourselves:

On the other hand, Carter worth of CNBC Options Action suggested on Friday that the S&P may fall 7% or so based on previous such falls:

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on Twitter