Editor’s Note: In this series of articles, we include important or interesting videoclips with our comments. This is an article that expresses our personal opinions about comments made on Television and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. Shades of 2013 & Not

Monday was a sharp, sudden drop of 23 handles with Nasdaq & Russell hit harder. But before you could say 2014 is different, Tuesday became just like 2013 again with SPX rallying almost 20 handles, NDX rallying almost 2% and Treasuries-Gold falling. Did the comforting retail sales number lift the gloom? David Rosenberg seemed to suggest so in his tweet in his Tuesday morning tweet:

- Gluskin Sheff @GluskinSheffInc – David Rosenberg: Were payrolls a headfake? Looks like consumer spending growth gripped a 4-handle in Q4! #Payroll #Q4

Which stores reported these strong sales, we wonder? Because just about every retailer reported bad numbers & several got their heady prices cut off this week.

Wednesday featured another 100 point rally in the Dow (almost 10 handles in S&P) with Nasdaq & Russell closing at new all time highs. Thursday & Friday saw declines from the highs with the S&P down for the week and the Dow barely up. The feeling was well described in the tweet on Friday afternoon:

- Bespoke @bespokeinvest – Just dreadful action to close out the week. Long weekend for traders to stew over a lot of bad charts too

2. U.S. & Global Economy

Henry McVey of KKR summed up the consensus bullish view in his conversation on BTV Market Makers on Monday:

- “I would say Friday’s jobs report is more of an aberration – weather, Obamacare… what’s different from last year this year is that Govt is going to be less of a drag … 4 pillars to domestic economy – housing, energy, autos & mfg – they have been doing fine for 12-18 months. – Govt last year was over a percent drag on the economy; this year it would be somewhere between zero & minus 30 bps; GDP should accelerate almost 100bps just from the lack of govt dysfunction; normal is closer to 3% GDP;”

The other extreme was articulated by Lakshman Achuthan of ECRI who still tells us that the U.S. economy went into a recession between Q4 2012 & Q1 2013. What does he say about 2014?

- “what is bothersome is that right now, the consensus is, hey, we’re taking off, right? we’re approaching the escape velocity. we’re going to be growing at 3% or something you were saying in 2014. we just don’t see that when we’re looking at the data, even the December jobs — pretend that didn’t happen. it’s still not there.”

The Bernanke Fed did worry about inflation but it worried about inflation more. And this week’s inflation numbers were worrisome. Low inflation seems to be worrying IMF’s Christine Lagarde who wrote this week:

- “What happens in advanced economies is central to global prospects; and, despite their stronger performance recently, the risks of stagnation and deflation continue to loom large. Central banks should return to more conventional monetary policies only when robust growth is firmly rooted.”

Larry Fink seems concerned as well, especially about the advanced economies of Europe. His main concern, his “black swan” or major global crisis case stems from the fact that the world has & will continue to have too many people without jobs.

- “great risk of Europe is the high unemployment rate; until we find new job creation we will have constrained inflation at best; Europe’s banks are still deleveraging”

- “my biggest worry is because of technology, countries worldwide are expressing worries about how to create new jobs; the bigger issue is countries like India, Brazil, China where you have millions of people moving from rural areas into cities. How are they going to find jobs as technology is aggressively transforming their workforce”

The same concept was succinctly expressed as a “Long Robots, Short Human Beings” investment theme by Michael Hartnett of BAC-Merrill this week. His chart tells the US part of the story simply and eloquently:

Source: BofA Merrill Lynch Global Investment Strategy, IFR, Bloomberg.

We hear that Janet Yellen is primarily a labor economist. So the concern expressed by Larry Fink must be central to her as well. Will she address this issue in the January FOMC meeting or in the March FOMC meeting? And what will she say?

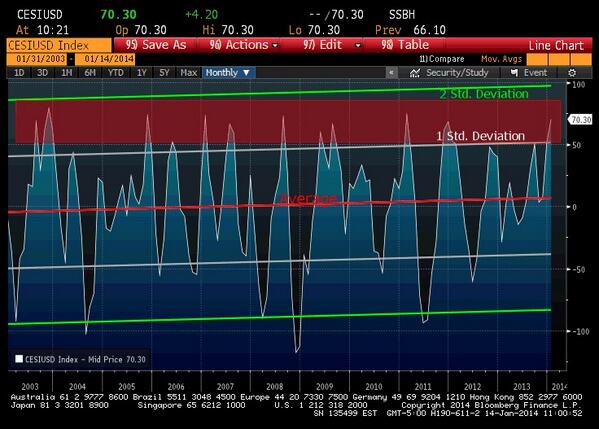

Those who believe in mean reversion of surprises in data might want to look at the tweet below by Brian Kelly of CNBC Fast Money:

- Brian Kelly @BrianKellyBK – Citi economic surprise index at extreme level, it is mean reverting, expect data to come in below expectations $spy pic.twitter.com/yWQza6F8rh

.

Doesn’t this week’s action in US interest rates seem more consistent with a slight mean reversion of economic data?

3. U.S. Interest Rates

The Treasury yield curve had a small bull flattening this week with the 30-yr & 10-yr yields falling by 5 bps & 4 bps while the 3-year & 2-year yields rose by 2 bps & 1 bp. Yields have dropped in the past two weeks across the curve with the 10-5 yr spread dropping by 13bps. The 30-year Treasury bond is up almost 5% in price in the past 2.5 weeks. Who would have thunk it before New Year’s eve?

The action led Rick Santelli to utter the “double-top” word on Thursday morning:

- “just a simple line to tell you why we are spending so much time at 3%. but the chart I really want to talk about is the chart just since May. you have what’s a double top at 3%. Why is this significant? because we never know when a double top kind of changes and maybe you take it out and it becomes a wedge or variety of other formations. but I will caution those that think it’s a fait accompli that rates have to go up to 4% us because the path at which they get there is what’s important and right now from where I see whether you look at gilt, bunds or treasuries there’s more downside than upside at least based on the recent chart”

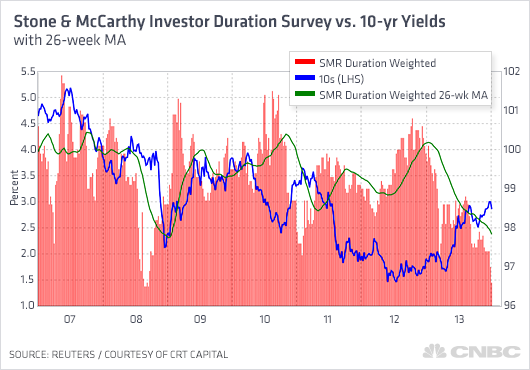

Article by CNBC’s Patti Dunn about Stone McCarthy duration chart & potential short covering:

- David Ader, chief Treasury strategist at CRT Capital. “The commitment of traders for example is also very short, especially in the 10-year sector.” Ader said even with the Fed tapering its purchases of Treasurys and mortgages, Treasurys could become attractive for investors who are focused on more richly priced spread products.

- “Historically speaking, Stone & McCarthy has been a reliable contrarian indicator,” Ader said. “We like it when you have a confluence of supporting information.” Ader said many of the money managers who are short Treasurys are actually long corporates and could be attracted to Treasurys as yields become more attractive in a higher range.

BlackRock’s Jeffrey Rosenberg on CNBC Futures Now on Tuesday, January 14

- “The best value in the fixed income market is precisely where people are leaving – that’s the long end of the yield curve – long Munis, long Treasuries, long TIPs, but if you are going to love the bond, it has to be conditional because you still have a rising rate environment;”

- “the 2-5 year part of the curve goes up much more than the long end; it goes up so you basically buy the long end and sell the short end“.

- “it is not booming growth expectations; it is simply to have a first year where we don’t disappoint; in that kind of environment, not the very front end of the curve, but the 2-5 year part of the curve will come unhinged; that’s in an environment good news that is OK for stocks , the long end of the yield curve only going up 40-50 bps, a 3.50% 10-year“,

- “closing yields for 2014 – 10 yr at 3.50% not that far off the consensus; it is really where you see the 2-yr & 5-yr – that’s not going up 50bps; that’s going up multiples of that; if we are right on our call here that the economy is going to do better and the Fed’s gonna lose control – that’s really where the risk is”

BlackRock’s Larry Fink on CNBC Squawk Box on Thursday, January 16

- “in the institutional business in 4th quarter, we actually saw institutions selling equities and buying bonds, especially the long end of the curve … we saw companies which had such large profits in companies needed to ask whether they want such a high allocation in equities and they wanted balance & so they sold equities and bought bonds”

- “10-yr don’t see 4% at all; 3.50% might see; I think what’s going to contain interest rates, they’re going to continue to see large demand as interest rates right from insurance companies. if interest rates continue to rise, and if we continue to have a stock rally, you will see rebalancing into fixed income”

- “inflation is going to hold down interest rates – yesterday, Christine Lagarde from the IMF said her biggest worry is deflation. I have true worries that we have a global economy that is — we have factory utilization below where it should be. we have unemployment rate at an unacceptable rate worldwide. but it’s not seeing you are also seeing technology gutting jobs worldwide“

- “Black Swan event – major crisis worldwide— I see is too many people with no jobs… rates will be more muted than consensus — great risk of Europe – high unemployment rate; Draghi has less flexibility; Europe seeing deleveraging until we we find new job creation – constrained inflation at best”

Henry Mcvey of KKR is at the other extreme as he told BTV Market Makers on Monday, January 13

- “you are going to be compensated to stay out of Government bonds; traditional asset allocation says you buy govt bonds when there is dislocation in markets; we are saying that govt bonds pose greatest risk in the markets & so you can use that capital to go elsewhere…”

4. U.S. Equities

Jeremy Siegel on CNBC Street Signs on Thursday, January 16

- “we’re much closer to fair market value now than we were a year or two ago. I still think we are below fair market value, so I still think we’ve got 10% to 15% to get there in the markets. We know nothing goes in a straight line, up to fair market value. either has

a correction or will over shoot. I’m calling for around 18,500 is what I think is the fair value“

Ralph Acampora & Dennis Gartman on CNBC Closing Bell on Thursday, January 16

- Acampora – one thing that stands out to me is that the Dow Industrials is not at a new high and the transport is. that doesn’t make me not sleep at night, but if that continues, I’d get a little concerned. … I don’t like it when they’re not both moving in the same direction. … If you look at the breadth of the market, it’s done real well. under the surface, things are okay.

- Gartman – if you put a chart on the wall, whether it’s of the S&P, whether it’s of the Dow, whether it’s of the Nasdaq, walk 20 feet away from them. they’re all moving from the lower left to it the upper right. it is a bull market. … the trend is still the trend…it is still moving to higher prices – it wont make a new high, it will fade, you will break some trend lines, it will fail to make a new high after that then you can say definitively the bull market has ended; until that happens – tops take usually months to develop; it will be a long awhile before this is done – it is still a bull market and any period of weakness, even 1-2% need to be bought; strength does not need to be sold into

Byron Wien on CNBC Futures Now on Tuesday, January 14

- “What’s going to cause it is that everybody’s on one side of the boat here, … Almost everybody’s made good money—maybe not 30 percent last year—but everybody was up … and people are generally feeling pretty positive. There’s almost a euphoric mood.”

- “Wien said it won’t take much to turn this manic high into a manic low. “When investor sentiment is as positive as this, [the market is] usually vulnerable to any kind of a disappointment,” he said. “There could be some earnings disappointment in the fourth quarter. And the geopolitical situation is still, in my mind, pretty unsettled. So you never know what it’s going to be. But you do know that when sentiment is euphoric, the market is vulnerable.”

- In his list of surprises for 2014, Wien forecast a “Dickensian market with the best of times and the worst of times”: specifically, that after a 10 percent correction, the S&P 500 will approach “a 20 percent total return by year-end.”

Henry McVey on BTV Market Makers on Monday, January 13

- Europe – focus more on the periphery I think – Europe will see 1-1.2% GDP growth; periphery is gonna grow faster; France would be slow; Netherlands will be slow; places like Ireland, Spain or even Portugal – that’s here the rate of change is better; you are going to see banks raise capital similar to what the US did in 2009 and people will take that as a positive and not a negative…, I don’t think Europe is in a structural bull market,but spreads collapsed in the periphery and that will ultimately have some follow through to the equity markets..

- Japan – we still think there is upside; it has gone from less bad to steady state and there is still a lot of monetary stimulus… .do you get wage increases at the base level in March 2014? that will be the inflecion point on which micro investors should focus.. because of the weaker Yen, Japan has actually got cheaper not more expensive; it is actually trading at a cheaper valuation currency adjusted

- EM – you need to focus on markets like Mexico where they are actually doing the right thing with their balance sheet; that is a very different story than what you see in the traditional BRICs..

Lawrence McMillan in his Friday summary:

- There is strong support for $SPX at 1810. Moreover, there is now resistance near 1850. In summary, the market is overbought but bullish. That means it can continue to rise, with the proviso that sharp, but short-lived corrections (such as last Monday’s) are possible at any time. In summary, there are some overbought conditions (although no confirmed sell signals), but unless $SPX breaks down below support at 1810, and $VIX climbs above 14.50, this will remain a bull market.

5. Gold & Commodities

Gold & Gold Miners acted great this week. The Gold miner ETFs, GDX & GDXJ, were up 5.8% & 11.9% this week. Kudos to Larry McDonald who was steadfastly bullish in December and argued that Gold miners were a great buy after January 1, 2014. He took a victory lap on Friday afternoon in his tweet:

- Lawrence McDonald @Convertbond – The Most Hated group in December, Gold Miners now up 15% from those lows $GDX #BuyFear

Jon Najarian of CNBC Fast Money also recommended GDXJ 32 calls a couple of weeks ago and those have been a rocket. Kudos to him. Others like Mark Dow, David Bannister, George Davis & George Gero recommended the Gold at least as a short covering trade as our weekly articles documented in December.

We recall that Dennis Gartman was bullish on Gold in Euro terms and considering going long Gold in Dollar terms. That is what Tom McClellan discussed in his Thursday’s article Gold Breaks Downtrend, Sort of:

- “Which of these statements is true: 1. Gold is still in a downtrend. 2. Gold has broken its downtrend. It turns out that they are both true, but only if viewed from the proper perspective. The price plot of gold as priced in dollars is still below the declining tops line which dates back to late August 2013. But the same line drawn on the plot of gold priced in euros has already been broken.”

- “So who’s right? History says that

the euro price is nearly always right during such disagreements, so I

expect that to be the case again this time.” - “Gold prices have just started the process of building a pattern of higher highs and higher lows to define an uptrend. But we already have a broken downtrend line on the plot of gold priced in euros.”

Abigail Doolittle of Peak Theories was quoted in a WSJ article saying:

- “technical conditions have become “very, very ripe” for a big move higher in gold, and the very long-term supporters of the metal are getting ready to add to their positions again. “These guys are starting to sense [a rally] is coming,” Ms. Doolittle said. “And when it comes, they will pounce. And it could produce manic-type buying.”

The WSJ article used the chart below as support for their view:

A more detailed case on Monday was made in an Minyanville article titled New Gold Bull Market Cycle Has Started.

- As of today, we have the reverse situation, with the bullish percent index at 13% and showing bullish divergence from that of gold stocks. This is an early signal that the new gold bull market cycle is turning up and it should not be overlooked.

- Also we see the 5th and final Elliott wave pattern forming, and we could once again witness another multi-year rally in the price of gold.

The chart in that article tells a pictorial story of the previous 4 cycles. With so much bullishness, we need to feature a bearish call as well.

Goldman’s Jeff Currie with CNBC’s Kate Kelly on Monday, January 13

- “when you think about a short on gold, which we have a target of 1050, it is essentially just a bet on a substantial recovery in the U.S. economy. in contrast, when we look at the outlook for both crude oil and copper, the story’s a little bit different. and there’s two key themes.

- one is this rotation away from EM-led demand or emerging market-led demand to developed market demand, and

- the second theme is what we like to call a normalization in supply.”

- “obviously the rotation away from EM into DM being DM less commodity intensive is more of a bearish dynamic. but couple that with normalization and supply which we see both in oil as well as in some of the key based metals, particularly copper, creates a lot of downside risk. In oil, we are unwilling at this point to get very short just given the fact you have the disruptions in Libya and Iran. however, in copper we believe there’s downside all the way down to 6200 really driven by the fact that you have less demand from the emerging markets and we’ve seen a significant increase in supply from 2% all the way to 4%. “

6. Inflows into Long Only Funds & Hollywood

Michael Hartnett of BAC-Merrill writes that long-only funds saw $6.5 billion inflows this week, the largest in 12 months. He says this is a sign that investors are warming to idea of active funds as opposed to just passive index strategies. Hopefully, he is right. Meanwhile, this week made it 12 straight weeks of EM equity redemptions, the longest outflow streak in 11 years.

There are those who believe that a peak in long-only funds could suggest at least a short term top. They may want to listen to Carter Worth of CNBC Options Action who related a new indicator of market tops, a Hollywood indicator. Pointing to his chart, he said:

- “this is 1987 peak and the movie Wall Street came out. Boiler Room was issued in 2000 at a peak. Wall Street Money knows no sleep, at or near top in ’07 and now here we are the Wolf of Wall Street and surely this is not a bottom. This title itself appeared once before, 1929, there is a movie with that title, the Wolf of Wall Street issued by Paramount. There is rhythm and rhyme here.”

7. NBC & Education and fearless Amanda Drury?

Much of America is on a mission to get more young women into STEM fields. NBC, as we recall, launched a series an year or so ago to focus on education of women. We have always wondered whether such initiatives are a lost cause. Because look around you – so many high paying fields are available to women. And these fields, like television for one, pay a great deal more to women than a science career would. Smart women know that. But most of them stay quiet. Not the fearless Amanda Drury of CNBC. As we recall, Ms. Drury made a flat “education is so over rated” declaration at the end of this week’s CNBC segment about states with most millionaires.

This was not her first moment of candor, as we recall. In an earlier CNBC special about a young woman winner of the spelling bee contest, Ms. Drury, as we recall, ended that segment with a contemptuous I would go the beach, not to a library type declaration.

We commend Ms. Drury for her outspoken honesty. Does any one doubt that CNBC pays Ms. Drury a lot more money that they would pay spelling bee winners and STEM graduates? Has CNBC even hired a single spelling bee winner? Be honest, CNBC – whom would you rather hire – a spelling bee winner, a STEM graduate or a beach babe? Kudos, Ms. Drury. Keep speaking honest truths.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter.com