Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Best Wishes for 2024

Our sincere wishes to all for a good & happy 2024. We are not going to say anything else after jinxing Baker Mayfield, Tua Tagovailova & Jared Goff last week.

And we have no real idea what will happen next year. So what follows are interesting statistics & views from smart people who have been mostly correct in 2023.

Since S&P is the one large index that did not reach a new all-time closing high in 2023, let’s begin with that. Our own empirical experience suggests that the S&P 500 is likely to close at a new all-time high soon, perhaps during the coming week. That could be because new retail flows tend to come in to the market in the first week of a New Year, especially after a great December & year before.

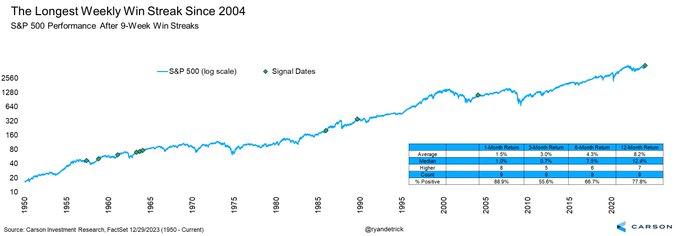

- Ryan Detrick, CMT@RyanDetrick – Dec 30 – Longest weekly win streak for the S&P 500 since 2004. What did it do after previous 9-week win streaks? Higher a month later 8 of 9 times. Higher a yr later 7 of 9, with a median return of 12.4%.

Another way of saying similar stuff:

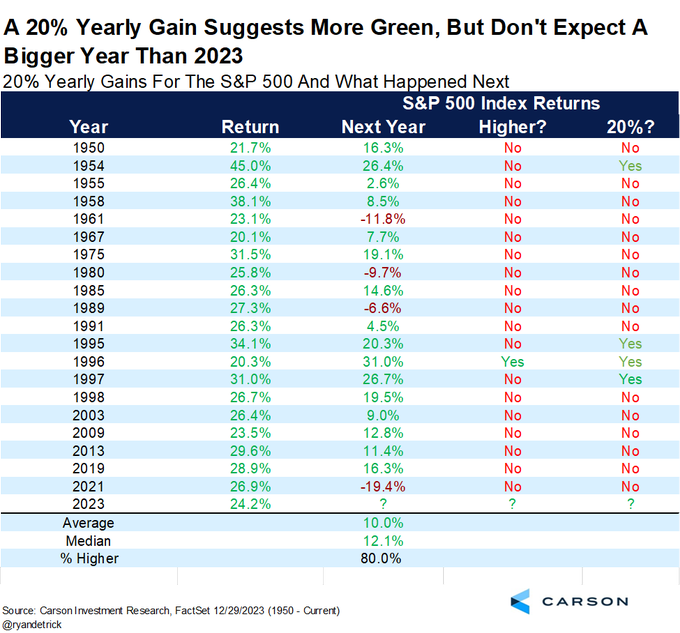

- Ryan Detrick, CMT@RyanDetrick – Dec 30 – S&P 500 up 20% for the year, what happens next? Up 80% of the time (better than avg) the following yr with an avg return of 10.0% (about avg). Only once in history did stocks gain more the next year (1997). Only four times (out of 20) did it gain 20% the next yr.

What sector shows high insider buying?

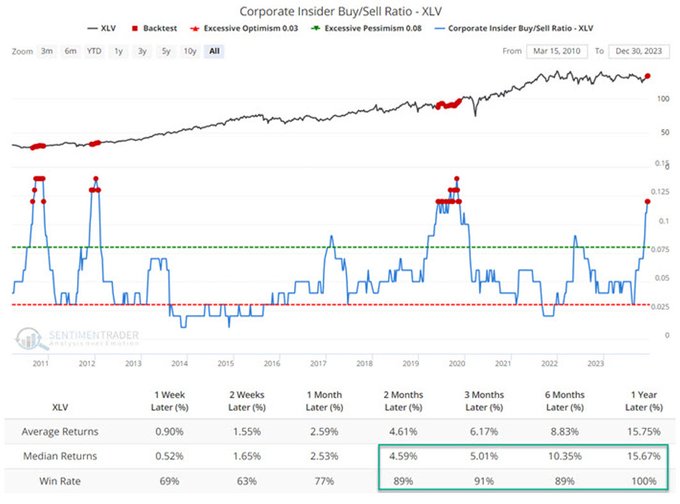

- Jay Kaeppel@jaykaeppel – Dec 30 – FWIW, healthcare corporate insiders continue to like healthcare stocks a lot these days. A guaranteed sure thing? Nope. Typically a good sign for the healthcare sector? Yep. @sentimentrader

Is that material for any major index?

- J.C. Parets@allstarcharts – Dec 30 – Healthcare has the largest weighting in the Dow Jones Industrial Avg

Now to the Nasdaq vs. NYSE. A warning perhaps?

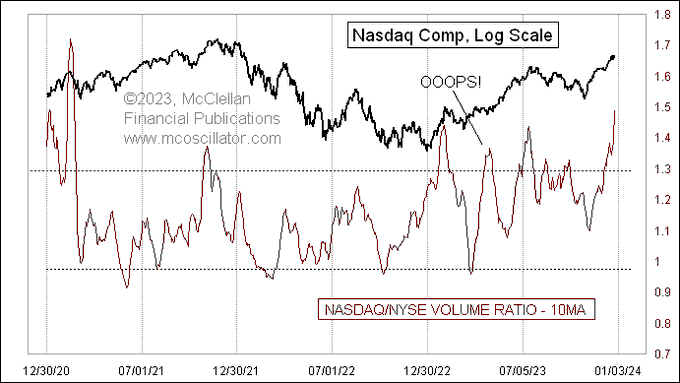

- Tom McClellan@McClellanOsc – Dec 27 – On Dec. 26, Nasdaq total volume was over 2x that of NYSE, part of an ongoing trend. This chart shows a 10MA of the daily NQ/NY TVOL ratio. High readings like this pretty reliably mark price tops, with one notable exception back in April 2023.

Slightly stronger in this negative way:

- Thomas Thornton@TommyThornton – Dec 27 – The last and only in 2023 DeMark Sequential and Combo sell Countdown 13’s with the $SPX occurred in mid July. It was in upside wave 3 of 5. The latest exhaustion signals have occurred in final upside wave 5 of 5.

Continuing the negative trend,

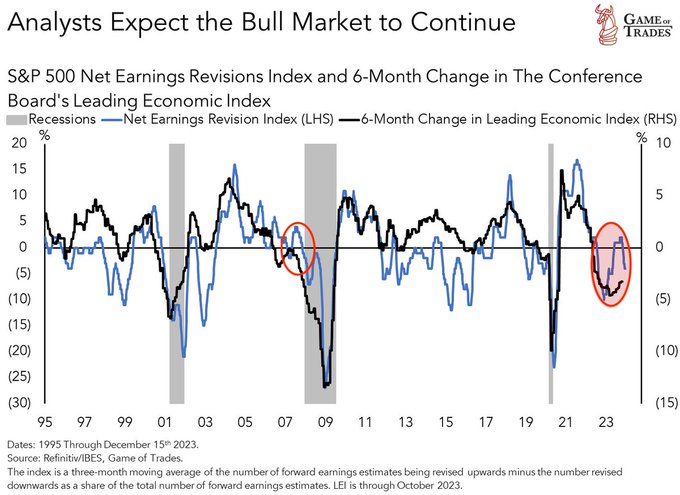

- Game of Trades@GameofTrades_ – Dec 27 – Analysts are repeating the same mistake they made in 2007 – 2008. Leading economic indicators are still contracting. But analysts had revised their earnings estimates upwards. Last time, this preceded a significant decline in stocks. Is this time different?

Not just US, but,

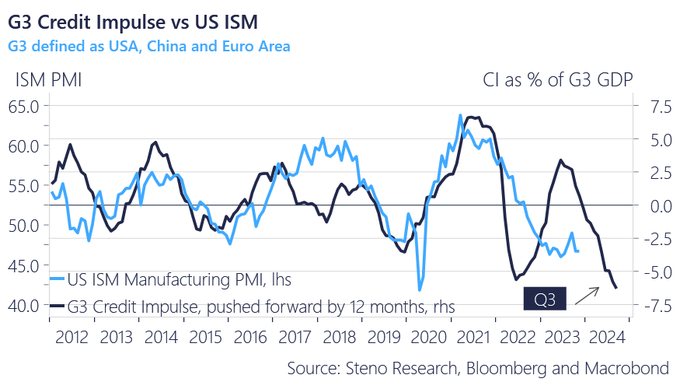

- AndreasStenoLarsen@AndreasSteno – Dec 26 – Confirmed Q3 credit impulse numbers from China, Europe and the US look abysmal. Nothing in the credit impulse rhymes with the soft landing narrative for 2024 and the starting point is weaker than in 22. Full story -> https://stenoresearch.com/watch-series/credit-watch-nothing-in-the-credit-impulse-speaks-in-favour-of-a-2024-comeback/

Finally by replacing “lesson” by “year” in a famous quote from a terrific film we get a closing statement:

Send your feedback to [email protected] Or @MacroViewpoints on Twitter