Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”beyond data-dependence“

We listened to the FOMC statement on Wednesday afternoon & saw some of Chair Yellen’s press conference. At that point, we had to leave for a meeting. When we got back well after the close, we couldn’t believe our eyes. And they weren’t lying eyes, either. The steep selloff in Treasury Notes, Bonds and in Gold miners between 3:20 pm & 4:00 pm on Wednesday looked even steeper on intra-day charts.

What happened, we wondered. Later that night, we heard Mohammed El-Erian on Bloomberg say Yellen went “beyond data dependence” in her answers. He thinks that is why the treasuries & gold fell off the cliff after her presser. To us it seemed that Yellen was angry, determined and signaled a greater willingness to raise rates beyond or even despite actual data they see next year.

The markets were absolutely unprepared for this. The best way to see how unprepared they were is to look at 5-day charts & look at what happened on Wednesday from 2:00 pm to about 3:20 pm and then what happened from 3:20 pm to the close;

TLT – 20 year + Treasury ETF IEI – 3-7 year Treasury ETF

GDX – Gold miner ETF EEM – Emerging Markets ETF

The top two charts are really interesting. We had wondered last week:

- “What does Janet Yellen prefer? A 3% 10-year yield by letting the economy run hot or a 2% 10-year yield by signalling 3-4 rate hikes in 2017?”

The Fed gets a steepening yield curve when they let the economy go hot & they get a flattening yield curve when the market senses their actions will slow down the economy. Chair Yellen not only signaled at least 3 rate hikes in 2017 but she also exuded contempt for those who think she might let the economy run hot. So what happened from 1:45 pm on Wednesday to Friday’s close?

- 30-yield rose by 3.3 bps while the 5-year yield rose by 13 bps & the 2-year yield rose by 10 bps.

- The Dollar exploded up by 1.9%; Gold fell 3.3% and GDX, GDXJ fell by 11.5% & 13.8% resp.

- Stocks closed down with SPY down 80 bps, Transports down 1.5% & EEM down 2.7%.

This was also the story of the week with the 5-year yield up 18 bps, the 3-year yield up 17.5 bps & the 2-year yield up 13 bps while the 30-year yield only rose by 2 bps. This sort of flattening doesn’t suggest an economy with accelerating growth. Instead it suggests a slowing in the rate of the economy’s growth. Did Chair Yellen actually intend to send such a signal to markets? Such a signal was sent by Greenspan in 2000 & by Bernanke’s slowness to ease in the summer of 2007.

Coincidentally:

- Charlie Bilello, CMT

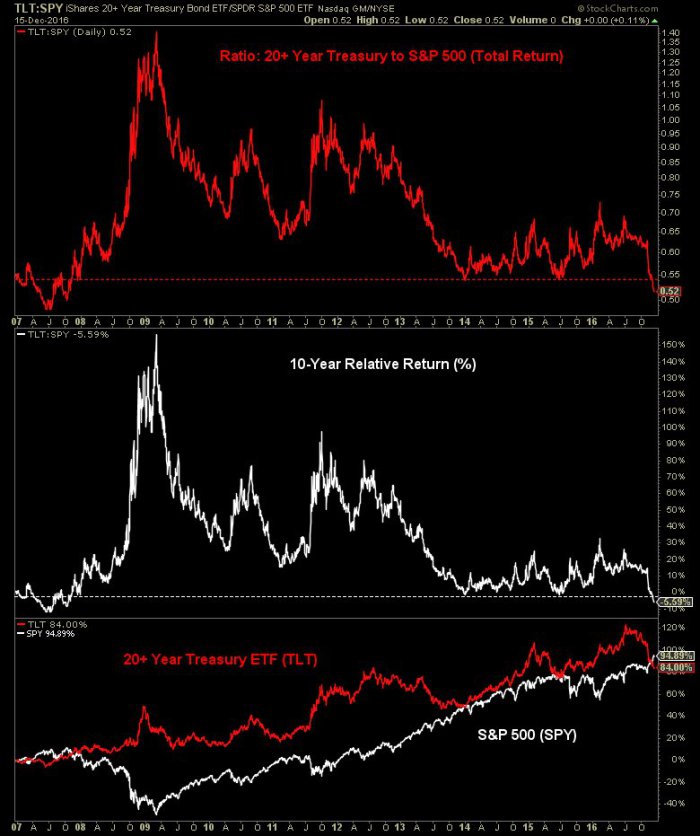

@charliebilello – Dec 15 – Ratio of the Long Bond ETF to the S&P 500 at its lowest level since October 2007.$TLT$SPY

Everyone knows that the Fed is the worst forecaster of the rate of economic strength. And their forecasting errors have led the FOMC to make mistakes at major turning points. That may be why the Treasury curve flattened viciously after Yellen’s press conference.

We confess to be concerned at Chair Yellen’s demeanor & tone in the press conference. She seemed more angry than usual, perhaps due to the treatment she has received in the tweets of President Elect Trump. She signaled her determination to remain the Chair until her term expires in 2018. We hope her anger at President Elect Trump does not move her to oppose or even torpedo his plans by being more hawkish in her statements than she needs to be.

Note we are concerned about her statements & not her actions. This FOMC has never understood that the immediate reaction of the Treasury market is to run faster & farther ahead of what they say. That is also what happened in 2013 during Bernanke’s taper tantrum. Frankly, the reaction in short rates might have been less strident had Chair Yellen raised rates by 50 bps on Wednesday and kept her tone mild.

The immediate question is whether the stock market re-imbibes the holiday spirit & ignores the message of the flattening yield curve for now. Our guess still is yes. Because if you look, what happened this week to the stock indices can at worst be called a consolidation. Note however that the Russell 2000 underperformed SPX ( down 1.7% to down 9 bps) and so did the transports (down 2.6%). Is that also a consolidation or is it a rotation?

The decisive moves of the week were in the U.S. Dollar and in Gold, with DXY up 1.3% & GLD, GDX, GDXJ down 2.2%, 8% & 12% resp. In contrast, the S&P was only down 9 bps on the week. This leads to another interesting observation:

- Charlie Bilello, CMT

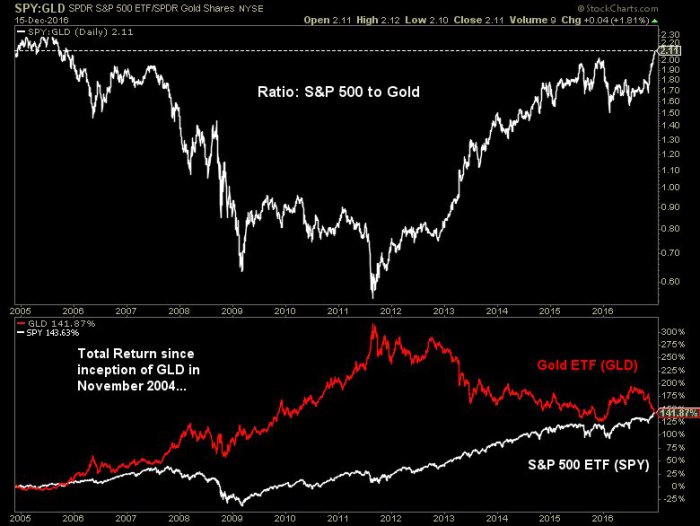

@charliebilello – Dec 15 – Ratio of S&P 500 to Gold at an 11-year high.$SPY outperforming$GLD since its inception (Nov ’04) for the first time since 2005.

2. The Fed giveth & the Fed taketh away

That is what they are supposed to do. But they are supposed to do it early, almost prematurely. But that old wisdom was tossed out by Alan Greenspan in 1999-2000 when he first created the tech bubble & then burst it too late in 2000. He was even more irresponsible in 2004. And his protege, Bernanke let his bubble grow to almost unmanageable scale until it burst. He & his protege, Janet Yellen, created another QE bubble that is still growing as we write this. So Yellen’s angry tone, her needlessly hawkish signal of 3-4 rate hikes in 2017 and the bond market’s immediate flattening of the treasury curve worry us.

Coincidentally as it were, David Rosenberg released a free report on Thursday, day after the FOMC statement & Yellen’s presser. He writes on page 10:

- “It is true that no cycle dies of old age, but they do die nonetheless, and usually at the hands of the Fed, who have engineered 10 recessions in the post-WWII era but only three “soft landings” and those soft landings occurred when the cycle was roughly three years old, not eight.”

Remember what is true for commodities – that high (or low) prices are the best antidote for high (low) prices? Because high (low) prices for commodities tend to spur increased (decreased) investment in production and that leads to lower (higher) prices.

That is just as true for a leveraged economy like ours and higher interest rates. Rosenberg addresses this on page 10:

- “As my good pal Peter Boockvar published,…. America is so heavily indebted that every 100 basis points increase in market rates causes interest charges to soar $470 billion or 2.5% of GDP. …. And we know that we are that much more late cycle than we were this time a year ago and that we are just six months away from this expansion celebrating its eighth birthday.”

The title of Rosenberg’s free report & his out-of-the-box call is Trump accidentally engineers a return to the disinflation trade. We do wonder whether he should have replaced “Trump” by “Yellen” but who are we to question the reliable Rosie?

3. King Dollar

We use the above favorite term of Larry Kudlow in recognition of the august role he is about to play in the Trump White House. Dana Lyons seems equally enamored:

- Dana Lyons

@JLyonsFundMgmt – (Post) Euro Going To Parity Like It’s 1999 – via@YahooFinance$FXE $6E_F http://jlfmi.tumblr.com/post/154548156555/euro-going-to-parity-like-its-1999 …

His headline – For the first time since the year of its inception, the Euro appears likely to drop down to 1.00 vs. the U.S. Dollar.

4. Treasuries

Wasn’t it just the week before that David Woo of BAML said on CNBC Squawk Box that the 5-year yield should be higher than 40-50 bps because it was not priced for 3-4 rate hikes in 2017. A week or so later, with the 5-year yield up by 18 bps this week, half of Woo’s projected rise is already behind us.

Woo was such a dove compared to the ebulliently strident Doug Dachille (CIO-AIG) on CNBC Squawk Box. Dachille’s target for 2-year yield at the end of 2017 – 2%, 74 bps higher than Friday’s close of 1.26%. You add this to the chorus of gurus who think the 10-year yield is at fair value at 2.6% and you get a massive flattening of the 10-2 curve to 60 bps. We hope one side is wrong because no one should be long anything real if the curve is going to flatten that much.

David Rosenberg wrote in his back to the disinflation free report on page 5:

- “I will go on record to say that sentiment and market positioning are so radically negative on Treasuries that it wouldn’t take much to elicit a countertrend bond market rally. We are way oversold here”.

In contrast, just the facts from:

- Charlie Bilello, CMT

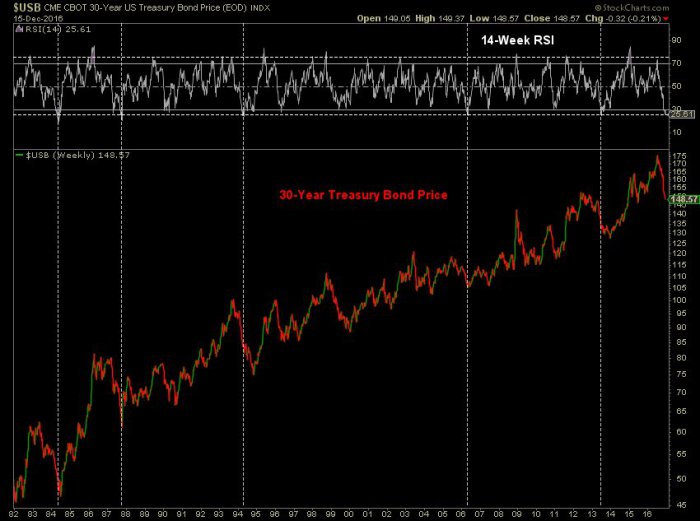

@charliebilello – Times in the past 35 years that the 30-Yr Treasury Bond has been more oversold than today (using 14-week RSI)… 1984 1987 1994 2006 2013

Which is the bigger force? Santa or Yellen? What does history say?

- Ryan Detrick, CMT

@RyanDetrick –#SPX up 2.9% as of#December 15th. Since ’50, only 6 yrs up more as of 15th. Good news? Rest of mo ALL 6 were green and avg up another 1.7%.

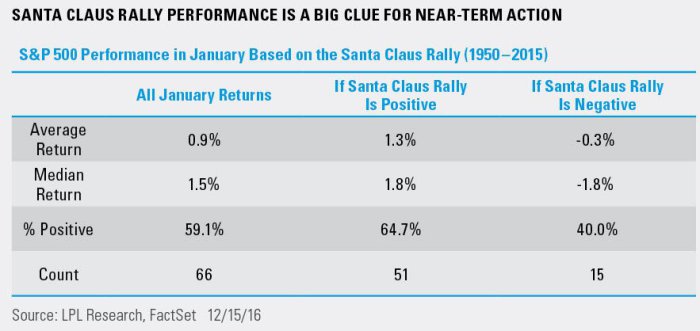

It seems Santa is not just for the last week of December but also for January:

- Ryan Detrick, CMT

@RyanDetrick – The key to#January? Looks like it is the#SantaClausRally. If#Santa doesn’t show,#SPX in Jan is usually red. https://lplresearch.com/2016/12/16/santa-claus-rally-or-the-grinch-who-stole-christmas-part-2/ …

6. Gold

Even a sadist would feel sorry for Gold miners & gold at this stage. But what else can anyone expect with Dollar screaming higher & rates zooming higher. And we have seen a serious correlation between Gold & Treasury prices recently. That makes the following interesting:

- Urban Carmel

@ukarlewitz$GLD trying to hammer outside the lower BB. It’s mega hated. Today might be it’s Cuervo moment. Needs to show more follow through

Guess what? Buyers stepped in to buy GDX Jan 20 calls in size on Thursday morning, as Jon Najarian reported on CNBC FM 1/2 on Thursday.

Send your feedback [email protected] Or @MacroViewpoints on Twitter