Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

0. Yawn?

Now we know that UBS has bought Credit Suisse for a throwaway sum plus CHR100 billion backstop for balance sheet & other problems they discover. There wasn’t any real question about Credit Suisse being allowed to die publicly. So this was expected to a large extent. All except the statement that this was a corporate resolution and NOT A BAILOUT! But it does feel better to get one mess out of the way, at least for now.

Is First Republic next? That is a little tougher even though Regulators have agreed to “share” a portion of the losses at that bank. So we get to what happened last week & what it might suggest for next week.

1.Ignored happening?

What a week it was with highly intelligent & timely commentary from the Cognoscenti! And quite sensibly so given the ramifications of what Chairman Powell would do & say in the FOMC statement & presser this coming Wednesday.

But, in the middle of all that, not many stooped to notice what was going on in the US stock market, something we had hinted at last week:

- MV Section 6 – Bear Stearns like Market Impact March 12, 2023 – So the Dollar is down, interest rates could be stable to down & stocks are probably oversold or might get oversold fast. Would that create a “whopper of a gap higher“? We have no clue of course but it might be sensible to look at taking the other side of any decline this week! At least for a rally!

Look what happened this past week in a sea of negative performances:

- SPX up 1.4%; NDX up 5.8%; SMH up 5.7%; MSFT up 12%; META up 7.4%; GOOGL up 11.6%; AMZN up 8.7%; AAPL up 4.1%; NFLX up 3.7%;

We don’t know if the below is a “momentum thrust” or a fancy term like that, but it is something for sure!

- Via The Market Ear – NASDAQ +7% from “crisis” lows – Believe it or not, but this is the biggest 4 day move higher in NASDAQ in a very long time…

What is going on? Apparently megacap tech is wearing an 8-point harness, according to Signor Feroli of JPM:

- Via The Market Ear – Via JPM’s trader Ron Adler: “People are looking for safety and comfort given the crosscurrents in the market, and tech gives them plenty of ease….names like MSFT and NFLX are viewed as “staples.” At the same time, businesses like META have already gone through an effective revenue recession, given AAPL’s IDFA changes last year. They continue to cut costs to fuel further margin expansion. Feroli noted an old quote yesterday that “Whenever the Fed hits the brakes, someone goes through the windshield.” While it’s still unclear who isn’t wearing their seatbelts right now, megacap tech is wearing an 8-point harness.“

Recall that Mark Newton had been unlucky in his tech call. Not only is the above good for him but now even cycles are turning for him, he says:

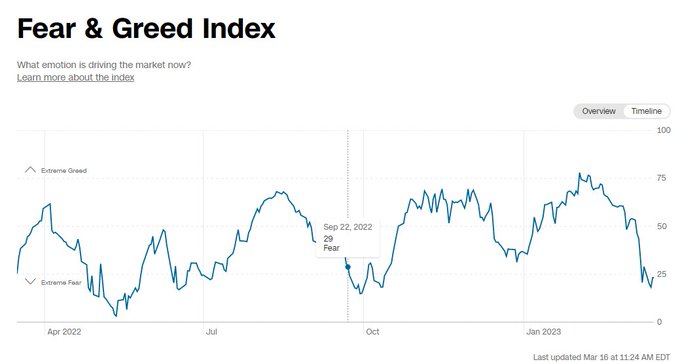

- Mark Newton CMT@MarkNewtonCMT – 3/16- Fear and Greed index shows sentiment this week having reached the lowest levels since last October, precisely at a time when several cycles bottom out. hmmm

What about the SPX? Anybody sees any value there?

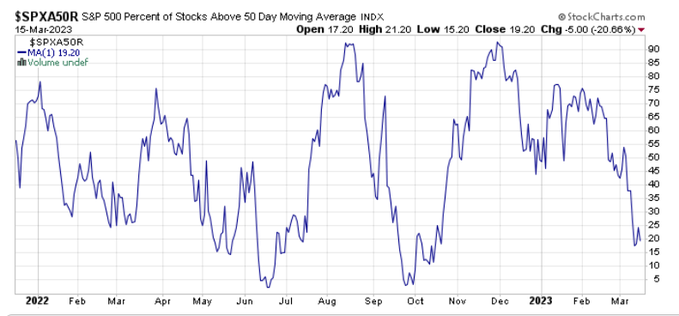

- Scarlett’s Grandpa@KASDad – 3/16 – The percentage of $SPX components above their 50 days SMA is close to levels where rallies have occurred in this bear mkt.

And,

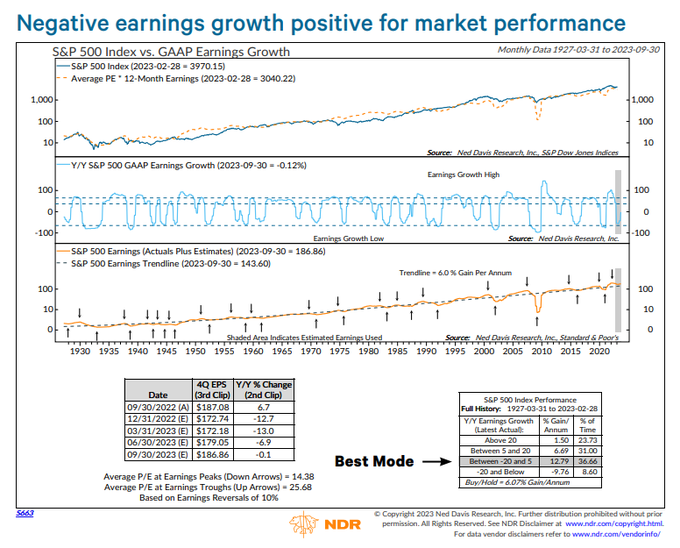

What about the feared crash in earnings? An earnings recession is a serious possibility but earnings are already down 13% year over year per Ned David Research. And this week’s earnings releases have been very well received, especially those of ADBE & FDX.

- Ryan Detrick, CMT@RyanDetrick – 3/15 – Interesting note from @NDR_Research today – One of the best times for future returns on stocks is when earnings are weak. Q4 earnings down about 13% YoY is the sweet spot for future returns on equities. It is when earnings are really good or really bad you need to worry.

But what about the VIX? It was up 2.9% this week and up 38% over the past two weeks. But that itself is a message that Tom McClellan decoded for simple folks like us in his article VIX Index Above All Of Its Futures:

- Most of the time, the VIX Index is quoted below all of its futures contracts. That is the normal state. When it goes too low below all of the VIX contracts, it shows an extreme of optimism among the options traders.

- Right now we have the opposite condition, wherein the VIX Index is above all of its futures contracts. That produces a negative reading on this chart. Such readings do not come along very often, and they are pretty good indications of a bottoming condition for stock prices. The direct message is that the SP500 options traders who drive the VIX Index are feeling more fearful than the VIX futures traders believe is merited.

- The VIX has been higher than 27 lots of times in the past, and could very well go higher than this current reading in the days ahead. That’s possible. But the message for now is that the market selloff has done enough to instill a decent condition of fearfulness into the hearts of traders.

Having said all that above, a reminder about Powell coming up and overhead supply looming above:

- J.C. Parets@allstarcharts – Sat 3/18 – a very respectable 1.4% rally in the S&P500 this week, but remains stuck below overhead supply

2.OMG – an almost perfect indicator?

Let us be clear. We are not suggesting that the above suggest buying bank stocks come Monday morning. But it does suggest to us that the Economist cohort, the ultimate backward-intelligence driven outfit, is now fully on board of the banking crisis. We also notice that the Governments & Quasi-Governments are fully in panic suggesting that investors should perhaps desist panicking further.

To focus on banking, there are two risks that can create loss-induced crisis for banks – duration-risks & credit risks. There may yet be a credit crisis ahead for Banks driven by commercial real estate, leveraged bank loans, high yield & so on. But today’s crisis in banks is mainly a duration risk crisis – crisis created by big losses in portfolios of bonds of long maturities.

Such a duration led crisis can simply be reduced or reduce itself in scope by a fast rally in long duration Treasury rates. And given the recent steep fall in Treasury yields, the scope of this crisis may have been reduced somewhat already:

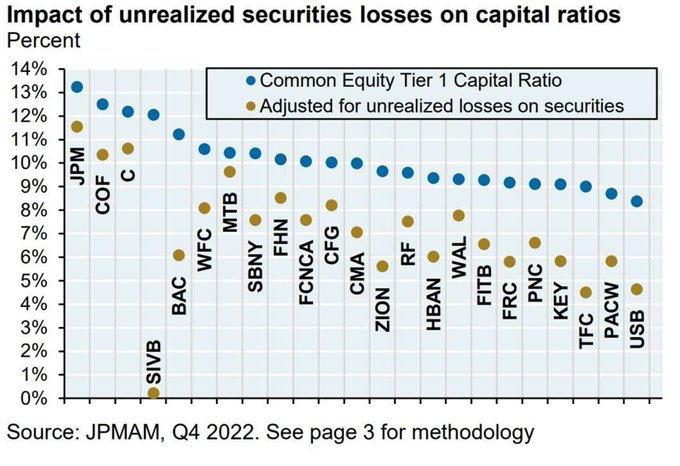

And what is the severity of this crisis across various banks?

- jeroen blokland@jsblokland – 3/15 – This is the best chart I have seen so far, suggesting #SiliconValleyBank may be an outlier!

Look what Bob Michele, Head of JPM Fixed Income Asset Management said on Thursday on BTV:

- “I wouldn’t be surprised if in August the entire Treasury curve is 3%. That may now actually happen faster. “

And Bespoke tweeted on Wednesday:

- Bespoke@bespokeinvest – 3/15 – The market is now pricing 100 bps of cuts by the September FOMC meeting.

But seriously are SVB & First Republic really big-important enough to create such a panic among regulators?

- Lawrence McDonald@Convertbond – The lesson here is a) the entire Street missed this regional bank credit risk fiasco, near disaster. And b) when the Fed looked under the hood, they saw something that frightened them into another embarrassing pivot.

How frightened?

- Via The Market Ear – 3/16 – RIP QT: Thanks for the $2 trillion – The Federal Reserve’s emergency loan program may inject as much as $2 trillion of funds into the US banking system and ease the liquidity crunch, according to liquidity God Nikos. Furthermore, remember this from CITI earlier this week: “Their new BTFP facility is QE in another name – assets will grow on the Fed balance sheet which will increase reserves…..although technically they are not buying securities, reserves will grow.” (Citi strategists Mathai, Williams & Vazquez Plata)

All this is a bit over our heads to be frank. So we decided to let our honest eyes take the charge.

Below are charts of BAC, Bank of America, in 4 steep declines – now=2023; 2008; 1998;1994. Remember Lehman actually went under in 2008; remember 1998 was blood-curdling in its impact on financials & 1994 was Greenspan’s proud moment of rapid rate hikes & bankruptcy of Orange County, CA. Our eyes see that the 2023 decline so far is somewhat greater than the ones in 1998 & 1994 but much smaller than in 2008.

2023 above

2008 above

1998 above

1994 above

Whether all the above makes the Big US Banks a buy is a question for each investor. But we feel certain that we are at least in the second half of the banks story in this crisis. And, personally speaking, it is the height of asininely arrogant backward thinking for The Economist to ask NOW “What is wrong with the Banks”!

3. What’s next for the economy, profits & interest rates?

Recall that the panic in 1998 was so great that it did not end until Chairman Greenspan cut interest rates twice between FOMC meetings. That ended the Long Term Capital crisis & launched the 1999 explosion in tech-telecom stocks. That is the danger that both Neal Dutta of Renaissance Macro and Anastasia Amoroso of iCapital see ahead.

- Neal Dutta – Thu 3/16 – BTV Surveillance at 1:18:09 – Part of the reasoning why the economy was so resilient was that it wasn’t that credit sensitive to begin with; …. I don’t think what is happening right now is enough to really send the US economy into a below potential growth state; .. as the data made clear we went into this with a lot of momentum; … I think we are in a 5%-6% underlying nominal growth environment now; 2.2.5% real growth with 4% inflation … if they pause, they may have to come back later & be even more aggressive …

And

- Anastasia Amoroso – Fri – 3/17 – BTV Surveillance ay 1:43:52 – this is an economy, this week aside, that sees consumer confidence has been strong; new mfg orders picking up; the economy is actually fine; that explains the resilience we have seen in the market; why we have hung around this 4,000-3,900 level; because the economy is fine. So I think the market is betting that the banking issue is going to make the Fed at least pause; …. ultimately this issue is fixed & then the Fed gets back to its inflation fighting mandate; then we have the major repricing that is probably coming for the market later from today’s terminal rate of 4.6% back to 5.8% may be 6.5% rate …

Now to Bob Michele, who among all we cover in this section, actually runs a huge amount of Fixed Income money at JPMorgan. We urge all to watch this longish conversation on Bloomberg Open on March 15 from 28:39 to 37:57 minute: A few excerpts are below:

- Bob Michele – Bloomberg Open – March 15 – 28:39 to 37:57 – I think this is the tip of this iceberg; there is a lot more consolidation; a lot more pain yet to come …. I say recession is inevitable …. ; what should be disturbing to a lot of investors is that the problems we are seeing now are in the investment grade market ;Its with investment grade banks, with banks that had very wealthy client bases … thats disturbing for everyone in the credit space. … I think inflation is now very backward looking; you are seeing cracks form; you are seeing liquidity & perhaps solvency of the banking system come under a lot of pressure. That’s going to cause businesses & consumers to pull back. ... there is credit tightening going on at every single level … And in the aftermath of this , you look at non-bank lenders, the people in the bond market, the private credit people …. we are going to see tightening credit conditions further as well …. there is nowhere for growth & inflation …

Then you see a summary of the size of the monies involved from Brian Reynolds, courtesy of CNBC’s Kelly Evans:

That brings us to the DR or BR Duo depending upon your choice of first or last names. The really big news is that NOW they agree on one big thing – the profits recession we are seeing & will see .

But Rich Bernstein says “the economy overall is actually remarkably healthy” & we are “not even close to a recession“. But it might come if we have “a deeper profits recession” that he “is anticipating“.

David Rosenberg said something really positive. His actual words “not like 08,09 but will go through a credit contraction .. brings recession closer “

Let us see what Chairman Powell says & who turns out to be right.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on Twitter