Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”best 5-day stretch“

Last week we had asked:

- “Was the three-day selloff enough of a pause? Actually it was getting worse until the magical voice of Art Cashin seemed to cool Thursday’s sell-off. He said it is important to hold 3,900. Low & behold, the S&P did close just above 3,900 on Thursday.”

We had added – “Then came the Friday liftoff“. Frankly we did wonder as we wrote that whether we were getting carried away. After all, terrific Friday rallies have a way getting dissipated come following Monday.

But worries are for sissies as someone has said. And that proved true this week as Josh Brown said on CNBC Half Time on Thursday:

- “this has been, I think, the best 5-day stretch in 6 months or 5 months and when you have price action like this, no matter how bearish you are, or no matter how cautious you want to be, you do have to stop and ask yourselves what I am missing or what might go right“

Look at the action yourselves:

- VIX down 6.8% to 18.51; Dow up 1.8%; SPX up 2.5% to 4071 (above the downtrend line); RSP up 2.4%; NDX up 4.7%; SMH up 5%; RUT up 2.4%; IWC up 1.5%; GS up 3.3%; BAC up 5.1%; CLF up 3.2%; FCX up 1.85%; Steel companies exploded; EEM up 1.3%; EWZ up 2.3%; EWY up 3.3%; EWG up 79 bps;

A few minutes later Anastasia Amoroso of iQ capital (Amo to our tired fingers) said:

- “4,200 is where I may be comfortable(as opposed to 4500) ; markets are more optimistic about what the back half of the year looks like ; .. & Scott there are reasons to be more optimistic about the economy …. you don’t want to invest when the PMIs are ta 60; you want to invest when the PMIs are below 50 or today’s 46; … we have got consumer confidence that has been picking up as inflation has been coming down & if we are 50 bps away from the end of the Fed rate hiking cycle, all of this is pretty good news for the economy; & markets have priced in a chunk of the slowdown ; if you think earnings need to be down by 13% in a recession scenario for 2023, they are down 10% already … so we are a long way there“

Three days prior to the above, the celebrated bear Mike Wilson had already reached where Josh Brown is & agreed partly with Amo’s conclusion above. Read look what Wilson said on BTV on Monday morning, January 23 (at minute 6:54 of the 7:18 minute clip):

- “3300 base case; 3,000 if it gets nasty… but if it is going to happen that way meaning bad outcome, that is going to happen early; its going to be early part of the year; its NOT going to be 2nd half of the year; … we make it that far, that means we probably did orchestrate a soft landing; at that point earnings growth will be turned back up again and we can look forward … “

Frankly, we are stunned at this admission & it enhances our respect for Mr. Wilson. He courageously violated the safe strategist dictum that says – predict direction-level Or predict timing, But never both.

But does Wilson’s admission mean we can sell July S&P 3,000 puts with abandon? Or at least with caution? Or buy Dec 4500 calls if Mark Newton proved to be right – His target is 4,500 for year-end & his thesis is that,

- ” … on equal-weighted basis, markets have already seen breakouts of broader equity market indices; we are in the most bullish of all 16 quarters of the Presidential cycle; …. EM, Europe are all up 10-15%; Semis broke out yesterday; we have seen evidence of U.S. Dollar & Treasury yields rolling over sharply that acts as a tailwind … “

2. Earnings – Starvation or Fat stomachs

Look at the graphic below:

Is that similar to reaction of investors to MSFT earnings?

We think both reflect starvation, serious life-threatening in the first case and serious career-threatening portfolio mal-positioning in the second case. Or as ZH-TME wrote:

- FAANGs leaving the 200 day behind – NYFANG crushed the 200 day a few sessions ago. We haven’t traded this much above it since forever…and people are still not long enough.

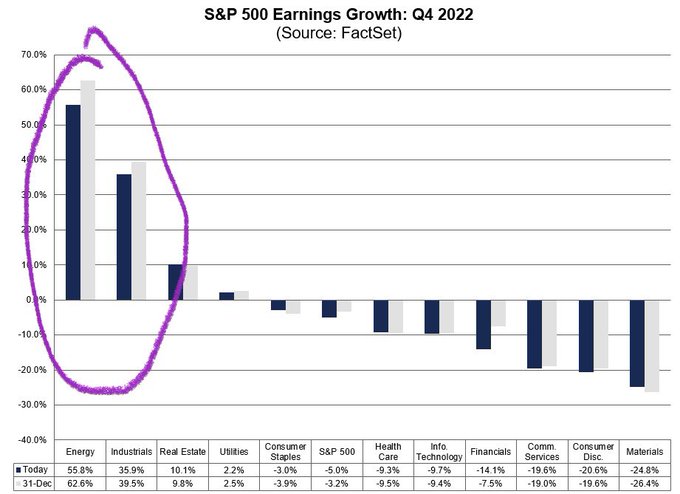

How long does this last? Until the earnings season is over? Or just until megacap tech earnings are behind us? After all, over all earnings are not great:

- Lawrence McDonald@Convertbond – Jan 28 –S&P 500 companies so far —— reporting a Y/Y earnings decline for Q4 2022 (-5.0%) for the first time since Q3 2020 (-5.7%). Via

@FactSet *ex Energy -10%?

Now think of Chevron. Great earnings & sector top of the earnings performance. Yet, CVX traded down almost 5% after earnings with investors crowding to buy it. Positioning???

That brings us to

- Jason@3PeaksTrading – –$QQQ also now two day above 3 ATR band which is a sign of short term exhaustion. Although prefer fading ATR’s on downside when get to -3 ATR oversold

And to a tweet thanks to Jason

- woman life Freedom@gbostom888 Replying to @3PeaksTrading and @elonmusk

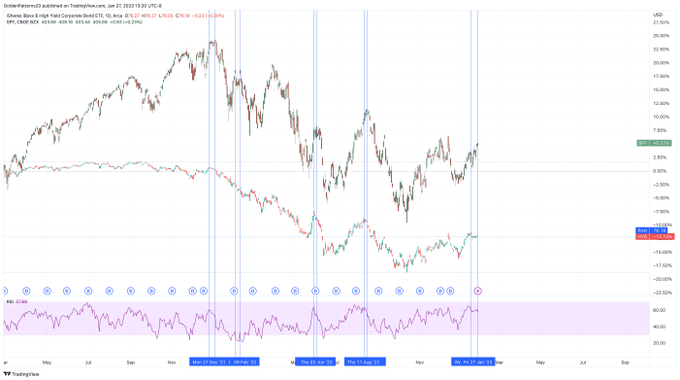

@3PeaksTrading – I also noticed this pattern! Whenever $SPY forms a higher high but $HYG doesn’t, we see a pullback for at least a couple of days.

That brings us to the biggest event of this rally.

3. Powell on deck

Recall that Mark Newton said above “U.S. Dollar & Treasury yields rolling over sharply”. In contrast, fellow technician Carter Worth put UUP as his fast money buy on Thursday and Treasury yields rose on 3 out of 5 days this week. Yes, we know that the three Treasury auctions met strong even very strong demand. But, if our memory serves us right, Treasury yields have often risen after a trio of very strong Treasury auctions.

And what about Gold, the 3rd rail of the Dollar weakness & falling Treasury yields? Tom McClellan has already answered it this week in his article Gold’s Price Oscillator:

- “The McClellan Price Oscillator for gold futures prices has reached a pretty high level, equivalent to what it did at the price top in March 2022, and it has just now turned down. This is a bearish signal and could set off a pretty big pullback.”

- “What we can see from this long term chart is that the current value of the PPO is not the highest ever, but it is still up pretty high, which merits a significant pullback in gold prices just to unstretch the rubber band and set up for the next potential up move. Such pullbacks usually continue until the Price Oscillator (and thus the PPO) gets down close to zero or even below it.”

What will happen to the ytd trends in Dollar, Treasury yields & Gold next week? That might depend on whether Chair Powell is verbally hawkish or whether he deigns to accept the easing of financial conditions in the past few weeks? It may also depend on whether his mind is as wide-open as are the ones we highlight below.

4. Three wide-open minds

Allow us to begin with the most bullish of our 3 wide-open minds. Jeff Gundlach spoke at a UBS event on Monday January 23. Near the end of his talk (minute 22;45), Bhanu Baweja, UBS strategist, asked Gundlach for his most right tail bet – meaning the most bullish bet he would make & how would he hedge against things going right? Here is what Mr. Gundlach said in brief:

- “weirdly the thing going right begins with something going wrong – recession gets here & gets steep; then what gets right is that we get the classic response to a recession which would be more money printing, zero interest rates potentially, more free money, massive budget deficit, because that is the way we have gotten ourselves out of recessions in the past 30 years;and that means you could have a return of inflation; that’s a weird way of saying positive about equities” ;

- “one thing about equities is that they can go up if there is inflation; so that is one thing that could go right; what I would suggest investors do is stay defensive for now; but, every day you wake up, try to say to yourselves “I am not going to take a mine-shaft decline in the equity market as a reason to sell; I am taking it as a reason to buy once we get a Fed & Treasury pivot“, which I fundamentally & thinking economically is a horrible long-term idea; its a method we were committed to and has reversed declines in 2018-1019, 2020 and the magnitude of that stimulus, my belief is, would be so substantial that it would cause inflationary revival”

- “so that’s a weird way to say something good but it is a potential opportunity as we move later in 2023“.

Here are Mr. Gundlach’s responses to 10 rapid fire questions from Bhanu Baweja:

- US 10-yr yield (3.7% now) one year out = closer to 3% not 4.5%

- S&P 500 (3,800 now) one year out = not close to either but prefers the lower number

- Oil ($80 now) one year out = close to $100 instead of $60

- Euro (1.06 now) one year out = closer to 1.15 instead of 0.95

- Bitcoin (16,800 now) one year out = closer to 8,000 instead of 25,000

- Trend Inflation in US & Europe below 2% in 5 years= NO

- China Trend Growth above 3% in 5 years = NO

- Major Central Banks doing QE in 5 years = YES

- EM assets delivered superior returns over DM in 5 yrs = YES definitely

- Italian Debt Crisis in 5 years = NO but if wrong, it will be a much bigger debt crisis

The second wide-open mind we refer to is of Suzy Orman, the one who understands finances of mainstream Americans better than any one else. She appeared on CNBC Fast Money on Wednesday & totally dispelled the FinTV consensus that the U.S. consumer is in very good shape & flush with cash.

She said “eventually that’s going to affect everybody“. What is her “that”?

- ” … here we are now, a year or two later – interest rates are through the roof; rent they can’t afford; they can’t buy a house; they can’t buy eggs; they are living paycheck to paycheck; – 74% of the people we survey are living paycheck to paycheck; – so they are spending down all the money they had in their savings accounts; soon they will be using their credit cards, not be able to pay it, start defaulting; look at the repossession of cars- we are at the highest repossession of cars we have ever been at; eventually this will hit all of use, if you ask me”

That brings us to our 3rd wide-open mind, the mind that seems so scary that we might wish it were closed. And we begin with where Suzy Orman left off above.

- US Big banks – the operative theme there is loan-loss provisioning in the USA… see what consumer credit has done in the past several months; 30-day arrears are just beginning to rise dramatically in the US; banks are preparing for a reversal of the credit cycle; they are preparing for credit losses & defaults …

Thus spake Rosenberg at minute 2:02:23 of The Year of the Rabbit: Hopping Out of the Hole! – a 2:33:32 minute presentation of Rosenberg Research. Our excerpts begin when David Rosenberg starts speaking ad hoc after the firm’s presentation at about 1:36:25. If you read what follows, keep a stiff drink handy or buy a load of US 30-yr Treasuries (preferably coupon strips):

- ” in the US, the housing market is just starting … & I am not talking about volumes; … I am talking about home prices; …In US you are talking about $50 trillion of long exposure to residential real estate on household balance sheets .. it is double what it was in the Great Financial Crisis, 15 yrs ago;“-

- “that has me a little un-nerved that asset deflation is going to make this out to be, especially as it pertains to housing ; housing is a lot more important than equities – 2/3rd of the population owns a home & that’s their prized asset ….”

- “home-owner affordability is a mean-reverting series; … it is a sin-curve … unless interest rates go down a lot, you need to see home prices deflate 25% to mean-revert ….”

- “we have had recessions without deflating a real-estate bubble; we deflated a tech bubble in 2001; … defaulting a residential real estate bubble, let alone a commercial real estate one … real estate deflation that’s a different animal …”

- “as sure as anything is sure in this life, we are going to have a recession; inflation never goes up in a recession. … Europe is going into a recession; our view is recession in Europe is going to be quite a bit deeper; they are in a more stagflationary environment than US is; .. they are much further below the US in their tightening cycle ….”

- “all roads lead to weaker U.S. Dollar“

Now if you think the above is bearish, read what Mr. Un-Rosy incarnate says about Canadian Debt Bubble:

- “Canadian household debt bubble is bigger and the housing price bubble & the leverage behind it in Canada is bigger than it was in USA in 06-07 and the interest rate cycle is more pernicious than it was back then … we are going to go through the mother of all deflations in Canadian residential real estate “…

Ask yourselves, folks! Is this a mind that should be legally free to remain open? While it remains free, someone should ask Mr. Rosenberg to compare today’s US or Canadian housing deflation to the 1990 real estate bear market in New York City & its aftermath for a couple of years. We would really like to know.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter