Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Big Story

What has been a fairly reliable sign of tightening of global financial conditions? An abnormal strength in the U.S. Dollar. That usually results in a fall in growth currencies around the world and an exodus of capital into U.S. Dollar, Treasuries & Stocks.

But FinTV remained oblivious to this big story of the past week:

- Mark Newton @MarkNewtonCMT – US Dollar broke out this week vs many Developed and LatAm currencies.. and this is one of the bigger developments of the week– Charts of the USDBRL, or Brazilian Real show the Dollar surging over the last 2 days vs Real a… https://stocktwits.com/

MarkNewtonCMT/message/ 164669802 …

How close is the world to the next “destructive” phase?

- Raoul PalVerified account@RaoulGMI – The most important chart in the world – the Fed Broad Trade Weighted Dollar Index – the data (for me) comes out a week late. The next release will have its nose pressed against the ceiling of 130. A break, and we are probably into the next and most destructive phase of $ rally.

What about a broad FX index? From The Market Ear:

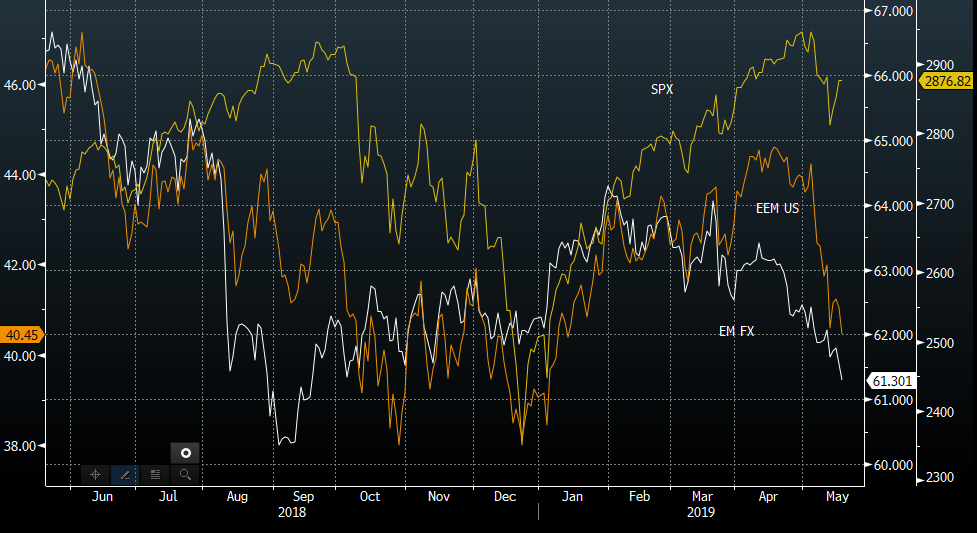

- “Meanwhile in EM FX space…JPM EM FX index new recent lows – We have not traded here since October last year.”

Is that what is giving speculators the courage to short despite incurring a negative 4.94% carry?

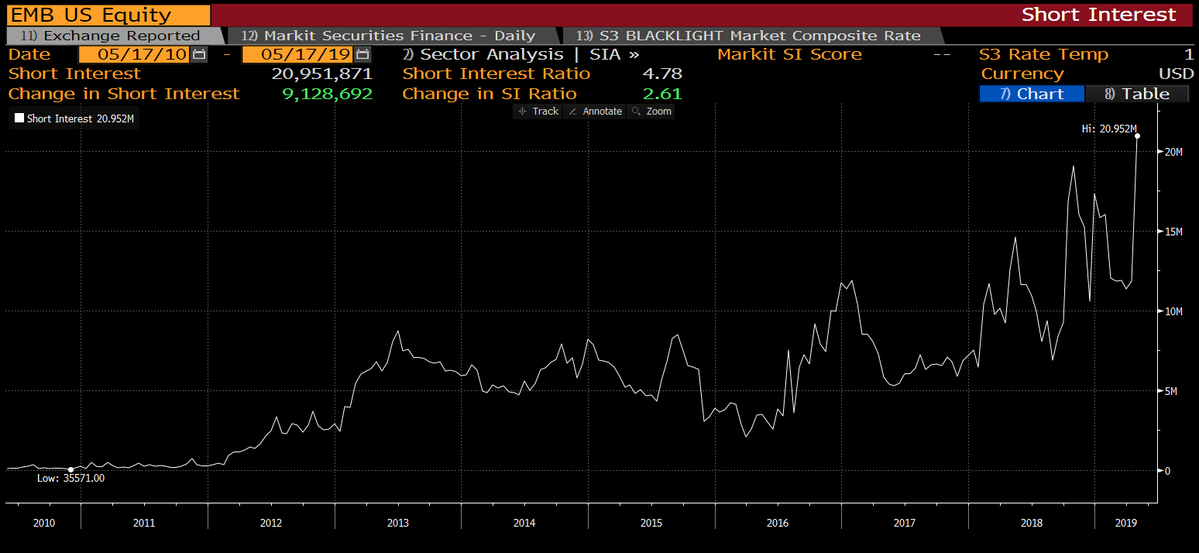

- Lisa AbramowiczVerified account @lisaabramowicz1 – There’s definitely a growing bearishness around emerging markets. Short interest on $EMB, the $14.5 billion USD emerging-markets debt ETF, recently reached a record high.

Ok, but what about speed of movement, or volatility as they call it? From The Market Ear:

- “Emerging markets really caught the flu. EM vol, VXEEM, continues to “outperform” the VIX. VXEEM vs VIX spread.”

That is good news, right? Sort of a Tepperian affirmation of God looking after us & not after the Godless Chinese (actually a friend of David Tepper said that, per him on CNBC Squawk Box awhile ago).

- Mark Newton @MarkNewtonCMT – See the extent to which Developed markets have begun to improve vs Emerging- a move back to new highs would in real acceleration out of EM space and China in particular

But then, you have spoil-sports, The Market Ear in this case, who keep writing like :

- Remember last year when EM FX started moving, then “spilled over” to the EEM US, and eventually spread to SPX.”

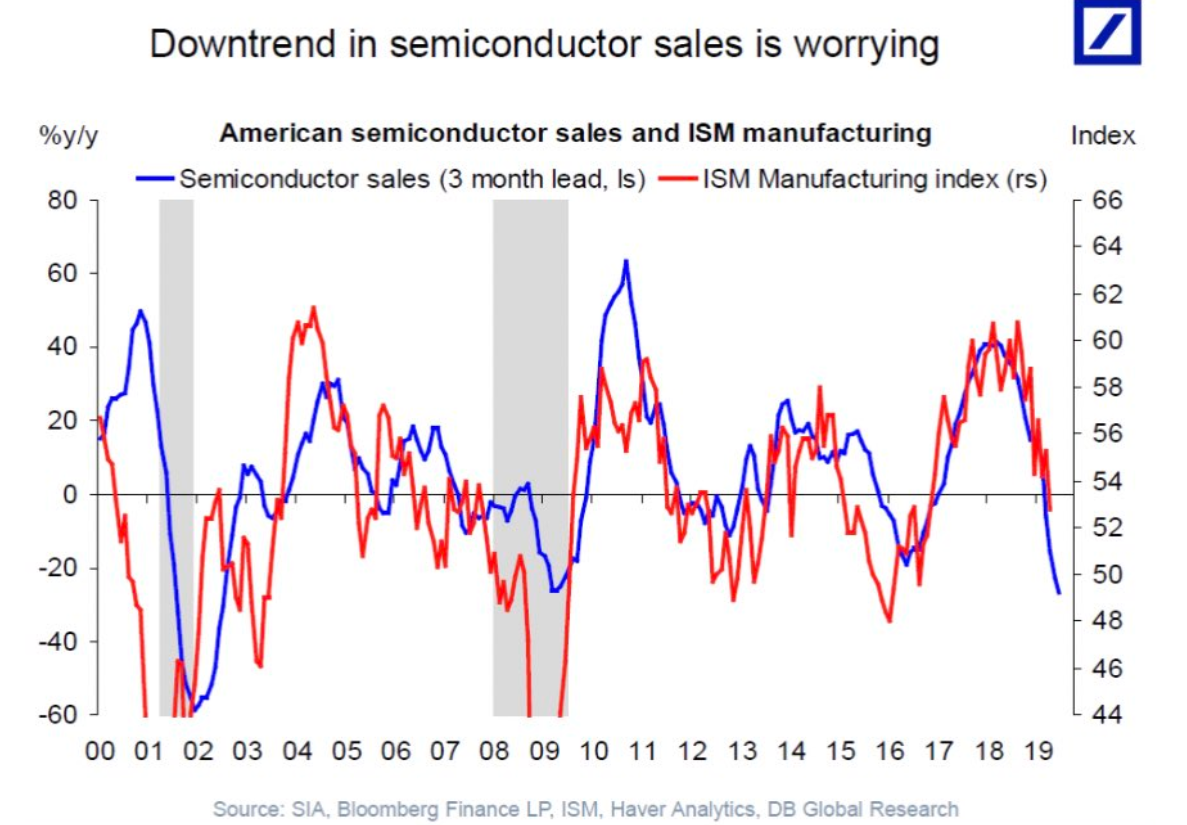

Yeah but is there any historical linkage between this EM-global stuff & good old U.S. manufacturing? From the same Market Ear guys:

Yeah but we have seen such soft spells before, right? These are all buying opportunities unless we face a recession coming across the horizon.

Yeah but we have seen such soft spells before, right? These are all buying opportunities unless we face a recession coming across the horizon.

2. R-word

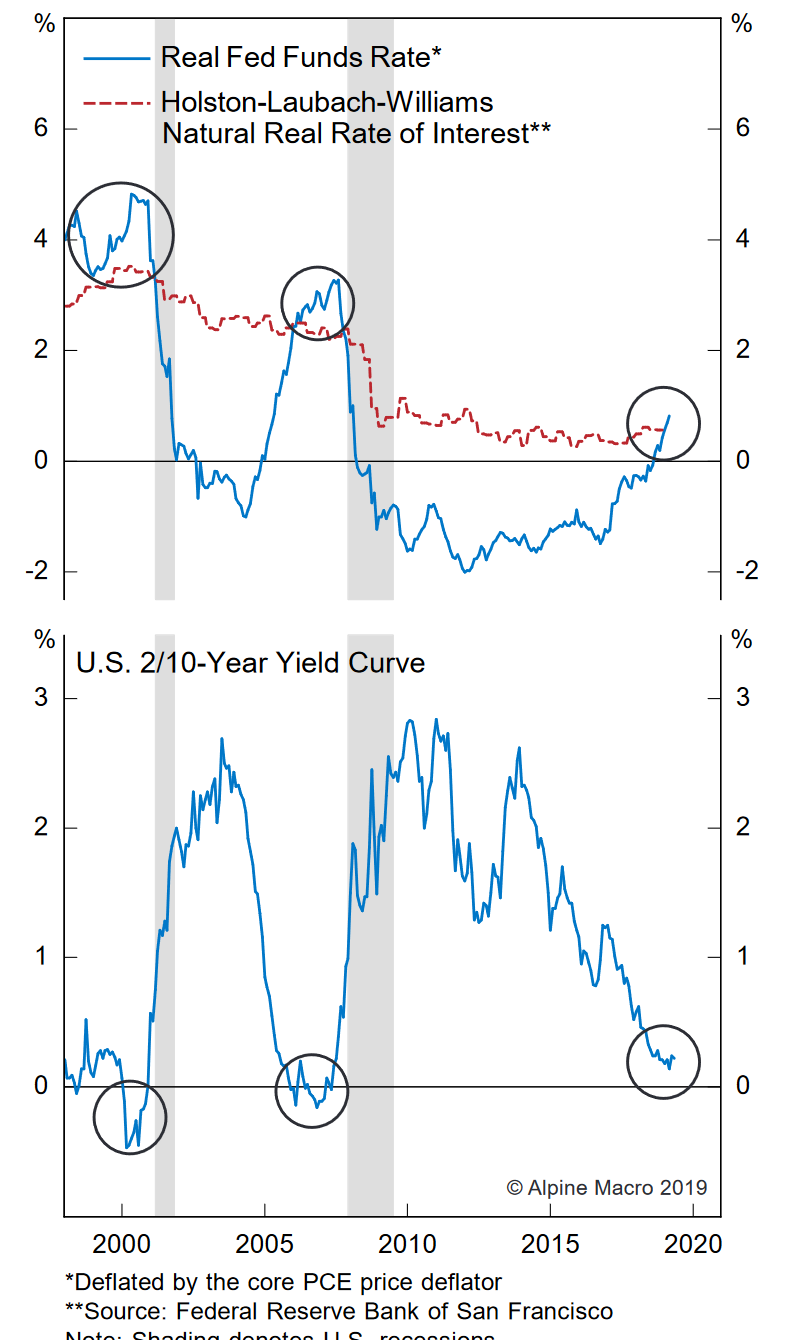

Yes, we know the Fedales (our humble contribution to Spanglish & to Fed dialog; since Federales is already taken; Fedheads is too exclusive & not respectful) & their FinTV gang will come at us for merely mentioning the R-word. They are so smugly complacent in their conviction they need to do nothing. But what about their own data, in this case from San Francisco Fed, courtesy of The Market Ear:

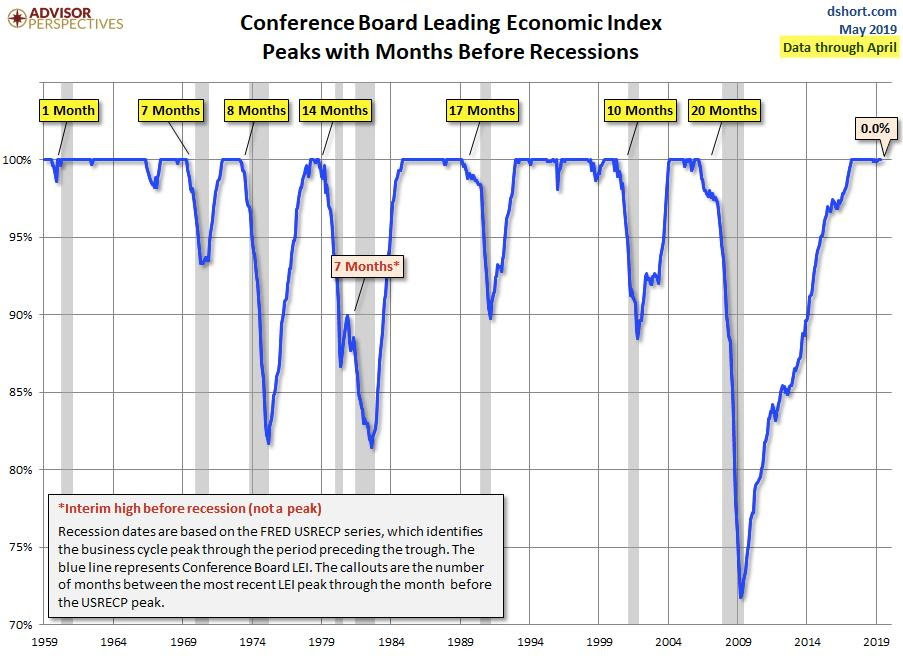

Yeah but didn’t we all see what the Leading Indicators are doing? That means smooth sailing for as long as the eye can see, right? Not according to,

- Urban Carmel @ukarlewitz – LEI at a new cycle high in April. In the past 50 years it has peaked a median of 10 mo before the next recession and 3 mo before $SPX https://www.advisorperspective

s.com/dshort/updates/2019/05/ 17/conference-board-leading- economic-index-increased-in- april …

But didn’t we all see the yuge Michigan sentiment number? Who can un-rosy that?

- David Rosenberg @EconguyRosie – Nice UMich headline, shame about the spending intentions: Large household goods fell to 154 from 159, lowest since August 2018; Housing plans down to 129 from 133 in April, tying the lowest since October 2008!

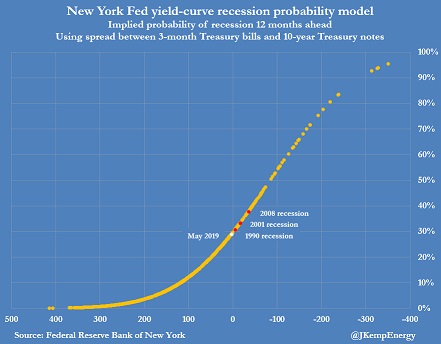

Speaking of as far as the eye can see, look below at what the New York Fed showed:

-

John Kemp @JKempEnergy – NEW YORK FED’s yield-curve model implies there is a probability of around 29% the U.S. economy will be in recession in May 2020 If that doesn’t sound very high, consider the implied probabilities 12 months ahead of the last three recessions: 2008: 38% 2001: 33% 1990: 31%

Wow; how close are? And Jeff Gundlach is about twice as bearish as the NY Fed:

- “The probability of a recession in the next 24 months is “extremely high,” Gundlach said. Over the next 12 months it is a 50/50 proposition, and over the next six months it is about 30%“

He added,

- “It’s a very dangerous time for fighting the next recession, ; The markets can’t handle the current Fed fund rate,”

David Rosenberg was more sure & more bearish in his address at the John Mauldin Strategic Investment Conference this week:

- A U.S. recession will occur within the next 12 months thanks to the Federal Reserve Board’s decision to “overtighten” the funds rate by 75 to 100 basis points over the last 15 months, … this recent Fed blunder would have severe consequences.

- The correlation between equity performance and the economy has declined, ; It used to be 70 percent; now it’s 40 percent.

- The Fed has “never called a recession when it is staring them in the face,”

So far, Rosenberg and Gundlach are on the same page. They both warn about the corporate bond bubble. But Gundlach thinks long maturity rates could rise because of the deficit. In contrast, Rosenberg actually recommends:

- U.S. Treasurys … are the place to be. If the Fed lowers rates to 1 percent, 30-year zero coupon Treasurys will return 35 percent.

3. Smart Money vs. Fast Money?

The Treasury curve kept falling in yield this week with the 3-7 year sector falling 8 bps & the 30-year yield falling 6 bps. The 1-month yield is still higher than all maturities up to the 10-year &, only thanks to the UMich sentiment report, the 3-month yield closed at the same level as the 10-year yield.

CNBC’s smart & sensible Mike Santoli said on Friday that the bond market is “screaming for a rate cut” while Scott Wapner of CNBC Fast Money Half Time raised the possibility of the Fed actually raising rates. The latter’s comments actually raised an intriguing question. Look at the chart from The Market Ear:

During the first bottom near the end of March, CNBC Fast Money, & most of FinTV, were engrossed in curve inversion discussion. In contrast, this week very few discussed that and, as we said above, CNBC Fast Money kept talking about rate hikes by the Fed.

If the 10-year yield rises above 2.40% & stays there, then the curve inversion warning could be diluted for the near term. And this week’s impulsive decline in yields could create a snap back in yield. Also, as Gundlach warned,

- “The bond market is “extremely exposed” to a downturn in the U.S. dollar, because some foreign buyers have been purchasing Treasuries without currency hedges.”

And Chairman Powell is scheduled to speak on Monday & the Fed minutes are out on Wednesday. Based on what Dr. Brainard & Dr. George said this past week, we expect Powell to stay the course & say how happy they are to be in this perfect “no rise no cut” position.

On the other hand, Fin TV & especially CNBC Fast Money tend to be wrong at important junctures. And the global action in bonds points to massive downward pressure on US yields.

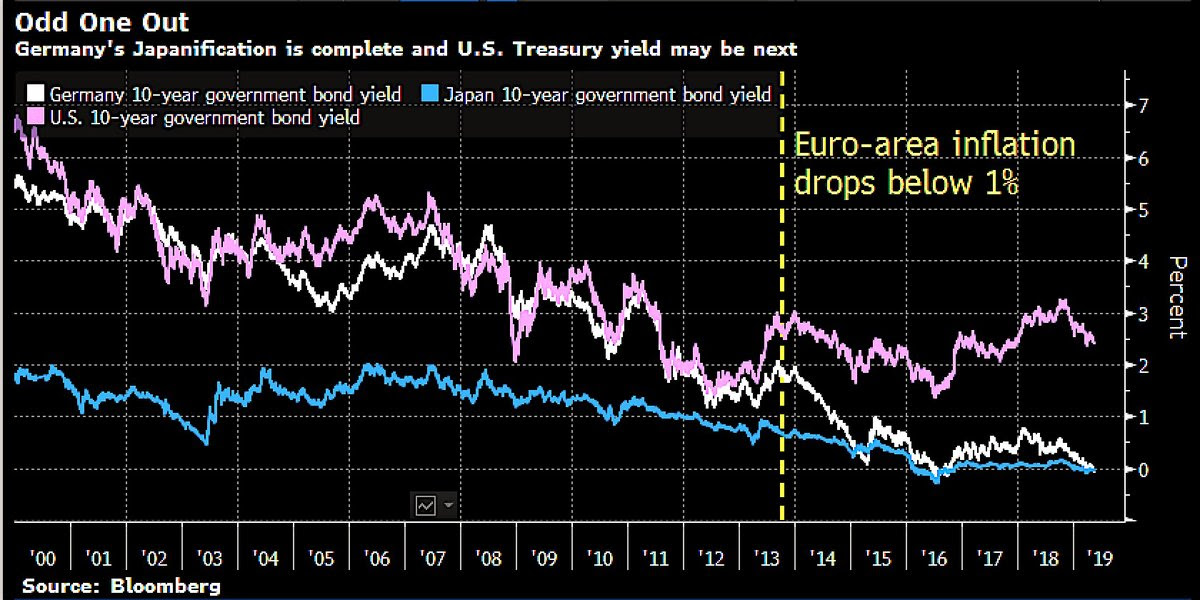

- Holger Zschaepitz @Schuldensuehner – Good Morning from Germany where Japanification has completed w/German 10y bond yields below Japanese ones. “Most commentators now accept Japanification of mainland Europe has occurred, but they just cannot conceive that same thing might happen w/US,” says SG’s Edwards. (via BBG)

Trust Mohamed El-Erian to point to the fallacy in the above chart:

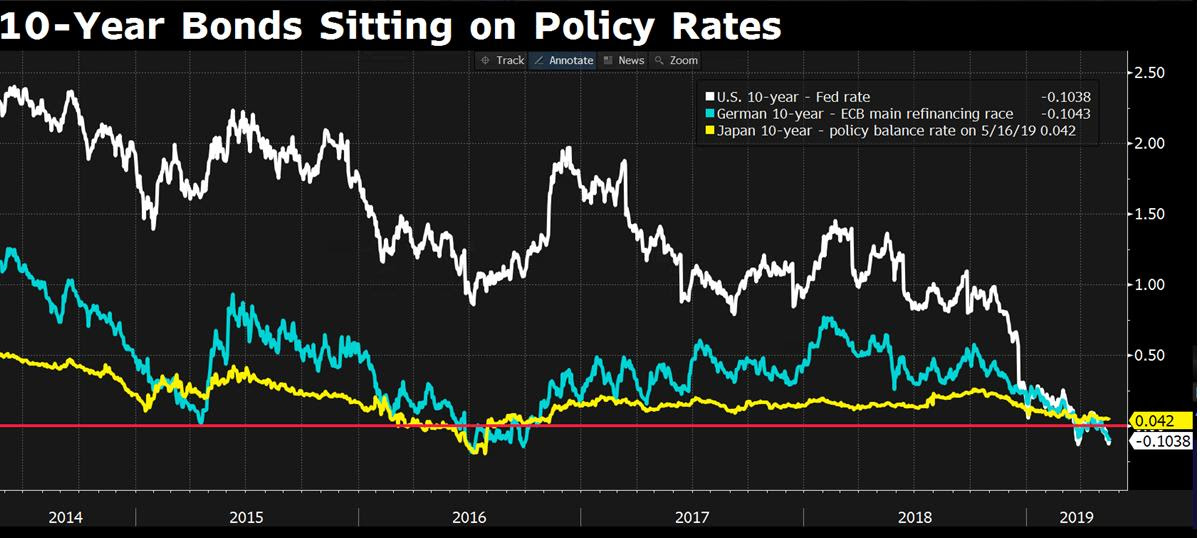

- Mohamed A. El-ErianVerified account @elerianm – From @FerroTV‘s “Real Yield” show on @BloombergTV illustrating the extent of narrowing in the differential between policy rates and the yield on 10-year government #bonds in each of #Germany, #Japan and the #US. #economy #centralbanks #markets @federalreserve @ecb #BoJ

When you consider 10-year yields minus central bank rates, the Fed has put America into the same basket as Germany & Japan. In other words, the Fed is leading America into a Japanification. How does the Fed convert this above chart into the above above Holger chart, the way it should be? CUT the Federal Funds Rate.

Germany & Japan are mercantile, export-dominated economies. They are in the current anti-trade cycle. America is a relatively closed domestic consumer spending economy. Yet, excessively high Fed Funds rate is Japanificating the American economy.

The Fed always tells us that the bond market is wrong & that the market doesn’t understand the Fed. Who in the end is proven to be wrong? The model-driven Fed just like January 2019. Will it happen again? We think so. When? After the Fed puts the U.S. economy into a recession again.

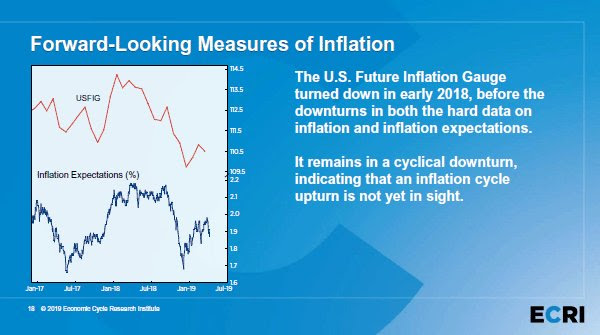

And what about Powell’s “transitory” label for inflation?

- Lakshman AchuthanVerified account @businesscycle – Want to know where the Fed’s headed? Watch the USFIG — its trajectory isn’t transitory. #ECRI #SIC2019

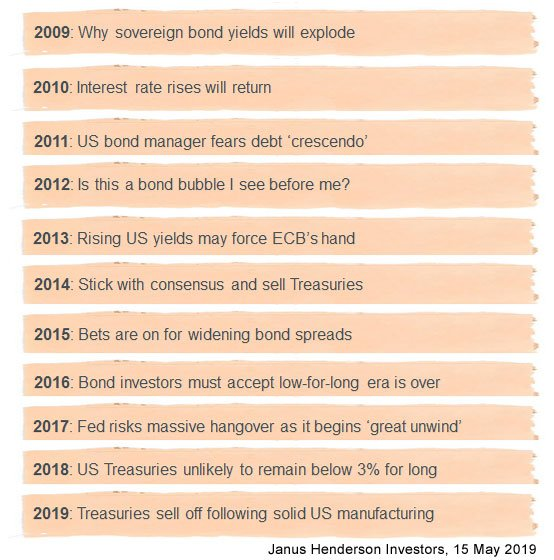

To put Financial Media comments about the bond market in a 10-year perspective,

- Jenna & John @StrategicBond – The bond market since 2009 in FT headlines:

4. U.S. Stocks

The selling of U.S. stocks seems to be originating overseas, perhaps due to the action in their own markets:

- Urban Carmel @ukarlewitz – Over the last 10 days, $SPY has lost a total of -2.8% but it has lost -6.6% overnight. Cash hours, it has gained +3.8%

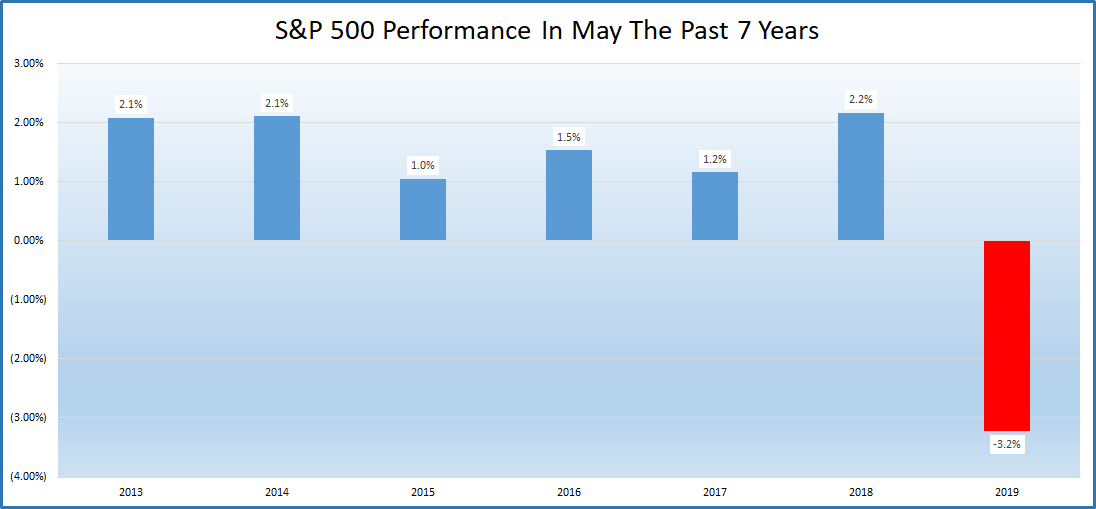

And the action in May seems consistent with seasonality:

- Ryan Detrick, CMT @RyanDetrick – Here’s what the S&P 500 has done in May the past 7 years. Still time, but 2019 no doubt off to a rough start.

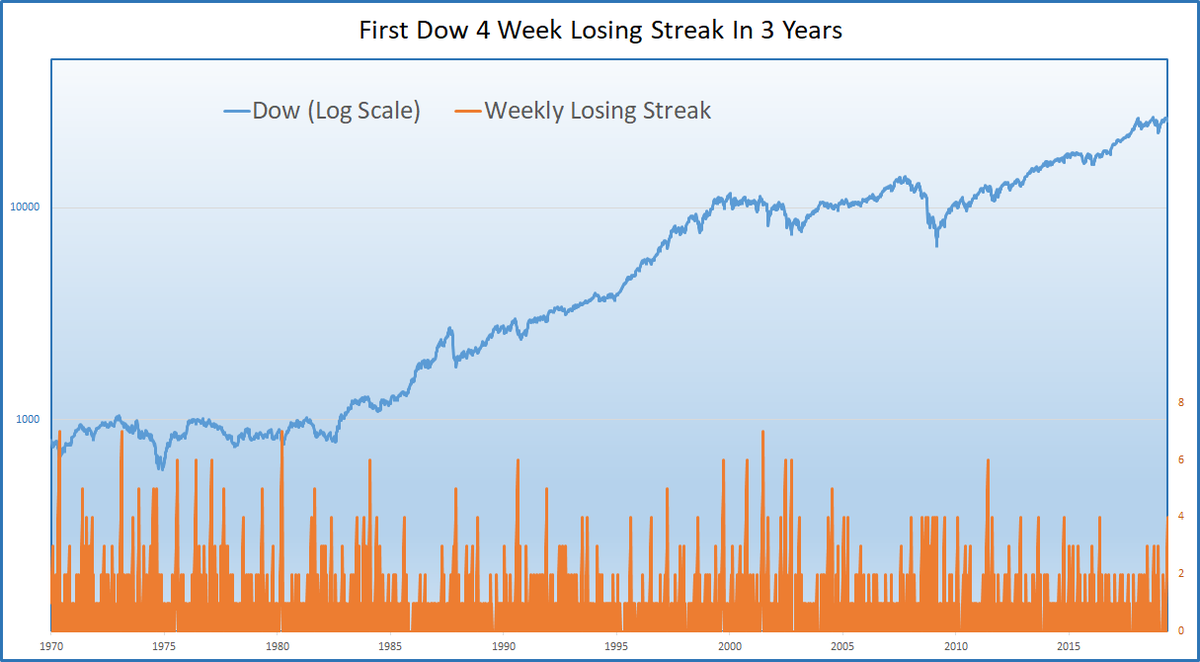

But Detrick did warn CNBC’s Brian Sullivan that, pre-election years, have seen a 10% correction mid-year. And 4-down weeks are ok but apparently 5 down weeks tell a different tale:

- Ryan Detrick, CMT @RyanDetrick – This was the first 4-week losing streak for the Dow in 3 years. Hasn’t been down 5 weeks in a row in 8 years!

Given all of the above, what’s a body to do? An ancient Sanskrut proverb considered the same confusion – different texts tell you different solutions; different gurus give you different advice. So the proverb says,

- महाजन: येन गता, स पन्थ: – the optimal path is the one taken by the Mahajan

The adjective Maha (Mahaa) means great or big; the word Jan means people. So Mahajan literally means great people or colloquially bigshots.

Mona Mahajan of Allianz Global has not been on Fin TV recently. So we turn to the path recommended by another mahajan,

- Lawrence McMillan of Option Strategist – In summary, there are arguments that can be made for both bullish and bearish scenarios. It will likely be settled by price action, as always. A move above 2900 or below 2800 should accelerate momentum in the direction of the breakout.

This past week was dominated by China-US trade news. Lest we all forget, something important & positive happened regarding trade on Friday. We will let another mahajan tell it:

- Tony Dwyer @dwyerstrategy – If we step back and forget the insanity of making decisions based on each trade war news item, if you gave me the choice of better trade relations with Mexico and Canada, or China – I would pick Canada and Mexico given level of importance to our export markets.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter