Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Impetus from $VIX

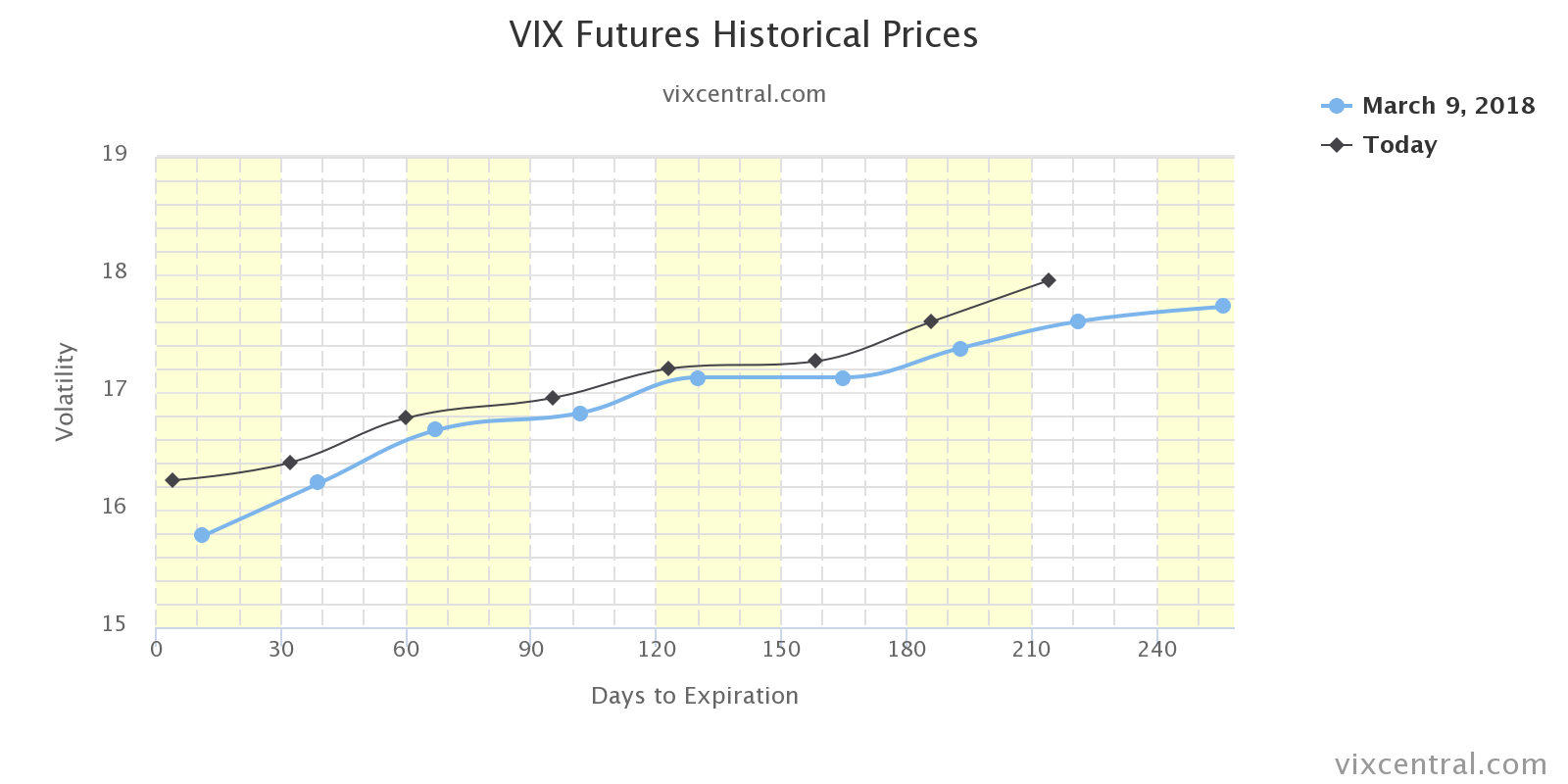

When stock indices fell apart in early February, two factors were held responsible – spike in Volatility & hard rise in interest rates. Tracking both over the past 4 weeks, it has been clear that rise & fall in $VIX is more directly linked to rise & fall in S&P 500. That is why we wondered after the VIX curve had normalized at the end of last week “how much of the impetus from the fall in VIX is left?”

Hardly any was the loud answer from markets as the first three days of this week were all down, down 578 points on the Dow. And what did $VIX do from Monday to Wednesday?

- Andrew Thrasher, CMT @AndrewThrasher – Wed Mar 14 – Adding 1 point today,$VIX now up nearly 20% since Friday

Promptly, $VIX fell hard on Thursday & Friday and closed the week at 15.80, up a modest 8% on the week. As a result, the VIX curve remains in its normal state:

Perhaps the next direction of the VIX curve will depend on what the new Fed Chairman Powell does and says on Wednesday, March 21. The actions & comments of Chair Yellen almost always resulted in a fall in volatility. But now we have a new regime.

Though the sharp rise in Treasury yields was a second factor in the hard decline in February, the recent stabilization and small decline in Treasury yields have not mattered much to the major stock indices. Chairman Powell could change that next Wednesday.

2. Treasury Yields

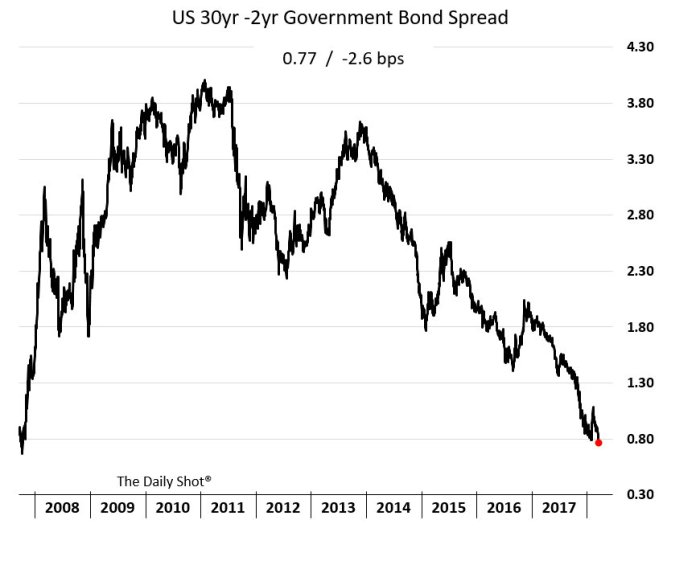

Long duration Treasuries had a good week. 30-year yield was down 8.7 bps on the week & the 10-year yield was down about 5.7 bps. The 3-5 year curve was almost unchanged but the 2-year yield closed up 2.5 bps on the week.

- (((The Daily Shot))) @SoberLook – Chart: 30yr – 2yr Treasury spread lowest since 2007 as the curve flattens further –

Was this factoring in what Chairman Powell would do on Wednesday? Recall that he had made an explicit statement that a severely flattening yield curve would be unacceptable to him.

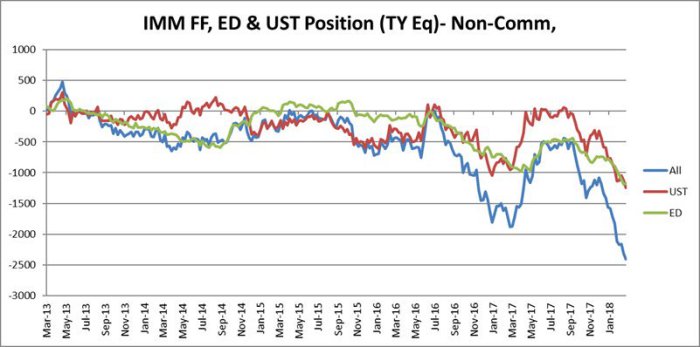

- Harald Malmgren @Halsrethink – Mon March 12 – If Fed hikes this month, what will be yield curve outlook be after hike? Speculators heavily short 10s&30s, but commercials heavy longs for 10s and 30s. If you believe smart money is really smart, expect yields on 10s&30s to FALL after Fed hike w/short squeeze

Why would there be a short squeeze?

- Emergingtrends @Emergingtrend

s – Mon Mar 12 – USTs: the short is now the largest ever by some distance… *surely* duration is going to struggle to sell off in the near term?

Tom McClellan gets the same message from the Summation Index of Corporate High Yield Bonds:

- “The message right now is that the high grade area of the bond market has gotten extremely oversold, and thus at least a bounce is due right now. Plus, a larger up move is in the script for later.”

- “The takeaway point is that even if there is a retest of the price low, we still can expect higher T-Bond and high grade corporate bond prices in the weeks and months ahead. And that will frustrate the legions of analysts expecting higher inflation and higher interest rates”

Note that, unlike other short term bounce predictions, Tom McClellan sees a large move over the next few months.

When we began writing about a fall in Treasury yields a couple of weeks ago, it was a fairly lonely position with just a few on our side. Now, all of a sudden, we find so many predicting a fall in Treasury yields, we wonder whether the swing from bearish to bullish is too large & too fast.

Look at the sampling below of bullish opinions:

- Lance Roberts @LanceRoberts – Have Treasury Yields Peaked for 2018? BMO Thinks So: https://www.bloomberg.com//new

s/articles/2018-03-14/have-yie lds-peaked-for-2018-bmo-thinks -so-with-10-year-at-2-8 … by @BChappatta$TLT$IEF

Second,

- Greg Harmon, CMTVerified account @harmongreg –

$TLT breaking higher out of base, 120.25/122/123.25/124.25 resistance, support 118.2/116.2/115.25/113.2

And a third:

- Jesse ColomboVerified account @TheBubbleBubble – See my latest – “Are U.S. Treasury Bonds Breaking Out?”: https://realinvestmentadvice.c

om/are-u-s-treasury-bonds-brea king-out/ … $TLT$IEF

On the other hand, the 2.80% level on 10-year yield has yet to be broken decisively. Whether that happens may well depend on what Chairman Powell says & does on Wednesday.

On the other hand, the 2.80% level on 10-year yield has yet to be broken decisively. Whether that happens may well depend on what Chairman Powell says & does on Wednesday.

But we wonder whether the consensus should be looking at the short end of the Treasury curve. Because if the short end stays at this level & the long end comes down in yield, then that would defeat Chairman Powell’s commitment to not flatten the curve. Wouldn’t his objectives be better accomplished by a dovish Powell who sends the 2-year yield lower. That may, counter-intuitively, push 10-30 year yields higher a bit because of inflation fears.

- Richard Bernstein @RBAdvisors – Everyone convinced there’s no

#inflation. But, one measure of vendor delivery time (Demand>Supply) remains at 30-40 year highs.

Wasn’t everybody convinced of high inflation a mere 3-4 weeks ago? How swift has been this change in sentiment?

Wasn’t everybody convinced of high inflation a mere 3-4 weeks ago? How swift has been this change in sentiment?

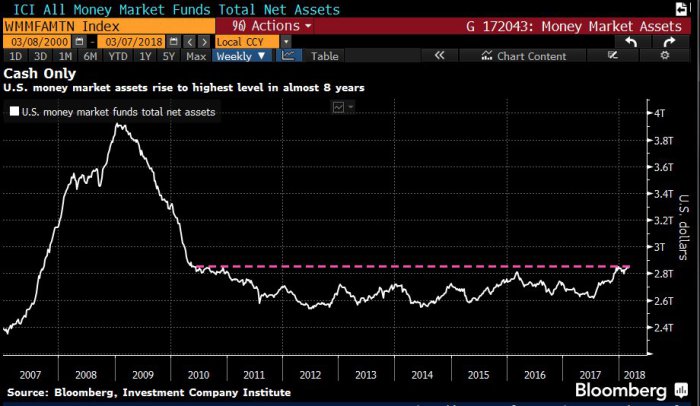

Also, investors already seem to like current levels of short term yields:

- Lisa AbramowiczVerified account @lisaabramowicz1 – Mon Mar 12 – Investors are starting to like the yields they’re seeing on ultra short-term debt. Total assets in U.S. money market funds rose to the highest level in almost 8 years.

@TheTerminal

The rise in short term rates have begun affecting the attractiveness of the S&P as well:

- Lisa AbramowiczVerified account @lisaabramowicz1 – Investors are earning the least extra yield on the S&P 500 relative to investment-grade bonds since 2010 (using the S&P earnings yield.)

Note the above spread is not merely above the S&P dividend yield but above the S&P earnings yield. So much of the earnings bounce may already been factored, at least in this chart. That leaves lower short term yields as the ideal solution for Chairman Powell, at least in the short term.

Note the above spread is not merely above the S&P dividend yield but above the S&P earnings yield. So much of the earnings bounce may already been factored, at least in this chart. That leaves lower short term yields as the ideal solution for Chairman Powell, at least in the short term.

The US economy may also be providing support for lower short term rates:

- Atlanta FedVerified account @AtlantaFed – More – The updated

#GDPNow estimate in Q1 2018 is 1.8%. Click to learn more from the#AtlantaFed https://goo.gl/YZKBVz

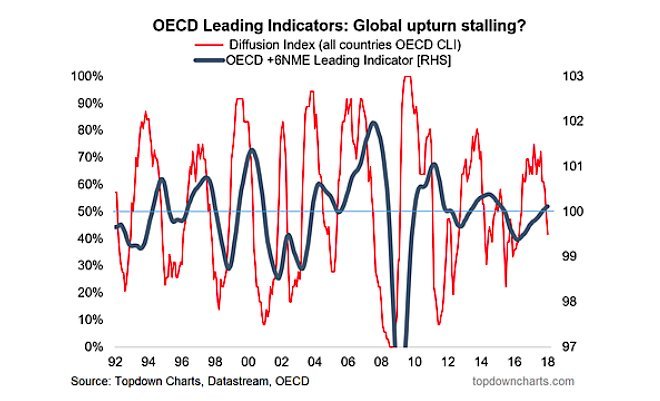

Not just the U.S. economy but OECD economies too:

- See It Market @seeitmarket – NEW Article: “Leading Indicators: Is The Global Economy Slowing Down?” – https://www.seeitmarket.com/le

ading-indicators-is-global-eco nomy-slowing-down-17923/ … by @Callum_Thomas$SPY$EEM

What has been a true signal to buy into a decline in stocks? A divergence that worked during the February decline and also worked on Wednesday afternoon, the bottom for this week:

- Bob Lang @aztecs99 – Wed Mar 14 afternoon – FANG stocks been super strong all day

That is another way of saying FANG represents safety in this market as well as the first place to put money. Or the bullish divergence of strength in FANG stocks in a down day is a signal to buy the broad indices at the close.

Ok, but what about Monday?

- Todd HarrisonVerified account @todd_harrison – Above these levels (S&P > 2748, NDX > 7,000) into the weekend and the bulls can claim technical victory. Also, lots of artificial influences on a quad-witch; feels coiled into Monday.

$SPX$NDX

On the other hand,

- Peter BrandtVerified account @PeterLBrandt – Anyone have an interest in joining me to take the

$DOG for a walk?

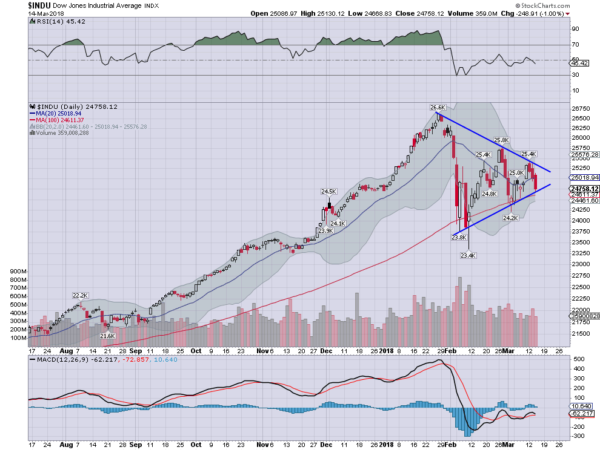

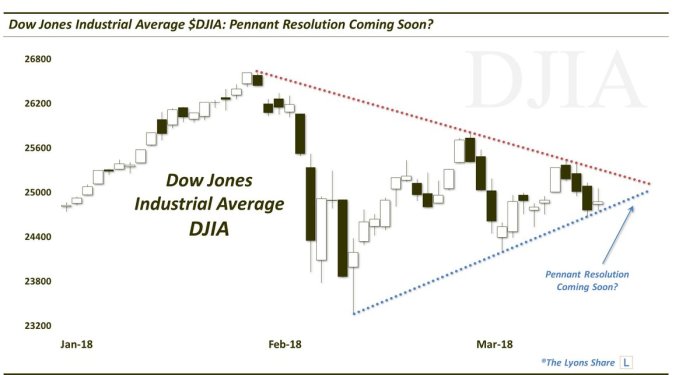

But when does the current churning in the stock market get resolved into a direction? Monetarily speaking, it could be post-FOMC on Thursday. Others look at it more geometrically:

- Dana Lyons @JLyonsFundMgmt – Dow Jones Industrial Average

$DJIA: Pennant Resolution Coming Soon?$DIA#TrendlineWednesday

Greg Harmon of Dragonfly Capital wrote in his The Diamond Triangle article:

Greg Harmon of Dragonfly Capital wrote in his The Diamond Triangle article:

- “The triangle is building. Another touch at the top of the triangle and then reversal leaves the DJIA at the lower rail of the triangle, and a total of 6 touches of its bounds.”

- This is a critical juncture. It is just past the power zone of 2/3 of the way through the triangle, and a break of it would look for a move of about 2700 points. To the downside that would mean a new lower low. And to the upside a new all-time high. Which will it be?

4. Emerging Markets & Dollar

Kudos to Thomas Thornton for his call on Friday, March 9:

- Thomas Thornton @TommyThornton – Mar 9 – Adding April Puts here at close SPY 274, QQQ 170, IWM 157 – 2.5% weight between all of them. Small size

What does he say now?

- Thomas Thornton @TommyThornton Brazil

$EWZ continues lower with a series of short term lower highs. Breaking 50 day today with a downside wave 3 price objective at 39.17. First support is 43.48 however

Since European Banks have been a big funding support for Emerging Markets,

- Thomas Thornton @TommyThornton – European Banks at 11 month lows.

#SX7E with downside DeMark Countdown in progress.

Can you really talk about EM stocks without talking about EM Debt, local as well as hard currency?

- Lisa AbramowiczVerified account @lisaabramowicz1 – The recent outperformance of local-currency emerging-markets credit has been impressive, with the debt returning 2.4% so far this year while U.S. IG credit has lost 2.5%. The divergence has steadily widened as the dollar weakens.

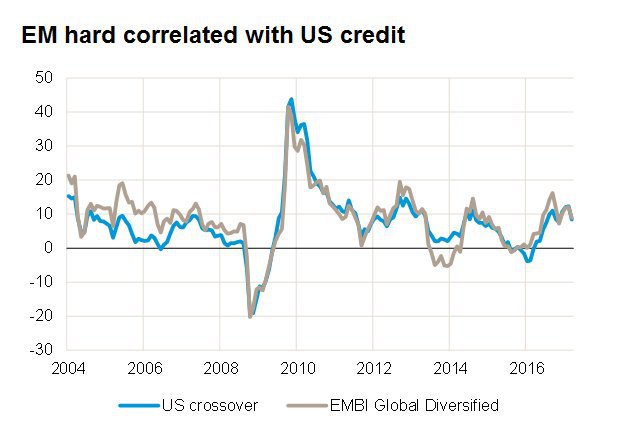

What about hard currency EM Debt?

What about hard currency EM Debt?

- Paul McNamara @M_PaulMcNamara – Meanwhile, EM hard-currency debt looks a lot more like a US$ credit play than an EM play

All this makes next week’s FOMC meeting really important. The US Dollar, Treasury yields, US Stocks, EM Debt & stocks, Gold could all be affected by what Chairman Powell does & says.

Finally, about a sector call in one emerging market:

- J.C. Parets @allstarcharts More – Here is India’s Fast Moving Consumer Goods Sector and then look at this sector relative to the

#NIFTY500 bottoming out. Looks like#NIFTYFMCG is one to expect outperformance moving forward#NIFTY#INDIA$EPI$PIN$INDY

Sticklers for valuation should look at the PEs (trailing) of the components of this NIFTYFMCG index and marvel – Proctor & Gamble India at 72.16 PE, Jubilant (Domino’s Pizza India) at 95.90 PE, Colgate India at mere 41.40 PE & Brittania (100% Indian company) at 61.34 PE. Remember the famous product of Brittania Industries, now available at WalMart :

Why the holes in these biscuits?

Why the holes in these biscuits?

- “The softer biscuits need holes in them so that during the baking process, steam can escape, preventing the cookie from cracking or breaking … If the holes weren’t there, steam would build up inside the biscuits, … The biscuit would collapse back down.” He says that getting the steam out of the biscuit also gives it an even texture—and you’ll notice that the bourbon biscuits do have a smooth surface.”

And what, if any, is the relationship between Bourbon biscuits & Bourbon Whiskey?

The small town of Bourbon l’Archambault in France. What does the name signify?

- Bourbon l’Archambault is Bourbon after Borvo the God, and Archambault after nine of its first rulers or seigneurs. There was Archambault the First in about 950 and Archambault the ninth 200 years later.

- The first Archambaults built a castle – and the remains of its 13th Century successor, three massive towers, still dominate the land.

Folks, just get a box of Bourbons from your neighboring WalMart or from Little India stores near 29th & Lex in Manhattan. Try these awesome biscuits. If you don’t like the taste, just send the biscuits to us. There is no limit to how many Bourbon biscuits we can eat.

5. Saint Patrick’s Day, India-Ireland & Bollywood

Irish Prime Minister Leo Varadkar visited America and President Trump this week. For those who may not know, Varadkar stands for those who migrated to other parts from the town of Varad, a small town in Maharashtra, the state of which Mumbai is the capital. The suffix “kar” signifies the place from which you originate. The PM’s father, Ashok Varadkar, did come from Varad & spent his childhood there. That is one reason for people from India to celebrate Saint Patrick’s Day.

Another reason is the film Ek Tha Tiger which is being shown on Saint Patrick’s Day on Sony TV channel in America. The first half of the film takes place in Dublin, Ireland. Specifically in Trinity College, Dublin, the college where we were invited to conduct a seminar in Group Theory in a different career. There were very very few Indians, if any, at Trinity College in those days. Look how Trinity College has changed and how its setting for Ek Tha Tiger has raised Ireland’s profile in India and in the Indian Diaspora.

[embedyt] http://www.youtube.com/watch?v=VfsFx_6Eluc[/embedyt]

An ex-Indian professor at Trinity College is targeted by NaPakistani intelligence. An Indian intelligence agent, code name Tiger, is sent to protect him and get his work. Yes, the NaPak agent is a lovely woman named Zoya and they get together. After a fight & chase with her NaPak assassin/protector that destroys parts of Dublin, Tiger lets her go. They meet again in Istanbul and get together. In a From Russia with Love redux, the pair escapes from Istanbul to Havana, Cuba where they are confronted by NaPak intelligence. After a spectacular fight, they escape.

[embedyt] http://www.youtube.com/watch?v=AlDKeuqdXpo[/embedyt]

Now in the sequel named Tiger Zinda Hai (Tiger is still alive), the pair goes to Iraq to rescue 27 Indian nurses captured by an ISIS commander. Of course, the pair kills the ISIS commander and rescues the Indian nurses. The premier of this sequel on US TV is on Sunday on Sony TV channel.

Our four favorite Bs for this weekend – Bourbons, Beer, Bollywood & Basketball. Can life get any better?

Send your feedback to [email protected] Or @MacroViewpoints on Twitter