Editor’s Note: In this series of articles, we include important or interesting tweets, articles, videoclips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. The Draghi Effect

On Thursday May 8, Draghi served notice, as we then put it, about a potential QE in Europe. What happens when QE is launched? – long duration stocks & speculative stocks rally relative to big cap indices, the currency of the QE country weakens, the Treasury yield curve steepens and proven trend exhaustion technical indicators fail. And what has happened in the markets from May 8 to May 23, this Friday?

- Netflix is up 25%, Facebook is up 7%, MSH, Morgan Stanley Tech Index (internet dominated) is up 4%, QQQ is up 3.8% while the S&P is up 1.3%. The Euro is weaker with FXE down 2% and the 30-5, 30-10 year yield spreads have steepened by 11 bps & 5 bps resp.

And yes, the forecast on May 8 by Tom DeMark that “market should top finally, finally … possibly within the next couple of days” has failed to materialize.

The above does suggest that the financial markets are running on the perceived stimulus of a potential QE by Draghi. What may stop, slow down, or accelerate these moves? Draghi himself at the June ECB meeting.

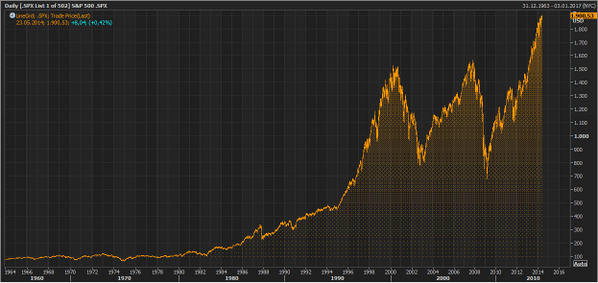

We should celebrate the breaching of 1900 by the S&P on Friday even though it might have been only by a nose. We do so here with the tweet & its chart below :

- Retweeted by John Melloy – Holger Zschaepitz @Schuldensuehner – In case you missed it: US Benchmark index S&P 500 closes above 1900 for the first time ever. pic.twitter.com/Vub4k2hc6x

And what happens when the S&P reaches an all-time new high?

- Mark Dow @mark_dow Doesn’t matter where you look, bears just get squeezed pic.twitter.com/r4KWYhOOCx

On the other hand,

- Jason Goepfert @sentimentrader – Could be the 5th time $SPX closed at a 52-wk high on day b/4 Memorial Day. Next week after the others: -0.7%, -1.7%, -1.6%, – 0.1%.

Did the S&P really close above 1900? We mean morally not literally because,

- Friday – Tim Backshall @credittrader – almost 1/3rd of S&P day’s gains gone after hours in Futures

But the gorgeous photo above of a bear being squeezed by a lion & a tiger leads us to ask what might really really put the proverbial squeeze on S&P bears?

- Wednesday – sachy Mishal @CapitalObserver – Selling the top of the range is getting a little too easy. Bears may be getting set up for something nasty

2. Volatility

Remember what BlackRock said about Volatility in their 2014 outlook?

- “Volatility is on sale – It is better to buy an umbrella before the rain. Volatility is cheap and many assets are expensive.”

If Volatility was “on sale” in December 2013, what kind of sale are we seeing now? And should we buy it?

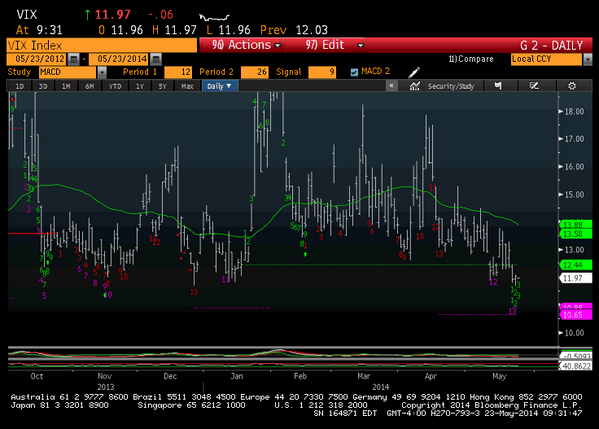

- Mark Newton @MarkNewtonCMT – VIX in the final stages of capitulation. Move down to near 11 should represent excellent area to accumulate ImpliedVol pic.twitter.com/cTjmmuUHta

Is the lack of volatility a signal of some kind?

- Thursday – Minyanville @Minyanville – The tape is coiling under the seemingly calm financial surface http://www.minyanville.com/special-features/random-thoughts/articles/Todd-Harrison-The-Federal-Reserve-Warns/5/22/2014/id/55053 … @todd_harrison #volatility pic.twitter.com/d1aRgF1WaT

When have we seen this before?

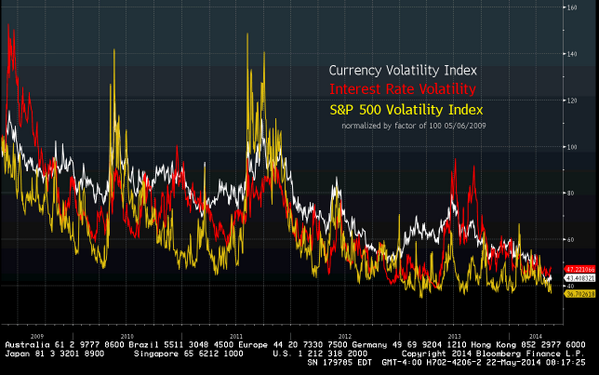

- Downtown Josh Brown

@ReformedBroker – Jim Bianco’s note this AM shows that bond, currency

and stock volatility are all at lows only seen once in the last 25

years: 2007.

And when might volatility spike?

- Monday – Ophir Gottlieb @OphirGottlieb – $SPLK – Why This Stock Chart May Just Be the Beginning of Huge Volatility: optionvol.blogspot.com/2014/05/splunk-splk-stock-collapsing-risk.html … pic.twitter.com/fl93YVe2RX

What might happen if volatility spikes in all markets simultaneously? Traditionally, long Treasuries have been a safe haven against big spikes in stock volatility and big spikes in bond volatility have been terrific post-spike buying opportunities in long duration Treasuries. But could stocks and bonds could both go down if volatility spikes simultaneously in both markets?

Remember BlackRock’s basic call for 2014 was that stocks and bonds will become increasingly correlated making diversification difficult. This week, Michael Gayed (@PensionPartners) wrote the following in his Marketwatch article Is a Bond and Stock Correction coming?

- “However, I do wonder if we may be in a period where long-duration Treasurys fall and stocks break, which in many ways leaves only short-duration Treasurys the place to be. … It also means the summer may be a lot harder for buy-and-hold asset allocators than most have been used to so far”

It is instructive to note that both the 5-year & 2-year Treasury yields closed this week (1.529% & 34.69 bps) below their closing levels on March 18 (1.546% & 35.1 bps), the day before Chair Yellen made her “6 months” remark.

What might create some real volatility in the near term? How about the ECB meeting is on Thursday, June 5 and the Non-Farm Payroll number on Friday, June 6?

3. U.S. Treasuries

On Wednesday, May 14, Larry McDonald and Jim Bianco crossed proverbial swords on long term Treasuries on CNBC Closing Bell:

- Larry McDonald – “I think it’s a capitulation moment for people that are short treasuries. … Now now is the time to go the other way, Sell bonds.”

- Jim Bianco – “I think that this capitulation trade we’re going to see now is a lot larger than people think. bonds, yields can fall a lot more before this is over with”

This Wednesday, Larry McDonald took a victory lap on Twitter.

- Wednesday – Lawrence McDonald ?@Convertbond – Nice back up in yields, $TBT is up nearly 5% from last week‘s low 10s 2.55%, up from 2.47% last week.

Supportive views came from,

- Tuesday – J.C. Parets ?@allstarcharts – it’s funny, now that everyone has come around to the bond trade (too little too late), I think rates get a little bounce & I sold bonds $TLT

- Bret Furgason ?@furg2000 – @allstarcharts Elliott is talking to me about. A possible ballistic move lower in TLT. Lol

Last Thursday, Helene Meisler had suggested that TLT was a sell mainly because TLT had reached the top of the channel. This Thursday, she seemed to reverse her stand in her tweet:

- Thursday – Helene Meisler ?@hmeisler – .my $TLT chart from last nite. Lower line tag shortly. Just like upper line tag last week. Stock girl pic.twitter.com/Qlw2mEUdNz

No doubts here:.

- Keith McCullough ?@KeithMcCullough – $TLT is the upside down version of $IWM; waiting on sub $112 to add to 1 of the best Macro longs of the yr

To be fair, Jim Bianco wasn’t really talking about a very near term move last Wednesday. Neither was his friend Rick Santelli in his Fibonacci retracement comments on this Friday in his Santelli Exchange. What does he come up with? the first target of 2.50% and a larger target of 2.16% for a big move. Of course, as he clarified, this is not necessarily in a straight line move.

Mark Newton comes to a target in the same area in:

- Friday – Mark Newton @MarkNewtonCMT – Expect that 10-Year TY yld trend eventually breaks support at 2.45, falling to 2-2.25% area between June-September pic.twitter.com/p9wEEKeZr0

But we don’t find Newton’s view that reassuring because,

- Mark Newton @MarkNewtonCMT – Tough to get too bearish on bonds, (bullish on yield), as 10-yr would require move over 2.63, looks doubtful pic.twitter.com/QMdjmiig7Y

Is he serious? The 10-year yield closed at 2.54% on Friday. He is doubtful about the 10-year yield rising by 10 bps in the next two weeks? Heck, a strong payroll number on June 6 could get you there in one day.

We are serious believers in market positioning. While bond futures positioning was short coming into 2013, we hear that it has now turned very long, led by hedge funds with Macro fund exposure to the 10-year at very high levels. So it may not take much to rock the boat given that so many have piled on at one side of the proverbial boat.

During the carnage last fall, David Ko

tok of Cumberland Advisors was advising his readers to buy long duration Muni bonds. What a phenomenal call that was? As he wrote this week:

- “Long tax-free yields are now down more than 100 basis points since the peak of the carnage last September whereas long Treasury yields have only declined by roughly 40 basis points. … The change in the TONE of the muni market is dramatic.”

So what is Mr. Kotok doing now?

- “At Cumberland we have spent the last couple of months actually reducing the average maturities and durations of accounts. … we have also actively reduced some of the longer bonds, as there is a big difference between 5%+ yields and yields of 4% or less.”

4. Stocks

The S&P closed at a new high and that too at a big figure of 1900. And all we heard on TV & Twitter were complaints about the volume. Yes, the volume was pathetic, perhaps the lowest of the year. And yes, the breadth keeps deteriorating with smaller number of new highs at every S&P high. But trends continue until they stop. Remember the 55% probability of Low for Longer scenario in BlackRock’s 2014 outlook:

- “… growth is low and fragile, running close to stall speed. Jobs and wage growth are muted in the developed world. Inflation is low but stable; Financial conditions stay very loose … real rates and overall volatility stay subdued. Momentum can easily propel equities higher. The hunt for yield intensifies. low investor conviction in trades and lofty valuations leave little room for error.”

Perhaps the grind higher is the stock market equivalent of Newtonian inertia.

The emotion we heard on Friday was all about Russia, perhaps driven by the non-diplomatic comments by Mr. Putin. All day Friday, CNBC kept telling viewers about the massive rally in Russian stocks and in the Russian Ruble in May. CNBC Fast Money actually made fun of White House Press Secretary Jay Carney about his call to short Russian stocks at the start of the Ukraine crisis.

And we must admit we were wrong last week about fading the near vertical rally in the Indian stock market. But our caveat was a new ytd high in the Indian Rupee. And the Indian Rupee did make a high for 2014 this week. The rise actually prompted the Reserve Bank of India to buy US Dollars to stem the rise of the Rupee. This week Indian Newspapers reported that a strong Rupee is going to be a core objective of Prime Minister (designate) Modi. Would a “Maharaja Rupee” make Larry Kudlow jealous? Being fans of “King Dollar” ourselves, we know we would become jealous. But a strong Rupee objective makes Modi-nomics the opposite of Abe-nomics and more like Reaganomics.

Indian newspapers also reported that plans for a new Finance-IT swat team have been prepared for presentation to Mr. Modi. As we wrote last week, Mr. Modi is committed to bringing back monies illegally hoarded outside India. The new Financial Swat team is supposed to be dedicated to this task. It wouldn’t surprise us if many of these monies are already being repatriated to India.

The steady rise in the Rupee would enable Reserve Bank Governor Rajan to maintain his hawkish monetary policy. They could get lucky and maim if not kill the high inflation predator that has troubled India. This potential is makes us think of the Reagan-Volcker comparison.

But what does one do now? CNBC Fast Money traders used both hands this week – Tim Seymour, Steven Weiss & Gemma Godfrey suggested lightening up while Josh Brown & the Najarian brothers advised staying in. The most bullish comment was from Josh Brown who said that the India trade in 2014 could be like the Japan trade of 2013.

All these CNBC FM traders managed to do something in unison – butcher the pronunciation of “Modi”. The correct pronunciation is not with a hard “d” like in David, but a soft one as on “the”. As we discovered, the simple trick is to pronounce it as you would phonetically say “Mothi”. And hearing the butchered pronunciation is sort of like Scott Wapner being forced to hear every one say his name as “Scoot”.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter