Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”Big Game”

This was the clip of the week for us. Paul Richards of Medley Global Advisors called Wednesday’s decline in the stock market & commodities as “tailgating before the big game” during Wednesday’s lunch time:

He said “the big game starts in 3 weeks” meaning the date in early September when tariffs on $200 billion of Chinese goods go into effect. He said “that day could be the start of something hell of a lot worse or significantly better; but the outcome, in my opinion, is going to be binary“. He added “market is saying we have had enough” about trade stuff and “market is going to have very serious trouble” if some kind of arrangement is not struck.

How correct was he, at least for this week? Just look at what happened on the dull Friday afternoon at 1:55 pm when news broke that Presidents Trump & Xi might have a summit meeting in November & that US-China have agreed on a road map:

(TLT – 20 year Treasury ETF)

The S&P ratcheted up by about 10 handles & TLT fell hard. Some of the move reversed into the close but the news had clear & demonstrated effect. The big rally on Thursday was also attributed to positive news about the US-China dialogue.

The end run to the November election begins after labor day and, as of now, the contrast between China & America couldn’t be clearer:

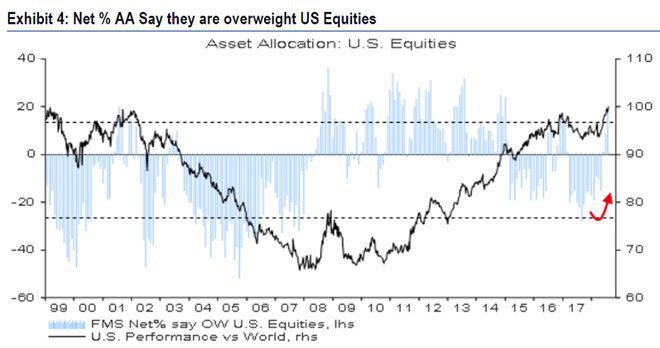

- Babak @TN – BoAML GFMS asset allocation to US equities jumped 10% pts to +19%, highest since January 2015 and net 67% for US as most favorable region for corporate profit expectations, – the highest in 17 years

- jeroen bloklandVerified account @jsblokland –

#China‘s stock market hits 2.5-year low!

We wonder whether an arrangement with China is really necessary ahead of the election. We think President Trump is ready to run with look how much China is in economic trouble because of his toughness and they have no choice but to deal with him argument. This week’s White House presentation by Larry Kudlow about China’s economy being in trouble could have been a test & a glimpse of what might follow.

Many people blamed Larry Kudlow for being so negative on the Chinese economy. They should read what Ruchir Sharma of Morgan Stanley Investment Management said in his interview with the Economic Times of India:

- “Every time the Chinese economy has weakened, they have put in more stimulus. But Chinese and US interest rates are almost at the same level for the first time. The question here is would you hold Chinese paper or US paper at similar interest rates. China’s current account surplus has disappeared, … the currency is relatively expensive and is not competitive anymore. There is a lot of money sloshing around in China. Every time China has weakened, they have gone for the standard tool of easing monetary policy. They can’t do that today because if they were to cut rates today, the capital deluge will be huge and if they do raise interest rates, how much can they allow the economy to weaken?“

What did he say about the US?

- “… the institutional strength of the US is incredible … The hegemonistic power of the US in financial terms is unparalleled. It has been a long time since the share in the global economy has dropped to 23% but their dominance of the financial economy of the world is extremely high (80% of all financial transactions involve the US dollar). The Chinese currency has just not been able to find any international recognition. This is the central problem for the global economy. In pure economic terms, we have G2—US and China—but in financial terms, US is way ahead. The Chinese currency is totally beholden to the US dollar“

Both President Trump and Larry Kudlow know this & understand this. So, given his ability to express his views, President Trump will be as able to run on holding out for a better deal from a weak China as on having made a pro-US deal with China.

2. Turkey

We expected Friday afternoon to be more like below until the news about the possibility of a Trump-Xi meeting in November broke:

- jeroen bloklandVerified account @jsblokland – Friday rerun? EM currencies like

#TRY and#RUB falling again as more sanctions loom, measures to stem currency decline remain light.

Turkey is far from settled. It is apparent that President Erdogan is getting even more obstinate. While that doesn’t make sense to an outsider, it seems quite sensible to a smart student like Stratfor’s Reva Gujon who knows the big big event in Turkish history – the 1920 Treaty of Sevres. This treaty, we are told, has the same sort of significance to Turkish people that the 1917 Treaty of Versailles had for the German people.

So what could Erdogan do instead of trying to solve the lira crisis? Stratfor writes:

- “Pro-government pundits say they are getting signals that Erdogan may move up the local elections by six months, to Nov. 4 this year. The reasoning would be that stronger economic headwinds are coming anyway, and Erdogan may as well take advantage of the political solidarity he can reap from his nationalist battle cries against enemy speculators. This is a rumor that I would take seriously. It would also imply that any serious structural reform would only have a chance of coming after the election while Turkey tries to ride out the storm in the near term. When Erdogan declares war against “evil” interest rates and likens dollars, euros and gold to “bullets, cannonballs and missiles” in a war that aims to take Turkey down, he is not entertaining the Western financial community; he is channeling a deep-seated paranoia rooted in the 1920 Treaty of Sevres, which dismembered the Ottoman Empire at the hands of Allied powers. The so-called Sevres syndrome can be channeled in Turkish politics to this day to raise hysteria of outside powers conspiring to kick Turkey while its down in the dust.“

The main point being Erdogan is not going to let the lira crisis to go waste. He will first reap political benefits and then, after the elections, he may come to terms assuming he doesn’t get serious financial assistance from Merkel & Middle East.

In the meantime, the Turkey crisis has serious corporate repurcussions according to Larry McDonald:

His main point is that Turkey represents a very big corporate risk and the discovery period is normally 30 days before the market figures out where the bodies are buried. He also points out that any bailout from Merkle-Germany and others will take months & months. So his recommendation is to Sell All Rallies for next 2-4 weeks.

This also seems consistent with Stratfor’s view of Turkish elections brought forward to November 4 from next year. By then, the markets will have figured out the damage, bailout proposal would be probably ready by Merkle-UAE et al and Erdogan might be ready to talk seriously.

David Rosenberg terms this period as “lag”:

- David Rosenberg @EconguyRosie – No contagion, eh? The only folks that can’t see it in the FX and commodity markets spend too much of their day gazing at the SPX and Russell 2000. There is no decoupling, just lags.

3. Economies, FOMC, ECB, BoJ & US Treasuries

Look what David Rosenberg wrote on Friday:

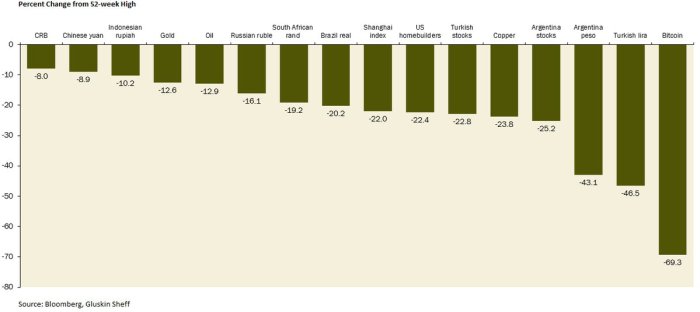

- Global cooling – In case you need to know why cyclicals are struggling in most equity markets, and why it is that most commodity prices either are in correction or a bear market phase, then look no further

If this is to be believed, shouldn’t we see some sign of it in monetary aggregates?

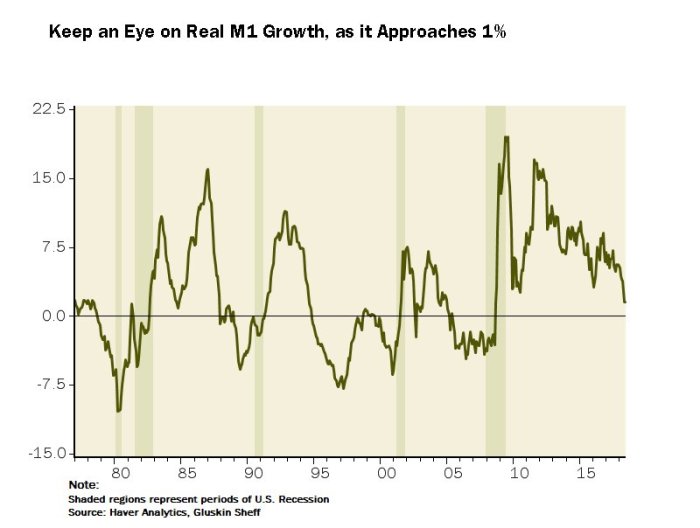

- David Rosenberg @EconguyRosie – All of the monetary aggregates have slowed substantially, and real M1 growth is flagging a 1% stall-speed growth economy once we get passed all the pre-tariff buying activity and fiscal sugar-high that skewed Q2 GDP.

This should make central bankers more dovish for sure. But how dovish? Tony Crescenzi of PIMCO said on Friday that the ECB will keep rates at zero for the next five years – they would raise rates from today’s minus 45 bps to minus 25 bps in 2019; raise rates again to + 25 bps or even to + 50 bps in 2020 ONLY to drop them back to zero. So net net the ECB will keep rates at zero for the next five years and so will BoJ. The Fed may take rates to 3% next year but will only tighten once more in 2018.

This should make central bankers more dovish for sure. But how dovish? Tony Crescenzi of PIMCO said on Friday that the ECB will keep rates at zero for the next five years – they would raise rates from today’s minus 45 bps to minus 25 bps in 2019; raise rates again to + 25 bps or even to + 50 bps in 2020 ONLY to drop them back to zero. So net net the ECB will keep rates at zero for the next five years and so will BoJ. The Fed may take rates to 3% next year but will only tighten once more in 2018.

With all this how do you think large players acted in the Treasury markets this week?

- Jeffrey GundlachVerified account @TruthGundlach – Massive increase this week in short positions against 10 &30 yr UST mkts. Highest for both in history, by far. Could cause quite a squeeze.

Guess who jumped ahead of this “squeeze” trade on Tuesday, August 14! Jim Cramer via his technician colleague Carley Garner.

Cramer said it could be a violent move higher in price & lower in yield.

Remember how a contemptuous comment about Treasuries from CNBC’s Becky Quick launched the Treasury rally a couple of months ago. This week, Becky was just as confident in saying she expects rates to go higher not lower. In our experience , such totally confident projections from CNBC anchors provide high probability entry points. Will that history repeat here to deliver lower rates over the next couple of weeks? This is not a negative comment about Becky. On the contrary, it takes courage to make a confident prediction for a FinTV anchor. Kudos to Becky for her courage. Hopefully our readers can make some money from fading her courage.

4. US Stocks

We could only find interesting charts that were skewed to the downside. Perhaps this in itself is a reverse signal. For whatever they are worth, here they are:

- Thomas Thornton @TommyThornton –

$INDU Dow Jones Industrial Average Index with daily upside DeMark Sequential Countdown 13 today. Last on on the upside was in January and last one on downside was in March. Joins$SPX and$OEX

- Thomas Thornton @TommyThornton –

$SPY also with a daily DeMark Sequential Countdown 13. Worked well in January ahead of 10% correction and at lows in March. If you want more sign up for a free trial at http://hedgefundtelemetry.com to get our daily note and more stuff

- Jeff York, PPT @Pivotal_Pivots –

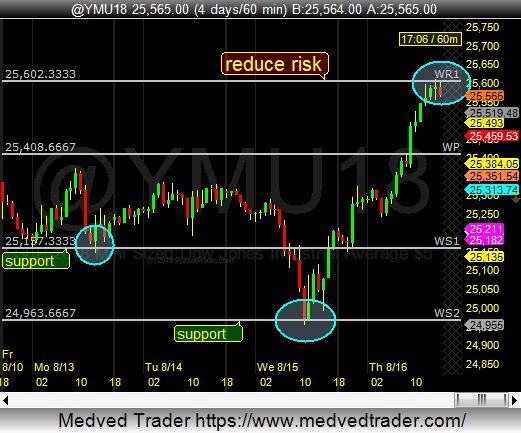

$YM_F$DJIA this week, keeps pivoting at the Weekly Pivot Points. Knowing in advance where these pivots are is a trading edge@PivotalPivots

- Jeff York, PPT @Pivotal_Pivots –

$ES_F today, made it back to the Weekly Pivot(WP) for a nice 40 pt. rally off the Weekly S2 Pivot(WS2).

#TradethePivots@PivotalPivots

5. India – Unique EM market?

As we showed last week, the performance of India’s Sensex & Nifty indices demonstrates that India is a fairly unique EM market. As everybody knows by now, India is a domestic market & not an export-dependent one. Secondly India is not integrated in today’s manufacturing supply chain and so impact of tariffs on the Indian economy is not that big. We add more details below but first things first.

Last week, we featured a clip that said buy India now despite its recent rally. This week, we feature views of Peter Brandt (from an interview with Economic Times of India) that are both contrary & not so contrary:

- Negative risk-reward in Indian indices? – Yes, absolutely. As a trader, for me, the market at this point has run its course and I would be a speculator on the sidelines. … As a global investor with a longer-term point of view, trading the Nifty futures, I would have to remain long until the market gave me an indication that the trend was turning down.

But the Indian currency market acts just like other EM currency markets:

- Brandt on Rupee – We think the situation in the rupee is very interesting and worth monitoring. There is a little bit of short-term conflict and confusion going on in the rupee. The rupee has been in a very tight range in recent months. Technically, should the rupee climb above 71, then we see the rupee going to 80 within four to six months. There could be a 10-15% run on the rupee.

On the other hand, Raghu-Raam Raajan, ex-Governor of Reserve Bank of India, was not worried about the Rupee in his interview with CNBC’s Sara Eisen. Neither was Ruchir Sharma, Morgan Stanley Asset Manager & author, in his interview with Economic Times of India. Sharma simply said – “I won’t read too much into what is happening with the rupee“.

More interesting are comments from Sharma about what makes the Indian market kinda unique:

- “Of all the emerging markets in the world, India has the best diversity and depth. As a share of the total market, it has the maximum number of companies which can be defined as high quality, which we define as companies which have a RoE consistently of above 15%, or earnings growth of more than 15% a year. This country has the maximum number of companies as a share of the total market of practically any country in the world, which I find very fascinating in terms of it, especially compared to other emerging markets etc.

- India has been fortunate that it has had a domestic investor base which has kept the market humming

- This is a very steady-as-shegoes economy. There will be unfortunate disruptions like demonetisation and GST implementation. The downside is that we will never break out. We’ll never have double-digit or 8-10% growth unless the global economy booms. That’s not the fabric of the nation. There is no incentive for it.

And what is the most shining uniqueness about the Indian market, actually about Indian housewives?

Now you understand the frustration of Prime Minister Modi. He has tried every way he could to persuade these housewives to convert their gold to “productive use”. But he has failed. He thinks of this enormous gold holding and probably dreams of a stable strong Rupee backed by this much Gold in the Central Bank’s Vaults.

Oh well! Midas had all the gold he could touch. But it didn’t make him happy, did it?

Send your feedback to [email protected] Or @MacroViewpoints on Twitter