Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Come on Santa!

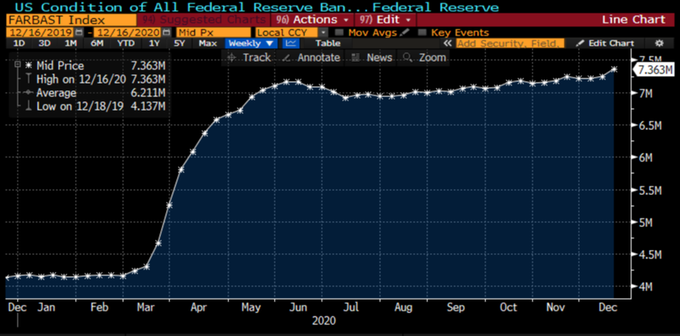

- Lisa Abramowicz@lisaabramowicz1 – Dec 17 – The Fed‘s balance sheet had the biggest one-week increase since May, rising $119.9 billion to a record $7.36 trillion, via @theterminal

Tom DeMark expects the S&P to rally to 3907 by year-end. What about yet another postponement of the Godo-lus despite the promise from McConnell to get it done this week? Reportedly Mr. DeMark doesn’t pay attention to that kind of stuff. Mr. DeMark is not alone in shooting for a year-end moon shot. Tom Lee also added his several cents to call for a rally to 3800 into year-end.

But neither thinks this will continue once the Year of the Vaccine rolls in (to use a Michael Hartnett term). Tom DeMark points out that “Markets top not because of smart sellers but it’s because the exhaustion of the last buyer.” Reportedly DeMark says, the year-end rally,

- “is likely to represent a top for stocks and estimates that the S&P 500 in the first half of 2021 is likely to decline by 5% to 11%, based on his models and the natural tendencies of assets in a downtrend. …It’s down severely in the first half [of 2021],”

Tom Lee is also calling for a 10% rally to 3500 early in 2021, probably in Feb-April period. Then he expects a 25% rally in the S&P in second-half of 2021 to close at 4300. Lee says “VIX will drop below 15 in the next two years” and he expects “negative real rates next year, minus 6% real rates“. That should lead the S&P to “at least 4300” by end of 2021.

Guess who agrees with Tom DeMark and the first part of Tom Lee’s prediction? The ultimate Ice-Age proponent, Albert Edwards of SocGen.

- Albert Edwards@albertedwards99 – Dec 17 – A nice summary of my recent thoughts Though I’m a believer that we have crossed the policy rubicon and the medium outlook is for higher inflation, the US will suffer a shocking deflationary bust over the next 3-6 months. Reflation trades will be crushed advisorperspectives.com/articles/2020/

No wonder David Rosenberg says he is buying Treasury Bonds. This week saw the resurgence of Anti-Trump Republicans who jammed up the nearly agreed to stimulus by refusing to allow the Fed to use the same programs the Fed was allowed to use in May-June. Their argument is temporary programs should be kept temporary & not made permanent. Democrats want these programs in because that would enable them or their Fed to bypass a Republican Senate. And Republicans don’t want these programs to keep control of what they think is a rapidly escalating debt situation. Doesn’t the term Godo-lus make some sense?

What may be far worse in both short-term & long-term is the serious damage to employment & the economy with what state & local governments are doing to small businesses. Look at the states that contribute the most to US GDP – New York, California, Illinois … Shutting down entire mega-cities is madness in any non-China country. What do they want? New Han instead of New York and Los Wuhanese instead of Los Angeles.

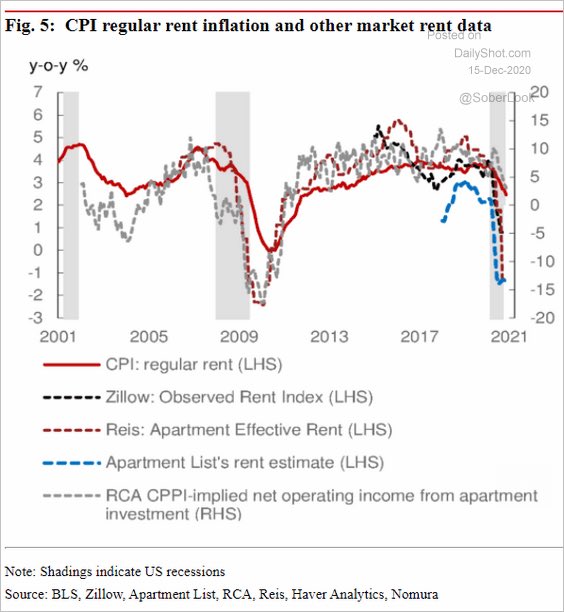

And what about tenant rents & landlord mortgage payments that have stopped thanks to the shutdowns & lack of stimulus? The morons on CNBC who scream about inflation that the Fed is not seeing don’t seem to know that 40% of Core CPI is rent inflation. Guess where that is going?

- Albert Edwards@albertedwards99 – Dec 17 – Great US CPI chart from Nomura via

@SoberLook – . Because of the gradual way the BLS survey rent, sharp falls only come though to the US CPI slowly. The CPI Shelter category is over 40% of core CPI and is driven by rent inflation. US core CPI is going to join Japan and EZ close to 0%

Yet some fat & fatuously arrogant anchor on Bloomberg TV keeps talking about the laudable Biden nominations who are focused on “Climate Change”.

But this doesn’t make Tom Lee wrong. If David Rosenberg & Albert Edwards are even remotely right, then the pressure on Biden, Congress & the Fed to act by Q2 will be almost impossible for them to bear. And then, we will see money poured into not merely the “system” but into the pockets of American people. We expect that to be another 10% of GDP sized stimulus.

If you see that, then wouldn’t Tom Lee’s 25% rally in second half of 2021 come true? We think it would. Those who think we are nuts (& many think we already are) should force themselves to remember Biden’s nominee for Treasury Secretary – Janet Yellen. And when you get Yellen, we bet you also get Bernanke. And what has Yellen already said the Fed should be able to do at some point – Buy Stocks.

But what about the Fed buying at such valuations, you ask? Notice Chairman Powell has already justified today’s PEs by saying they are not high compared to low Treasury yields. But what about the massive amounts of Treasuries the Fed would already have to buy?

What massive amounts you ask? The same ones Janet Yellen will be issuing in 2021 at 5X-10X the Mnuchin issuance in 2020. No we are not saying something this crazy:

- UBS via Market Ear – “The duration-adjusted Treasury supply flows net of Fed’s purchases and rolldown is set to surpass $100bn of 10yr equivalents per month in 2021, a big jump from $10-$20bn of 10yr equivalents per month in early 2020”.

But that won’t be a problem because, as the ever-beaming Sarah Bloom Raskin told CNBC viewers, Jay Powell is so happy to be able to again work hand-in-hand with Janet Yellen.

But wait a minute. Wouldn’t the Fed need to get the big money center banks to co-operate in these Treasury purchases? What incentive could Chairman Powell offer the banks to do so? See that is they are the Fed & we are simple novices who can only marvel at how they play the game.

- Lisa Abramowicz@lisaabramowicz1 – The Fed will once again allow Wall Street banks to resume stock buybacks. JPMorgan immediately announces $30 billion of share repurchases; its shares pop in after-market trading. bloomberg.com/news/articles/

2. EM – win in 2021 but perhaps lose big later?

Who wins in 2021? Emerging Markets, said Marko Kolanovic of JP Morgan, along with EM-type sectors such as Energy, Materials, Industrials:

Makes perfect sense, right? How could it not? The question is for how long. Why do we ask? Because we recall the phrase history rhymes. What history? Think back to just over 10 years ago. To be more precise to November 19, 2010. What clip did CNBC’s Steve Liesman put up that day? It was called A New Cold War. How did we describe it?

- CNBC November 19, 2020 – “This Friday, Dr. Bernanke went farther than any of his predecessors and essentially declared Financial War on China. This is not just our expression, but of Steve Liesman, that outspoken CNBC journalist who always speaks the Fed’s mind. It is “Bernanke vs, Beijing “, Steve Liesman said in his opening remarks in his conversation with CNBC’s Trish Regan on Friday morning. Liesman showed Dr. Bernanke’s comments in a clip appropriately titled A New Cold War :”

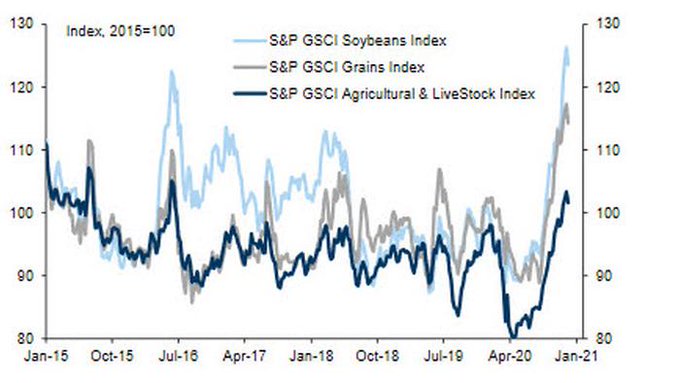

The same morning Jim Rickards made it clear that Bernanke’s QE was designed to export inflation to China to stop them from exporting deflation to America. In a clip titled Currency War Brews, Rickards said, as we quoted on November 20, 2010,:

- “It is a currency war. It is going to continue….What’s going on is very simple. Bernanke is haunted by Deflation. The possibility of deflation scares him to death, it is driving everything… If you are the United States, the problem is China is basically exporting deflation to us. The Chairman wants inflation, not too much. He wants a little bit. But China is exporting their deflation to us, importing our deflation to them. So as hard as Bernanke tries, he is not getting the inflation he wants.”

How did that work out? Fast forward to January 19, 2011. That morning Jim Rickards said on CNBC Squawk Box that “We just won round one in the currency wars“. Now look what we wrote ten days later on January 29, 2011:

- “On Friday, we saw the first enormous and completely unintended consequence of Bernanke’s Financial War. When inflation ravaged the poor across the emerging world, Bernanke did not care about the “unintended consequences” of his QE2. He was too busy congratulating himself on the 20% S&P rally and the 30%+ Small Cap rally. When Tunisia blew up, Bernanke did not care.”

- “But when Egypt blew up on Friday morning and when it was clear that the Obama Administration was deeply worried about a complete breakdown of its Mid-East policy, did Bernanke begin caring?”

- “Perhaps, he found out yesterday that exporting inflation to China may create tension in China but it can also fan an explosion in poorer, middle eastern countries teeming with poor, educated young men who can’t find a job and can’t feed themselves.”

Most do not remember. But Albert Edwards does and he tweeted this week:

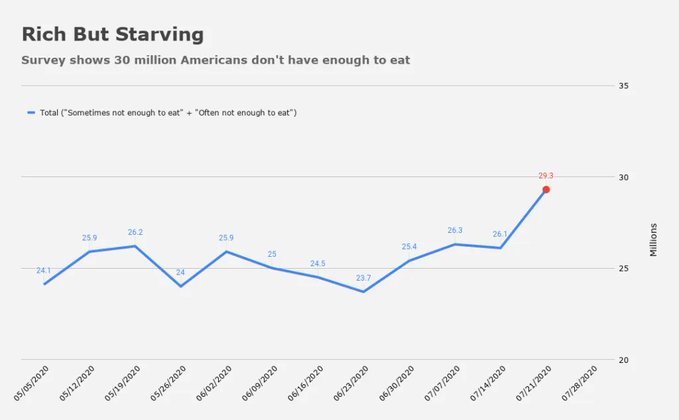

- Albert Edwards@albertedwards99 – 6…Some don’t see the surge in food prices as a major issue! In my view, CBs have just poured unprecedented QE gasoline into financial markets and if food prices ignite like 2011, an awful lot of hungry and angry people will be taking to the streets.

And this time, we have 30 million Americans who don’t have enough to eat. And reportedly, China is already short of food. So what happens to poorer, smaller Emerging Markets?

The reality is that every disastrous EM bust has followed an ebullient & big EM bull. Countries & EM corporations borrow to the hilt using the weak Dollar. When that reverses, hell follows, as we saw in 2011.

But that is 2022’s business. In the meantime, let us enjoy the big cap stock rally in the S&P next year. Luckily we will never see any real inflation here & so Fed will remain our friend.

3. Bitcoin, Gold, Silver

First, the timer extraordinaire:

- Jesse Felder@jessefelder – Tom DeMark: Bitcoin price rally near point of ‘exhaustion’ marketwatch.com/story/bitcoin-

Then the RB team. David Rosenberg called Bitcoin a bubble on BTV and

- Richard Bernstein@RBAdvisors – Hello? Anyone still rational? The #USD is down 9% in 5 years. #XBT is up 5300%. Folks, it’s a bubble if ever there was one.

But what is the difference in Bitcoin and Amazon or S&P? Don’t they all have the same force behind them?

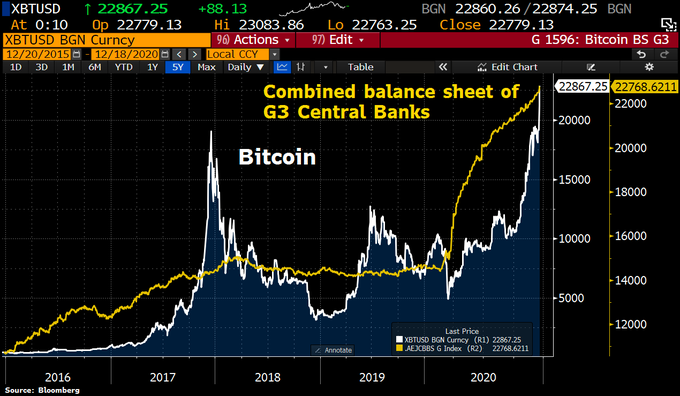

- Holger Zschaepitz@Schuldensuehner – This chart highlights one main driver behind the #Bitcoin rally: rising Central Banks balance sheet. Bitcoin has traded in tandem w/combined balance sheets of Fed, BoJ and #ECB.

Remember the guy who said “Buy Bonds, Wear Diamonds” way before Treasury Bonds started moving up. Look what he said on August 10 when Bitcoin was around 11290:

- Raoul Pal@RaoulGMI – – I like to get the texture of a move by looking at the long-term charts. Bitcoin is a stunner. The monthly chart has only just broken out this month. It has a long way in time and price to go….

So what is he saying now?

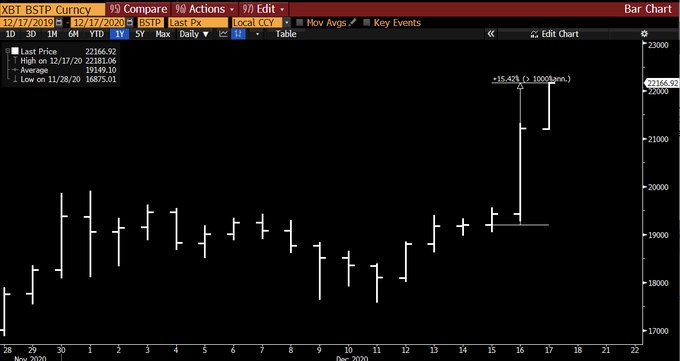

- Raoul Pal@RaoulGMI – Dec 16 – Right, off to bed but I’ll leave you with this – The last 2 days rise in bitcoin would annualize at 1000%. Good night and good luck. Corrections will come at some pint, some will be scary. Buy them. BTW – I think 10x is more than realistic.

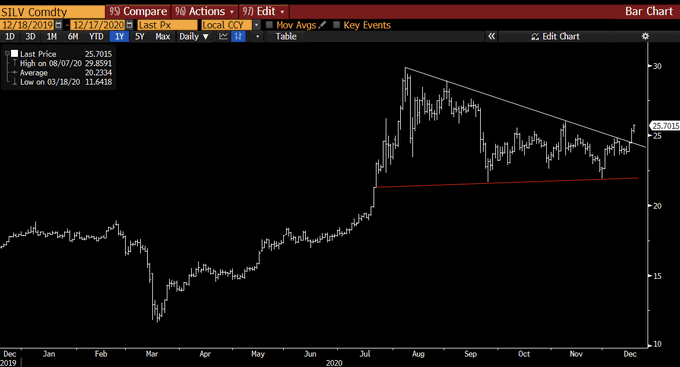

Before Bitcoin, Silver used to be the alpha. Now it only rallies by 7.5% during an up week:

- Raoul Pal@RaoulGMI – Dec 17 – Silver has broken its wedge pattern and should squeeze to new highs in due course… Bitcoin is the alpha in this space but gold and silver will follow.

- Raoul Pal@RaoulGMI – Dec 17 – Gold looks like it has bottomed. The small inverse head and shoulders is broken, next step the top of the trend channel, which will break in due course as gold heads to new highs.

We saw a statement from somebody who said Bitcoin was a retail play while Gold is an institutional play. That would make Brevan Howard a retail player, right?

- Raoul Pal@RaoulGMI – Dec 16 – Alan is one of the worlds greatest investors… he has been in the space for a while but is now going BIG. Expect more in time… https://www.bloomberg.com/news/articles/2020-12-16/bitcoin-whale-surfaces-with-1-billion-and-alan-howard-s-backing?sref=87bXqOFO

Eric Peters, CEO of One River Asset Management & subject of the article, said

- “There is going to be a generational allocation to this new asset class, … The flows have only just begun. … “This is the most interesting macro trade I’ve seen in my career.”

And yes, we do remember a well known smart money manager who said to us about Cisco in March 2000 that “it has only begun“. He was spectacularly wrong while those who said the same in March 1999 proved to be spectacularly right.

The reality is “bubblicious” trades mainly collapse due to spikes in volatility, Fed contracting money supply or Governments stepping in. That is true of S&P 500, Amazon, Gold-Silver & probably Bitcoin as well.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter